Guest Post: The Happiest Company on Earth?

Many of us grew up with a diet of the brilliant work of Walt Disney. As children we laughed and cried along with the characters of Donald Duck and Mickey Mouse, Cinderella and Bambi. More recently, boosted by the purchase of Steve’s Job’s Pixar business, Disney continues to build its library and draw many more generations into the fold with the characters of Finding Nemo, Toy Story, Monsters Inc and Cars. The company dominates with its ‘share-of-mind’ competitive advantage. In this Guest Post Andrew takes the scalpel to the company and dissects its major components.

Many of us grew up with a diet of the brilliant work of Walt Disney. As children we laughed and cried along with the characters of Donald Duck and Mickey Mouse, Cinderella and Bambi. More recently, boosted by the purchase of Steve’s Job’s Pixar business, Disney continues to build its library and draw many more generations into the fold with the characters of Finding Nemo, Toy Story, Monsters Inc and Cars. The company dominates with its ‘share-of-mind’ competitive advantage. In this Guest Post Andrew takes the scalpel to the company and dissects its major components.

What does your company REALLY do?

A nuts and bolts look inside the happiest company on earth

The ability to make assumptions about the future prospects of a business is fundamentally linked to how we understand that business. Without a good understanding you will be more than likely flying blind and your perceptions and reality could be in very different places and therefore throwing a great deal of uncertainty into any estimate of intrinsic value (which is linked more to the future prospects than anything).

A company that I am very fond of and one that I am sure almost everyone here has heard of is the Walt Disney Company (NYSE:DIS). I thought this would make a great case study in understanding the business.

So what does Walt Disney do? The first thing that comes to mind is the feature cartoons that it made its name on and its theme parks. These are the most iconic images that are attached to this famous company and more than likely where we were first knowingly exposed to the brand whether it be entering Disneyland for the first time and looking up Main Street towards the castle or watching movies like Snow White, Dumbo, Pinocchio.

What may surprise some people however is that most of the revenue and net income for the company comes from television.

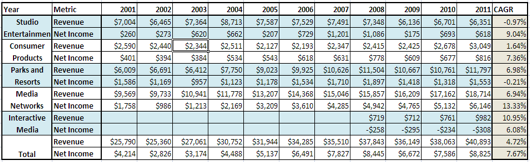

Take a look at the below table:

Figure 1-Yearly breakdown of DIS segment revenue and net income (net income is before non-controlling interests taken out and are reported in US$ Millions)

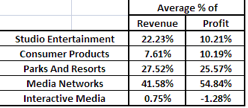

As you can see in Fig.1, every year from 2001 to 2011, the largest contributor to revenue and profit (except 2002) was the Media Networks segment of the business. Over this period the company has on average brought in around 41.5% of the groups revenue and 55% of the net income as shown by fig 2.

Figure 2- Average % of total group figures

This technique of looking at the individual segment results and comparing them to the overall group is a technique I like to use to really understand the nuts and bolts of the business. Looking at these figures I can see that even though DIS made its name by animating feature cartoons and opening gigantic theme parks, it is the TV channels they own that make up the most crucial element of the business as it is today. There for if you were interested in investing in DIS you would be very wise to focus particular attention on understanding how the media Networks business derives its revenue and what risks are associated with this segment. Luckily the DIS annual report defines this in quite good detail but back to this later. One thing to realise though is that this type of analysis is greatly influenced by scale of operations. The biggest divisions will or at least should, bring in the bulk of the revenue and profits. It may be helpful to see on a relative basis at where the magic happens.

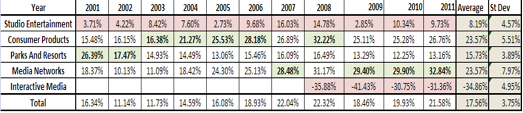

To do this, you might like to use profit margins of each segment. It is not uncommon for a diversified businesses smallest division to have the highest profit margin as in Qantas with their frequent flyer division. Disney is no different. It can change from year to year as shown in figure 3 however. Once again as you can see, lately it has been about the media networks. Looking at this however, you can gain a clearer picture of the profitability of each division in a relative manner. Despite being one of the smallest divisions, the consumer products segment is right up there in regards to profitability.

Figure 3- Net margins by division and overall group

So now, simply by looking at the financials we can get a clearer picture as to what DIS is really all about. We can see that the media networks business is arguably the most important. I can also see that the parks and resorts division is a pretty predictable segment with revenue and profit growth pretty consistent throughout the years and whose margins remain quite stable.

So where to next? Well you want to understand the risks associated with each segment so that you can be better placed to understand them and be able to make informed decisions and assumptions on the future. As mentioned earlier, the DIS annual Report actually goes into detail about the specific risks of each segment as well as detail as to how they derive their revenue. All annual reports will have a description of what the principal activities of the business are as well and if the management is shareholder orientated than it may include some very handy bits of information about the companies past, present and future. This is the next step, read all the information you can about that company whether it be through annual reports or newspaper articles, also read about the industry and read industry specific media to see what the insiders are doing and saying about the future. Knowledge is indeed power.

These are the simple steps to understanding a business and is aimed at the beginning investor although I think everyone can benefit from thinking more about how to understand a business they want to invest in.

Have you got any examples of businesses where the core operation may differ from what people may perceive? What gems can be found in the nuts and bolts of existing businesses? What techniques do you use to understand a new business? Feel free to post any thoughts below.

What do I think of Disney? Their return on equity has been increasing but is still below my required return so my valuation would still be at around or lower than their reported book value but I would love to own them personally. They are one of the biggest brands in the world and when they get it right, they create products that will last generations.

Guest Author: Andrew Leggett. Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 18 April 2012.

Matthew Smith

:

Hi Andrew,

Segment analysis is very important and I agree with your process – i am biased though as I do something very similar.

I would also suggest investors look at subsidiaries and other potential undervalued assets on the balance sheet.

If you can find these before others do like any undervalued security, can provide very attractive risk adjusted returns!!

Another company that people have perceived incorrectly or at least focus on the wrong segments would be KONE a Finnish elevator company which is a fantastic razor and razor blade business model – revenue split between new installations (40%) and service business (60%).

I have spoken to analysts who seem to focus on the growth in the new sales rather than the majority segment of recurring revenues!!

Andrew

:

A kind of postscript to this article.

I believe this type of analysis can help gain a better understanding of a company but also be in a better place to see if there are any cocnerns that are coming up through the business units. As a whole a company might look fine however there may be certain departmetns that are finding themselves in a tough spot. (Think JBH and their portable games division)

Some companies like Wesfarmers, Woolworths, BHP etc have a diversified business base even though one might perceive it as being in a particular market.

The more you understand the better you will be able to make decisions and find information that is desirable. As part of my Disney analysis i found a site which is able to give a score out of ten in reference to crowd numbers in the Disney parks. THis type of information (especially over a long term) could be desirable as average guest numbers and average revenue per guest are key indicators.

if you dig deep into a company and build a strong understanding you will never know what pleasant or unpleasant things you may find but at elast you will be equipped.

Roger Montgomery

:

And thats what analysis is!

Leanne

:

I know this is a serious finance blog but I must go YAY!! I LOVE DISNEY!! (yes – I am a tragic who holidays in Orlando every year) Notice that dip in 2009? Disney have been working hard to make back that dip – and it is more than just price rises. As the two previous commentors have noted they have many fingers in many pies – they recent bought Marvel – which is deliciously ironic because Universal Studios have been licensing Marvel characters for their parks and those royalties go to Disney! They are careful about Parks and Resorts – their hotels are now time share; and they bring through lots of cheap little changes to keep people returning every year. Their fans are deeply dedicated and they can keep raising prices without lose of customers

Roger Montgomery

:

Thanks you for those fantastic insights Leanne.

David

:

This company is a lot more diverse than you think and operates right across the media spectrum. I heard a random interview with a band that has language warnings all over their albums and openly talk about using drugs etc. called the Insane Clown Possey Apparently Disney approached them when they were just starting out and offered them a recording contract. It appears that profit and expansion comes first for Disney, but they do a great job of upholding their reputation and keeping our focus on the products they are best known for.

Andrew

:

ICP as they are affectionately known were indeed part of a record company owned by Disney but if my recollection of John Safrans TV show is correct there was some controversy here and they were dumped.

The above is just a starting point, kind of like those old russian dolls. You open one thing up and then you will be real surprised at what you see.

lance

:

Hi Andrew, interesting post.

The most important point you missed out in the Media Network breakdown is that Disney owns 80% of the most valuable property in cable television which is the ESPN Sports network. This is an almost compulsory part of any pay-tv package which most Americans have.

Andrew

:

Hi Lance,

You are completely right. I left it out of the blog but was part of the reason for my line about “knowingly” exposed to Disney. It is why i wrote this blog, there are some companies where if you really delve deep into them you will find some really quality assets. I also think the purchase of Marvel was a good strategic move as well.

ESPN is definitely a jewel in the crown. That is what i like about this company it has so many iconic names and brands.