Search Results for: property

-

Can a bubble be made from Coal?

Roger Montgomery

April 19, 2010

Serendibite is arguably the rarest gem on earth. Three known samples exist, amounting to just a few carats. When traded at more than $14,000 per carat, the price is equivalent to more than $2 million per ounce. But that’s serendibite, not coal.

Serendibite is arguably the rarest gem on earth. Three known samples exist, amounting to just a few carats. When traded at more than $14,000 per carat, the price is equivalent to more than $2 million per ounce. But that’s serendibite, not coal.Coal is neither a gem nor rare. It is in fact one of the most abundant fuels on earth and according to the World Coal Institute, at present rates of production supply is secure for more than 130 years.

The way coal companies are trading at present however, you have to conclude that either coal is rare and prices need to be much higher, or there’s a bubble-like mania in the coal sector and prices for coal companies must eventually collapse.

The price suitors are willing to pay for Macarthur Coal and Gloucester Coal cannot be economically justified. Near term projections for revenue, profits or returns on equity cannot explain the prices currently being paid.

To be fair, a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.

Swimming against the tide is not popular. Like driving a car the wrong way down a one-way street, criticism and even abuse follows the investor who seeks to be greedy when others are fearful and fearful when others are greedy. Right now, with analysts’ projections for the price of coal and iron ore to continue rising at high double digit rates, and demand for steel, glass, cement and fibre cement looking like a hockey stick, its unpopular and decidedly contrarian to be thinking that either of these are based on foundations of sand or absent any possibility of change.

The mergers and acquisitions occurring in the coal space now are a function of expectations that the good times will continue unhindered. I hope they’re right. But witness the rash of IPOs and capital raisings in this space. Its not normal. The smart money might just be taking advantage of the enthusiasm and maximising the proceeds from selling.

A serious correction in the demand for our commodities or the prices of stocks is something we don’t need right now. But such are the consequences of overpaying.

Overpaying for assets is not a characteristic unique to ‘mum and dad’ investors either. CEO’s in Australia have a long and proud history of burning shareholders’ funds to fuel their bigger-is-better ambitions. Paperlinx, Telstra, Fairfax, Fosters – the past list of companies and their CEO’s that have overpaid for assets, driven down their returns on equity and made the value of intangible goodwill carried on the balance sheet look absurd is long and not populated solely by small and inexperienced investors. When Oxiana and Zinifex merged, the market capitalisations of the two individually amounted to almost $10 billion. Today the merged entity has a market cap of less than $4 billion.

The mergers and takeovers in the coal space today will not be immune to enthusiastic overpayment. Macarthur Coal is trading way above my intrinsic value for it. Gloucester Coal is trading at more than double my valuation for it.

At best the companies cannot be purchased with a margin of safety. At worst shares cannot be purchased today at prices justified by economic returns.

Either way, returns must therefore diminish.

Posted by Roger Montgomery, 19 April 2010.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.

-

Is there any value in Property Trusts?

Roger Montgomery

April 9, 2010

The other day, Andrew Robertson interviewed me for ABC’s Lateline Business Program about property trusts (you can find the transcript in the Media Room, On TV). I thought you might benefit from an expanded précis.

The other day, Andrew Robertson interviewed me for ABC’s Lateline Business Program about property trusts (you can find the transcript in the Media Room, On TV). I thought you might benefit from an expanded précis.For a very long time, property trusts were described rather derisorily as the investments of widows and orphans – boring, uneventful and staid. Then with the advent of a name change to REITS (Real Estate Investment Trusts), cheap credit and a healthy dose of me-too-ism, property trust managers trotted down the path that took them to near extinction.

Managers of today’s REITS are falling over themselves to once again describe themselves as staid boring old property trusts. But don’t be fooled, while a decade of stable returns and the life savings of so many are gone, many of the managers responsible are not.

With some basic arithmetic, let me explain what has occurred. Company A has $10 of Equity per Share that is returning 7% to 11% year-in and year-out. Somewhere between 2005 and 2006, like a kid at a toy shop screaming “I want one too”, the managers of property trusts started expanding in a debt-fuelled binge to get bigger.

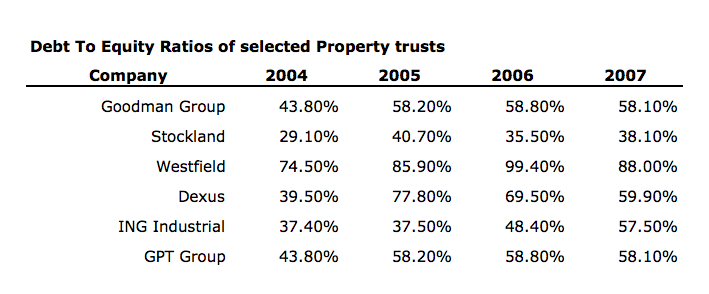

Arguably led by Westfield a year earlier in 2004, and as one might expect, the increased debt produced rising Returns on Equity. But it didn’t last.

The party’s last song may have been August 29, 2007. That’s when Westfield was leading again. It sold a half share of Doncaster Shoppingtown for $738 million to one of the world’s largest property managers, LaSalle, on a yield of 4.7% – a record low. Westfield also sold half of its Westfield Parramatta centre for $717 million at a time when Centro, for example, was still loading up on debt. It sold another $1.3 billion in property-linked notes, launched a UK wholesale fund into which it sold $1.3 billion of its inventory, and sold more than A$750 million of US assets. And while it was selling assets, it was raising $3 billion of capital through a rights issue ostensibly to acquire more assets.

Unfortunately for many investors, the managers of other property concerns thought they were smarter than the Lowys. Have a look at the debt to equity ratios in 2007 and compare them to the corresponding ratios in 2004. And the US was reported to be heading into recession.

While it would be some time before the revelers turned into pumpkins and mice, the band had packed up and gone home.

If you want to set your kids on the road to financial success, tell them this: “If you can’t afford to buy it with cash, you don’t deserve to have it.” Its harsh, but I grew up on that advice. There were a few lay-buys for Christmas, but there wasn’t a single card in my Mother’s glomesh purse.

The lesson however was lost on the property trust managers, and it wasn’t their money anyway!

Eventually everything did turn to pumpkins and mice, and what happened next saved the entities and protected many of the executive jobs but arguably did far fewer favours for the unit holders.

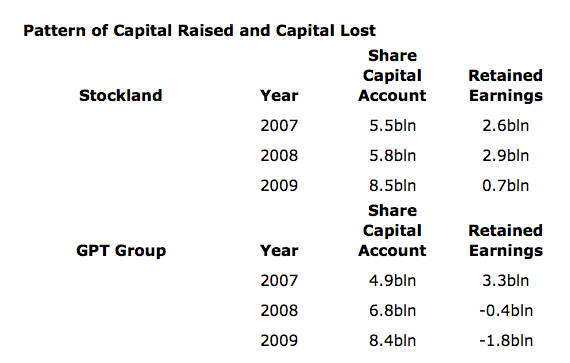

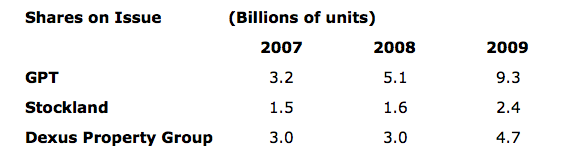

In 2008 Company A writes down its properties, triggering loan covenants and LVR limits. Debt to equity ratio explodes. Bank tells Company A to sort it out. Company A’s share price falls to meaningless price and far below even the written down NTA. Company A conducts a capital raising anyway and issues hundreds of millions of new shares at a discount to the price and in complete annihilation of the equity per share, as the following tables demonstrate.

The result of all this activity, quite apart from the corporate finance fees it generated, was a dilution of Equity per unit, Earnings per unit and Return on Equity.

GPT’s, ING’s and Goodman’s Returns on Equity are expected to average 5 per cent or less for the next two years – that’s less than a bank account. Stockland and Dexus are expected to average 7 or 8 per cent – a little better, but nothing to write home about.

And finally, you can’t dilute Equity per Share, Earnings per Share and Returns on Equity without a reduction in the intrinsic values of these entities, and that’s precisely what has happened.

Stockland’s intrinsic value has fallen from $4.00 in 2008 to $2.16 today. Westfield from $8.25 to $6.71, Dexus from $2.74 in 2007 to 15 cents today and GPT, from $4.10 in 2007 to 30 cents today. Those intrinsic values aren’t going anywhere in a hurry either, unless Returns on Equity can rise significantly, but with debt now substantially lower that appears less likely.

Posted by Roger Montgomery, 9 April 2010.

by Roger Montgomery Posted in Companies, Property.

- 20 Comments

- save this article

- 20

- POSTED IN Companies, Property.

-

Mirvac in talks to buy Westpac trust

Roger Montgomery

April 7, 2010

Developer and funds manager Mirvac has unveiled a $500 million capital raising and revealed it is in exclusive takeover talks with Westpac’s fund management arm. Fund manager Roger Montgomery says he’s not surprised at Mirvac’s interest. Read transcript. Read related blog post.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

What will happen when China’s property bubble bursts

Roger Montgomery

March 11, 2010

When China’s property bubble bursts, what will be the consequences for BHP and RIO? In the first part of his appearance on Your Money Your Call with Nina May Roger Montgomery also discusses Centennial Coal (CEY), Mortgage Choice (MOC), Virgin Blue (VBA), Santos (STO) and Woodside (WPL). Unfortunately none of these companies make Roger’s A1 grade. Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- 4 Comments

- save this article

- 4

- POSTED IN Media Room, TV Appearances.

-

Is The TV Your Investment Strategy?

Roger Montgomery

March 5, 2010

Mark Twain (1835 – 1910) said; “I Am Not So Concerned With The Return On My Money As The Return Of My Money.” It may surprise you to know he was quite the investor and liked to make comment about his observations. His quips always revealed a deep understanding of the nonsense that goes on in the stock market. What fascinates me is that the mistakes Twain observed during his lifetime are being repeated today.

I am occasionally asked why I spend so much time offering my insights when many observe that there is neither an obligation nor financial need. The reason is quite simple, I enjoy the process and of course, the proceeds of investing this way. I find it reasonably undemanding and so I have a little time to share my findings. And there’s the ancillary benefit of seeing hundreds of light-bulb moments when people ‘get it’. I note Buffett’s obligations and financials are even less necessitous and yet he has devoted decades to educating investors and students. I really enjoy my work. It is fun and thank you for making it so.

Investing badly in stocks is both simple and easy. But while investing well is equally simple – it requires 1) an understanding of how the market works, 2) how to identify good companies and finally, 3) how to value them – investing well is not easy.

This is because investing successfully requires the right temperament. You see you can be really bright – smartest kid in the class – and still produce poor or inconsistent returns, invest in lousy businesses, be easily influenced by tips or gamble. I know a few who fit the “intelligent but dumb” category. Because you are bombarded, second-by-second, by hundreds of opinions and because stocks are rising and falling all around you, all the time, investing may be simple but its not easy.

Buffett once said; “If you are in the investment business and have an IQ of 150, sell 30 points to someone else”.

Everyone reading this blog is capable of being terrific investors. But it is important to know what you are doing and to do the right things.

To this end I have asked a couple of investors with whom I have corresponded for permission to discuss their correspondence because it provides a more complete understanding of the research that’s required before buying a share.

I regularly warn investors that what I can do well is value a company. What I cannot do well is predict its short-term share price direction. Long-term valuations (what I do) are not predictions of short term share prices (what I don’t do).

Generally the scorecard over the last 8 months is pretty good. The invested Valueline Portfolio, which I write about in Alan Kohler’s Eureka Report, is up 30% against the market’s 20% rise. I have avoided Telstra and Myer, bought JBH, REH, CSL and COH. Replaced WBC with CBA last year and enjoyed its outperformance. Bought MMS and sold it at close to the highs – right after a sell down by the founding shareholder – avoiding a sharp subsequent decline.

But this year, there have been a couple of reminders of the inability I admit to frequently, that of not being able to accurately predict short term prices. And it is understanding the implications of this that may simultaneously serve to warn and help.

Even though I bought JB Hi-Fi below $9.00 last year, its value earlier this year was significantly higher than its circa $20 price. And the price was falling. It appeared that a Margin of Safety was being presented. And then…the CEO resigned and the company raised its dividend payout ratio. The latter reduces the intrinsic value and the former could too, depending on the capability of Terry Smart.

The point is 1) You need a large margin of safety and 2) DO NOT bet the farm on any one investment – diversify.

You can see my correspondence about this with “Paul” at http://rogermontgomery.com/what-does-jb-hi-fis-result-and-resignation-mean/

The second example is perhaps more predictable. Last year, Peter Switzer asked me for five stocks that were high on the quality scale; not necessarily value, but quality. We didn’t then have time to reveal the list, so I was asked back, in the second half of October 09. By that time, the market had rallied strongly, as had some of the picks. The three main stocks were MMS, JBH and WOW.

But because I didn’t have five at that time, I was asked for a couple more. I offered two more and warned they were “speculative”. “Speculative” is a warning to tread very, very carefully – think of it as meaning a very hot cup of tea balanced on your head. You just don’t need to put yourself in that position! But I was aware that viewers do like to investigate the odd speculative issue. A company earns the ‘speculative’ moniker because its size or exposure (to commodities, for example) or capital intensity render its performance less predictable or reliable, earning it the ‘speculative’ moniker. Nevertheless, based on consensus analyst estimates they were companies whose values were rising and whose prices were at discounts to the intrinsic values at the time – a reasonable starting point for investigative analysis. ERA was one and SXE was the other. Both speculative and neither a company that I would buy personally because their low predictability means valuations can change rapidly and in either direction.

My suggestions on TV or radio should be seen as an additional opinion to the research you have already conducted and should motivate investors to begin the essential requirement to conduct their own research. Unfortunately, I have discovered to my great disappointment, that some people just buy whatever stocks are mentioned by the invited guests on TV. Putting aside the fact that I have said innumerable times that I cannot predict short-term movements of share prices, it seems some investors aren’t even doing the most basic research.

As I have warned here on the blog and my Facebook page on several occasions:

1) I am under no obligation to revisit any previous valuations.

2) I may not be on TV or radio for some weeks and in that time my view may have changed in light of new information. Again, I am not obligated to revisit the previous comments and often not asked. Only a daily show could facilitate that. An example may be, the suggestion to go and investigate ERA because of a very long term view that nuclear power is going be an important source of energy for a growing China followed by a more recent view (see the previous post) that short term risks from a Chinese property bubble could prove to be a significant short-term obstacle to Chinese growth.

3) I don’t know what your particular needs and circumstances are.

4) I assume you are diversified appropriately and never risk the farm in any single investment

5) The stocks that I mention should be viewed, in the context of other research and your adviser’s recommendations, as another opinion to weigh up – to go and research not rush out and trade…rarely is impatience rewarded.

There are further warnings that are relevant and described in the correspondence related to the post you will find at http://rogermontgomery.com/what-does-jb-hi-fis-result-and-resignation-mean/

One investor wrote to me noting he had bought ERA and it had dropped in price. This should not be surprising – in the short run prices can move up and down with no regard or relationship to the value of the business. But like JBH before it, ERA had of course made a surprise announcement that would affect not only the price but the intrinsic value. In this case, it was a downgrade and a rather bleak outlook statement relating to cash flows. Analysts – whose estimates are the basis for forecast valuations here – would be downgrading their forecasts and as a result the valuations would decline just as they did when JB Hi-Fi increased its payout ratio. Over the long-term the valuations in ERA’s case, continue to rise (these valuations are also based on earnings estimates – new ones but which it should be noted are themselves based on commodity prices that are impossibly hard to forecast), but all valuations are lower than they were previously.

Our correspondence reminded me to regularly serve you with NOTICE that there is serious work to be done by you in this business of investing. In a rising market you can pretty much close your eyes and buy anything but you should never conduct yourself this way. If you work appropriately during a bull market, you will be rewarded in weaker markets too. And while many may complain when I say on air “I can’t find anything of value at the moment”, I would rather you complain about the return ON your money than the return OF your money.

Posted by Roger Montgomery, 5 March 2010.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 41 Comments

- save this article

- 41

- POSTED IN Companies, Insightful Insights.

-

Is Australia’s future written inside a fortune cookie?

Roger Montgomery

March 4, 2010

On 3 March I shared my thoughts about the future of Australian companies that supply directly or indirectly, the Chinese building industry, or have more than 70% of their revenues or profits reliant on China with subscribers of Alan Kohler’s Eureka Report. Following are my insights…

Glancing over yet another set of numbers as reporting season draws to a close, my mind started to wander as I wade through forecasts for one, two and three years hence. I began to consider what might happen that could take the shine off these elaborate constructions and which companies are in the firing line. Consider Rio Tinto, which, in an effort to make itself “takeover proof” back in 2007, loaded itself up with debt up to acquire the Canadian aluminium company Alcan. It paid top-of-the-market multiples just 12 months before the biggest credit crunch in living memory forced it to sell assets, raise capital and destroy huge amounts of shareholder value. Do you think they saw that coming?

Before I elaborate on events that could unfold, allow me to indulge in a bit of history and take you back to the mid-1990s when I was in Malaysia and the Kuala Lumpur skyline was filled with cranes because of a credit-fuelled speculative boom. It was the same throughout the region.

A year or so after my visit, the Asian tiger economies were in trouble and the Asian currency crisis was in full flight. These are the returns that are produced by unjustified, credit-fuelled “investing” unsupported by demand fundamentals.

In December 2007, as I travelled to Miami, I experienced a distinct feeling of déjà vu as I once again witnessed residential and commercial property construction fuelled by low interest rates and easy credit, unsupported by any real demand.

These are not isolated incidences. Japan, Dubai, Malaysia, the US. Credit fuelled speculative property booms always end badly.

So what does this have to do with your Australian share portfolio? Australia’s economic good fortune lies in its proximity – and exports of coal and iron ore – to China. Much of those commodities go into the production of steel, one of the major inputs in the building industry.

In China today there is, presently under construction and in addition to the buildings that already exist, 30 billion square feet of residential and commercial space. That is the equivalent of 23 square feet for every single man, woman and child in China. This construction activity has been a key driver of Chinese capital spending and resource consumption.

About two years ago if you looked at all the buildings, the roads the office towers and apartments under construction the only thought to pop into your head would be to consider how much energy would be required to light and heat all those spaces.

But that won’t be necessary if they all remain empty. In the commercial sector, the vacancy rate stands at 20% and construction industry continues to build a bank of space that is more than required for a very, very long time.

Because of this I am more than a little concerned about any Australian company that sells the bulk of its output to the Chinese, to be used in construction. That means steel and iron ore, aluminium, glass, bricks, fibre cement … you name it.

Last year China imported 42% more iron ore than the year before, while the rest of the world fell in a heap. It consumes 40% of the world’s coal and the growth has increased Australia’s reliance on China; China buys almost three-quarters of Australia’s iron ore exports – 280 million of their 630 million tonne demand.

The key concern for investors is to examine the valuations of companies that sell the bulk of their output to China. Any company that is trading at a substantial premium to its valuation on the hope that it will be sustained by Chinese demand, without a speed hump, may be more risk than you care for your portfolio to endure.

The biggest risks are any companies that are selling more than 70% of their output to China but anything over 20% on the revenue line could have major consequences.

BHP generates about 20%, or $11 billion, of its $56 billion revenue from China; and Rio 24%, or $11 billion, from its $46 billion revenue. BHP’s adjusted net profit before tax was $19.8 billion last year and Rio’s was $8.7 billion.

While BHP’s profitability would be substantially impacted by any speed bumps that emerge from China, the effect on Rio Tinto would be far worse.

According to my method of valuation, Rio Tinto is worth no more than its current share price and while the debt associated with the $43 billion purchase of Alcan is declining, the dilutive capital raisings (so far avoided by BHP) have been disastrous for its shareholders.

As a result, return on equity is expected to fall from 45% to 16% for the next three years. Most importantly the massive growth in earnings for the next three years is driven by the ever-optimistic analysts who are relying on China’s growth to extend in a smooth upward trajectory.

Go through your portfolio: do you own any companies that supply directly or indirectly, the Chinese building industry, have more than 70% of their revenues or profits reliant on China and are trading at steep premiums to intrinsic value?

Make no mistake: Australia’s future is written inside a fortune cookie – some companies’ more than others.

Subscribe to Alan’s Eureka Report at www.eurekareport.com.au.

Posted by Roger Montgomery, 4 March 2010

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.

-

What does Roger Montgomery think of FWD, ANZ, CBA and HIG?

Roger Montgomery

February 25, 2010

Roger Montgomery joins Nina May on Your Money Your Call and answers viewer questions about Fleetwood (FWD), suppliers of the China property boom, identifying companies with durable competitive advantages, ANZ, CBA, Highlands Pacific (HIG), and the key ratio to look at when assessing mining companies.Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

What are Roger Montgomery’s current and future valuations for WBC, CBA, ANZ and NAB

Roger Montgomery

February 11, 2010

BHP or RIO – both are expensive, but which is the better business with high ROE, low debt and a rising intrinsic value? Roger Montgomery also reveals the current and future values of Westpac, CBA, ANZ and NAB, repeats his thoughts on Telstra and answers viewer questions about Valad Property and his five rules of when to sell. Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

The Lowe’s are the best in the business, but would I buy Westfield?

Roger Montgomery

January 30, 2010

Since early December Paul, Squigly, Steven and Darren have requested I value Westfield. WDC is also a popular stock with viewers of Nina May’s Your Money Your Call on the Sky Business Channel (you can watch highlights at my YouTube channel, just type ‘Westfield’ into the search feature), and rightly so. It’s a company run by three of the most capable men in the world and one whose shares I have owned in the past.

Today its price, according to a number of analysts and strategists, does not appear to have responded to expectations for an improvement in economic conditions in the US. The biggest gap between inventories and orders since the mid 70’s, the decline in housing inventory, the strong turnaround in cyclical indicators and the steep yield curve all suggest an acceleration in US economic growth – by the way if this doesn’t sound like me, you are right. I am just repeating what I have been reading.

I don’t subscribe to the view that it’s the job of the investor to allow macro economic forecasts to influence micro-based investment decisions.

If however the economists are right, and the US economic recovery does gain traction, then all that remains is a recovery in consumer confidence to see Westfield benefit. Of course if the US economic strength is sustained, then one suspects the US dollar will also recover, making Westfield’s profits more valuable in Australian dollar terms.

Those things aside, lets have a quick look at the valuation and take a dispassionate view about the price irrespective of whether others believe the price has or hasn’t responded to US growth expectations. Continue…

by Roger Montgomery Posted in Companies, Consumer discretionary, Property.

- 9 Comments

- save this article

- 9

- POSTED IN Companies, Consumer discretionary, Property.

-

Should shareholders be treated like Kings?

rogermontgomeryinsights

September 1, 2009

According to Richard Puntillo, in theory, publicly traded corporations have shareholders as their kings, boards of directors as the sword-wielding knights who protect the shareholders and managers as the vassals who carry out orders. In practice, in the past decade, managers have become kings who lavish gold upon themselves, boards of directors have become fawning courtiers who take coin in return for an uncritical yes-man function and shareholders have become peasants whose property may be seized at management’s whim.

When a listed company announces an acquisition, commerciality is often cited as the reason for failure to disclose the purchase price. But with Australia’s corporate graveyard littered with the write downs of overpriced acquisitions past (think Fosters, Paperlinx,AMP, Lend Lease, RIO and Valad) it is about time that companies treated their shareholders like kings.

By Roger Montgomery, 1 September 2009

by rogermontgomeryinsights Posted in Insightful Insights.

- 2 Comments

- save this article

- 2

- POSTED IN Insightful Insights.