Search Results for: property

-

What has probing the reporting season avalanche revealed?

Roger Montgomery

August 24, 2011

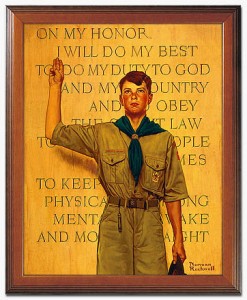

With reporting season in full swing, I would like to share my insights into whose Quality Score has improved, and whose has deteriorated. Remember, none of this represents recommendations. It is intended to be educational only. You must seek and take personal professional advice before acting or transacting in any security.

To date, 232 companies have reported their annual results. I am sure you can understand why we feel snowed under. With almost 2,000 companies listed on the ASX, the avalanche still has a way to roll.

We have updated all of our models for each of the 164 companies that we are interested in. As you know, we rank all listed companies from A1 down to C5. The inputs for those rankings always come from the company themselves. I would hate to think how bipolar they would be if we allowed our emotions and personal preferences to infect those ratings (or be swayed by analyst forecasts)!

Rather than arbitrary and subjective assessments, we download some 50-70 Profit and Loss, Balance Sheet and Cash Flow data fields from each annual report to populate five templates. All of these templates employ industry specific metrics to calculate the Quality Scores. This allows us to rank every ASX-listed business from A1 – C5. Its our objective way to sort the wheat from the chaff.

For Value.able Graduates not familiar with our scoring system, company’s that achieve an A1 Score are those we believe to be the best businesses, and the safest. C5s are the poorest performers and carry the highest risk of a possible catastrophic event.

A1 does not mean nothing bad will ever befall a company. A1 simply means to us that it has the lowest probability of something permanently catastrophic. Further, ‘lowest probability’ doesn’t mean ‘never’. A hundred-to-one horse can still win races, even though the probability is low. Similarly, an A1 business can experience a permanently fatal event. In aggregate however, we expect a portfolio of A1 businesses to outperform, over a long period of time, a portfolio of companies with lesser scores.

With that in mind, we are of course most interested in the A1s and – on a declining scale – A2, B1 and B2 businesses.

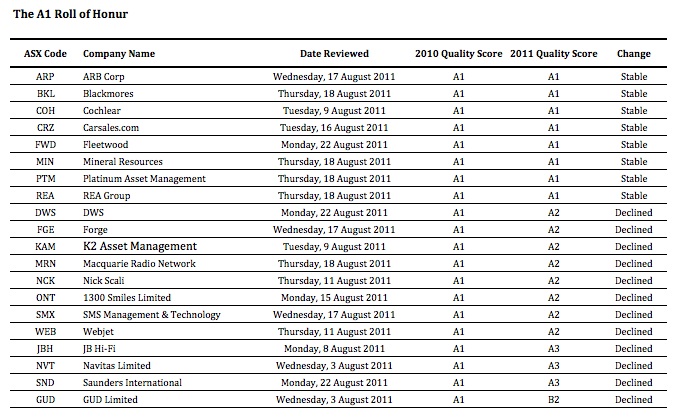

So, who has managed to retain their A1 status this reporting season? And which businesses have achieved the coveted A1 status? If you hold shares in any of the companies whose scores have declined (based of course on their reported results), please read on.

Of the companies that have reported so far, last year 20 of them were A1s, 28 were A2s, one was a B1 and 13 scored B2. That’s an encouraging proportion, although we tend to discover each reporting season that the better quality businesses and the better performing businesses are generally keen to get their results out into the public domain early.

Its towards the end of every reporting season where the quality of the businesses really drops off. This is always something to watch out for – companies trying to hide amongst the many hundreds reporting at the end of the season. It’s always a good idea to turn up to a big fancy dress party late, if you aren’t in fancy dress.

This year we have seen the number of existing A1s fall to nine from 20, A2s from 28 to 24, B1s rise from one to two and B2s fall from 13 to six.

The first table shows all twenty 2009/2010 A1 companies that have reported to date. You’ll see a number of very familiar names in here, including ARB Corp (ARP), Blackmores (BKL), Cochlear (COH), Carsales.com (CRZ), Fleetwood (FWD), Mineral Resources (MIN), Platinum Asset Management (PTM), REA Group (REA), DWS (DWS), Forge (FGE), K2 Asset Management (KAM), Macquarie Radio Network (MRN), Nick Scali (NCK), 1300 Smiles Limited (ONT), SMS Management & Technology (SMX), Webjet (WEB), JB Hi-Fi (JBH), Navitas Limited (NVT), Saunders International (SND) and GUD Limited (GUD). Nine have maintained their A1 rating this year.

Now, before you go jumping up and down, a drop from A1 to A2 is like downgrading from Rolls Royce to Bently. When we talk about A2s, its not a drop from RR Phantom to a Ford Cortina, not that there’s anything wrong with the old Cortina (if you are too young to know what I am talking about Google it!).

The only big rating decline is GUD Holdings, which made a large acquisition (Dexion) during the year. Indeed, a common theme amongst the higher quality and cashed up businesses this reporting season has been the deployment of that cash towards, for example, acquisition or buybacks (think JB Hi-Fi).

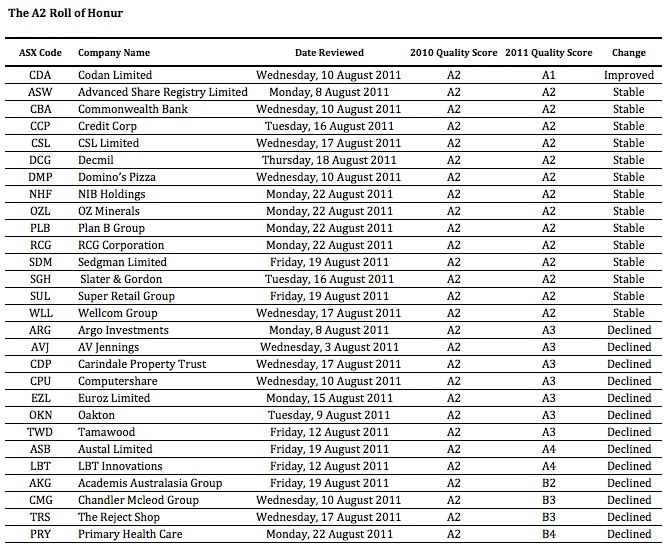

Moving onto the 2009/2010 A2 honour roll: Codan Limited (CDN), Advanced Share Registry Limited (ASW), Commonwealth Bank (CBA), Credit Corp (CCP), CSL Limited (CSL), Decmil (DCG), Domino’s Pizza (DMP), NIB Holdings (NHF), OZ Minerals (OZL), Plan B Group (PLB), RCG Corporation (RCG), Sedgman Limited (SDM), Slater & Gordon (SGH), Super Retail Group (SUL), Wellcom Group (WLL), Argo Investments (ARG), AV Jennings (AVJ), Carindale Property Trust (CDP), Computershare (CPU), Euroz Limited (EZL), Oakton (OKN), Tamawood (TWD), Austal Limited (ASB), LBT Innovations (LBT), Academis Australasia Group (AKG), Chandler Mcleod Group (CMG), The Reject Shop (TRS) and Primary Health Care (PRY).

The businesses that make up this list showed slightly more stability. The biggest fall in quality this year was Primary Healthcare (PRY),which is still struggling to digest the large purchases it made a few years ago. The Reject Shop (TRS) also declined, to B3. TRS is still investment grade and we would lean towards believing this is a short-term decline, given the floods in QLD that caused the complete shutdown of their new distribution center and the massive disruptions subsequently caused. As the company said, you can’t sell what you haven’t got!

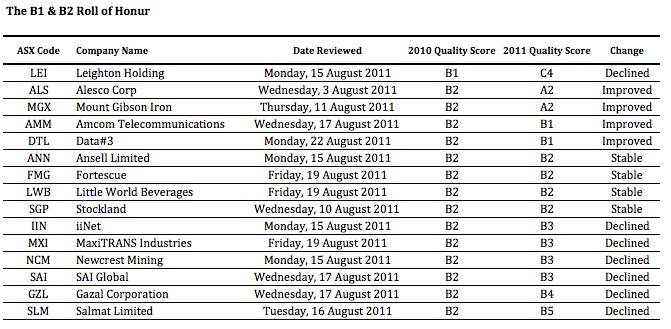

Finally, B1 and B2 companies: Leighton Holdings (LEI), Alesco Corp (ALS), Mount Gibson Iron (MGX), Amcom Telecommunications (AMM), Data#3 (DTL), Ansell Limited (ANN), Fortescue (FMG), Little World Beverages (LWB), Stockland (SGP), iiNet (IIN), MaxiTRANS Industries (MXI), Newcrest Mining (NCM), SAI Global (SAI), Gazal Corporation (GZL) and Salmat (SLM).

About half the companies in the B1/B2 list retained or improved their ratings from last year. Mind you, half also saw their rating decline!

The clear fall from grace is Leighton Holdings, whose problems have been well documented in the media and via company presentations.But once again, like The Reject Shop, this could be a temporary situation. If the forecast $650m profit comes through, I expect LEI’s quality score will improve. What the dip will do, however, is remain a permanent reminder that Leighton is a cyclical business. Getting the quote right on a job is important, even more a massive enterprise like Leightons.

Are you surprised by any of the changes? We certainly were!

Sticking to quality is vitally important. That’s what my team and I do here at Montgomery Inc, and its what our amazing next-generation A1 service is all about. Value.able Graduates – your invitation is pending.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Remember, you must do your own research and remember to seek and take personal professional advice.

We look forward to reading your insights and will provide another reporting season update soon.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 24 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are there really five bargains to research further?

Roger Montgomery

July 29, 2011

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.As you would know from reading Value.able, I am not a fan of the Price to Earnings Ratio. Nothing has changed on that front. Nevertheless, value may just be in the eye of the beholder and not only is the P/E Ratio common in literature about investing and in market commentary, it is, whether rightly or wrongly, in wide use.

Indeed, if you are like many Baby Boomers now on the cusp of selling your business, you will be spending a great deal of time in negotiations and assisting in due diligence to arrive at a simple multiple of earnings.

The humble P/E Ratio may be misused, misunderstood and relied on far too heavily, but popular it remains.

One version of the earnings multiple that is adopted for comparison purposes by private equity buyers is the enterprise model. The enterprise model takes the market value of the equity (market cap) and debt, less cash, and divides the whole lot by the EBITDA (earnings before interest tax depreciation and amortisation). Of course, if you have a company with high operating margins but lots of property, plant and equipment (PP&E) to maintain, you may find the results a little optimistic.

Simply take a standard price to earnings approach, but subtract the cash the company has in the bank.

If you were to buy a business outright, you may take into account the cash the company has in its bank accounts. After buying the business you may be able to access this cash and withdraw it to lower the purchase price. Alternatively, if you are selling a business, in an IPO for example, you may be just as keen to take the cash out before selling it to maximise the return to you and reduce the return available to otherwise anonymous share market investors (this latter strategy is very popular).

The arithmetic result of taking out the cash is a lower P/E multiple. And that is what I thought you may be interested to discuss.

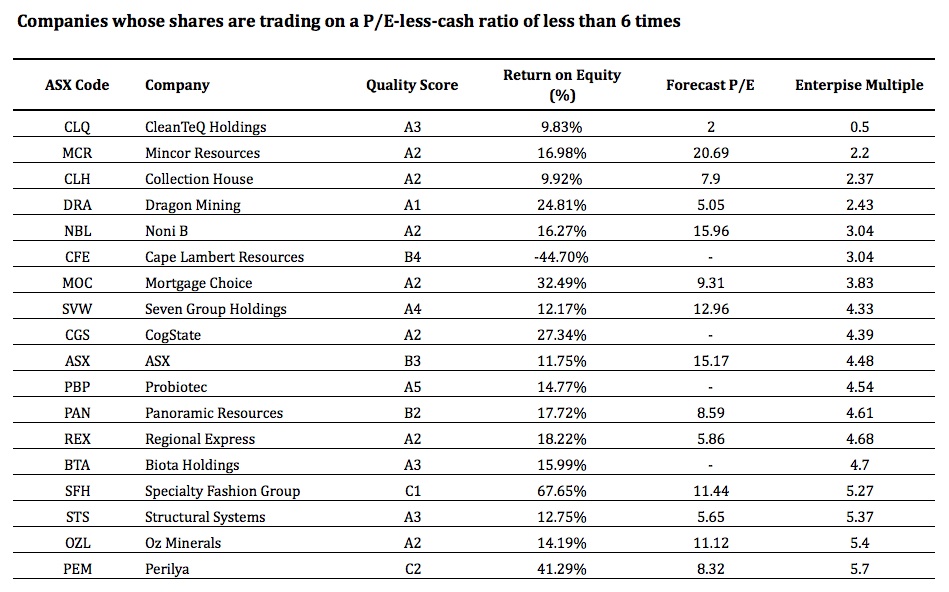

Are there any companies listed in Australia that are trading on very low multiples of earnings once their cash is taken into consideration? The broad based market declines have ensured there are indeed a few.

Step 1

My search began by opening our next-generation A1 service (Value.able Graduates – your exclusive invitation to pre-register is not far away). I applied a filter to discover those companies whose shares were trading at a P/E-less-cash ratio of less than 6 times. From the more than 2000 companies reviewed, there are 18 such companies that meet the criteria today. Keeping in mind some businesses have cash on their balance sheet that would NOT be accessible to a buyer (legislated, regulation or simply working capital needs), here are the eighteen:

Step 2

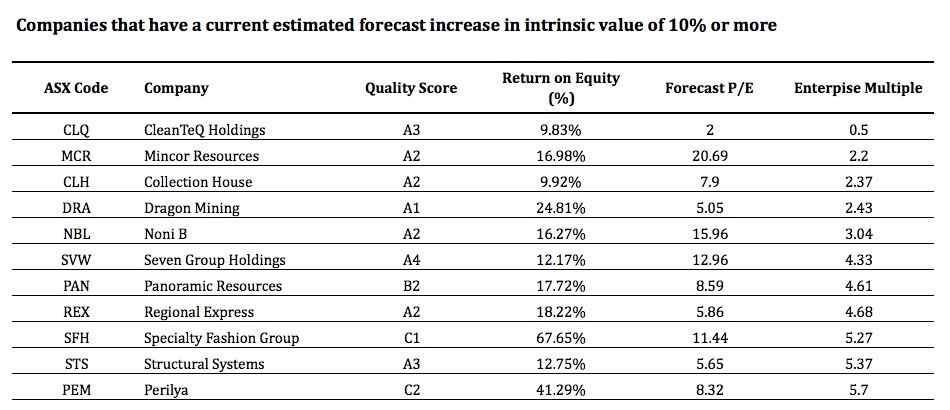

Next, I retained only those companies that have a current estimated forecast increase in intrinsic value of 10% or more. This filter reduced the field to just 11 companies, removing ASX, OZL, CGS, CFE, BTA, PBP AND MOC. Here are the eleven:

Step 3

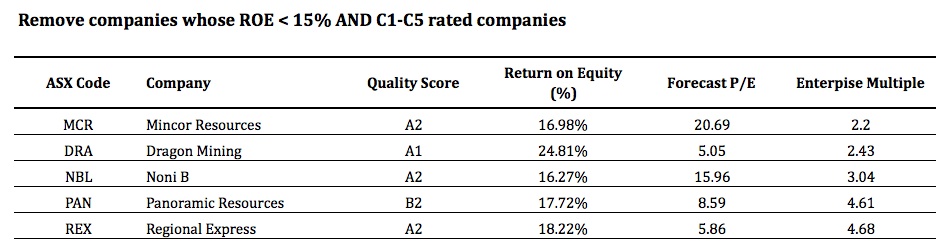

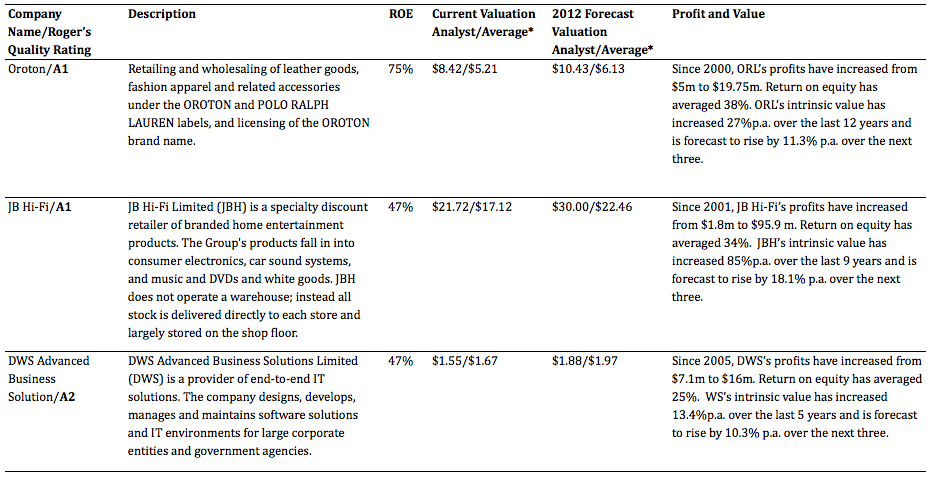

Finally, I removed companies whose previous year’s ROE was less than 15%. I also removed any companies with a C1-C5 Quality Score. Low ROE stocks removed were; CLQ, CLH, SVW AND STS and C-rated companies removed were; SFH AND PEM. That left just five companies. Here they are:

And there you have it, companies trading at enterprise multiples that may be attractive to a buyer who could potentially use the cash on the balance sheet to reduce their purchase price.

Amazing, incredible simple. No manual calculations required (ever again).

Remember, this exercise did not incorporate any of the traditional Value.able investing considerations we usually discuss at the Insights Blog… safety margin, intrinsic value.

For the record, only two of the listed businesses look cheap on the Value.able score today. With reporting season about to begin in ernest, keep in mind the results and cash balances of these companies will all change.

You must do your own research into their prospects and remember to seek and take personal professional advice.

Very soon, finding extraordinary A1 companies offering large safety margins will become simple and even fun. Our next-generation A1 service that my team and I have been tirelessly working on will inspire your investing and re-energise your portfolio.

Value.able Graduates – stay tuned. Your exclusive invitation to pre-register will arrive in your inbox very soon. If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Back to the program… this reporting season, who do you think will surprise with better than expected earnings?

Who do you think will struggle?

And what stocks are looking cheap to you right now?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 29 July 2011.

by Roger Montgomery Posted in Companies, Investing Education.

- 87 Comments

- save this article

- 87

- POSTED IN Companies, Investing Education.

-

Property heading into a storm, banks to feel pain

Roger Montgomery

July 1, 2011

Baby boomers have boosted the property market, but what’s going to happen when they retire? Investment expert Roger Montgomery says he isn’t encouraged by comments by the housing industry. Listen to the podcast.

by Roger Montgomery Posted in Media Room, Radio.

- save this article

- POSTED IN Media Room, Radio.

-

What if the sell-off is just a Flash?

Roger Montgomery

June 23, 2011

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?In the short run prices move independently of the underlying business, so let’s encourage the market to decline further!

For those truly concerned about Australia’s prosperity, relax. Be comfortable in the knowledge that short-term share price moves are unlikely to impact the employment policies of Australia’s largest listed businesses.

Looking over the financials of fifty-six A1 companies, little has changed. While Telstra and Fosters share prices are beating to the drum of hoped-for franked dividends and a takeover, the fundamentals of many other companies, particularly A1s (and indeed A2 and B1), are resolute. Are these businesses worth 10% to 26% less than they were worth before? No chance. The Value.able intrinsic valuations of companies that were cheap before haven’t changed.

So what has changed?

Only investors’ perceptions. Perceptions about the global economic outlook; perceptions about a US slowdown becoming a recession; perception about a Chinese slowdown causing a global rout the world cannot afford; and hope that Australian house prices will fall to levels people can actually afford.

Think about that for a moment. Baby boomers own $1m + homes that they will be forced to liquidate to fund their retirements and health care. Meanwhile, Generation Y is struggling to afford a property. Something has to give. Economics 101 suggests price declines.

Investors have simply been reducing their appetite for risk.

Armageddonists are spouting scenarios similar to those that followed Britain’s exit from the gold standard in 1931.

But this fear may be unfounded. It’s most certainly not a cause for permanent worry. Even if a recession does transpire, it will not be permanent.

Our job as Value.able Graduates is not to guess the gyrations of the economy – while they are vital in determining the sustainability of a given return on equity, many of the world’s very best investors do not even employ economists (they employ former US Federal Chairmen).

Your mantra is to simply put together a list of ten extraordinary businesses that you believe will be much more valuable in five, ten or twenty years time.

Of course trying to fit all this into your daily life can be a challenge. Completely eliminating the drudgery, and making it simple and fun, is something my team and I have been working on for you. We created our A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. We have worked really hard to create our next-generation service because its what we all want to use. We are its first members! Soon, you will be able to make your investing life simpler too (remember, Value.able Graduates will be invited first – have you secured your copy?). It’s an A1 service that is like nothing you have ever seen before.

You may sense our excitement…

… back to the regular program.

So, here it is. Our list of out-of-favour-but-extraordinary businesses. WARNING: out-of-favour does not always mean ‘bargain’.

Steve Jobs once said; “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully.”

With that in mind, here are my thoughts on ten businesses we have discussed over the past few months with a back-of-the-business card reason for interest…

JB Hi-Fi (ASX: JBH, MQR: A1) – Bad news across the board in retail may get worse, but it will turn around and JB Hi-Fi is not Harvey Norman. The buyback has increased intrinsic value at the same time the price slides below.

Cochlear (ASX: COH, MQR: A1) – The shining star amongst A1s (COH is one of this country’s best export successes), yet the worst performer on the share market amongst its peers. Rational, anyone? Australian dollar fluctuations doesn’t change the quality of COH’s business, only the nature or shape of its earnings. Aussie dollar appreciation may last a while, but is not permanent.

CSL Limited (ASX:CSL, MQR: A1) – Another A1 amongst A1s. Like COH, earnings are affected by currency fluctuations.

Woolworths (ASX: WOW, MQR: B1) – Trading at a premium to current Value.able intrinsic value, but a small discount to 2012. Intrinsic value has taken five years to catch up to the price and the price has complied by waiting. In the absence of further downgrades, intrinsic value for future years now rises beyond the price at a good clip.

Reece (ASX: REH, MQR: A2) – Great quality business. Wait for weaker prices or intrinsic value to catch up.

Platinum Asset Management (ASX: PTM, MQR: A1) – Whilst few businesses can compete with Platinum on an ROE and low capital intensity basis, patience is required before acquiring.

Matrix C&E (ASX: MCE, MQR: A1) – Matrix is unique amongst its small capitalisation peers also servicing the resources sector. Watch the full year results closely.

ANZ (ASX: ANZ, MQR: A3) – Short of swimming off the island, we don’t have much choice when it comes to choosing a banking partner. Thanks to fears of an ineffectual Asia roll-out, ANZ is the cheapest of Australia’s big four at the present time.

Vocus Communications (ASX: VOC, MQR: A1) – Run by some of the best in the business, the intrinsic value of Vocus has the potential to be much, much higher in five years time.

Zicom Group (ASX: ZGL, MQR: B2) – Like Matrix, Zicom is exposed to both small-cap and resource sector engineering negativity. And like Vocus, the intrinsic value could rise much higher on the back of further rises in the price of oil and demand for gas.

What’s on your list?

This market, with an increasing number of companies hitting 52-week lows, is demanding your attention!

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 177 Comments

- save this article

- 177

- POSTED IN Companies, Insightful Insights.

-

Tech Wreck MkII Continued: Signs of a bubble?

Roger Montgomery

June 20, 2011

Irrational exuberance and tech stocks are old bedfellows. In my previous post, Is this time different?, I wrote “I never ever allow myself to believe this time is different to the last”.

With that in mind, approach the following list of upcoming IPOs with the same trepidation as a Value.able Graduate would the P/E ratio. Don’t get too distracted.

Facebook, Groupon, Kayak, HomeAway, Milennial Media, Trulia and Zillow Inc are expected to float in the near future. I’ll be watching them for signs of irrational exuberance. Why? Because locally, James Packer is buying into similar companies (Scoopon.com.au, catchoftheday.com.au and groceryrun.com.au), one suspects to subsequently spin them off, through an IPO, to you.

If you would like to keep this list updated, go right ahead.

On behalf of Value.able Graduates and every other investor who reads my Insights blog, I would be delighted to see you expand this list.

In your comments, feel free to add any upcoming floats or recent floats that I have left out (Zipcar, for example). Stay tuned for MQR’s and intrinsic valuations for these companies too! (they’re just a small part of our new A1 service – my team will invite all Value.able Graduates to pre-register soon).

Facebook: If floated, as many expect, in April 2012, Facebook could be valued at $100 billion. You can imagine the float price will be a bit silly… the company will tell 700 million users about it and will attract many first time Gen Y ‘investors’. Facebook is currently valued around $70 billion on the private market.

Groupon: One of the very first deal-of-the-day websites set up all the way back in 2009, Groupon has already filed to go public. The company estimated sales of $2 billion and is expected to float at $30 billion but that sales figure is based on the revenue from selling coupons. A significant percentage of that must go to the business that offers the goods/service in the first place. If ebay reported its sales revenue as the total value of all goods sold, it would amount to $61 billion rather than the $9 billion they did report. The correct sales number for Groupon is about $530 million. The valuation compares to $135 million funding in April 2010 that gave the company a $1.35 billion valuation, Google’s offer in November 2010 of $6 billion, and a $590 million raising in January 2011 that valued the company at 15 billion. At $30 billion the price-to-sales ratio is 51 times. This compares to Google at 6 times, Microsoft at 3.5 times, Apple at 5 times, and Amazon and Yahoo at 3 times.

Kayak: The leader in travel search filed for an IPO in November 2010. It generated $53 million in revenue for the quarter ending March 31, up 43 per cent from pcp (previous corresponding period). The company processed 214 million queries in the quarter, up 48 per cent from pcp and there were more than one million downloads of its mobile applications in the quarter, up 226 per cent from pcp. Kayak had a net loss of $6.9 million in the quarter, up from $854,000 in the year-ago period. But the company took a $15 million charge for dropping its Sidestep.com URL. The company stated:

“During the first three months of 2011 we determined that we would no longer support two brand names and URLs in the United States and decided to migrate all traffic from www.sidestep.com to www.kayak.com, resulting in the impairment charge.”

Kayak sources 56 per cent of content for the Kayak flight queries from a company called ITA Software. Google has acquired ITA software and is expected to build a competing product. On this development, Kayak has said that it received 7.8 per cent of total advertising from Google in the most recent quarter. It notes that a consent decree requires Google to renew Kayak’s contract with ITA. If, however, Google limits Kayak’s access to ITA or develops replacement software, Kayak could be hurt.

HomeAway: The vacation rental site filed for a $230 million IPO in March 2011, hoping to sell 9.2 million shares at $24 to $27 each. HomeAway will list this week. Last week the company raised the goal for its initial stock offering to $248.4 million giving it a proposed value of $2 billion. 2010 revenue was $167.9 and net profit was $16.9 million. HomeAway makes more than 91 per cent of its cash annual subscription fees. Most property managers/owners pay $329 per listing per year to be featured on HomeAway.com, HolidayRentals (UK) and HomeAway FeWo-direkt (Germany). It’s a subscription fee business model that doesn’t rely on ad dollars, but according to the company, is “highly predictable and profitable”. Last year, more than 75 per cent of HomeAway’s clients renewed their existing listings. But $2 billion for a profit of $16 million in profits? Fairfax got a steal when they bought OzStayz! The auditors can relax about the valuation of goodwill on the company’s balance sheet.

Milennial Media: The third-largest mobile-advertising company in the US is talking to bankers about a potential initial public offering. The IPO is expected late this year or in early 2012, values the company at $700 million to $1 billion. Milennial Media helps advertisers find space on mobile devices, such as smartphones. It’s increasing its market share in the industry, but its competitors include global dominators Google and Apple. According to research firm IDC, Millennial accounted for 6.8 percent of mobile-ad revenue last year, up from 5.4 percent in 2009. Also according to IDC, total US mobile-ad market, however, generated just $877 million in 2010.

Trulia: Real estate search engine Trulia hired former Yahoo CEO Paul Levine in February. Trulia won’t say when it plans to float, but Chief Executive Pete Flint recently told Reuters that an offering is part of the company’s longer-term plans. “Building an IPO-ready management team is our focus, but we’re certainly in no rush, and as we announced, we’re profitable, so we’re not in need of external capital.” Its main competitor is Zillow.com (see below).

Zillow Inc: Filed on April 18 to raise $51.8 million, the company is backed by venture capital firms Accel Partners and Sequoia Capital . Zillow has hired Citigroup Inc. to handle the IPO. In three years its revenue mix has gone from being advertising-based, to fees and subscriptions from its Zillow Mortgage Marketplace, which connects borrowers with lenders. In 2009, Zillow earned 22 percent of its revenues from the marketplace, and 78 per cent from display advertising.

In 2010 display advertising dropped to 57 per cent of the total pool, while marketplace revenues more than doubled. Display advertising revenues however grew by 27 percent this year. In total, Zillow earned $30.4 million last year, and made a loss of $14.1 million in 2010 after a loss of $12.9 million in 2009. Its venture capital investors have sunk $87 million into the company.

So there’s the list and I would be delighted to see you expand it. Irrational exuberance in the US can spread like a virus here. James Packer’s investment in the founders of catchoftheday, dealsdirect and groceryrun values the coupon business at $200 million. What valuation will be given when they are dressed up for a float here? Watch this space…

What upcoming or recent floats are you watching? Feel free to submit the new Aussie floats that you are watching and I’ll add the Montgomery Quality Ratings and Value.able intrinsic valuations to them over the coming weeks.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 20 June 2011.

by Roger Montgomery Posted in Companies, Technology & Telecommunications.

-

…You can’t touch this?

Roger Montgomery

June 13, 2011

“Yet you do not know about what may happen tomorrow. What is the nature of your life? You are but a wisp of vapor that is visible for a little while and then disappears“. James 4:14

“Suddenly a mist fell from my eyes and I knew the way I had to take.” Edvard Grieg

“Fog and smog should not be confused and are easily separated by color.” Chuck Jones

With apologies to 90’s rapper M.C Hammer, today I plan to lift the lid, ever so slightly, on a misconception about the value of tangible assets. I’ll throw in a few Value.able intrinsic valuations for you too.

Were you as fascinated recently, as I was, to read Harvey Norman suggesting that the price premium to book value of JB Hi-Fi compared to that of itself was unjustified? The company pointed out – and allow me to paraphrase – that the market capitalisation of JB Hi-Fi ($1.9 billion) against just $365 million of book value is high, when Harvey Norman’s market capitalisation is $2.7 billion and its book value is expected to be $2.2 billion at the end of this financial year.

The attachment to physical assets held by many is not unusual, nor is the belief that intangible assets are akin to a puff of smoke. Premiums to book value however are justified when that ‘book’ generates above average rates of return. And it is assets of the intangible variety – the economic goodwill (rather than the accounting variety) – that are more valuable anyway. Physical assets can be replaced, imitated and replicated. Any competitor (with deep enough pockets) can purchase almost all of them. Ultimately, any unusual returns these generate will be competed away as competitors secure the same machines, tools, equipment etc. Many in the printing game experience this phenomenon. A new machine gives them a marginal advantage only for as long as it takes their competitor to make the same investment.

Assets of an intangible nature are less easily copied and so high rates of return can be sustained longer, and are therefore worth more.

A company’s book value is the net worth of its assets. Book value is made up of both tangible assets and intangible assets. Tangible assets are physical and financial and include property, plant & equipment, inventory, cash, receivables and investments. Intangible assets aren’t physical or financial and may include trademarks, franchises and patents.

To demonstrate the difference in value between intangible and tangible, have a look at Google; That company’s market capitalisation is US$165.5 billion and yet its book value is just US$48.6 billion. Its price to book value is 3.42 times. JB Hi-Fi’s price to book value is 5.2 times and Harvey Norman’s is 1.22 times. But Google’s ‘book’ generates returns of 19.16%, JB Hi-Fi; 41.5% and Harvey Norman; 11.6%. There is indeed a relationship between the price premium to ‘book’ and the profitability of that ‘book’ (‘ROE’). A business is worth much more than its net tangible assets when it produces profits well in excess of market-wide rates of return.

I wrote about the capital intensity of airlines in Value.able (re-read Pages 60-63, 122, 164, 172-3), so you should know my thoughts about this already (You can also read any of these articles and transcripts for a refresher: Taking-off or crash-landing?, Qantas cuts costs to stay in profit, Qantas cuts staff, flights to counter fuel price hit and Flights reduced, jobs cut at Qantas).

When it comes to physical assets, less is more. For a business to double sales and profits, there is frequently the requirement to increase the level of physical assets. The higher the proportion of physical assets compared to sales that are required, the less cash flow available to the owner. This is the antithesis of the intangible-heavy business that continually produces profits without the need to spend money on maintenance, upgrades or replacements.

Let me demonstrate with an admittedly rudimentary example. Take two companies Rich Pty Limited and Poor Pty Limited. Both companies earn a profit of $100,000. Rich Pty Limited has net assets of $1 million. Intangible assets, such as patents and a brand, represent six hundred thousand dollars while physical assets, including machinery running at full capacity and inventory, represent $400,000. Poor Pty Limited also has a net worth of $1 million, but this time the intangible/intangible mix is reversed and eight hundred thousand dollars represents tangible assets and $200,000 is intangible.

Rich P/L is earning $100,000 from tangible assets of $400,000 and Poor P/L is earning $100,000 from tangible assets of $800,000.

If both companies sought to double earnings, they may also have to double their investment in tangible assets. Rich P/L would have to invest another $400,000 to increase earnings by $100,000. Poor P/L would have to spend another $800,000.

For many investors a large proportion of physical assets – also reflected in a high NTA – is seen as a solid backstop in the event something catastrophic should befall a company. I would suggest that the opposite may just be true. A high level of physical assets may be a drag on your returns.

Physical assets are only worth more if they can generate a higher rate of earnings. Any hope that they are worth more than their book value is based on the ability to sell them for more, and that, in turn, is dependent on either finding a ‘sucker’ to buy them or a buyer who can generate a much higher return and therefore justify the higher price.

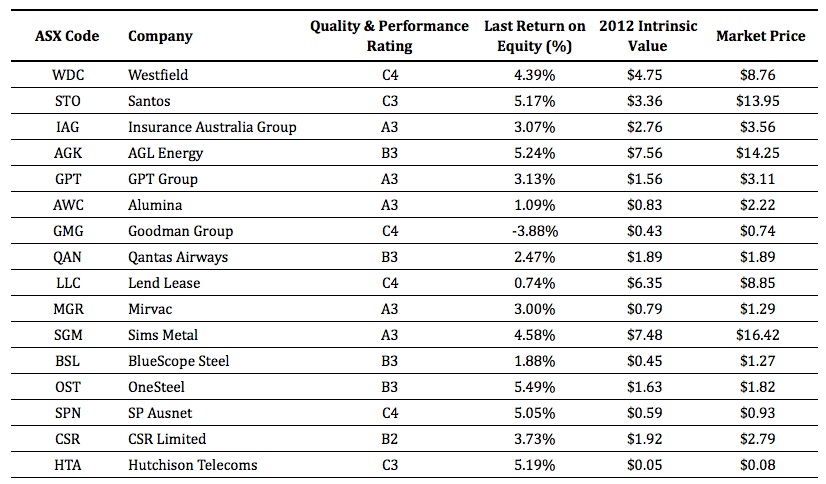

With these ideas in mind, its worth looking at a list of companies that further investigation may show have very high levels of tangible assets compared to their profits. Let’s also throw in those companies that have highly valued intangible assets too. If they are generating low returns on these, the auditors should arguably take a knife to their stated ‘book’ values.

Starting with those companies whose market captitalisation is more than $1 billion (156), I then ranked them by return on equity (return on book value) in ascending order. 49 (31 per cent) companies generate returns less than your bank term deposit. The 16 largest (based on market capitalisation) companies with low ROE, possibly indicating either high levels of tangible assets or possibly overstated intangible assets carried on the balance sheet, are:

I have excluded resource companies. For while there are plenty that qualify, their returns are dependent on commodity prices.

Something to remember about the Quality & Performance Rating…

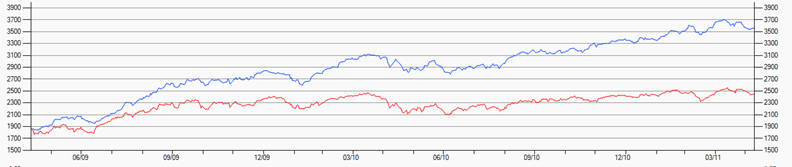

Rated A1 to A5, B1 to B5 and C1 to C5, every listed company is rated based on a series of over 30 discrete metrics, measured at both a point in time and over time. Most importantly, the Quality and Performance Rating is applied without any subjectivity. All companies are judged according to the metrics they generate. A1s have the lowest probability of a liquidation event. “Lowest probability” however doesn’t mean a liquidity event won’t occur. It just means far fewer A1s will have a liquidity event imposed on them compared to C5s. A liquidity event includes a capital raising, debt default or renegotiation, administration, receivership etc. An A1 company could of course raise capital if it needs to fast track construction of a new factory. MCE is an example of a high quality company whose cash flow has needed supplementation for this reason. Sticking to A1s and avoiding C5s should, over time, produce better returns. I demonstrate in the following chart:

The above chart shows the performance of a portfolio of the 20 biggest companies listed on the ASX rated ‘A1’. The red line is the poor old ASX 200.

There is merit with sticking to A1s (just as those who like the taste of Coca-Cola don’t settle for Pepsi). My team and I are fine-tuning something that will make the identification of A1s extraordinarily simple. So ignore those ‘Beat-the-tax-man’ pre-June 30 ‘special’ offers from various investing experts and other ‘helpers’. Avoid the temptation of an extra one, two or three month ‘subscription’, a show bag full of tips, a free magazine, DVD, or even a set of free steak knives.Wait for an A1 opportunity instead. Your patience will be rewarded.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 13 June 2011.

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights, Value.able.

- 80 Comments

- save this article

- 80

- POSTED IN Airlines, Companies, Insightful Insights, Value.able.

-

Are Australian CEOs asleep at the wheel?

Roger Montgomery

May 5, 2011

Have Australia’s lauded CEO’s earned a good reputation when it comes to the impact of their bigger-is-better ambitions on the shareholders for whom they work?

Have Australia’s lauded CEO’s earned a good reputation when it comes to the impact of their bigger-is-better ambitions on the shareholders for whom they work?According to Richard Puntillo; “in theory, publicly traded corporations have shareholders as their kings, boards of directors as the sword-wielding knights who protect the shareholders and managers as the vassals who carry out orders. In practice, in the past decade, managers have become kings who lavish gold upon themselves, boards of directors have become fawning courtiers who take coin in return for an uncritical yes-man function and shareholders have become peasants whose property may be seized at management’s whim.”

When a listed company announces an acquisition, commerciality is often cited as the reason for failure to disclose the purchase price. But with Australia’s corporate graveyard littered with the writedowns of overpriced acquisitions past, it is about time companies treated their shareholders like kings.

I have long advocated the idea that companies should retain profits and reinvest them, provided they can achieve high rates of return on equity. The result? Much higher returns – indeed returns that ultimately match the rate of return on equity being achieved by the company. But the rather worse-than-patchy record of Australian Merger & Acquisitions (M&A) in creating shareholder value, gives shareholders plenty of ammunition in their calls for companies to ‘hand the money back’.

Here’s a couple of examples…

Where, MQR: Montgomery Quality Rating; Value.able IV: Value.able Intrinsic Value; Today: Value.able Intrinsic Value as at today (5 May 2011); Ten Year IV Change: Ten year change in Value.able Intrinsic Value.

Foster’s

MQR: C5; Value.able IV 2001: $2.99; Today: $3.50; Ten Year IV Change: 1.6%p.a.

Foster’s Share Price 2001 $5.71; Today: $5.51

Last week, Foster’s shareholders voted to spin off the company’s wine business. After buying Southcorp for $3.1 billion in 2005 (my valuation using the steps in Value.able was closer to $2.30 per share than the $4.17 Foster’s paid) Foster’s rejected a $2 billion private equity bid for its wine business, saying it “significantly undervalues” the Treasury Wine Estates.

When they bought Southcorp the execs were lyrical in their praise. Trevor O’Hoy said “The combination of our two great companies will create the world’s leading premium wine company”.

If you came to me to buy Southcorp in 2005, the year after it earned just $46 million in profit (the same profit as it earned ten years earlier by the way) and you wanted a margin of safety, I would advise that the right price to pay for Southcorp would be less than 65 cents. Try it yourself – plug 5% return on equity, $1.17 of equity per share and a payout ratio of just over 60 per cent into the Value.able formula. In 2005, when you came to me, the share price was $4.20 and using the price as a reference point, you would have thought I was crazy. The $3.5 billion in writedowns however since then, suggests it is the ‘too-cheap’ price for a copy of Value.able that is crazy!

PaperlinX

MQR: B2; Value.able IV 2001: $2.29; Today: $0.17; Ten Year IV Change: -23%p.a.

PaperlinX Share Price 2001: $4.93; Today: $0.28

On 9 September 2003, PaperlinX announced that it had purchased Buhrmann Paper for $1.1 billion. In June of that year Paperlinx’s share price was $3.77.

At the time, Ian Wightwick, Managing Director of PaperlinX said, “It is very pleasing that the hard work put in by our team undertaking due diligence has confirmed our initial view of the quality of Buhrmann’s Paper Merchanting Division business, its people and its assets. This business has great potential, and we are confident that the acquisition will deliver strong earnings per share growth for our shareholders.”

Ten days after the announcement the share price had shot up to $4.93. My Value.able Intrinsic Value estimation suggests it fell from $2.50 to $1.82! Nine hundred million was borrowed that calendar year and $150 million of capital was raised, to fund the acquisition.

For the year prior to the acquisition, PaperlinX earned $147 million. Since then profits have generally declined every year, and in 2009 PaperlinX lost $197 million and another $29 million in 2010. The share price has fallen from $4.93 to 28 cents today. Worse, there were 447.9 million shares on issue in 2003 and now there are almost 50% more.

AMP

MQR: A3; Value.able IV 2001: $4.01; Today: $3.97; Ten Year IV Change: 0%p.a

AMP (adjusted) Share Price 2001: $13.90; Today: $5.29

AMP launched a cash and scrip bid for AXA Asia Pacific in late 2010. Under the deal with AXA’s French parent, AMP paid more than $4 billion for AXA Asia Pacific’s New Zealand and Australian businesses. The deal valued the entire AXA company at $13.3 billion, but the Value.able intrinsic value of AXA is significantly lower.

AMP bid about $5.40 per share. And just like Southcorp shareholders, AXA shareholders wanted a higher bid. Well of course they did, and as I have said previously, I would rather receive a few million more for my house too. But AXA’s performance doesn’t justify it.

AMP’s chief executive Craig Dunn said that the deal would create an effective competitor to the big four banks and makes AMP the biggest player in all segments of Australia’s $1.2 trillion wealth management sector with 20 per cent market share.

In a bout of déjà vu (reminiscent of PaperlinX), AMP’s shares rallied after the deal was announced.

According to analyst estimates at the time, AXA would generate a return on equity of about 13 percent over the next two years. With the exception of the 2008 loss, the return on equity for the last ten years has ranged between 6.8% in 1999 and 27% in 2003. Based on the forecast ROE and a payout ratio of between 61% and 67%, AXA’s 2010 equity of $2.58 per share is worth a little more than $3.00 per share. At the time of the bid, AXA’s shares traded at $5.84.

When Oxiana and Zinifex merged to form OZ Minerals, the market capitalisation of the two individually amounted to almost $10 billion. Today the merged entity has a market cap of $4.6 billion.

The above examples are not rare. With more space, we could go through many, many more.

Overpaying for assets is not a characteristic unique to ‘mum and dad’ investors. CEOs in Australia have a long and proud history of burning shareholders’ funds to fuel their bigger-is-better ambitions. PaperlinX, Fairfax, Foster’s – the past list of companies and their CEOs that have overpaid for assets, driven down their returns on equity and made the Value.able value of intangible goodwill carried on the balance sheet look absurd, is long.

Nothing gets the blood racing more than a takeover and when blood leaves the head for other regions, common sense usually follows. You should be on your guard when your company announces an acquisition.

Posted by Roger Montgomery, author and fund manager, 3 May 2011.

by Roger Montgomery Posted in Value.able.

- 112 Comments

- save this article

- 112

- POSTED IN Value.able.

-

What does my 2031 crystal ball predict?

Roger Montgomery

January 13, 2011

I’m going to kick off 2011 with two things that I will unlikely repeat. Rather than look at individual companies today – something I am hitherto always focused on (and always will be) – I would like to share my insights, ever so briefly, into what I think are the major and possibly predictable themes for the next twenty years. The second? A 1781 word blog post.

I’m going to kick off 2011 with two things that I will unlikely repeat. Rather than look at individual companies today – something I am hitherto always focused on (and always will be) – I would like to share my insights, ever so briefly, into what I think are the major and possibly predictable themes for the next twenty years. The second? A 1781 word blog post.A word of warning… my track record at correctly predicting market direction is lousy. Thankfully this inability hasn’t hindered my returns thus far and probably won’t in the future.

Having provided that requisite warning, I invite you to consider the following thematic predictions (and yes, they are predictions).

1. Higher Oil Prices

The International Energy Agency (IEA), Energy Information Administration (EIA) and Platts Oilgram News have ‘confirmed’ that peak oil (maximum daily global oil production) was reached in 2005/06. With this backdrop, any hint of Chinese demand increasing and drawing down on spare capacity can cause significant price surges. It is interesting that prior to the last oil price spike, and when oil traded at $90/barrel, US unemployment was about 4%. If someone back then had asked you what the oil price should be in 2011 if US unemployment was more than double – you would not guess ‘still $90’.

It strikes me that there is a lot of demand for oil supporting the price that is not contingent on a strong US economy. China is the first that comes to mind. Other analysis reveals the Middle East, driven by the desire to be a global leader in the manufacture of plastic, is using much more oil than in the past.

And as Jim Rogers has regularly noted; if the US and global economies strengthen, demand for oil will increase. What if they don’t? Rogers anticipates the US Federal Reserve will print more money and the price of commodities will go up.

2. Higher Coal and Uranium Prices

Of the 6.8 billion people on Earth, over 3.5 billion have little or no access to electricity. Irrespective of greenhouse gas concerns, rising demand for energy will see coal’s current share increase. China and India will lead the demand. China’s demand shifted the country to net importer status in 2009 and by 2015 will more than triple consumption from 1990 levels. According to some reports, China is commissioning a coal-fired power plant every week.

In India coal generates three quarters of the country’s electricity, yet over 400 million people have no access to electricity. Demand for coal has risen every year for the past ten years. Some expect India will triple its coal imports in the next… wait for it… two or three years. Democracy hinders the ability of the government to install decent transport infrastructure (it can take six or seven hours to travel just 250 kilometers) and one would expect the same issues will prevent any substantial increase in the domestic mining of coal.

Don’t be surprised if there are more takeovers of Aussie coal companies.

Uranium has recently bounced 50 percent from the lows, but remains half the level of 2007 highs.

If the price of coal and oil rises, then the political opposition to uranium that has resulted in underutilisation of this resource (and of course constrained supply) will cause the price to rise materially.

According to the World Nuclear Association (WNA), global demand for uranium is about 68.5 thousand metric tons. Supply from mines is 51 thousand. The Russian and US megatons-to-megawatts program fills the shortfall, but clearly that provides only a short-term band-aid. So there is already a shortfall; currently, nearly 60 reactors globally are under construction and nearly another 150 are on order.

Late last year China increased its nuclear power target for the end of the new decade by 11 times its current capacity. And China plans to build more plants in the next ten years than the US has, ever.

On the supply side, new mines can take more than a decade to go from permit to production and while Australia has the largest reserve in the world, government debate has barely begun.

3. Higher Rubber Prices

Less than 50 people per 1000 own a car in China, and the country already consumes a third of the world’s rubber! The numbers elsewhere are three times that per thousand. It doesn’t matter whether those cars are electric, hybrid, diesel or petrol – the Chinese will need rubber for their car tyres.

On the supply side, rubber comes from trees predominantly grown in Asia. They take many years to mature and recent catastrophic weather has dented supply.

4. Weather, Weather everywhere

Many years ago my wife gave me a copy of The Weather Makers. In it Tim Flannery predicted the south-east corner of Australia would dry up and the northern states would experience increased rainfall. Whilst it seemed farfetched at the time, it was sufficiently concerning for me to put the purchase of a rural property in the North East of Victoria on hold. The 2009 Black Saturday bushfires and now, the devastating floods being experienced by 75 per cent of Queensland, are enough to convince me that Flannery’s predictions were prescient. The rest of the world has not been spared – the closure of Heathrow and JFK airports are testament to the fact that, irrespective of whether humans are responsible, the climate is changing.

Expect the price of agricultural products and foods to strengthen. This never occurs in a straight line so there will be bumps along the way, but food prices are going to rise and 140 year highs in cotton, for example, may be just the beginning.

Jim Rogers reckons you will be rich if you buy rice, and I would have to agree. Global increases in demand, supply shortfalls and then disruptions due to more violent weather patterns (La Niña notwithstanding) should be expected to dramatically increases prices.

Floods in Thailand (the world’s rice bowl) will cut production, insufficient monsoonal floods will cut production in Vietnam (the world’s second most important rice bowl) and freak weather elsewhere has meant other producing countries now rely more on imports. Rice is the staple for half the world’s population. Riots in 2007, when the price of rice hit a long-term high, offers an insight into how important this food is.

And as Jeremy Grantham said on CNBC: “We’re running out of everything”.

5. Inflation and Interest Rates

With wheat, cotton, pork and oats rising more than 50% last year and copper, sugar, canola and coffee up more than 30%, the inflation train has left the station, so to speak. Then there is the US Federal Reserve’s perpetual printing press – driving yields down and causing a currency tidal wave to flow to emerging countries, like China. Once the funds get there, they seek assets to buy, pushing their prices higher and thus exporting inflation elsewhere.

Despite this, in the US at least, the trend has been to invest in bonds. After being beaten to within an inch of their lives in stocks and real estate, there has been a love affair with bonds. The ridiculously low yields in bonds and treasury notes does not reflect the US’ credit worthiness and has caused some observers -including US Congressman Ron Paul (overseer of the US Fed) in Fortune magazine – to describe US Bonds as being in a “bubble”.

The Fed’s policies are geared towards low interest rates. But artificially-set low rates don’t reflect genuine supply and demand of money – they perpetuate a recession or at best merely defer it. The low rates trigger long-term investment by businesses even though those low rates are not the result of an increase in the supply of savings. If savings are non-existent, then the long-term investment by businesses will produce low returns because customers don’t have the savings to purchase the products the businesses produce. But that is a side issue.

The US, for want of a better description, appears to be bankrupt. A country with the poorest of credit ratings and living off past victories will not forever be offered the ability to charge the lowest interest rates. And China won’t continue to allow itself to be the sponge that absorbs US dollars either. Indeed at the start of this year, China allowed its exporters – for the first time – to invest their foreign currency directly in the countries they were earned. No longer do they have to repatriate foreign funds and hand them to the Peoples Bank of China in return for Yuan. This is a solution that Nouriel Roubini didn’t consider in his article – how China may respond to inflows that inevitably drive up its exchange rate, published in the Financial Review late last year.

5a. Expect US interest rates to rise

Inflation in the US has been held down in the first instance, arguably, by some questionable number crunching, but also by the export of deflation by China to the US. Now the inflation train has left the station (coal, uranium, food, agriculture, rubber et. al., Chinese input costs will go up – because its currency hasn’t (to help its exporters remain competitive)) – and the ability of the US to continue to report benign inflation numbers becomes problematic.

If inflationary expectations rise, so will interest rates. Declining bond prices will again dent the investment performance of pension funds that have been pouring into treasury and municipal bonds (they’re another fascinating story – Subprime Mk II). In turn, the ageing US consumer will feel the double impact of poor present economic conditions and poor retirement prospects.

Over in China, even if the government tries and mitigate inflation by simply capping prices, suppliers won’t invest in additional capacity and the resultant restriction in supply will simply defer, but not prevent, even higher prices.

Tying it all together

It’s far easier to invest when the tide is rising and it is also easier to make profits in businesses when your pool of customers is expanding and becoming wealthier. Value.able investment opportunities (extraordinary businesses at big discounts to intrinsic value) will be found in companies that sell products and services to Asia and India (from financial to construction), as well as those that stand to benefit from the ongoing impact of rising demand for, and [climate] effects on, food and energy etc. These opportunities will dominate my thoughts this year and this decade and I believe they should guide yours too.

So now I ask you – the Value.able Graduate Class of 2010 and Undergraduate class of 2011. What are your views, predictions and suggestions? Which companies do you expect to benefit the most? Be sure to include your reasonings.

I will publish my Montgomery Quality Rating (MQRs) and Montgomery Value Estimate (MVE) for each business you nominate in my next post, later this month.

Posted by Roger Montgomery, 13 January 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

Why aren’t you answering my comments or emails Roger?

Roger Montgomery

December 8, 2010

At 7.30am this morning after inspecting a property, I found myself on the street being presented with a sealed envelope and cryptic directions to a taxi suspiciously parked just 10 metres from where I was standing.

At 7.30am this morning after inspecting a property, I found myself on the street being presented with a sealed envelope and cryptic directions to a taxi suspiciously parked just 10 metres from where I was standing.Turns out my family thought my upcoming 40th was a pretty good reason to celebrate and surprise me! They have whisked me away for a few days, as one of mates put it, for a ‘birthday soriee’.

I am completely unprepared. My laptop sits idle on my desk and iPhone charger is still in the power point (not turned on). I have been told there is an internet café where we are staying, however I’m not certain how reliable the connection will be.

I was planning to publish a new post today: What are the twelve stocks of Christmas? Thankfully all the post requires is one final proof read and then a click on ‘Publish’. I’ll venture down to the internet café this evening.

Please keep posting your comments here at the blog and on Facebook over the next few days and I will reply upon my return. I will be back in the office on Monday 13 December

Thank you in advance for your understanding and patience.

Posted by Roger Montgomery, 8 December 2010.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- 44 Comments

- save this article

- 44

- POSTED IN Insightful Insights, Value.able.

-

Which bank?

Roger Montgomery

November 11, 2010

Everyone from the media, to politicians and litigation funders have been busy bashing our banks over the head. Led by a possibly tipped-off/advised Joe Hockey, this particular attack seems to have legs. Have you been distracted by the noise?

Not me, I have been busy looking at the latest set of financial results from ANZ, NAB and WBC and comparing them to my CBA benchmark.

I have spent many hours and analysed many industries and their KPI’s and for the banks I will simply say that CBA and WBC are currently my two highest quality banks (based on the Montgomery Quality Rating). WBC gets an A1 MQR (up from an A5!), CBA is an A2 (up from an A4). They’re also the biggest.

My salient facts for the big four are shown below.

While ANZ appears to be the cheapest and the most tempting, I continue focusing on the goal of filling the portfolio with only the best businesses. So it may prove a better option to exercise patience and wait for wider safety margins. With the latest round of bank bashing and China announcing further tightening measures, I may not have to wait long.

Between now and then you will read many views about the size of each bank’s reported profits, why they have too much power, why they should cut this fee or stop doing this and that. But keep in perspective that no matter what is written or said, they provide many services and functions that are vital to capitalism.

Another important couple of things to remember is that they collectively have 92% market share and don’t provide all (or any!) of their services for free. ATM Fees… Debit Card Transaction Fees… Annual account-maintenance fees… Monthly Account keeping Fees… Minimum Balance Fees… Wire Transfer Fees… Overdraft Protection Fees… Overdrawn fees… Dishonour Fees… Clearance Fees… Statement Fees… Voucher Fees… Periodical Payments or transfer fees… Stop payment fees… Recent Transaction List Fee… Overseas transaction fees… Electronic banking fees… Interest fees… Establishment Fees… Deferred establishment fees… Over the limit fees… Currency conversion fees… Annual Fees… Deposit Fees… Withdrawal Fees… Online-banking fees… Teller fees… the list goes on, there’s even “late” payments fees for paying your credit card too early.

As you might know there are four basic sources of competitive advantage – something Buffett is primarily focused on – they are: economies of scale, the network effect, intellectual property rights and high switching costs. The four biggest banks enjoy both economies of scale and the benefits of high switching costs. It is personally more taxing for a client to change banks than the benefits that inhere from switching. And so very few people switch. As I have often said, if you live on an island with a long swim to anywhere else, then owning a bank is not a bad idea. They can charge you to put your money in, charge you to take your money out and even charge you to find out how much money you have.

For me, being active in the share market can bring on-line brokerage fees, telephone order fees, custody fees, software fees, transfer fees, late settlement fees, margin lending fees etc…

No matter where you turn, the banks are entrenched in my daily life.

And where do all of these fees, along with net interest income and trading profits go? Into wafer thin 1% margins. Yes, our banks rely on massive volumes. WBC has $620b of assets. A 1% return on those assets equates to a profit of $6.2b – roughly what they reported in their full year result.

They are also some of Australia’s highest leveraged businesses shouldering enormous risks (albeit controlled) to generate that return. If you have ever heard that ‘X’ bank has a tier 1 risk weighted capital ratio of 8%, generally this means that the bank is holding only $8 for every $100 that a customer has borrowed. Being highly geared, it is therefore in the bank’s interest to ensure that everything in our economy ticks along.

By far the biggest variable expenses for banks are bad debts. During the GFC when bad debts increased dramatically, do you remember what happened when things turned ugly? Those wafer thin profit margins disappeared like the last Mars Polar Lander. The impact on NAB’s profits, for example, was dramatic with profit in 2009, $2 billion lower than the year before.

With these risks in mind it seems a tad irrational to quibble over the enormous profits being earned, particularly when they are largely returned to Australians. Shareholders receive 70%-80% of profits in fully franked dividends and the Australian public receive 30% of pre-tax profits via tax payments to the government.

On the other side of the coin is the very real fact that these are mature businesses. As Value.able Graduate Richard Quadrio mentioned in his comment here on the blog yesterday, banks can only increase their profit by either lending us more or charging us more. The former depends on our appetite, which may be slowing. That leaves the latter.

In my mind, they have the power to keep increasing prices but the legislators now need to be convinced that they should be allowed to in return for wanting to continue lending and perpetuating the GDP growth dream. Paralysed by these competing forces, I go back to what I know – investing, and ask; which bank is the best? For me that’s the only question – which bank?

Posted by Roger Montgomery, 11 November 2011.

by Roger Montgomery Posted in Financial Services.

- 114 Comments

- save this article

- 114

- POSTED IN Financial Services.

-

Is cash made from Sandalwood?

Roger Montgomery

October 28, 2010

A number of Value.able Graduates have asked me to share my view on TFS Corporation Ltd (ASX:TFC), the owner and manager of Indian sandalwood plantations in the east Kimberley region of Western Australia (an area I have visited and can’t wait to get back to).

A number of Value.able Graduates have asked me to share my view on TFS Corporation Ltd (ASX:TFC), the owner and manager of Indian sandalwood plantations in the east Kimberley region of Western Australia (an area I have visited and can’t wait to get back to).The first comment is from SI:

“I just had a look at TFS… wow is all I can say. I agree this is a monopoly in the making. They have control over customers with many signing up to a % of production years in advance and $$ to be set at point of sale. There appears to be medical interest developing, significant cosmetic and industry demand and cultural/religious needs not wants. So demand is very strong and lacking substitutes. On the supply side I see world supply is dwindling and TFS is really the only viable source – also natural/sustainable and green! There also appears to be huge barriers to entry for any competition and TFS is 15 years ahead of any rivals! So using Porters 5 forces: they have power over customers, power of suppliers, no realistic substitute, huge barriers to entry and a monopoly position… WOW they are also vertically integrated soil to end product! Also trading on a PE of approx 5, making money now growing trees, paying a dividend and yet to benefit from revenue from harvest….which appears to offer huge revenue flows starting in 2 years.”

And from James:

“… Their ROE is good, payout low and currently well under value.”

Putting aside the more than slight promotional tone of SI’s comments – thanks SI, it appears on first blush that TFS has several things going for it: bright prospects, possible competitive advantages, high levels of profitability and a valuation greater than the current price. Thanks SI for openly sharing your thoughts on the business.

To add my two cents worth, it would be useful to revisit a very important chapter of Value.able: Cashflow and Goodwill. I fear its importance may have been overlooked by readers. There are been precious few questions about, or discussion, of cashflow at my blog, even though it occupies a very large part of my time analysing companies. For TFS, in the current stage of its lifecycle, this chapter has many considerations for investors to take on board before jumping onto the Sandalwood bandwagon.

Let me start on page 147, third paragraph, bold font: “The cashflow of a company that you invest in must be positive rather than negative”. The reason I have emphasised this statement is because I want to make something very clear – reported accounting profits often bears little resemblance to the cash profits or cashflow of a company.

In business you can only spend cash. Indeed, cash is ‘king’. Try going to the local grocer, showing him an empty wallet and offering instead some accounting surplus to pay for the weeks fruit and veg. You will get just as far in business without real cash – unless the business has access to external funding to plug the gap. Please make sure you re-visit Chapter 9 of Value.able.

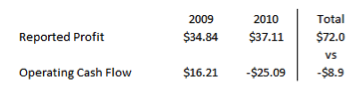

With re-reading from page 145 in mind, focus your attention to the profits and operating cash flows reported by TFS in 2009 and 2010.

TFS has not generated a single dollar of cumulative positive cash flow in the past two years. Despite reporting $72m in profits, TFS actually experienced a cash outflow of -$8.9m. In 2010, a record $37.11m in profits is matched by negative operating cash flows of -$25.09m. Remember page 147, third paragraph, bold font?

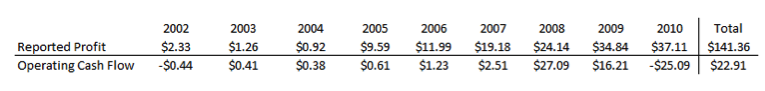

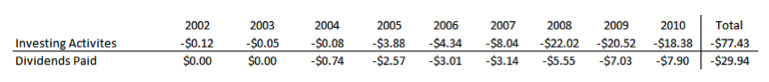

It could however be that the cash flow disparity is merely a timing issue. No problem; a longitudinal study will help. Turning our attention to the past 10 years, is the situation any better?

Total reported profits over this period equate to $141.36m, but this is money TFS cannot spend. The total of operating cash flows produced over the same period, money the business can spend, is significantly lower at $22.91m.

What if I now told you that over the same 10 years, the business had spent $77.43m on investments including property, plant and equipment, and paid $29.94m in dividends!

And all this from Cash Flow of only $22.91m? This is generally only achievable if a business has very accommodating shareholders and financiers – who, to date, have tipped in $61.14m in equity and $43.19m in debt to plug the hole.

Does this business meet Chapter 9’s description of a Value.able business?

Extraordinary businesses don’t have to wait for cash flow. Their already-entrenched competitive position ensures that cash flows readily into management’s hands to be re-deployed/re-invested (with shareholders best interests at heart), or returned.

TFS and many other businesses listed on the ASX are able to utilise various accounting standards to depict the appearance of a profitable business when they are in actual fact heavily reliant on external financing to fund and grow operations.

I am not saying in any way, shape or form that TFS is a business that will head down the same path as many in the sector before it – remember Great Southern Plantations and Timbercorp? TFS may soon produce fruit (so to speak). And if SI and management are right, the business offers “huge revenue flows starting in 2 years”, is a “monopoly in the making” and 2011 will see a significant increase in positive operating cash flow as settlement of institutional sales occurs throughout the year. If this occurs, the business may achieve an investment grade Montgomery Quality Rating (MQR).

I prefer to see runs on the scoreboard – a demonstrated track record – and profits being backed up by uninhibited cash streaming through the door before I open my wallet. Yes, one will miss opportunities adopting this approach but those fish you do catch are generally very good eating.

So until such time as TFS’s cash starts to flow, there are other cash-producing listed A1 businesses to choose from.

This brings up an important point to consider; make sure reported profits are backed up by cash flowing into the business. If it isn’t, be very conservative in your assumptions. Better still, move on to valuing businesses that are extraordinary, those with an MQR of A1, A2 and B1. TFS is a B3.

I will watch this one from the sidelines for now, even if I miss out on returns in the meantime.

Posted by Roger Montgomery, 28 October 2010.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 78 Comments

- save this article

- 78

- POSTED IN Companies, Energy / Resources.

-

Is one man’s trash another man’s treasure?

Roger Montgomery

October 25, 2010

I am writing this post so that we have a record in the event Private Equity some day offers to offload the business to me. It’s one for those of you who have ever been to the local tip and paid for the privilege.

I am writing this post so that we have a record in the event Private Equity some day offers to offload the business to me. It’s one for those of you who have ever been to the local tip and paid for the privilege.It has been reported this week that Visy, the German-based waste group Remondis, Sydney-based Sita Environmental Solutions, private equity groups Ironbridge and Archer as well as listed disappointment Transpacific are all eyeing off garbage collector and tip owner WSN Environmental Solutions.

If you happen to live on Sydney’s north shore and ever had the delightful job of taking a trailer load of rubbish to the tip, you may be familiar with their North Ryde facility at Wicks Road. Drive onto the weigh bridge and over your credit card, go and dump your rubbish and unwanted items, get reweighed and both your car and your credit card are lighter. Ask the ladies at the entry which is the busiest day and they will gladly report; “every day, its always busy here”.

There are huge competitive advantages inherent in approved waste dump sites in high density areas. Environmental regulations ensure the approval of another site being built by a competitor next door is virtually impossible. WSN has 10 sites around Sydney and another at Moruya, about 250kms south of Sydney.

WSN collects kerbside waste, recylables and ‘clean-up day’ waste (225,000 households in 2009), and operates seven transfer stations that streamlines transporting and resource recovery. The company also operates an Alternative Waste Technology facilities as an alternative to landfill and its Eastern Creek facility processes 10% of Sydney’s household waste. The company operates materials recycling facilities (MRFs) at Chullora, Macarthur Resource Recovery Park (Narellan) and Moruya, sorting and recovering resources from the council kerbside collections of 450,000 households.

Aluminium, steel, plastic, paper and cardboard are sent (sold) to manufacturers to be processed into new products. Glass is processed at WSN’s new glass recycling plant at Chullora and marketed (sold) as an additive in bricks, tiles and water filtration materials.

At Lucas Heights, Eastern Creek, Ryde and Chullora Waste and Recycling Centres and Macarthur Resource Recovery park, WSN processes garden organics from 613,300 kerbside collections, as well as from drop-offs by householders (including me occasionally) and small businesses. These materials are used either as biofuel (sold) to produce green energy, or processed into compost and mulch products (sold) for agricultural and horticultural use.

The company also benefits from synergies with its subsidiary, Camden Soil Mix Pty Ltd, a leading composting and blending business in the Macarthur region that currently processes 10 per cent of garden organics in the Sydney basin market. Trading as Camden Soil Mix, the business continues to produce high quality compost from the kerbside garden organics that it receives from councils and contractors.

Think about that for a minute; Councils, individuals and businesses pay the company to take their rubbish away and the company is then paid to sell the processed output. It is paid by its customers and its suppliers. Only online lists and the big supermarkets can claim such wonderful economics.

Importantly, with landfill on the nose (pun intended), revenue from landfill now represents less than half of the company’s total. Back in 2003 it was 85%. Perhaps the biggest risks for the company under private ownership are regulations around environmental impact/footprint and the impact of transport and waste levy costs.

Revenues ‘excluding levy’ have increased substantially each year, despite the fact waste tonnes received was lower in 2009 than in 2005 and are generally stable. But for 2009, at least, that’s where the good news ended.

The business saw cash flow from operations drop by more than 50% from $42 million to $20 million and my ‘business cash flow’ calculation records a loss of $30 million. On a net basis however $44.5 million was spent on new property plant and equipment, but depreciation of roughly $20 million per year probably understates the actual maintenance capital expenditure. So call it a loss of $5 – 10 million. This was however a year (2009) in which expenses – particularly interest thanks to a near doubling of borrowings – significantly exceeded the previous year.

Like QR National, one expects private ownership would produce better results but the listed Transpacific Industries (ASX: TPI) achieves a C4 Montgomery Quality Rating (MQR) and is forecast to generate a return on equity of between 4-6% over the next three years (although TPI did raise $1 billion in 2007 and prior to that year generates much higher ROEs).

According to the media, WSN earned EBITDA of $30 million in 2010. Assuming debt hasn’t changed and is at $62 million (interest $5 million), Assets haven’t changed (depreciation & amortisation $22 million) and tax of 30%, the NPAT for 2010 was about $2 million, or a return on equity of about 1 per cent.

In theory there are some great assets with competitive advantages here (with the risk of legislative change always looming of course). I personally think it could be lucrative to own the Ryde transfer station with perhaps a green waste processing facility thrown in, but it seems the total is worth less than the parts. Perhaps that’s what Private Equity has noticed too.

Oh, and one other thing…watch out for the defined benefits plan, which according to the actuaries (read Buffett’s view about the way the fair values are arrived at) has a shortfall of $3.8 million – thankfully all closed to new members!

Published by Roger Montgomery, 25 October 2010.

UPDATE

A couple of weeks ago, Value.able Graduate Chris shared with me a story about his Grandad, a ‘scrapper’ in Adelaide.

There are some people in this world – affectionately known as “scrappers”, who do indeed take what is someone else’s trash and turn it into treasure. My Grandad was a ‘scrapper’ all his life because he used to recycle tins, lead, batteries, old cars – whatever he had – but he didn’t need to. He had his Army pension and his work pension, and him and Grandma lived quite comfortably, plus we also took care of them. I think that he just loved doing it – the game ! :) He loved the fact you could get something for nothing ! :)

Opal miners in Coober Pedy have been doing this kind of thing for ages – some of them are very, very rich and have a beautiful house down here in Adelaide, but have a rickety old shack up there, built out of scrap sheets and with DIY plumbing and wiring. I think that really, they like it that way – and you have to watch yourself when you set foot in their ‘house’ – never be critical of it or their hospitality, because you never know just who you might be talking to ! (and yes – I DO know some of these people as well, and the opal that they find is beautiful).

When you were in Adelaide, you’ll probably have noticed the “scrappers” riding bikes around or pushing trolleys. They’re raiding the bins for the 10c CDL refund – and let me tell you, I know a couple of them and they’re very savvy ! One of them has got a beautiful, MINT CONDITION 1986 Mercedes – in white. It is gorgeous. To most people, these guys look like they have nothing. Some don’t, but some are very, very wealthy from the sheer hard work and long hours of scrounging cans, iced coffee cartons and bottles to trade in for 10c a piece.

That’s why SA is such a great place – the home of the 10c refund. Yes – I do it too, but mainly for kicks and with whatever’s left over from daily life and the nightly one/two beers with dinner. I’m certainly not a “full time scrapper” like these people, but I put the money away and invest it on top of whatever I get from my normal job.

I love Gordon Elwood’s, Pokey Bills’ and Curt Degerman’s stories !

Chris

by Roger Montgomery Posted in Companies.

- 64 Comments

- save this article

- 64

- POSTED IN Companies.

-

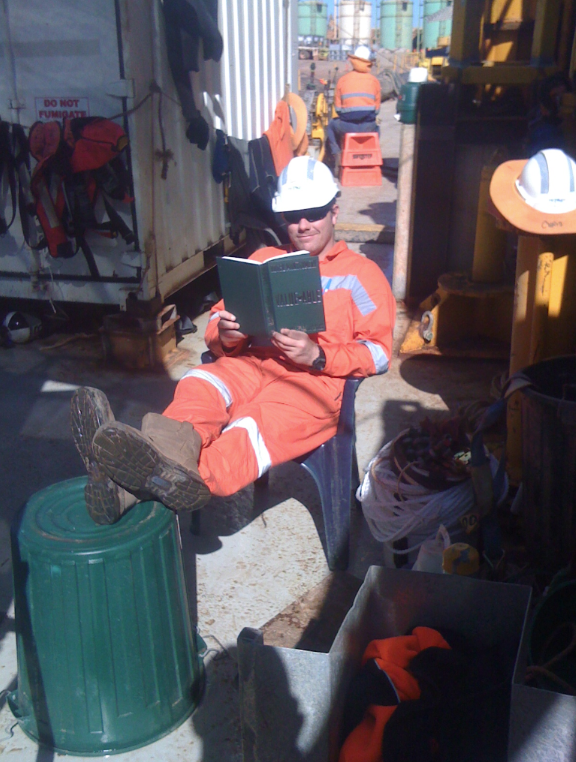

Is this the first photographic evidence of Value.able in action?

Roger Montgomery

August 17, 2010

Based on your emails, blog posts and Facebook comments, I knew my Value.able lesson had spread to Asia, Canada, the UK and the US.

This morning Jesse sent the first photographic evidence of its far-reaching net.