Search Results for: thorn group

-

Returning to regular programming shortly…we hope!

Roger Montgomery

December 16, 2011

Continuing on our hypothecation theme, David Stockman, former Director of the White House Office of Management and Budget during the Reagan Administration penned the following to Mrs Lee Adler of the Wall Street Examiner. Stockman is currently writing a book on the financial crisis and some of the thoughts he expresses in his exchanges with Adler relate to the ideas he is developing in the book.

Continuing on our hypothecation theme, David Stockman, former Director of the White House Office of Management and Budget during the Reagan Administration penned the following to Mrs Lee Adler of the Wall Street Examiner. Stockman is currently writing a book on the financial crisis and some of the thoughts he expresses in his exchanges with Adler relate to the ideas he is developing in the book.Those you hoping for a quick end to the ructions in Europe and a return to normal levels of volatility may wish to ponder Mr Stockman’s thoughts on why European Banks are on the verge of collapse:

“The real story of the present is the shadow banking system, the unstable and massive repo market, and the apparent daisy chain of hyper-rehypothecated collateral. It looks like the sound bite version amounts to the fact that the European banking system is on the leading edge of collapse for the whole system. These institutions are by all evidence now badly deficient of the three hallmarks of real banks—deposits, capital and collateral.

BNP-Paribas is the classic example: $2.5 trillion of asset footings vs. $80 billion of tangible common equity (TCE) or 31x leverage; it has only $730 billion of deposits or just 29% of its asset footings compared to about 50% at big U.S. banks like JPMorgan; is teetering on $500 billion of mostly unsecured long-term debt that will have to be rolled at higher and higher rates; and all the rest of its funding is from the wholesale money market , which is fast drying up, and from repo where it is obviously running out of collateral.

Looked at another way, the three big French banks have combined footings of about $6 trillion compared to France’s GDP of $2.2 trillion. So the Big Three [F]rench banks are 3x their dirigisme-ridden GDP. Good luck with that! No wonder Sarkozy is retreating on France’s AAA and was trying so hard to get Euro bonds. He already knows he is going to be the French Nixon, and be forced to nationalize the French banks in order to save his re-election.

By contrast, the top three U.S. banks which are no paragon of financial virtue—JPM, Bank of America, and Citigroup—have combined footings of $6 trillion or 40% of GDP. The French equivalent of that number would be $45 trillion. Can you say train wreck!

It is only a matter of time before these French and other European banks, which are stuffed with sovereign debt backed by no capital due to the zero risk weighting of the Basel lunacy, topple into the abyss of the shadow banking system where they have funded their elephantine balance sheets. And that includes Germany, too. The German banks are as bad or worse than the French. Did you know that Deutsche Bank is levered 60:1 on a TCE/assets basis, and that its Basel “risk-weighted” assets are only $450 billion, but actual balance sheet assets are $3 trillion? In other words, due to the Basel standards, which count sovereign and other AAA assets as risk free, DB has $2.5 trillion of assets with zero capital backing!

This is all a product of the deformation of central banking and monetary policy over the last four decades and the destruction of honest capital markets by the monetary central planners who run the printing presses. Furthermore, this has fostered monumental fiscal profligacy among politicians who have been told for years now that the carry cost of public debt is negligible and that there would always be a central bank bid for government paper. Perhaps we are now hearing the sound of some chickens coming home to roost.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 December 2011.

by Roger Montgomery Posted in Financial Services, Market Valuation.

- 15 Comments

- save this article

- 15

- POSTED IN Financial Services, Market Valuation.

-

Hyper what?

Roger Montgomery

December 12, 2011

How many of you have heard the financial term ‘Hypothecation’? Microsoft word hasn’t – the bug-prone program constantly tells me to check the spelling. If it’s also new to you, take note because you may be hearing a lot more about it and it could impact your portfolio.

How many of you have heard the financial term ‘Hypothecation’? Microsoft word hasn’t – the bug-prone program constantly tells me to check the spelling. If it’s also new to you, take note because you may be hearing a lot more about it and it could impact your portfolio.Prior to the collapse of MF Global, it’s unlikely that many in the investment world would have ever heard of the terms; ‘hypothecation’ or ‘re-hypothecation. If you hold any dollars in an international brokerage / trading account, especially one where your funds are dispatched to somewhere in the UK, hypothecation may be the canary in the mine.

MF Global was allegedly using client-segregated monies for its own trading activities – a practice that is for obvious reasons, not practiced in most countries. The trading brought a 230-year old firm to its knees in a matter of weeks and resulted in the freezing of client funds. Funds thought to be ‘segregated’ and separate from the working capital of the firm, weren’t. But is MF Global an isolated case or is a practice that levers clients funds widely practiced and one that could undermine the financial system?

What the MF Global collapse has uncovered is that laws designed to prevent to access to ‘segregated’ accounts are being circumvented. Some firms may have also shifted accounts to countries where it is legal to access client’s funds for the firms trading activities. When you thought the only risk was that of your trade or investment selection going wrong, think again.

Hypothecation is, in simple terms, the practice of a borrower putting up collateral to secure a debt. An example of this is the typical purchase of a house. The buyer puts down a 20% deposit and borrows the remaining 80%. In this case the borrower has put up some cash and the house (at an agreed value) as collateral to cover the debt until the mortgage is paid off. Until such the borrower retains ownership of the collateral. Thus the collateral (both the deposit and the house) remains “hypothetically” controlled by the creditor, usually a bank. If the borrower can’t afford to meet agreed repayments (default), the creditor can take possession of the collateral and sell it to recover its assets. That’s Hypothecation – hypothetically the borrower owns the house, but in fact, they don’t until all loans are paid off. The same goes for securities purchased on margin.

With the basics out of the way we return to MF Global. Surprisingly hypothecation occurs when an investor puts their capital into a trading account to buy and sell securities such as CFD’s, Futures, Options, Commodities, etc.

And that should be that. Your money sits in your segregated trading account as collateral covering your positions – margined or not – until such as a time that you suffer an inability to pay back your debt to your broker (creditor) – if you ever do. And that is as we know it in Australia. MF Global here in Australia appears to have followed that procedure. But has it done so in the UK and the US? And how do others behave?

The practice and rules regulating hypothecation vary depending on the jurisdiction in which the trading account exists. In the US for example, the legal right for the creditor to ONLY take FULL ownership of the collateral if the debtor defaults is classified as a lien – a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation.

In the UK however, these rules are more than a little different. In the US there are some breaks, re-hypothecation is capped at 140% of a client’s debit balance. In the UK however, there is no limit on the amount of a clients funds that can be re-hypothecated, except if the client has negotiated an agreement with their broker that includes a limit or prohibition. UK brokers can ‘REUSE’ collateral put up by clients to secure their own trading activities and borrowings through a little unknown process called Re-hypothecation! While you may think that your ‘segregated’ capital is being used only as collateral for your own trading activities and borrowings / margin, a firm such as MF Global who operates out of the UK, can re-use their clients collateral to back their own trades and borrowings! Are you thinking credit card on credit card, gearing on gearing, leverage on leverage? And how do excessively leveraged position usually work out? Not well generally.

In the industry it’s referred to as “fractional reserve” synthetic liquidity creation by Prime Brokers. The IMF in their 2010 paper The (sizable) Role of Rehypothecation in the Shadow Banking System” Manmohan Singh and James Aitken state: “Mathematically, the cumulative ‘collateral creation’ can be infinite in the United Kingdom”. They add that courtesy of no re-hypothecation haircuts one can achieve infinite “shadow” leverage and the creation of a large shadow banking system.

Gary Gorton in his 2009 paper “Haircuts” about systemic risk in the repo market (something I used to teach for the Securities Institiute of Australia) suggests that banks’ reliance on the repo market constitutes a systemic fragility which renders the entire banking system prone to runs: “Gorton predicts the crisis was not a one-off event and it could happen again”.

He also addresses the relationship between confidence and liquidity suggesting when “confidence” is lost, “liquidity dries up” and concludes the financial crisis was a manifestation of an age-old problem with private money creation, banking panics. ‘Haircuts’ are the functional equivalent of information arbitrage: “When all investors act in the run and the haircuts become high enough, the securitized banking system cannot finance itself and is forced to sell assets, driving down asset prices. The assets become information-sensitive; liquidity dries up. As with the panics of the nineteenth and early twentieth centuries, the system is insolvent.” “Liquidity requires symmetric information, which is easiest to achieve when everyone is ignorant. This determines the design of many securities, including the design of debt and securitization.”

What Gorton says is that the increasing complexity of banks and the securities they issue is motivated by the need to obfuscate the masses and distract them from what is really occurring.

Let’s say a hedge fund (who is managing your money) puts up $100,000 collateral to support a leveraged position of $1,000,000. If the broker then re-hypothecates that $100,000 and uses this to support the same level of leverage, the firm is in a position where just $100,000 in collateral (not theirs) is supporting $2,000,000 in leveraged market positions.

A move of just 5% on $2,000,000 equates to $100,000 in profit and both you and your broker make $50,000 each. A move however of 5% against a $2,000,000 position can however wipe most of the collateral – and such moves are not uncommon today. While a single trade will unlikely bring down a broker’s diversified trading book, if all trades move in unison (remember US house prices were never expected to all decline at once), as was the case when MF Global traded European bonds, you can see how quickly everything can unravel.

And remember, while the broking firm enjoys all of the trading profits and fees, the clients bear the risk. If the broker loses, they file for bankruptcy, leaving clients holding an empty can. This appears to be what transpired at MF Global. It’s the ultimate privatization of profits and socialization of losses. And according to an increasingly vocal group of experts it could all happen again if a sovereign defaults.

And now you also have the reason why Central Banks around the world are applying a policy of ‘price stability’ or ‘price support’ in asset markets like the stock market – everyone is leveraged to the hilt.

It has been estimated that in 2007, re-hypothecation accounted 50% of the worlds Shadow banking system and the IMF estimated that US banks received $4 trillion of funding from the UK from re-hypothecation using just $1 trillion in clients funds, funds being levered several times over. In this light, don’t think for a moment that MF Global is alone in using client’s funds to trade and borrow for their own trading activities.

It appears in the current market environment that the first question you should ask is not whether or not your investment idea will work out correctly, it’s more a question of whether the money you put into your broker sponsored account will ever come back.And now that re-hypothecation is exposed, I wonder how many assets have been double, tripled and quadruple-counted. An expose on this subject by Reuters about this subject following the collapse of MF Global, revealed that “Engaging in hyper-hypothecation have been Goldman Sachs ($28.17 billion re-hypothecated in 2011), Canadian Imperial Bank of Commerce (re-pledged $72 billion in client assets), Royal Bank of Canada (re-pledged $53.8 billion of $126.7 billion available for re-pledging), Oppenheimer Holdings ($15.3 million), Credit Suisse (CHF 332 billion), Knight Capital Group ($1.17 billion), Interactive Brokers ($14.5 billion), Wells Fargo ($19.6 billion), JP Morgan($546.2 billion) and Morgan Stanley ($410 billion).”

And if you are wondering what the implications are, it may not be what you think. Initially there will be the denials and then, if Prime Brokers have to recall all the stock they lent out, imagine the global short covering rally?

And meanwhile the Euro crisis related elimination of deficit spending could force banks into administration or liquidation, which in turn causes assets to be marked down to market and pressure on equities. We invest in interesting times…but don’t forget highest quality stocks at substantial discounts to intrinsic value.

Posted by Roger Montgomery, Value.able author and Fund Manager, 12 December 2011.

by Roger Montgomery Posted in Financial Services.

- 33 Comments

- save this article

- 33

- POSTED IN Financial Services.

-

Not waving drowning?

Roger Montgomery

December 3, 2011

This is a retail business that I’ve known for a long time, indeed in a past life I influenced one of its largest shareholdings.

This is a retail business that I’ve known for a long time, indeed in a past life I influenced one of its largest shareholdings.At that time the company was leveraging its 90% brand awareness; increasing its return on equity every year, from 40% to ultimately more than 70%, without any debt; it was rolling out stores; it appeared to have perfected its buying strategy; and the share price had risen from $2.40 to a high of $18.60.

More than a year since I wrote that The Reject Shop shares were among the most expensive retail stocks and they touched their high, the performance has been somewhat unsurprising: declining to a closing low of $9 recently – a fall of just over 50%.

For those of you who have been fortunate enough to have been following us since 2009, you may recall in September 2009 when I wrote about the reasons why I decided to sell The Reject Shop:

“I can’t stop thinking that the value of the business just cannot rise at a fast enough clip to justify the current price. I really don’t like trading things that I have bought but I don’t think the value of the business can continue to rise indefinitely. With a share price of $13.45 (intraday today) and a valuation of $11.27, the shares are 24% above their intrinsic value. This combination of factors tells me we are safer in cash.”

Today the shares trade at about my current estimate for intrinsic value (see graph) of $9.22 and in anticipation of a possible big discount being presented, it’s worth reviewing our stance to determine whether we need to change it for this company.

Since I last wrote about the Reject Shop, a number of events have served to deliver sufficient concerns to market participants – analysts as well as investors – that they have turned their back on this once market darling.

First, the Queensland floods closed the Queensland distribution centre, seriously denting any supply chain efficiencies the company had built. Second, the company has doubled its equity base since 2006, from $26.6 million to $53 million, and this has been entirely due to the retention of earnings rather than less-desirable capital raisings. In the absence of an equivalent increase in profits, return on equity would be expected to decline. One way to stave off a decline in the all-important return on equity measure of performance is to increase leverage. The problem for the Reject Shop’s intrinsic value is that leverage has indeed increased – 34-fold – and yet return on equity next year is forecast to be lower next year than in 2006.

The Reject Shop still enjoys its high brand awareness but, as is typical in many store roll out stories, as the offer matures the later sites are less profitable than the early sites.

This doesn’t fully explain the fact that during a period in the economy where one would expect a bargain offering to shine, it hasn’t. Eighty percent of Australians still know the brand but I believe consumer experience and mismanagement has done it some damage.

According to one report, 20% of the population believe the company offers rubbish – cheap Chinese junk that quickly breaks after use and fills our tips. It’s the very reputation China itself is trying, but frequently failing, to shake off.

The other reason for damage to the brand is confusion brought on by mismanagement. Several years ago the average unit price was about $9 and basket size was $11, but over the years one cannot help but have noticed many higher-priced items creeping into the stores.

The Reject Shop was originally the place you went to for discounted seconds and end-of-line items. Under lauded retailer and merchant Barry Saunders, The Reject Shop successfully transitioned to a discount variety retailer, offering everyday lines at cheaper prices than the incumbents. Grey market (“parallel import”) Colgate toothpaste for $2 a tube and toilet paper for a few cents a roll ensured repeat business, higher inventory turnover and higher margins from consumers filling their baskets with other higher-margin items.

The company had successfully implemented the Walmart and Woolworths profit loop. Adding more expensive items, some in the $30, $40 and $50 bracket, confuses the offer and damages the brand. Simultaneously, inventory turnover falls and working capital costs increase.

Higher-priced items should at least partly explain why the company has not been performing well in the two-speed economy (I prefer to call it the one-cylinder economy) that would normally lend itself to the “bargain” offer. The other reason for the declining performance, including declining same-store sales growth, is the enthusiastic emergence of competitors. It’s really a second wave: The Reject Shop had put an end to Millers and the Warehouse Group previously. But now BIG W, Kmart, Target, Bunnings, a reinvigorated Mitre 10 and Masters will compete directly with The Reject Shop; you may have already seen some of their aggressive Christmas advertising.

If The Reject Shop’s offering had not been confused by the inclusion of higher-priced items, the company would have been in a much better position to defend its turf. The misguided product mix, however, appears to have left the gate open and the well-funded competitors have rushed in, as have Crazy Clarke’s, Sams Warehouse, Chicken Feed, GO-LO and more than 35 others. Of course these competitors will also compete for sites, potentially relegating The Reject Shop to less preferred sites or having to pay more for the best of the remaining locations.

That, and the possibility of a fall in the Australian dollar, represents the bad news. The good news is that The Reject Shop still has terrific brand awareness, many more stores to open, a reinvigorated marketing campaign and the reopening of the Queensland Distribution Centre ahead of the Christmas peak selling period.

On balance, if the company can hit its targets it could increase its intrinsic value by more than 15% per annum over the next three years and many believe the bad news and bearish case is factored into the share price. But I would like to see a decline in debt or a greater margin of safety or both, before buying its shares.

Rest assured that a rising tide (a rally in the stock market) will lift the price of the company’s shares. To be certain of a good return rather than be hopeful of an excellent one, we simply need a bigger discount, as the graph illustrates.

Posted by Roger Montgomery, Value.able author and Fund Manager, 3 December 2011.

by Roger Montgomery Posted in Value.able.

- 55 Comments

- save this article

- 55

- POSTED IN Value.able.

-

Are bargains available at Woolworths?

Roger Montgomery

November 17, 2011

On Wednesday November 2 Woolworths held a strategy briefing for professional investors. Woolworth’s effectively asked us to adopt a longer time frame before judging its performance and revealed four strategic priorities that I will describe in a moment.

Prior to the strategy day, the company updated the stock market with a growth outlook that was the lowest in a decade. The market responded negatively to the change and it entrenched previous sentiment by professional investors to switch from Woolworths to Coles.

But Woolworths remains a superior business from a business economics perspective, with high return on equity and it also remains cheaper than its competitor as measured by the larger discount to an estimate of its intrinsic value.

The wider sentiment towards Woolworths Supermarkets is that the period of strong growth is over, and the other businesses, such as Big W, the New Zealand supermarkets, the Masters hardware venture and a possible acquisition of The Warehouse group could be the focus of earnings growth for the company. Gambling pre-committments would not be.

Meanwhile, the Woolworths-owned Dick Smith electronics business appears to have failed to excite consumers and has certainly failed to excite investment professionals. Dick Smith is a relatively weak offering in a market that has been hit particularly hard by the empowerment of the consumer through high Australian dollar.

Moreover, in many ways these businesses are peripheral since the Australian Food & Liquor division accounts for 80% of earnings before interest and tax.

The impact of the company’s lower growth profile on intrinsic value, particularly intrinsic values over the next two years, has been negative and intrinsic value does not appear to be going anywhere in a great hurry (see Skaffold chart below).

This combination of circumstances, in my experience, set Woolworths shares up to be vulnerable to any negative shocks.

Estimating intrinsic value is not the same as predicting price direction, however the above circumstances are not unique historically in putting a lead on price appreciation.

On top of the above combination of factors, there is also the continuing debate in Parliament about the introduction of preset loss limits for poker machines, which, if introduced, would negatively impact Woolworths’ gaming business. Though it is most closely associated with supermarkets, Woolworths is actually the largest poker machine owner in the country, with more than 10,700 pokies.

And a few weeks ago, The Economic Times of India also reported that Woolworths appears to have been dumped by its Indian partner, Tata Group. Woolworths enjoyed a five-year partnership with Tata, introducing Dick Smith-style electronics stores to India under the Infiniti Retail brand. Even though foreign retailers are not permitted to have a direct presence in India, Woolworths partnership offered the hope of growth – albeit with a partner – if the rules were ever relaxed.

Nonetheless, despite these accumulative negative factors, Woolworths is regarded by conventional analysts and investors as a defensive’ company. Its strong cash flows and its status as a major retailer of food makes it an ideal investment in a recessionary or slow or low growth environment. The company also enjoys entrenched competitive advantages over smaller rivals that, until now, the ACCC has done little about. One example of this are the new EFTPOS charges.

From the first of this month, the new Eftpos Payments Australia Limited (EPAL) fees mean retailers incur a 5¢ fee for every transaction over $15 (75% of all EFTPOS transactions). Previously there was no fee and that will still be the case for transactions under $15, which means 25% of transactions.

The retailer’s bank will charge the retailers, some of whom are describing the charges as an “EFTPOS tax”, and they will have no choice but to pass on to the consumer.

Unsurprisingly, EPAL’s members include the major banks, Coles and Woolworths and, because they manage their own terminals, they can opt out of the new charges.

But despite these entrenched advantages, Woolworths has been hit – or so it says – by the state of the economy, noting in its annual report: “Consumer confidence remained historically low as customers reacted adversely to rising utility costs, interest rate hikes in the first half of the year and general global uncertainty, and opted to save rather than spend their money”.

From an investment perspective it is worth noting that retail investors now have a choice of supermarkets, with Coles improving its offering to consumers and taking market share from the incumbent Woolworths.

The investment community is not convinced that further changes to private-label offerings or more innovation around the supply chain will make a dramatic difference to the growth prospects for Woolworths, which set below forecast growth in household income, population and the economy.

One other source of earnings growth is cost-cutting, but the reality is that gains from such strategies are one-offs and again unlikely to excite investors.

Having presented the negatives – which have caused the share price to fall 12% since July, one positive was the strategy briefing’s opportunity to showcase new CEO Grant O’Brien, who replaces Michael Luscombe. The company announced that it planned to extend and defend its leadership in food and liquor, act on the “portfolio” to maximise shareholder value, maintain its track record of building new growth businesses (we’ll ignore Dick Smith) and finally, put in place the enablers for a new era of growth.

In the supermarkets business WOW hopes to grow fresh produce from 28% market share to 36% market share. If achieved this would be an additional $2.5b in sales. Woolies also wants to target a doubling of home brand sales and this aim flies in the face of the ACCC’s stated concerns.

The company will also open 35 new BIG W stores in next 5 years reaching 200 by 2016.

In a reflection of the massive structural shift online, BIG W’s 85,000 in-store SKUs will be expanded and all put online.

And the topic on the tip of everyone’s tongue; Masters. There are now five stores open, another two are due to open in December/January, there are 16 under construction another 100 in the pipeline and the company reported the venture is well ahead of budget.

I also note the advertised sale of $900 million of property ($380 million of which was sold last financial year); and, most recently, the oversubscribed $500 million hybrid note raising that substantially extend the balance sheet strength of the company.

Below we examine the intrinsic value track record and prospects for Woolworths based on current expectations for earnings growth and returns on equity using Skaffold.com

Woolworths (MQR: B2) is currently trading at the same price it was in December 2006 and February 2007, despite the fact profits have risen 11.1% pa, from $1.3 billion to a forecast $2.2 billion in 2012. This growth in profit however is offset by having 16 million more shares on issue; by increased borrowings – up $1.8 billion to $4.8 billion; and by retained earnings, which have risen by $2 billion. The increase in shares on issue and retained earnings have offset the positive impact on return on equity rising profit would normally have.

The latest estimate of its intrinsic value, of $23.23, is forecast to rise modestly over the next two years. For investors looking at opportunities to investigate only when a meaningful discount to intrinsic value is presented, a price of $19 or less for Woolworths would represent at least 20 per cent.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Is it just Harvey Norman or bricks & mortar retailing generally?

Roger Montgomery

November 17, 2011

You don’t normally expect to get investment tips from a mothers’ group get-together, but that’s what happened to me recently when the conversation turned to retail operations.

Relaxing with a glass of pinot gris the women, who have met regularly for a decade, were explaining why they spend less time in Harvey Norman stores than they used to. Why? Tired stores, tired layouts and uncompetitive prices have served the retailer only with the need to revamp its entire offering. And that, it hasn’t done.

Retailing in Australia has been in the eye of a perfect storm for some time. As I’ve written previously, the strong Australian dollar has encouraged overseas travel and online purchases from overseas businesses; and the two-speed economy has ensured that credit growth (the borrowing of more money to buy stuff) is muted.

I’ve always been suspicious of a company that issues a report to the market after the close of trade. On Monday 31 October, a major retail business in Australia did just that. After closing time, Harvey Norman released its sales and earnings for the first quarter of the 2012 financial year. Given its timing, the announcement was almost certain to be negative. Indeed, the stock fell 4% the next day.

Instead of focusing on the retailing offer, refreshing store designs and improving range, company representatives focus on property, horse racing (Gerry Harvey is one of the country’s biggest bloodstock owners), goading the Reserve Bank of Australia to cut rates in “the national interest” and campaigning to have Australians pay GST on items they buy overseas for less than $1000.

Harvey Norman’s first-quarter sales were down 3.8%, as were like-for-like sales. In Australia, like-for-like sales were down 2.8%, in New Zealand down 10.6%, down 8.9% in Slovenia and down 11.1% in Northern Ireland. A stronger currency against the New Zealand dollar, the Euro and the pound has exacerbated the results. Profit before tax – a very important measure to us when estimating intrinsic value – was down by … wait for it, 19.3%!

Harvey Norman claims the strong Australian dollar and the closure of 34 Clive Peeters stores contributed to the poor result. I would argue that a failure to reinvent the offering also contributed. More worryingly, this latter factor is unlikely to go away any time soon.

Compounding this problem is the very likely scenario that the declining iron ore price – recently at about $115 a tonne – will seriously crimp margins for the only sector that has been running at full capacity in this country. Australia’s stock market has become the tail that wags the dog. Its wealth-effect on Australians and the impact on sentiment are important determinants of activity and in particular, retail activity.

With the All Ordinaries index dominated by resource companies and financial services companies it is possible, if not probable, that a declining iron ore price leads to lower stock prices and lower economic activity. I am no economist, but I can understand some experts’ calls for further rate cuts.

Back to Harvey Norman, and like-for-like sales declines of 2.8% compares favourably with JB Hi-Fi’s decline of 3.5%. Indeed, if it became a trend, one would argue Harvey Norman is winning back market share from JB Hi-Fi.

But before you get too excited about this comparison, you have to realise JB Hi-Fi’s profits are higher than they were last year and last year’s profits were higher than the year before that. In Harvey Norman’s case, profits before tax are down 19.3% compared to the same time last year, and last year first-half profits were down 16.5% from the year before that! One retail analyst I know and respect made the point that at this rate Harvey Norman will produce an average profit slightly ahead of the first-half profit made back in 2004, when it generated sales revenue of 62% of today’s sales.

My intrinsic value estimate for Harvey Norman is about $2.00 a share against today’s share price of $2.17. However this is based on earnings per share of 23¢ for 2012 and that is, quite possibly, optimistic. Over the next few weeks, analysts will bring their earnings after tax estimates down for 2012 materially. This will have a negative impact on intrinsic values and I suspect we will discover a price above $2 is a premium to intrinsic value. Most interestingly, for followers of any rational approach to calculating intrinsic value, Harvey Norman’s updated intrinsic value is no higher today than it was nine years ago, in 2003.

This can be seen in the following chart, which plots the share price of Harvey Norman against its estimated intrinsic value. Generally, we look for companies that have a demonstrated track record of rising intrinsic values and are available at a large discount to the current year’s intrinsic value (see 2006 in the graph).

The lack of any real change in intrinsic value and prices (which follow intrinsic value in the long run) reflects the maturation of the business. You can see that in the short run (in 2007 and again in 2009-2011) prices can get ahead of themselves thanks to many factors including irrational exuberance.

In the long run, however, the market’s weighing machine will do its thing and prices generally revert to intrinsic value. That’s why having a rational method for estimating intrinsic value is so important!

The forecast change in intrinsic value may also decline now that Harvey Norman has provided lower guidance. And it’s not unusual for analyst forecasts to be “hockey-stick” optimistic at the commencement of the financial year.

But long-term, Harvey Norman is a mature business in a small country and it continues to swim upstream against the online retailing avalanche. This is a structural shift rather than a short-term trend and Harvey Norman will need to respond by convincing Australian women in mothers’ groups all round the country that it is fresh, new and competitive.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Are these stocks where the highest risk resides?

Roger Montgomery

November 9, 2011

I have not discovered a method for predicting the short term direction of share prices. Once we purchase an A1 company’s shares at a discount to intrinsic value, we cannot know what the share price will do in the short term. We do know that provided the prospects for intrinsic value growth remain bright, the weighing machine that is the market will eventually cause share price and intrinsic value to converge.

Thats why it is so valuable to have an current and future intrinsic value estimate for every company updated daily. Having a long term demonstrated track record of intrinsic value growth can also provide us with insights into management’s capital allocation decisions. Knowing what the cash flow profile of a company looks like and whether the company has profitably employed capital entrusted to it by shareholders can further ensure you aren’t overstaying the party.

Soon you too will able to simply and confidently navigate the noisy distraction of the stock market to be shown those securities that deserve your time and avoid those that have a higher probability of permanently impairing your returns. Skaffold is launching now (so keep an eye on your inbox today!)

Last week I spoke on CNBC with my old friend and peer Matthew Kidman.

You can watch the interview here: http://video.cnbc.com/gallery/?video=3000054986

Our view about the market is influenced by how many companies we can find that are both high quality and cheap. I remember back in April this year, we had just started investing on behalf of investors in our fund but we could only find a small group of suitable companies. That was enough to suggest that the other 2050 listed companies were either expensive and or of unsuitable quality. A similar thing appears to be happening now. The lower credit growth and declining iron ore prices have impacted the growth rates of future intrinsic values for banks and resource companies and these dominate our stock market index.

If you are following the Value.able-style approach to value investing, you would only be interested in high quality companies with bright prospects at substantial discounts to IV. If that fact changes as a result of the constant process of re-evaluating the prospects for the businesses in which we are interested, then one must act accordingly.

I cannot tell you whether the market is going to rise or fall in the weeks and months ahead but it does seem that value is a precious and rare commodity. With that in mind, what are the companies that may be most at risk?

We will update this post with a table shortly but here is the short list (keep in mind the issues that have caused the companies to be in this predicament may be temporary): Tap Oil, Neptune Marine, AACo, Somnomed, Elders, Centro and Gunns. I will update soon with a more comprehensive list of expensive C4s and C5s soon.

The current list is not exhaustive, what I have done is taken C4 and C5 companies and sorted them by those that most recently reported cash flows that were unable to cover interest. There are many more but these are the names that piqued my interest and I thought they might pique yours.

Posted by Roger Montgomery, Value.able author and Fund Manager, 09 November 2011.

by Roger Montgomery Posted in Investing Education.

- 71 Comments

- save this article

- 71

- POSTED IN Investing Education.

-

Was this float a Turkey?

Roger Montgomery

November 3, 2011

The float of Collins Foods earlier in the year at a price of $2.50 did not interest your author. The lack of interest however was not shared by others and the company listed on the ASX with a ‘Top 20 Shareholders’ list that included many if not most of the major nominee companies (Nominee companies have long been established as the mechanism by which asset managers and custodians can process transactions on behalf of their clients).

I wrote a column for Alan Kohler in which I explained why investors might want to reconsider any enthusiasm and you can find the full column here http://rogermontgomery.com/invest-in-kfc-or-just-eat-it/

Much of the commentary around the time of the float referred to the “defensive” nature of fast food restaurants but as we have always suggested here, the only truly defensive stock market investment is an extraordinary business at a large discount to a conservative estimate of its intrinsic value.

One of the issues I had with the float was articulated thus:

“To begin with it is important to note that Pacific Equity Partners (PEP) – the private equity firm behind REDgroup, the parent company of Angus & Robertson and Borders now under administration – will be exiting its stake completely.

“Perhaps more interestingly, the existing management team is cashing in, too. Managing director Kevin Perkins will reduce his holding from over 20 per cent to about 8% and the rest of management will reduce their holding, too.

“When Pacific Equity Partners paid $US210 million in September 2005 (the $US6.92 a share was a 42% premium to the then traded price of $US4.92) for Worldwide Retail Concepts, the US publicly listed company that is now Collins Foods, management then co-invested with a 48% stake. According to all reports, management will now retain just 10%. In other words, management is selling 80% of its holdings into this float.”

Shares fall 50%

The prospectus (which didn’t include the above photo of a genetically modified chook) noted Collins Foods strengths included: “Attractive market dynamics”, “Leading market position” and “strong financial track record”. But just two months after the float, Collins Foods has warned that it will miss prospectus forecasts. The shares are down 50% at the time of writing after the company stated that it would miss forecasted by almost a third (up to 27% to be precise). Collins Food said that the downgrade is due to “fragile consumer confidence and a highly competitive restaurant industry”.

Indeed. My contacts tell me that, according to analysis of credit card usage, the only place doing really well in Australia’s retail sector is…wait for it…restaurants. Meanwhile at yesterday Dominos Pizza AGM, that company confirmed that on a like-for-like basis, sales had grown by double digits.

You cannot help but wonder, what was motivating management to sell so much of their stake into the float?

If you had your hands on the prospectus for Collins Foods and followed the steps in Chapter 11 of Value.able to value the float of Collins Foods, you might have used a forecast profit of $16 million, equity of $161 million, 93 millions shares on issue (giving an equity per share of $1.73), earnings per share of 17.3 cents and dividends per share of 11.8 cents (giving a payout ratio of 68%).

Return on equity of 10% is low and this is with the benefit of leverage (total borrowings $105 million). Immediately you know that if you are using an Investor Required Return of more than the ROE of 10%, the intrinsic value will necessarily be less than the equity per share of $1.73.

Shares fall to Intrinsic Value Estimate

Using Tables 11.1 and 11.2 and an Investor Required Return of 13% Table 11.1 produces an income valuation of $1.33 and Table 11.2 produces a growth valuation of $1.08. Multiplying $1.33 by the payout ratio of 68% results in 90 cents and Multiplying $1.08 by one minus the payout ratio of 68% results in 34 cents. Adding 34 cents and 90 cents gives a valuation of $1.24. (You can see just how bullish you or I would have to be to produce, at the time of the float, a valuation of $2.50!)

You might like to download the prospectus yourself from the ASX website here and try using Value.able’s Table 11.1 and 11.2 to arrive at the same valuation. If you don’t have a copy of Value.able, you can order your copy here

I’d love to know how you go. If you have valued any ‘Turkey’s’ yourself, go right ahead and upload your thoughts about the company and your valuation, along with a comparison to its current price.

Posted by Roger Montgomery, Value.able author and Fund Manager, 03 November 2011.

by Roger Montgomery Posted in Consumer discretionary.

- 34 Comments

- save this article

- 34

- POSTED IN Consumer discretionary.

-

Invest in KFC or just eat it?

Roger Montgomery

October 25, 2011

Back in July I wrote the following column about the impending float of Collins Foods/KFC at between $2.50 and $2.92 per share and suggested I would not be participating in the float on behalf of investors in the Montgomery [Private] Fund. For Value.able investors, the column, along with the fact the shares now trade at a substantial reduction, offers some insights into the thinking around a new float…

Back in July I wrote the following column about the impending float of Collins Foods/KFC at between $2.50 and $2.92 per share and suggested I would not be participating in the float on behalf of investors in the Montgomery [Private] Fund. For Value.able investors, the column, along with the fact the shares now trade at a substantial reduction, offers some insights into the thinking around a new float…“As a parent I’ve never been much of a fan of fast food but I do know that many of the strong brands in this sector command enormous market share.

But I’m not here today to give you a lesson in nutrition; what I want to talk about is the opportunity to invest in the future success of KFC in Australia through the $238 million initial public offering of Collins Food Group.

The KFC brand is owned by US-based and listed Yum! Brands. Owning a strong brand is one of the best competitive advantages money cannot buy.

The value of this competitive advantage is reflected in the returns on equity, gross margins and pre-tax profit margins Yum! Brands generates of 66.2%, 33.6% and 14.3% respectively for the most recent 12-month period.

Amongst 47 listed restaurants in the United States, Yum is number two by return on equity and 17th among 790 listed services companies by the same measure. There are indeed very high returns to be made from leveraging a great brand like KFC and selling franchises.

Being the franchisee, on the other hand, is rarely as lucrative and the forthcoming listing of Australia’s largest KFC franchisee – Collins Foods Limited (CKF) – will demonstrate this to investors.

Collins has 119 KFC stores (117 of them in Queensland), along with 26 Sizzler restaurants in Western Australia, NSW and Queensland, and it’s the franchisor of maybe 60 Sizzlers in Asia.

The price point of these restaurants will inevitably have fund managers – who are participating in this week’s bookbuild – referring to Collins as a “defensive” investment. But as I have previously indicated, the only defensive investment is a brilliant one; mediocre companies need not apply.

To begin with it is important to note that Pacific Equity Partners (PEP) – the private equity firm behind REDgroup, the parent company of Angus & Robertson and Borders now under administration – will be exiting its stake completely.

Perhaps more interestingly, the existing management team is cashing in, too. Managing director Kevin Perkins will reduce his holding from over 20 per cent to about 8% and the rest of management will reduce their holding, too.

When Pacific Equity Partners paid $US210 million in September 2005 (the $US6.92 a share was a 42% premium to the then traded price of $US4.92) for Worldwide Retail Concepts, the US publicly listed company that is now Collins Foods, management then co-invested with a 48% stake. According to all reports, management will now retain just 10%. In other words, management is selling 80% of its holdings into this float.

If PEP bought the company in 2005 alongside management who owned 48%, and you buy in 2011 with management owning just 10%, do you think the deal has a whiff of fried chicken to it?

During the privatisation, PEP and the management were arguably similarly incentivised but when you buy Collins Food Group’s from PEP in the IPO, you will not have the same committed management.

And when PEP bought Worldwide Retail Concepts in 2005, the company operated, joint ventured or franchised 302 Sizzler restaurants (with 28 in Australia), 112 KFC sites (111 in Queensland) and it also owned 22 sites of the US “quick casual” or family value restaurant chain Pat & Oscars.

Worldwide Restaurant Concepts reported revenues of $US347.2 million in the year to April 30, 2004 ($A444 million at the then exchange rate of US78¢) and 70% was generated in Australia. All this for $US210 million ($A269 million).

According to reports, you are being asked to pay $A230–278 million ($US244–295 million) for 119 KFC outlets, 26 Sizzlers and around 55 franchised Sizzlers in Asia. I am not sure if the IPO company will offer a stake in the other 220 Sizzlers but I can tell you the Pat & Oscars chain was sold to management in 2009 after another buyer in 2007 failed to secure funding.

Oh, what doesn’t Google know!

Same-store sales growth has been positive while in the care of PEP and Collins Foods, and is forecast to hit $430 million in 2012, according to one report, but it is the growth in earnings since the purchase in 2005 that has been spectacular.

For the year to April 30, 2004, Worldwide Restaurant Concepts earned just $4 million. In 2011 that number might be closer to $25 million for Collins Foods and it is probably for all this hard work that management want to cash in their 38%.

Despite this wonderful growth in profits, the best (read most optimistic) estimate of intrinsic value I can give you is $2.55. This represents the low end of the expected range of possible prices at which you might be entitled to any shares.

But before you jump in like a headless chicken, remember two things: management are taking their cream; and the franchisor always makes more money than the franchisee. Just look at Yum! Brands’ return on equity and compare it to Collins Food Group’s when we see it.

Finally, it’s always interesting to follow the cash account, which can give an alternative picture of the company’s position before and after its float. For those who have access to the prospectus have a look at the pro forma cash balance prior to the float.

Let’s presume it is close to $50 million. That cash balance will first increase by the proceeds of the float – say $250 million – but any debt repayment will see the account decline again.

Then you need to look carefully. If there is a further drawdown (because all the proceeds were used to reduce debt) it will see the account restored but then payments to vendors and reimbursing costs associated with the float will result in a starting cash balance that may be a lot less than it was before any float was contemplated.

If this is indeed the scenario – and it would not be one without precedent – the drawdown would have effectively funded the payment to vendors and costs. If there is no further drawdown or refinancing, there could be no payment to the vendors including management.

The prospectus will be out shortly. The last float we looked at was MACA at $1 and we suggested participation for those lucky enough to have been offered shares.

MACA shares now trade at $2.35, after being as high as $2.96, trouncing the return of the other floats we reviewed, Myer and QR National. Will Collins Food Group be an addition to the portfolio? There’s a greater chance that my kids will be regulars at a KFC restaurant!”

Posted by Roger Montgomery, Value.able author and Fund Manager, 25 October 2011.

by Roger Montgomery Posted in Consumer discretionary.

- save this article

- POSTED IN Consumer discretionary.

-

Are your profits recurring?

Roger Montgomery

September 30, 2011

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.Stability and predictability are two key words that many investors are unlikely to have heard in recent times and two important components of the ‘toolkit’ that may have gone astray. But at all junctures of the business cycle, stability and predictability are helpful investment partners.

Irrespective of whether you are building a portfolio from the ground up or are reviewing your current holdings, it is vital that you ensure your portfolio is always pointed in the right direction. Few, if any are able to reliably and predictability predict short-term share prices so there is relevance, if not necessity, in ensuring the very best opportunity is given to your portfolio. When a recovery transpires and investors are willing to accept risk again, the portfolio constructed from businesses with some stability and predictability to their revenues and earnings streams will have an excellent chance of outperformance.

While there are many definitions of what constitutes ‘stable’ and ‘predictable’, in terms of business analysis, recurring revenue would be the one I would use. And if you built a portfolio of such businesses, would it matter if this week a country defaulted on its debt or another had its credit rating downgraded? These issues are both temporary in nature and only likely to impact share prices, not the economics of the business.

Long-term contracts are the best form of recurring revenues and these contracts take many forms; There are of course the obvious long-term contracts, such as a mobile phone plan, internet or TV subscription, a car lease or a property tenancy, but less obvious are the long-term contracts we have with our own bodies to feed them, clean them and take out the waste. We have a long-term contract with our teeth, our cutlery and our toilets and these contracts ensure Coles and Woolworths, Kelloggs, Procter & Gamble and Kimberley Clark have millions of customers buying their consumables frequently and with monotonous regularity. In other words – recurring revenue.

Knowing that a percentage of revenue can be relied upon to come in the door each year allows a business to budget, rewarded staff consistently and plan expansions with fewer surprises.

And if you are buying a small piece of such a business, you can sleep more comfortably at night ‘knowing’ that your share will always have value even if the share price halves or worse.

The following two businesses are examples of companies we hold in The Montgomery [Private] Fund, and that we believe display the characteristic discussed.

M2 Telecommunications is a reseller of telecommunications equipment and services into the $6 billion SMB Telecommunications market. While dominated by Telstra (ASX:TLS) with 80 per cent market share, M2 is the seventh largest Telco in Australia with a 4.5 per cent share.

Two thirds of the business’s revenue is recurring via traditional fixed voice services, mobile (phone and broadband) and wholesaling services. Typically, contracted revenue is on 2-4 year terms giving management a significant amount of predictability.

It is due to this predictability that management have forecast 15 per cent earnings growth for FY12 and have the ability to self-fund a couple of large acquisitions, which Vaughn Bowen has moved aside from day-to-day duties to focus on.

Credit Corp – With new management installed and a demonstrated focus on transparency and sustainable growth, 70 per cent of collections are now on recurring payment arrangements.

This frees up collection staff to focus on those clients that are finding it harder to repay their liabilities and drives efficiencies across the group. Not only this, but the degree of certainty has allowed management to invest in even more self-funded ledger purchases and forecast earnings of $21m-$23m in FY12.

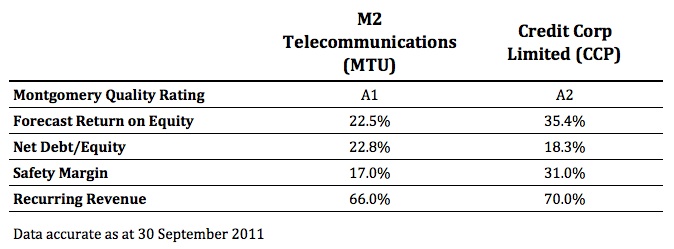

Additionally, the businesses offer the following financial metrics:

High Montgomery Quality Ratings (MQR), high forecast ROE’s, low debt levels, a Safety margin and high, recurring revenues have attracted us. After conducting your own research and seeking and taking personal professional advice, I’d be interested to know whether these companies or any others meet your recurring revenue test.

Go ahead and use this blog post as the beginning of a thread listing companies with solid recurring revenue and earnings.

Given the time to be interested in stocks is when no one else is, now is the time to go through your portfolio and determine those holdings that have a component of revenues that are recurring.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 30 September 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Would a dash of income and yield help you survive?

Roger Montgomery

September 29, 2011

It’s not unusual for stock market investors, including Value.able Graduates, to assume, incorrectly, that I’m against high dividends.

It comes from the position I take: companies that generate high rates of return on equity would make their shareholders a lot more money in the long term if they retained their profits (rather than paid them out as dividends) and continued to earn those high rates.

Not all companies, however, have the ability to sustain high rates of return on incremental equity, and so not all companies have the ability to retain all their profits at high rates of return.

A man with a hammer thinks every problem is a nail, and so given large amounts of cash, a CEO may go and do something silly. Understandably, many Australian investors prefer their Boards of Directors to pay the cash out in the form of a dividend.

There is another method that produces similarly attractive returns as retaining and compounding, but allows for the distribution of accumulated franking credits. For investors on tax rates lower than the corporate tax rate, it makes sense for a company to pay out all of its profits (to the extent that they are fully franked, which rules out a few companies) and replace the capital by way of a renounceable rights issue.

Arguably, a non-renounceable rights issue would be less dilutive on your stake in the business, but may fail to replace all the capital paid out.

As a Value.able Graduate confirmed recently, this only works where the costs associated with the capital raising are less than the tax benefit from paying fully franked dividends out. But that is not the subject of this post.

Don’t get me wrong, I like dividends!

Simply, I prefer to see companies with the ability to generate high rates of return on incremental equity (i.e. strong growth opportunities) retain more capital, borrow less and raise less capital. Borrowing increases risk and capital raisings (acknowledging of the above discussion) dilute ownership.

Dividends are Boring

Stepping aside from the stock market rollercoaster and taking the long-term view, a ‘growing dividends’ route to wealth is hardly an exciting proposition. Indeed, it’s akin to walking around Ikea without a wallet.

Yet many investors who lose money on the stock market, going for the quick buck, keep going back for more (akin to going back to Ikea again) and fail to realise that there is a slow but sure way to riches.

Did you know the stock market is trading about where it was in December 2004? Googling that shocked me – nearly seven years of zero appreciation… it seems zero is indeed the new normal!

Over those same seven years many companies have significantly increased their dividends (I should say that comparison is commonly used by the advisory community and the commentariat but it fails to recognise that there are many companies whose share prices are up three, four and seven fold in the last seven years).

Notwithstanding the weak comparison, it is indeed true that some companies have grown dividends significantly, despite a generally lacklustre market. The Reject Shop grew dividends by 394 per cent between 2005 and 2010 from 17 cents per share to 67 cents; M2 by 800 per cent from 2 cents to 16 cents and JB Hi-Fi by 1100 per cent from 7 cents to 77 cents.

Identifying extraordinary companies – those that generate lots of cash – has the power to make you very happy, just not overnight. In that sense it’s pretty unexciting. Mind you, I am yet to find a book or manual that says investing has to be exciting.

When it comes to investing, what is exciting is the effect of compounding. If you could find a portfolio of companies that paid a 5 per cent dividend yield and was able to grow those dividends by 10 per cent per year, your initial $20,000 portfolio earning $1000 would be generating $6,727 in 20 years – a 34 per cent yield on the initial purchase price. And if The Reject Shop could keep growing dividends at 31 per cent per year (unlikely without hiccoughs), they’d be generating dividends of $53.95 in another 15 years (you see why I said unlikely).

Extraordinary businesses paying attractive dividends

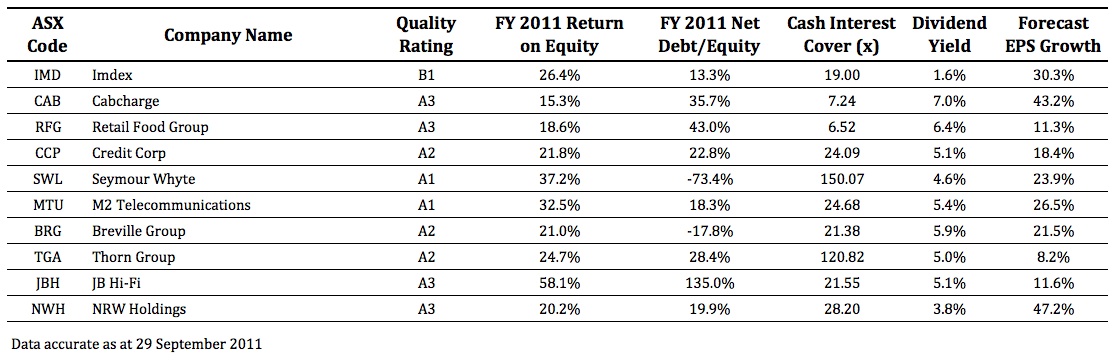

Following you will discover ten extraordinary companies that meet the criteria for high return on equity combined with attractive dividend yields: Imdex (B1), Cabcharge (A3), Retail Food Group (A3), Credit Corp (A2), Seymour Whyte (A1), M2 Telecommunications (A1), Breville Group (A2), Thorn Group (A2), JB HiFi (A3), NRW Holdings (A3).

How did I produce this list?

The goal was to find companies with the potential to significantly increase their dividends in the future. I logged into Skaffold® and refined my search to companies that generate high rates of return on equity (>15 per cent), have little or no debt (interest cover of more than 4 times) and have the strongest expected growth in earnings for at least the next year (EPS growth > 5 per cent).

And because I simply cannot advocate paying more than intrinsic value, I have also selected those that appear to be trading at a rational price (Safety Margin > 15 per cent).

For the record, I only selected A1, A2 A3, B1, B2 and B3 companies. From 1 November, you will be able to conduct searches like this yourself – high ROE, low debt, specified safety margin – the parameters are endless. Your resultant list of companies will quickly help you navigate the 2080 listed companies to find your own income champions.

What other companies make your income champion list?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 29 September 2011.

Skaffold® is a registered trademark of Skaffold Pty Limited.

by Roger Montgomery Posted in Investing Education.

- 35 Comments

- save this article

- 35

- POSTED IN Investing Education.

-

How would Roger Montgomery manage this inherited portfolio?

Roger Montgomery

September 23, 2011

Imagine you inherited a portfolio that included Ausdrill (ASL), Boart Longyear (BLY), Monadelphous Group (MND), Bradken (BKN), UGL Limited (UGL), Fortescue (FMG), BlueScope (BSL), Oz Minerals (OZL), Incitec Pivot (IPL), Mirabela Nickel (MBN), Myer (MYR), Fleetwood Corp (FWD), Santos (STO), Oil Search (OSH), Reckon (RKN), Iress (IRE), Roc Oil (ROC), Webjet (WEB), Forge Group (FGE), Mineral Resources (MIN), Clean Seas Tuna (CSS), McMillan Shakespeare (MMS) and Galaxy Resources (GXY). In this appearance on Switzer TV with Peter Switzer, Roger Montgomery reveals is Quality Scores for these companies and shares his thoughts on how to manage the transition of this portfolio. Watch this interview and discover what stocks Roger would sell, and what stocks he would add to the portfolio. Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

Should you be readying yourself?

Roger Montgomery

September 23, 2011

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.I know of seasoned market practitioners that have deferred the upping of stumps to set up new businesses because they believe there is worse to come. I also know of prominent Australians that are cashing up and I have met with many professional investors who liken the current conditions to those preceding a severe recession or even depression. Berkshire Hathaway shares are trading below $100,000 for the first time in a while (not that it matters). And Bill Gross at Pimco reckons the fact that you can get a better yield over two years by ‘barbelling’ – putting 10 per cent into 30 year bonds and 90 per cent into cash – and beat the yield on 2yr T-Notes is destroying credit creation and so low yields are having the opposite effect to the stimulation they are intended to generate.

Ok. So what do I think?

These are the times to prepare yourself for the possibility of another rare opportunity to buy extraordinary businesses at even more extraordinary discounts to intrinsic value. You have to be ready, you have to have your Value.able intrinsic valuations prepared and your preferred safety margins calculated.

In the short term (6-12 months), on balance, I think shares could get even cheaper (As I write those words, I log on to see the European markets down five per cent and the Dow Jones opening down more than 3 per cent and I am conscious of the fact that an outlook can be tainted by the most recent price direction). But our large cash proportion/position in The Montgomery [Private] Fund since the start of the calendar year has reflected for some time the impact of this possibility on future valuations and our requirement for larger discounts to intrinsic value.

Longer term, I like some of the research put out by McKinsey. The new infrastructure, such as roads, ports, railways and terminals that developing countries such as China, India and South America will need, will require tens of trillions of dollars. McKinsey Global Institute analysis reckons that by 2030 the supply of capital could fall short of demand to the tune of $2.4 trillion – a credit crunch that will slow global GDP growth by a percentage point annually. Even if China and India cool off, a similar gap could occur.

Back to the immediate outlook and there is a simple mental framework that I have been using to think independently about all the ructions impacting our portfolios.

I am no economist, but its pretty easy to see that if trend line US economic growth is barely 1 per cent, then any slowdown in the business cycle will push the economy towards the zero growth line. One per cent is quite simply very close to zero and the business cycle can push growth rates around more than the difference between them. Every time there is a whiff of a slowdown, there will, at the very least ,be fears of another recession. Again, I am not forecasting a recession nor am I forecasting slow growth. Indeed, I am not forecasting at all. I am simply pointing out the fact that tiptoeing on the edge of a precipice (the US at 1 per cent growth) is more frightening than doing circle work in a paddock a long way from any edge at all (China at 7, 8 or 9 per cent growth). Bill Gross’s comments about the destruction of credit further feeds the idea of a slowdown.

On balance I believe there will be some very attractive buying opportunities in the next six to twelve months. Before you read too much into this statement, I should alert you to the fact that I say it every year.

Analysts are prone to optimism too.

I think it’s also appropriate to remember that analysts typically are generally optimistic about earnings forecasts at the start of a financial year. This can be seen in another McKinsey research note (as well as thousands of other similar studies), where analysts commented:

“No executive would dispute that analysts’ forecasts serve as an important benchmark of the current and future health of companies. To better understand their accuracy, we undertook research nearly a decade ago that produced sobering results. Analysts, we found, were typically overoptimistic, slow to revise their forecasts to reflect new economic conditions, and prone to making increasingly inaccurate forecasts when economic growth declined.

Alas, a recently completed update of our work only reinforces this view—despite a series of rules and regulations, dating to the last decade, that were intended to improve the quality of the analysts’ long-term earnings forecasts, restore investor confidence in them, and prevent conflicts of interest. For executives, many of whom go to great lengths to satisfy Wall Street’s expectations in their financial reporting and long-term strategic moves, this is a cautionary tale worth remembering.”

And concluded: “McKinsey research shows that equity analysts have been overoptimistic for the past quarter century: on average, their earnings-growth estimates—ranging from 10 to 12 percent annually, compared with actual growth of 6 percent—were almost 100 percent too high. Only in years of strong growth, such as 2003 to 2006, when actual earnings caught up with earlier predictions, do these forecasts hit the mark.”

Demand bigger discounts

Those thoughts provide the ‘Skaffolding‘ in my mind around which I construct an opinion of where the landmines and risks may be for an investor. I tend to 1) look for much bigger discounts to intrinsic values that are based on analyst projections for earnings and 2) lower our own earnings expectations for those companies we like best.

Cochlear is one example of this. Many analysts have forecast a 10-20 per cent NPAT decline from the recent recall of their Cochlear implant. Only one analyst has considered and forecast a 40-50 per cent NPAT decline. The truth will probably be somewhere in between. Such a decline however would come as a shock to many investors if it were to transpire. And so it is important to be aware of that possibility when calibrating the size of any position in your portfolio. In other words, be sure to have some cash available for such an event because intrinsic value based under that scenario is between $23 and $30.

Your “Top 5”

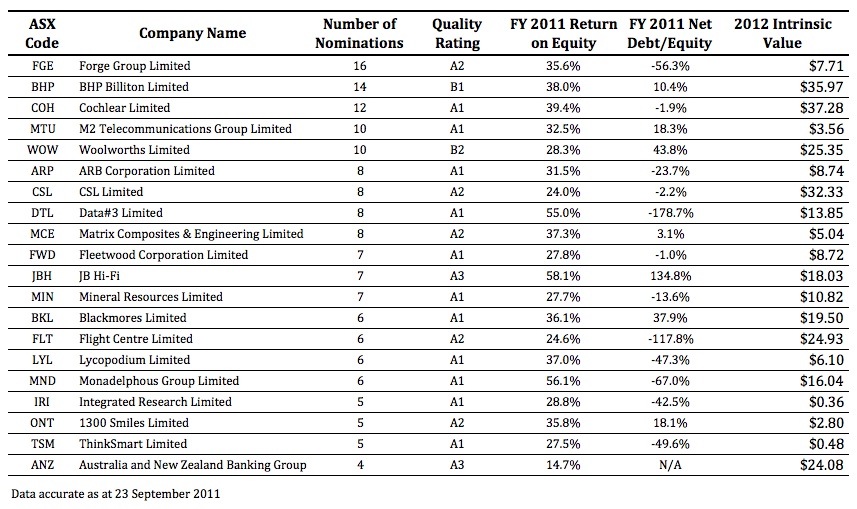

Earlier this month I asked you to list your “Top 5” value stocks – those that you believed represented good value at present. I was delighted to receive so many contributions.

On behalf of the many Value.able Graduates and stock market investors who read our Insights blog thank you for sharing with us the result of all your fossicking, digging and analysis.

There were more than 115 suggestions. The most popular was Forge Group with 16 mentions.

The following table presents the Quality Score, FY2011 ROE, FY2011 Net Debt/Equity and 2012 Value.able Intrinsic Value for Forge Group (FGE), BHP, Cochlear (COH), M2 Telecommunications (MTU), Woolworths (WOW), ARB Corp (ARP), CSL , Data#3 (DTL), Matrix (MCE), Fleetwood (FWD), JB Hi-Fi (JBH), Mineral Resources (MIN), Blackmores (BKL), Flight Centre (FLT), Lycopodium (LYL), Monadelphous (MDN), Integrated Research (IRI), 1300 Smiles (ONT), ThinkSmart (TSM) and ANZ.

As you know these quality scores and the estimates for intrinsic values can change at a moments notice (just ask those working at Cochlear!) so be sure to conduct your own research into these and any company you are considering investing in and as I always say, be sure to seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 23 September 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation.

-

Are these the best value stocks right now?

Roger Montgomery

September 8, 2011

With reporting season over, and armed with the Value.able mantra, how are you uncovering the very best stocks worthy of your attention?

With reporting season over, and armed with the Value.able mantra, how are you uncovering the very best stocks worthy of your attention?Lifebuoy soap was once marketed as Floating Above the Rest. Are there any companies post reporting season doing the same?

While many of my peers believe 2012 could be a very difficult year for investors, there are currently a selection of companies that appear to be both high quality and trading at prices offering a rational safety margin compared to our estimates of their intrinsic value.

Each reporting season we present a short-list of companies worthy of careful analysis. This reporting season is no different. As always, the list is not exhaustive. You are free to agree, disagree or append the list. Indeed, I encourage you to do so. For debate often brings A1 ideas.

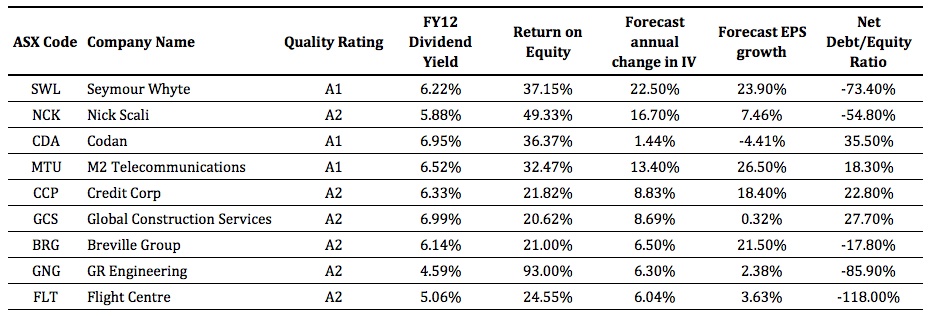

I decided to look for Large Caps, Mid Caps, Small Caps, Micro Caps and Nano Caps with an A1 or A2 Quality Score across all sectors and industry groups.

I’m also interested in companies for which there are analyst forecasts for at least one year ahead and whose current market price offers a safety margin of more than 10 per cent.

From over 2080 listed companies, 17 meet the criteria.

An attractive and sustainable Return on Equity is also important, so let’s seek out companies whose ROE is greater than 20 per cent in the most recent financial year, have a forecast dividend yield of more than four per cent and whose intrinsic value that is forecast to rise at least six per cent per annum.

The result?

Nine companies trading at a discount to intrinsic value that may be worthy of your attention.

Here they are: Seymour Whyte (ASX:SWL), Nick Scali (NCK), Codan (CDA), M2 Telecommunications (MTU), Credit Corp (CCP), Global Construction Services (GCS), Breville Group (BBG), GR Engineering (GNG) and Flight Centre (FLT).

If we were in a bull market, I suspect a stampede to get ‘set’ may ensue, without proper research. With the luxury of a market where the tide may still be going out, you may just have the indulgence of time to conduct plenty of research. Regardless, independent research is essential. As is seeking personal, professional financial advice.

So, what have you been researching? Go ahead and list your “Top 5”. We’ll put together a worthy riposte.

Alternatively, put forward your A1 suggestions and we’ll compile a list of intrinsic valuations and Skaffold® Quality Ratings for the next blog post.

Finally, keep in mind that I cannot predict where the share prices for these companies are headed. They could all halve, or worse. And remember, seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 8 September 2011.

by Roger Montgomery Posted in Companies, Market commentary.

- 317 Comments

- save this article

- 317

- POSTED IN Companies, Market commentary.

-

Value.able: The Makers

Roger Montgomery

August 31, 2011

Reports of the death of Australian manufacturing are greatly overstated. Roger Montgomery visits Australia’s unloved manufacturing sector and finds a group of thriving companies worth adding to your watchlist. Read Roger’s article at www.eurekareport.com.au.

by Roger Montgomery Posted in Media Room, On the Internet.

- 22 Comments

- save this article

- 22

- POSTED IN Media Room, On the Internet.

-

What has probing the reporting season avalanche revealed?

Roger Montgomery

August 24, 2011

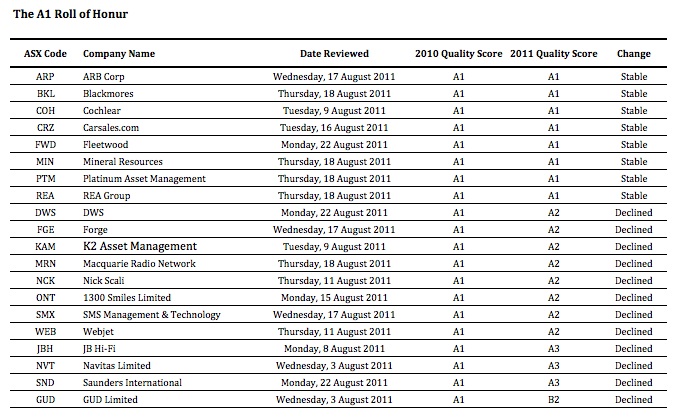

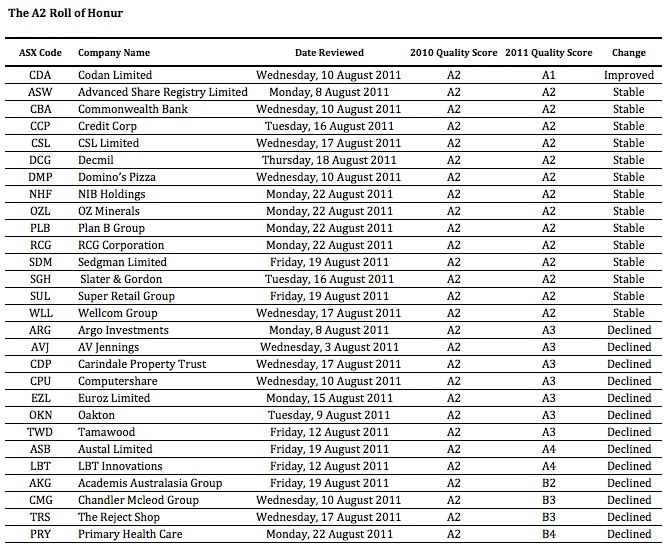

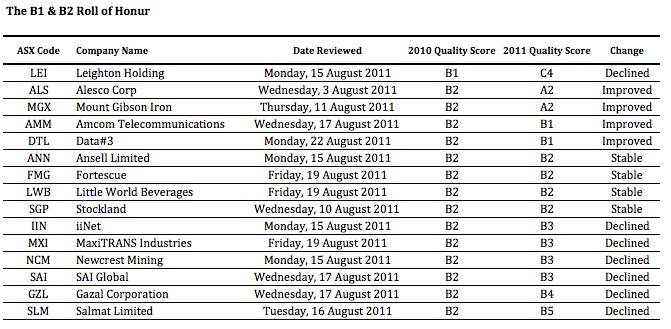

With reporting season in full swing, I would like to share my insights into whose Quality Score has improved, and whose has deteriorated. Remember, none of this represents recommendations. It is intended to be educational only. You must seek and take personal professional advice before acting or transacting in any security.

To date, 232 companies have reported their annual results. I am sure you can understand why we feel snowed under. With almost 2,000 companies listed on the ASX, the avalanche still has a way to roll.

We have updated all of our models for each of the 164 companies that we are interested in. As you know, we rank all listed companies from A1 down to C5. The inputs for those rankings always come from the company themselves. I would hate to think how bipolar they would be if we allowed our emotions and personal preferences to infect those ratings (or be swayed by analyst forecasts)!

Rather than arbitrary and subjective assessments, we download some 50-70 Profit and Loss, Balance Sheet and Cash Flow data fields from each annual report to populate five templates. All of these templates employ industry specific metrics to calculate the Quality Scores. This allows us to rank every ASX-listed business from A1 – C5. Its our objective way to sort the wheat from the chaff.

For Value.able Graduates not familiar with our scoring system, company’s that achieve an A1 Score are those we believe to be the best businesses, and the safest. C5s are the poorest performers and carry the highest risk of a possible catastrophic event.

A1 does not mean nothing bad will ever befall a company. A1 simply means to us that it has the lowest probability of something permanently catastrophic. Further, ‘lowest probability’ doesn’t mean ‘never’. A hundred-to-one horse can still win races, even though the probability is low. Similarly, an A1 business can experience a permanently fatal event. In aggregate however, we expect a portfolio of A1 businesses to outperform, over a long period of time, a portfolio of companies with lesser scores.

With that in mind, we are of course most interested in the A1s and – on a declining scale – A2, B1 and B2 businesses.

So, who has managed to retain their A1 status this reporting season? And which businesses have achieved the coveted A1 status? If you hold shares in any of the companies whose scores have declined (based of course on their reported results), please read on.

Of the companies that have reported so far, last year 20 of them were A1s, 28 were A2s, one was a B1 and 13 scored B2. That’s an encouraging proportion, although we tend to discover each reporting season that the better quality businesses and the better performing businesses are generally keen to get their results out into the public domain early.