-

China deflates – persistent price drops signal economic strain

Roger Montgomery

June 26, 2025

The latest data out of China reveals the country is sliding deeper into deflation. In May 2025, consumer prices fell 0.1 per cent year-on-year, the fourth consecutive monthly decline, while producer prices plunged 3.3 per cent – the steepest drop since mid-2023. Continue…

by Roger Montgomery Posted in Foreign Currency, Market commentary.

- save this article

- POSTED IN Foreign Currency, Market commentary.

-

MEDIA

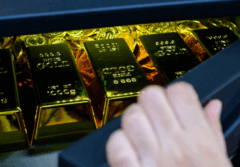

ABC NEWCASTLE MORNINGS – THE GOLD RUSH

Roger Montgomery

April 2, 2025

I recently joined Paul Turton on ABC Newcastle to discuss the five key reasons behind why the price of gold has skyrocketing. The first reason being the volatility seen across the S&P 500, NASDAQ, ASX 200, and the Small Ordinaries Index. Additionally, interest rates in developing countries are declining – meaning investors are turning toward other assets (like gold). Thirdly, I highlight that gold is an inflation hedge, meaning its value tends to increase during periods of rising inflation. Geopolitical tensions across China/U.S. and in the Middle East are also a key reason as to why the price of gold is being driven up. And lastly, investors get a ‘fear of missing out’ and tend to invest in trends.

by Roger Montgomery Posted in Radio.

- LISTEN

- save this article

- POSTED IN Radio.

-

Bond market on alert: rising yields, weak demand and looming debt flood

Roger Montgomery

June 19, 2025

Recently, I recorded a video discussing the U.S. bond market flashing red. That video, to our great surprise, went a little viral. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

MEDIA

AUSBIZ – THE IMPACT OF ON-AGAIN, OFF-AGAIN TARIFFS ON THE ECONOMY

David Buckland

April 23, 2025

I joined Juliette Saly from Ausbiz last week to discuss the market reaction to Trump’s on-again off-again tariffs. The unpredictable nature of these trade measures has fuelled volatility in markets, further compounded by China’s retaliatory actions. Continue…

by David Buckland Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

MEDIA

ABC Nightlife – the impact of geopolitics on markets and more

Roger Montgomery

June 25, 2025

Last night on ABC Nightlife with Tim Webster, we unpacked the impact geopolitical tensions can have on markets, the Australian housing market and China’s deflation dilemma. Continue…

by Roger Montgomery Posted in Market commentary, Radio.

- save this article

- POSTED IN Market commentary, Radio.

-

MEDIA

A return to fundamentals

Roger Montgomery

April 29, 2025

In the second week of April, the S&P 500 recorded a historic day, on Tuesday the key Wall Street index’s intraday swing marked the first time since at least 1978 the benchmark hit an intraday high up more than 4 per cent – only to close down more than 1 per cent. And the Nasdaq blew its biggest intraday gain since at least 1982. Continue…

by Roger Montgomery Posted in In the Press.

- READ

- save this article

- POSTED IN In the Press.

-

In gold they trust – China’s hedge against uncertainty

Roger Montgomery

June 24, 2025

An article published by the Shanghai Metal Market on 7 June 2025, revealed that the People’s Bank of China (PBOC) increased its gold reserves for the seventh consecutive month, up 60,000 ounces month-on-month. Continue…

by Roger Montgomery Posted in Foreign Currency, Global markets, Market commentary.

- save this article

- POSTED IN Foreign Currency, Global markets, Market commentary.

-

MEDIA

ABC Newcastle Mornings – Winners and losers of the Australian election & market volatility

Roger Montgomery

May 15, 2025

I recently joined Paul Turton on ABC Newcastle Mornings to discuss current market volatility and what investors might expect under a Labor government. Continue…

by Roger Montgomery Posted in Radio.

- LISTEN

- save this article

- POSTED IN Radio.

-

Aura Private Credit Income Fund has been reassigned a ‘very strong’ investment rating

Scott Phillips

May 29, 2025

We are pleased to announce that Foresight Analytics & Ratings, has reassigned the Aura Private Credit Income Fund a ‘VERY STRONG’ Investment Rating. Continue…

by Scott Phillips Posted in Aura Group.

- save this article

- POSTED IN Aura Group.

-

MEDIA

ABC Statewide Drive – The consequences of Trump’s tariffs on the global economy

Roger Montgomery

April 4, 2025

I joined Jess McGuire on ABC Radio’s Statewide Drive yesterday on ‘Liberation Day’, to discuss the consequences of Trump’s tariffs on the global economy.

We took a step back in time to explore the similarities between the 1930 Smoot-Hawley Tariff Act and Trump’s newly announced tariffs. Given the striking similarities of these policies, we explored the consequences of the 1930s tariffs and considered the potential parallels for today’s global economy such as slowing global trade, slowing global growth, and the risk of recession. Continue…

by Roger Montgomery Posted in Radio.

- LISTEN

- save this article

- POSTED IN Radio.

Watch our latest Ausbiz event: Private credit – calm amid market mayhem WATCH HERE.

It seems like a distant memory now, but 2025 began with an upbeat outlook, buoyed by deregulation and robust earnings. By February, however, the mood shifted as the U.S. released a significant trade policy document, hinting at a tough stance towards its trading partners.