Search Results for: thorn group

-

Wylie E. Coyote or Road Runner?

Roger Montgomery

March 7, 2013

You will have to forgive the rather startling image we have chosen for this blog post. Its really been selected for dramatic effect only.

You may not realise this but all the way back in August 2010 we were BHP bulls, writing; “If you take on blind faith a A$22b profit, BHP’s shares are worth AUD $45-$50 each.”

But then in February 2011 we became a little more circumspect. You can read about the change here.

Continue…by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, Value.able.

-

GWA Group – not all beer and skittles

Roger Montgomery

February 27, 2013

In his Short Cut column for the Herald Sun published 27 February, Roger highlights how the buoyant share price of GWA Group is not supported by the company’s recent performance. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Property.

- READ

- save this article

- POSTED IN In the Press, Insightful Insights, Property.

-

Monadelphous Group – Revenue growth to flatten from Fiscal 2014

David Buckland

February 19, 2013

The Monadelphous Group (MND) is one of Australia’s most successful project management, construction, asset management and maintenance service companies focused on the Resource, Energy and Infrastructure sectors. Revenue, over the five years to June 2013, is forecast to jump from under $1.0 billion to $2.6 billion.

Mona’s interim report, released on Tuesday 19 February, revealed a more sober outlook from Fiscal 2014.

by David Buckland Posted in Insightful Insights, Market Valuation.

- 3 Comments

- save this article

- 3

- POSTED IN Insightful Insights, Market Valuation.

-

Telstra: Price Up, Value Way Down

Roger Montgomery

February 7, 2013

In these highlights from The 7 February edition of the Switzer Report, Roger addresses in detail the causes for the rising Telstra share price, and how the underlying position of the company is being impacted.

Roger also discusses The Reject Shop (TRS), Kathmandu (KMD), CSL (CSL), Seek (SEK), REA Group (REA), Resmed (RMD), and Leightons (LEI) – do they achieve the coveted A1 grade? Watch now to find out. Watch here.

by Roger Montgomery Posted in Technology & Telecommunications, TV Appearances.

-

Brand Manager Battles

Russell Muldoon

January 24, 2013

The half-year reporting season has begun in earnest this week with a slight trickle of financials coming through.

Of little interest to us so far are the reports from a number of listed investment companies (LIC’s) and also Agenix Limited (ASX: AGX), an unprofitable early-stage medical device company. These reports and many others like them are quickly pushed to one side to ensure we focus our time, energy and effort on more productive outcomes. Conversely, we have read GUD Holdings half year with interest.

Continue…by Russell Muldoon Posted in Insightful Insights, Market Valuation.

- 5 Comments

- save this article

- 5

- POSTED IN Insightful Insights, Market Valuation.

-

FlexiGroup quick out of the blocks

Roger Montgomery

December 22, 2012

But market has factored in too much growth too soon.

Buying a stock that has doubled in a year and become a “market darling” is hard work for value investors. It gets even harder when the company has declining return on equity (ROE), patchy earnings per share (EPS) growth, high debt, and an aggressive growth strategy.

Based on its current valuation, the market seems to think FlexiGroup can do no wrong. The fast-growing provider of consumer and retail point-of-sale finance has done remarkably well after raising $264 million through an Initial Public Offering in 2006.

by Roger Montgomery Posted in Financial Services, Whitepapers.

- 1 Comments

- save this article

- 1

- POSTED IN Financial Services, Whitepapers.

-

Cutting down the flowers to water the weeds?

Ben MacNevin

December 17, 2012

Fairfax have announced that they are selling their holdings of Trade Me group, which is an online classified platform in New Zealand. Despite Trade Me being one of Fairfax’s key performing assets (comprising $86 million of the group’s $506 million in earnings in FY12), it is being sold down to reduce Fairfax’s net debt.

Many would argue they are cutting down the roses to water the weeds but before jumping on that bandwagon, it suggests to me they have a plan. I reckon its an online plan and one they believe they can repeat.

The proceeds are required to “provide the financial flexibility to invest and to complete the company’s structural transformation”. While it makes you wonder how successful the company’s “structural transformation” will be if they offload this river of gold I reckon they have a plan to repeat their Trade Me success. The database is huge and with the right offering(s) they have the opportunity to dominate mobile the way no-one has yet. Oh, and its interesting that the share price is the closest its been to intrinsic value (according to Skaffold.com) in a decade…

by Ben MacNevin Posted in Media Companies.

- 1 Comments

- save this article

- 1

- POSTED IN Media Companies.

-

Creating the perception of a superior product

Ben MacNevin

December 10, 2012

It was pleasing to see figures released last week by Tourism Research Australia that revealed Chinese tourists were still flocking to Australia’s shores. According to the report, there were 573,071 Chinese arrivals in the 12 months to September, which was a 17 per cent increase over the previous corresponding period.

While there has been a lot of commentary on the state of the tourism industry, there is one company that is frequently cited as the shining example of a group that can successfully capture the opportunities in this growing tourism market, and that is Crown Ltd.

by Ben MacNevin Posted in Insightful Insights, Tourism.

- 1 Comments

- save this article

- 1

- POSTED IN Insightful Insights, Tourism.

-

What is the ‘new normal’ for housing?

Russell Muldoon

December 10, 2012

A few months ago we commented here on an article in the AFR speculating that Gen Y may soon be buying a house cheap from boomers who have no-one else to sell to and why renting makes more sense than buying. Since Roger bought the bigger family home in 2006,he has argued that house prices would cease rising to new highs – especially the six and seven bedroom variety.

Whilst the mere mention of Australian housing and prices can stir up passionate and spirited argument for and against house price rises, just this morning I stumbled across the below series of charts produced by Citigroup’s Matt King.

Similar to the M/O ratio which plots P/E ratios against the ratio of the middle-age cohort, age 40–49, to the old-age cohort, age 60–69 from 1954 to 2010, Matt looks at the relationship between the inverse dependency ratio (the proportion of population of working age relative to old and young) and maps that against real house prices over time. This produces a longer-term measure of prices home owners are willing to (or have to) pay for housing.

The charts are a powerful representation of a force driving all economies and prices: demographics. Whilst prices have somewhat lagged the dependency ratio on the way up, give or take a number of years and almost every country here shows that the peak in real estate prices is highly correlated with the peak in dependency ratio.

Its worth contemplating whether the recent past, characterised by rising gearing levels and falling price to income ratios (affordability) is the new normal, or whether, as we transition into an environment where there are more pensioners than workers and therefore fewer people to ‘downsize’ too,what may transpire in the future in Australia is anything like the experience in the US, Japan, Ireland, Spain and the UK.

As always, delighted to hear your thoughts.

by Russell Muldoon Posted in Insightful Insights.

- 6 Comments

- save this article

- 6

- POSTED IN Insightful Insights.

-

More choice and lower prices? Fat chance.

Roger Montgomery

December 6, 2012

Rising costs, lower productivity and a strong Australian dollar will inevitably be blamed for the collapse of another food manufacturer in Australia this week.

Gourmet Group, the company that owns the iconic Rosella Brand of tomato sauce has been placed in receivership with reports it owes as much as $50 million.

But this additional nail in the coffin of our collapsing food manufacturing industry is exactly what the government wants, it may also be what the ACCC wants and it is what Australian consumers want. And if they all complain that they don’t want it, it’s what they’re going to get.

by Roger Montgomery Posted in Insightful Insights, Manufacturing.

- 9 Comments

- save this article

- 9

- POSTED IN Insightful Insights, Manufacturing.

-

Cash rates do the round trip to 3.0% on slowing growth

David Buckland

December 5, 2012

Yesterday, the Reserve Bank of Australia cut their cash rate to 3.0%, down from 4.75% at October 2011, and the lowest level since mid-2009. Data points from manufacturing, the job market and the terms of trade are not cheery reading – all pointing to weaker GDP growth – and we expect the cash rate to fall further in 2013.

by David Buckland Posted in Insightful Insights.

- save this article

- POSTED IN Insightful Insights.

-

Unearthing informed Mining Services research

Russell Muldoon

November 26, 2012

Although it has taken a while for our alert earlier this year to flow through, project delays, cancellations and profit downgrades are mounting as the mining services sector confronts its post-capex-boom. To name a few: Macmahon is shedding staff and cutting pay rates, Emeco’s hiring rates have collapsed with an industry wide surplus of idle heavy machinery, Diploma Group is no longer proceeding to build a 244 man camp near Tom Price for Rio Tinto, ALS is reporting no growth, Ausdrill severed its earnings guidance and Orica wrote down the value of its equipment finance division, Minova, by $367m.

by Russell Muldoon Posted in Energy / Resources, Insightful Insights.

-

Lamenting the Australian Index

Tim Kelley

November 24, 2012

One of the strategies available to people who lack the time or inclination for active portfolio management is to “buy the index”. This is normally done via an index fund, which invests in companies according to their index weights. These funds have a certain intuitive appeal, as they typically charge low fees and are easy to understand.

However, if you step back and think about it, we think some serious issues arise. In essence, an index fund invests in a company, simply because it is there. This may be a satisfactory rationale for climbing a mountain, but we think it falls short as an investment strategy, particularly in the Australian context.

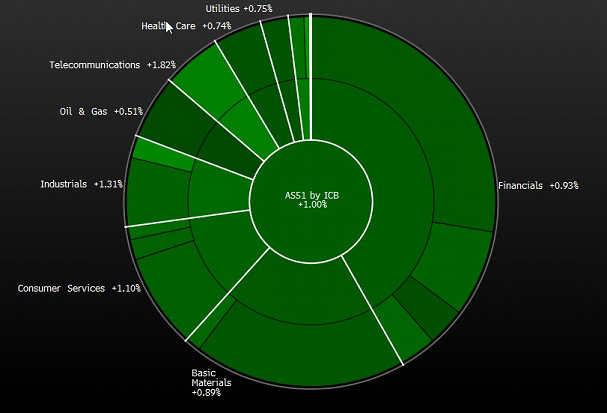

The chart below shows the industry composition of the ASX200 index. Ignore the % numbers – they are the daily price changes from yesterday – and look at the size of the slices. What stands out is that financials and basic resources together account for more than 60% of the total. If you buy the Australian index, your returns will be dominated by the big 4 banks and a handful of large resources companies. This doesn’t look like a sensible portfolio construction to us, and the rationale “because they’re there” doesn’t provide much comfort.

ASX200 Index Composition

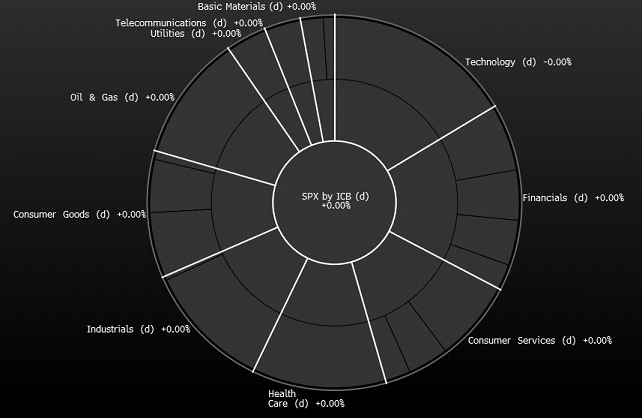

For comparison, the second chart, below, shows the composition of the US S&P500 index. A few things to note:

– Firstly, the US index has a much more even distribution, with 7 different industry groups representing a material part of the whole.

– Secondly, it’s interesting to note that technology is the largest single component of the US index, but is nothing more than a rounding error in the Australian index. In an age where commerce is being transformed by technology, is it good enough for Australian investors to have a <1% allocation to this sector ?

S&P500 Index Composition

by Tim Kelley Posted in Insightful Insights, Technology & Telecommunications.

-

Important enhancements to Skaffold

Roger Montgomery

November 5, 2012

If like me, you are a Skaffold member, you will have noticed something dramatic has happened when you logged in recently.

(If you are not a member, what are you waiting for?)

Quietly and without much fanfare, Skaffold just got a whole lot more valuable to me.

I’d like to share with you – just this once – some of the information that Skaffold members received recently and tell you a bit about the change.

Continue…by Roger Montgomery Posted in Companies, Skaffold.

- 1 Comments

- save this article

- 1

- POSTED IN Companies, Skaffold.

-

It’s a Tasty,Tempting Mix

Roger Montgomery

November 1, 2012

In his Money Magazine November 2012 article, Roger highlights the ongoing competitive advantage of Breville Group (BRG). Read here.

by Roger Montgomery Posted in Companies, Market Valuation, On the Internet.

- save this article

- POSTED IN Companies, Market Valuation, On the Internet.

-

What is Russell Muldoon’s outlook on Commodities?

Roger Montgomery

October 17, 2012

Do CSL (CSL, Silverlake (SLR), FKP (FKPDA), Breville Group (BRG), Codan (CDA), QBE Insurance (QBE), NAB (NAB), Wesptac (WBC), AMP (AMP), ALS (ALQ), Prima (PRR), Rio Tinto (RIO), Lynas (LYC), or Mesoblast (MSB) achieve the coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call 17 October 2012 program now to find out, and also learn Russell’s insights into the commodities sector. Watch here.

by Roger Montgomery Posted in Companies, Financial Services, Insightful Insights, Intrinsic Value, TV Appearances.

-

Back to the Future

Roger Montgomery

October 17, 2012

By Russell Muldoon and Roger Montgomery

Growing up in inner Melbourne in the 1970’s I cannot tell you how many post hockey-game lunches my mother trotted out on the ‘Breville’. The original scissor action Breville Sandwich Toaster was released in 1974. It sold 400,000 in its first year and reached 10% of Australian households. It was quickly improved in 1976 with the release of the Breville Snack’n’Sandwich Toaster (pictured) which was the first sandwich toaster to cut and seal sandwiches in half. It was a revelation and became an icon of the appliance world – we could eat a sandwich while riding our BMX’s without the contents of the sandwich spilling everywhere. And Mum was happy because a healthy and warm lunch was done in a few minutes and while it was being made, she could get the carpet sweeper out and do a quick run up and down the hallway or throw a slipper at any kid that was mucking up because they were hungry!

by Roger Montgomery Posted in Companies, Manufacturing.

- 6 Comments

- save this article

- 6

- POSTED IN Companies, Manufacturing.

-

Vita Group Investor Report

Roger Montgomery

October 13, 2012

Here at the insights blog we like to encourage deep thought and facilitate genuine community. To that end we have been thinking carefully about how we publish Harley’s research report on Vita Group – or should I see ‘tome’. Its great and we really appreciate Harley’s work. I think you will too. We have resolved to produce a pdf for you to download and read at your leisure. Harley, well done and keep them coming. We now have a system and process for publishing your reports. If anyone else would like to share their research with the tens of thousands of unique investors who visit the Insights Blog each week and the hundreds of thousands who visit each month, including CEO,s planners, advisors and fund managers, then feel free to submit your reports to Feedback & Support.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights.

-

Qantas needs all the debt it can get.

Roger Montgomery

October 8, 2012

News of a new debt facility of $400 million for Qantas should send investors zipping up their wallets. Qantas Group is Australia’s largest domestic and international airline.

Back in 2000 the balance sheet of Qantas comprised:

› $2.8 billion of shareholders equity

› $3.1 billion of bank debt

For financial year 2000, Qantas reported earnings of $517 million giving an ROE of 17.45%.

But more recently, Qantas recorded a normalised loss of $16.3 million. The 2012 loss follows the $317 million profit of 2011, the $175.2 million profit of 2010 and the $164.6 million profit of 2009. All of these were lower than what the business reported its earnings to be in 2000 – eleven years ago.

The company however has seen its debt balloon in that time to $6.5 billion and shareholders equity is at $5.9 billion. Meanwhile any simple bank account, with an additional $12.4 billion of capital injected, would be earning more than it did a dozen years ago.

Owners have put in another $3 billion of equity on top of the $2.8 billion injected by 2000. But despite the life support, the company still lost $16 million in 2012.

Even with the very best management running the show and the most generous bankers, there’s no escaping these economics.

by Roger Montgomery Posted in Airlines, Value.able.

- 4 Comments

- save this article

- 4

- POSTED IN Airlines, Value.able.

-

Materials prices to collapse further

Roger Montgomery

September 30, 2012

If you think the declines so far in iron ore are significant, you ain’t seen nothing yet.

I think the declines we have seen in commodity prices still have a long way to go.

We’ve long argued that a classic supply response would follow the massive investment in exploration and production that itself followed a surge in demand from China that caused prices to reach historic highs.

But China’s demand – itself was based on unsustainable growth in fixed investment spending – is now fading. China represents less than 11% of the global economy, but it commanded 30% to 40% of total global demand for copper and 60% of total global demand for cement and iron ore thanks to the massive social modification projects that required bridges, roads, ports, cities, subways and skyscrapers.

This is not sustainable and so demand for the raw ingredients will decline. Additionally, the nature of future growth will change and more consumer driven growth will again demand less materials.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Value.able.