Is there any value in Property Trusts?

The other day, Andrew Robertson interviewed me for ABC’s Lateline Business Program about property trusts (you can find the transcript in the Media Room, On TV). I thought you might benefit from an expanded précis.

The other day, Andrew Robertson interviewed me for ABC’s Lateline Business Program about property trusts (you can find the transcript in the Media Room, On TV). I thought you might benefit from an expanded précis.

For a very long time, property trusts were described rather derisorily as the investments of widows and orphans – boring, uneventful and staid. Then with the advent of a name change to REITS (Real Estate Investment Trusts), cheap credit and a healthy dose of me-too-ism, property trust managers trotted down the path that took them to near extinction.

Managers of today’s REITS are falling over themselves to once again describe themselves as staid boring old property trusts. But don’t be fooled, while a decade of stable returns and the life savings of so many are gone, many of the managers responsible are not.

With some basic arithmetic, let me explain what has occurred. Company A has $10 of Equity per Share that is returning 7% to 11% year-in and year-out. Somewhere between 2005 and 2006, like a kid at a toy shop screaming “I want one too”, the managers of property trusts started expanding in a debt-fuelled binge to get bigger.

Arguably led by Westfield a year earlier in 2004, and as one might expect, the increased debt produced rising Returns on Equity. But it didn’t last.

The party’s last song may have been August 29, 2007. That’s when Westfield was leading again. It sold a half share of Doncaster Shoppingtown for $738 million to one of the world’s largest property managers, LaSalle, on a yield of 4.7% – a record low. Westfield also sold half of its Westfield Parramatta centre for $717 million at a time when Centro, for example, was still loading up on debt. It sold another $1.3 billion in property-linked notes, launched a UK wholesale fund into which it sold $1.3 billion of its inventory, and sold more than A$750 million of US assets. And while it was selling assets, it was raising $3 billion of capital through a rights issue ostensibly to acquire more assets.

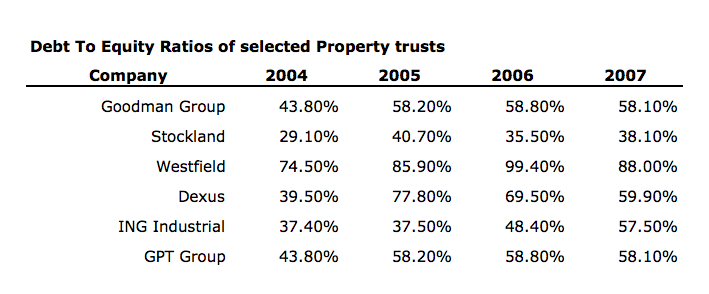

Unfortunately for many investors, the managers of other property concerns thought they were smarter than the Lowys. Have a look at the debt to equity ratios in 2007 and compare them to the corresponding ratios in 2004. And the US was reported to be heading into recession.

While it would be some time before the revelers turned into pumpkins and mice, the band had packed up and gone home.

If you want to set your kids on the road to financial success, tell them this: “If you can’t afford to buy it with cash, you don’t deserve to have it.” Its harsh, but I grew up on that advice. There were a few lay-buys for Christmas, but there wasn’t a single card in my Mother’s glomesh purse.

The lesson however was lost on the property trust managers, and it wasn’t their money anyway!

Eventually everything did turn to pumpkins and mice, and what happened next saved the entities and protected many of the executive jobs but arguably did far fewer favours for the unit holders.

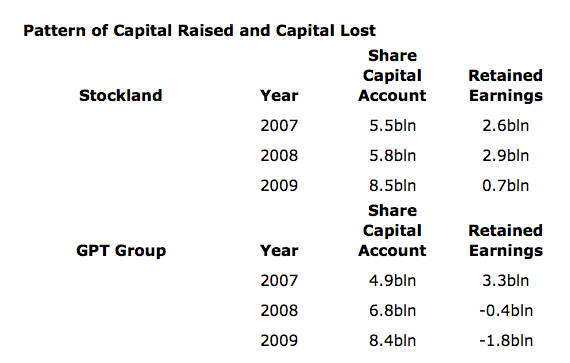

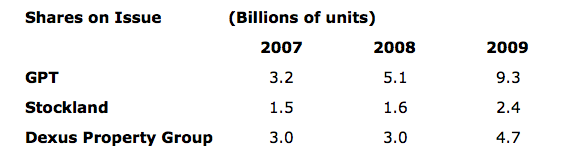

In 2008 Company A writes down its properties, triggering loan covenants and LVR limits. Debt to equity ratio explodes. Bank tells Company A to sort it out. Company A’s share price falls to meaningless price and far below even the written down NTA. Company A conducts a capital raising anyway and issues hundreds of millions of new shares at a discount to the price and in complete annihilation of the equity per share, as the following tables demonstrate.

The result of all this activity, quite apart from the corporate finance fees it generated, was a dilution of Equity per unit, Earnings per unit and Return on Equity.

GPT’s, ING’s and Goodman’s Returns on Equity are expected to average 5 per cent or less for the next two years – that’s less than a bank account. Stockland and Dexus are expected to average 7 or 8 per cent – a little better, but nothing to write home about.

And finally, you can’t dilute Equity per Share, Earnings per Share and Returns on Equity without a reduction in the intrinsic values of these entities, and that’s precisely what has happened.

Stockland’s intrinsic value has fallen from $4.00 in 2008 to $2.16 today. Westfield from $8.25 to $6.71, Dexus from $2.74 in 2007 to 15 cents today and GPT, from $4.10 in 2007 to 30 cents today. Those intrinsic values aren’t going anywhere in a hurry either, unless Returns on Equity can rise significantly, but with debt now substantially lower that appears less likely.

Posted by Roger Montgomery, 9 April 2010.

Stephanovic

:

Hello Roger,

Any thoughts on WRT?

Seems way over intrinsic value but should REIT’s be valued differently?

While debt is likely to be low they have commitments to $406 million in capex in the next 12 months.

Thanks

Roger Montgomery

:

Hi Steph,

I do make some adjustemnets to the reported profit figures for REITs, suffice to say I cannot find any bargains.

Wing

:

Hi Roger,

Thanks again. As you have already pointed out, REITs have destroyed billions of wealth during the financial crisis as they geared too much to buy overvalued assets, and had to write-down assets plus huge dilution of their equities through capital raising.

I maybe wrong. When you analyse their earnings, how will you treat those asset “write-offs”? and if you have included them in your valuation, is there any chances that when the economy gets better in the next few years, they will mark up their assets again?

Also, I have been closely watching any news from FGE… I don’t think anyone will accept the offer which is lower than the market price unless they want to give an early Xma’s present to CLO. Hope you can update us your view on FGE when any news & figures available.

Great thanks & wish to read your book soon :)

Wing

admin

:

Hi Wing,

For a REIT ‘revals’ and ‘devals’ are a normal part of the business. Your job as an investor is to see through them to decide whether they are sustainable. You could try that by taking all the changes out and you would simply be looking at teh rental income which is also perhaps not realistic. Over time however capital growth will track the improvement in the performance of the asset. Go to the FGE stream of comments to see my thoughts there. Basically, it doesn’t matter whether you accept Clough’s bid or not. They say they will secure 31% which will trigger the strategic alliance. It doesn’t change the value fo the company in the short term.

Ben

:

Hi Roger,

A similar investing proposition seems to be the utilities and infrastructure related stocks. ie; APA, DUE etc. They seem to also use heavy gearing and have had large capital raisings over the past 12-18 months.

Using Warren Buffett’s formula for calculating intrinsic value for stocks that pay all their earnings out as dividends, most of these companies seem outrageously overvalued. Mainly because they all seem to be earning very low ROEs and have enormous amounts of debt as well (imagine how low they would be without the debt).

What I notice however is many of them are paying out more than earnings. Does that mean intrinsic values are even lower than calculated? Was wondering what happens in that case.

Cheers

admin

:

Hi Ben,

Yes. Because the dividends are effectively reducing equity (unless gearing increases even further).

bradley

:

Hi Roger

Thanks for opening discussion on REITS – the scenarios you paint above are exactly my nightmare!

I am embarrassed to say I bought MPF and a bagful of hope at 50c in 2008 , bought more on the way down and am left with debt and stock worth 10c today ( written down NTA 38c) My only excuse is that I was following the lead of my financial advisor!

My question is this – it could apply to any investment – when you do make a major mistake like this and face an 80% loss , do you stay in and treat it as an ongoing lesson , or is it best to take the loss so you aren’t reminded of your failure every day???

Have you any experience of this you can share?

Bradley

admin

:

Hi Bradley,

I don’t have this experience to the extent that the decision to stay or go was a big deal. If the position was weighted correctly, then the decision is an easier one. My recommendation is to go back to that adviser that put you in and demand a response about what to do now.

Alan

:

Hi Roger

Any thoughts on the Goodman Group (GMG)? What is their intrinsic value?

Thanks

admin

:

Hi Alan,

I will get that to you in a few days.

Roger

:

Hi Roger

I have for the last year or so watched Cromwell (CMW}….they have a balanced business and seem to have navigated through the last couple of years quite well…..what are your observations and view of potential please

Thankyou

RB

admin

:

Hi Roger B.,

I have now had a few requests for this company so I will look into it.

Chris

:

Roger, thanks for the article on A-REITs.

Just for my own understanding – surely it is very difficult to make a high ROE if you are a conservative, Australian-only focused, plain, vanilla model (buy, lease, collect rent) with very low debt as some A-REITs are ?

They are still good income producing assets, just – you’re not going to see mega capital growth from them – but they would be able to provide the portfolio with a level of income, or for an investor more focused in this area, as opposed to capital growth.

The ones that I am thinking of don’t really have a stellar ROE – high single digits – and since, by definition, the ‘classic’ model was to buy,lease,collect – they weren’t actually ‘producing’ anything that they could ‘sell’ in a great quantity like a developer (more buildings) or an industrial (widgets from a factory). Hence, in this model, with annual x% above CPI rent rises, your level of revenue is fairly predictable – you know which buildings you own and what your rents are – and so, your profits would be too, because property is less volatile than an equity share.

I say this because they are just buying a building, not overgearing the portfolio and collecting the rent. No property development work (which would potentially increase the gains and the revenue), no overseas ventures.

P.S. The GICS classification of ‘financials’ under my broker account annoys me because to me, they are not ‘Financials’, when they can class the other side of the coin as ‘Fin x-REITS’ – making my asset allocation look skewiff.

admin

:

Hi Chris,

Yes the GICS classifications have caused me a lot of frustration too but that is not something most investors have to worry about. Regarding REIT’s I don’t have a problem with the lower ROE’s here. You can value the companies just the same. The issue I have is that the ROEs have declined substantially and therefore, so have the values. That decline has been compounded by the issue of shares and the reduction total wipeout of retained earnings.

Steve

:

Hi Roger,

Thanks for this great insight into property trusts.

I was wondering if you would give me your thoughts and possible valuation on another company called Ardent Leisure Group (AAD). It is listed as a property trust but has become more of an operating company comprising of leisure assets including theme parks, bowling, gyms and marinas. I have owned it for many years and it had always done well in the past. It seems to have hit a hurdle in recent months and I wonder if this is partly because of the reduction in return on equity, similar to the scenario you wrote about above, due to their recent capital raising. I feel that the assets they own are of a high quality, have a good management team and that leisure spending should increase again as the economy picks up. Do you think the ROE is going to take too long to catch up in this instance?

Thanks in advance.

admin

:

Hi Steve,

Great question. I hadn’t heard of Ardent but your description, particularly the combination of bowling and Marina assets tells me its the old Macquarie Leisure – a company I have always been intrigued by. But in 2007 when the price hit $3.80 per unit, the intrinsic value had fallen to $1.32 from $1.90. Intrinsic value now is 92 cents, thats up lots from 2009 but there has been much change in intrinsic value for three or four years and so you cannot expect the price to do much if the value isn’t going anywhere.

David C.

:

Roger

A lot of Australians seem to be trying to build their own little residential property trusts (gearing into multiple residential investment properties) as a path to wealth creation and financial independence. Assisted by the tax shelter of negative gearing.

Do you have any comments on this trend? Are they making the same mistakes as the AREITS but with limited access to equity capital via capital raisings?

Can/ have you apply/ applied your valuation approach to residential property investment?

I’m not aware of a listed AREIT investing in residential properties? Is this correct?

Thanks DC

admin

:

Hi David,

Asset prices cannot continue to grow independently of their intrinsic values which are driven by their cash generating ability. Its a big mistake to say that I I will get 20% capital growth” if the income growth doesn’t support it. Middle class and upper middle class property speculators in China who buy 3, 4 or 5 condos and don’t tenant them (in order to keep them new looking and while ignoring depreciation) are about to find this out. Negative gearing is a euphemism for; losing $1 to save 50 cents. In the short run you can make a lot of money if you time it right because in the short run the market for property is a voting machine, but like all asset markets, in the long run its a weighing machine.

Chris

:

Absolutely. Glenn Stevens is right (in my view) for his comments earlier in the week about “not punting on property as a guaranteed road to wealth”. Australians have a mania with residential property – talk about any other kind like Industrial or Commercial, or any other asset class to ‘mum and dad’ investors and their eyes glaze over or they think that the sharemarket is ‘risky’ and houses are ‘safe’, like a T-bill.

Many mainland Chinese have found themselves in the seemingly enviable position of having too much money and not enough things to buy with it or invest it in, but as Roger has pointed out, and in my words, “this methodology of investing is something of a false economy”. They have had their eyes opened to the good things that the West can offer, they marvel at all the (seemingly) plentiful supply of nice food and drink, handbags, cars, our big houses, multiple TV channels etc. – and now they want them too.

I know because I just hosted some middle-class Chinese guests here recently. They went nuts – over-consuming fine brandies, cigars, oysters, seafood, meat etc. and thought my (modest) house was ‘huge’. They were astounded I had two cars.

Maybe their money is finding it’s way to other countries that are not quite a high sovereign risk as their own – in case the mighty PRC undergoes major change and the party (sic) is pooped ? It happened in East Germany and other Eastern-bloc nations, why not in China ?

Tim

:

Excellent question David C.