Search Results for: thorn group

-

My…Err?

Roger Montgomery

May 27, 2012

Investors don’t have to have astronomic IQ’s and be able to dissect the entrails of a million microcap startups to do well. You only need to be able to avoid the disasters.

In an oft-quoted statistic, after you lose 50% of your funds, you have to make 100% return on the remaining capital just to get back to break even. This is the simple reasoning behind Buffett’s two rules of investing. Rule number 1 don’t lose money (a reference to permanent capital impairment) and Rule Number 2) Don’t forget rule number 1! Its also the premise behind the reason why built Skaffold.

Avoiding those companies that will permanently impair your wealth either by a) sticking to high quality, b) avoiding low quality or c) getting out when the facts change, can help ensure your portfolio is protected. Forget the mantra of “high yielding businesses that pay fully franked yields” – there’s no such thing. That’s a marketing gimmic used by some managers and advisers to attract that bulging cohort of the population – the baby boomers – who are retiring en masse and seeking income.

Think about it; How many businesses owners would speak about their business in those terms? “Hi my name is Dave. I own an online condiments aggregator – ‘its a high yielding business that pays a fully franked yield’. You will NEVER hear that from a business owner. That only comes from the stock market and from those who have never owned or run a business.

They key is not to think about stocks or talk stock jargon. Just focus on the business. Thats what we did when Myer floated in 2009. And with the market value of Myer now 50% lower than the heady days of its float, it might be instructive to revisit the column I wrote back on 30 September 2009, when I reviewed the Myer Float.

And sure, you can say that the slump in retail is the reason for the slump in the share price of Myer (I am certainy one who believes that the dearth of really high quality companies means multi billion dollar fund managers are bereft of choice meaning that a recovery in the market will make all stocks rise – not because they are worth more but because fund managers have nothing else to buy). But the whole point of value investing is to make the purchase price so cheap that even if the worst case scenario transpires, you are left with an attractive return.

It would be equally instructive to review the reason why we didn’t buy the things that subsequently went well (QRN comes to mind) so we’ll leave that for a later date.

Here’s the column from September 2009:

“PORTFOLIO POINT: The enthusiasm surrounding the Myer float is good reason for a value investor to stay clear. So is the expected price.

With more than 140,000 investors registering for the IPO prospectus, everyone wants to know whether the float of the Myer department store group will be attractive. This week I want to focus exclusively on this historic offer.

At present it is suggested the stock will begin trading somewhere between $3.90 and $4.90.

The prospect of a stag profit draws a self-fulfilling crowd. But if chasing stag profits is your game, I would rather be your broker than your business partner, for history is littered with the remains of the enthusiasm surrounding popular large floats.

Popularity, you see, is not the investment bedfellow of a bargain and being interested in stocks when everyone else is does not lead to great returns. You cannot expect to buy what is popular, travel in the same direction as lemmings and generate extraordinary results. Conversely thumb-sucking produces equally unattractive returns.

Faced with these truisms, I lever my Myer One card, obtain a prospectus and open it for you.

The Myer float is one of the hottest of the year and I am not referring to the cover adorned by Jennifer Hawkins! If those 146,000 people who have apparently registered for a Myer prospectus were to invest just $20,000 at the requested price, the vendors will have their $2.8 billion plus the $100 million in float fees in the bag.

A word about the analysis: It is the same analysis I have used to buy The Reject Shop at $2.40 (today’s close $13.35), JB Hi-Fi at $8 ($19.86), Fleetwood at $3.50 ($8.75), to sell my Platinum Asset Management shares at more than $8 on the morning they listed (at $5), and to warn investors to get out of ABC Learning at $8 (they were 54¢ when ABC delisted in August 2008) and Eureka Report subscribers to get out of Wesfarmers as it acquired Coles.

I don’t list these to boast but merely to demonstrate the efficacy of the analysis; analysis that is equally applicable to existing issues and new ones.

By way of background, TPG/Newbridge and the Myer Family acquired Myer for $1.4 billion three years ago. They copped flack for paying too much, but “only” used $400 million of their own capital; the remainder was debt. Before the first anniversary, the Bourke Street, Melbourne, store was sold for $600 million and a clearance sale reduced inventory and netted $160 million. The excess cash allowed the new owners to reduce debt, pay a dividend of almost $200 million and a capital return of $360 million. Within a year the owners had recouped their capital and obtained a free ride on a business with $3 billion of revenue. Good work and smart.

But I am not being invited to pay $1.4 billion, which was 8.5 times EBIT. I am being asked to pay up to $2.9 billion, or more than 11 times forecast EBIT. And given the free “carry”, the bulk of the money raised will go to the vendors while I replace them as owners. Ownership is a very good incentive to drive the performance of individuals.

And driven they have been. In three years, $400 million has been spent on supply chain and IT improvements, eight distribution centres have been reduced to four and supply-chain costs have fallen 45%. Amid relatively stable gross profit margins, EBIT margins improvement to 7.2% and a forecast 7.8% reflect disciplined cost identification and management. Fifteen more stores are planned for the next five years and the prospectus notes that trading performance improved significantly in the second half of 2009 and into the first half of 2010. The key individuals have indeed performed impressively, but with less skin in the game they may not be incentivised as owners in future years as they have been in the past.

And what value have all these improvements created? The vendors would like to believe about $1.4 billion, and if the market is willing to pay them that price, they will have been vindicated, but price is not value and I am interested simply in buying things for less than what they are worth.

In estimating an intrinsic value for Myer, I will leave aside the fact that the balance sheet contains $350 million of purchased goodwill and $128 million of capitalised software costs. This latter item is allowed by accounting standards but results in accounts that don’t reflect economic reality. Historical pre-tax profits have thus been inflated.

I will also leave aside the fact that the 2009 numbers and 2010 forecasts have also been impacted by a number of adjustments, including the addition of sales made by concession operators “to provide a more appropriate reference when assessing profitability measures relative to sales”; the removal of the incentive payments to retain key staff – not regarded as ongoing costs to the business; costs associated with the gifting of shares to employees; and, most interestingly, the reversal of a write-off of $21 million in capitalised interest costs – all regarded as non-recurring.

Taking a net profit after tax figure for 2010 of $160 million and assuming a 75% fully franked payout, we arrive at an owners’ return on equity of about 28% on the stated equity of $738 million, equity that could have been higher after the float if $94 million in cash wasn’t also being taken out of retained profits. Using a 13% required return, I get a valuation of $2.90.

Looking at it another, albeit simplistic way, I am buying $738 million of equity that is generating 28%. If I pay the requested $2.9 billion for that equity or 3.9 times, I have to divide the return on equity by 3.9 times, which produces a simple return on “my” equity of 7.2%. For my money, it’s just not high enough for the risk of being in business.

Importantly, the return on equity – based on the simple assumptions that three stores, each generating $40 million in sales will be opened annually over the next five years and that borrowings will decline by $60 million in each of those years – should be maintained. But the end result is that the valuation only rises by 6% per year over the next five years and delivers a value in 2015 of $3.90: the price being asked today.

My piece of Myer seems a bit hot for My money.”

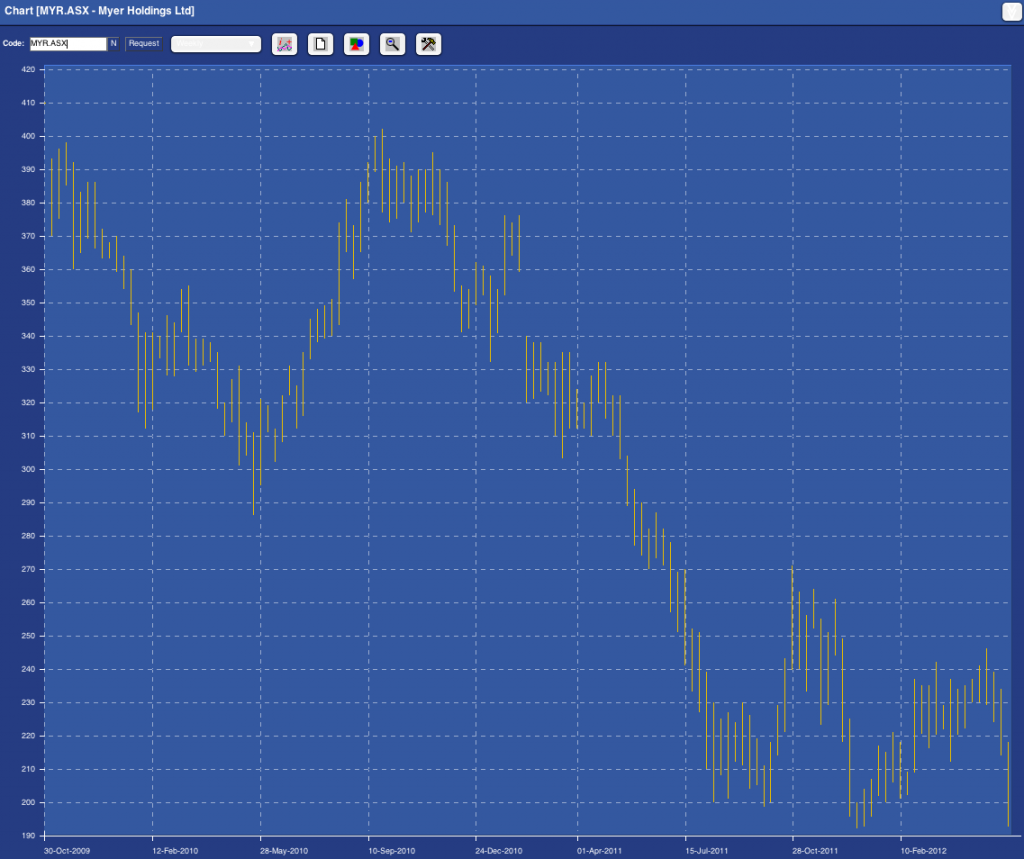

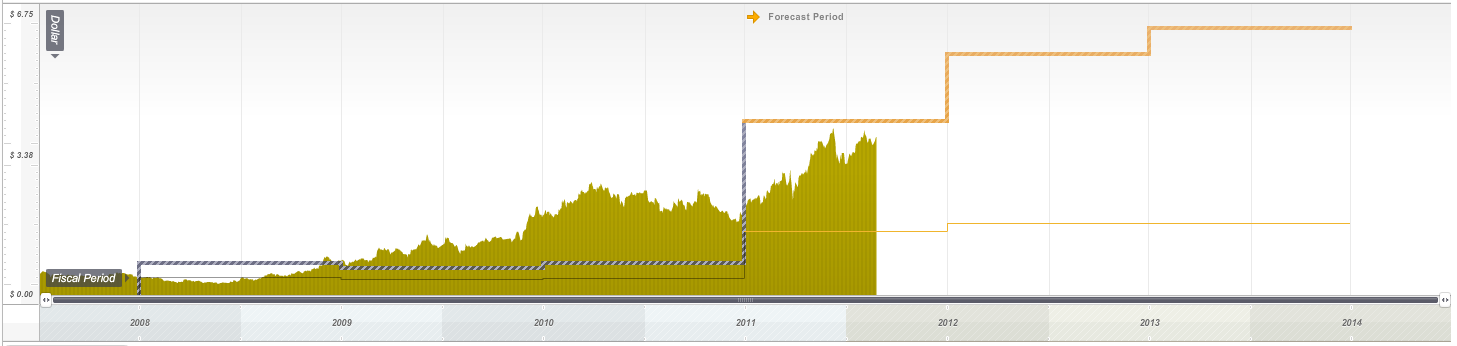

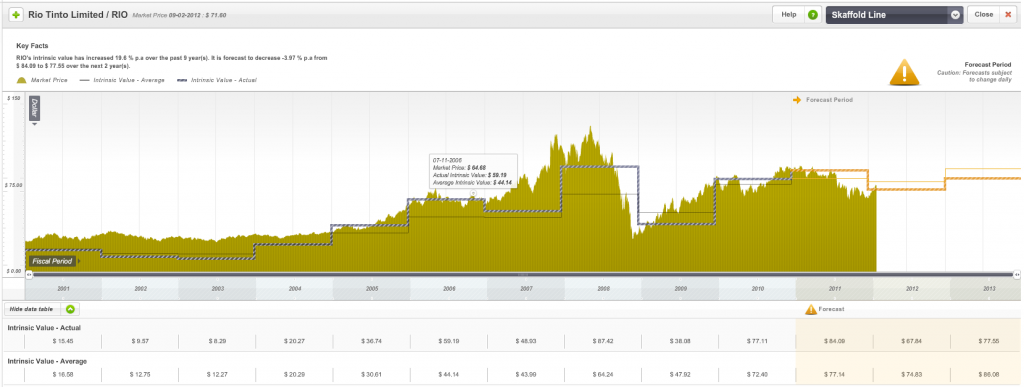

That was 2009. Has anything really changed? Has the following chart reveals. Myer is now trading at close to Skaffold’s current estimate of its intrinsic value. Before you get too excited (although the shortage of large listed high quality retailers means even this company’s shares may go up in a market or economy recovery) take a look at the pattern of intrinsic values in the past and the currently anticipated path of forecast intrinsic values; Past intrinsic values have been declining (generally undesirable unless forecasts for a recovery are correct) and forecast intrinsic values are flat.

Fig.1. Skaffold Myer Intrinsic Value Line

And as the Capital History chart reveals, 2014 profits are not expected to be better than 2010. That 4 years without profit growth. Question: Would you buy an unlisted business (as a going concern) that was not forecasting profit growth for four years?

Fig. 2. Skaffold Myer Capital History Chart

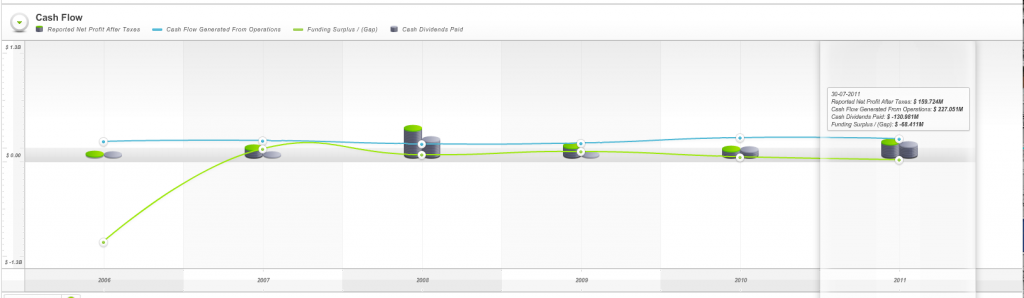

Finally the cash flow chart reveals the company has produced what Skaffold refers to as a Funding Gap. Its cash from operations have not been enough to cover the investments it has made in others or itself plus the dividends it has paid. In other words for 2010 and 2011, the two financial years it has registered as a listed company, it appears from Skaffold’s data that the company has had to dip into either 1) its own bank account, or 2) borrow more money or 3) raise capital (the three sources of funds available if a funding gap is produced) to cover this “gap”.

Fig. 3. Skaffold Myer Cash Flow Chart

I’d be interested to know if you are a loyal Myer shopper or not and why? If you don’t shop at Myer, why not? If you do shop at Myer, what do you like about the company, its stores and the experience? And I am particularly interested to hear from anyone who DOES NOT shop there but DOES own the stock!

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 May 2012.

by Roger Montgomery Posted in Companies, Consumer discretionary, Value.able.

- 14 Comments

- save this article

- 14

- POSTED IN Companies, Consumer discretionary, Value.able.

-

The G-8 or a win in Race 7 at Moonee Valley?

Roger Montgomery

May 20, 2012

Its hard to tell from the photo, but these are the world’s leaders – those at the centre of the current financial crisis anyway – at the weekend’s G-8 Summit at Camp David Maryland USA.

Its hard to tell from the photo, but these are the world’s leaders – those at the centre of the current financial crisis anyway – at the weekend’s G-8 Summit at Camp David Maryland USA.Sadly structural change, when foisted on a country, industry sector or company is often hard to discern from the usual cyclical changes. Hopes of a near term recovery persist but are nothing but hope.

The G-8 didn’t agree on next steps to calm the euro zone debt crisis (although money printing has to be on the agenda).

As Famed hedge fund founder Ray Dalio noted at the weekend in an interview with Barrons: “At the moment, there is a tipping toward slowing growth and a question of whether there will be a negative European shock, and that will favor low-risk assets. But to whatever extent we have negative conditions, central banks will respond by printing more money. There will be a big spurt of printing of money, and that will cause a rally and an improvement in the stock markets around the world. It’s like a shot of adrenaline: The heart starts pumping again and then it fades. Then there is another shot of adrenaline. Everybody is asking, “Are we going to have a bull market or a bear market?” I expect we will have both with no big trend. Typically, in these up and down cycles, the upswing will last about twice as long as a down swing. We are now in the higher range of the up-cycle.”

You can read more of Ray’s interview here:

Back to Camp David and the forthright language of point 31 seems sufficiently united to suggest its a topic that we may see in the headlines more because it has a tone of imminence to it…

Here’s the official statement for your ‘leggera’ reading pleasure.

Camp David Declaration

Camp David, Maryland, United States

May 18-19, 2012

Preamble

1. We, the Leaders of the Group of Eight, met at Camp David on May 18 and 19, 2012 to address major global economic and political challenges.

The Global Economy

2. Our imperative is to promote growth and jobs.

3. The global economic recovery shows signs of promise, but significant headwinds persist.

4. Against this background, we commit to take all necessary steps to strengthen and reinvigorate our economies and combat financial stresses, recognizing that the right measures are not the same for each of us.

5. We welcome the ongoing discussion in Europe on how to generate growth, while maintaining a firm commitment to implement fiscal consolidation to be assessed on a structural basis. We agree on the importance of a strong and cohesive Eurozone for global stability and recovery, and we affirm our interest in Greece remaining in the Eurozone while respecting its commitments. We all have an interest in the success of specific measures to strengthen the resilience of the Eurozone and growth in Europe. We support Euro Area Leaders’ resolve to address the strains in the Eurozone in a credible and timely manner and in a manner that fosters confidence, stability and growth.

6. We agree that all of our governments need to take actions to boost confidence and nurture recovery including reforms to raise productivity, growth and demand within a sustainable, credible and non-inflationary macroeconomic framework. We commit to fiscal responsibility and, in this context, we support sound and sustainable fiscal consolidation policies that take into account countries’ evolving economic conditions and underpin confidence and economic recovery.

7. To raise productivity and growth potential in our economies, we support structural reforms, and investments in education and in modern infrastructure, as appropriate. Investment initiatives can be financed using a range of mechanisms, including leveraging the private sector. Sound financial measures, to which we are committed, should build stronger systems over time while not choking off near-term credit growth. We commit to promote investment to underpin demand, including support for small businesses and public-private partnerships.

8. Robust international trade, investment and market integration are key drivers of strong sustainable and balanced growth. We underscore the importance of open markets and a fair, strong, rules-based trading system. We will honor our commitment to refrain from protectionist measures, protect investments and pursue bilateral, plurilateral, and multilateral efforts, consistent with and supportive of the WTO framework, to reduce barriers to trade and investment and maintain open markets. We call on the broader international community to do likewise. Recognizing that unnecessary differences and overly burdensome regulatory standards serve as significant barriers to trade, we support efforts towards regulatory coherence and better alignment of standards to further promote trade and growth.

9. Given the importance of intellectual property rights (IPR) to stimulating job and economic growth, we affirm the significance of high standards for IPR protection and enforcement, including through international legal instruments and mutual assistance agreements, as well as through government procurement processes, private-sector voluntary codes of best practices, and enhanced customs cooperation, while promoting the free flow of information. To protect public health and consumer safety, we also commit to exchange information on rogue internet pharmacy sites in accordance with national law and share best practices on combating counterfeit medical products.

Energy and Climate Change

10. As our economies grow, we recognize the importance of meeting our energy needs from a wide variety of sources ranging from traditional fuels to renewables to other clean technologies. As we each implement our own individual energy strategies, we embrace the pursuit of an appropriate mix from all of the above in an environmentally safe, sustainable, secure, and affordable manner. We also recognize the importance of pursuing and promoting sustainable energy and low carbon policies in order to tackle the global challenge of climate change. To facilitate the trade of energy around the world, we commit to take further steps to remove obstacles to the evolution of global energy infrastructure; to reduce barriers and refrain from discriminatory measures that impede market access; and to pursue universal access to cleaner, safer, and more affordable energy. We remain committed to the principles on global energy security adopted by the G-8 in St. Petersburg.

11. As we pursue energy security, we will do so with renewed focus on safety and sustainability. We are committed to establishing and sharing best practices on energy production, including exploration in frontier areas and the use of technologies such as deep water drilling and hydraulic fracturing, where allowed, to allow for the safe development of energy sources, taking into account environmental concerns over the life of a field. In light of the nuclear accident triggered by the tsunami in Japan, we continue to strongly support initiatives to carry out comprehensive risk and safety assessments of existing nuclear installations and to strengthen the implementation of relevant conventions to aim for high levels of nuclear safety.

12. We recognize that increasing energy efficiency and reliance on renewables and other clean energy technologies can contribute significantly to energy security and savings, while also addressing climate change and promoting sustainable economic growth and innovation. We welcome sustained, cost-effective policies to support reliable renewable energy sources and their market integration. We commit to advance appliance and equipment efficiency, including through comparable and transparent testing procedures, and to promote industrial and building efficiency through energy management systems.

13. We agree to continue our efforts to address climate change and recognize the need for increased mitigation ambition in the period to 2020, with a view to doing our part to limit effectively the increase in global temperature below 2ºC above pre-industrial levels, consistent with science. We strongly support the outcome of the 17th Conference of the Parties to the U.N. Framework Convention on Climate Change (UNFCCC) in Durban to implement the Cancun agreements and the launch of the Durban Platform, which we welcome as a significant breakthrough toward the adoption by 2015 of a protocol, another legal instrument or an agreed outcome with legal force applicable to all Parties, developed and developing countries alike. We agree to continue to work together in the UNFCCC and other fora, including through the Major Economies Forum, toward a positive outcome at Doha.

14. Recognizing the impact of short-lived climate pollutants on near-term climate change, agricultural productivity, and human health, we support, as a means of promoting increased ambition and complementary to other CO2 and GHG emission reduction efforts, comprehensive actions to reduce these pollutants, which, according to UNEP and others, account for over thirty percent of near-term global warming as well as 2 million premature deaths a year. Therefore, we agree to join the Climate and Clean Air Coalition to Reduce Short-lived Climate Pollutants.

15. In addition, we strongly support efforts to rationalize and phase-out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption, and to continue voluntary reporting on progress.

Food Security and Nutrition

16. For over a decade, the G-8 has engaged with African partners to address the challenges and opportunities afforded by Africa’s quest for inclusive and sustainable development. Our progress has been measurable, and together we have changed the lives of hundreds of millions of people. International assistance alone, however, cannot fulfill our shared objectives. As we move forward, and even as we recommit to working together to reduce poverty, we recognize that our task is also to foster the change that can end it, by investing in Africa’s growth, its expanding role in the global economy, and its success. As part of that effort, we commit to fulfill outstanding L’Aquila financial pledges, seek to maintain strong support to address current and future global food security challenges, including through bilateral and multilateral assistance, and agree to take new steps to accelerate progress towards food security and nutrition in Africa and globally, on a complementary basis.

17. Since the L’Aquila Summit, we have seen an increased level of commitment to global food security, realignment of assistance in support of country-led plans, and new investments and greater collaboration in agricultural research. We commend our African partners for the progress made since L’Aquila, consistent with the Maputo Declaration, to increase public investments in agriculture and to adopt the governance and policy reforms necessary to accelerate sustainable agricultural productivity growth, attain greater gains in nutrition, and unlock sustainable and inclusive country-led growth. The leadership of the African Union and the role of its Comprehensive Africa Agriculture Development Program (CAADP) have been essential.

18. Building on this progress, and working with our African and other international partners, today we commit to launch a New Alliance for Food Security and Nutrition to accelerate the flow of private capital to African agriculture, take to scale new technologies and other innovations that can increase sustainable agricultural productivity, and reduce the risk borne by vulnerable economies and communities. This New Alliance will lift 50 million people out of poverty over the next decade, and be guided by a collective commitment to invest in credible, comprehensive and country-owned plans, develop new tools to mobilize private capital, spur and scale innovation, and manage risk; and engage and leverage the capacity of private sector partners – from women and smallholder farmers, entrepreneurs to domestic and international companies.

19. The G-8 reaffirms its commitment to the world’s poorest and most vulnerable people, and recognizes the vital role of official development assistance in poverty alleviation and achieving the Millennium Development Goals. As such, we welcome and endorse the Camp David Accountability Report which records the important progress that the G-8 has made on food security consistent with commitments made at the L’Aquila Summit, and in meeting our commitments on global health, including the Muskoka initiative on maternal, newborn and child health. We remain strongly committed to reporting transparently and consistently on the implementation of these commitments. We look forward to a comprehensive report under the UK Presidency in 2013.

Afghanistan’s Economic Transition

20. We reaffirm our commitment to a sovereign, peaceful, and stable Afghanistan, with full ownership of its own security, governance and development and free of terrorism, extremist violence, and illicit drug production and trafficking. We will continue to support the transition process with close coordination of our security, political and economic strategies.

21. With an emphasis on mutual accountability and improved governance, building on the Kabul Process and Bonn Conference outcomes, our countries will take steps to mitigate the economic impact of the transition period and support the development of a sustainable Afghan economy by enhancing Afghan capacity to increase fiscal revenues and improve spending management, as well as mobilizing non-security assistance into the transformation decade.

22. We will support the growth of Afghan civil society and will mobilize private sector support by strengthening the enabling environment and expanding business opportunities in key sectors, as well as promote regional economic cooperation to enhance connectivity.

23. We will also continue to support the Government of the Islamic Republic of Afghanistan in its efforts to meet its obligation to protect and promote human rights and fundamental freedoms, including in the rights of women and girls and the freedom to practice religion.

24. We look forward to the upcoming Tokyo Conference in July, as it generates further long-term support for civilian assistance to Afghanistan from G-8 members and other donors into the transformation decade; agrees to a strategy for Afghanistan’s sustainable economic development, with mutual commitments and benchmarks between Afghanistan and the international community; and provides a mechanism for biennial reviews of progress being made against those benchmarks through the transformation decade.

The Transitions in the Middle East and North Africa

25. A year after the historic events across the Middle East and North Africa began to unfold, the aspirations of people of the region for freedom, human rights, democracy, job opportunities, empowerment and dignity are undiminished. We recognize important progress in a number of countries to respond to these aspirations and urge continued progress to implement promised reforms. Strong and inclusive economic growth, with a thriving private sector to provide jobs, is an essential foundation for democratic and participatory government based on the rule of law and respect for basic freedoms, including respect for the rights of women and girls and the right to practice religious faith in safety and security.

26. We renew our commitment to the Deauville Partnership with Arab Countries in Transition, launched at the G-8 Summit last May. We welcome the steps already taken, in partnership with others in the region, to support economic reform, open government, and trade, investment and integration.

27. We note in particular the steps being taken to expand the mandate of the European Bank for Reconstruction and Development to bring its expertise in transition economies and financing support for private sector growth to this region; the platform established by international financial institutions to enhance coordination and identify opportunities to work together to support the transition country reform efforts; progress in conjunction with regional partners toward establishing a new transition fund to support country-owned policy reforms complementary to existing mechanisms; increased financial commitments to reforming countries from international and regional financial institutions, the G-8 and regional partners; strategies to increase access to capital markets to help boost private investment; and commitments from our countries and others to support small and medium-sized enterprises, provide needed training and technical assistance and facilitate international exchanges and training programs for key constituencies in transition countries.

28. Responding to the call from partner countries, we endorse an asset recovery action plan to promote the return of stolen assets and welcome, and commit to support the action plans developed through the Partnership to promote open government, reduce corruption, strengthen accountability and improve the regulatory environment, particularly for the growth of small- and medium-sized enterprises. These governance reforms will foster the inclusive economic growth, rule of law and job creation needed for the success of democratic transition. We are working with Partnership countries to build deeper trade and investment ties, across the region and with members of the G-8, which are critical to support growth and job creation. In this context, we welcome Partnership countries’ statement on openness to international investment.

29. G-8 members are committed to an enduring and productive partnership that supports the historic transformation underway in the region. We commit to further work during the rest of 2012 to support private sector engagement, asset recovery, closer trade ties and provision of needed expertise as well as assistance, including through a transition fund. We call for a meeting in September of Foreign Ministers to review progress being made under the Partnership.

Political and Security Issues

30. We remain appalled by the loss of life, humanitarian crisis, and serious and widespread human rights abuses in Syria. The Syrian government and all parties must immediately and fully adhere to commitments to implement the six-point plan of UN and Arab League Joint Special Envoy (JSE) Kofi Annan, including immediately ceasing all violence so as to enable a Syrian-led, inclusive political transition leading to a democratic, plural political system. We support the efforts of JSE Annan and look forward to seeing his evaluation, during his forthcoming report to the UN Security Council, of the prospects for beginning this political transition process in the near-term. Use of force endangering the lives of civilians must cease. We call on the Syrian government to grant safe and unhindered access of humanitarian personnel to populations in need of assistance in accordance with international law. We welcome the deployment of the UN Supervision Mission in Syria, and urge all parties, in particular the Syrian government, to fully cooperate with the mission. We strongly condemn recent terrorist attacks in Syria. We remain deeply concerned about the threat to regional peace and security and humanitarian despair caused by the crisis and remain resolved to consider further UN measures as appropriate.

31. We remain united in our grave concern over Iran’s nuclear program. We call on Iran to comply with all of its obligations under relevant UNSC resolutions and requirements of the International Atomic Energy Agency’s (IAEA) Board of Governors. We also call on Iran to continuously comply with its obligations under the Nuclear Non-Proliferation Treaty, including its safeguards obligations. We also call on Iran to address without delay all outstanding issues related to its nuclear program, including questions concerning possible military dimensions. We desire a peaceful and negotiated solution to concerns over Iran’s nuclear program, and therefore remain committed to a dual-track approach. We welcome the resumption of talks between Iran and the E3+3 (China, France, Germany, Russia, the United Kingdom, the United States, and the European Union High Representative). We call on Iran to seize the opportunity that began in Istanbul, and sustain this opening in Baghdad by engaging in detailed discussions about near-term, concrete steps that can, through a step-by-step approach based on reciprocity, lead towards a comprehensive negotiated solution which restores international confidence that Iran’s nuclear program is exclusively peaceful. We urge Iran to also comply with international obligations to uphold human rights and fundamental freedoms, including freedom of religion, and end interference with the media, arbitrary executions, torture, and other restrictions placed on rights and freedoms.

32. We continue to have deep concerns about provocative actions of the Democratic People’s Republic of Korea (DPRK) that threaten regional stability. We remain concerned about the DPRK’s nuclear program, including its uranium enrichment program. We condemn the April 13, 2012, launch that used ballistic missile technology in direct violation of UNSC resolution. We urge the DPRK to comply with its international obligations and abandon all nuclear and ballistic missile programs in a complete, verifiable, and irreversible manner. We call on all UN member states to join the G-8 in fully implementing the UNSC resolutions in this regard. We affirm our will to call on the UN Security Council to take action, in response to additional DPRK acts, including ballistic missile launches and nuclear tests. We remain concerned about human rights violations in the DPRK, including the situation of political prisoners and the abductions issue.

33. We recognize that according women full and equal rights and opportunities is crucial for all countries’ political stability, democratic governance, and economic growth. We reaffirm our commitment to advance human rights of and opportunities for women, leading to more development, poverty reduction, conflict prevention and resolution, and improved maternal health and reduced child mortality. We also commit to supporting the right of all people, including women, to freedom of religion in safety and security. We are concerned about the reduction of women’s political participation and the placing at risk of their human rights and fundamental freedoms, including in Middle East and North Africa countries emerging from conflict or undergoing political transitions. We condemn and avow to stop violence directed against, including the trafficking of, women and girls. We call upon all states to protect human rights of women and to promote women’s roles in economic development and in strengthening international peace and security.

34. We pay tribute to the remarkable efforts of President Thein Sein, Daw Aung San Suu Kyi, and many other citizens of Burma/Myanmar to deliver democratic reform in their country over the past year. We recognize the need to secure lasting and irreversible reform, and pledge our support to existing initiatives, particularly those which focus on peace in ethnic area, national reconciliation, and entrenching democracy. We also stress the need to cooperate to further enhance aid coordination among international development partners of Burma/Myanmar and conduct investment in a manner beneficial to the people of Burma/Myanmar.

35. We recognize the particular sacrifices made by the Libyan people in their transition to create a peaceful, democratic, and stable Libya. The international community remains committed to actively support the consolidation of the new Libyan institutions.

36. We condemn transnational organized crime and terrorism in all forms and manifestations. We pledge to enhance our cooperation to combat threats of terrorism and terrorist groups, including al-Qa’ida, its affiliates and adherents, and transnational organized crime, including individuals and groups engaged in illicit drug trafficking and production. We stress that it is critical to strengthen efforts to curb illicit trafficking in arms in the Sahel area, in particular to eliminate the Man-Portable Air Defense Systems proliferated across the region; to counter financing of terrorism, including kidnapping for ransom; and to eliminate support for terrorist organizations and criminal networks. We urge states to develop necessary capacities including in governance, education, and criminal justice systems, to address, reduce and undercut terrorist and criminal threats, including “lone wolf” terrorists and violent extremism, while safeguarding human rights and upholding the rule of law. We underscore the central role of the United Nations and welcome the Global Counterterrorism Forum (GCTF) and efforts of the Roma-Lyon Group in countering terrorism. We reaffirm the need to strengthen the implementation of the UN Al-Qaida sanctions regime, and the integrity and implementation of the UN conventions on drug control and transnational organized crime.

37. We reaffirm that nonproliferation and disarmament issues are among our top priorities. We remain committed to fulfill all of our obligations under the Nuclear Nonproliferation Treaty and, concerned about the severe proliferation challenges, call on all parties to support and promote global nonproliferation and disarmament efforts.

38. We welcome and fully endorse the G-8 Foreign Ministers Meeting Chair’s Statement with accompanying annex.

Conclusion

39. We look forward to meeting under the presidency of the United Kingdom in 2013.

Indeed!

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 20 May 2012.

by Roger Montgomery Posted in Economics.

- 9 Comments

- save this article

- 9

- POSTED IN Economics.

-

Guest Post: Who’s on the Phone?

Roger Montgomery

April 29, 2012

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.Take a look at any of the financial media channels or websites and you will likely notice the prevalence of brokers, advisors and commentators claiming that Australian stocks are currently cheap when viewed on a P/E basis. There is no denying that at the present time investors in the Australian stock market are willing to pay considerably less for the earnings of a company than they were just a few years ago. There are a number of possible explanations for this from the risk of external shocks to the increased demand for fixed income securities but there is no doubt that one of the main drivers of the lower market multiple is that investors are pricing in an expectation of lower growth rates in the majority of industries. The earnings of companies in retail, mining, property and construction just to name a few are all expected to experience low to moderate growth, if not stagnation, in the foreseeable future.

In an environment where opportunities for growth are sparse, when a true opportunity presents itself investors have demonstrated their willingness to pay up. There is no better example of this than the substantially higher industry average P/E in the telecommunications sector, where internet growth and new technological developments are driving rates of growth unrivaled elsewhere in the market. As a result investors have their eyes set on discovering the next rising star in the telecommunications world. My Net Fone Ltd may be about to have its turn in the limelight.

My Net Fone (ASX:MNF)

In the words of the company:

“My Net Fone Limited, (ASX:MNF) is Australia’s leading provider of hosted voice and data communications services for residential, business and enterprise users. My Net Fone was first founded in 2004, was listed on the ASX in mid 2006, has 52.5 million shares on issue, has operated profitably since 2009 and has paid dividends to its shareholders every six months since September 2010.

The company has a reputation for quality, value and innovation, having won numerous awards including the Deloitte Technology Fast 50 (2008, 2009, and 2010), PC User Product of the Year (2005), Money Magazine Product of the Year (2007) and many others.

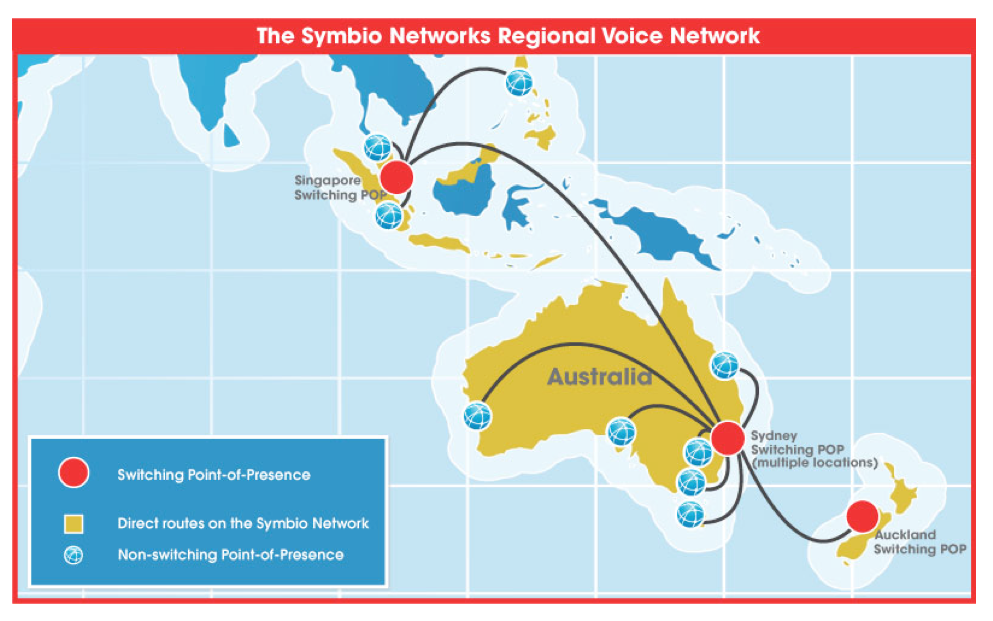

My Net Fone’s wholly owned subsidiary, Symbio, owns and operates Australia’s largest VoIP network, providing wholesale carrier services to the Australian industry, including number porting, cloud‐based hosted PBX services, call termination, call origination and many other infrastructure enabled services. The Symbio network carries over 1.5 Billion minutes of voice per annum.”

What is VoIP? A Look At The Industry

Before looking closer at MNF, it is helpful to have a sound understanding of the industry in which the company operates. Indeed one should first gain a complete and comprehensive understanding of the injdustry and the competitive landscape.

VoIP, or Voice Over Internet Protocol, in its simplest form refers to the group of services that use the internet as a means for communication rather than the standard phone line. A phone call via VoIP involves the call conversation being split into data packets, transmitted over the internet and then reassembled at the other end. The primary benefit as a result is that there is no need for line rental, which provides significant savings to consumers and businesses alike. While cost reduction is generally seen as the most attractive feature of VoIP services the benefits are not limited solely to reduced expenses with a range of other products and services offered by MNF including Virtual PBX, number porting, SIP trunking and hosted services. While their terms may sound complicated they all fit under the catch all term of ‘VoIP.’

The VoIP market is highly competitive and the battle is generally fought over price. For a retail customer, the main reason you would choose VoIP over your traditional provider would of course be the cost savings that occur as a result. But for small and medium businesses, while cost is also of primary importance, other factors come into consideration including product offering, service quality and the ability of the provider to continually innovate and develop new products and services.

VoIP is not new nor is it only just now gaining popularity. If you have ever used Skype or a similar service, you have used VoIP (in fact Skype is a client of MNF’s wholesale division). But there are different VoIP service types and the kind you use when you Skype your family while away on holiday is very different to the kind you would install in your small to medium sized business of 50 full time employees. The two do not directly compete with each other. Sure, businesses may use Skype for video conferencing, but they will still need a communications system, multiple phone numbers, 1300 numbers, fax over IP, remote access to their VoIP number and a host of other services provided by MNF and their competitors. Customers of MNF have reported cost savings on phone bills of up to 50% and in the current business environment it seems likely that businesses will continue to look at ways to reduce costs while still maintaining or even increasing productivity. VoIP services have much to offer small to medium businesses in this regard.

In the early years of VoIP the main restriction was (and at times still is) the issue of low quality broadband. If the broadband connection was weak then the quality of the VoIP service would follow suit, thus making the adoption of VoIP unworthy of the investment for anyone without the highest quality broadband connection. It is no surprise then that in the case of Europe those countries with a high rate of strong broadband connection to homes and businesses (eg France) saw a higher uptake of VoIP than European countries with lower rates of high quality broadband access.

As broadband speeds improve, so too will the quality and available range of VoIP services in Australia. The roll out of the NBN will provide significant opportunities for MNF across all divisions of their business. As more people have access to fast, high quality broadband the potential market for MNF will grow. In the transition period there is likely to be a strong push for new customer acquisition by service providers as retail and business customers alike consider changing from their service type and/or service provider (See MNF’s current marketing program offering significant savings for customers to sign up prior to the roll out of the NBN). While this could result in greater competition in the business and retail markets, as we will see the wholesale division is well positioned to benefit from more service providers setting up shop creating higher demand for wholesale services.

Historic Performance – A Demonstrated Track Record Of Growth

Many investors require a demonstrated track record, which is seen as a way to further reduce the risk one takes in any given investment. As a result there are those who will take one look at the financial reports of MNF, notice the accumulated losses and be frightened away, preferring to wait until MNF has had a few years of strong returns, improving margins and profit growth under its belt. For some, turnaround stories are no go zones.

There is nothing wrong with this method of investing, in fact it can be incredibly successful (witness one W.E. Buffett) but in the case of MNF it is important to understand why the company experienced losses in its early years and why the profits are about to start rolling in.

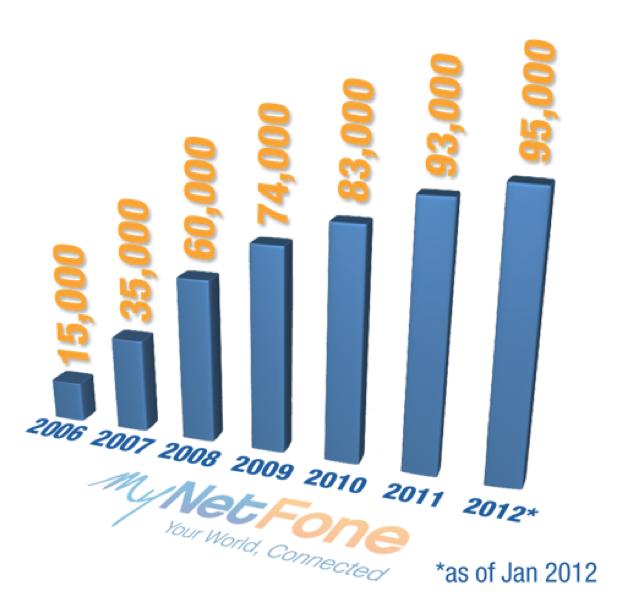

First of all, MNF does possess a proven track record in regards to consistent revenue growth. MNF was started from scratch and has since grown to become a company that currently has 95000 subscribers. Any business owner will know that in the early years of operation profits can take time to come to fruition and a period of investment and cash outflows inevitably precedes growth in scale and subsequent cash inflows. In the case of MNF the company was operating in a brand new industry where the majority of individuals and businesses were still becoming aware of the potential for VoIP services, not to mention the fact that only the tech savvy had the necessary high speed broadband connection to make VoIP worthy of investment in the first place. In 2006, a year that VoIP uptake experienced rapid growth, 19 percent of small to medium businesses in Australia used VoIP services. But of those that didn’t, 35% were completely unaware it existed and another 7% did not understand how it could be implemented into their business.

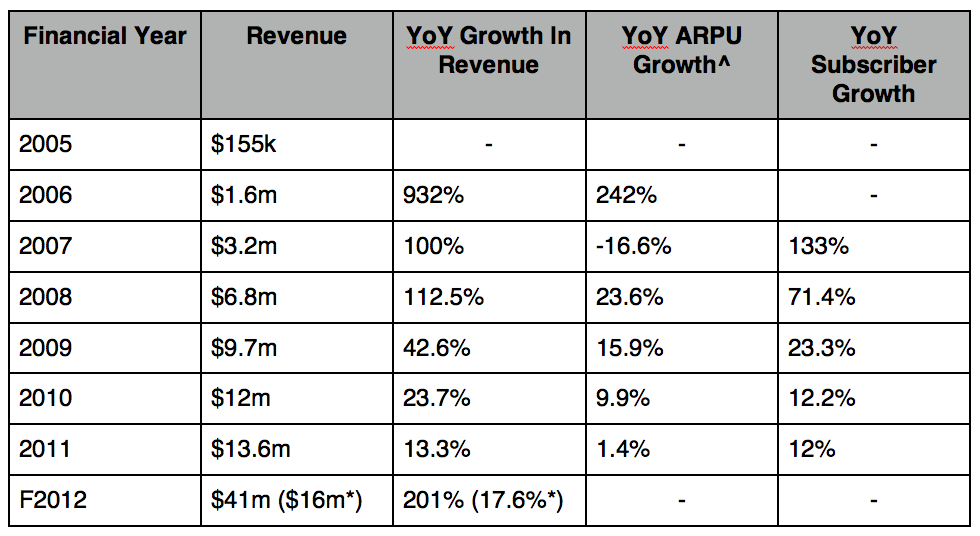

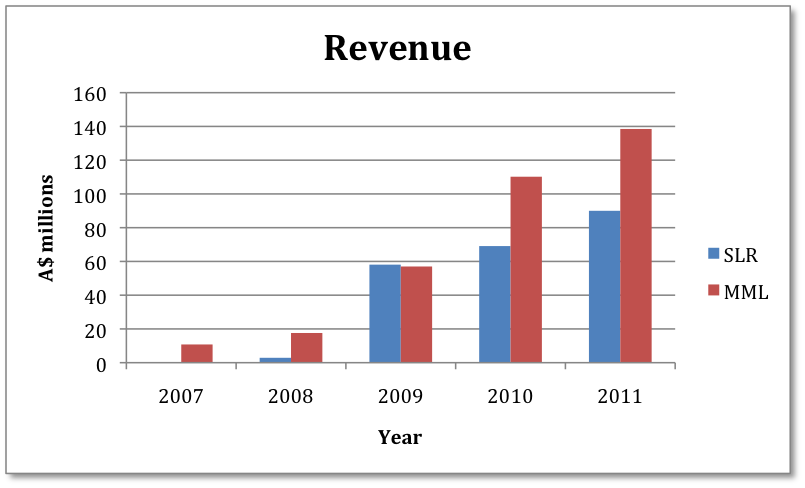

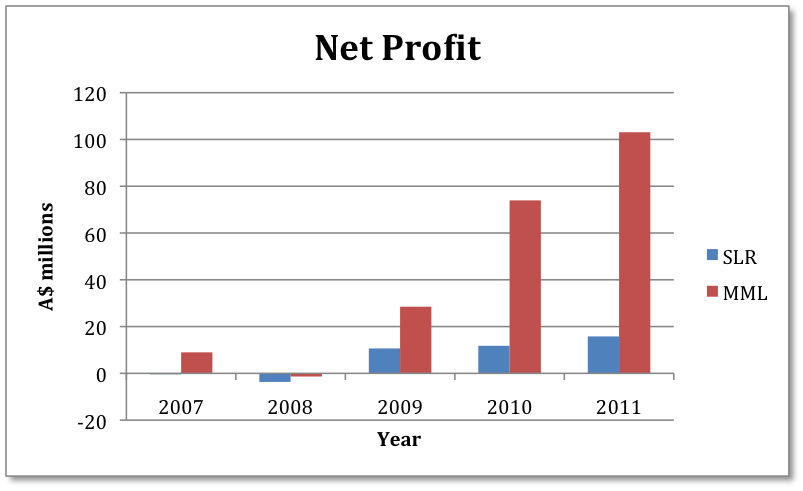

Having said that the growth in revenues (shown in the table below) since MNF listed as a public company is very impressive.

^Provides general summary; figures are not broken down into individual or small to medium business customers

*Minus the contribution of the newly acquired Symbio Networks

Similarly impressive is the year on year growth in MNF’s total customer base, as shown both in the table above and below in a graphic from the company’s website.

Today consumer awareness regarding VoIP is strong and growing. The uptake amongst small and medium businesses is gaining considerable traction due to the significant cost savings and continually developing services on offer. While MNF’s subscriber growth rate is declining from its dizzying heights the company now has access to the potentially lucrative wholesale market through their acquisition of Symbio Networks. And to top things off the government is about to gift MNF with a once in a lifetime opportunity.

NBN – Opportunities Abound For MNF

As previously mentioned, in the past one of the restrictions holding back individuals and businesses from subscribing to VoIP based services was the lack of access to high quality broadband. While broadband penetration in Australia is not particularly low (we were ranked 21st out of OECD countries for fixed broadband penetration and 8th for wireless broadband penetration as at 30 June 2011) the roll out of the National Broadband Network (NBN) will only serve to increase the equality of access to high speed broadband across Australia. What this means is that MNF’s potential market will grow as the NBN roll out progresses.

The capability of MNF’s services are enhanced by any increase in computer power, software/hardware development or internet speeds. Furthermore since product innovation is a demonstrated strength of the company, as technology progresses the range of potential product and service offerings that MNF can deliver to their market will increase. Product and service innovation is a vital differentiating factor in any highly competitive market.

The NBN, in the company’s own words is “a once in a lifetime opportunity” for new customer acquisition as their is a mass transition from the current copper fibre network to the NBN. If the NBN achieves its objectives 93% of Australian households, schools and businesses will have access to broadband services. This will increase the up take potential for residential and SMB VoIP services significantly, and while MNF will likely have to deal with the arrival of many, many new competitors as a result of the expanding market, their wholesale division is likely to benefit from general growth of the VoIP market regardless of which service providers win market share.

(on the flip side, note the higher costs to all competitors/participants after the NBN rolls out and consider the implications of the NBN possibly becoming fibre to the node if Labour loses the next election)

The Importance Of Scale and Differentiation

As an investor it is certainly advantageous to focus on industries experiencing rapid growth. As they say, ‘A rising tide lifts all boats’ and to an extent this will be seen in the performance of internet and VoIP service providers for years to come as the tremendous growth rates are forecast to continue into the foreseeable future. But a market experiencing rapid growth breeds intense competition and if a company cannot differentiate itself from the pack it will be left to fight solely on the basis of being the lowest cost provider, which very rarely ends well for those involved.

There are two things that can separate a company from the pack and ensure it achieves financial performance above the industry average. The first is the presence of scale. MNF’s margins have historically been quite tight, but as revenue grows the margins will naturally improve. The VoIP service industry, while intensely competitive, is such that those who are able to achieve economies of scale have the potential to experience strong margin expansion as each incremental dollar of revenue generates a higher proportion of value to the bottom line. Symbio Networks, the wholesale division of MNF, currently operates at 50% utilisation leaving significant room for margins to be increased at little incremental cost to the company. So while revenue growth will likely taper off to more sustainable growth rates it is highly likely that NPAT growth will outpace revenue growth over the next few years.

In order to reach and sustain a level where economies of scale begin to benefit the bottom line, a company like MNF needs to be able to differentiate itself from competitors. There needs to be a reason why individuals and businesses will choose MNF over other VoIP providers if we, as investors, can be confident that the current high rates of return being generated by the company can be sustained.

The first differentiating factor relates to the vision of MNF management and their focus since the founding of the company. Unlike some of their larger competitors who are being forced to make the transition from older technologies and offer VoIP in addition to their current services, MNF is coming off a lower cost base and with sole focus on New Generation Networks and innovation within the VoIP market. Since the founding of MNF the goal has been “to be the leading VoIP provider in Australia.” The acquisition of the owner of the largest supplier of VoIP wholesale and managed services in Australia also helps separate MNF from the pack.

A quick read through MNF’s past annual reports will give you an idea of the demonstrated ability of the company to come up with new and innovative product offerings. In the past this has no doubt served to enhance the ability of MNF to grab market share, and is reflected in their many industry awards for exceptional products and services. As an investor your job is to determine whether or not MNF will be able to sustain the current high rates of return well in to the future. Start by researching the company’s product offering, read testimonials and compare it with those of MNF’s competitors. Sometimes the best way to form a view over the future of a company is not to approach things as an investor, but to view the business from the perspective of a potential customer.

Perhaps the most attractive feature of MNF’s business model and that which most effectively differentiates MNF from its competitors is the fact that the company is not simply a reseller of VoIP services. A large proportion of VoIP providers are in the business of buying from a wholesaler and reselling the product to the end consumer. Prior to the acquisition of Symbio, this is what it appeared as though MNF was doing when Symbio Networks was external but in actual fact the company was creating these voice services using Symbio’s VoIP technology, adding value through internally developed software and delivering a unique product offering to their customers. The company places a great deal of importance on the development of software and intellectual property to ensure they add value to the services they sell to customers. In the words of the CEO, Rene Sugo, “Today our advantage is largely technical – in terms of scalability, quality, reliability and innovative intellectual property. That is what has driven our growth, and will continue to do so in the medium term.”

Ultimately there is no negating the fact that for a company like MNF (where product development and technological advancement happens faster than most of us can fathom) we are heavily reliant on the competence of management.

The Founders – Interests aligned with shareholders

The two founders, Andy Fung and Rene Sugo, own just over 50% of the company between them. In the first quarter of this year Andy Fung retired from his position as CEO and Rene Sugo took his place. Fung is staying on as a non-executive director and retains his significant holding in the company. Both have strong backgrounds in the telecommunications industry, as well as experience and in depth knowledge in the area of Next Generation Networks. In the ever developing industry of VoIP service providers, experienced and business savvy management is integral to a company’s success.

There is more than just their significant shareholdings in the company that indicates management’s strong desire for MNF to succeed. In the early stages the directors performed services for the company at no or low cost and salaries were kept artificially low as the company dealt with the low capital base nature of a start up business. Similarly, the company was “supported by the low cost provision of services, technology and business support from Symbio Networks Pty Ltd during the start up and early growth phase of the business.” Andy Fung and Rene Sugo were the founders of Symbio Networks, and the company is now wholly owned by My Net Fone after the (related party?) acquisition was finalised earlier this year.

When MNF listed in 2006 they raised $2.5m. Unlike so many of the companies that list on the ASX these funds were not used to repay loans to related parties or to line the pockets of directors, but to fund an expanded marketing program and increase sales and support staff, which was no doubt a raging success evidenced by the growth in total customer numbers of those early years.

Management have also shown their ability to innovate and stay one step ahead of the market. They were the first to remove the pay-for-time model of pricing on international calls and pioneered the move to the now prevalent flat charge for international VoIP calls. The development of ‘On-the-Go’ services which allowed customers to access VoIP services on their mobile in 2007, ‘Meet-Me Conferencing’ in 2010 and the regularly introduced new service plans available to customers are all examples of MNF’s commitment to continually innovating their product offering.

In the process of conducting your research on MNF, do as Roger has suggested frequently here and read each financial report from the prospectus through to the most recent half yearly report. No doubt you will notice the trend of management promising something one year and delivering the next. This is, I believe, exactly what you should be looking for in the management of companies you choose to invest in. In the announcements regarding the Symbio acquisition, and in related articles, the CEO of MNF regularly described the increase in growth that he believed the company was about to experience. On the 23rd of April the company delivered yet again with a profit upgrade that they attributed to the “outstanding performance across the group,” particularly in the March quarter.

The interests of management appear strongly aligned with those of shareholders and as investors our money seems in more than capable hands. Do take the time to read the past annual reports of MNF. Not only will you better understand the growth path that management have in mind for the company but you will most certainly notice the way in which management come across as genuinely interested in the future of the company, its customers and its shareholders, something which is unfortunately rare in many ASX listed companies.

Symbio Networks – A Game Changer For My Net Fone

In September of last year MNF announced they were acquiring Symbio Networks for a maximum consideration of $6m. Symbio Networks is Australia’s largest supplier of VoIP wholesale and managed services. The company was founded by Andy Fung and Rene Sugo, the same founders of My Net Fone. The acquisition of Symbio significantly changes the dynamics of MNF as it means the company is now positioned to benefit from the entry of more VoIP providers.

Management plans to run Symbio as a wholly owned subsidiary, separate to the day to day business of My Net Fone. This is important as some of Symbio’s customers are direct competitors with the retail and business division of MNF. Symbio is actually larger than My Net Fone when comparing on the basis of revenues, with $25m of MNF’s FY12 revenue expected to come from Symbio.

The wholesale operations Symbio brings with it is a game changer for MNF. It means that the company is effectively diversified from the inevitable increase in competition that is sure to arise if and when VoIP uptake continues to grow. While the business and retail division benefits only if customers choose MNF over its competitors, Symbio, as the owner and operator of Australia’s largest VoIP network, is positioned to benefit from any overall increase in competition.

Because Symbio has clients across the Asia Pacific the company will not only benefit from the NBN in Australia, but are also positioned to do well from any further increase in broadband penetration or VoIP uptake in Singapore, New Zealand and Malaysia. As such the growth potential for Symbio, and thus MNF, is not limited solely to the Australian market.

The story of both Symbio Networks and My Net Fone are evidence of in my opinion, the visionary skills of the founders of both companies, Andy Fung and Rene Sugo. What we are seeing in the market today with increased uptake of VoIP, new VoIP related products and services being developed and the beginnings of the transition of VoIP to mobile applications, were all envisioned by Fung and Sugo as early as 2002. Today, Rene Sugo is the CEO of the merged entity and Andy Fung will remain as an advisor, consultant and significant shareholder. If their current views on the potential growth in the wholesale, retail and business divisions of their company is half as accurate as their views from ten years ago then it appears MNF is well positioned for the future.

Key Risks (may not be exhaustive)

While the prospects for MNF appear very attractive, like any investment there are risks one needs to consider:

- The NBN: While the NBN is expected to be a fantastic opportunity for MNF there are risks that surround its ultimate effect on the company. These risks include potential increases in costs that favour the larger ISPs, the possibility of substantial changes to the NBN between now and final rollout and of course the fact that the opposition intends to scrap the plan altogether. The first of these risks is reduced by the merger of My Net Fone and Symbio and the fact that MNF’s customer base, while not among the largest, is substantial at around 100,000 customers. The risk of any changes to the details of the NBN that may negatively impact MNF is negated somewhat by management’s active and ongoing correspondence with government and the fact that as the largest VoIP network operator in Australia MNF does indeed have some say in negotiations. And finally if the NBN were to be scrapped, business would go on as usual and if the recent past is anything to go by MNF will continue to grow both revenues and subscribers.

- With the acquisition of Symbio, MNF is liable to pay up to $6m depending on the performance of the now wholly owned subsidiary. The risk here is that if cash flows are impaired for whatever reason the company may need to reduce its dividend payment to fulfill its obligations. With current strong operating cash flows, growing profits and no debt this risk appears minimal.

- External shocks. While MNF is not immune to financial crises occurring in Europe, China or even here in Australia, to some degree their business is defensive in nature. The worse the economic environment becomes the more likely businesses and consumers will decide to cut costs. MNF’s services offer cost reductions in conjunction with improved efficiency and so will benefit from more Australian businesses looking to reduce their overheads.

- VoIP failing to grow and/or the introduction of a new disruptive technology. VoIP itself is a disruptive technology and one that old generation service providers are now finding themselves forced to deal with. But that does not mean a new, more efficient technology won’t come along and steal some of VoIP’s market share, so this risk is certainly one to keep in mind.

- Some other risks may be covered by watching for director’s selling of stock

The Financials

As outlined earlier MNF have grown revenues consistently since listing on the ASX. This year they are forecast to generate $41m in revenue, with $25m coming from the recently acquired Symbio Networks. In their recent earnings upgrade management forecast FY12 NPAT to come in between $2.75m and $3m, with FY13 NPAT guidance for $4m (Note: as a result of past losses the company has tax assets of $930k). If we assume the lower end of guidance then on a fully diluted basis MNF will earn around 5c per share in FY12. In the past the company has paid a dividend around half of the total earnings and with operating cash flows remaining strong there seems no reason why that will stop any time soon. Under these assumptions the company is currently trading on a PE of 7.5 and is paying a respectable dividend. What multiple should the market attribute to a company undergoing strong growth in earnings, paying a healthy dividend and operating in the rapidly expanding internet industry? That is anyone’s guess but there are numerous examples of similar companies currently trading on the ASX that the market has priced on a P/E multiple in the mid-teens, and there is no reason why MNF will not or should not be priced accordingly.

While the company appears to be cheap on a P/E multiple basis the most attractive feature of MNF’s financial performance for me, is its ability to continue to generate fantastic returns on incremental capital for many years to come. The current returns on equity are unsustainably stratospheric – a result of the accumulated losses on the balanced sheet. But even if we calculate return on equity with total contributed capital from shareholders, ignoring the reduction in equity that has resulted from accumulated losses, the company will still generate a return on equity in excess of 50% for FY12 and FY13. The nature of this business is such that provided success continues, high returns on equity can be sustained.

I believe the market is yet to factor in that MNF is now a significant player in the wholesale VoIP market and while its business and retail division will continue to face growing competition, the company has demonstrated its ability to differentiate itself from its competitors. With what seems like highly competent management, bright industry prospects and the ability to sustain current high rates of return My Net Fone currently appears to tick all of my value investing boxes.

Let Harley know what you think of his work and share your own insights. Please note the views of the author are his own and may not represent those of the publisher. It is a must that you conduct your own research and seek and take personal professional advice before undertaking any security transactions. The sources of data Harley relied upon to produce this post may or may not be accurate so readers must investigate and satisfy themselves that are are completely aware of and accept all risks before undertaking any securities transactions they conduct after they have sought advice from a licence adviser familiar with their needs and circumstances.

Authored by Harley and posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 29 April 2012

by Roger Montgomery Posted in Insightful Insights, Technology & Telecommunications.

-

Guest Post: Can you beat the worlds biggest banks?

Roger Montgomery

April 19, 2012

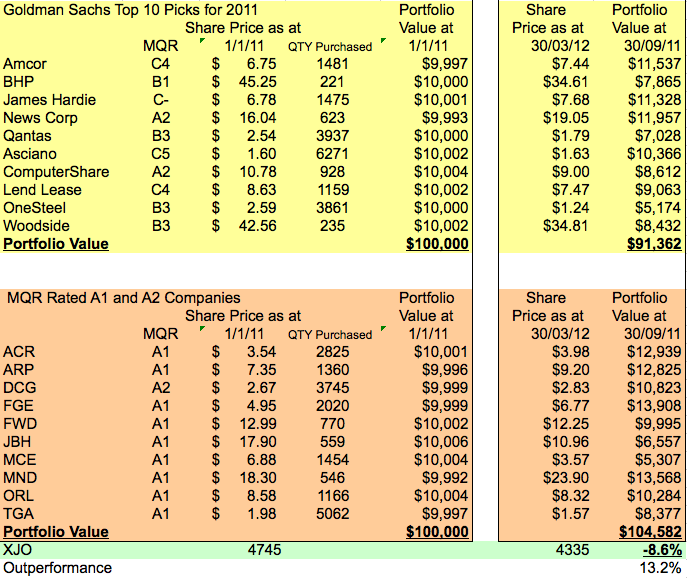

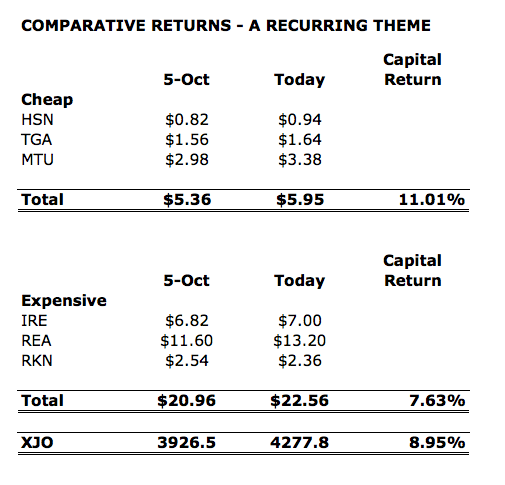

For new readers to the blog, welcome. Here at Roger’s blog we are conducting an ongoing study comparing the performance of investment portfolios recommended by major broking houses verses a loose selection of A1 and A2 stocks bought as a big a discount to IV as possible.

For new readers to the blog, welcome. Here at Roger’s blog we are conducting an ongoing study comparing the performance of investment portfolios recommended by major broking houses verses a loose selection of A1 and A2 stocks bought as a big a discount to IV as possible.(Its Roger here: Its important to understand this is a hypothetical investment portfolio based on one of the Twin’s consistent approaches to stock selection. In that regard it is not a collection of small high risk bets whose returns could be easily ramped. I will be very surprised if you see high double digit returns from such an approach for that reason. At Montgomery, managing +$200 million simply precludes us from investing in the small companies that would produce higher returns on relatively insignificant $5000 sums – irrespective of whether or not the returns can be boosted by disingenuous marketing by social media marketing experts or worse, even ramping. Its easy to make 50% per annum on $100,000. Much harder on $1billion. Even personally our individual speculative selections may have a couple of hundred thousand dollars allocated to them and so we are also precluded from employing capital where liquidity may be boosted only by the participation of a small group of invisible Facebook friends. Worse, our experience tells us that such anonymous groups can be a manic depressive bunch and when they’re told that a holding has been sold, the illiquid volumes of the companies they are toying with will produce the very opposite result of that which they aspired to achieved.)

We have been following twin brothers and their investment decisions and performances since December 2010.

The twins each inherited $100,000 and sought differing advice how to invest it, the quarterly reports of their investments can be found here:

http://rogermontgomery.com/will-david-beat-goliath/

http://rogermontgomery.com/how-are-the-a1-twins-performing/

http://rogermontgomery.com/which-a1-twin-is-outperforming/By the end of 2011 our first twin, the regional Queensland accountant was still head down, trying to help hundreds of clients recover from all the natural disasters of the previous 12 months, government help was available but so was the paperwork. As these tasks drew to a close, Queensland entered a bitter and hard fought state election, so comprehensive was the coverage, it was hard to watch anything else. There had been a lot on, and checking on the performance of his portfolio had really been at the bottom of the list.

Our NSW based public servant had pretty much had the same six months, but for very different reasons. Being in the Foreign Affairs office of the federal public service, he was now getting used to the third minister in 2 years, much changed, often needlessly and nobody had any time for anything other than redeploying resources and priorities.

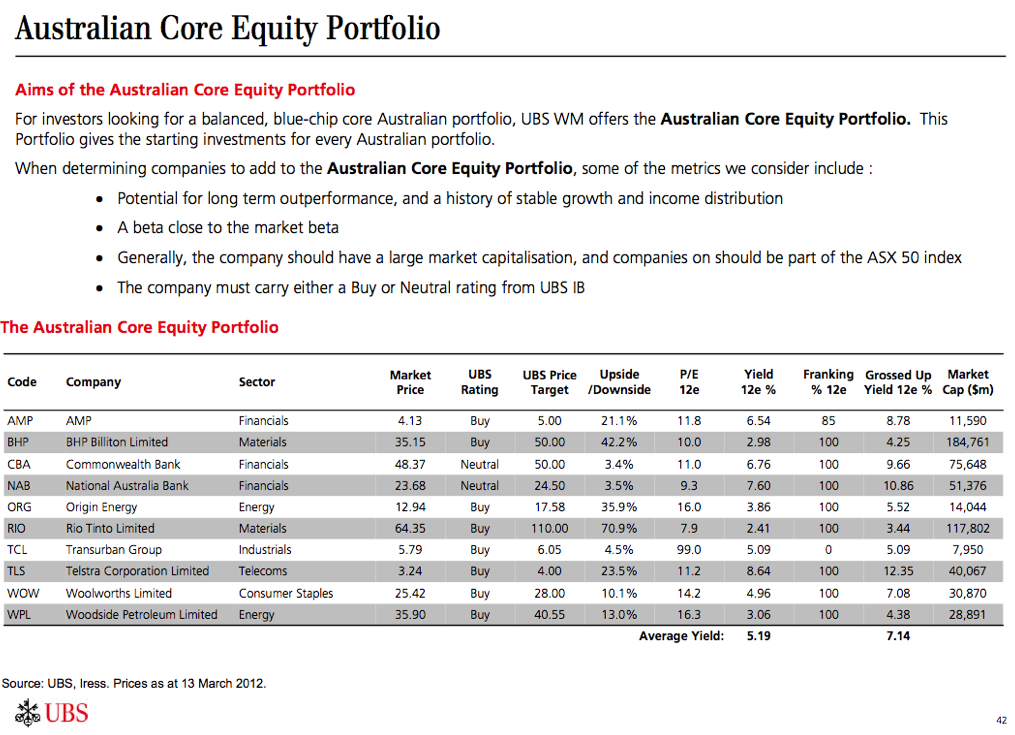

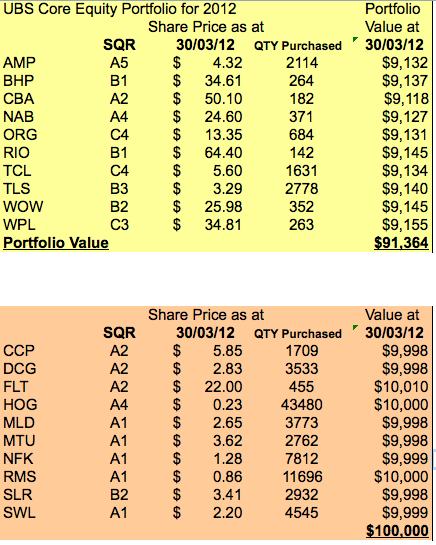

As March ended and the weather cooled, both brothers had a chance for a bit of R&R and to catch up on personal business. Neither were particularly thrilled with the performance of their portfolio; Our public servant , who had always invested through Goldman Sachs had performed exactly in line with the broader market, his portfolio was down 8.6% over the 15 months, and had lost nearly $9 000. He felt he could do better, and had been thinking about getting other advice for quiet a while now, and decided to act. He now only had $91 000 left and decided to switch brokers and became a client of the giant international broking firm UBS, who provided him with their Australian Equity Core Portfolio. Here is an image of the advice from UBS and how his $91 000 was divided amongst the 10 stocks listed.

Source: March 2012 ASX Investor Hour. www.asx.com.au

Our Queensland accountant had faired significantly better, by investing in A1 and A2 stocks he had outperformed the market by 13.2% over the 15 months. However, he acknowledged that a couple of his investment decisions had performed poorly and wanted to rebalance his portfolio, he too decided to act. With over $104 000 available to invest he decided to round down his investable sum back to $100 000 and spend the surplus on a short Gold Coast holiday with his family and the balance on a membership to Skaffold. Skaffold is the research tool that would help him scour the every listed company to find quality stocks that may be selling at a price that offered a discount to estimated intrinsic value. Skaffold would also save him the time of sorting through ten years of annual reports for every listed company. Armed with ability to narrow down the choice of stocks, he would able to focus on the few that met his criteria and do further research on them before investing.

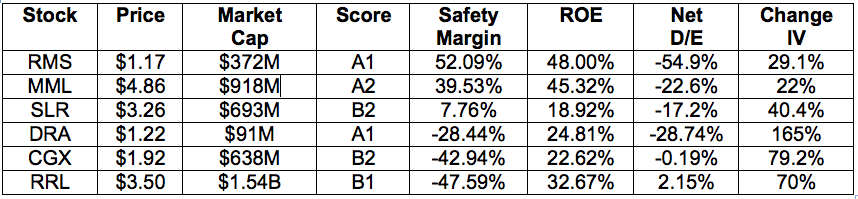

Here are the twin’s portfolios side-by-side:

The varying quality ratings of the 2 portfolios makes for interesting reading. On the basis of quality, the UBS portfolio doesn’t look very disciplined yet the portfolio chosen with the help of Skaffold looks pretty consistent. Except for 1 stock that is an A4. Our Skaffold user feels this cash flow positive producer may be about to be rerated by the market and A4 is as speculative as he could bring himself to be.

We will revisit our investing twins just after June 30 to see which portfolio is performing better, many thanks to Roger for putting the stocks to the test and actively encouraging this ongoing project.

All the Best

Scott TKeep in mind this is a hypothetical and educational exercise only and not a recommendation of any kind.

Authored by Scott and posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 19 April 2012.

by Roger Montgomery Posted in Investing Education, Skaffold.

- 37 Comments

- save this article

- 37

- POSTED IN Investing Education, Skaffold.

-

Guest Post: Thoughts on Risk.

Roger Montgomery

April 19, 2012

RISK: Successful investing is all about managing risk and, as luck would have it, this is one of the things that we, as a species are not particularly good at.

It is demonstrably true that humans are terrible at evaluating the complex risks associated with modern environments. This is not new information and there are plenty of oft referred examples which you can probably bring to mind; how we assess the actual probability of death from road vehicles vs. the perceived risk of death from spiders, snakes, sharks and aircraft (1,414 deaths vs. 32 in Australia 2009), the detrimental health risks of nuclear power vs. the dangers of fossil fuels (for every nuclear power linked death, there are an estimated 4,000 coal related deaths. Both candles and wind power are linked to more deaths than nuclear energy), or the real risk of bacterial infection vs. swine flu or mad cow disease (septicaemia alone was responsible for 993 Australian deaths in 2009).

Even if we acknowledge this shortcoming and integrate this knowledge to inform our everyday decisions, humans are hardwired to act on perceived risk, and are thus influenced to varying degrees by emotion. This is an evolutionary thing, and was suitable during the times that most of our transition to the dominant species occurred, but far less so now. The data necessary to evaluate complex risk often requires computers to calculate, and gut feel just won’t cut it anymore. To make it worse, we (as an aggregated faceless mass of humanity) are more inclined to trust information that reinforces existing beliefs (a well established phenomena known as confirmation bias). In a world where prominent politicians (and others) oppose the use of vaccines responsible for the eradication of polio and smallpox, in direct contradiction of peer reviewed science, finding someone who will tell us that we are right about pretty much anything is not challenging.

In summary, our natural instinct is to assess risk using our perception rather than facts, our perception is very often wrong, and even if we go looking for facts, we are inclined to assign more validity to data that supports our predisposition rather than to conduct an objective assessment.

You want more? In an apparent contradiction, this inability to overestimate our abilities may even confer an evolutionary advantage. Unfortunately, this would work at a species level, rather than for the wealth of the individual, and is a complex topic for another day (more about it here van Veelen,M. and Nowak,M.A. (2011) Evolution: Selection for positive illusions. Nature, 477, 282-283)

So, why is this important, and how is it relevant to investment?

Investment, as we all know, is about accurately assessing risk, and requiring an appropriate return to compensate for these risks to our capital. The more accurately we can assess risk in our investments AND act accordingly, the more likely we are to maximize returns. Knowing that investment is about managing risk however, is VERY different, and a lot easier than doing the work that this understanding requires.

Risk is managed using facts and knowledge. There is no place for gut feel. The more relevant facts we have about an investment, and the more knowledge we have about how to integrate this mass of data, the more accurately we can ascertain risk. As investors, we are looking for opportunities where professionals, with millions of dollars allocated to data collection, and which have analysts with years of experience, have mispriced this risk.

It could be argued that this is not necessarily so, that we could accept the average rate of return, such as with an index ETF. In this case we are accepting the risk premium applied by the market, and the inferred risk premium is out of our control. Historically, the 10 year compound annual rate of return for the ASX is 2.4% (excluding dividends), and for 5 years -3.1%. Even going back 22 years to 1990 only gets you just over 4%. In my opinion, the reward over any of these time frames is clearly inadequate, even allowing for dividends. These returns are comparable or worse than much lower risk investments including cash (not accounting for tax).

This leaves us competing against experienced, well resourced professionals and, more dangerously, many not-so-great investors as we try to outperform the market. In this context a quick look at P/E ratios is unlikely to yield the stocks that will lead to suitable returns. We need to be able to value businesses, find those that are mispriced and, most importantly, identify and assess the risks inherent in our calculations.

There are many tools for valuing businesses, such as the intrinsic value method described by James E Walter and explained much more accessibly in Valu.able, and even some for assessing risk (such as the Macquarie Quality Rating). The research necessary to even partially determine such metrics for all of the companies on the ASX (let alone internationally) with any accuracy is far beyond that available to the average retail investor, so historically we have had to only work on a handful of stocks recommended by professional researchers or investment publications, or use our gut as a first pass.

Like so many other things, the information age has turned this on its head. These days, a single service can value, and assess the quality of, the entire ASX, identifying companies worthy of further, thorough analysis. And this is exactly what products like Skaffold are useful for, and why they always come with a disclaimer.

When you make an investment, it is your cash, and your decision. You will reap the rewards if you get the risks right and pay the price if you do not. Tools like Skaffold (as an implementation of the MQR and intrinsic method) simply remove the noise, and allow you to find gold without having to pan too much gravel. When I first came across the MQR, both Forge Group and JB Hi-Fi were A1 and trading at a discount to estimated I.V. The decision to invest in the former and not the latter was not a function of luck, but an exercise in risk management.

The reason I invested in Forge was, that I know the industry, because I worked in it. I know the way high ROE is achieved in construction and mining services, the kind of businesses that can maintain it, and how such businesses generally grow. After carefully considering all of the available data and quantifying what I did not, or could not know, I felt I really did understand the risk and the potential reward, and as such made the investment.

In contrast, I did not understand how JB Hi-Fi would continue its level of growth, even in the medium term. I also work in the technology industry, and the threat to margins from online retailers was obvious, even two years ago. (This threat and the maturing nature of JBH was written about by Roger Montgomery some years ago) The discount to I.V was there, but the risk that ROE could not be maintained was too high for me. This is not a comment on the quality of JB Hi-Fi as a company, but on its valuation as a growth stock using historical ROE.