-

Farewell fiscal 2025, hello fiscal 2026

David Buckland

July 1, 2025

The Magnificent Seven; Alphabet (NASDAQ:GOOG), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Meta (NASDAQ:META), Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), and Tesla (NASDAQ:TSLA), which rose by an average 111 per cent over calendar 2023, continued its strong upward trajectory, increasing a further 63 per cent, on average, over calendar year 2024. Continue…

by David Buckland Posted in Economics, Editor's Pick, Foreign Currency, Market commentary.

- save this article

- POSTED IN Economics, Editor's Pick, Foreign Currency, Market commentary.

-

Navigating the storm

Roger Montgomery

May 1, 2025

In the days following Trump’s tariff announcement, the S&P 500 plunged 10 per cent in just two days, 10-year treasury yields swung wildly, and gold, after touching a peak, stumbled. Add to this the backdrop of escalating global trade tensions – think U.S.-China tariffs – and it’s no surprise that investors are on edge. Meanwhile, consumers are wrestling with their own worries about inflation, jobs, and the economy’s trajectory. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

MEDIA

Ausbiz – bull vs bear market outlook for 2025

Roger Montgomery

May 19, 2025

Last week, I joined Juliette Saly on Ausbiz to discuss the contrasting bull and bear market outlooks for 2025. Continue…

by Roger Montgomery Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

The latest AI goldrush – its not what you think

Roger Montgomery

July 4, 2025

The race to lead in artificial intelligence (AI) feels like a modern gold rush, but instead of more power or better performance, the latest race is for people – brilliant minds. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

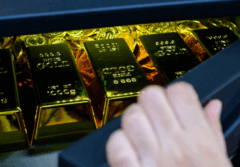

In gold they trust – China’s hedge against uncertainty

Roger Montgomery

June 24, 2025

An article published by the Shanghai Metal Market on 7 June 2025, revealed that the People’s Bank of China (PBOC) increased its gold reserves for the seventh consecutive month, up 60,000 ounces month-on-month. Continue…

by Roger Montgomery Posted in Foreign Currency, Global markets, Market commentary.

- save this article

- POSTED IN Foreign Currency, Global markets, Market commentary.

-

MEDIA

ABC Nightlife – the impact of geopolitics on markets and more

Roger Montgomery

June 25, 2025

Last night on ABC Nightlife with Tim Webster, we unpacked the impact geopolitical tensions can have on markets, the Australian housing market and China’s deflation dilemma. Continue…

by Roger Montgomery Posted in Market commentary, Radio.

- save this article

- POSTED IN Market commentary, Radio.

-

Bond market on alert: rising yields, weak demand and looming debt flood

Roger Montgomery

June 19, 2025

Recently, I recorded a video discussing the U.S. bond market flashing red. That video, to our great surprise, went a little viral. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

Buffet’s litmus test for quality stocks

Roger Montgomery

July 10, 2025

When Warren Buffett was asked to distil the essence of investing success, he offered the following:

“Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, 10 and 20 years from now. Over time, you will find only a few companies that meet these standards – so when you see one that qualifies, you should buy a meaningful amount of stock. You must also resist the temptation to stray from your guidelines: If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.” Continue…

by Roger Montgomery Posted in Investing Education, Market commentary.

- save this article

- POSTED IN Investing Education, Market commentary.

-

Bonds are still flashing red

Roger Montgomery

June 18, 2025

Following strong interest from my latest video insight on the U.S. bond market this update takes a deeper look. Continue…

by Roger Montgomery Posted in Video Insights.

- 2 Comments

- save this article

- 2

- POSTED IN Video Insights.

-

A reflection on today’s market landscape

Roger Montgomery

July 3, 2025

Stepping back from the tidal wave of Trump’s pronouncements, backtracks and absurdly weak understanding of basic arithmetic (“egg prices have fallen 400 per cent!”), today’s investing environment is one of the most dynamic in recent history, shaped by transformative technological advancements, the threat of war, dynamic and unpredictable economic policies, and evolving investor behaviours. From the disruptive potential of artificial intelligence (AI) to the resurgence of retail investing and the spectre of market bubbles, the current landscape demands a little reflection. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

RBA holds fire – watch our latest Ausbiz episode on the surprise RBA decision HERE.