Part II: What else has the reporting season avalanche uncovered?

The second full week of reporting season has just been and gone and saw another 80-100 companies report their financial results. More than 200 have reported and yes I am working feverishly to keep up and cover them all. I am happy to report that I’m ready for another week.

The second full week of reporting season has just been and gone and saw another 80-100 companies report their financial results. More than 200 have reported and yes I am working feverishly to keep up and cover them all. I am happy to report that I’m ready for another week.

So far the results have been mixed. Information Technology, Banking and Mining/Oil & Gas Services sectors have stood-out, receiving high Montgomery Quality Ratings. The remainder have been distributed somewhat randomly amongst the other sectors.

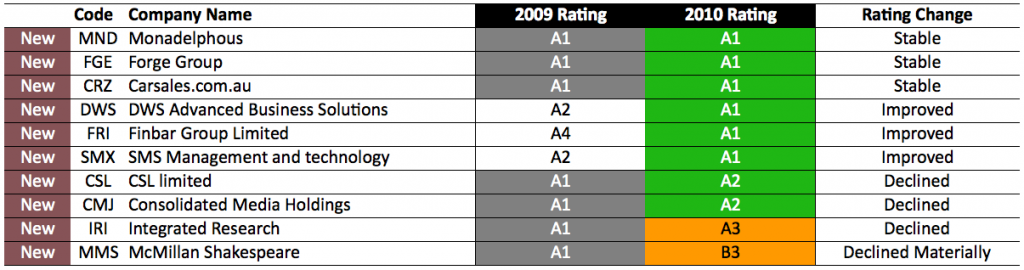

And having analysed all of them so far, I can reveal that only 11 (5.5%) of the 200 have achieved my coveted A1 status (an additional six on top of the five from my previous post). These businesses have all passed my rigorous stress tests and come up trumps.

You may be surprised that after another full week and 80-100 individual results, only six additional companies have made it. But my A1 rating system has been specifically formulated to yield only the best and it is performing its function very well.

Of the six companies, three held onto their A1 status. These are Carsales.com.au (CRZ), Forge Group (FGE) and Monadelphous (MND) which have been joined by 3 new entrants in DWS Advanced Business Solutions (DWS), Finbar Group Limited (FRI) and SMS Management and technology (SMX).

Unfortunately, on a net basis we lost one A1 this year with four other businesses experiencing ratings declines from A1. These businesses include CSL limited (CSL), Consolidated Media Holdings (CMJ), Integrated Research (IRI) and McMillan Shakespeare (MMS). While CSL and CMJ have both declined to A2 status – nothing to be sneezed at, IRI and MMS have had larger rating declines.

Most notably, MMS has declined materially in terms of quality as I predicted it might after its acquisition, and it is now a ‘B3’. The mostly debt-funded acquisition of Interleasing (Australia) is the cause of this fall which I will cover in a separate post.

There are also another 20 A2 businesses that have passed my stress tests and rate in the top 15 per cent of the market in terms of overall quality.

Don’t forget to combine these lists with the A1 and A2 businesses I highlighted last week to continue identifying the best of the rest and stay tuned, I will post my intrinsic valuations for all 11 A1 businesses soon.

Finally, an update on my Telstra valuation. Last week I said that my valuation following the annual result was $2.50. I have updated my numbers and now get $2.30.

I sincerely hope that my Telstra comments have served your research well and that you have not been caught by all of the “it’s high yield and therefore a cheap stock” talk.

While others may have been tempted to buy shares for ‘yield’, you can use Value.able to first discover the intrinsic value. To save you a little time, Telstra’s valuation has declined since it listed. Even in the past year intrinsic value has fallen from $3.00 to $2.30! And the share price has fallen from $3.55 to the current $2.77.

In reality this is a widely reported and closely tracked company and its weighting in the index ensures a level of support from the large, conventional, index-based and tracking-error-focused funds. Indeed this is one of the reasons it has taken so long for Benjamin Graham’s weighing machine to catch up to the valuation – ten years! An improvement in the clarity for Telstra (forgetting whether its profitable for the business) could be enough to result in substantial price rises. Of course as a disciplined value investor focused on only the highest quality business, I cannot let that speculation tempt me.

Posted by Roger Montgomery, 24 August 2010.

Vish

:

Hi Roger & fellow investors !

It know it was in September last year when the last comment on this topic was made – I have a question related to a stock discussed here and don’t know where else to post my question – so here it goes !

Whilst most of the discussions on the blog seems to be around buying – I thought I would throw in something different and talk about selling !

I know there is a chapter in your book on selling – I do own a copy but I lent it to a (doctor) mate of mine to read and it doesn’t look like I am going to get it back soon !

I would like to talk about one of your A1/A2 (?) stocks – MND. It is

currently at it’s all time high without showing any signs to stop. Has it run too fast and in too short a span of time ? My calculations say it is priced much much higher then even its 2013 Intrinsic Value ! I think it is still an excellent business but the rise in share price is not proportional to the rise of profits. Should an investor be thinking of taking part profits in cases like these ?

many thanks

Roger Montgomery

:

You must politely ask for your copy to be returned Vish, if only to re-read Chapter 13.

Vish

:

Hi Roger,

Thanks for your reply !

I certainly did but still without any luck. At first he tried , without any success though, to do a trade between ValueAble and The White Tiger. I know I would love to read something written by an fellow Indian chap but I guess ‘Valuabe’ is till too valuable for me :-)

I will keep you posted with my progress while MND (and the market) still keeps swinging up and down all this time !

Regards.

Kathy

:

Hi Roger,

Just wondering if you have analysed Data#3 (DTL)? The company is debt free and generates a high ROE. I have applied your valuation tables and found that the stock is trading at a discount to its valuation.

Looking forward to hearing your thoughts on this company and its valuation.

Kathy

Roger Montgomery

:

Hi Kathy,

Data#3 looks good but I have to do some more work on it. Can anyone else share any insights into Data#3?

Alison

:

Hello Roger. Your website is amazing. Thank you for posting such a wonderful blog.

Reading between the lines it seems to me that you are sorely tempted by Telstra for all your discipline…

a former blue chip. On the ropes. Possibility of a Government decision creating a rise in value. David Thodey being the one who might be able to turn it around.

And those big dividend cheques…. you could always sell it after 1 dividend and after the certainty issue drags the price up temporarily…

I can see you are tempted… Telstra is the tar baby of the ASX though. We know technology will knock it down, and we know it has a bloated culture of ex-public servants in its workforce that are so difficult to shift even after years and years of privatisation.

Roger Montgomery

:

Hi Alison,

I think you may be reading a bit too much between the lines. I don’t the market’s nascent enthusiasm(!) for it. That of course could change at any time. You write very well by the way and thank you for contributing.

David

:

Hi Roger,

is Sirtex Medical Limited (SRX) still an A1 based upon is reporting on 26/8/2010. I have done a quick IV check for the following 24 months and if they meet their EPS forecasts then they look to be trading a reasonable discount to their future IV. What are your thoughts? Thanks in advance, David

Roger Montgomery

:

Hi David,

I will take a look. I am in the studio with Ross Greenwood on 2GB so I can only give a quick answer. Its an A2 and not trading at a discount to this years intrinsic value.

Jim

:

Hi Roger

Just finished reading your book-absolutely fabulous. Thank you also for showing us how to get better use out of our bank broker platform web sites.

I’d be interested in your thoughts about FMG. They seemed to have turned a corner with ROE and debt reduction. Many,many thanks again

Cheers

Jim Hasn

Roger Montgomery

:

Hi Jim,

I do get lost of questions about FMG, so I will put it up as a future blog post proposition.

ron

:

hi Roger,

i have some more interesting companies for you to check out:

CBD energy (CBD) – big discount to IV, rob millner shareholder….

RER group (RGD) – discount to IV, unique services

Saunders intl. (SND) – consistent returns 20%+

any feedback on seymour whyte?

cheers.

Roger Montgomery

:

Hi Jon,

CBD, appears to be at a discount but gets a C4 rating. RER at its intrinsic value and an A2 but you might prefer another receivables management company. Saunders, looks ok too, trading at its intrinsic value but no growth in profits over the last four years. Do you have any forecasts or has the company given guidance that suggests profits to rise substantially? Let me know what you have so that I can incorporate it.

Mark G

:

Hi Roger,

Thank you for the book. It clarified a lot of queries that I had about the stock market in general and how to look at individual companies. I was one of many who lost money with ABC leaning and wish I read your book about 3 years ago. I feel like I was a blind person who just got proscription glasses and finally started seeing again.

I understand that you receive a lot of e-mails and posts and can not possible reply to all of them, but I would really appreciate if you could explain how you arrived to Telstra IV($2.30) as I am getting $3.48. I am also very interested as the writers above in your IV for WTF. I arrived to $3.54. And the last ( I know I am pushing my luck a bit ) what do you think about Infomedia( IFM) as my IV $0.53 and it’s currently trading at $0.24.

Roger Montgomery

:

Hi Mark,

Thank you for the inspiring feedback. WIth regards to telstra, you have to look forward rather than backwards. Use future ROE estimates rather than past ones. With regards to the others I will put them on the list for a post very soon.

Mark G

:

Thanks, Roger. Would you give a tip or two how to estimate the future ROE. Would you go with the average over so many years or there is a better way?

Roger Montgomery

:

Hi Mark,

I have never ben a fan of average. Keep in mind Charlie Munger’s answer to the question; “what makes you such a good investor?” His answer; “My guesses are better than yours.”

Ken Milhinch

:

Roger,

When I entered FRI into my spreadsheet I was left wondering how you rated them as A1, and then I noticed that the ComSec website shows them as having zero debt, but the company report shows $77.2M. Is there something about debt that is not obvious here ?

Roger Montgomery

:

Hi Ken,

My data says they have $77 million in debt. As I have mentioned here a few times, an A1 rating doesn’t mean there’s no debt. It means it has the lowest probability of going bust.

joe defina

:

hi roger

I bought forge shares 18mths ago , price range 16cents to 3.00. it is my largest holding

I love investing in engineering companies . I read an article once and it said infrastructure projects will always be needed bridges,roads,tunnels and mining , things get old, population increases and all of these have to be upgraded.

my holdings are mce, lyl, mnd, fge which are quiet well known

but i have another company which seems to be of every ones radar

its called logicams lcm.I think it could be a possible takeover.If possible could i have your thoughts. I think it is undervalued

Roger Montgomery

:

Hi Joe,

Regarding Logicamms; lowish returns on equity and a price that is not at a discount to intrinsic value. There may indeed be a takeover of it, but that would be speculating would it not?

Brad

:

RE WTF, I got val $4.03: ROE 60%, payout 80% and RR 10%.

Roger Montgomery

:

Thanks Brad. I will have a look.

Brad

:

RE MOC I got val of $2 based on ROE 25%, payout 80% and RR 10%. RR is low but my ROE is conservative. Qualitatively it looks OK.

My surprise of the reporting season vals is REX – IV of $2 va last trade $1.15. ROE is 20% and ROC has been >15%. I don’t think i could buy an airline but the numbers show not a bad business at this point in time.

Roger Montgomery

:

Hi Brad,

Yep. REX does come up as interesting. Airlines though…

Frank

:

I tried some Valueable 2010 valuations on CCV and FXL with fairly conservative ROE of 20% and got a value of 0.88 cents and 1.72 cents respectively. If I include the current cash in hand it would be equivalent of 0.13 cents for CCV and 0.28 cents for FXL. Therefore a margin of safety of more than 50% for CCV and about 40% for FXL.

I think I am being very conservative here. I am not sure if its because they are really undervalued or my calculation is flawed somewhere.

Roger Montgomery

:

Frank,

You should add the cash back in if you are excluding it from your calculation of equity when you conduct your first valuation calc.

Frank

:

Any comments on CCV or FXL?

CCV had a record year although this is on the back of some aggressive acquisitions. I know there are quite extensive discussions on CCV but the latest news change any of your thoughts?

Also, Flexigroup – FXL had a very good year. I like their business and their counter recession charactereistics. Any thoughts?

Roger Montgomery

:

Hi Frank,

I will spend some time on them in the near future and will revisit CCV.

william gill

:

Hi Roger & all

Great book Roger, it will always sit within easy reach of my hands, for reinforcing my thoughts.

A query on Potash, I am thinking it may not be the consistent revenue raiser. On looking at Potash on Wikipedia it seems to have a bumpy history due to mines flooding in Saskatchewan etc. Sometimes the mines have been closed for years at a time.Also not sure if like oil and minerals, the longer the mines have been in production the deeper they have to dig.

Roger Montgomery

:

Hi William,

Commodity businesses are often beholden to Acts of God and tend to be cyclical. No surprises there and thank you for pointing it out.

ron

:

hi roger, any thoughts on seymour whyte (SWL)? small construction contractor with high ROE, lots of cash, good track record and growth prospects? i got IV around $2….

Roger Montgomery

:

Hi Ron,

Thanks for the suggestion. I will have a good look at it. You appear to be right on your points and since it only listed in June, may be trading under everyone’s radar.

Craig

:

Hi Roger,

I was looking at the recently released preliminary final report. When the issued capital consists of fully paid and partly paid shares, how does this impact my attempt to come up with an IV?

Regards,

Craig.

Roger Montgomery

:

Hi Craig,

Conservatively, you make the assumption that the partly paids are fully paid (they generally will be) and we aren’t calculating a value based just on this year’s performance.

David

:

Hi All,

I have also been looking at SWL. Balance sheet looks good, but the only concern I have is as 100 percent of its current book is government contracts, what happens when the inevitable constriction in spending occurs as part of the election mop up. Keen to get others views on this.

Roger Montgomery

:

Thanks David,

The floor is open. Peter, if you are there would you care to contribute?

ron

:

regarding SWL, the great thing about roads, is that they constantly need to be upgraded. whether its election year or not. it seems like with these contractors they need to reach some critical mass in terms of their balance sheet to accommodate for project growth. it seems like these guys are at this point….maybe? also the discount to IV is very tempting….

Roger Montgomery

:

Thanks for the ‘heads up’ Ron.

ron

:

thanks Roger, so what valuations do you get on SWL?

Roger Montgomery

:

Hi Ron,

I have been looking at Seymour Whyte and first note the following comment from the annual report: “The Directors remain positive that the group will achieve a stable level of NPAT. In making this assessment, the directors believe the groups strong order book will be sufficient to balance the downward pressure caused by competitive market conditions over the next 6 to 12 months”. I note the 47% return on equity but the business cash flow was a lot lower. Also if the directors guesses are right ROE and the payout ratio stays the same, the ROE will drop to 37%. This would produce a valuation of just over $2.00, but not an A1. Seek personal professional advice before doing anything.

David Hardman

:

Hi Roger

Love your work and commentary. You’re the best commentator on Sky Business by a long shot!

I’ve been a long term holder in DWS so its nice to see it on your conviction list. I think the IT sector as a whole is really hotting up.

With this in mind I’d be interested in your comments on MAQ. They just released their results today and look very good.

Trading at $5.80

123m Market Cap

53M cash in bank

No debt

40c Divi – first time divi paid by MAQ

50c EPS

Expanding margins

More growth forecasted.

Tight share register

Ticks most of my boxes but would still be very interested in your opinion?

Roger Montgomery

:

Hi David,

I will put MAQ on my list for a post in the very near future. Thanks for the suggestion.

Adam

:

Hi Roger,

I note the ASX announcement today that the Matrix directors have sold today a large amount of shares. Do you have any comments on this?

Adam

Roger Montgomery

:

Hi Adam,

There is a very low correlation between directors selling and shares falling. But it is something to watch.

Brad

:

Hi Roger

What IV have you got for MOC?

Cheers

Brad

Roger Montgomery

:

Hi Brad,

Thanks for the request. I have only had a cursory look at the 2010 results published yesterday. The company appears to be trading about its intrinsic value based on yesterday’s result but there doesn’t appear to be any dramatic change in that intrinsic vale for the next couple of years. Do you have any info for us or know something? What do you guys think of it?

Ashley Little

:

Hello Roger,

A thought just poped into my head.

Perhaps it would be better to value TLS like an annuity not a bond.

This will remove the yield argument from the equation.

Roger Montgomery

:

Hi Ashley,

Thats not a bad idea. The result shouldn’t be very different though.

Mike C

:

Hi Roger,

I was wondering what your opinion was of Wotif Holdings – WTF, The stock was recently $8 – now it is nearly half that. It has posted record revenues and strong growth. Also, I note theres a few new changes in substantial holdings in August which is a positive.

Would love to know your thoughts.

Cheers

Roger Montgomery

:

Hi Mike,

I am sorry that I haven’t confessed to the fact that I am very interested in its recent decline. I will post thoughts about WTF in the near future.

Tony Carson

:

Hi Roger

Opps i meant help. We all know you dont give advice

Regards

Tony

Tony Carson

:

Hi Roger would it be possible to put your intrinsic values next to the company’s so we could work our way back or check our work

I got the examples out to within a few cents but am struggling to find the right information on the company’s balance sheets. Or You could just give us more homework. Many thanks for your valuable advice and excellent book

Regards

Tony

Roger Montgomery

:

Hi Tony,

Thanks for the kind words about my book. I really appreciate it. The next exercise will be about finding the data in the annual report. Its coming soon so stay tuned. I don’t give advice though. You will have to seek personal professional advice of your own.

Chris

:

Hi Roger,

Interested in your thoughts on WTF’s results. Another strong increase in revenue and after tax profit, little debt, high ROE but a struggling Asian division. Also the payout ratio seems quite high.

The new flight booking division seems to be performing very well, accounting for 5% of revenue, though I wonder how it will compete with companies like Flight Centre? Being able to offer accomodation vouchers as a reward for booking flights may be enough to see this division grow.

The enormous decline in the share price is enough to make me watch this space.

Roger Montgomery

:

I agree Chris,

It is worth taking a close look. Many people have told me they prefer to use Wotflight.com.au rather than webjet

Daksha

:

Hi Roger,

In your list of A2 companies above you mentioned 20 companies, I can only see 10 companies?

Can you please add ARB Corporation stock code ARP and SRX in your next list.

Thanks heaps for sharing your ideas, I have your book, the way you have written it, it is so easy to follow and understand the concepts, examples of Australian companies quiet eye opener on how some companies management ends up paying huge amount of money to purchase another company. On that note What do you think of BHP’s offer of $130 per share for Potash Corp? How much trust can we put into BHP’s management?

Kind Regards,

Daksha

Roger Montgomery

:

Hi Daksha,

I get a valuation of $117 for Potash but if the experts are right about future food demand, food prices will rise and the response will be a need for higher production yields and that will require more fertiliser and or higher prices. In that event, the historic returns on equity may not be a good indication of future returns. There are however others better than me at forecasting commodity prices.

Lloyd

:

Roger,

Can you comment on the preponderance of small, even microcap, stocks in you’re list of A1’s and what this means for the likelihood of the the realization of IV in such cases?

It seems to me that the perceived greater risk attached to small caps by most market participants, means that they will in all likelihood trade at a heavy discount to value for an extended period. The perception of greater risk is often misplaced (particularly so in the case of A1’s), but the perception is a fact of life. As a result, the “weighing machine” dynamic of the market may not cut in for many years, perhaps not until such time as the small cap A1 reaches sufficient size to be included in an index and attract the interest of investment funds.

This in no way undermines your buy A1’s at a discount for the long run approach; in fact it strengthens it. But I am not certain how many of your blog followers appreciate the implication. It also explains the reason that Buffett can buy good small businesses at a discount to IV and the recent Clough play on FGE for a cornerstone position at low cost relative to IV and Advent acquisition value of ITX at a massive discount to IV.

How does this sit with your view of things?

Regards

Lloyd

Roger Montgomery

:

Hi Lloyd,

If you were right then JB Hi Fi would not be in the top 100 now, nor Fleetwood into the top 200 nor The Reject Shop. There is much to be gained buying before entry into into an index and my observation is that they a lot less time to be recognised. This is because there is a dearth of truly extraordinary businesses. When one is found, nobody waits to own it. Three thousand funds chasing such a small universe of stocks will ensure they are recognised.

Lloyd

:

Roger,

I think you misunderstood my message to your readers.

So it is with due respect I ask, how long did it take for JBH to rise to, or exceed its IV and for how long it has traded at or in excess of IV?

The answer is that JBH traded on its first day as a publicly listed company at a 30% premium to IV. The euphoria of public listing over, it sank to a discount to IV for years until briefly in 2007 it traded at 30% premium to IV before falling to trade at a discount to IV ever since (based on FY end closing prices).

So the fact is that these stocks can trade at very appreciable discounts to IV for many years.

That said your approach to buy stocks with a growth trajectory based on rising IV is very sound and demonstrated by the JBH example. Buying them at a deep discount to IV is even better and by deep I mean 50%-60% for the small cap space.

My message to your readers is simply not to believe that any such stock will necessarily move to to or trade in excess of IV in a time frame that is measured in anything less than years. It may do so, but usually it will require the catalysts of market recognition. The latter may well arise from exposure via the Roger Montgomery brand which places such companies in the limelight, albeit perhaps for a brief period. But the thesis has yet to be proven and in the interim small cap quality companies can be expected to trade at discounts to IV for extended periods.

The investment value proposition comes from the rising IV, not the fact that the market necessarily rises to, or exceeds the IV of the company in question. If it does the latter then all the better, but don’t count on it to occur for many years.

Regards

Lloyd.

Roger Montgomery

:

Hi LLoyd,

I concur.

Craig

:

Hi Roger,

Thanks for the list. It’s gratifying for me to see SMX on your list of A1. I haven’t yet acquired a stake in SMX but reading through its annual reports for the last few years indicate to me that it’s one of the best performing listed IT companies.

I’m hoping to acquire shares in SMX at a substantial discount to what I believe to be its intrinsic value.

Roger Montgomery

:

Thanks Craig,

Just make sure that you seek and take personal professional advice.

Matthew

:

Hi Craig,

I find your thoughts interesting, I have also looked at SMX but I moved on because the main competitive advantage that I could identify was their human capital – something that I don’t believe will last forever. The way I see it their competitive advantage (their smart people and their corporate knowledge) will either move on, go in to competition, retire or ask for higher remuneration!

I’m sure you know a lot more about this company than I do. But from what I will admit is a very superficial assessment, I don’t see how they will still be the dominant player in their space in 5, 10 and 20 years time because of these very strong erosive factors.

As someone who has followed the company over a few years I am interested to hear your thoughts on this.

Thanks!

David

:

Hi Roger,

I know there are a couple of requests on the list before mine, but I’d like your opinion on Lycopodium (LYL), Dominion Mining (DOM), ProMedicus (PME) and Carnarvon Petroleum (CVN). All strong ROE% performers, but competitive advantage is difficukt to identify. Would these sit in your A2 to A5 categories? Thanks again for sharing your valuation model.

Kind regards,

David

Roger Montgomery

:

Ok David,

Thanks for the list. Give me some time. Reporting season is flat out as you can imagine.

David

:

Hi Roger,

I found Lloyd’s summary of CVN in a previous posting. Thanks Lloyd. Certainly some food for thought and I appreciate you sharing your knowledge on the industry. DOM posted results and paid out a dividend much greater than EPS. ROE was only 3percent, but they have been doing some significant upgrades to the mine. What approach do you use for assessing whether CAPEX will result in future ROE improvements? Thanks again for sharing your knowledge with us. MCE has gone north quickly of late. Not sure if the phrase has been used yet, but is this down to the ‘Montgomery’ effect? Great work!

Roger Montgomery

:

Hi David,

Yes we concur. Lloyds contributions are very useful. Thank you again Lloyd. Re the “Montgomery” effect – I am doing my absolute best to warn everyone to do their own research AND to seek and take personal professional advice. I am delighted to see the share price performing well but we are looking at a very short term window in which prices move are largely random. The gains could all be reversed tomorrow and it wouldn’t change my view of the company or its value…but it would change everyone’s view about me! Short term trading IS NOT what this blog is about. If you are looking for short-term stock trading tips you have come to the wrong place.

michael predojevic

:

Hello Roger and others, ive just completed my finance diploma and work as an accountant, i look forward to joining in the discussions.

i have looked at Dominos, i have a 2011 IV of $3.72 and 2012 IV of $4.63, which is still below current prices,

also i have looked at Mcphersons, i get higher IV than the current share price, but they have high intangibles and low cash balances and analysis of their improved margins has come from the improved $AUS

As a risk adverse investor, there is the possibility of a double dip or slowing economy which may result in everyone piling into the $US which would have consequences for MCP, so i therefore would be more inclined to ignore this as an investment and be patient for Mr Market to give me lower prices for Dominos, as they would benefit from this due to their international earnings.

If you could add some thoughts Roger it would be appreciated and i look forward to getting involved more in discussions

cheers Michael Predojevic

Roger Montgomery

:

Hi Michael,

I have friends who are currency strategists and economists but I am not one so I am reluctant to forecast the Aussie dollar. For what its worth, I think there’s a causal relationship between Chinese Gov’t forcing banks to reduce lending, LVR’s and bring off balance liabilities back on – slowing fixed asset spending – lower demand for resources – declining iron ore prices – declining aussie dollar and at least resource stocks.

Hardin

:

Hi Roger

I think some people may need to read your book a little more carefully and stop reacting to price, switch the stockmarket off and look at value. You can not accept any responsibilty if someone loads up on a stock just because you buy it without any consideration of personal tolerances of risk or portfolio construction.

Roger Montgomery

:

Thanks Hardin,

I appreciate your comments in support of being responsible for your own actions.

Frank

:

Hi,

I work in the oil and gas offshore industry involved in conceptual and FEED design. The trend is obviously to move to deeper and deeper waters for oil and gas with platforms and drill rigs. However, also emerging is the concept of floating gas facilities (FPSO) – e.g. Shell sunrise FLNG project.

There is a lot of talk and discussion now about FLNG and floating facilities in the engineering community, safety issues, technological issues etc. However, I believe sooner or later, that is where it will be heading. MCE should benefit from that.

Roger Montgomery

:

Thanks for sharing your insights Frank. Now that’s Value.able!

ron

:

i have an idea of what you should call your next book: “Most Value.able”

you can talk about how to rate stocks A1 etc. and maybe analyze some current A1’s as examples. i think the main problem in today’s library of investment books is that most of them are written by overseas investors and therefore not as relevant company wise to us here.

Roger Montgomery

:

Thanks Ron,

There seems to be a bit of a theme forming around what a second book should be about. I appreciate your time in making this suggestion.

Ashley Little

:

Yes Roger,

A1-C5 and how you do it.

a must for a new book

Roger Montgomery

:

Thanks Ashley,

I will think about that. I see my role as giving everyone a leg-up rather than a hand-out.

Roger D

:

Definitely support that idea.

Ben

:

Roger. Your book talks about how to value the stock based on its intrinsic value. Do you think another book that talks about how you rate a stock as say A1 against A3 etc. might be good to produce? I mean there are a number of variables that you use to determine this, is this published?

Roger Montgomery

:

Hi Ben,

I do discuss the quality scores here but thats about as far I will go for the time being. The idea of a book on the subject is a really good one. Thank you for the suggestion.

ken Milhinch

:

Gee Roger, I was a little bewildered last week when you rated AV Jennings so highly, but you have floored me with your A1 rating for Primary. Using my own tests of debt/equity and ability to service the debt, I give them a score of 7 out of 18. At that level I rate them as an unacceptable risk. My tests are nowhere near as comprehensive as yours are, I am sure, but investing in them would make me very nervous. (Of course they are also trading at $3.23 as I write this and I have an IV of $2.04.)

Roger Montgomery

:

Hi Ken,

primary gets an A2. The score tells me that the company isn’t going bust. It doesn’t mean I am going to buy it.

Ken

:

Sorry, that should have said A2. Even so, it leads me to believe that my assessments need more work in order to get somewhere near yours. Back to the spreadsheets for me !

Roger Montgomery

:

Keep at it Ken, Don’t give up.

Lloyd

:

Roger,

That’s a big avalanche on the photo accompanying the Part II header. I infer that this selection and placement is by design and reflects the fact that more stocks than not might slip down the MQR slope in the avalanche of reporting?

One thing that stands out for me is how many former growth darlings of the market are now struggling to maintain their earnings in a deleveraging global economy. It highlights that many an A1 (with zero debt) was dependent on the flow through consequences of cheap and easy credit into its market place to underpin the growth story. Additionally, it seems that many of the large cap growth stories of the last decade have run into the inevitable consequence of the law of large numbers, which makes a double digit growth rate impossible to sustain.

Just as HVN went ex-growth last decade on market saturation, so the same appears to be in the wind for WOW, QBE and CSL and I detect a bit of a breeze on the bow for JBH.

I’d be interested to read your views on what to look for by way of factors (in addition to declining IV) that signal that a high growth story for a business is coming to an end.

Regards

Lloyd

Roger Montgomery

:

Hi Lloyd,

It is indeed one of the biggest avalanches I have seen photographed. You shouldn’t infer anything else though. You are right about saturation. I have also discussed that subject here previously in reply to several comments. I will write something up on signs of a maturing business soon. There’s a bit to cover. It is a great topic for a post so thanks for the suggestion.

Peter

:

Hi Roger,

Where do Specialty Fashion Group (SFH) and Thorn Group (TGA) fit on your rating scale? They both have good ROE (SFH very good), minimal debt and iare n reasonable shape in terms of profit growth.

Also, how much of a track record does a company need to get A1 / A2? A quick look at Noni B indicates earnings and equity have risen and fallen a bit over recent years, so I’m interested in your thoughts on this question.

Roger Montgomery

:

Hi Peter,

I will put SFH and TGA on the list to review soon.

kyle

:

Thanks Roger,

If this is the amount of work that you put in when you are ‘retired’, I would have like to have seen you when you were at ‘work’.

I look forward to your IV for the A1 companies, it will be a good test of whether my valuations get close to yours after reading your book.

Kyle

Roger Montgomery

:

OK Kyle. Stay tuned.

Tony

:

Hi Roger,

I guess your A1 rating for MND answers some of the questions I have been having about it’s declining ROE. On a more technical note, I use a third party service as a resevoir of company information, especially around reporting season. But recently I noticed that the ROE figure reported in that service, differed to the one reported by MND in their results presentation. I queried this with the company that offers the service and their reply was that they calculate ROE using Profit before tax and significant items, ie an operating profit ROE. They stated it has been their experience that tax, eg carried forward losses, can skew an after tax ROE figure. Do you have any insights on which metric is preferred, before tax or after tax ROE?

Thanks for the help and the good work posting your reporting season A1’s. (BTW, I bought SMX during the GCF, so very happy)

Roger Montgomery

:

In 1994 at the Berkshire Hathaway AGM, Buffett said “…we’d certainly like to think we were discounting the AFTER TAX stream of cash by at least 10 per cent.” I hope that answers your question.

Tony

:

Thanks Roger,

Much Appreciated

Grant

:

Regarding the above post^

After watching MCE for around a week now I have been having the same thoughts Roger.

I have a target buy price in mind and I am not going to buy at any price above it due to the extreme volatility it has been experiencing (mainly positive so far however).

The company reads well and I would like to own this stock, however I think I would rather wait until the dust has settled, so to speak.

Roger Montgomery

:

Hi Grant,

It doesn’t matter how much I warn people about blindly following, a few will still do it. Of course the share price could halve – which I would be delighted about as I have only allocated a comfortable portion of my portfolio to the investment – and if someone has invested too high a proportion they will be hurt and unable to invest further funds. That is why I INSIST you seek and take personal professional advice before conducting any transaction.

Peter

:

As far as I can tell, ROE for last three years are roughly 7%, 15%, and then a whopper at 45%. I disregarded the float proceeds to equity in my calculations, and included all of retained earnings. If I “average out” retained earnings, then I have a figure that exceeds 60% for ROE.

Coming off the back of 7% and 15%, I find it difficult to accept an ROE of 60%, let alone 45%. I have not been able to get any other financials apart from the last 3 years, so if anyone has a financial history going back to 1999 when the current products started to be sold, then it would be a great edge.

If investors were to just plug in the relevant figures, with a 10% required rate of return, then the numbers are certainly worth salivating over, which I suspect, accounts for the lack of substantive postings on MCE since your first alert. Let’s not let the secret out of the bag for fear of rising prices….

But you do have to ask, is 45% ROE sustainable? Are we looking at cyclical peak earnings? Is there something obvious we have missed?

My problem is of course, that the business is not within my circle of competence, at least not yet at the current time. I probably could not tell the difference between one subsea buoyancy module from another. I have no idea of the primary drivers for this sort of business, at this time.

Roger Montgomery

:

Hi Peter,

Thanks for sharing your thoughts about MCE. There are macro economic risks but as a true-to-label value investor, you can’t resist that rather substantial discount to intrinsic value.

Pat

:

I noticed that you did not mark any of the six A1’s from week two as being owned by you. Is this correct ?

Roger Montgomery

:

Thank you Pat for drawing it to my attention,

That could be an oversite. Will check and edit if necessary in the next day or so. I am concerned that people are rushing out and buying shares (despite my warnings) simply because I have.

Pat

:

I won’t be buying any of the stocks unless their price drops because of the six A1’s listed in week two, I only have Forge and Finbar at a good discount to 2011 IV calculations. I already own some Forge and Finbar is normally thinly traded and may be difficult to get out of if bad news arrives, so I will stay out of it. I agree that people should not buy something just because you have purchased them, we will not know your purchase price, what percentage of your portfolio is invested in them, whether you intend buying more, whether you have a stop/loss on them, etc, etc.

Roger Montgomery

:

Thats great Pat. Thank you for reassuring me that many investors understand the importance of having their own strategy and seeking advice if necessary.