Search Results for: coh

-

Sounding out the risks

Ben MacNevin

August 7, 2014

Cochlear Ltd (ASX: COH) released its 2014 full-year financial results on Tuesday. The market reacted favourably to the result, largely due to the considerable increase in revenues from the first half of 2014 to the second half of 2014. However, we remain cautious about the company’s prospects for two reasons. Continue…

by Ben MacNevin Posted in Companies, Insightful Insights, Value.able.

- save this article

- POSTED IN Companies, Insightful Insights, Value.able.

-

Navitas and the rock star lecturer

Ben MacNevin

July 10, 2014

(Additional commentary by Roger Montgomery.)

Navitas (NVT: ASX) has announced that its largest University Pathways partner – Macquarie University – will not extend its partnership after 12 February 2016. Continue…by Ben MacNevin Posted in Insightful Insights.

- 1 Comments

- save this article

- 1

- POSTED IN Insightful Insights.

-

Reporting Season’s Winners and Losers

Roger Montgomery

February 25, 2014

As the current reporting season draws to a close, we’ve come up with our list of the market’s best (and, by default, less-than-best) performers.by Roger Montgomery Posted in Companies.

- 16 Comments

- save this article

- 16

- POSTED IN Companies.

-

2013… what a year!

Roger Montgomery

December 26, 2013

As we draw the curtains on 2013, we thought it would be interesting to look back at the three most popular stories from the year. They are… Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

Checking in on Cochlear

Tim Kelley

November 22, 2013

Cochlear Limited (COH) is one of the businesses we have followed with interest over the years. More recently, we have been concerned that competitors like Med-El and Sonova might be closing the technological gap on COH, and threatening its dominant market position. Continue…

by Tim Kelley Posted in Companies.

- 2 Comments

- save this article

- 2

- POSTED IN Companies.

-

Thinking about Virtus

Russell Muldoon

June 19, 2013

A key investing theme at Montgomery Investment Management has for some time been the positive financial impact on healthcare companies from an ageing western demographic. Given that the sector is stable and growing, it’s a must have, at the right price, in our investment portfolios. Of the invested assets in The Montgomery [Private] Fund, healthcare currently occupies approximately 26%. Continue…

by Russell Muldoon Posted in Health Care, Insightful Insights.

- 1 Comments

- save this article

- 1

- POSTED IN Health Care, Insightful Insights.

-

Analysing developments at Cochlear

Tim Kelley

June 5, 2013

Disappointing news from Cochlear (COH) this week. Following weak 2nd half sales, the company announced that it expected FY13 NPAT to fall between $130 and $135m – a large step down from what broking analysts had expected. Continue…

by Tim Kelley Posted in Companies.

- save this article

- POSTED IN Companies.

-

What’s happening in the markets?

David Buckland

May 22, 2013

In these highlights from Your Money Your Call, David Buckland talks about whether confidence is likely to climb in the new financial year, as well as giving his views on Fleetwood (FWD), IMF (IMF), Silver Lake (SLR), Navitas (NVT), Carsales.com (CRZ), Newcrest Mining (NCM), and Cochlear (COH). Watch here.

by David Buckland Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

Threats to Cochlear’s market position?

Tim Kelley

April 22, 2013

Many readers will have noticed the dramatic fall in the price of Cochlear (COH) shares from above $80 per share at the start of February to below $60 recently. COH is an Australian-based world beater in cochlear implants (note that “cochlear” is both the name of the company (COH) and the part of the inner ear into which cochlear implants are implanted, whether they are supplied by COH or a competitor). At Montgomery, we are big fans of COH, and in the past it has been a significant holding of the Montgomery [Private] Fund. With the recent decline in share price we have again been taking interest in the business.

Continue…by Tim Kelley Posted in Insightful Insights, Technology & Telecommunications.

-

Is now the right time to buy gold?

Roger Montgomery

April 17, 2013

In these highlights from Your Money Your Call, David shares his insights on Gold, including Robust Resources (ROL), and discusses the prospects for Telstra (TLS), Cochlear (COH), The Reject Shop (TRS), Cedar Woods (CWP) and Codan (CDA). Watch here.

by Roger Montgomery Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

The view from the top of Australia…

Roger Montgomery

April 16, 2013

It was interesting to read in yesterday’s Australian Financial Review that auction clearance rates surged past 70% at the weekend. There’s almost an air of desperation at some auctions. The fear of missing out is a much greater influence on investor behaviour than the fear of loss.

Continue…by Roger Montgomery Posted in Insightful Insights, Property.

- 1 Comments

- save this article

- 1

- POSTED IN Insightful Insights, Property.

-

What is the ‘new normal’ for housing?

Russell Muldoon

December 10, 2012

A few months ago we commented here on an article in the AFR speculating that Gen Y may soon be buying a house cheap from boomers who have no-one else to sell to and why renting makes more sense than buying. Since Roger bought the bigger family home in 2006,he has argued that house prices would cease rising to new highs – especially the six and seven bedroom variety.

Whilst the mere mention of Australian housing and prices can stir up passionate and spirited argument for and against house price rises, just this morning I stumbled across the below series of charts produced by Citigroup’s Matt King.

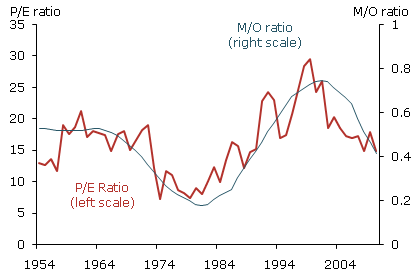

Similar to the M/O ratio which plots P/E ratios against the ratio of the middle-age cohort, age 40–49, to the old-age cohort, age 60–69 from 1954 to 2010, Matt looks at the relationship between the inverse dependency ratio (the proportion of population of working age relative to old and young) and maps that against real house prices over time. This produces a longer-term measure of prices home owners are willing to (or have to) pay for housing.

The charts are a powerful representation of a force driving all economies and prices: demographics. Whilst prices have somewhat lagged the dependency ratio on the way up, give or take a number of years and almost every country here shows that the peak in real estate prices is highly correlated with the peak in dependency ratio.

Its worth contemplating whether the recent past, characterised by rising gearing levels and falling price to income ratios (affordability) is the new normal, or whether, as we transition into an environment where there are more pensioners than workers and therefore fewer people to ‘downsize’ too,what may transpire in the future in Australia is anything like the experience in the US, Japan, Ireland, Spain and the UK.

As always, delighted to hear your thoughts.

by Russell Muldoon Posted in Insightful Insights.

- 6 Comments

- save this article

- 6

- POSTED IN Insightful Insights.

-

What are Tim Kelley’s insights into Cabcharge’s prospects?

Roger Montgomery

September 25, 2012

Do Sedgman (SMD), Decmil Group (DCG), cochlear (COH), Seek (SEK), IAG (IAG), Resolute Mining (RSG), Magellan Financial Group (MFG), Syrah Resources (SYR), ASG (ASZ), Goodman Group (GMG), Silex Systems (SLX), AMP (AMP) or Service Stream (SSM) achieve Roger’s and Tim’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 25 September 2012 program now to find out, and also learn Tim’s insights to the outlook for Cabcharge (CAB). Watch here.

by Roger Montgomery Posted in Companies, TV Appearances.

- save this article

- POSTED IN Companies, TV Appearances.

-

Gen Y will be buying cheaper houses soon

Roger Montgomery

September 4, 2012

Ben Hurley – the AFR journo typical of Gen Y – will soon be buying a house cheap from boomers who have no-one else to sell to.

Last week Ben (here) wrote:

“I would love to own a home. I could upgrade my crappy electric stove, get a hot water system that actually fills the bathtub, and stop asking the landlord for permission to put a nail in the wall.

But I’m reluctant because I think buying a home is a dud deal. And renting, while expensive, is less of a dud deal because renters typically give the landlord a return of about 3 per cent on the asset’s value. A lot of my friends in their early 30s feel the same way.”Ben goes on to explain why renting makes more sense than buying and I reckon he’s right, but for an entirely different reason.

by Roger Montgomery Posted in Market commentary, Property.

- 11 Comments

- save this article

- 11

- POSTED IN Market commentary, Property.

-

You wouldn’t believe it…

Roger Montgomery

August 9, 2012

Many believe that understanding economics is the key to being able to predict the stock market. Curiously the Chinese economy is growing the fastest of all economies and is variously described as the global growth engine. And the Chinese ripples positively impact many peripheral economies too, as my recent visits to Singapore have shown me.

Many believe that understanding economics is the key to being able to predict the stock market. Curiously the Chinese economy is growing the fastest of all economies and is variously described as the global growth engine. And the Chinese ripples positively impact many peripheral economies too, as my recent visits to Singapore have shown me.Meanwhile the US economy is in the doldrums, threatening to fall into another recession with anemic growth, stubbornly high unemployment and continued weakness in housing.

And yet the Chinese market as measured by the Shanghai Stock Exchange A Share index remains 65% below its high of 6391.98 in October 2007. Perhaps ironically the S&P500 made its high of $1565.42 on October 10, 2007 and today it sits just 11% below that. If the Total Return index is taken into account, its sits level or just above its 2007 highs.

So all that chatter about recessions, depressions, unemployment and the like counts for very little. How many children are suffering needlessly because the money spent on economists isn’t directed to the kids?

What we do know is that investors should be looking at individual companies. Or talking to people on the ground. In China, balance sheets are deteriorating as receivables blow out while in the US, of the 411 companies listed on the S&P 500 that have reported earnings so far this quarter, 297 have exceeded analysts’ estimates, while less than 110 have missed their forecasts. And as many of our travelling clients have informed us, things seem to be swimming along in the US.

Keep an eye on individual companies and you’ll go far. So don’t worry about whether you should say Go Australia or not. We say Go ARB, Go WOW, Go CCP, Go COH and Go CSL!

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation.

-

My…Err?

Roger Montgomery

May 27, 2012

Investors don’t have to have astronomic IQ’s and be able to dissect the entrails of a million microcap startups to do well. You only need to be able to avoid the disasters.

In an oft-quoted statistic, after you lose 50% of your funds, you have to make 100% return on the remaining capital just to get back to break even. This is the simple reasoning behind Buffett’s two rules of investing. Rule number 1 don’t lose money (a reference to permanent capital impairment) and Rule Number 2) Don’t forget rule number 1! Its also the premise behind the reason why built Skaffold.

Avoiding those companies that will permanently impair your wealth either by a) sticking to high quality, b) avoiding low quality or c) getting out when the facts change, can help ensure your portfolio is protected. Forget the mantra of “high yielding businesses that pay fully franked yields” – there’s no such thing. That’s a marketing gimmic used by some managers and advisers to attract that bulging cohort of the population – the baby boomers – who are retiring en masse and seeking income.

Think about it; How many businesses owners would speak about their business in those terms? “Hi my name is Dave. I own an online condiments aggregator – ‘its a high yielding business that pays a fully franked yield’. You will NEVER hear that from a business owner. That only comes from the stock market and from those who have never owned or run a business.

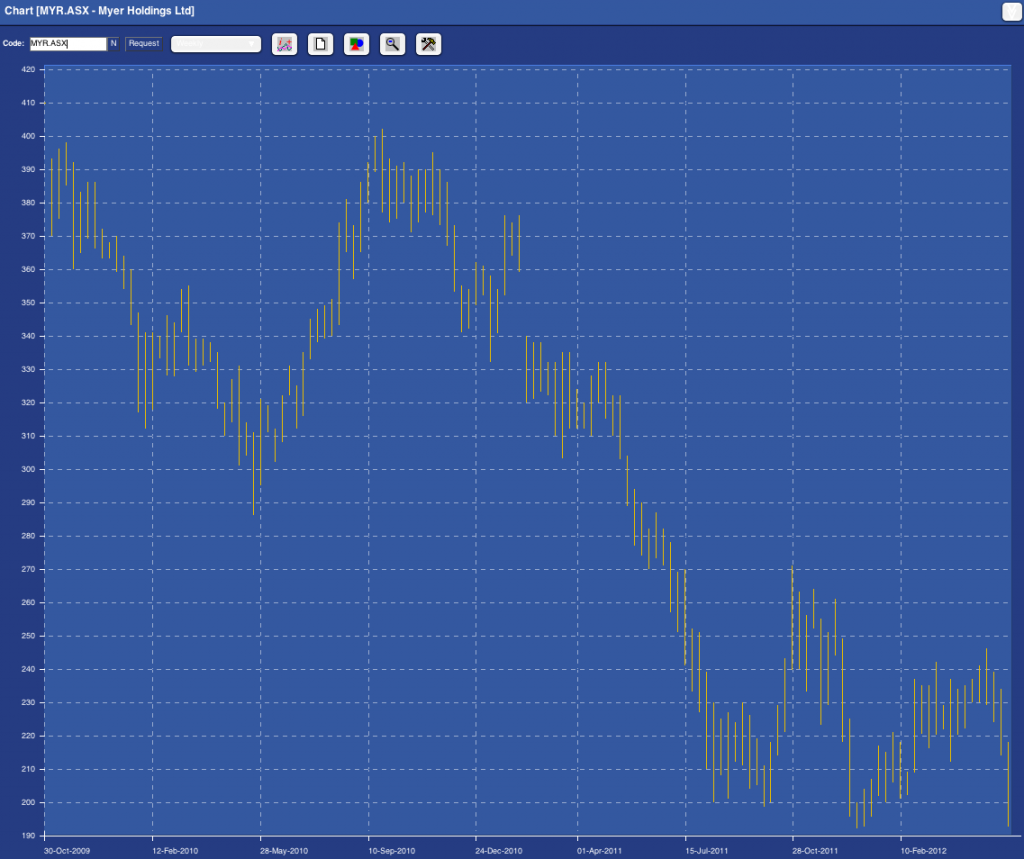

They key is not to think about stocks or talk stock jargon. Just focus on the business. Thats what we did when Myer floated in 2009. And with the market value of Myer now 50% lower than the heady days of its float, it might be instructive to revisit the column I wrote back on 30 September 2009, when I reviewed the Myer Float.

And sure, you can say that the slump in retail is the reason for the slump in the share price of Myer (I am certainy one who believes that the dearth of really high quality companies means multi billion dollar fund managers are bereft of choice meaning that a recovery in the market will make all stocks rise – not because they are worth more but because fund managers have nothing else to buy). But the whole point of value investing is to make the purchase price so cheap that even if the worst case scenario transpires, you are left with an attractive return.

It would be equally instructive to review the reason why we didn’t buy the things that subsequently went well (QRN comes to mind) so we’ll leave that for a later date.

Here’s the column from September 2009:

“PORTFOLIO POINT: The enthusiasm surrounding the Myer float is good reason for a value investor to stay clear. So is the expected price.

With more than 140,000 investors registering for the IPO prospectus, everyone wants to know whether the float of the Myer department store group will be attractive. This week I want to focus exclusively on this historic offer.

At present it is suggested the stock will begin trading somewhere between $3.90 and $4.90.

The prospect of a stag profit draws a self-fulfilling crowd. But if chasing stag profits is your game, I would rather be your broker than your business partner, for history is littered with the remains of the enthusiasm surrounding popular large floats.

Popularity, you see, is not the investment bedfellow of a bargain and being interested in stocks when everyone else is does not lead to great returns. You cannot expect to buy what is popular, travel in the same direction as lemmings and generate extraordinary results. Conversely thumb-sucking produces equally unattractive returns.

Faced with these truisms, I lever my Myer One card, obtain a prospectus and open it for you.

The Myer float is one of the hottest of the year and I am not referring to the cover adorned by Jennifer Hawkins! If those 146,000 people who have apparently registered for a Myer prospectus were to invest just $20,000 at the requested price, the vendors will have their $2.8 billion plus the $100 million in float fees in the bag.

A word about the analysis: It is the same analysis I have used to buy The Reject Shop at $2.40 (today’s close $13.35), JB Hi-Fi at $8 ($19.86), Fleetwood at $3.50 ($8.75), to sell my Platinum Asset Management shares at more than $8 on the morning they listed (at $5), and to warn investors to get out of ABC Learning at $8 (they were 54¢ when ABC delisted in August 2008) and Eureka Report subscribers to get out of Wesfarmers as it acquired Coles.

I don’t list these to boast but merely to demonstrate the efficacy of the analysis; analysis that is equally applicable to existing issues and new ones.

By way of background, TPG/Newbridge and the Myer Family acquired Myer for $1.4 billion three years ago. They copped flack for paying too much, but “only” used $400 million of their own capital; the remainder was debt. Before the first anniversary, the Bourke Street, Melbourne, store was sold for $600 million and a clearance sale reduced inventory and netted $160 million. The excess cash allowed the new owners to reduce debt, pay a dividend of almost $200 million and a capital return of $360 million. Within a year the owners had recouped their capital and obtained a free ride on a business with $3 billion of revenue. Good work and smart.

But I am not being invited to pay $1.4 billion, which was 8.5 times EBIT. I am being asked to pay up to $2.9 billion, or more than 11 times forecast EBIT. And given the free “carry”, the bulk of the money raised will go to the vendors while I replace them as owners. Ownership is a very good incentive to drive the performance of individuals.

And driven they have been. In three years, $400 million has been spent on supply chain and IT improvements, eight distribution centres have been reduced to four and supply-chain costs have fallen 45%. Amid relatively stable gross profit margins, EBIT margins improvement to 7.2% and a forecast 7.8% reflect disciplined cost identification and management. Fifteen more stores are planned for the next five years and the prospectus notes that trading performance improved significantly in the second half of 2009 and into the first half of 2010. The key individuals have indeed performed impressively, but with less skin in the game they may not be incentivised as owners in future years as they have been in the past.

And what value have all these improvements created? The vendors would like to believe about $1.4 billion, and if the market is willing to pay them that price, they will have been vindicated, but price is not value and I am interested simply in buying things for less than what they are worth.

In estimating an intrinsic value for Myer, I will leave aside the fact that the balance sheet contains $350 million of purchased goodwill and $128 million of capitalised software costs. This latter item is allowed by accounting standards but results in accounts that don’t reflect economic reality. Historical pre-tax profits have thus been inflated.

I will also leave aside the fact that the 2009 numbers and 2010 forecasts have also been impacted by a number of adjustments, including the addition of sales made by concession operators “to provide a more appropriate reference when assessing profitability measures relative to sales”; the removal of the incentive payments to retain key staff – not regarded as ongoing costs to the business; costs associated with the gifting of shares to employees; and, most interestingly, the reversal of a write-off of $21 million in capitalised interest costs – all regarded as non-recurring.

Taking a net profit after tax figure for 2010 of $160 million and assuming a 75% fully franked payout, we arrive at an owners’ return on equity of about 28% on the stated equity of $738 million, equity that could have been higher after the float if $94 million in cash wasn’t also being taken out of retained profits. Using a 13% required return, I get a valuation of $2.90.

Looking at it another, albeit simplistic way, I am buying $738 million of equity that is generating 28%. If I pay the requested $2.9 billion for that equity or 3.9 times, I have to divide the return on equity by 3.9 times, which produces a simple return on “my” equity of 7.2%. For my money, it’s just not high enough for the risk of being in business.

Importantly, the return on equity – based on the simple assumptions that three stores, each generating $40 million in sales will be opened annually over the next five years and that borrowings will decline by $60 million in each of those years – should be maintained. But the end result is that the valuation only rises by 6% per year over the next five years and delivers a value in 2015 of $3.90: the price being asked today.

My piece of Myer seems a bit hot for My money.”

That was 2009. Has anything really changed? Has the following chart reveals. Myer is now trading at close to Skaffold’s current estimate of its intrinsic value. Before you get too excited (although the shortage of large listed high quality retailers means even this company’s shares may go up in a market or economy recovery) take a look at the pattern of intrinsic values in the past and the currently anticipated path of forecast intrinsic values; Past intrinsic values have been declining (generally undesirable unless forecasts for a recovery are correct) and forecast intrinsic values are flat.

Fig.1. Skaffold Myer Intrinsic Value Line

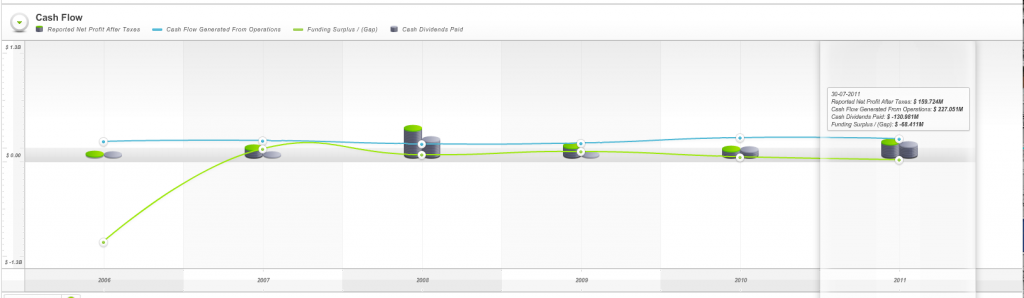

And as the Capital History chart reveals, 2014 profits are not expected to be better than 2010. That 4 years without profit growth. Question: Would you buy an unlisted business (as a going concern) that was not forecasting profit growth for four years?

Fig. 2. Skaffold Myer Capital History Chart

Finally the cash flow chart reveals the company has produced what Skaffold refers to as a Funding Gap. Its cash from operations have not been enough to cover the investments it has made in others or itself plus the dividends it has paid. In other words for 2010 and 2011, the two financial years it has registered as a listed company, it appears from Skaffold’s data that the company has had to dip into either 1) its own bank account, or 2) borrow more money or 3) raise capital (the three sources of funds available if a funding gap is produced) to cover this “gap”.

Fig. 3. Skaffold Myer Cash Flow Chart

I’d be interested to know if you are a loyal Myer shopper or not and why? If you don’t shop at Myer, why not? If you do shop at Myer, what do you like about the company, its stores and the experience? And I am particularly interested to hear from anyone who DOES NOT shop there but DOES own the stock!

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 May 2012.

by Roger Montgomery Posted in Companies, Consumer discretionary, Value.able.

- 14 Comments

- save this article

- 14

- POSTED IN Companies, Consumer discretionary, Value.able.

-

The G-8 or a win in Race 7 at Moonee Valley?

Roger Montgomery

May 20, 2012

Its hard to tell from the photo, but these are the world’s leaders – those at the centre of the current financial crisis anyway – at the weekend’s G-8 Summit at Camp David Maryland USA.

Its hard to tell from the photo, but these are the world’s leaders – those at the centre of the current financial crisis anyway – at the weekend’s G-8 Summit at Camp David Maryland USA.Sadly structural change, when foisted on a country, industry sector or company is often hard to discern from the usual cyclical changes. Hopes of a near term recovery persist but are nothing but hope.

The G-8 didn’t agree on next steps to calm the euro zone debt crisis (although money printing has to be on the agenda).

As Famed hedge fund founder Ray Dalio noted at the weekend in an interview with Barrons: “At the moment, there is a tipping toward slowing growth and a question of whether there will be a negative European shock, and that will favor low-risk assets. But to whatever extent we have negative conditions, central banks will respond by printing more money. There will be a big spurt of printing of money, and that will cause a rally and an improvement in the stock markets around the world. It’s like a shot of adrenaline: The heart starts pumping again and then it fades. Then there is another shot of adrenaline. Everybody is asking, “Are we going to have a bull market or a bear market?” I expect we will have both with no big trend. Typically, in these up and down cycles, the upswing will last about twice as long as a down swing. We are now in the higher range of the up-cycle.”

You can read more of Ray’s interview here:

Back to Camp David and the forthright language of point 31 seems sufficiently united to suggest its a topic that we may see in the headlines more because it has a tone of imminence to it…

Here’s the official statement for your ‘leggera’ reading pleasure.

Camp David Declaration

Camp David, Maryland, United States

May 18-19, 2012

Preamble

1. We, the Leaders of the Group of Eight, met at Camp David on May 18 and 19, 2012 to address major global economic and political challenges.

The Global Economy

2. Our imperative is to promote growth and jobs.

3. The global economic recovery shows signs of promise, but significant headwinds persist.

4. Against this background, we commit to take all necessary steps to strengthen and reinvigorate our economies and combat financial stresses, recognizing that the right measures are not the same for each of us.

5. We welcome the ongoing discussion in Europe on how to generate growth, while maintaining a firm commitment to implement fiscal consolidation to be assessed on a structural basis. We agree on the importance of a strong and cohesive Eurozone for global stability and recovery, and we affirm our interest in Greece remaining in the Eurozone while respecting its commitments. We all have an interest in the success of specific measures to strengthen the resilience of the Eurozone and growth in Europe. We support Euro Area Leaders’ resolve to address the strains in the Eurozone in a credible and timely manner and in a manner that fosters confidence, stability and growth.

6. We agree that all of our governments need to take actions to boost confidence and nurture recovery including reforms to raise productivity, growth and demand within a sustainable, credible and non-inflationary macroeconomic framework. We commit to fiscal responsibility and, in this context, we support sound and sustainable fiscal consolidation policies that take into account countries’ evolving economic conditions and underpin confidence and economic recovery.

7. To raise productivity and growth potential in our economies, we support structural reforms, and investments in education and in modern infrastructure, as appropriate. Investment initiatives can be financed using a range of mechanisms, including leveraging the private sector. Sound financial measures, to which we are committed, should build stronger systems over time while not choking off near-term credit growth. We commit to promote investment to underpin demand, including support for small businesses and public-private partnerships.

8. Robust international trade, investment and market integration are key drivers of strong sustainable and balanced growth. We underscore the importance of open markets and a fair, strong, rules-based trading system. We will honor our commitment to refrain from protectionist measures, protect investments and pursue bilateral, plurilateral, and multilateral efforts, consistent with and supportive of the WTO framework, to reduce barriers to trade and investment and maintain open markets. We call on the broader international community to do likewise. Recognizing that unnecessary differences and overly burdensome regulatory standards serve as significant barriers to trade, we support efforts towards regulatory coherence and better alignment of standards to further promote trade and growth.

9. Given the importance of intellectual property rights (IPR) to stimulating job and economic growth, we affirm the significance of high standards for IPR protection and enforcement, including through international legal instruments and mutual assistance agreements, as well as through government procurement processes, private-sector voluntary codes of best practices, and enhanced customs cooperation, while promoting the free flow of information. To protect public health and consumer safety, we also commit to exchange information on rogue internet pharmacy sites in accordance with national law and share best practices on combating counterfeit medical products.

Energy and Climate Change

10. As our economies grow, we recognize the importance of meeting our energy needs from a wide variety of sources ranging from traditional fuels to renewables to other clean technologies. As we each implement our own individual energy strategies, we embrace the pursuit of an appropriate mix from all of the above in an environmentally safe, sustainable, secure, and affordable manner. We also recognize the importance of pursuing and promoting sustainable energy and low carbon policies in order to tackle the global challenge of climate change. To facilitate the trade of energy around the world, we commit to take further steps to remove obstacles to the evolution of global energy infrastructure; to reduce barriers and refrain from discriminatory measures that impede market access; and to pursue universal access to cleaner, safer, and more affordable energy. We remain committed to the principles on global energy security adopted by the G-8 in St. Petersburg.

11. As we pursue energy security, we will do so with renewed focus on safety and sustainability. We are committed to establishing and sharing best practices on energy production, including exploration in frontier areas and the use of technologies such as deep water drilling and hydraulic fracturing, where allowed, to allow for the safe development of energy sources, taking into account environmental concerns over the life of a field. In light of the nuclear accident triggered by the tsunami in Japan, we continue to strongly support initiatives to carry out comprehensive risk and safety assessments of existing nuclear installations and to strengthen the implementation of relevant conventions to aim for high levels of nuclear safety.

12. We recognize that increasing energy efficiency and reliance on renewables and other clean energy technologies can contribute significantly to energy security and savings, while also addressing climate change and promoting sustainable economic growth and innovation. We welcome sustained, cost-effective policies to support reliable renewable energy sources and their market integration. We commit to advance appliance and equipment efficiency, including through comparable and transparent testing procedures, and to promote industrial and building efficiency through energy management systems.

13. We agree to continue our efforts to address climate change and recognize the need for increased mitigation ambition in the period to 2020, with a view to doing our part to limit effectively the increase in global temperature below 2ºC above pre-industrial levels, consistent with science. We strongly support the outcome of the 17th Conference of the Parties to the U.N. Framework Convention on Climate Change (UNFCCC) in Durban to implement the Cancun agreements and the launch of the Durban Platform, which we welcome as a significant breakthrough toward the adoption by 2015 of a protocol, another legal instrument or an agreed outcome with legal force applicable to all Parties, developed and developing countries alike. We agree to continue to work together in the UNFCCC and other fora, including through the Major Economies Forum, toward a positive outcome at Doha.

14. Recognizing the impact of short-lived climate pollutants on near-term climate change, agricultural productivity, and human health, we support, as a means of promoting increased ambition and complementary to other CO2 and GHG emission reduction efforts, comprehensive actions to reduce these pollutants, which, according to UNEP and others, account for over thirty percent of near-term global warming as well as 2 million premature deaths a year. Therefore, we agree to join the Climate and Clean Air Coalition to Reduce Short-lived Climate Pollutants.

15. In addition, we strongly support efforts to rationalize and phase-out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption, and to continue voluntary reporting on progress.

Food Security and Nutrition

16. For over a decade, the G-8 has engaged with African partners to address the challenges and opportunities afforded by Africa’s quest for inclusive and sustainable development. Our progress has been measurable, and together we have changed the lives of hundreds of millions of people. International assistance alone, however, cannot fulfill our shared objectives. As we move forward, and even as we recommit to working together to reduce poverty, we recognize that our task is also to foster the change that can end it, by investing in Africa’s growth, its expanding role in the global economy, and its success. As part of that effort, we commit to fulfill outstanding L’Aquila financial pledges, seek to maintain strong support to address current and future global food security challenges, including through bilateral and multilateral assistance, and agree to take new steps to accelerate progress towards food security and nutrition in Africa and globally, on a complementary basis.

17. Since the L’Aquila Summit, we have seen an increased level of commitment to global food security, realignment of assistance in support of country-led plans, and new investments and greater collaboration in agricultural research. We commend our African partners for the progress made since L’Aquila, consistent with the Maputo Declaration, to increase public investments in agriculture and to adopt the governance and policy reforms necessary to accelerate sustainable agricultural productivity growth, attain greater gains in nutrition, and unlock sustainable and inclusive country-led growth. The leadership of the African Union and the role of its Comprehensive Africa Agriculture Development Program (CAADP) have been essential.

18. Building on this progress, and working with our African and other international partners, today we commit to launch a New Alliance for Food Security and Nutrition to accelerate the flow of private capital to African agriculture, take to scale new technologies and other innovations that can increase sustainable agricultural productivity, and reduce the risk borne by vulnerable economies and communities. This New Alliance will lift 50 million people out of poverty over the next decade, and be guided by a collective commitment to invest in credible, comprehensive and country-owned plans, develop new tools to mobilize private capital, spur and scale innovation, and manage risk; and engage and leverage the capacity of private sector partners – from women and smallholder farmers, entrepreneurs to domestic and international companies.

19. The G-8 reaffirms its commitment to the world’s poorest and most vulnerable people, and recognizes the vital role of official development assistance in poverty alleviation and achieving the Millennium Development Goals. As such, we welcome and endorse the Camp David Accountability Report which records the important progress that the G-8 has made on food security consistent with commitments made at the L’Aquila Summit, and in meeting our commitments on global health, including the Muskoka initiative on maternal, newborn and child health. We remain strongly committed to reporting transparently and consistently on the implementation of these commitments. We look forward to a comprehensive report under the UK Presidency in 2013.

Afghanistan’s Economic Transition

20. We reaffirm our commitment to a sovereign, peaceful, and stable Afghanistan, with full ownership of its own security, governance and development and free of terrorism, extremist violence, and illicit drug production and trafficking. We will continue to support the transition process with close coordination of our security, political and economic strategies.

21. With an emphasis on mutual accountability and improved governance, building on the Kabul Process and Bonn Conference outcomes, our countries will take steps to mitigate the economic impact of the transition period and support the development of a sustainable Afghan economy by enhancing Afghan capacity to increase fiscal revenues and improve spending management, as well as mobilizing non-security assistance into the transformation decade.

22. We will support the growth of Afghan civil society and will mobilize private sector support by strengthening the enabling environment and expanding business opportunities in key sectors, as well as promote regional economic cooperation to enhance connectivity.

23. We will also continue to support the Government of the Islamic Republic of Afghanistan in its efforts to meet its obligation to protect and promote human rights and fundamental freedoms, including in the rights of women and girls and the freedom to practice religion.

24. We look forward to the upcoming Tokyo Conference in July, as it generates further long-term support for civilian assistance to Afghanistan from G-8 members and other donors into the transformation decade; agrees to a strategy for Afghanistan’s sustainable economic development, with mutual commitments and benchmarks between Afghanistan and the international community; and provides a mechanism for biennial reviews of progress being made against those benchmarks through the transformation decade.

The Transitions in the Middle East and North Africa

25. A year after the historic events across the Middle East and North Africa began to unfold, the aspirations of people of the region for freedom, human rights, democracy, job opportunities, empowerment and dignity are undiminished. We recognize important progress in a number of countries to respond to these aspirations and urge continued progress to implement promised reforms. Strong and inclusive economic growth, with a thriving private sector to provide jobs, is an essential foundation for democratic and participatory government based on the rule of law and respect for basic freedoms, including respect for the rights of women and girls and the right to practice religious faith in safety and security.

26. We renew our commitment to the Deauville Partnership with Arab Countries in Transition, launched at the G-8 Summit last May. We welcome the steps already taken, in partnership with others in the region, to support economic reform, open government, and trade, investment and integration.

27. We note in particular the steps being taken to expand the mandate of the European Bank for Reconstruction and Development to bring its expertise in transition economies and financing support for private sector growth to this region; the platform established by international financial institutions to enhance coordination and identify opportunities to work together to support the transition country reform efforts; progress in conjunction with regional partners toward establishing a new transition fund to support country-owned policy reforms complementary to existing mechanisms; increased financial commitments to reforming countries from international and regional financial institutions, the G-8 and regional partners; strategies to increase access to capital markets to help boost private investment; and commitments from our countries and others to support small and medium-sized enterprises, provide needed training and technical assistance and facilitate international exchanges and training programs for key constituencies in transition countries.

28. Responding to the call from partner countries, we endorse an asset recovery action plan to promote the return of stolen assets and welcome, and commit to support the action plans developed through the Partnership to promote open government, reduce corruption, strengthen accountability and improve the regulatory environment, particularly for the growth of small- and medium-sized enterprises. These governance reforms will foster the inclusive economic growth, rule of law and job creation needed for the success of democratic transition. We are working with Partnership countries to build deeper trade and investment ties, across the region and with members of the G-8, which are critical to support growth and job creation. In this context, we welcome Partnership countries’ statement on openness to international investment.

29. G-8 members are committed to an enduring and productive partnership that supports the historic transformation underway in the region. We commit to further work during the rest of 2012 to support private sector engagement, asset recovery, closer trade ties and provision of needed expertise as well as assistance, including through a transition fund. We call for a meeting in September of Foreign Ministers to review progress being made under the Partnership.

Political and Security Issues

30. We remain appalled by the loss of life, humanitarian crisis, and serious and widespread human rights abuses in Syria. The Syrian government and all parties must immediately and fully adhere to commitments to implement the six-point plan of UN and Arab League Joint Special Envoy (JSE) Kofi Annan, including immediately ceasing all violence so as to enable a Syrian-led, inclusive political transition leading to a democratic, plural political system. We support the efforts of JSE Annan and look forward to seeing his evaluation, during his forthcoming report to the UN Security Council, of the prospects for beginning this political transition process in the near-term. Use of force endangering the lives of civilians must cease. We call on the Syrian government to grant safe and unhindered access of humanitarian personnel to populations in need of assistance in accordance with international law. We welcome the deployment of the UN Supervision Mission in Syria, and urge all parties, in particular the Syrian government, to fully cooperate with the mission. We strongly condemn recent terrorist attacks in Syria. We remain deeply concerned about the threat to regional peace and security and humanitarian despair caused by the crisis and remain resolved to consider further UN measures as appropriate.

31. We remain united in our grave concern over Iran’s nuclear program. We call on Iran to comply with all of its obligations under relevant UNSC resolutions and requirements of the International Atomic Energy Agency’s (IAEA) Board of Governors. We also call on Iran to continuously comply with its obligations under the Nuclear Non-Proliferation Treaty, including its safeguards obligations. We also call on Iran to address without delay all outstanding issues related to its nuclear program, including questions concerning possible military dimensions. We desire a peaceful and negotiated solution to concerns over Iran’s nuclear program, and therefore remain committed to a dual-track approach. We welcome the resumption of talks between Iran and the E3+3 (China, France, Germany, Russia, the United Kingdom, the United States, and the European Union High Representative). We call on Iran to seize the opportunity that began in Istanbul, and sustain this opening in Baghdad by engaging in detailed discussions about near-term, concrete steps that can, through a step-by-step approach based on reciprocity, lead towards a comprehensive negotiated solution which restores international confidence that Iran’s nuclear program is exclusively peaceful. We urge Iran to also comply with international obligations to uphold human rights and fundamental freedoms, including freedom of religion, and end interference with the media, arbitrary executions, torture, and other restrictions placed on rights and freedoms.

32. We continue to have deep concerns about provocative actions of the Democratic People’s Republic of Korea (DPRK) that threaten regional stability. We remain concerned about the DPRK’s nuclear program, including its uranium enrichment program. We condemn the April 13, 2012, launch that used ballistic missile technology in direct violation of UNSC resolution. We urge the DPRK to comply with its international obligations and abandon all nuclear and ballistic missile programs in a complete, verifiable, and irreversible manner. We call on all UN member states to join the G-8 in fully implementing the UNSC resolutions in this regard. We affirm our will to call on the UN Security Council to take action, in response to additional DPRK acts, including ballistic missile launches and nuclear tests. We remain concerned about human rights violations in the DPRK, including the situation of political prisoners and the abductions issue.

33. We recognize that according women full and equal rights and opportunities is crucial for all countries’ political stability, democratic governance, and economic growth. We reaffirm our commitment to advance human rights of and opportunities for women, leading to more development, poverty reduction, conflict prevention and resolution, and improved maternal health and reduced child mortality. We also commit to supporting the right of all people, including women, to freedom of religion in safety and security. We are concerned about the reduction of women’s political participation and the placing at risk of their human rights and fundamental freedoms, including in Middle East and North Africa countries emerging from conflict or undergoing political transitions. We condemn and avow to stop violence directed against, including the trafficking of, women and girls. We call upon all states to protect human rights of women and to promote women’s roles in economic development and in strengthening international peace and security.

34. We pay tribute to the remarkable efforts of President Thein Sein, Daw Aung San Suu Kyi, and many other citizens of Burma/Myanmar to deliver democratic reform in their country over the past year. We recognize the need to secure lasting and irreversible reform, and pledge our support to existing initiatives, particularly those which focus on peace in ethnic area, national reconciliation, and entrenching democracy. We also stress the need to cooperate to further enhance aid coordination among international development partners of Burma/Myanmar and conduct investment in a manner beneficial to the people of Burma/Myanmar.

35. We recognize the particular sacrifices made by the Libyan people in their transition to create a peaceful, democratic, and stable Libya. The international community remains committed to actively support the consolidation of the new Libyan institutions.

36. We condemn transnational organized crime and terrorism in all forms and manifestations. We pledge to enhance our cooperation to combat threats of terrorism and terrorist groups, including al-Qa’ida, its affiliates and adherents, and transnational organized crime, including individuals and groups engaged in illicit drug trafficking and production. We stress that it is critical to strengthen efforts to curb illicit trafficking in arms in the Sahel area, in particular to eliminate the Man-Portable Air Defense Systems proliferated across the region; to counter financing of terrorism, including kidnapping for ransom; and to eliminate support for terrorist organizations and criminal networks. We urge states to develop necessary capacities including in governance, education, and criminal justice systems, to address, reduce and undercut terrorist and criminal threats, including “lone wolf” terrorists and violent extremism, while safeguarding human rights and upholding the rule of law. We underscore the central role of the United Nations and welcome the Global Counterterrorism Forum (GCTF) and efforts of the Roma-Lyon Group in countering terrorism. We reaffirm the need to strengthen the implementation of the UN Al-Qaida sanctions regime, and the integrity and implementation of the UN conventions on drug control and transnational organized crime.

37. We reaffirm that nonproliferation and disarmament issues are among our top priorities. We remain committed to fulfill all of our obligations under the Nuclear Nonproliferation Treaty and, concerned about the severe proliferation challenges, call on all parties to support and promote global nonproliferation and disarmament efforts.

38. We welcome and fully endorse the G-8 Foreign Ministers Meeting Chair’s Statement with accompanying annex.

Conclusion

39. We look forward to meeting under the presidency of the United Kingdom in 2013.

Indeed!

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 20 May 2012.

by Roger Montgomery Posted in Economics.

- 9 Comments

- save this article

- 9

- POSTED IN Economics.

-

Perhaps one of the most important charts?

Roger Montgomery

January 31, 2012

Late last year the Federal Bank of San Francisco’s research department published their findings about a relationship between the ageing baby boomers and P/E ratios. I have long held the view that when Australia’s baby boomers (the majority of whom are asset rich and cash poor) reach the age that they need to fund their retirement spending and healthcare, they will need to sell their assets (typically real estate). Given the next generation have long complained of being unable to afford a house, it seems logical that prices for homes will need to fall. Only if prices fall can a generation of sellers meet the generation of buyers who say they cannot afford to pay current prices.

Late last year the Federal Bank of San Francisco’s research department published their findings about a relationship between the ageing baby boomers and P/E ratios. I have long held the view that when Australia’s baby boomers (the majority of whom are asset rich and cash poor) reach the age that they need to fund their retirement spending and healthcare, they will need to sell their assets (typically real estate). Given the next generation have long complained of being unable to afford a house, it seems logical that prices for homes will need to fall. Only if prices fall can a generation of sellers meet the generation of buyers who say they cannot afford to pay current prices.If that is indeed true for one asset classes then perhaps it makes sense for other asset classes. Wealthier baby boomers with DIY share portfolios will also need cash. They may not sell the family home (although downsizing is a very real trend), instead they may use their share portfolios as their ATM. This could put pressure on the multiples of earnings, sales and book values that trade in a free market.

The FRBSF seems to agree…Zheng Liu and Mark M. Spiegel discovered a strong relationship between the age distribution of the U.S. population and stock market performance.

“A key demographic trend is the aging of the baby boom generation. As they reach retirement age, they are likely to shift from buying stocks to selling their equity holdings to finance retirement. Statistical models suggest that this shift could be a factor holding down equity valuations over the next two decades.

The baby boom generation born between 1946 and 1964 has had a large impact on the U.S. economy and will continue to do so as baby boomers gradually phase from work into retirement over the next two decades. To finance retirement, they are likely to sell off acquired assets, especially risky equities. A looming concern is that this massive sell-off might depress equity values.Many baby boomers have already diversified their asset portfolios in preparation for retirement. Still, it is disconcerting that the retirement of the baby boom generation, which has long been expected to place downward pressure on U.S. equity values, is beginning in earnest just as the stock market is recovering from the recent financial crisis, potentially slowing down the pace of that recovery.

We examine the extent to which the aging of the U.S. population creates headwinds for the stock market. We review statistical evidence concerning the historical relationship between U.S. demographics and equity values, and examine the implications of these demographic trends for the future path of equity values.

Demographic trends and stock prices: Theory

Since an individual’s financial needs and attitudes toward risk change over the life cycle, the aging of the baby boomers and the broader shift of age distribution in the population should have implications for capital markets (Abel 2001, 2003; Brooks 2002). Indeed, some studies attribute the sustained asset market booms in the 1980s and 1990s to the fact that baby boomers were entering their middle ages, the prime period for accumulating financial assets (Bakshi and Chen 1994).

However, several factors may mitigate the effects of this demographic shift. First, demographic trends are predictable and rational agents should anticipate the impact of these changes on asset demand. Consequently, current asset prices should reflect the anticipated effects of demographic changes. In addition, retired individuals may continue to hold equities to leave to their heirs and as a source of wealth to finance consumption in case they live longer than expected (e.g., Poterba 2001).

Foreign demand for U.S. equities might also reduce the downward pressure on asset prices. However, the effect is probably limited for two reasons. First, other developed nations have populations that are aging even more rapidly than the U.S. population (Krueger and Ludwig, 2007). Second, there is substantial evidence of home bias in equity holdings. Individual investors typically hold disproportionate shares of domestic assets in their portfolios. For example, in 2009, the foreign equity holdings of U.S. investors were only 27.2% of the share of foreign equities in global market capitalization. While the low level of international equity diversification is still not well understood (Obstfeld and Rogoff 2001), it suggests that foreign demand for U.S. equities is unlikely to offset price declines resulting from a sell-off by U.S. nationals.

Demographic trends and stock prices: Some evidence

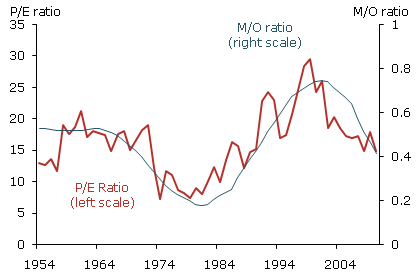

To examine the historical relationship between demographic trends and stock prices, we consider a statistical model in which the equity price/earnings (P/E) ratio depends on a measure of age distribution (for another example, see Geanakoplos et al. 2004). We construct the P/E ratio based on the year-end level of the Standard & Poor’s 500 Index adjusted for inflation and average inflation-adjusted earnings over the past 12 months. We measure age distribution using the ratio of the middle-age cohort, age 40–49, to the old-age cohort, age 60–69. We call this the M/O ratio.

We prefer our M/O ratio to the M/Y ratio of middle-age to young adults, age 20–29, studied by Geanakoplos et al. (2004). In our view, the saving and investment behavior of the old-age cohort is more relevant for asset prices than the behavior of young adults. Equity accumulation by young adults is low. To the extent they save, it is primarily for housing rather than for investment in the stock market. In contrast, individuals age 60–69 may shift their portfolios as their financial needs and attitudes toward risk change. Eligibility for Social Security pensions is also likely to play a first-order role in determining the life-cycle patterns of saving, especially for old-age individuals.

Figure 1 displays the P/E and M/O ratios from 1954 to 2010. The two series appear to be highly correlated. For example, between 1981 and 2000, as baby boomers reached their peak working and saving ages, the M/O ratio increased from about 0.18 to about 0.74. During the same period, the P/E ratio tripled from about 8 to 24. In the 2000s, as the baby boom generation started aging and the baby bust generation started to reach prime working and saving ages, the M/O and P/E ratios both declined substantially. Statistical analysis confirms this correlation. In our model, we obtain a statistically and economically significant estimate of the relationship between the P/E and M/O ratios. We estimate that the M/O ratio explains about 61% of the movements in the P/E ratio during the sample period. In other words, the M/O ratio predicts long-run trends in the P/E ratio well.

Figure 1.

This evidence suggests that U.S. equity values are closely related to the age distribution of the population.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 31 January 2012.

by Roger Montgomery Posted in Value.able.

- 20 Comments

- save this article

- 20

- POSTED IN Value.able.

-

Cochlear update

Roger Montgomery

December 20, 2011

Aside from fears of reputational damage, one of the big concerns surrounding Cochlear’s recall earlier this year, was how long it would take to return to market. As you know we purchased shares after the announcement that it had recalled its Nucleus CI500 cochlear implant much to the chagrin of some investors who follow our musings here at the Insights blog.

In NSW every child receives a hearing test within two days of birth. Those identified as having profound hearing loss are often assisted by Cochlear. And thats just NSW. Cochlear sells its devices in 100 countries. Once implanted changing devices is not easy. Changing brands may be even harder. Audiologists and speech pathologists are involved and the devices are finetuned to ensure the device suits the individual.

As Matthew pointed out here on the blog a few days ago: “A family member [of Matthews’s] is a key member of a large Australian charity that does a lot of work with children that are deaf and many get the implants. All the equipment they use to “map” or finetune the device after implanting is specific to that company. For example the only brand they have is Cochlear. Recently they had a child from the US that they began to support that had a different brand implanted – they had to change many things to be able to help them. When thinking about market share with these devices I think it is important to know that the decision isn’t solely with the surgeon or specialist, because all of the support people have to change too. I don’t think market share will change quickly or by very much because of these barriers.”

Analysts at Macquarie recently surveyed 389 US-based Audiologists. Despite the product recall, Cochlear is still the world leader in CI devices and retains 60% market share selling into 100 countries. The broker also believes the market is growing at 12 per cent per year.

Many of you know we purchased shares in Cochlear after the September recall (see below), confident this was a temporary issue being treated as permanent by a perennially short-term-focused market.

That now appears to be the case as today’s announcement, posted on the ASX platform by the company reveals; 20122011_COH CI500 impant update

The company previously covered the subject in its AGM presentation here: http://www.cochlear.com/files/assets/corporate/pdf/agm_presentation_18102011.pdf

Analysts were subsequently concerned that 1500 units are going to have to be removed through surgery and another 2800 units have been pulled from shelves. They also worry that an inventory shortfall across the entire market will lead to market share losses from insufficient inventory as well as damage to reputation.

Today’s announcement reveals any small market share loss (we estimate five percent and some analysts suggest between five and ten per cent overall) will be now stemmed by the timely identification of the manufacturing issue that resulted in the failure of 1.9% of devices and their subsequent recall.

Cochlear has ramped up production and its early intervention has enhanced its reputation rather than damaged it as evidenced by several surveys with clinicians. In fact, 93% of doctors surveyed by Macquarie felt that Cochlear handled the recall well, while only 8% believe the company’s reputation has been tarnished.

Ultimately the company’s intrinsic value is determined by its profit and we expect there will be an impact on profit of some import. Cochlear has already created a provision of $130-$150 million and an after tax cash cost of $20 to $30 million. Given the news flow that will now transpire, one expects these costs may be treated by analysts as a ‘one-off’ and investors may have to wait for another temporary setback before being able to buy shares cheaply again…

For those of you interested in following our thoughts back in September 14 (COH $51.30), I wrote the following :

“Imagine spending years waiting patiently for the opportunity to buy that rare coin, vintage bottle of wine or celebrated painting, only to be outbid when it finally comes up for auction.

Sometime later the opportunity presents itself again and you are outbid once more, this time by much more. Successive auctions only take the price further out of your reach – if only you acted sooner!

Then one day you stumble across that very thing you desire being offered for sale by someone who appears to have no interest in its long-term value, for a price you regard as a fraction of its real worth.

Would you buy it?

That is the situation I find myself in today as the Cochlear share price plunges another 14% to $51.30, or about 40% since its April 2011 high of $85.

As Cochlear’s technicians work to isolate the problem with the Nucleus 5 range, the company will dust off the Nucleus Freedom range, which it has marketed successfully for many years against products such rivals as Advanced Bionics and Med-El.

Overnight one of those rivals received FDA approval to sell its product (which was itself recalled in November last year) into the US market. This turn of events is not unusual for the industry … but it is unusual for Cochlear and that’s why the news this week came as such a blow. Cochlear is one of the highest-quality companies trading on the ASX today. The company that almost never puts a foot wrong appears to have tripped itself up and investors are spooked.

The financial impacts of these events (and there will be an impact) have yet to be quantified so until they are why don’t we look at how the company has performed in the past and see if we can’t learn something about it in the interim.

Over the past decade, Cochlear has increased profits every year with the exception of 2004. Net profit was just $40 million in 2002 and last week the company reported profits of $180 million for 2011.

Operating cash flow over the same period has risen from less than a $1 million (an exception for 2002) to more than $201 million, allowing debt to decline to just $63 million from nearly $200 million in 2009. Net gearing is now minus 1.86%.

Those impressive economics have resulted in an intrinsic value that has risen by nearly 18% each year since 2004. If your job as a long-term investor is to find companies with bright prospects for intrinsic value appreciation – believing that in the long run prices follow values – then it quite possible that Cochlear is being served up on a plate.

The recently reported net profit figure of $180.1 million for 2011 was up 16% and in line with consensus analyst estimates, although this occurred despite sales of $809.6 million exceeding analysts’ estimates. It seems the analysts did not expect the EBIT and NPAT margins that were reported. These were flat, which given a very strong Australian dollar, suggests impressive efficiency gains in the operations.

If only that blasted “Australian peso” would go down and stay down!

Back on August 19, 2009, I wrote: “Fully franked dividends have risen every year for the past decade, growing by almost 500% (or 22% pa) since 2000. These are not numbers to be sneezed at; the company has produced an impressive and stable return on equity since 2004 of about 47% with very modest debt. Clearly this is a company worth some significant premium to its equity.”

Nothing changed really for 2011. A final dividend of $1.20 per share was 70% franked and up 14%.

Importantly, it seems Cochlear’s market is growing. Unit sales volumes were up 17% for the year and, given in the first half they were up 20%, it suggests the second half were up 14%. Double digit growth was reported in sales volumes for all major regions and Asia was the most impressive, rising more than 30% to the point where it makes up 16% of total revenues.

This really is impressive stuff. Just two years ago the company reported unit sales growth of only 2%, to 18,553 units, and many analysts were blaming slow China sales. Nobody expected the company to ever repeat its 2007 and 2008 volume growth of 24% and 14% respectively, and certainly not off a higher base.

Growth has always been viewed as is limited by the high cost of the devices and the reliance on insurance and healthcare schemes to subsidise the costs and those of surgery to implant to them.

According to the World Health Organization however, almost 280 million people suffer from moderate to profound hearing loss and an ageing population means this figure will rise. Cochlear is one of a handful of companies that actively contributes to improving the quality of life of its clients.

When great companies stumble, the impact can be exaggerated by the reaction of shareholders who never believed it could happen. Then comes a wave of selling amid doubts that the company will ever regain its mantle.

But strong market share and strong cash flow, high returns on equity and low debt, are rarely offered at bargain prices so I picked up some Cochlear stock yesterday for the Montgomery [Private] Fund. It is likely that I will to add to this position over the coming days and weeks when the full financial impact of the recall is known.

I must confess I didn’t bet the farm on this particular investment because the financial impact of the recall – and there will be one – remains unclear; when that changes it will impact my intrinsic value estimate (UBS has revised its forecast net profit for 2012 by 10.5% to $179.5 million).

Whatever the impact, it will be temporary, even though it won’t necessarily preclude lower prices from this point. During the GFC, Cochlear shares fell from $78 to $44. No company is immune to lower share prices and I don’t know when or in what order they will transpire.

What I do know is that in 2021 we aren’t likely to be thinking about this recall, just as nobody now talks about the Wembley Stadium delays that dogged Multiplex back in 2006. Mercifully, investors’ memories tend to be short.

Recalls, competition, marketing gaffes and wayward salary packages are all part of the cut and thrust of business and if lower prices ensue for Cochlear shares, it will be important to determine whether the recall will inflict permanent scars. My guess is that it will not.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Health Care, Investing Education, Value.able.

- 45 Comments

- save this article

- 45

- POSTED IN Companies, Health Care, Investing Education, Value.able.

-

Drunk from binge borrowing?

Roger Montgomery

November 25, 2011

A good friend who lives and works in the UK recently sent me an allegory that succinctly describes, for those who haven’t read Michael Lewis, the growth of sub-prime loans, the collateralised debt obligations into which they were securitised and the credit default swaps which were the tradable insurance contracts on the CDO’s. It then goes on to neatly leave us with the consequences.

A good friend who lives and works in the UK recently sent me an allegory that succinctly describes, for those who haven’t read Michael Lewis, the growth of sub-prime loans, the collateralised debt obligations into which they were securitised and the credit default swaps which were the tradable insurance contracts on the CDO’s. It then goes on to neatly leave us with the consequences.If you have seen it before or believe you have a solid understanding of the events, you are many steps ahead of most. For the rest of us,

Heidi provides an explanation;

Heidi is the proprietor of a bar … She realises that virtually all of her customers are unemployed alcoholics and, as such, can no longer afford to patronise her bar. To solve this problem, she comes up with a new marketing plan that allows her customers to drink now, but pay later.

Heidi keeps track of the drinks consumed on a ledger (thereby granting the customers loans). Word gets around about Heidi’s “drink now, pay later” marketing strategy and, as a result, increasing numbers of customers flood into Heidi’s bar. Soon she has the largest sales volume for any bar in Manchester…

By providing her customers freedom from immediate payment demands, Heidi gets no resistance when, at regular intervals, she substantially increases her prices for wine and beer, the most consumed beverages. Consequently, Heidi’s gross sales volume increases massively.

A young and dynamic manager at the local bank recognizes that these customer debts constitute valuable future assets and increases Heidi’s borrowing limit. He sees no reason for any undue concern because he has the debts of the unemployed alcoholics as collateral!

At the bank’s corporate headquarters, expert traders figure a way to make huge commissions, and transform these customer loans into DRINKBONDS. These “securities” then are bundled and traded on international securities markets.

Naive investors don’t really understand that the securities being sold to them as ‘AAA Secured Bonds’ really are debts of unemployed alcoholics. Nevertheless, the bond prices continuously climb – and the securities soon become the hottest-selling items for some of the nation’s leading brokerage houses.

One day, even though the bond prices still are climbing, a risk manager at the original local bank decides that the time has come to demand payment on the debts incurred by the drinkers at Heidi’s bar. He so informs Heidi. Heidi then demands payment from her alcoholic patrons. But, being unemployed alcoholics they cannot pay back their drinking debts. Since Heidi cannot fulfil her loan obligations she is forced into bankruptcy. The bar closes and Heidi’s 11 employees lose their jobs.

Overnight, DRINKBOND prices drop by 90%. The collapsed bond asset value destroys the bank’s liquidity and prevents it from issuing new loans, thus freezing credit and economic activity in the community. The suppliers of Heidi’s bar had granted her generous payment extensions and had invested their firms’ pension funds in the BOND securities. They find they are now faced with having to write off her bad debt and with losing over 90% of the presumed value of the bonds. Her wine supplier also claims bankruptcy, closing the doors on a family business that had endured for three generations, her beer supplier is taken over by a competitor, who immediately closes the local plant and lays off 150 workers.

Fortunately though, the bank, the brokerage houses and their respective executives are saved and bailed out by a multibillion dollar no-strings attached cash infusion from the government. The funds required for this bailout are obtained by new taxes levied on employed, middle-class, non-drinkers who have never been in Heidi’s bar.

Its nicely articulated don’t you think? Fortunately the problem is contained to…Earth. But where too next?

Postscript: This week, China’s vice-premier and head of finance, Wang Qishan, predicted that the global economy has commenced a long-term recession. He observed: “Now the global economic situation is extremely serious and in such a time of uncertainty the only thing we can be sure of is that the world economic recession caused by the international crisis will last a long time.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 25 November 2011.

by Roger Montgomery Posted in Insightful Insights.

- 104 Comments

- save this article

- 104

- POSTED IN Insightful Insights.