Search Results for: coh

-

Should you be readying yourself?

Roger Montgomery

September 23, 2011

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.I know of seasoned market practitioners that have deferred the upping of stumps to set up new businesses because they believe there is worse to come. I also know of prominent Australians that are cashing up and I have met with many professional investors who liken the current conditions to those preceding a severe recession or even depression. Berkshire Hathaway shares are trading below $100,000 for the first time in a while (not that it matters). And Bill Gross at Pimco reckons the fact that you can get a better yield over two years by ‘barbelling’ – putting 10 per cent into 30 year bonds and 90 per cent into cash – and beat the yield on 2yr T-Notes is destroying credit creation and so low yields are having the opposite effect to the stimulation they are intended to generate.

Ok. So what do I think?

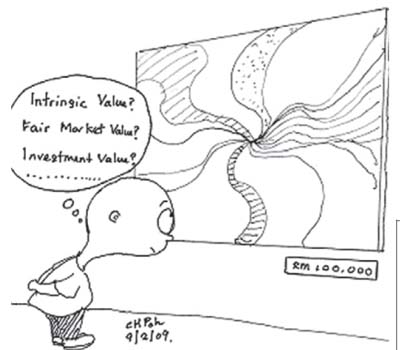

These are the times to prepare yourself for the possibility of another rare opportunity to buy extraordinary businesses at even more extraordinary discounts to intrinsic value. You have to be ready, you have to have your Value.able intrinsic valuations prepared and your preferred safety margins calculated.

In the short term (6-12 months), on balance, I think shares could get even cheaper (As I write those words, I log on to see the European markets down five per cent and the Dow Jones opening down more than 3 per cent and I am conscious of the fact that an outlook can be tainted by the most recent price direction). But our large cash proportion/position in The Montgomery [Private] Fund since the start of the calendar year has reflected for some time the impact of this possibility on future valuations and our requirement for larger discounts to intrinsic value.

Longer term, I like some of the research put out by McKinsey. The new infrastructure, such as roads, ports, railways and terminals that developing countries such as China, India and South America will need, will require tens of trillions of dollars. McKinsey Global Institute analysis reckons that by 2030 the supply of capital could fall short of demand to the tune of $2.4 trillion – a credit crunch that will slow global GDP growth by a percentage point annually. Even if China and India cool off, a similar gap could occur.

Back to the immediate outlook and there is a simple mental framework that I have been using to think independently about all the ructions impacting our portfolios.

I am no economist, but its pretty easy to see that if trend line US economic growth is barely 1 per cent, then any slowdown in the business cycle will push the economy towards the zero growth line. One per cent is quite simply very close to zero and the business cycle can push growth rates around more than the difference between them. Every time there is a whiff of a slowdown, there will, at the very least ,be fears of another recession. Again, I am not forecasting a recession nor am I forecasting slow growth. Indeed, I am not forecasting at all. I am simply pointing out the fact that tiptoeing on the edge of a precipice (the US at 1 per cent growth) is more frightening than doing circle work in a paddock a long way from any edge at all (China at 7, 8 or 9 per cent growth). Bill Gross’s comments about the destruction of credit further feeds the idea of a slowdown.

On balance I believe there will be some very attractive buying opportunities in the next six to twelve months. Before you read too much into this statement, I should alert you to the fact that I say it every year.

Analysts are prone to optimism too.

I think it’s also appropriate to remember that analysts typically are generally optimistic about earnings forecasts at the start of a financial year. This can be seen in another McKinsey research note (as well as thousands of other similar studies), where analysts commented:

“No executive would dispute that analysts’ forecasts serve as an important benchmark of the current and future health of companies. To better understand their accuracy, we undertook research nearly a decade ago that produced sobering results. Analysts, we found, were typically overoptimistic, slow to revise their forecasts to reflect new economic conditions, and prone to making increasingly inaccurate forecasts when economic growth declined.

Alas, a recently completed update of our work only reinforces this view—despite a series of rules and regulations, dating to the last decade, that were intended to improve the quality of the analysts’ long-term earnings forecasts, restore investor confidence in them, and prevent conflicts of interest. For executives, many of whom go to great lengths to satisfy Wall Street’s expectations in their financial reporting and long-term strategic moves, this is a cautionary tale worth remembering.”

And concluded: “McKinsey research shows that equity analysts have been overoptimistic for the past quarter century: on average, their earnings-growth estimates—ranging from 10 to 12 percent annually, compared with actual growth of 6 percent—were almost 100 percent too high. Only in years of strong growth, such as 2003 to 2006, when actual earnings caught up with earlier predictions, do these forecasts hit the mark.”

Demand bigger discounts

Those thoughts provide the ‘Skaffolding‘ in my mind around which I construct an opinion of where the landmines and risks may be for an investor. I tend to 1) look for much bigger discounts to intrinsic values that are based on analyst projections for earnings and 2) lower our own earnings expectations for those companies we like best.

Cochlear is one example of this. Many analysts have forecast a 10-20 per cent NPAT decline from the recent recall of their Cochlear implant. Only one analyst has considered and forecast a 40-50 per cent NPAT decline. The truth will probably be somewhere in between. Such a decline however would come as a shock to many investors if it were to transpire. And so it is important to be aware of that possibility when calibrating the size of any position in your portfolio. In other words, be sure to have some cash available for such an event because intrinsic value based under that scenario is between $23 and $30.

Your “Top 5”

Earlier this month I asked you to list your “Top 5” value stocks – those that you believed represented good value at present. I was delighted to receive so many contributions.

On behalf of the many Value.able Graduates and stock market investors who read our Insights blog thank you for sharing with us the result of all your fossicking, digging and analysis.

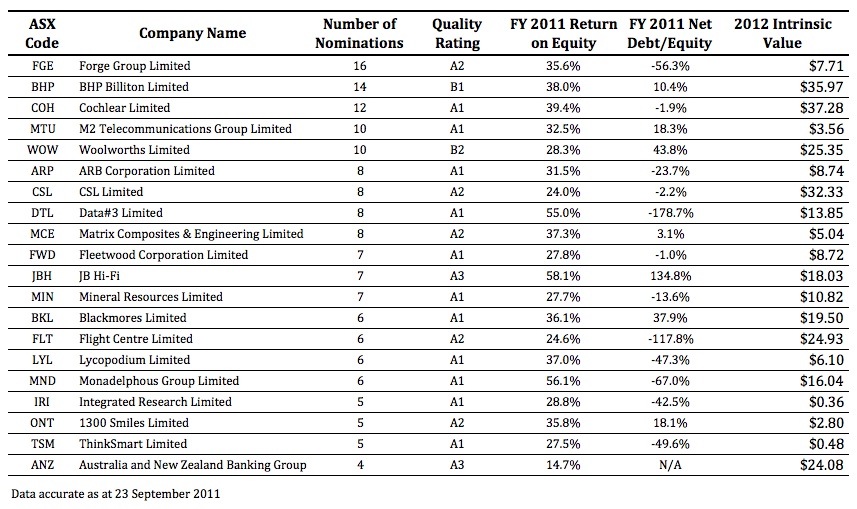

There were more than 115 suggestions. The most popular was Forge Group with 16 mentions.

The following table presents the Quality Score, FY2011 ROE, FY2011 Net Debt/Equity and 2012 Value.able Intrinsic Value for Forge Group (FGE), BHP, Cochlear (COH), M2 Telecommunications (MTU), Woolworths (WOW), ARB Corp (ARP), CSL , Data#3 (DTL), Matrix (MCE), Fleetwood (FWD), JB Hi-Fi (JBH), Mineral Resources (MIN), Blackmores (BKL), Flight Centre (FLT), Lycopodium (LYL), Monadelphous (MDN), Integrated Research (IRI), 1300 Smiles (ONT), ThinkSmart (TSM) and ANZ.

As you know these quality scores and the estimates for intrinsic values can change at a moments notice (just ask those working at Cochlear!) so be sure to conduct your own research into these and any company you are considering investing in and as I always say, be sure to seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 23 September 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation.

-

Is Roger Montgomery buying Cochlear?

Roger Montgomery's Team

September 14, 2011

Cochlear (COH) is one of just a few Australian businesses that can be compared to the likes of Coca-Cola and Johnson & Johnson. So when the company recently announced a recall of its market-leading product, the share market reacted. Does Roger Montgomery believe this is a once-in-a-lifetime opportunity to acquire shares in this extraordinary A1 company at a price less than his estimate of its Value.able intrinsic value? In this appearance on Your Money Your Call, Roger also shares his insights on Drilltorque (DTQ), Matrix (MCE) and gold stocks Silverlake Resources (SLR) and Troy (TRY). Watch the interview.

by Roger Montgomery's Team Posted in Media Room, TV Appearances.

- 10 Comments

- save this article

- 10

- POSTED IN Media Room, TV Appearances.

-

What has probing the reporting season avalanche revealed?

Roger Montgomery

August 24, 2011

With reporting season in full swing, I would like to share my insights into whose Quality Score has improved, and whose has deteriorated. Remember, none of this represents recommendations. It is intended to be educational only. You must seek and take personal professional advice before acting or transacting in any security.

To date, 232 companies have reported their annual results. I am sure you can understand why we feel snowed under. With almost 2,000 companies listed on the ASX, the avalanche still has a way to roll.

We have updated all of our models for each of the 164 companies that we are interested in. As you know, we rank all listed companies from A1 down to C5. The inputs for those rankings always come from the company themselves. I would hate to think how bipolar they would be if we allowed our emotions and personal preferences to infect those ratings (or be swayed by analyst forecasts)!

Rather than arbitrary and subjective assessments, we download some 50-70 Profit and Loss, Balance Sheet and Cash Flow data fields from each annual report to populate five templates. All of these templates employ industry specific metrics to calculate the Quality Scores. This allows us to rank every ASX-listed business from A1 – C5. Its our objective way to sort the wheat from the chaff.

For Value.able Graduates not familiar with our scoring system, company’s that achieve an A1 Score are those we believe to be the best businesses, and the safest. C5s are the poorest performers and carry the highest risk of a possible catastrophic event.

A1 does not mean nothing bad will ever befall a company. A1 simply means to us that it has the lowest probability of something permanently catastrophic. Further, ‘lowest probability’ doesn’t mean ‘never’. A hundred-to-one horse can still win races, even though the probability is low. Similarly, an A1 business can experience a permanently fatal event. In aggregate however, we expect a portfolio of A1 businesses to outperform, over a long period of time, a portfolio of companies with lesser scores.

With that in mind, we are of course most interested in the A1s and – on a declining scale – A2, B1 and B2 businesses.

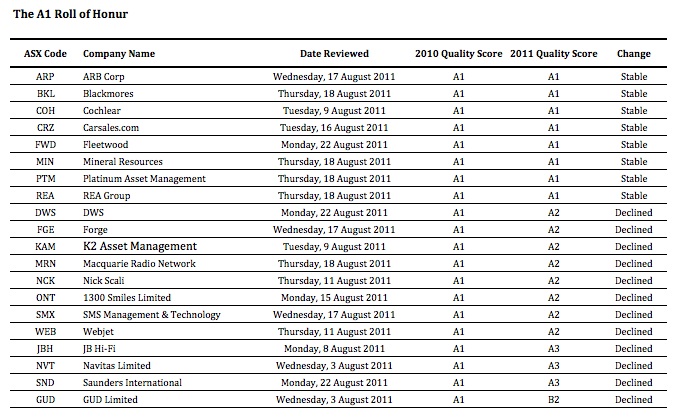

So, who has managed to retain their A1 status this reporting season? And which businesses have achieved the coveted A1 status? If you hold shares in any of the companies whose scores have declined (based of course on their reported results), please read on.

Of the companies that have reported so far, last year 20 of them were A1s, 28 were A2s, one was a B1 and 13 scored B2. That’s an encouraging proportion, although we tend to discover each reporting season that the better quality businesses and the better performing businesses are generally keen to get their results out into the public domain early.

Its towards the end of every reporting season where the quality of the businesses really drops off. This is always something to watch out for – companies trying to hide amongst the many hundreds reporting at the end of the season. It’s always a good idea to turn up to a big fancy dress party late, if you aren’t in fancy dress.

This year we have seen the number of existing A1s fall to nine from 20, A2s from 28 to 24, B1s rise from one to two and B2s fall from 13 to six.

The first table shows all twenty 2009/2010 A1 companies that have reported to date. You’ll see a number of very familiar names in here, including ARB Corp (ARP), Blackmores (BKL), Cochlear (COH), Carsales.com (CRZ), Fleetwood (FWD), Mineral Resources (MIN), Platinum Asset Management (PTM), REA Group (REA), DWS (DWS), Forge (FGE), K2 Asset Management (KAM), Macquarie Radio Network (MRN), Nick Scali (NCK), 1300 Smiles Limited (ONT), SMS Management & Technology (SMX), Webjet (WEB), JB Hi-Fi (JBH), Navitas Limited (NVT), Saunders International (SND) and GUD Limited (GUD). Nine have maintained their A1 rating this year.

Now, before you go jumping up and down, a drop from A1 to A2 is like downgrading from Rolls Royce to Bently. When we talk about A2s, its not a drop from RR Phantom to a Ford Cortina, not that there’s anything wrong with the old Cortina (if you are too young to know what I am talking about Google it!).

The only big rating decline is GUD Holdings, which made a large acquisition (Dexion) during the year. Indeed, a common theme amongst the higher quality and cashed up businesses this reporting season has been the deployment of that cash towards, for example, acquisition or buybacks (think JB Hi-Fi).

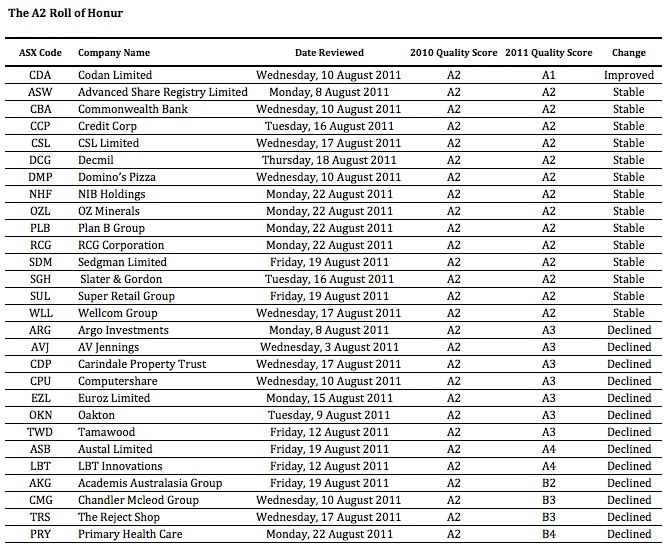

Moving onto the 2009/2010 A2 honour roll: Codan Limited (CDN), Advanced Share Registry Limited (ASW), Commonwealth Bank (CBA), Credit Corp (CCP), CSL Limited (CSL), Decmil (DCG), Domino’s Pizza (DMP), NIB Holdings (NHF), OZ Minerals (OZL), Plan B Group (PLB), RCG Corporation (RCG), Sedgman Limited (SDM), Slater & Gordon (SGH), Super Retail Group (SUL), Wellcom Group (WLL), Argo Investments (ARG), AV Jennings (AVJ), Carindale Property Trust (CDP), Computershare (CPU), Euroz Limited (EZL), Oakton (OKN), Tamawood (TWD), Austal Limited (ASB), LBT Innovations (LBT), Academis Australasia Group (AKG), Chandler Mcleod Group (CMG), The Reject Shop (TRS) and Primary Health Care (PRY).

The businesses that make up this list showed slightly more stability. The biggest fall in quality this year was Primary Healthcare (PRY),which is still struggling to digest the large purchases it made a few years ago. The Reject Shop (TRS) also declined, to B3. TRS is still investment grade and we would lean towards believing this is a short-term decline, given the floods in QLD that caused the complete shutdown of their new distribution center and the massive disruptions subsequently caused. As the company said, you can’t sell what you haven’t got!

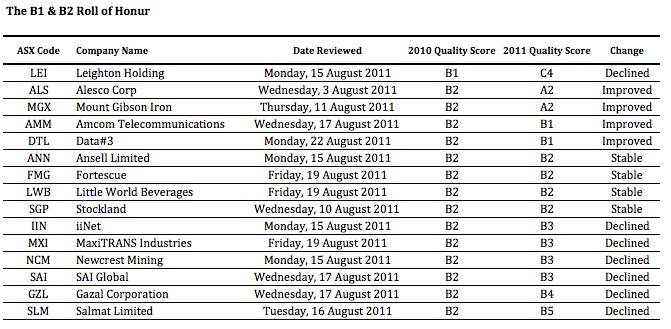

Finally, B1 and B2 companies: Leighton Holdings (LEI), Alesco Corp (ALS), Mount Gibson Iron (MGX), Amcom Telecommunications (AMM), Data#3 (DTL), Ansell Limited (ANN), Fortescue (FMG), Little World Beverages (LWB), Stockland (SGP), iiNet (IIN), MaxiTRANS Industries (MXI), Newcrest Mining (NCM), SAI Global (SAI), Gazal Corporation (GZL) and Salmat (SLM).

About half the companies in the B1/B2 list retained or improved their ratings from last year. Mind you, half also saw their rating decline!

The clear fall from grace is Leighton Holdings, whose problems have been well documented in the media and via company presentations.But once again, like The Reject Shop, this could be a temporary situation. If the forecast $650m profit comes through, I expect LEI’s quality score will improve. What the dip will do, however, is remain a permanent reminder that Leighton is a cyclical business. Getting the quote right on a job is important, even more a massive enterprise like Leightons.

Are you surprised by any of the changes? We certainly were!

Sticking to quality is vitally important. That’s what my team and I do here at Montgomery Inc, and its what our amazing next-generation A1 service is all about. Value.able Graduates – your invitation is pending.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Remember, you must do your own research and remember to seek and take personal professional advice.

We look forward to reading your insights and will provide another reporting season update soon.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 24 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

What if the sell-off is just a Flash?

Roger Montgomery

June 23, 2011

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?In the short run prices move independently of the underlying business, so let’s encourage the market to decline further!

For those truly concerned about Australia’s prosperity, relax. Be comfortable in the knowledge that short-term share price moves are unlikely to impact the employment policies of Australia’s largest listed businesses.

Looking over the financials of fifty-six A1 companies, little has changed. While Telstra and Fosters share prices are beating to the drum of hoped-for franked dividends and a takeover, the fundamentals of many other companies, particularly A1s (and indeed A2 and B1), are resolute. Are these businesses worth 10% to 26% less than they were worth before? No chance. The Value.able intrinsic valuations of companies that were cheap before haven’t changed.

So what has changed?

Only investors’ perceptions. Perceptions about the global economic outlook; perceptions about a US slowdown becoming a recession; perception about a Chinese slowdown causing a global rout the world cannot afford; and hope that Australian house prices will fall to levels people can actually afford.

Think about that for a moment. Baby boomers own $1m + homes that they will be forced to liquidate to fund their retirements and health care. Meanwhile, Generation Y is struggling to afford a property. Something has to give. Economics 101 suggests price declines.

Investors have simply been reducing their appetite for risk.

Armageddonists are spouting scenarios similar to those that followed Britain’s exit from the gold standard in 1931.

But this fear may be unfounded. It’s most certainly not a cause for permanent worry. Even if a recession does transpire, it will not be permanent.

Our job as Value.able Graduates is not to guess the gyrations of the economy – while they are vital in determining the sustainability of a given return on equity, many of the world’s very best investors do not even employ economists (they employ former US Federal Chairmen).

Your mantra is to simply put together a list of ten extraordinary businesses that you believe will be much more valuable in five, ten or twenty years time.

Of course trying to fit all this into your daily life can be a challenge. Completely eliminating the drudgery, and making it simple and fun, is something my team and I have been working on for you. We created our A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. We have worked really hard to create our next-generation service because its what we all want to use. We are its first members! Soon, you will be able to make your investing life simpler too (remember, Value.able Graduates will be invited first – have you secured your copy?). It’s an A1 service that is like nothing you have ever seen before.

You may sense our excitement…

… back to the regular program.

So, here it is. Our list of out-of-favour-but-extraordinary businesses. WARNING: out-of-favour does not always mean ‘bargain’.

Steve Jobs once said; “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully.”

With that in mind, here are my thoughts on ten businesses we have discussed over the past few months with a back-of-the-business card reason for interest…

JB Hi-Fi (ASX: JBH, MQR: A1) – Bad news across the board in retail may get worse, but it will turn around and JB Hi-Fi is not Harvey Norman. The buyback has increased intrinsic value at the same time the price slides below.

Cochlear (ASX: COH, MQR: A1) – The shining star amongst A1s (COH is one of this country’s best export successes), yet the worst performer on the share market amongst its peers. Rational, anyone? Australian dollar fluctuations doesn’t change the quality of COH’s business, only the nature or shape of its earnings. Aussie dollar appreciation may last a while, but is not permanent.

CSL Limited (ASX:CSL, MQR: A1) – Another A1 amongst A1s. Like COH, earnings are affected by currency fluctuations.

Woolworths (ASX: WOW, MQR: B1) – Trading at a premium to current Value.able intrinsic value, but a small discount to 2012. Intrinsic value has taken five years to catch up to the price and the price has complied by waiting. In the absence of further downgrades, intrinsic value for future years now rises beyond the price at a good clip.

Reece (ASX: REH, MQR: A2) – Great quality business. Wait for weaker prices or intrinsic value to catch up.

Platinum Asset Management (ASX: PTM, MQR: A1) – Whilst few businesses can compete with Platinum on an ROE and low capital intensity basis, patience is required before acquiring.

Matrix C&E (ASX: MCE, MQR: A1) – Matrix is unique amongst its small capitalisation peers also servicing the resources sector. Watch the full year results closely.

ANZ (ASX: ANZ, MQR: A3) – Short of swimming off the island, we don’t have much choice when it comes to choosing a banking partner. Thanks to fears of an ineffectual Asia roll-out, ANZ is the cheapest of Australia’s big four at the present time.

Vocus Communications (ASX: VOC, MQR: A1) – Run by some of the best in the business, the intrinsic value of Vocus has the potential to be much, much higher in five years time.

Zicom Group (ASX: ZGL, MQR: B2) – Like Matrix, Zicom is exposed to both small-cap and resource sector engineering negativity. And like Vocus, the intrinsic value could rise much higher on the back of further rises in the price of oil and demand for gas.

What’s on your list?

This market, with an increasing number of companies hitting 52-week lows, is demanding your attention!

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 177 Comments

- save this article

- 177

- POSTED IN Companies, Insightful Insights.

-

What are Roger Montgomery’s Value.able intrinsic valuations for his top three A1s?

Roger Montgomery

October 28, 2010

In this appearance on Your Money Your Call, Roger Montgomery reveals his Value.able intrinsic valuations for popular retailer JB Hi-Fi (JBH), hearing device manufacturer Cochlear (COH), mortgage broking company Mortgage Choice (MOC), fund manager Platinum Asset Management (PTM) and construction company Leighton Holdings Limited (LEI). Which of these businesses are trading at a discount to Roger’s Value.able intrinsic valuation? And which businesses score Roger’s coveted A1 Montgomery Quality Rating (MQR)? Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

Who is in front of the reporting season avalanche?

Roger Montgomery

August 17, 2010

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.TLS was a clear disappointment, as it has been since it listed. I have been on the front foot for a long time saying that this is a company to avoid, I hope you took notice. My valuation has fallen now from $3.00 to almost $2.50. If anyone can turn it around however I think Thodey can.

Qantas should have come as no surprise. A $300 million cash loss and I wouldn’t be surprised to see another raising of capital or debt.

Personally though I am not interested at all in TLS or QAN as investment candidates. I am only interested in the highest quality best performing businesses available – it’s here that intrinsic value can be created rather than destroyed and with reporting season just about to kick into top gear from this week, to find them, I put each company through the same rigorous process.

My initial screening process is a vital part of the investment process as it allows me to determine those companies that deserve to retain their place in the short list and it also highlights new opportunities as they arise. But to do this for some 2,000 listed Australian companies can be a very burdensome task unless you have a systematic way of analysing and comparing results in a consistent manner.

For me, it involves pulling out some 50-70 profit and loss, balance sheet and cash flow data fields from each annual report to populate my five models. All of these models employ industry specific metrics to calculate my quality and performance scores. This allows me to rank all companies from A1 – C5 to sort the wheat from the chaff.

For those not familiar with my ranking system, A1s are the simply the best businesses and the safest to own, while C5s are the poorest performers and the least safe.

Out of the 80 companies that have reported, only 5 have achieved my coveted A1 status – around 6.25% (the best of the rest).

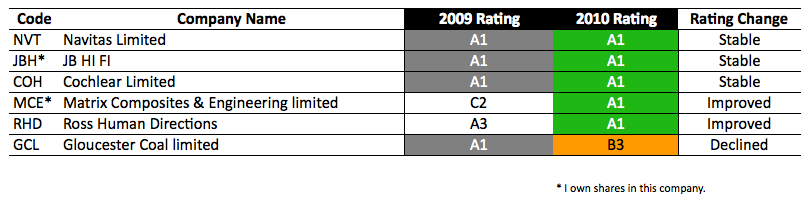

NVT, JBH and COH had my A1 rating last year and retained it this year and there are 2 new entrants in MCE and RHD, with GCL (it was an A1 last year) having a dramatic rating decline. I tend to shy away from resource companies for obvious reasons.

On my blog I have previously spoken about NVT, JBH and COH and also mentioned ITX, so please revisit those thoughts. itX is under takeover and Navitas, it was recently reported, had been approached some time ago by Kaplan – a company I have done some consulting work for and a subsidiary of Warren Buffett’s Washington Post company – so a big tick for the A1 to C5 Rating system!

That only leaves MCE, an engineering business that currently generates most of its returns from the manufacture of riser buoyancy modules for deep-sea oil rigs. Its order book is already underwriting a doubling of revenue for 2011. The 2010 result revealed profits had almost tripled and significantly exceeded prospectus forecasts and it is producing returns on equity of 49% – a rate that is unavailable generally elsewhere. Borrowings amount to about $8 million compared to equity of about $60 million (of which a little over 10% is capitalised development and goodwill intangibles). Best of all, the share price over the last week is a long way below my estimate of its intrinsic value.

If you have seen me on TV or heard me on radio in the last week or so you would have heard me mention that I had bought something, MCE is it. Please be mindful that if you act rashly and go and push the share price up, you will be helping me perhaps more than yourself. Also remember that I am not recommending the stock to you and that I cannot forecast the share price direction (although I am pleased with its performance since my purchase). The share price, I warn you, could halve, for example if there is a recession and or the oil price plunges – delaying expenditure of the construction of oil rigs globally. I simply am not recommending it to you.

Also remember that I am under no obligation to keep you informed of when I buy or sell nor answer any specific questions, which means 1) you have to do your own research and 2) you have to be responsible for your own decisions. Seek and take personal professional advice BEFORE you do anything.

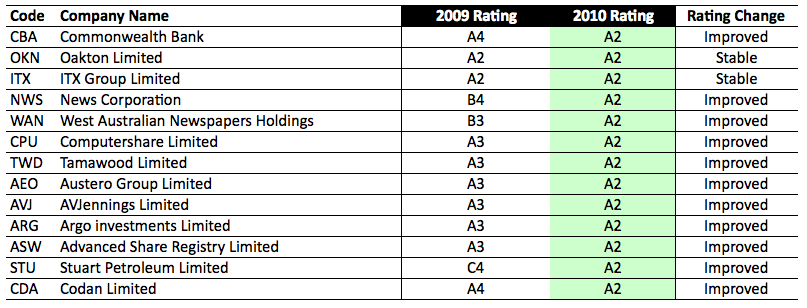

Moving on, another 13 companies have achieved my second highest rating of A2. They are listed below with their prior years rating so you can compare.

Noteworthy in this list is the excellent performance of the Commonwealth Bank (which I continue to hold in my Eureka Report Value Line portfolio, along with JBH and COH) and those companies I generally classify as being in the Information Technology sector including OKN, ITX, CPU and ASW. Both sectors appear to be doing well in aggregate.

While focus should always be placed on the A1’s (the top 5-7% of the market) at any one point in time, A2’s are still very high quality businesses. The use of the two lists in tandem will therefore provide you with an excellent starting point in isolating those who have reported high quality financials and performance levels above the average business. An important first step in the Value.able Montgomery brand of investing.

It is from here that I will select candidates worthy of further analysis (qualitative and quantitative) and possibly meet with company management, if I have not already done so. Once again I have taken you to the river I fish in, you have my fishing rods and tackle box. Now up to you to catch the right priced fish.

Please use these two lists as a starting point to conduct your own research and use Value.able as a guide to estimate your own valuations. If you don’t yet have a copy you can order one at www.rogermontgomery.com so you too can do your own valuations. Remember to always focus on the highest quality and best performing business available.

If you focus on the best when they are cheap and simply forget the rest, you should avoid more (if not all) of the disasters and should be able to build a portfolio that will give you a greater chance of out-performing the market.

Happy reporting season!

To be continued… Read Part II.

Post by Roger Montgomery, 17 August 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

What do I think these A1 companies are really worth?

Roger Montgomery

July 6, 2010

If you recently ordered my book Value.able, thank you and welcome! You have joined a small band of people for whom the inexplicable gyrations of the market will soon be navigated with confidence and far more understanding. If you have ever had an itch or the thought; “there must be a better way”, Value.able is your calamine lotion.

If you recently ordered my book Value.able, thank you and welcome! You have joined a small band of people for whom the inexplicable gyrations of the market will soon be navigated with confidence and far more understanding. If you have ever had an itch or the thought; “there must be a better way”, Value.able is your calamine lotion.Its hard to imagine that my declaration to Greg Hoy on the 7.30 Report that Myer was expensive as it listed at $4.10, or elsewhere that JB Hi-Fi was cheap and Telstra expensive has anything to do with the 17th century probability work of Pascal & Fermet.

The geneology of both modern finance and separately, the rejection of it, runs that far back. From Fermet to Fourier’s equations for heat distribution, to Bachelier’s adoption of that equation to the probability of bond prices, to Fama, Markowitz and Sharpe and separately, Graham, Walter, Miller & Modigliani, Munger and Buffett – the geneology of value investing is fascinating but largely invisible to investors today.

It seems the intrinsic values of individual stocks are also invisible to many investors. And yet they are so important.

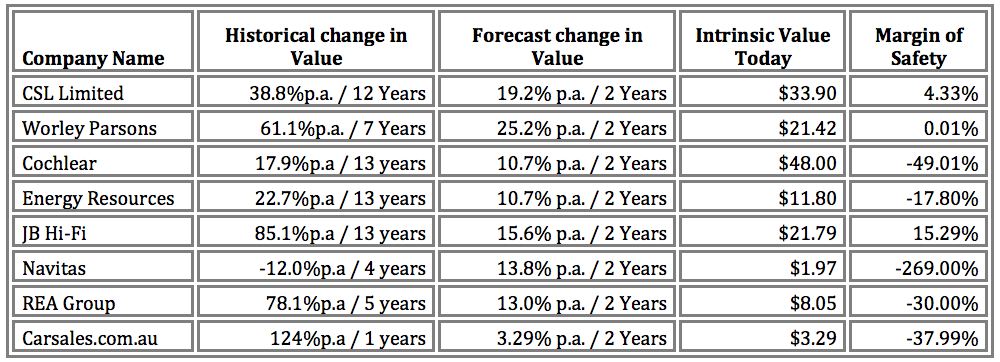

My 24 June Post ‘Which 15 companies receive my A1 status?’ spurred several investors to ask what the intrinsic values for those 15 companies were. You also asked if I could put them up here on my blog so you can compare them to the valuations you come up with after reading Value.able. Apologies for the delay, but with the market down 15 per cent since its recent high, I thought now is an opportune time to share with you a bunch of estimated valuations.

I have selected a handful from the 15 ‘A1’ companies named in my 20 June post and listed them in the table below. The list includes CSL Limited (CSL), Worley Parsons (WOR), Cochler (COH), Energy Resources (ERA), JB Hi-Fi (JBH), REA Group (REA) and Carsales.com.au (CRZ).

If you are surprised by any of them I am interested to know, so be sure to Leave a Comment. And when you receive your copy of my book (I spoke with the printer yesterday who informed me the book is on schedule and will be delivered to you very soon), you can use it to do the calculations yourself. I am looking forward to seeing your results.

The caveats are of course 1) that the list is for educational purposes only and does not represent a recommendation (seek and take personal professional advice before conducting any transactions); 2) the valuations could change adversely in the coming days or weeks (and I am not under any obligation to update them); 3) these valuations are based on analysts consensus estimates of future earnings, which of course may be optimistic (or pessimistic, and will also change). They may also be different to my own estimates of earnings for these companies; 4) the share prices could double, halve or fall 90 per cent and I simply have no way of being able to predict that nor the news a company could announce that may cause it and 5) some country could default causing the stock market to fall substantially and I have no way of being able to predict that either.

With those warnings in mind and the insistence that you must seek advice regarding the appropriateness of any investment, here’s the list of estimated valuations for a selection of companies from the 15 A1 companies I listed back on 20 June.

Posted by Roger Montgomery, 6 July 2010

by Roger Montgomery Posted in Companies, Investing Education.

- 58 Comments

- save this article

- 58

- POSTED IN Companies, Investing Education.

-

Who has time favoured the most?

Roger Montgomery

May 21, 2010

I was in Melbourne last week filming this year’s The Path Ahead DVD with Alan Kohler and Robert Gottliebsen. This is the third time Alan has asked Monique and I to participate, and in addition to enjoying it immensely, I am incredibly humbled by the invitation.

We sit around the breakfast table, enjoy some wonderful pastries, fruit and cheeses (a welcome break from my Dr Ross Walker breakfast regime) and I get to debate and hear a range of views about markets and the big picture issues for investors. The dialogue becomes quite animated at times, and I have to admit to often forgetting the four or five cameras recording our every utterance.

Tony Hunter from the ASX holds court, and directs questions that have been received by Alan to the panel, and almost always without notice. I thought I would write about this year’s experience only because one of the questions got me thinking about the clichés that investors often have at the back of their mind when making investment decisions.

Relying on investing clichés can be dangerous, if not because they are prevarications, but because they are the domain of the lazy who seek to grab the attention of those whose concentration has been diminished by the constant noise of the markets – much of which is useless and information-free (the noise that is).

Here is a few that came to mind immediately (some are useless but perhaps others aren’t); Sell in May and go away. Buy the rumour, sell the fact. Don’t catch a falling knife. Feed the ducks while they’re quacking. Buy dips. Buy low and sell high. Only buy stocks that go up. This time its different. The trend is your friend. You can’t go broke taking a profit. Its time in the market not timing the market that counts.

You may have a few too, and I would love to hear them. Let me know if any have helped or hindered and feel free to add them by clicking ‘Leave a Comment’ at the bottom of this post.

There is no doubt you have heard many, if not all, of them before. They have become part of investing lore and yet they lead more to pain and suffering than they do to enlightenment. So why do they survive? Is it because there is truth in them?

I believe it is because there is a steady stream of new investors entering the market for whom the cliché has not yet become one. They run the risk of seeing the investing cliché as a truth – to be memorized and applied – and in doing so, they are guaranteed to repeat the mistakes made by the many that came before them.

Cliché 1: You can’t go broke taking a profit

Think about the statement, You can’t go broke taking a profit; A new investor is almost certain to go broke doing just that. Why? Because a new investor will inevitably purchase a share only to see the price decline. Buying a low quality company (not one of my A1’s for example) or paying too a high a price (not estimating the intrinsic value of a company) will inevitably lead to a permanent loss of capital. The share price goes down and the investor, not wanting to accept a loss, holds on in the hope that one day the shares will recover. Then suppose the next investment decision leads to a gain; do you think the investor will hold this share for very long? The short answer is no. The fear of repeating the first mistake, resulting in another loss, is just too great. Better to take a small profit now than to see the shares fall again and have another loss. The end result of repeating this numerous times is that the investor has several large losses and several small profits. The net result, of course, is a loss. You can go broke taking a profit just as surely as you can go broke saving money buying excessively-priced items that are on sale.

A further example refers to inflation, and its effect on the purchasing power of your money. Trading frequently involves substantial frictional costs. Brokerage, slippage and spreads seriously impinge on the returns otherwise available from a buy and hold strategy. Earning 15 per cent from buying and holding is always preferable to 15 per cent from trading, and that’s even before tax is factored into the equation. Suppose however, you don’t even achieve 15 per cent from trading frequently; after 20 years, you merely match the rate of inflation. Arguably, you have not lost purchasing power, but you have not gained any either. You have been taking profits but have not made any.

Similarly, if you sell a stock (using rising or trailing stops, for example) and make a 100 per cent return, but the shares rise 400 per cent, I would argue you have left a great deal of money on the table. You have certainly lost money taking a profit.

Cliché 2: Its ‘Time in the market’ not ‘Timing the market’ that leads to success.

Another cliché that comes to mind is the idea that time in the market is the key to success rather than timing. At the outset, let me state that I don’t believe that timing the market or share prices works. Nor do I believe that time in the market works always, and if it sometimes does, the time can be so long that the returns are meaningless. Take for example the investor who purchased shares in Macquarie Bank at $90 some years ago; they are still waiting for a positive return. Or what about the investor who bought shares in Great Southern Plantation when the company listed? No chance of a positive return at all. If you purchased shares in Qantas or Telstra ten years ago, you would now have an investment with less value than you what commenced with.

Time in the market is no good if you buy poorly performing businesses or pay prices that are far above the intrinsic value of a company. For the seventeen years bound by 1964 and 1981 the Dow Jones rose just 1/10th of one percent. Time, it seems, was not the friend of the merely patient investor. I can show you equally long periods of low returns on the Australian market too.

The point however is that time is only the friend of the investor who buys wonderful businesses at large discounts to intrinsic value. Otherwise, time is an enemy that steals returns just as surely as it steals a great day.

Don’t use time then as a band-aid to heal your investing mistakes. Stick to A1 businesses bought at discounts to intrinsic value and time will be your friend. So what are the businesses that time has befriended the most? What businesses have been increasing in intrinsic value the most over the last three, five or ten years?

The following Table should offer the answers.

Remember, these companies may be higher quality (Some are my A1’s), but they might not currently be cheap and I have not discussed the path of their intrinsic values in the future, which arguably is more important for the investor. Be sure to seek personal professional advice before transacting in any security.

Company ASX Code Annual Gain in Intrinsic Value Company ASX Code Annual Gain in Intrinsic Value MND (Monadelphous) 30% CAB (Cabcharge) 25% WOR (Worley Parsons) 61% ANG (Austin Eng) 98% BTA (Biota) 38% WEB (Webjet) 24% COH (Cochlear) 18% SUL (Supercheap Auto) 17% RKN (Reckon) 29% REX (Regional Express Airlines) 47% CRZ (Car Sales) 124% CPU (Computershare) 36% REA (Realestate.com) 78% TRS (The Reject Shop) 28% CSL (CSL) 39% REH (Reece) 21% NMS (Neptune) 25% IRE (Iress market tech) 19% ORL (Oroton) 27% ARP (ARB) 19% JBH (JB Hi-Fi) 85% The table reveals the companies that have demonstrated the highest growth in intrinsic values over the years and perhaps unsurprisingly, if my method for calculating intrinsic value is any good, you will find a very strong correlation between the increases in values and the increases in share prices.

If you have any questions of course, or would like to contribute a cliche you once thought of as a lore to live and invest by but now see it for what it is, feel free to share by clicking the ‘Leave a Comment’ link below.

Posted by Roger Montgomery, 22 May 2010

by Roger Montgomery Posted in Investing Education.

- 86 Comments

- save this article

- 86

- POSTED IN Investing Education.

-

Is there value in the healthcare sector?

Roger Montgomery

April 22, 2010

IRESS Market Technology (IRE) is one of Roger Montgomery’s A1 businesses. So are CSL and Cochlear (COH). In his appearance on Your Money Your Call Roger shares his insights on the defensive healthcare sector, revealing valuations for Ramsay (RHC), Sonic (SHL) and Primary Healthcare (PRY), and discusses the outlook for IRE in the event of another stock exchange entering the Australian market. Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

What are Roger Montgomery’s A1 filters?

Roger Montgomery

March 24, 2010

Roger Montgomery always talks about buying A1 businesses at great prices, but what does a business need to do to get Roger’s A1 score for quality and performance? High ROE that is also superior to its peers, strong competitive advantage, stability of earnings, low chance of default, great management, low debt. In his appearance on Your Money Your Call Roger also shares his thoughts on UGL Limited (UGL), Dolomartix (DMX), Cochlear (COH), Incite Pivot (IPL), Alumina (AWC) and AWB Limited (AWB). Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- 2 Comments

- save this article

- 2

- POSTED IN Media Room, TV Appearances.

-

Is The TV Your Investment Strategy?

Roger Montgomery

March 5, 2010

Mark Twain (1835 – 1910) said; “I Am Not So Concerned With The Return On My Money As The Return Of My Money.” It may surprise you to know he was quite the investor and liked to make comment about his observations. His quips always revealed a deep understanding of the nonsense that goes on in the stock market. What fascinates me is that the mistakes Twain observed during his lifetime are being repeated today.

I am occasionally asked why I spend so much time offering my insights when many observe that there is neither an obligation nor financial need. The reason is quite simple, I enjoy the process and of course, the proceeds of investing this way. I find it reasonably undemanding and so I have a little time to share my findings. And there’s the ancillary benefit of seeing hundreds of light-bulb moments when people ‘get it’. I note Buffett’s obligations and financials are even less necessitous and yet he has devoted decades to educating investors and students. I really enjoy my work. It is fun and thank you for making it so.

Investing badly in stocks is both simple and easy. But while investing well is equally simple – it requires 1) an understanding of how the market works, 2) how to identify good companies and finally, 3) how to value them – investing well is not easy.

This is because investing successfully requires the right temperament. You see you can be really bright – smartest kid in the class – and still produce poor or inconsistent returns, invest in lousy businesses, be easily influenced by tips or gamble. I know a few who fit the “intelligent but dumb” category. Because you are bombarded, second-by-second, by hundreds of opinions and because stocks are rising and falling all around you, all the time, investing may be simple but its not easy.

Buffett once said; “If you are in the investment business and have an IQ of 150, sell 30 points to someone else”.

Everyone reading this blog is capable of being terrific investors. But it is important to know what you are doing and to do the right things.

To this end I have asked a couple of investors with whom I have corresponded for permission to discuss their correspondence because it provides a more complete understanding of the research that’s required before buying a share.

I regularly warn investors that what I can do well is value a company. What I cannot do well is predict its short-term share price direction. Long-term valuations (what I do) are not predictions of short term share prices (what I don’t do).

Generally the scorecard over the last 8 months is pretty good. The invested Valueline Portfolio, which I write about in Alan Kohler’s Eureka Report, is up 30% against the market’s 20% rise. I have avoided Telstra and Myer, bought JBH, REH, CSL and COH. Replaced WBC with CBA last year and enjoyed its outperformance. Bought MMS and sold it at close to the highs – right after a sell down by the founding shareholder – avoiding a sharp subsequent decline.

But this year, there have been a couple of reminders of the inability I admit to frequently, that of not being able to accurately predict short term prices. And it is understanding the implications of this that may simultaneously serve to warn and help.

Even though I bought JB Hi-Fi below $9.00 last year, its value earlier this year was significantly higher than its circa $20 price. And the price was falling. It appeared that a Margin of Safety was being presented. And then…the CEO resigned and the company raised its dividend payout ratio. The latter reduces the intrinsic value and the former could too, depending on the capability of Terry Smart.

The point is 1) You need a large margin of safety and 2) DO NOT bet the farm on any one investment – diversify.

You can see my correspondence about this with “Paul” at http://rogermontgomery.com/what-does-jb-hi-fis-result-and-resignation-mean/

The second example is perhaps more predictable. Last year, Peter Switzer asked me for five stocks that were high on the quality scale; not necessarily value, but quality. We didn’t then have time to reveal the list, so I was asked back, in the second half of October 09. By that time, the market had rallied strongly, as had some of the picks. The three main stocks were MMS, JBH and WOW.

But because I didn’t have five at that time, I was asked for a couple more. I offered two more and warned they were “speculative”. “Speculative” is a warning to tread very, very carefully – think of it as meaning a very hot cup of tea balanced on your head. You just don’t need to put yourself in that position! But I was aware that viewers do like to investigate the odd speculative issue. A company earns the ‘speculative’ moniker because its size or exposure (to commodities, for example) or capital intensity render its performance less predictable or reliable, earning it the ‘speculative’ moniker. Nevertheless, based on consensus analyst estimates they were companies whose values were rising and whose prices were at discounts to the intrinsic values at the time – a reasonable starting point for investigative analysis. ERA was one and SXE was the other. Both speculative and neither a company that I would buy personally because their low predictability means valuations can change rapidly and in either direction.

My suggestions on TV or radio should be seen as an additional opinion to the research you have already conducted and should motivate investors to begin the essential requirement to conduct their own research. Unfortunately, I have discovered to my great disappointment, that some people just buy whatever stocks are mentioned by the invited guests on TV. Putting aside the fact that I have said innumerable times that I cannot predict short-term movements of share prices, it seems some investors aren’t even doing the most basic research.

As I have warned here on the blog and my Facebook page on several occasions:

1) I am under no obligation to revisit any previous valuations.

2) I may not be on TV or radio for some weeks and in that time my view may have changed in light of new information. Again, I am not obligated to revisit the previous comments and often not asked. Only a daily show could facilitate that. An example may be, the suggestion to go and investigate ERA because of a very long term view that nuclear power is going be an important source of energy for a growing China followed by a more recent view (see the previous post) that short term risks from a Chinese property bubble could prove to be a significant short-term obstacle to Chinese growth.

3) I don’t know what your particular needs and circumstances are.

4) I assume you are diversified appropriately and never risk the farm in any single investment

5) The stocks that I mention should be viewed, in the context of other research and your adviser’s recommendations, as another opinion to weigh up – to go and research not rush out and trade…rarely is impatience rewarded.

There are further warnings that are relevant and described in the correspondence related to the post you will find at http://rogermontgomery.com/what-does-jb-hi-fis-result-and-resignation-mean/

One investor wrote to me noting he had bought ERA and it had dropped in price. This should not be surprising – in the short run prices can move up and down with no regard or relationship to the value of the business. But like JBH before it, ERA had of course made a surprise announcement that would affect not only the price but the intrinsic value. In this case, it was a downgrade and a rather bleak outlook statement relating to cash flows. Analysts – whose estimates are the basis for forecast valuations here – would be downgrading their forecasts and as a result the valuations would decline just as they did when JB Hi-Fi increased its payout ratio. Over the long-term the valuations in ERA’s case, continue to rise (these valuations are also based on earnings estimates – new ones but which it should be noted are themselves based on commodity prices that are impossibly hard to forecast), but all valuations are lower than they were previously.

Our correspondence reminded me to regularly serve you with NOTICE that there is serious work to be done by you in this business of investing. In a rising market you can pretty much close your eyes and buy anything but you should never conduct yourself this way. If you work appropriately during a bull market, you will be rewarded in weaker markets too. And while many may complain when I say on air “I can’t find anything of value at the moment”, I would rather you complain about the return ON your money than the return OF your money.

Posted by Roger Montgomery, 5 March 2010.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 41 Comments

- save this article

- 41

- POSTED IN Companies, Insightful Insights.