Would a dash of income and yield help you survive?

It’s not unusual for stock market investors, including Value.able Graduates, to assume, incorrectly, that I’m against high dividends.

It comes from the position I take: companies that generate high rates of return on equity would make their shareholders a lot more money in the long term if they retained their profits (rather than paid them out as dividends) and continued to earn those high rates.

Not all companies, however, have the ability to sustain high rates of return on incremental equity, and so not all companies have the ability to retain all their profits at high rates of return.

A man with a hammer thinks every problem is a nail, and so given large amounts of cash, a CEO may go and do something silly. Understandably, many Australian investors prefer their Boards of Directors to pay the cash out in the form of a dividend.

There is another method that produces similarly attractive returns as retaining and compounding, but allows for the distribution of accumulated franking credits. For investors on tax rates lower than the corporate tax rate, it makes sense for a company to pay out all of its profits (to the extent that they are fully franked, which rules out a few companies) and replace the capital by way of a renounceable rights issue.

Arguably, a non-renounceable rights issue would be less dilutive on your stake in the business, but may fail to replace all the capital paid out.

As a Value.able Graduate confirmed recently, this only works where the costs associated with the capital raising are less than the tax benefit from paying fully franked dividends out. But that is not the subject of this post.

Don’t get me wrong, I like dividends!

Simply, I prefer to see companies with the ability to generate high rates of return on incremental equity (i.e. strong growth opportunities) retain more capital, borrow less and raise less capital. Borrowing increases risk and capital raisings (acknowledging of the above discussion) dilute ownership.

Dividends are Boring

Stepping aside from the stock market rollercoaster and taking the long-term view, a ‘growing dividends’ route to wealth is hardly an exciting proposition. Indeed, it’s akin to walking around Ikea without a wallet.

Yet many investors who lose money on the stock market, going for the quick buck, keep going back for more (akin to going back to Ikea again) and fail to realise that there is a slow but sure way to riches.

Did you know the stock market is trading about where it was in December 2004? Googling that shocked me – nearly seven years of zero appreciation… it seems zero is indeed the new normal!

Over those same seven years many companies have significantly increased their dividends (I should say that comparison is commonly used by the advisory community and the commentariat but it fails to recognise that there are many companies whose share prices are up three, four and seven fold in the last seven years).

Notwithstanding the weak comparison, it is indeed true that some companies have grown dividends significantly, despite a generally lacklustre market. The Reject Shop grew dividends by 394 per cent between 2005 and 2010 from 17 cents per share to 67 cents; M2 by 800 per cent from 2 cents to 16 cents and JB Hi-Fi by 1100 per cent from 7 cents to 77 cents.

Identifying extraordinary companies – those that generate lots of cash – has the power to make you very happy, just not overnight. In that sense it’s pretty unexciting. Mind you, I am yet to find a book or manual that says investing has to be exciting.

When it comes to investing, what is exciting is the effect of compounding. If you could find a portfolio of companies that paid a 5 per cent dividend yield and was able to grow those dividends by 10 per cent per year, your initial $20,000 portfolio earning $1000 would be generating $6,727 in 20 years – a 34 per cent yield on the initial purchase price. And if The Reject Shop could keep growing dividends at 31 per cent per year (unlikely without hiccoughs), they’d be generating dividends of $53.95 in another 15 years (you see why I said unlikely).

Extraordinary businesses paying attractive dividends

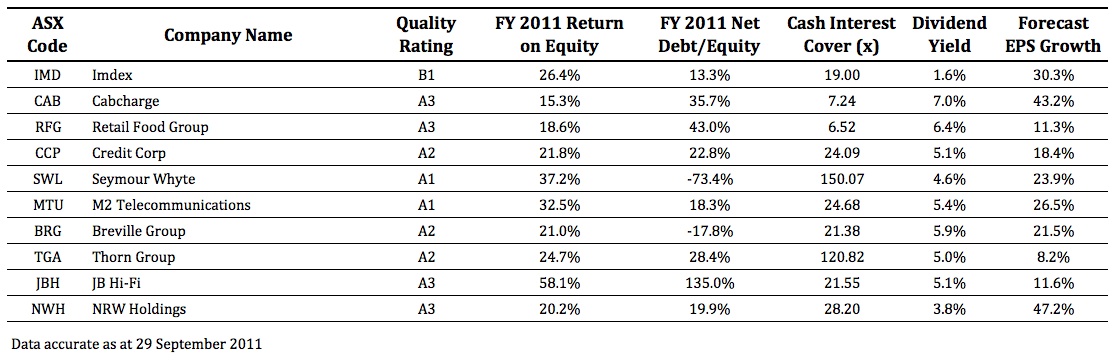

Following you will discover ten extraordinary companies that meet the criteria for high return on equity combined with attractive dividend yields: Imdex (B1), Cabcharge (A3), Retail Food Group (A3), Credit Corp (A2), Seymour Whyte (A1), M2 Telecommunications (A1), Breville Group (A2), Thorn Group (A2), JB HiFi (A3), NRW Holdings (A3).

How did I produce this list?

The goal was to find companies with the potential to significantly increase their dividends in the future. I logged into Skaffold® and refined my search to companies that generate high rates of return on equity (>15 per cent), have little or no debt (interest cover of more than 4 times) and have the strongest expected growth in earnings for at least the next year (EPS growth > 5 per cent).

And because I simply cannot advocate paying more than intrinsic value, I have also selected those that appear to be trading at a rational price (Safety Margin > 15 per cent).

For the record, I only selected A1, A2 A3, B1, B2 and B3 companies. From 1 November, you will be able to conduct searches like this yourself – high ROE, low debt, specified safety margin – the parameters are endless. Your resultant list of companies will quickly help you navigate the 2080 listed companies to find your own income champions.

What other companies make your income champion list?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 29 September 2011.

Skaffold® is a registered trademark of Skaffold Pty Limited.

Liz

:

Thanks Michael and Roger. It’s not only shocking but it’s one of the difficulties re the current market in terms of value. I know I’ll be shouted down re intrinsic value, regardless of timing. However, for example, ARG and AFI have been a stock that performed steadily for investors in the past years offering both FF dividends and growth. Taking ARG, I’ve simply reinvested the dividends year after year yet would have been better off not doing so over the last 3 years. They’ve been one of my poorest performing stocks! You could say this of most LIC’s. Then there’s PTM, historically a great performer but the GFC and their international exposure has knocked them about. The lesson for me has been not to sell the stock I’ve mentioned but think carefully about the DRP in the context of current global macro events.

Yes, the world will recover but I’m seeing events not before experienced in my lifetime exacerbated by the fact that we live in an interconnected and interdependent world. So, it may be that longer timeframes are required for real recovery. (Just look at the problems in Europe which are beyond our control!). Does this mean what we think of as ‘value’, whether it be shares, property, art or anything else, be de-valued?

I’ve put some money into SUL, CDD, WOW and APA in the past 12 months. There are some service providers in the mining sector with good growth outlooks in the next couple of years BUT with the anticipated downturn in commodity prices things can change quickly. As well, apart from currency movements making goods cheaper out of USA and Europe, watch Chinese companies take work from the AU service providers (design and construct) and manufacturing industry (mining equipment) where they have stakes in mining projects.

I’m sure there are plenty of people grappling with these thoughts albeit they state them more eloquently.

Value is arguing with protection of capital!

Roger Montgomery

:

Whether we are talking about individuals, companies or countries, the impact of debt on activity is the same. It simply takes time to pay debt down to a level after which normal activity can resume.

John C

:

Hi Liz – I agree with you about DRPs. I would prefer to choose when and what to invest in (and at what price), than take the small discounts that most DRPs offer, especially when prices often seem to be manipulated during DRP pricing periods. If you still like LIC’s (and I’m not sure that you do, after re-reading your comment), have a look at DJW. I have invested in AFI and ARG in the past but have finally sold the last of my ARG shares. I also hold DJW because I find their dividend yield is better and their profits stand up better in the years when the others drop. I do have many direct investments also, but LIC’s are OK too for income investors (I’m one of them).

With reference to your comment about Chinese companies taking work away from Australian mining services companies when the Chinese have a direct interest in the mines, it’s an interesting line of thought, but I’m rather hoping that they’ll maybe just buy the Australian mining services companies instead…

Phil A

:

Hi Roger

I have been with you for longer than many if not most. Have always enjoyed your insights as part of my overall research.

IMD is a great stock. I have been a long term investor in it since it was at $0.30. I have traded portions of my holdings out and back in a couple of times when the values have been too high or too low.

Another old favourite of mine is CDD. Great dividend, and some capital growth as well. Its has lower ROE than some others you like, but it keeps delivering, and imprtantly, management seems to know what they are doing. Generally seems to be off the radar but its a reliable performer.

Roger Montgomery

:

Great to hear from you again Phil. Please post again whenever you’ve something to share.

John C

:

Hi Phil, Thanks for the thoughts on IMD & CDD. I hadn’t considered CDD before, but I’ve bought some this morning after doing a couple of hours of research on them. I like them. I used to own Coffey International (COF), which is a similar company, but COF expanded too quickly with very high gearing and got themselves into a bit of trouble. I ended up bailing out of COF because I lost faith in management – and because I have a predominantly income-focussed portfolio, and after COF ceased paying dividends, I had to make a call on how long the turn-around would take with COF, if it happened at all. The time-frame was too long in my opinion, and there were better places to use the money that I had tied up in COF shares (so I took a hit on them).

Cardno are a far better company than Coffey from what I’ve been able to ascertain, and appear to have a more measured and sensible approach to growth through acquisitions. Since I like the space that they’re in, and due to the quality of the company, I’m happy to invest in CDD at this time, at these prices. Thanks again for the tip.

Andyc

:

I took a 10 second look at CDD and they look impressive, except when I look at shares on issue — going from around 50mill in 06/07 to 100+mill currently.

I can see that revenue and profit also increased nicely, but an expanding number of shares always concerns me.

Anyone have any ideas on when this is, or isn’t, OK?

John C

:

On the surface, it appears that CDD may have expanded their shares on issue to allow for some rapid expansion without resorting to increased debt levels. The industry that they’re in requires an international presence with experience across multiple disciplines in order to win large government and NGO contracts. I agree that shares on issue doubling in around 5 years is of concern, but if the alternative was high gearing (which appeared to be the road that COF took in the same time period), then CDD may well have made the better choices. If the revenue and profit have doubled along with the shares on issue, and the company is now better positioned to win future contracts (and therefore achieve further growth), then I think they may have done well.

John C

:

Since that last post, the SP of CDD has risen over 30%, and they have issued 1 for 9 renounceable (tradable) rights which have a face value currently of approx. $1.29 (and last traded at $1.255), plus the 4th April 18 cent dividend (70% franked). It’s been a solid investment to date. Thanks again Phil for mentioning them on this blog.

Roger Montgomery

:

Smart guys at the helm too.

John C

:

Good post Roger. I’ve got 4 of those: CAB, MTU, BRG & JBH. Other favourites of mine that have a good yield, high ROE, low gearing (or no debt), include:

ARP (you have to take the regular special dividends into account when assessing ARB, otherwise their yield can look ordinary, but an extraordinary business any way you look at it)

BKL (expensive)

CDA

CLV

CSL

CWP

DWS

FWD

HSN

IRE

MIN

MND

ORL

SMX

WSA

plus three that are almost there:

AMM (borderline)

SAI (borderline)

ZGL (borderline)

NFK could fit the bill now that they have re-instated their dividends, although their future yield is a little uncertain (ROE is certainly high enough though!).

Also, if there are people who have substantial unallocated cash reserves, and you’re looking for somewhere to park it, consider MQCPA, Macquarie CPS (Convertible Preference Shares), they aren’t too volatile, trading at between $100 and $110 (last: $101) per share, and they pay over 10% (unfranked) dividends. The dividends are paid late June and late December, and there is usually plenty of liquidity if you need to sell them fast to get to your cash. The only major risk (as I see it) is that Macquarie goes completely bust, and I see that as a very low risk indeed, so I’ve found MQCPA to be a handy place to park cash while waiting for opportunities to come along. The other risk is that the value of the shares will drop, but considering their trading range and the face value of the shares (being Convertible Preference Shares) is $100, if you buy them at close to $100, they are unlikely to fall much, if at all. As Roger says, get your own advice, do your own research, etc. but it’s an idea that’s worked for me.

John C

:

Sorry – a couple of those in my list above have “moderate” rather than “low” gearing (or no debt). CWP is one. Not “Low”, so shouldn’t have been included in that particular list. I still hold them and like them a lot however.

David King

:

I too hold MCQPA. Be aware that :

1. At current price, included is accrued interest (“coupon”) of about $3, so the actual yield is about 11.4% (unfranked)

2. MQG share price at maturity of these hybrids needs to be $27.11 or above. If not, the shares convert to a floating rate of BBSW plus 3.5% until the share price reaches the threshold. If the shares ARE redeemed at maturity (for $100 each) your yield is nearer 13%.

Check out also BENPA paying about 8.8% and maturing next year.

Roger Montgomery

:

Well done David. Thank you.

Matthew Smith

:

I also hold MQCPA plus a few others at present, which were all bought at substantial discounts to their face & fair value.

These fixed income securities are even easier to value then businesses!!

Even more so when they have a fixed rate.

Have fun guys.

Steve

:

Thanks Roger, this is a very appropriate and timely post. I have been doing a bit of soul searching recently in regards to my investment goals and methods, as I’m sure many others have too. Personally, I like the idea of getting rich slowly!

I remember my Dad bought me a couple of finance books by Noel Whittaker when I was around 18. It was all about the basic principles of wealth building and how to get rich SLOWLY. This concept appealed to me as it seemed realistic and started me on my investing journey (with its many ups & downs, mostly downs!!).

Going forward there is a chance capital gains might be harder to come by in property and shares. At least by holding high yielding stocks, you can be reasonably sure of a growing income. I have been disappointed over the last 5+ years watching capital gains appear briefly only to be wiped out again.

I think the following plan might work well in terms of implementing the income concept:

1. Still buy QUALITY stocks

2. Still buy stocks when they are cheap – wait until the inevitable major corrections to come along (and keep some money in cash until this happens)

3. Buy stocks with a reasonable and sustainable yield

Luckily my portfolio already holds a number of these sorts of stocks so no need for any major re-work to implement a strategy like this, just some tidying up

Roger Montgomery

:

Keeping cash until a correction, seems to have appeal Steve. Someone should do a quick bit of research into what happens if you only buy when yield > p/e. According to one of my peers it’s a simple recipe for success.

Ash Little

:

Not saying this will happen here and just looking at historical data over many years in many countries for banks but when PE drops below yield it has been a warning sign……Both yields and PE have usually disappeared

The banks usually trade at their book value but this will be hard to guess…….As Charlie says……my guesses are better than yours so good luck with the guesses if this happens

Alex

:

DWS.

9% FF on payout ratio 85%

ROE 30%

Revenue growing

25% operating margin

Zero debt

Trading at or below my IV

Darren78

:

Yeah I am expecting an after tax yield on this one of 8%+, it will be more than I get for ANZ which is considered a good yielder. I think the dividend payment date is today or tomorrow.

The other side of the equation though is that IV is not rising at a big rate, but should still increase steadily if the forecast profits come about.

Gavin

:

Is it that some discussions are not as futile as they seem at the time?

In relation to the re-raising of required funds.

Renounceable is just fine – because what you want as an owner is the right, not the obligation of putting more capital to work. If you haven’t got the funds available to fund your portion of the capital raising at least you can sell your right/s and receive compensation.

Institutional Placement = right that should belong to owner is given to others. Good if the funds are going to be used uneconomically but bad if the opportunity is worthwhile.

Non-renounceable rights issue = both right and obligation to new capital deployments. Seems it is often used with a large discount to strong arm owners into providing capital for uneconomical businesses.

Retained earnings = both right and obligation to new capital deployments. Good if the funds are used economically – bad otherwise. Outcome is dependent on calibre of management.

Renounceable rights issue = right but not obligation to new capital deployment opportunities. There is an option value here. Final capital allocation decision is moved from manger to owner.

Franking credits not being distributed and/or capital raising via any means other than a renounceable rights issue are two factors that make me look carefully at a boards commitment to putting their shareholders first. (There may be good reasons, but I want to know what they are)

Dan S

:

Gavin, I think original thought will always be met first by scepticism.

Interesting points theoretically, but just a slightly different perspective:

Whether management will look to use a placement v renounceable structure will depend on the register. Given management (and underwriters) are after funding certainty (a register which will support the business when required – i.e. buy and hold institutions), then if there isn’t a decent insto presence, the company will look to an insto placement coupled with either a SPP or entitlement offer to appease retail punters.

Re: Renounceable – as RM alluded to, these are generally done at a bigger discount to non-renounceable.

Further, getting value for your rights is not guaranteed, this ultimately depends on where the stock is trading at the retail bookbuild. As we have seen lately, many of these are underwater and investors don’t get value for their renounced entitlements. There some structures where the insto bookbuild and the retail bookbuild is combined to ensure equality, but this doesn’t seem to be the norm.

Further, moving the allocation decision from the managers to the owners may result in an undesirable register, i.e. a “flipper” hedge fund that bids over the top at the retail bookbuild.

Roger Montgomery

:

All good points based on market experience

Roger Montgomery

:

Good points and have to appreciate the desire of the board to consider the composition ofbthe sharevregister as I think Dan may point out.

Rod h

:

What concerns me about projected dividends is that if the market drops significantly won’t many businesses be tempted to drop their dividends in line with the drop in their stock price ?

Roger Montgomery

:

Not necessarily Rod. Share price performance doesn’t determine dividend policy however a falling share price can sometimes suggest investors don’t expect the current dividend level to be maintained.

Andrew

:

I think there is some potential in the retail sector for quality high yielding companies trading at a discount.

The first one that comes to mind is Oroton.

This covers some of Rogers criteria.

ROE is greater than 15% by a considerable margin

Interest cover is about 30x

It argueably doesn’t cover the EPS growth. Consensus forecasts for example by my calcs identify EPS growth of 1.75%

The other potential thing it doesn’t fit in the above criteria is the MOS. if you use the just reported 2011 year to calculate value and a market price of $7.62, i get a MOS of 22.2%. if you use forecast values than i would argue that the MOS is probably not there or big enough as per Rogers criteria.

Regardless, the yield due to them routinley paying about 80% of earnings out as dividends is around the 6% mark currently in regards to the $7.62 market price.

DJS is another company that fits a few, but not all criteria of Rogers in this blog and has an attractive yield which last calculated was around 8% i think. The MOS is not there for me however.

JBH was mentioned in Rogers post, and WOW is a pretty good candidate as well.

As the lower the price goes the higher the yield it is even more important for us to ensure we buy at big margins of safety. In fact i dare say for DJS to become within buying zone i will be rewarded with a div yeild of over 10%.

I know some have problems with retaila t rpesent but for me, i can see opportunities and they are often very good cash generating businesses with them receiving money from their customers instantly rather than the 14,20,30,60+ days. This means i think the sustainability of such yields is quite good.

Chris B

:

Here’s a list of businesses that have high ROE, and dividend yields > 4% (expected to increase in future years based on analyst forecasts)…

This list is not exhaustive.

ANZ

NCK

JBH

CDA

CCP

BRG

GNG

FLT

HSN

ORL

DTL

MND

FWD

PTM

SMX

TGA

WLL

WTF

WOW

UGL

MMS

Cheers,

Chris B

Glenice A

:

Hi,

this is not really a reply to Chris’s post, but I cannot seem to be able to enter a comment, so am hoping this way it will come through. Roger, you are always saying to seek professional advice; well a couple of months ago I rang my broker and told him to sell MQG (then $35.45) and he talked me out of it. So I guess I forgot another piece of advice, and that is to think independently. I am looking forward to the offer for Skaffold – I think I really need it! Also, I bought a very small parcel of TSM recently at .69c, and it is steadily falling, and even Roger has revised his 2012 IV down to .48c; yet I studied the latest Annual Report and read all the ASX announcements, and just the other day they reaffirmed their guidance, so can anyone shed any light on its price and IV decline? ( No good asking my broker!!)

Cheers,

Glenice

Andrew

:

Probably won’t offer much help here, but i thought i would comment on my surprise that a broker talked you out of a trade. This is not normal broker behaviour in my experience.

Andrew

:

Good post Roger, i think your view to dividends is one of the areas some people seem to get a bit confused over (another example is diversification).

I like dividends. Although i am on the younger side and have time on my side. I don’t mind receiving dividends as it allows me the cash to make further investments (if opportunities exist) without needing to go into my own money/savings allowing that to compound on the side whilst increasing my portfolio size.

At the end of the day, the only thing i really care about are that the company is quality and that the same quality company is trading at a large enough discount to make an investment attractive.

WOW pays out a decent dividend but if they didn’t, the sustainability of their 20-30% ROE would be a lot less sustainable. I’m not going to miss buying into WOW because they pay and increase their dividends. The only problem i would have is if overall the company stopped being a quality one.

Roger Montgomery

:

Great points Andrew. Have a great weekend.

John P

:

Hi Roger,

Another great post and it will be interesting to see what value.able graduates uncover.

Coincidently I have been holding a cash position for some time but could not resist buying both Thorn Group and Seymour White two days ago for the very reasons you have stated in this blog.

Michael

:

The ASX index being where it was in December 2004 is actually a good performance compared to the major exchanges around the world. By my calculations, the current levels are as follows for other world indexes:

* Dow Jones Industrial Average: April 1999

* German DAX: May 1998

* London FTSE: September 1997

* Japan: Pre 1984 (the limit of the data I have access to)

Some of underperformance of the Australian market in recent years compared to the US may be catch up for the past decade, with the Australian market still ahead over the decade.

Roger Montgomery

:

Another rather shocking observation. Thanks Michael.