Should you be readying yourself?

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.

I know of seasoned market practitioners that have deferred the upping of stumps to set up new businesses because they believe there is worse to come. I also know of prominent Australians that are cashing up and I have met with many professional investors who liken the current conditions to those preceding a severe recession or even depression. Berkshire Hathaway shares are trading below $100,000 for the first time in a while (not that it matters). And Bill Gross at Pimco reckons the fact that you can get a better yield over two years by ‘barbelling’ – putting 10 per cent into 30 year bonds and 90 per cent into cash – and beat the yield on 2yr T-Notes is destroying credit creation and so low yields are having the opposite effect to the stimulation they are intended to generate.

Ok. So what do I think?

These are the times to prepare yourself for the possibility of another rare opportunity to buy extraordinary businesses at even more extraordinary discounts to intrinsic value. You have to be ready, you have to have your Value.able intrinsic valuations prepared and your preferred safety margins calculated.

In the short term (6-12 months), on balance, I think shares could get even cheaper (As I write those words, I log on to see the European markets down five per cent and the Dow Jones opening down more than 3 per cent and I am conscious of the fact that an outlook can be tainted by the most recent price direction). But our large cash proportion/position in The Montgomery [Private] Fund since the start of the calendar year has reflected for some time the impact of this possibility on future valuations and our requirement for larger discounts to intrinsic value.

Longer term, I like some of the research put out by McKinsey. The new infrastructure, such as roads, ports, railways and terminals that developing countries such as China, India and South America will need, will require tens of trillions of dollars. McKinsey Global Institute analysis reckons that by 2030 the supply of capital could fall short of demand to the tune of $2.4 trillion – a credit crunch that will slow global GDP growth by a percentage point annually. Even if China and India cool off, a similar gap could occur.

Back to the immediate outlook and there is a simple mental framework that I have been using to think independently about all the ructions impacting our portfolios.

I am no economist, but its pretty easy to see that if trend line US economic growth is barely 1 per cent, then any slowdown in the business cycle will push the economy towards the zero growth line. One per cent is quite simply very close to zero and the business cycle can push growth rates around more than the difference between them. Every time there is a whiff of a slowdown, there will, at the very least ,be fears of another recession. Again, I am not forecasting a recession nor am I forecasting slow growth. Indeed, I am not forecasting at all. I am simply pointing out the fact that tiptoeing on the edge of a precipice (the US at 1 per cent growth) is more frightening than doing circle work in a paddock a long way from any edge at all (China at 7, 8 or 9 per cent growth). Bill Gross’s comments about the destruction of credit further feeds the idea of a slowdown.

On balance I believe there will be some very attractive buying opportunities in the next six to twelve months. Before you read too much into this statement, I should alert you to the fact that I say it every year.

Analysts are prone to optimism too.

I think it’s also appropriate to remember that analysts typically are generally optimistic about earnings forecasts at the start of a financial year. This can be seen in another McKinsey research note (as well as thousands of other similar studies), where analysts commented:

“No executive would dispute that analysts’ forecasts serve as an important benchmark of the current and future health of companies. To better understand their accuracy, we undertook research nearly a decade ago that produced sobering results. Analysts, we found, were typically overoptimistic, slow to revise their forecasts to reflect new economic conditions, and prone to making increasingly inaccurate forecasts when economic growth declined.

Alas, a recently completed update of our work only reinforces this view—despite a series of rules and regulations, dating to the last decade, that were intended to improve the quality of the analysts’ long-term earnings forecasts, restore investor confidence in them, and prevent conflicts of interest. For executives, many of whom go to great lengths to satisfy Wall Street’s expectations in their financial reporting and long-term strategic moves, this is a cautionary tale worth remembering.”

And concluded: “McKinsey research shows that equity analysts have been overoptimistic for the past quarter century: on average, their earnings-growth estimates—ranging from 10 to 12 percent annually, compared with actual growth of 6 percent—were almost 100 percent too high. Only in years of strong growth, such as 2003 to 2006, when actual earnings caught up with earlier predictions, do these forecasts hit the mark.”

Demand bigger discounts

Those thoughts provide the ‘Skaffolding‘ in my mind around which I construct an opinion of where the landmines and risks may be for an investor. I tend to 1) look for much bigger discounts to intrinsic values that are based on analyst projections for earnings and 2) lower our own earnings expectations for those companies we like best.

Cochlear is one example of this. Many analysts have forecast a 10-20 per cent NPAT decline from the recent recall of their Cochlear implant. Only one analyst has considered and forecast a 40-50 per cent NPAT decline. The truth will probably be somewhere in between. Such a decline however would come as a shock to many investors if it were to transpire. And so it is important to be aware of that possibility when calibrating the size of any position in your portfolio. In other words, be sure to have some cash available for such an event because intrinsic value based under that scenario is between $23 and $30.

Your “Top 5”

Earlier this month I asked you to list your “Top 5” value stocks – those that you believed represented good value at present. I was delighted to receive so many contributions.

On behalf of the many Value.able Graduates and stock market investors who read our Insights blog thank you for sharing with us the result of all your fossicking, digging and analysis.

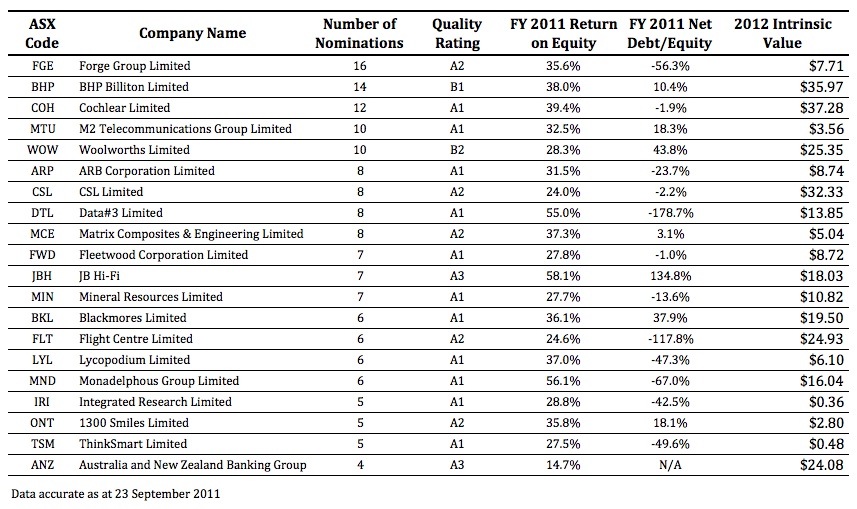

There were more than 115 suggestions. The most popular was Forge Group with 16 mentions.

The following table presents the Quality Score, FY2011 ROE, FY2011 Net Debt/Equity and 2012 Value.able Intrinsic Value for Forge Group (FGE), BHP, Cochlear (COH), M2 Telecommunications (MTU), Woolworths (WOW), ARB Corp (ARP), CSL , Data#3 (DTL), Matrix (MCE), Fleetwood (FWD), JB Hi-Fi (JBH), Mineral Resources (MIN), Blackmores (BKL), Flight Centre (FLT), Lycopodium (LYL), Monadelphous (MDN), Integrated Research (IRI), 1300 Smiles (ONT), ThinkSmart (TSM) and ANZ.

As you know these quality scores and the estimates for intrinsic values can change at a moments notice (just ask those working at Cochlear!) so be sure to conduct your own research into these and any company you are considering investing in and as I always say, be sure to seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 23 September 2011.

who cares

:

Any views on lyc.ax massive fall?

is it below intrinsic?

Ash Little

:

Hey Who,

We would be happy to give you an IV but we need to know the prices of rare earths for the next 10 years plus when the plant in Malay will open.

Cheers

Steve

:

Did anybody else notice the swipe Marcus Padley took at value investors in last weekends SMH business section? I’m guessing he follows this blog for insights into the behaviour of value investors

Roger Montgomery

:

Marcus is a supporter of value investing and of Value.able. While I didn’t read the column, I have every confidence that it was written to ensure no favourites are being played. Keep in mind, we have owned small positions in the stocks mentioned and yet are still outperforming the market significantly. Value investing cannot claim to pick the tops and bottoms of markets. We leave that expertise to those who claim they can. And diversification ensures we aren’t betting the farm on any one company either so picking two or three examples and then taking a swipe at Value investing…well…

Steve

:

Very true Roger. It is easy to cast aspersions when the market is in the state it’s in!

Glad to hear your fund is still outperforming the market. Although I doubt many average value investors could say the same thing right now! Anyone that had diversified amongst any of the following value stocks: FGE, MCE, VOC, ZGL, DCG, TSM etc. would surely be well and truly underperforming the market right now!

Roger Montgomery

:

Yes you are doing a good job.

Make no mistake, with a large proportion of cash, I am elated on those 4% down days even though our existing holdings may fall by more than the market on that day.

We have or have had exposure to all of the stocks you listed and are outperforming by a significant margin. Portfolio construction is also an important part of investing.

Disciplined adherence to quality and value principles cannot ensure you will out perform at all times of course.

Indeed, if you are a net investor, it is preferable that there are intermittently periods where significant underperformance transpires, ensuring the opportunity to add to holdings of extraordinary businesses.

To enjoy the periods of significant outperformance it’s arguably necessary for periods where individual holdings significantly underperform.

Greg Mc

:

Those last two paragraphs are the ones that those who disparage value investing don’t understand.

Parag

:

I like Roger’s quote I heard today – “the safest asset is the one that no one wants.”

Provided its quality and at a cheap price to value.

There are plenty of quality businesses trading at no growth valuations – tga, maq, fge to name a few.

Ash Little

:

Spot on Greg Mc

Thanks

Andrew

:

I didn’t really take it as a swipe, although if you are going to take it that way than he basically had a swipe at everyone else too.

The way i read it he wasn’t even commenting on investment styles but the psychological element to investing. The way some people are too easily convinced to gamble if a stockbroker tells them to buy but if it happened outside of the stockmarket where people tend to think more rationally he would tell the stockbroker to go somewhere not very pleasant if he asked the person for money.

It was a call to reset the compass and start thinking a bit more businesslike in regards to investing.

I am surprised he didn’t quote the TISM lyric from their song “BFW” where they say the stock market is full of people with cunning trying to rip eachother off, when he was mentioning the truth that for every winner there is a loser or for every buyer there is a seller.

Steve

:

I apologise if my reference to the current underperformance of value stocks frustrates anyone. But I note that many people (including the boss himself) over the last year were promoting the performance of their value stocks and how well they were doing when things were going up. Using it as an example of the success that can be had by investing in these stocks. I therefore think it’s only reasonable to also discuss the times of serious underperformance too, regardless of how long it lasts.

Andrew – I think the article was also a call to convince people that you shouldn’t just sit back and let the market destroy your wealth. He was suggesting that people should not have held onto QBE, Matrix & Forge in the (apparently misguided?) hope that they will go back up. Being a ‘victim’. I think the main point he is advocating is to have some kind of trading plan and stop loss.

I know the above is sacrilege to many value investors, but I personally have an open mind. I am yet to find the perfect system that works for me and am still trialling different approaches. I have been following Roger and value investing for the last year or 2 and I like a lot of the principles. I also like the idea of investing long term and letting time hopefully work its magic.

On the other hand, I can also see merit in setting a trailing stop loss which could potentially save a heck of a lot of capital gain/loss, as we have just witnessed. I know that Marcus suggests you can do both – invest for the long term and hold onto good stocks – but also protect capital on the downside. I think I like the idea of combining different methods

Roger Montgomery

:

Steve,

Would you like to suggest some stop loss techniques that you believe fit the bill? I will ask you to exclude simplistic versions like 5% or 10% etc…Its important to remember that I have always said 1) get advice, 2) do your own research, 3) I don’t know where shares prices could go next – they could halve, and 4) I am under no obligation to keep anyone here up to date with all of my buying and selling.

Steve

:

Roger,

As I said “I am yet to find the perfect system that works for me and am still trialling different approaches”. I can see negatives and positives in all of the different methods. Trailing stop losses are something I have only just started looking at and am still researching.

I prefer the concept of value and long term investing to technical analysis but perhaps combining some aspects such as stop losses could have saved significant amounts of capital over the last couple of months. Capital that could take a very long time to replenish, as the other Steve articulates well in a post below. The issue is not so much the price drops but the fact that in many cases with these value stocks, the market was right well before the fact! We saw significant and sustained price drops which were then backed up by an announcement or results which seriously changed the prospects of these companies going forward, thereby reducing the chances of a return to previous valuations.

I don’t know the answer. As I said, I am still learning and trying to soak up as much information as I can from different sources. I haven’t decided if any particular method is right or wrong and still have an open mind. What I do know is that the stock market can be very challenging and in the end it’s probably all a form of gambling… no matter which approach you use!

Steve

:

I should add to the above that I think it’s a form of gambling… unless you have a very, very long time frame (20+ years?). By then I’d hope compounding would have worked some magic

John R

:

Not sure really there is such a thing as a value stock. However clearly the IV methodology tends to lead to small, high growth and low dividend yield stocks. These are not really defensive and it is not surprising they have been smashed in a bear market. This just illustrates in my view why in a portfolio one also needs some more defensive stocks (eg WOW) to balance the position.

Those who just blindly bought all the stocks mentioned on this blog without doing their own analysis were inevitably going to be disappointed – life is never that easy!

Roger Montgomery

:

Not sure about that conclusion John. The IV method that we subscribe to has led us to COH, WOW, ANZ among others. I think your conclusions may have been influenced by the discussions here at the insights blog. There are a meaningful number of large cap, high yielding stocks that also meet the Value.able criteria.

Andrew

:

I have to agree Roger, at least 70% if not more of my watchlist is made up of such stocks. I could probably count on one hand the number of smallish companys that John describes.

I think the bias towards low yielding and high growth companys is caused by the premise and mathamatically proved idea that a company earning high ROE’s is better retaining all its earnings rather than paying it out.

Although this is true, my first and main bit of criteria is quality. if that is a large company paying out 80% to 100% of dividends then that is fine by me.

I am not against buying small companys with low yields but i am yet to find many that fit my circle of competence.

John R

:

Hi Roger – I did not mean exclusively small shares although of the three you mention the only one where I have a MOS is ANZ.

I appreciate your efforts with this blog, it really is very useful in assisting formulating one’s own views.

Nick Mason

:

Hello Steve,

I have not read the article so will comment on what you have posted as Marcus having suggested.

“He was suggesting that people should not have held onto QBE, Matrix & Forge in the (apparently misguided?) hope that they will go back up.”

This is a completely ridiculous argument (having been written in hindsight and without any thought to the longer term future.) If I or anyone else could invest with hindsight I would be the World’s richest man and probably wouldn’t spend a daily amount of time on this excellent blog. Of course had a magic genie appeared and told me when MCE was $8 or $9 that it would be soon trading at $3.50 I would have sold and then promptly re bought although trying to accurately predict short term fluctuations in the market or the economy is a mugs game and has been recognised as such in numerous studies.

At the end of the day all you are left with is your knowledge of the company, its prospects and your rough valuation of what its worth. Peter Lynch once said that he thought the stomach was the most important organ in the body when it came to investing and investors may like to reflect on that when wondering if they should be selling simply because everyone else is.

Best Wishes.

Chris B

:

Hi all.

I have wanted to buy COH for a very long time. Like some others on this blog, I recently used the sell off in COH as a buying opportunity…I have started the averaging in process for COH.

For those interested in COH, have A read of this announcement.

http://imagesignal.comsec.com.au/asxdata/20110926/pdf/01221566.pdf

All it tells me is that the reputation and brand awareness will continue to be incredibly strong for the foreseeable future for COH. Let those of us who wish to buy COH hope for much cheaper prices.

Chris B

Jason

:

Lucky you didn’t buy it a long time ago Chris, as COH has only returned ~5%p.a. in the last ten years. May be better buying now though.

Cheers

sapporosteve

:

All,

I am interested to see if any investors here are purchasing MCE. I know many investors here (including me) have a stake in this company and while I do not have a large stake in it, I know some have stated that they have a large portion of their portfolio in MCE.

I must say that I am scratching my head looking at how an A1 company’s intrinsic value can go from around $11 to $5 in such a short space of time (even if you ignore what has happened to the share price). I understand that this can happen, although if a company is rated A1 by many investors and ticks many boxes such as maintaining a competitive advantage, having an experienced management team and was trading at a large discount to intrinsic value, then surely we have failed to appropriately assess the company?

I can not see any comfort in demanding a large MOS. MCE had a large MOS at one stage of greater than 50%. In addition to this, many value investors (including Buffett) believe that the bigger the MOS, the bigger the investment.

Surely a drop of this magnitude would bring into question whether MCE is an A1 company worthy of investment? No doubt it’s earnings are “lumpy” and this has contributed to its IV decline, but if that is the case, then can it be considered a A1 company if by the nature of the industry, it’s earnings and cash flow are always going to be an issue? My understanding of Buffett is that he has stated that he always desires a steady upward path of earnings.

Although future IV can rise just as quickly as it can decline (if it wins orders), those who participated in MCE’s share purchase at $8.50 or a purchase price that is above its current IV (and given it’s current price) are faced with two possible choices – there is a long wait in store if they are to avoid a capital loss or sell.

If you are prepared to wait because you believe it will rise again, and you believe that you are investing for the long term, then at the current price you need a 150% rise in the price or a greater than 50% rise in the IV (if you participated in the capital raising). This also requires that you ignore the fact that Ben Graham stated that price follows value.

Maybe we should buy more?

Ignoring the fact that the MCE’s IV has halved, if you consider using the 5 reasons to sell, then MCE should be sold not bought due to 1) the performance of the business, 2) the declining IV 3) the value is not expected to rise “at a good clip” and finally 4) you are fully invested but there are superior investment opportunities.

I understand that IV can change quickly, but if this is the case then I must question what use determining future IV is if it is prone to wild swings of such large magnitudes? Even with A1 companies.

If I can finish with another example, FGE is currently shown as having an IV of around $8 – it currently has a large MOS. Should we be lining up to buy some? But can the same thing happen to FGE that happened to MCE?

I would be very appreciative if anyone can shed some light on any of these issues I have raised here – not necessarily those pertaining to just MCE.

regards

Steve

Roger Montgomery

:

That depends on how you regard A1. A1 means its not going broke tomorrow. After tomorrow however, the next results may see a drop in the quality rating. To be something you can rely on the quality ratings have to be based on facts not hopes or speculation. Thats the quality dealt with.

In terms of intrinsic value; IV is zero/nil/nothing if they earn nothing. There is however an order book of $110 million now but they do need to make an announcement about an order (preferably worth more than $114 million) imminently to reach their stated forecast 20% increase in revenue. If they achieve that – $224 million of revenue – then IV is $6.80. If all they get is the$110 you could argue the intrinsic value is a lot lower but if they only earn the dollars in the order book and receive no new orders I would argue IV is a lot less or declining (something I mentioned many months ago – declining IV). Intrinsic values must be based on the business performance and if that performance changes, so must intrinsic value.

Hope that helps.

Kent Bermingham

:

Like Steve and possibly many, many of your Graduates I thought an A! company was bullet proof, great cash flow, great management, rising IV, low debt, competitive advantage etc etc

How disapointing to read it is only good for today!

Like Steve and many other graduates we invested in MCE based on being led to believe this was a very solid company today and going forward – see numerous interviews and newspaer atricles.

This has changed my whole philosophy about Valueable as I need to make decisions based on Company ratings that are sustainable going forward at least 3 years.

I am disappointed A! means not going broke tomorrow as we all have been educated to invest in companies with a rising IV going forward at a good clip and yor comments have certainly put a cloud over how we invest in future.

Seek professional advice and education is what I thought this blog assisted us to do.

Well done Steve, I thought you would have received a better answer.

Roger Montgomery

:

Absolutely delighted to hear it Kent. The certainty with which you are attributing a requirement to changing the way you think is fantastic.

If I may be permitted to explain: An A1 does NOT mean rising IV. The question of value is separate to the question of quality. You want to buy extraordinary companies at rational prices. So there are two parts to the Value.able method.

An A1 company has the lowest probability of catastrophe. Just keep in mind lowest probability does not mean ZERO probability. Some A1 companies could blow up. Most blow up however will be lower rated companies. And nobody has said MCE will blow up. Now, you can extend that ‘lowest probability’ out for a year or two. By then, the next report may have changed the rating. Thats why I said “today”. When the next report comes out, the rating could change. So its good for now, but next year and the year after there will be new and updated ratings which will be based on the company’s reported performance at that time.

ARB has been an A1 or A2 for a decade. Qantas or Leightons or Boral have seen much more significant shifts in their ratings. Which would you prefer to invest in? That seems very powerful to me. I delight in having a method for classifying all companies this way.

MCE’s cash flows have deteriorated. Value.able has an entire chapter devoted to understanding cash flow so it sounds like you should read that chapter again. It also sounds like you have not done your own research as I tell everyone here to do.

I have not written off MCE yet, but they do need to announce some contract wins. Thats business Kent they need cash receipts soon to meet there own forecasts. I would have thought that is a useful insights. Not sure what better answer to give you and Steve.

Take a look at Centro’s accounts. Its been a C5 since 06/07 = highest probability of catastrophe. I would attribute a very high weighting to the quality ratings contribution to our outperformance over many years.

Well done Steve I am delighted you got Kent and others thinking. I believe you have all the answers Kent. If you are looking for ‘better’ ones however I am not sure how I can help further. I do genuinely hope the insights offered here help make every visitor a better investor.

Kent Bermingham

:

Roger, I am still learning the art of successful investing and Value Investing, a couple of speed bumps along the way hurt but it is all part of the learning process.

As I have said many times before I am a strong believer in your philosophies and Valueable formula but I am learning to be much more conservative in approach to which companies I apply it too, MCE was a big loss for me and possibly others and it is a hard way to learn and a long way back to recovrer those losses.

Thankyou for your detailed response it was appreciated.

Roger Montgomery

:

Hi Kent,

One of the reasons I emphasise seeking and taking personal professional advice is because the importance of diversification and portfolio construction cannot be understated. For example, even when MCE ticks every single box, its initial position size in our portfolio would not exceed seven per cent.

Kent Bermingham

:

Roger, I am diversified MCE represented 9%+15 other holdings it still had a big impact as it is relevant to how much you have invested.

.

As you have 30% of Funds invested, say 30 million, 7.5% = $2.25 Million so I would think you are also feeling some pain.

Lessons well learnt and will focus on much bigger and stronger companies with significant MOS still, low debt etc in future

Roger Montgomery

:

Hi Kent,

As I said; IF it ticked all the boxes the maximum would be 7.5. Held less than 1% after the half yearly results. See their cash flow. Was mentioned here.

George Economou

:

Hi Roger and fellow contributors,

Roger I’ve heard you state on Switzer’s program that 15 stocks is the ideal portfolio size, any more and the benefits of further diversification are minimal. Can you or any contributor recommend any references that I could read to learn more about portfolio theory/construction especially in the light of the investing principles you espouse (I dont work in the industry nor do I have any educational background in finance/investing).

I’ve learnt much from the book, the articles and the contributors to this blog. I am much obliged.

I hope everyone has a safe and enjoyable weekend.

George

Roger Montgomery

:

Sure George, try googling efficient portfolio or maximising diversification benefits

Andrew

:

A1’s to my understanding and might be confirmed with what Roger says about them is that it has never taken into account anything other than the chance of catastrophe. It might imply through the ratio’s that Roger uses to come up with the MQR that it has all the aspects you mention, competitive advantage, low debt etc however it is not a measure of that.

There are many A1’s which i believe do not have a strong or any competitive advantage. I think Roger has said similar things himself.

Ray H

:

Hi Sapporosteve,

Sometimes it is worth taking a step back and thinking about these things a little more rationally. Do YOU really think the intrinsic value of MCE has halved? What do YOU think of the business model? What do YOU think of the prospects for the business?

Roger is a nice guy, and he does us all a huge favour by providing this blog, his insights, and some of his calculated intrinsic values and thoughts about publicly listed businesses. But he isn’t god. Roger’s intrinsic values that he provides us are based on HIS assumptions. Frankly, if you are making all of your investment decisions based on them then you are not a value investor, you are a speculator.

Use the ideas that Roger (and others here) share as a guide rather than gospel to help inform and shape your own ideas and assumptions and further your own research. Then you are ready to invest based on the value.able method.

For what it is worth, I have never calculated an IV for MCE that I regard as realistic above $11 and I think the current IV is close to $8. That is not a huge move. But that is based on MY assumptions. Make your own.

Roger Montgomery

:

Great suggestions Ray. Thanks fo rthe post and adding to the discussion.

sapporosteve

:

Ray,

Thanks for the response. I would also like to thanks Roger and the others for their responses which have indeed provided enlightenment.

The internet is a wonderful thing as sitting in Tokyo I get to communicate with fellow value investors all over the world. It is, however, no substitute for a good conversation where one is allowed to explain their position in full in real time.

I would like to deal with your raised capitals “YOU”. By this, I assume you are stating that I need to be more independent from Roger.

At no time do I blame Roger or Valu.able’s methodology for the valuation variance of MCE. I too never had MCE at $11. I am simply looking for some explanations and from the various responses I received them.

Independence is a funny thing. For example, an academic study done some years ago showed that has anyone who purchased the same shares that Buffett did after his purchases were made public would have outperformed the market over a substantial period of time.

I bought Matrix at just above $5. The reason was it too me that long to do my research to determine that I was comfortable making the investment. Had I simply followed Roger and purchased straight after his public acknowledgement, I would have got it at about $3.00 if memory serves me correctly.

I can also say the same for FGE and VOC.

Roger I understand is 60% in cash. I am 10%. I would be looking at out-performance rather than my current under-performance if I followed Roger.

Of the 10 shares that Roger recently announced that the Montgomery Fund had invested in we share 2.

Maybe I should have ignored my independence and just followed Roger?

I bought Buffettology years ago and it influenced me greatly. I bought other value investing books and they too influenced me. I bought Valu.able and it did the same.

I come to this site to be influenced (via their comments) by Roger, Ash, Lloyd, GregMc, ScottyT, Ron Shamgar and all the other value investors.

As value investors, I think you would agree that there are probably three things that separate us from the crowd.

The first is the ability to think and contemplate various possible investments and possible outcomes – I get potential investments from companies suggested here and from other places and from my own searches.

The second is we act, in the main, rationally after doing sufficient research – I do my own research, measured against my own criteria and checklist. As part of that research, I check this site for any information or opinion regarding the company. I dont know if Roger is God but I certainly know I’m not:)

The third is we accept responsibility for all our decisions – I own every one of my investments because of steps 1 and 2.

I believe that if you are unable to do any of these, then I suspect you cant say that you are a value investor, nor will you stay long on this site. I have found in my experience that failure to undertake these steps means you are speculating, are prone to emotion based decisions, and display a tendency to blame others instead of themselves for their losses.

Like Roger and many others here, I have not, and do not, intend to sell my MCE holdings. I sought the input of others because I was at a loss to explain (to myself) the large decline in IV. As part of that assessment I need to explore whether I should consider selling.

It is useful for me to “put it out there” so that I can see whether my judgement is clouded or there is something that I am missing. In short, I want to benefit from the wisdom that others here offer.

I would be happy to discuss your assumptions and what your thoughts are regarding MCE’s IV.

Just as a little aside, my wife and I welcomed our second biggest investment named Lola-Rose on Thursday, 29 September at 11.30am. Your reply gave me some food for thought regarding what “independence” is. I do not want her to be independent. I want her to benefit from what wisdom my wife and I and others can offer her. I want her to be thoughtful in her decision making. And I want her to be responsible for her decisions and actions. Just like my methodology for making all my investments.

regards

Steve

Roger Montgomery

:

Congrats Steve on the safe arrival of baby Lola-Rose. I am thrilled for you both. May peace be with you all at this time.

Greg Mc

:

I second Roger’s congratulations, Steve. Holding that little one for the first time is one of life’s greatest pleasures. I do think that Roger wishing you peace at this time is a bit optimistic though….if yours are anything like mine!

Roger Montgomery

:

Precisely why I was hoping he might have some.

Michael

:

Hi Steve,

Great post. My view is you need to be careful with the ROE you adopt for companies such as MCE and FGE. Be more conservative for companies that have revenues that are less predictable. I would adopt an ‘over the cycle’ ROE.

My valuations also use the same ROE for all years (i.e an across the cycle ROE). I don’t agree when someone says ‘I get $2 for 2012 & $4 for 2013’. If you are valuing the current year correctly, the increase in the in intrinsic value should equal the discount rate. It also prevents you having intrinsic values that change just as dramatically as share prices. In my mind, a valuation drop from $11 to $5 should can occur only for one of three reasons. Either, the valuation method is inappropriate for the company being valued, the method is appropriate, but was incorrectly applied, or an unforeseen occurrence took place that caused the value to fall.

In summary, I have taken the parts of Rogers methods that fit with my beliefs, and discarded the parts that don’t. This is what you must do to make your investment style your own.

Roger Montgomery

:

Great stuff Michael and excellent suggestion regarding through-the-cycle ROE (does require good understanding of the business, its sector, its competitive landscape and where in the cycle you are). Don’t agree with the PV/Discount rate idea as it doesn’t allow for improving of deteriorating business performance.

sapporosteve

:

Hi Michael,

Thanks for your thoughts. There is some valuable advice there. I was interested in the comment regarding consideration of the business’ ROE over the business cycle – ie those companies that have less predictable revenue. In some senses I wonder whether these companies have a sustainable advantage? Let’s say that it is established that MCE indeed has a moat. But the issue regarding what I call lumpy earnings or revenue, to me makes it difficult to place anything close to a forward IV on it.

If I use MCE, it’s IV has varied considerably (no matter what IV you had, you would have to say that the decline is large), so does this lead to increased risk? If you adjust your RR and ROE to accommodate these lumpy earnings, then doesn’t that make it a less appealing company?

I understand your reasoning regarding the 3 reasons, but can’t an additional one be simply that the company fluctuates in it’s earnings and therefore the IV moves around considerably. Therefore making it difficult to value at any particular point in time? So while it may have a moat, it makes it somewhat riskier as to when to buy?

regards

Steve

Andrew

:

Thought i would measure some of my 2012 values against yours and i get pretty close to the ones i have checked. So yay for me.

I have WOW at $26.32, COH at $34.19 and JBH at $17.39.

Cochlear after recall meant that i expanded my range of forecast ROE to somewhere between 15% and 35%.

I think currently there are some good opportunities so it is definitley a time where value investors should be taking stock and preparing. However, few companys i currently look at have the margin of safety i would require to step in. Only a couple fall into this area.

CBA ($55.40 pending re-evaluation) and JB Hi Fi ($17.39) are probably the ones making the most compelling case. A few others are trying to get my attention as well but haven’t managed to jump over that 10 ft barrier yet.

So in short, the way i feel is yes it is time to get ready, but not get so ready we jump the gun, wait for the appropriate margin of safety.

Chris

:

Hi everyone,

Sorry if this is a little off topic Roger, you can delete if too irrelevant. I have a few questions that I have been thinking about and kindly ask for some of the blog’s thoughts.

Firstly, should we include macroeconomic factors in our buying/selling decisions or just focus on the business itself? For example, right now if you believe that the world is headed for another economic crisis (not saying that I am), should you hold off buying in anticipation of lower prices? However, if you are wrong and we enter another bull market, you will miss out on many great opportunities and have to wait years for these stocks to become cheap again. I remember Buffett saying that he has never allowed macro factors to influence his decisions.

Secondly, when considering selling as the share price exceeds its intrinsic value, why not use a trailing stop order, say 10 or 15% below the current share price. If the share price rises higher, you don’t miss out on those gains and if it drops, you are still selling at a price that you are happy with. This is particularly useful in a bull market as you can benefit from increases in share prices instead of otherwise sitting in cash.

Finally, as Value.able explains, the required rate of return or discount rate is affected by interest rates and inflation. For instance, take the current US conditions, interest rates are close to zero and so are short term government bonds. This would lead to a lower required rate of return and thus higher intrinsic values. But we can be confident that these conditions will not last indefinitely and interest rates will go back up, leading to lower intrinsic values. Therefore, should we use current rates or a historical average? Also, I think that US government bonds are not exactly risk free so would it be ok to use something like Australian bonds instead?

Any comments would be appreciated.

Thanks,

Chris

Roger Montgomery

:

Hi Chris,

Buffett’s done well without employing economic forecasting. It helps to have some understanding of the business cycle and how it impacts the sector in which your preferred business operates. Buffett’s also done well without stop losses. I have some experience in building trading ‘robots’ as they are now called and I have yet to find a stop loss method that keeps you invested during temporary or small corrections but gets you out of those that ultimately prove to be much bigger or longer lasting. Finally, you can deal with low interest rates and rising interest rates by employing a high enough discount rate to begin with.

Ann

:

Time for cash I feel

Chris B

:

I just thought I’d quickly outline a strategy that I like to use when buying stock. It won’t be for everyone as it involves the use of options, and there is the perception out there that options are ultra risky (and yes they can be depending on how they are being utilised).

I might be wasting my time writing this, but who knows, it might be of interest to someone out there…and I thought it was appropriate for this post, because this strategy should only really be used if you have prepared yourself – in that you know at what price you are prepared to buy stock.

Basically the strategy involves selling put option contracts against the stock you are hoping to buy at predetermined lower prices.

I will use ANZ bank shares to illustrate.

ANZ last traded at $18.75. Let’s say you are prepared to buy 100 ANZ shares ONLY if ANZ trades at or below $18.

If you know you are prepared to buy 100 ANZ shares at $18, you could sell 1 $18.50 put option (1 contract infers 100 shares).

For selling the $18.50 put option expiring on 27th of October, you would receive around $60 (for one contract).

If ANZ is trading under $18.50 on expiry, you would be assigned on your contract and would be obliged to buy ANZ shares at $18.50.

This would be a good thing, because it means you got to buy your 100 ANZ shares at the level you hoped to buy them at.

And because you keep the premium ($60), you would essesntially be buying 100 ANZ shares for $17.90 per share (ignoring comissions for the sake of this example).

If you were to sell 10 contracts, your premium would be $600, and you would be obliged to buy 1,000 ANZ shares.

Why would you bother doing this you may ask????

Well if ANZ isn’t trading below the price your willing to buy it at by expiry you would simply keep the premium collected for selling the put contracts.

In other words you get paid for waiting for something you want to happen.

There are not that many stocks listed on the ASX that investors are able to trade options over. And of those that do have option liquidity, not many are worthy of considering.

A few that might be of interest, for anyone interested include…

CSL, WOW, QBE, BHP and all the banks. Typically, only the stocks considered as ‘blue chip’ stocks have market makers making option prices available. Most of the blog favourites are not available for option trading.

Make sure you understand the risks involved in trading options, particularly shorting options, which is the strategy I outlined above. A google search on options will provide plenty of hits if you want to explore further.

Chris B

Kent Bermingham

:

Over the past 18 months I have read how well everyone has done with MCE, FGE, VOC, ORL, JBH, ZGL etc etc these companies have not all of a sudden gone bad as Roger has selected them as A! companies for the long term not just for the moment.

We should be buying more at huge discounts as in the long term Price always follows intrinsic value, provided in 10 years time IV keeps rising at a good clip and being Investment Grade this should happen..

There will be short term IV girations but what we should be donig is setting IV’s 5 years out to ride the ups and downs of Mr Market and support Roger’s long term philiosophy with these companies and not bag them.

Roger Montgomery

:

Hi Kent,

Thanks for the support but the more bagging, the better for any net buyer! We should be encouraging the bagging no?

Andrew S.

:

Hi Roger,

am I right in seeing BHP IV $35.97? Yesterday (Fri 23/9) it was over sixty dollars and I nodded sagely to myself…’ah yes, just as I thought’…

And Forge IV has changed overnight too, though not so radically. I’m not dreaming, am I? That BHP IV can’t be right, surely?

As you can see, I live a very exciting life.

Roger Montgomery

:

Corrected typos. Apologies. Always do your own research – good to see you are – and always seek and take personal professional advice.

Parag

:

I run two valuations. 1 using an average ROE throughout the last 10years for bhp across the cycle and 1 using future expected ROE from analyst reports. The average one gets a iv of ~$35 and future analyst estimates gets an iv of ~$55.

Parag

:

Also high RR 14%.

Andrew S.

:

Hi again Roger,

I redid both BHP and FGE’s IV’s at the above ROE’s and 12% rr and I think you’re right – typos indeed, but weren’t they right the first time ie BHP’s IV is now over $60 and FGE over $8?

Thanks for your thoughts on not deciding what is ‘cheap’ too quickly, especially in these ‘buffeting’ times.

Andrew S.

:

Hi again,

I think I get it Roger….the current slump in the base metals (and oil) that make up the bulk of BHP’s products….makes sense.

Dave W

:

I wonder, don’t commodities also have an IV? One that is based on predicted long term demand and supply?

I haven’t reevaluated my IV for BHP for some time, but it was definitely over $50 when I last did. Certainly, if one is able to accurately account for lower commodity prices in recalculating an IV for BHP, you would assume the IV would have decreased.

On the other hand, you could take the opinion that commodities prices are a figment of the market, and do not necessarily represent their IV. Has the demand for base metals really decreased by 15% plus in the last week or two? Of course not, but the predicted future demand has decreased.

This becomes a much more speculative exercise which seems to me to be based almost entirely on macro economic conditions. i.e. if future demand for commodities will indeed be lower than was previously thought (only a matter of weeks ago) because of declining growth in China and elsewhere, then the new IV for these commodities will be lower and this will in turn mean that the IV of companies like BHP will immediately decrease.

I guess what I’m getting at is that the value.able approach is to switch off the market and focus on the business. But for companies like BHP, isn’t this impossible if we are going to change our IV based largely on the short term movements of commodity markets?

Macca McLennan

:

Hi Rogor

I like to compare my IV to your Iv (i use 10% RR)

in the above table my values are often 20% to 80% higher

even though i adjust ROE to yours

Your A1 ratings to appear to have about a12.5% RR

However A3 appear to be much higher perhaps 17.5% RR

If you supplied RR % & Div Payout % it would make it much easier

to compare IV

Regards Macca

Roger Montgomery

:

Thanks Macca.

David

:

In a very recent table posted on the website, the IV for TSM was above $1, but now it’s sunk to 0.48. In the space between those posts the company reported a fair result, although i note high AUD may be a worry for them. Appreciate it if you could explain the large drop in outlook for this company.

Roger Montgomery

:

Not sure the drop was that large but the IV falls this year due to lower EPS.

Mike Punch

:

I am struggling a bit with the idea that the past (say 5 years actuals) and analysts projections for the next two years (even discounted by 50%) can represent IV now. The past does not equal the future even though I wish it would. I think about a business with a turnover of say 500mil with a net net profit of 20%, 100,000$. If turnover drops by 5% and costs remain sticky then net net profit drops by 25,000$ to 75K.

For this simplified example the one year IV could be expected to drop by 25%.

So a MOS of 25% going into a possible recession is looking a bit optimistic and my own MOS target of 30% is looking a bit optimistic as well. I have set up falling buys (at BIG mos) as I am sure I couldn’t pull the trigger in the middle of the storm. Cheers Punchy

Roger Montgomery

:

Mike,

Analysis a bit simplistic. You need to factor in operating leverage. Not all companies the same.

Mike Punch

:

Info on Operating Leverage below. My concern is that Operating Leverage is grossly underestimated at the start of recessions and this will lead to massive downgrading of IV very quickly in comming months. 30% MOS to IVs based on recent annual reports and analysts reports is optomistic in my view.

extract from Investopedia. Investopedia explains Operating Leverage

A measurement of the degree to which a firm or project incurs a combination of fixed and variable costs.

The higher the degree of operating leverage, the greater the potential danger from forecasting risk. That is, if a relatively small error is made in forecasting sales, it can be magnified into large errors in cash flow projections. The opposite is true for businesses that are less leveraged. A business that sells millions of products a year, with each contributing slightly to paying for fixed costs, is not as dependent on each individual sale.

For example, convenience stores are significantly less leveraged than high-end car dealerships.

Chris B

:

Hi Roger,

In line with this post, “should you be readying yourself”, yes indeed I believe value investors should be readying themselves.

Obviously investors should be prepared by arming themselves with knowledge of the businesses in question, estimated intrinsic values of those business and corresponding target entry prices.

I also think investors should be prepared for something else. They need to be prepared to ride out potentially long periods of market volatility.

My preferred way to remain prepared for market volatility (aside from knowing I am buying only the highest quality businesses) is to not over extend myself. In other words, I always have cash on the sidelines waiting, and hoping, for even cheaper prices.

At the moment I am only 18% invested, so it suits me fine to see the market fall another 10% to 20%, or even further. I know what businesses I want to buy, and I know what I prices I am prepared to buy them at (Roger has mentored me well).

As to how aggressively individuals buy shares now should be, amongst other things, a reflection of how confident they are in themselves that they can withstand potentially large capital (paper) losses in the short to medium term.

Some stocks I am slowly accumulating include FGE, JBH, CSL, FLT and CCP.

Due to the massive sell off in VOCUS Communications, I am now becoming interested in buying this business as well. I have a little more reading to do on VOC, however everything seem to line up pretty well for VOC to be a long term investment candidate. Also, I wouldn’t be surprised to see this business as a take over target some time in the future (this has nothing to do with me wanting to buy).

One thing I have noticed is that VOC has been under some very persistent selling pressure. In fact, it has fallen over 50% from its highs in May!

I know the company issued shares at $2.00, and there was also the release of shares from escrow, but does anyone know if there is something else behind the share price falling so dramatically? I have read the announcements released by VOC and personally can’t find anything to be concerned about.

I have a future valuation in the range of $2.2 – $2.4, so buying at under $1.40 today seems a sensible thing to do.

Take care everyone, and seriously consider if you have the personality to absorb large paper losses that may very well be on the cards.

Chris Brincat

Roger Montgomery

:

Thanks Chris for taking the time to post.

ken fraser

:

Chris, I have IV for VOC for 2012 of $1.31 ROE 21.6% ( using 20% ) EPS 13.1cents so it seems to be trading at around 2012 IV.

ken fraser

:

Sorry Chris, Forget my previous post it was wrong. I have IV for VOC for 2012 at $1.66 using broker research which may or may not be correct. What do other bloggers get? I`ve used 14%RR and $9.1M NP. I hold VOC shares but they owe me $2.11 this time in.

Will

:

I get valuation of 2.2 for 2012 but I’m not sure how accurate broker estimates are for Vocus

Darren78

:

I don’t have analyst forecasts for VOC but I am using $10m NPAT for 2012 and getting a value of $2.66 @ 14% RR. I might be optimistic but I certainly don’t see any slowdown coming for internet bandwidth (even though the cost may come down).

Luke

:

Hi Roger and fellow bloggers,

There are some great bargains in that list. I already hold some of them. I am somewhat sceptical of the BHP figure (I hold). It’s a great company and will continue to be a great company while commodity prices stay high. There is some commodity price risk there but they are somewhat diversified in what they produce. So, I think they need to have a high RR to accommodate that risk. Having said that, BHP is still “cheap” even when just looking at the PE ratio! If it drops significantly further, I will be buying more.

Cheers,

Luke

Parag

:

I was doing some reading on valuations of cyclical resource companies. Usually the PE ratio is the lowest at the top of the cycle (usually single digits) and at the bottom of the economic cycle the PE is usually higher (12-15). So be careful.

Uni

:

Thanks for sharing, Roger.

And again, you show the compass at the right time: “Demand bigger discounts”. Yeah, the buyers have the power. I can handpick the best & I can bargain.

I am so surprised at myself that as a first year investor, I am so calm when the storm is just at the corner. All thanks to your education and bloggers’ insights.

MattB

:

Great post Roger. Thanks. It must encourage you that your most of businesses people want to know about are investment grade.

Roger Montgomery

:

There’s a long tail of course, many of which weren’t. But generally very encouraged.

Angela

:

Hi Roger, Looking at the table above I have an intrinsic value for MIN as $12.04. I calculated it the same way I do the others and usually get pretty close to your value. Can you give me a hint as to whats so special (or not) about this one. Checked and rechecked. Cant work it out. Thanks Angela. PS You have done well with the others. So far they are close to my numbers.

Roger Montgomery

:

Thanks Angela. Delighted they correspond in some cases. Obviously they won’t in all and it’s those differences that are the result of some meaningful variances in our approach.

Andrew

:

I take a similar approach to working out forecast valuations.

I will work out two valuations, one as a best case scenario and one for a worse case scenario. With this i will then get an area where i believe intrinsic value will fall. It is also why i seek companys that have a stable ROE as it makes it easier to forecast and norrows this field. The average of which i will use my target value that the margin of safety is worked out upoon and the margin of safety will be larger depending on the size of the space between the high ROE and the Low ROE. This means that i will very often get a lot lower forecast valuations than what is probably needed but i feel better to be conservative, if it the ROE is towards the upper end of the range i will be rewarded if it is on the lower end the increased margtin of safety should help reduce the risk.

joe

:

dear roger

your intrisic value of forge is spot on . I have followed forge since it listed and do hold shares . for some reason it is marked down compared to its peers like mnd , wor and cdd.I went back a few years and looked at mnd and wor revenues and profit

wor in 2004 revenue was373 million .in2005 ,1247 million

mnd in 2006 revenue was532 million in 2007, 963 million

My point is forge now a teir 1 contractor could easily double its renenue this year with the larger contracts it is tendering on .And the 500million Roy hill project that clo stated in presentation. 50/50 joint venture over 2 years .IF they get it, add this to fge revenue looks very good, also the opportunity in Africa and hopefully some oil and gas projects will come through. I remember speaking to peter hutchinsn 2 years ago (ceo) He said the main aim was to get to teir 1 level ,thats what will separate the men from the boys and I think forge is comming of age. very much undervalued r

Jordan

:

Hi Roger,

I hope the 2012 IV for MIN is $11.31, rather than $1.31…

Roger Montgomery

:

Thanks for the pick-up Jordan. We have corrected. Roger’s team.

Bret

:

Can someone help me understand where you get the debt/equity from. I’ve been adding the current and non-current debt to get a total debt and dividing it by this years equity.

Not sure how you get negative number

lets say total debt is 20m and equity is 50m 20m divided by 50m is .4

is this correct and how do you get a negative number?

Need some understanding please

Roger Montgomery

:

Net debt subtracts cash from borrowings. Hope that helps Bret

Andrew

:

Hi Bret, as Rgoer says you subtract the cash from the total of the short and long term borrowings and then divide by equity.

Steve

:

Hi Roger,

You wrote a blog post on 29th April that referred to the rise in the price of Vocus as an example of the success that could be had using the Value.Able method. You wrote: “The critics are necessary. Not only do they help refine your ideas, but without them, how else would we be able to buy… Vocus at $1.60 or Zicom at $0.32!”.

The price rise was very short lived and since then it has fallen by more than 50%. Now that it is once again below the level mentioned above, do you still see it as being a great opportunity? I also note many Value.Able graduates were very keen to get in on the capital raising at $2.

As VOC is not mentioned in the above list, would appreciate your thoughts. Thanks

Roger Montgomery

:

Hey Steve,

It’s not in the above list because it didn’t receive sufficient mentions/requests. We own Vocus. Don’t take your investing queues from price. Focus on value.

Greg Mc

:

Yes, I’ve been watching VOC with interest over the past 6 weeks or so as it has trickled down on very low volume and bought in yesterday. I think it is a steal at $1.40. I also think that demand for its services will be fairly ‘economy inelastic’ so I’m happy with this one. Then again, if it falls to $1.20, I’ll be happier again (as long as there’s no worthy cause for the fall).

Roger Montgomery

:

SOme interesting obersvations about data downloads in Saturdays SMH. Majority transmitted over fixed broadband etc etc..

Michael

:

Hi Steve,

I usually go by the theory that if my stocks go up, I am right. If they go down, the market is irrational!

But on a serious note, my view is that value.able investing works, but the short term price rises in stocks such as VOC and ZGL were not the right evidence to use that it does work. In any case you need to stick with the core principles, and you will put the odds in your favor. Be careful of the small stocks eg VOC, ZGL & BGL. They may not be all they are cracked up to be.

Roger Montgomery

:

Research reported today in SMH reveals massive increases in data traffic majority of which is over fixed broadband and sizeable proportion not Telstra. Good for Vocus’ dark fibre strategy?

Simon Anthony

:

Perhaps Vocus’ dark fibre strategy has been undervalued relative to the ever growing traffic in data transport and accessibility. Both are hidden value that isn’t built into VOC share price…yet!

Simon Anthony

:

Additionally Vocus’ dark fibre strategy compliments the current trend towards cloud-based services via the increased need for fibre access services and redundant links between small business and data redundant international access. By adding value to these businesses via data centre colocation and direct dark fibre link to the “on- site” premises is the next new frontier, which many ISPs, corporates and medium-large internet users now require in ever increasing amounts.