Search Results for: property

-

Hyper what?

Roger Montgomery

December 12, 2011

How many of you have heard the financial term ‘Hypothecation’? Microsoft word hasn’t – the bug-prone program constantly tells me to check the spelling. If it’s also new to you, take note because you may be hearing a lot more about it and it could impact your portfolio.

How many of you have heard the financial term ‘Hypothecation’? Microsoft word hasn’t – the bug-prone program constantly tells me to check the spelling. If it’s also new to you, take note because you may be hearing a lot more about it and it could impact your portfolio.Prior to the collapse of MF Global, it’s unlikely that many in the investment world would have ever heard of the terms; ‘hypothecation’ or ‘re-hypothecation. If you hold any dollars in an international brokerage / trading account, especially one where your funds are dispatched to somewhere in the UK, hypothecation may be the canary in the mine.

MF Global was allegedly using client-segregated monies for its own trading activities – a practice that is for obvious reasons, not practiced in most countries. The trading brought a 230-year old firm to its knees in a matter of weeks and resulted in the freezing of client funds. Funds thought to be ‘segregated’ and separate from the working capital of the firm, weren’t. But is MF Global an isolated case or is a practice that levers clients funds widely practiced and one that could undermine the financial system?

What the MF Global collapse has uncovered is that laws designed to prevent to access to ‘segregated’ accounts are being circumvented. Some firms may have also shifted accounts to countries where it is legal to access client’s funds for the firms trading activities. When you thought the only risk was that of your trade or investment selection going wrong, think again.

Hypothecation is, in simple terms, the practice of a borrower putting up collateral to secure a debt. An example of this is the typical purchase of a house. The buyer puts down a 20% deposit and borrows the remaining 80%. In this case the borrower has put up some cash and the house (at an agreed value) as collateral to cover the debt until the mortgage is paid off. Until such the borrower retains ownership of the collateral. Thus the collateral (both the deposit and the house) remains “hypothetically” controlled by the creditor, usually a bank. If the borrower can’t afford to meet agreed repayments (default), the creditor can take possession of the collateral and sell it to recover its assets. That’s Hypothecation – hypothetically the borrower owns the house, but in fact, they don’t until all loans are paid off. The same goes for securities purchased on margin.

With the basics out of the way we return to MF Global. Surprisingly hypothecation occurs when an investor puts their capital into a trading account to buy and sell securities such as CFD’s, Futures, Options, Commodities, etc.

And that should be that. Your money sits in your segregated trading account as collateral covering your positions – margined or not – until such as a time that you suffer an inability to pay back your debt to your broker (creditor) – if you ever do. And that is as we know it in Australia. MF Global here in Australia appears to have followed that procedure. But has it done so in the UK and the US? And how do others behave?

The practice and rules regulating hypothecation vary depending on the jurisdiction in which the trading account exists. In the US for example, the legal right for the creditor to ONLY take FULL ownership of the collateral if the debtor defaults is classified as a lien – a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation.

In the UK however, these rules are more than a little different. In the US there are some breaks, re-hypothecation is capped at 140% of a client’s debit balance. In the UK however, there is no limit on the amount of a clients funds that can be re-hypothecated, except if the client has negotiated an agreement with their broker that includes a limit or prohibition. UK brokers can ‘REUSE’ collateral put up by clients to secure their own trading activities and borrowings through a little unknown process called Re-hypothecation! While you may think that your ‘segregated’ capital is being used only as collateral for your own trading activities and borrowings / margin, a firm such as MF Global who operates out of the UK, can re-use their clients collateral to back their own trades and borrowings! Are you thinking credit card on credit card, gearing on gearing, leverage on leverage? And how do excessively leveraged position usually work out? Not well generally.

In the industry it’s referred to as “fractional reserve” synthetic liquidity creation by Prime Brokers. The IMF in their 2010 paper The (sizable) Role of Rehypothecation in the Shadow Banking System” Manmohan Singh and James Aitken state: “Mathematically, the cumulative ‘collateral creation’ can be infinite in the United Kingdom”. They add that courtesy of no re-hypothecation haircuts one can achieve infinite “shadow” leverage and the creation of a large shadow banking system.

Gary Gorton in his 2009 paper “Haircuts” about systemic risk in the repo market (something I used to teach for the Securities Institiute of Australia) suggests that banks’ reliance on the repo market constitutes a systemic fragility which renders the entire banking system prone to runs: “Gorton predicts the crisis was not a one-off event and it could happen again”.

He also addresses the relationship between confidence and liquidity suggesting when “confidence” is lost, “liquidity dries up” and concludes the financial crisis was a manifestation of an age-old problem with private money creation, banking panics. ‘Haircuts’ are the functional equivalent of information arbitrage: “When all investors act in the run and the haircuts become high enough, the securitized banking system cannot finance itself and is forced to sell assets, driving down asset prices. The assets become information-sensitive; liquidity dries up. As with the panics of the nineteenth and early twentieth centuries, the system is insolvent.” “Liquidity requires symmetric information, which is easiest to achieve when everyone is ignorant. This determines the design of many securities, including the design of debt and securitization.”

What Gorton says is that the increasing complexity of banks and the securities they issue is motivated by the need to obfuscate the masses and distract them from what is really occurring.

Let’s say a hedge fund (who is managing your money) puts up $100,000 collateral to support a leveraged position of $1,000,000. If the broker then re-hypothecates that $100,000 and uses this to support the same level of leverage, the firm is in a position where just $100,000 in collateral (not theirs) is supporting $2,000,000 in leveraged market positions.

A move of just 5% on $2,000,000 equates to $100,000 in profit and both you and your broker make $50,000 each. A move however of 5% against a $2,000,000 position can however wipe most of the collateral – and such moves are not uncommon today. While a single trade will unlikely bring down a broker’s diversified trading book, if all trades move in unison (remember US house prices were never expected to all decline at once), as was the case when MF Global traded European bonds, you can see how quickly everything can unravel.

And remember, while the broking firm enjoys all of the trading profits and fees, the clients bear the risk. If the broker loses, they file for bankruptcy, leaving clients holding an empty can. This appears to be what transpired at MF Global. It’s the ultimate privatization of profits and socialization of losses. And according to an increasingly vocal group of experts it could all happen again if a sovereign defaults.

And now you also have the reason why Central Banks around the world are applying a policy of ‘price stability’ or ‘price support’ in asset markets like the stock market – everyone is leveraged to the hilt.

It has been estimated that in 2007, re-hypothecation accounted 50% of the worlds Shadow banking system and the IMF estimated that US banks received $4 trillion of funding from the UK from re-hypothecation using just $1 trillion in clients funds, funds being levered several times over. In this light, don’t think for a moment that MF Global is alone in using client’s funds to trade and borrow for their own trading activities.

It appears in the current market environment that the first question you should ask is not whether or not your investment idea will work out correctly, it’s more a question of whether the money you put into your broker sponsored account will ever come back.And now that re-hypothecation is exposed, I wonder how many assets have been double, tripled and quadruple-counted. An expose on this subject by Reuters about this subject following the collapse of MF Global, revealed that “Engaging in hyper-hypothecation have been Goldman Sachs ($28.17 billion re-hypothecated in 2011), Canadian Imperial Bank of Commerce (re-pledged $72 billion in client assets), Royal Bank of Canada (re-pledged $53.8 billion of $126.7 billion available for re-pledging), Oppenheimer Holdings ($15.3 million), Credit Suisse (CHF 332 billion), Knight Capital Group ($1.17 billion), Interactive Brokers ($14.5 billion), Wells Fargo ($19.6 billion), JP Morgan($546.2 billion) and Morgan Stanley ($410 billion).”

And if you are wondering what the implications are, it may not be what you think. Initially there will be the denials and then, if Prime Brokers have to recall all the stock they lent out, imagine the global short covering rally?

And meanwhile the Euro crisis related elimination of deficit spending could force banks into administration or liquidation, which in turn causes assets to be marked down to market and pressure on equities. We invest in interesting times…but don’t forget highest quality stocks at substantial discounts to intrinsic value.

Posted by Roger Montgomery, Value.able author and Fund Manager, 12 December 2011.

by Roger Montgomery Posted in Financial Services.

- 33 Comments

- save this article

- 33

- POSTED IN Financial Services.

-

Is the bubble bursting?

Roger Montgomery

December 8, 2011

In 2010 here at the Insights Blog I wrote:

In 2010 here at the Insights Blog I wrote:“a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.”

I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to bigs drops in margins for a sizeable portion of the market index…

Watch this video and decide for yourself.

Posted by Roger Montgomery, Value.able author and Fund Manager, 8 December 2011.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation, Property, Value.able.

-

Are bargains available at Woolworths?

Roger Montgomery

November 17, 2011

On Wednesday November 2 Woolworths held a strategy briefing for professional investors. Woolworth’s effectively asked us to adopt a longer time frame before judging its performance and revealed four strategic priorities that I will describe in a moment.

Prior to the strategy day, the company updated the stock market with a growth outlook that was the lowest in a decade. The market responded negatively to the change and it entrenched previous sentiment by professional investors to switch from Woolworths to Coles.

But Woolworths remains a superior business from a business economics perspective, with high return on equity and it also remains cheaper than its competitor as measured by the larger discount to an estimate of its intrinsic value.

The wider sentiment towards Woolworths Supermarkets is that the period of strong growth is over, and the other businesses, such as Big W, the New Zealand supermarkets, the Masters hardware venture and a possible acquisition of The Warehouse group could be the focus of earnings growth for the company. Gambling pre-committments would not be.

Meanwhile, the Woolworths-owned Dick Smith electronics business appears to have failed to excite consumers and has certainly failed to excite investment professionals. Dick Smith is a relatively weak offering in a market that has been hit particularly hard by the empowerment of the consumer through high Australian dollar.

Moreover, in many ways these businesses are peripheral since the Australian Food & Liquor division accounts for 80% of earnings before interest and tax.

The impact of the company’s lower growth profile on intrinsic value, particularly intrinsic values over the next two years, has been negative and intrinsic value does not appear to be going anywhere in a great hurry (see Skaffold chart below).

This combination of circumstances, in my experience, set Woolworths shares up to be vulnerable to any negative shocks.

Estimating intrinsic value is not the same as predicting price direction, however the above circumstances are not unique historically in putting a lead on price appreciation.

On top of the above combination of factors, there is also the continuing debate in Parliament about the introduction of preset loss limits for poker machines, which, if introduced, would negatively impact Woolworths’ gaming business. Though it is most closely associated with supermarkets, Woolworths is actually the largest poker machine owner in the country, with more than 10,700 pokies.

And a few weeks ago, The Economic Times of India also reported that Woolworths appears to have been dumped by its Indian partner, Tata Group. Woolworths enjoyed a five-year partnership with Tata, introducing Dick Smith-style electronics stores to India under the Infiniti Retail brand. Even though foreign retailers are not permitted to have a direct presence in India, Woolworths partnership offered the hope of growth – albeit with a partner – if the rules were ever relaxed.

Nonetheless, despite these accumulative negative factors, Woolworths is regarded by conventional analysts and investors as a defensive’ company. Its strong cash flows and its status as a major retailer of food makes it an ideal investment in a recessionary or slow or low growth environment. The company also enjoys entrenched competitive advantages over smaller rivals that, until now, the ACCC has done little about. One example of this are the new EFTPOS charges.

From the first of this month, the new Eftpos Payments Australia Limited (EPAL) fees mean retailers incur a 5¢ fee for every transaction over $15 (75% of all EFTPOS transactions). Previously there was no fee and that will still be the case for transactions under $15, which means 25% of transactions.

The retailer’s bank will charge the retailers, some of whom are describing the charges as an “EFTPOS tax”, and they will have no choice but to pass on to the consumer.

Unsurprisingly, EPAL’s members include the major banks, Coles and Woolworths and, because they manage their own terminals, they can opt out of the new charges.

But despite these entrenched advantages, Woolworths has been hit – or so it says – by the state of the economy, noting in its annual report: “Consumer confidence remained historically low as customers reacted adversely to rising utility costs, interest rate hikes in the first half of the year and general global uncertainty, and opted to save rather than spend their money”.

From an investment perspective it is worth noting that retail investors now have a choice of supermarkets, with Coles improving its offering to consumers and taking market share from the incumbent Woolworths.

The investment community is not convinced that further changes to private-label offerings or more innovation around the supply chain will make a dramatic difference to the growth prospects for Woolworths, which set below forecast growth in household income, population and the economy.

One other source of earnings growth is cost-cutting, but the reality is that gains from such strategies are one-offs and again unlikely to excite investors.

Having presented the negatives – which have caused the share price to fall 12% since July, one positive was the strategy briefing’s opportunity to showcase new CEO Grant O’Brien, who replaces Michael Luscombe. The company announced that it planned to extend and defend its leadership in food and liquor, act on the “portfolio” to maximise shareholder value, maintain its track record of building new growth businesses (we’ll ignore Dick Smith) and finally, put in place the enablers for a new era of growth.

In the supermarkets business WOW hopes to grow fresh produce from 28% market share to 36% market share. If achieved this would be an additional $2.5b in sales. Woolies also wants to target a doubling of home brand sales and this aim flies in the face of the ACCC’s stated concerns.

The company will also open 35 new BIG W stores in next 5 years reaching 200 by 2016.

In a reflection of the massive structural shift online, BIG W’s 85,000 in-store SKUs will be expanded and all put online.

And the topic on the tip of everyone’s tongue; Masters. There are now five stores open, another two are due to open in December/January, there are 16 under construction another 100 in the pipeline and the company reported the venture is well ahead of budget.

I also note the advertised sale of $900 million of property ($380 million of which was sold last financial year); and, most recently, the oversubscribed $500 million hybrid note raising that substantially extend the balance sheet strength of the company.

Below we examine the intrinsic value track record and prospects for Woolworths based on current expectations for earnings growth and returns on equity using Skaffold.com

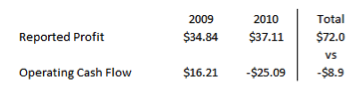

Woolworths (MQR: B2) is currently trading at the same price it was in December 2006 and February 2007, despite the fact profits have risen 11.1% pa, from $1.3 billion to a forecast $2.2 billion in 2012. This growth in profit however is offset by having 16 million more shares on issue; by increased borrowings – up $1.8 billion to $4.8 billion; and by retained earnings, which have risen by $2 billion. The increase in shares on issue and retained earnings have offset the positive impact on return on equity rising profit would normally have.

The latest estimate of its intrinsic value, of $23.23, is forecast to rise modestly over the next two years. For investors looking at opportunities to investigate only when a meaningful discount to intrinsic value is presented, a price of $19 or less for Woolworths would represent at least 20 per cent.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Is it just Harvey Norman or bricks & mortar retailing generally?

Roger Montgomery

November 17, 2011

You don’t normally expect to get investment tips from a mothers’ group get-together, but that’s what happened to me recently when the conversation turned to retail operations.

Relaxing with a glass of pinot gris the women, who have met regularly for a decade, were explaining why they spend less time in Harvey Norman stores than they used to. Why? Tired stores, tired layouts and uncompetitive prices have served the retailer only with the need to revamp its entire offering. And that, it hasn’t done.

Retailing in Australia has been in the eye of a perfect storm for some time. As I’ve written previously, the strong Australian dollar has encouraged overseas travel and online purchases from overseas businesses; and the two-speed economy has ensured that credit growth (the borrowing of more money to buy stuff) is muted.

I’ve always been suspicious of a company that issues a report to the market after the close of trade. On Monday 31 October, a major retail business in Australia did just that. After closing time, Harvey Norman released its sales and earnings for the first quarter of the 2012 financial year. Given its timing, the announcement was almost certain to be negative. Indeed, the stock fell 4% the next day.

Instead of focusing on the retailing offer, refreshing store designs and improving range, company representatives focus on property, horse racing (Gerry Harvey is one of the country’s biggest bloodstock owners), goading the Reserve Bank of Australia to cut rates in “the national interest” and campaigning to have Australians pay GST on items they buy overseas for less than $1000.

Harvey Norman’s first-quarter sales were down 3.8%, as were like-for-like sales. In Australia, like-for-like sales were down 2.8%, in New Zealand down 10.6%, down 8.9% in Slovenia and down 11.1% in Northern Ireland. A stronger currency against the New Zealand dollar, the Euro and the pound has exacerbated the results. Profit before tax – a very important measure to us when estimating intrinsic value – was down by … wait for it, 19.3%!

Harvey Norman claims the strong Australian dollar and the closure of 34 Clive Peeters stores contributed to the poor result. I would argue that a failure to reinvent the offering also contributed. More worryingly, this latter factor is unlikely to go away any time soon.

Compounding this problem is the very likely scenario that the declining iron ore price – recently at about $115 a tonne – will seriously crimp margins for the only sector that has been running at full capacity in this country. Australia’s stock market has become the tail that wags the dog. Its wealth-effect on Australians and the impact on sentiment are important determinants of activity and in particular, retail activity.

With the All Ordinaries index dominated by resource companies and financial services companies it is possible, if not probable, that a declining iron ore price leads to lower stock prices and lower economic activity. I am no economist, but I can understand some experts’ calls for further rate cuts.

Back to Harvey Norman, and like-for-like sales declines of 2.8% compares favourably with JB Hi-Fi’s decline of 3.5%. Indeed, if it became a trend, one would argue Harvey Norman is winning back market share from JB Hi-Fi.

But before you get too excited about this comparison, you have to realise JB Hi-Fi’s profits are higher than they were last year and last year’s profits were higher than the year before that. In Harvey Norman’s case, profits before tax are down 19.3% compared to the same time last year, and last year first-half profits were down 16.5% from the year before that! One retail analyst I know and respect made the point that at this rate Harvey Norman will produce an average profit slightly ahead of the first-half profit made back in 2004, when it generated sales revenue of 62% of today’s sales.

My intrinsic value estimate for Harvey Norman is about $2.00 a share against today’s share price of $2.17. However this is based on earnings per share of 23¢ for 2012 and that is, quite possibly, optimistic. Over the next few weeks, analysts will bring their earnings after tax estimates down for 2012 materially. This will have a negative impact on intrinsic values and I suspect we will discover a price above $2 is a premium to intrinsic value. Most interestingly, for followers of any rational approach to calculating intrinsic value, Harvey Norman’s updated intrinsic value is no higher today than it was nine years ago, in 2003.

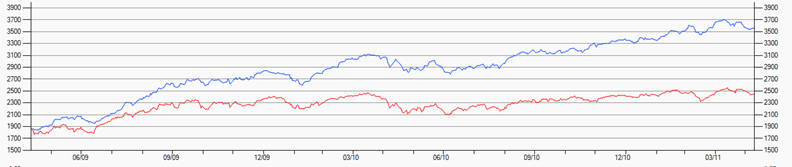

This can be seen in the following chart, which plots the share price of Harvey Norman against its estimated intrinsic value. Generally, we look for companies that have a demonstrated track record of rising intrinsic values and are available at a large discount to the current year’s intrinsic value (see 2006 in the graph).

The lack of any real change in intrinsic value and prices (which follow intrinsic value in the long run) reflects the maturation of the business. You can see that in the short run (in 2007 and again in 2009-2011) prices can get ahead of themselves thanks to many factors including irrational exuberance.

In the long run, however, the market’s weighing machine will do its thing and prices generally revert to intrinsic value. That’s why having a rational method for estimating intrinsic value is so important!

The forecast change in intrinsic value may also decline now that Harvey Norman has provided lower guidance. And it’s not unusual for analyst forecasts to be “hockey-stick” optimistic at the commencement of the financial year.

But long-term, Harvey Norman is a mature business in a small country and it continues to swim upstream against the online retailing avalanche. This is a structural shift rather than a short-term trend and Harvey Norman will need to respond by convincing Australian women in mothers’ groups all round the country that it is fresh, new and competitive.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Are the banks robbing sensible investment returns?

Roger Montgomery

November 15, 2011

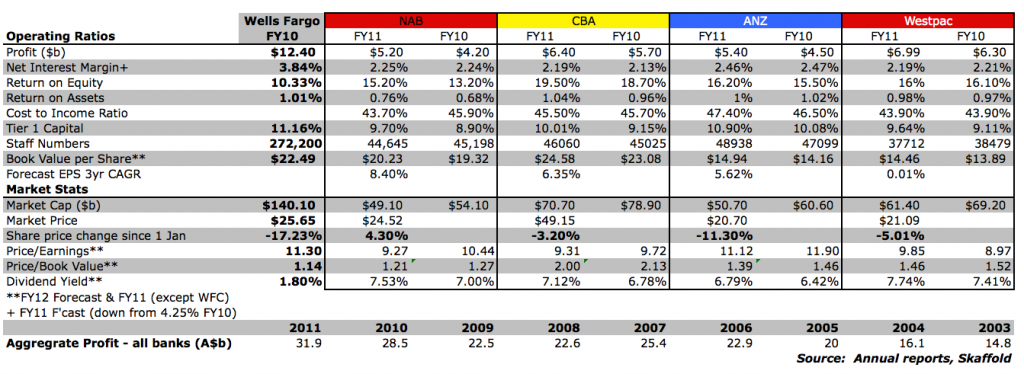

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).Buffett (or was it Todd Combs?) topped up Berkshire’s holdings in the world’s 24th biggest bank by 9.7 million shares in the three months to June 2011 (we don’t have more recent information because Berkshire requested and was granted permission to withhold stock specific information). Between 1 March and 30 June – the three months during which the stake was increased – Wells Fargo traded as high as $33 and as low as $27.

WFC currently trades at $25.65 and its book value is $26.10 per share. Paying a small discount to book value for a bank that earns a return of 11.86 per cent on that book value doesn’t seem like a fantastic bargain and paying a premium to book value is perhaps less so. But the fact remains one of the best investors of our generation, reckons it is ok to be selectively buying US banks. Is Buffett going to make off with a bank fortune the way Butch Cassidy did or will he be caught red handed this time? Should you be doing the same as Buffett with Australian Banks?

Wells Fargo is the biggest U.S. home lender (think Commonwealth Bank) and Berkshire is its biggest shareholder. Given Berkshire’s interest in Wells Fargo and Bank of America should be taking a look at our own Banks?

I know there are conflicting and well-articulated opinions here at the blog about the banks, so feel free to add your own thoughts.

Here are mine.

Broadly, the local banking system is in a relatively strong position compared to peers globally. The funding, capital and liquidity position of the major banks has been strengthened and those who fear a housing collapse in Australia should be mindful that such an event would impact consumer confidence and credit growth more than the immediate profits of the banks, who have insured their exposure.

From a funding perspective, bank deposit growth has outstripped lending growth and while further increases in wholesale funding costs could reasonably be expected, the banks are ahead of schedule in raising term wholesale funding that is said to provide 6 months grace. Of course if deposits continue to grow faster than loans, the gap that is funded from overseas wholesale markets diminishes.

As I have previously noted, high levels of leverage at the consumer, company and country level simply take time to pay off. You just don’t go off spending aggressively again until you feel your debt is under control. As a result, it is reasonable to expect bank balance sheet expansion will be muted over the next year or two at least. Some of you may think even longer or permanently…

Globally, the banking picture is at the very least, interesting to watch. The five biggest US banks excluding bank of America posted 8 per cent profit growth, while in the UK the five majors posted H1’11 profits that were half of those reported the year before. Predictably this has resulted in announcements of an intended five billion Sterling cost cutting drive by 2014. In Europe, the largest ten banks saw profits fall less than 8 per cent. Curiously some observers suggest that the present problems befalling sovereigns will have less of an impact on banks than the GFC because sovereign debt is less complex than credit default swaps on collateralized debt obligations and stress testing has been completed and widely reported. With little exposure to European debt and strong growth domestically, Asian banks (with the exception of Japan) are the one bright spot.

Globally, banks are targeting cost to income ratios of less than 40 per cent despite the higher costs associated with reengineering systems and procedures to meet a heightened regulatory environment.

Locally, our major banks have posted more than acceptable profits considering global financial conditions and local consumer and business sentiment, which has remained muted

Growth has been achieved at least partly by the reduction in the provision for bad and doubtful debts. Additionally, the reduction in the aggregate loan impairment charge was 37%; from $8.4 billion to $5.3 billion.

While significant reductions in loan impairment charges can be seen as a positive, future growth in profits – in the absence of a recovery in consumer and business confidence – will have to come from cost cutting.

Collectively, cost cutting is being reflected in some results – cost to income ratios improved for the CBA and NAB and less so for the ANZ and Westpac. Further improvements should be expected and I have been reliably informed to expect significant retrenchments – in the thousands – in the financial services sector, even though full time employees increased at the ANZ and CBA last year. The changes in cost to income ratios should also be seen in the light of the dramatic reductions achieved since the early nineties when cost to income ratios were; ANZ 74%, WBC 68%, CBA 67% and NAB 57%.

Net interest margins – the net margin earned or the difference between interest paid on deposits and interest earned on loans – were broadly unchanged and while the CBA recorded an improvement, this has not been widely reported elsewhere as being materially due to an accounting reclassification of net swap costs. Competition for retail deposits and higher-cost, post-GFC funding as well as regulatory changes forcing an increase in liquid assets put pressure on margins. A broad maintenance of margins is therefore laudable.

The banking industry’s preferred measure of profit is Cash Profit (after tax), which removes the impact of discontinued operations, adjustments for acquisitions, Treasury shares and fair value adjustments.

On this measure, all the banks posted healthy increases.

The ANZ increased profits from $5.1 to $5.6, the CBA $6.1 to $6.8, NAB $4.6 to $5.5 and Westpac from $5.9 to $6.3.

Non-interest income, which includes trading, fees & commissions and Wealth management & insurance (which includes life insurance, superannuation and investment management products), declined in aggregate. Fees & commissions across the major banks were largely steady at just under $12 billion due to a drop in lending offset by an increase in corporate M&A. Wealth management profits fell for all the banks bar Westpac (BT). Profits here are largely a function of equity market performance given the big brand’s focus on index hugging and fund inflows/outflows. Funds under management and administration grew only for the CBA.

The outlook for Australian banks will remain mired by the general ‘funk’ Australian consumers and business are in. Our one-cylinder economy is not going to spur rapid balance sheet expansion (read credit growth) for the banks in the near term. With property prices and volumes in some areas also depressed the number of mortgages and the size of a loan on any individual property is necessarily lower. Banks love mortgages the most because their perceived lower risk means the banks have to provision less for each one they write. You are welcome to discuss your views about the direction of property in Australia in the comments below and I would welcome your thoughts. I think that we shouldn’t expect any immediate recovery in property activity to spur bank balance sheet expansion.

With the details broadly out of the way what are the current estimated valuations and prospects for intrinsic value growth for each of the banks? Keep in mind the intrinsic value expectations for the next three years are based on earnings growth and equity figures as stated in the table included with this column.

Skaffold’s (www.Skaffold.com) current estimated intrinsic values for the banks are: WBC $22.12, ANZ $24.49, CBA $51.54 and NAB $27.69. Of course these will change over the next weeks and months as estimates are updated and the banks make announcements about prospects, acquisitions or capital raisings etc. and I may not update those details here at the Insights Blog.

The bank displaying the greatest estimated margin of safety currently is ANZ, which at the current price, is displaying an estimated safety margin of 16%. Of the others NAB appears to be next, with an estimated margin of safety of 11%, WBC 5% and CBA 3%.

Despite being second on this list, the NAB has produced the lowest returns on equity and assets but also the lowest cost to income ratio, second highest Net interest margin and the highest forecast earnings per share growth for the next three years.

In aggregate the opportunity to buy at either very large discounts or smaller discounts but with solid growth potential does not appear to be available. An investor requiring meaningful margins of safety, would demand lower prices before being seriously interested. I will leave that decision to you after taking personal professional advice of course – from Buffett or your advisor. Growth doesn’t have to be sensational to make attractive returns but in such cases, one should require a large margin of safety to be more certain of a reasonable return.

What are you thoughts about the banks? Have I missed an angle that you would like to add? For example do you think the economic growth prospects are bright for the US compared to Australia? What are your estimates for earnings growth and what are your expectations for the residential, agricultural or commercial property market? I would be delighted to facilitate a discussion on these subjects.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 November 2011.

by Roger Montgomery Posted in Financial Services.

- 48 Comments

- save this article

- 48

- POSTED IN Financial Services.

-

Are your profits recurring?

Roger Montgomery

September 30, 2011

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.Stability and predictability are two key words that many investors are unlikely to have heard in recent times and two important components of the ‘toolkit’ that may have gone astray. But at all junctures of the business cycle, stability and predictability are helpful investment partners.

Irrespective of whether you are building a portfolio from the ground up or are reviewing your current holdings, it is vital that you ensure your portfolio is always pointed in the right direction. Few, if any are able to reliably and predictability predict short-term share prices so there is relevance, if not necessity, in ensuring the very best opportunity is given to your portfolio. When a recovery transpires and investors are willing to accept risk again, the portfolio constructed from businesses with some stability and predictability to their revenues and earnings streams will have an excellent chance of outperformance.

While there are many definitions of what constitutes ‘stable’ and ‘predictable’, in terms of business analysis, recurring revenue would be the one I would use. And if you built a portfolio of such businesses, would it matter if this week a country defaulted on its debt or another had its credit rating downgraded? These issues are both temporary in nature and only likely to impact share prices, not the economics of the business.

Long-term contracts are the best form of recurring revenues and these contracts take many forms; There are of course the obvious long-term contracts, such as a mobile phone plan, internet or TV subscription, a car lease or a property tenancy, but less obvious are the long-term contracts we have with our own bodies to feed them, clean them and take out the waste. We have a long-term contract with our teeth, our cutlery and our toilets and these contracts ensure Coles and Woolworths, Kelloggs, Procter & Gamble and Kimberley Clark have millions of customers buying their consumables frequently and with monotonous regularity. In other words – recurring revenue.

Knowing that a percentage of revenue can be relied upon to come in the door each year allows a business to budget, rewarded staff consistently and plan expansions with fewer surprises.

And if you are buying a small piece of such a business, you can sleep more comfortably at night ‘knowing’ that your share will always have value even if the share price halves or worse.

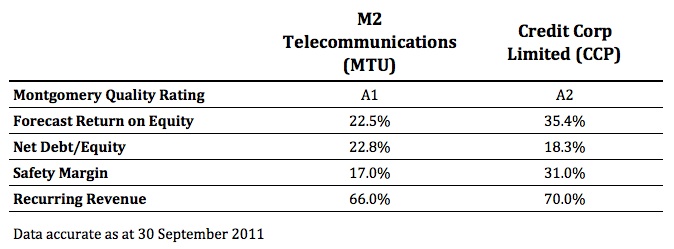

The following two businesses are examples of companies we hold in The Montgomery [Private] Fund, and that we believe display the characteristic discussed.

M2 Telecommunications is a reseller of telecommunications equipment and services into the $6 billion SMB Telecommunications market. While dominated by Telstra (ASX:TLS) with 80 per cent market share, M2 is the seventh largest Telco in Australia with a 4.5 per cent share.

Two thirds of the business’s revenue is recurring via traditional fixed voice services, mobile (phone and broadband) and wholesaling services. Typically, contracted revenue is on 2-4 year terms giving management a significant amount of predictability.

It is due to this predictability that management have forecast 15 per cent earnings growth for FY12 and have the ability to self-fund a couple of large acquisitions, which Vaughn Bowen has moved aside from day-to-day duties to focus on.

Credit Corp – With new management installed and a demonstrated focus on transparency and sustainable growth, 70 per cent of collections are now on recurring payment arrangements.

This frees up collection staff to focus on those clients that are finding it harder to repay their liabilities and drives efficiencies across the group. Not only this, but the degree of certainty has allowed management to invest in even more self-funded ledger purchases and forecast earnings of $21m-$23m in FY12.

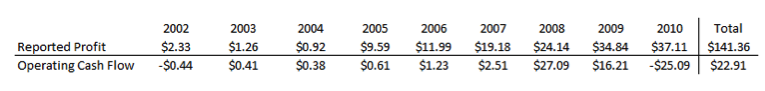

Additionally, the businesses offer the following financial metrics:

High Montgomery Quality Ratings (MQR), high forecast ROE’s, low debt levels, a Safety margin and high, recurring revenues have attracted us. After conducting your own research and seeking and taking personal professional advice, I’d be interested to know whether these companies or any others meet your recurring revenue test.

Go ahead and use this blog post as the beginning of a thread listing companies with solid recurring revenue and earnings.

Given the time to be interested in stocks is when no one else is, now is the time to go through your portfolio and determine those holdings that have a component of revenues that are recurring.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 30 September 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Will Qantas be Taken Over?

Roger Montgomery

September 1, 2011

Who would have thought a little comment at the end of my 17 August Value.able column for Alan Kohler’s Eureka Report on Qantas’ strategic direction announcement would cause such a stir!

Who would have thought a little comment at the end of my 17 August Value.able column for Alan Kohler’s Eureka Report on Qantas’ strategic direction announcement would cause such a stir!It appears I wasn’t the only Value.able Graduate wondering aloud about the coincidental timing of the strategic change of direction, coming as it did whilst the share price was trading at near record lows.

My Value.able column started like this: “Sick of losing money, Qantas CEO Alan Joyce revealed a long-overdue change of strategy for the airline earlier this week, which included cutting jobs, delaying the delivery of six A380s until 2019, buying smaller aircraft, launching two new Asia-based airlines and an attempt to turn around the fortunes of Qantas International.”

And ended like this: “This may not disturb parties that have taken notice of the share price trading below NTA and considered mounting a takeover. You may recall that back in 2007 a consortium that included former CEO Geoff Dixon and former chairman Margaret Jackson had a bid of $5.45 share on the table. At yesterday’s closing price of $1.525 I think it’s safe to say they dodged a bullet.

“If there’s a way to get around the Qantas Sale Act and increase aircraft utilisation rates with an offshore hub, I reckon someone out there in the world of institutional finance has thought of it and run the ruler over Qantas

“…if there was ever a second tilt at Qantas, now would be as good a time as any…”

Have a quick look at the Balance Sheet.

Ignoring the $470 million ‘investments accounted for using the equity method’, QAN has twenty billion of assets (only $593 million are intangibles – landing slots, brand and software). There is $3 billion of cash and $13.8 billion of property, plant and equipment. Now add to that $14 billion of liabilities, some of which is represented by Redemption Revenue*, a portion of which may never be claimed.

For the moment, put aside the Qantas Sale Act (a small thing to do here because it suits this discussion!), now imagine…

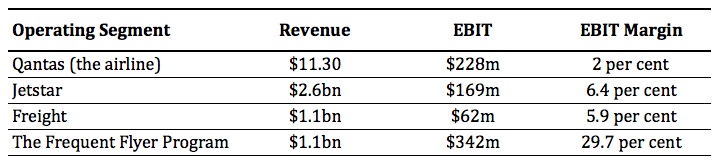

You mount a bid for $3.5 billion (funded largely by the cash in the company’s bank account). You sell all the planes, the property and all the equipment to pay off the liabilities, but keep the frequent flyer business, which then cost you nothing.

While it is true my scenario is embarrassingly simplistic (and not nearly as obvious as bidding for ING during the depths of the GFC) it may also be true that the most profitable frequent flyer program in the world (and Qantas’ most profitable Operating Segment) could be in the sights of an audacious bidder.

Let’s compare the Revenue, Earnings Before Interest and Tax (EBIT) and resulting EBIT Margin of Qantas’ four core operating segments:

I know which segment I want to own!

In 2007 Qantas was the target of a takeover attempt by APA (Airline Partners Australia) – a consortium put together specifically for that purpose. They were willing to pay $11 billion.

At the time, fears around the impact of a highly leveraged owner on Australian superannuation funds were added to the national interest concerns. The bid was not supported by employees or the community. Interestingly, the government of the day didn’t intervene in the bid because of undertakings that the company would remain Australian owned and headquartered in Australia. We are a proud nation.

A bid today at, say $4.5 billion, and with the same undertakings, would either make the current bidders look very wily, or those involved in the previous attempt very silly.

Many analysts now have buy recommendations on Qantas. Whilst I agree that the shares are at a discount to tangible equity, I don’t believe the discount is as great as being stated. This is because retained earnings in equity were never really earned. The economic profit of the airline is, as I have stated on many occasions over the years, much lower than the accounting construct that produced the retained earnings entry. But a discount to NTA does appear to exist.

If you were a bidder, and can overcome all the obstacles, with the share price well below NTA and the imminent prospect of the company committing to acquire another 100 planes, you’d want to get a move on.

Of course this is a purely economic discussion and does not take into account the impact on the jobs and livelihoods of QAN’s 34,000 staff and their families. Nor have I taken into account Australia’s national interest.

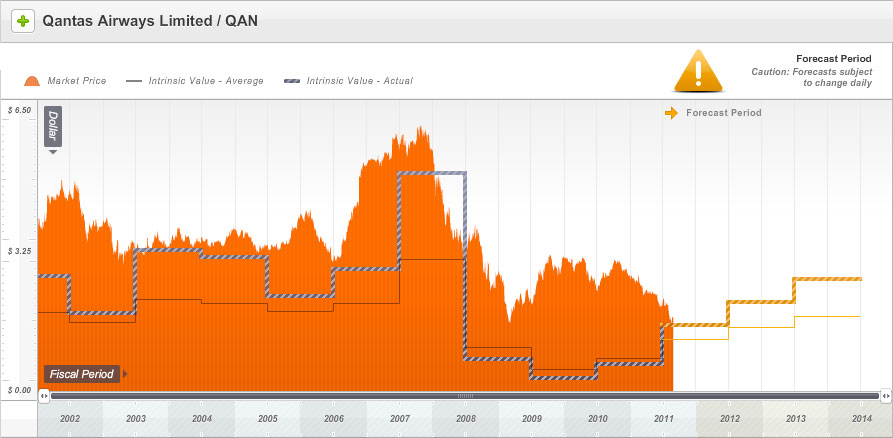

There haven’t been many occasions when QAN shares have traded below my estimate of the company’s Value.able intrinsic either.

Ten days ago Qantas was trading at intrinsic value. Based on recent results and current expectations, our estimate of intrinsic value is forecast to rise by as much as 30 per cent over the next three years.

Sneak Peek #2: Ten years of historical intrinsic value and three years of forecast valuations for Qantas, compared to the current market price. Why is the price chart orange, I hear you ask? Because Qantas scores a B for quality. In our next-generation A1 service B = Adequate Quality and Adequate Quality = orange. Amazing, incredible, simple.

There are just two requirements to ensure you receive an invitation to become a founding member of our next-generation A1 service.

1. Read Value.able

2. Change some part of the way you think about the stock market

You may also like to submit your photograph to the Value.able Graduate album at my Facebok page, however this is optional. If you haven’t yet secured your copy of Value.able and joined the Graduate Class, click here.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 1 September 2011.

*The company’s notes states; “Unused tickets are recognised as revenue using estimates regarding the timing of recognition based on the terms and conditions of the ticket. Changes in these estimation methods could have a material impact on the financial statements of Qantas.” Some have suggested that more can be made from unused tickets than those actually claimed/uplifted.

Redemption revenue received for the issuance of FF points is deferred as a liability (revenue received in advance) until the points are redeemed or the passenger is uplifted in the case of flight redemptions. Redemption revenue is measured based on management’s estimate of the fair value of the expected awards for which the points will be redeemed. The fair value of the awards are reduced to take into account the proportion of points that are expected to expire (breakage). The accounting steps are [a current liability if they will be earned within one year] debit to the asset Cash for the amount received and a credit to the liability account such as revenue received in advance.

As the amount received in advance is earned, the current liability account will be debited for the amount earned and the Revenues account reported on the income statement will be credited. This is done through an adjusting entry.

by Roger Montgomery Posted in Airlines.

- 39 Comments

- save this article

- 39

- POSTED IN Airlines.

-

How much capital intensity does it take to sell seats?

Roger Montgomery

August 30, 2011

Did you know some of Qantas’ planes are more than twenty years old? And our estimate is that they fly, on average, 14 hours per day. The rest of the time they mimic that expensive bit of fashion in your garage, earning no income. That garage/hangar time has expensive ramifications for the economics of airlines, just as your decision to buy an expensive but garaged ‘fashion’ item has expensive ramifications for you.

Did you know some of Qantas’ planes are more than twenty years old? And our estimate is that they fly, on average, 14 hours per day. The rest of the time they mimic that expensive bit of fashion in your garage, earning no income. That garage/hangar time has expensive ramifications for the economics of airlines, just as your decision to buy an expensive but garaged ‘fashion’ item has expensive ramifications for you.Capital-intensive businesses, such as airlines, erode shareholder wealth. Inflation ensures their maintenance and replacement is a significant proportion of cash flow, which could otherwise be paid out to shareholders. Parts plus labour, which protect the business assets from wear and tear, actually causes wear and tear on shareholders’ funds.

Raising capital and increasing debt, has hitherto been easy for Qantas, but the market is slowly coming to the realisation that it cannot continue. The market capitalisation of Qantas – the ‘value’ the market ascribes – is less than all the equity that the company has raised – much less.

As a result of the market’s slow migration to understanding the economics of airlines, fresh management have had to respond quickly.

The best measure of economic performance is Return on Equity (ROE). This year QAN achieved a ROE of just over four per cent. Meanwhile, Oroton shareholders have been enjoying eighty per cent returns. Did you know there are 267 companies that earn more than 15 per cent returns on equity?

The business of selling seats is an expensive one for Qantas, and while the business of selling the hope-of-getting-a-seat (the Frequent Flyer program) is extremely profitable, owning planes means the cash is always inhibited – it can’t be distributed to shareholder owners.

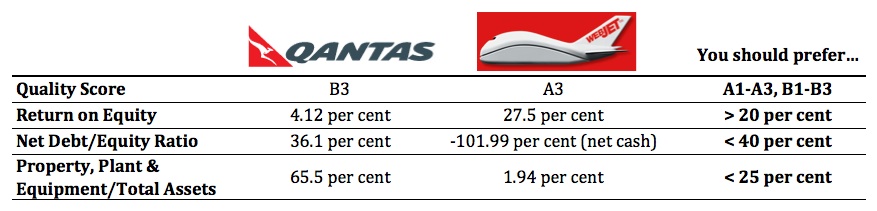

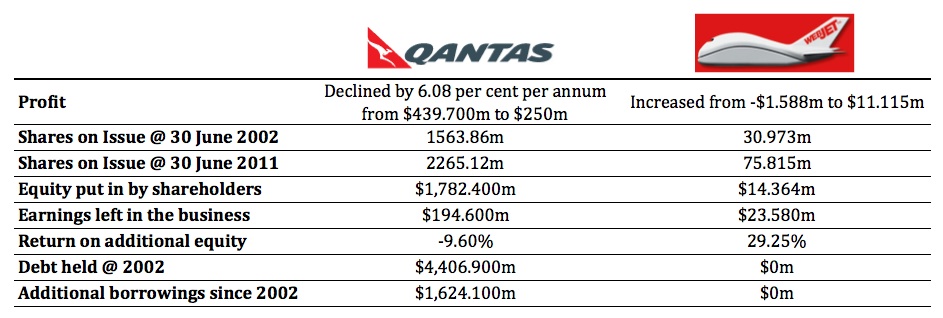

Qantas however isn’t the only seller of seats on planes. Indeed there are businesses that sell seats on planes and they don’t have any planes. Let’s compare two seat-sellers: Qantas and Webjet.

I believe the very best businesses online are lists – lists of jobs, lists of apps, lists of songs, lists of cars, lists of houses, list of flights and lists of seats. What is particularly attractive is that a business with a list of seats doesn’t have any planes. Sure its revenue is going to be lower, but what about its profit?

Let’s compare…

Now, lets take a look the economics of these businesses over the past ten years.

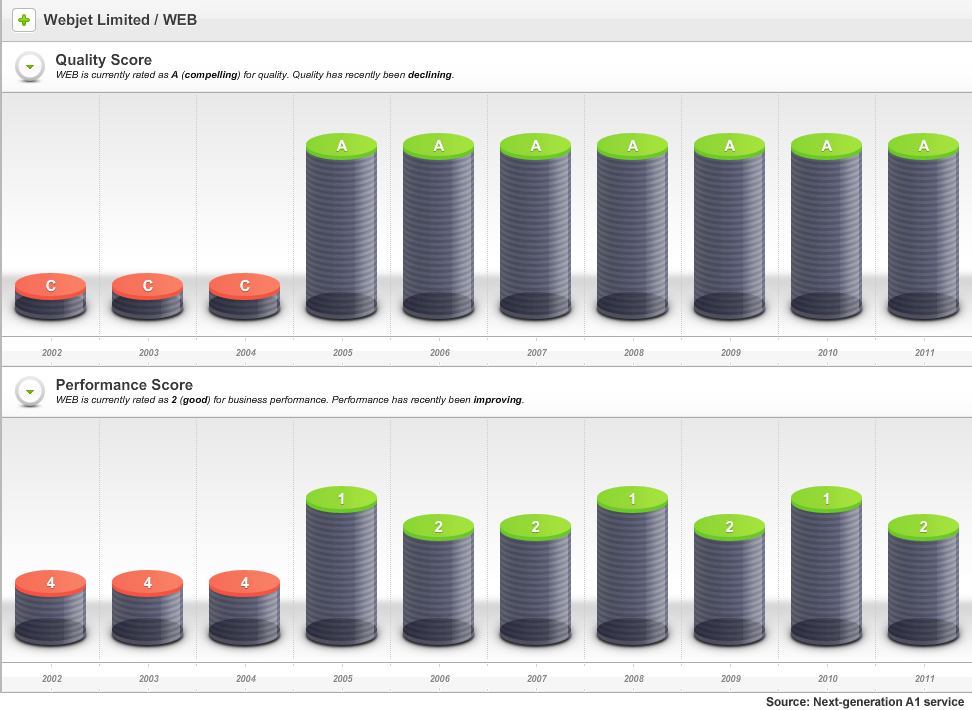

As the following sneek peek charts from our soon-to-be-released next-generation A1 stock market service display, Webjet has scored, on average, an A2 since 2005.

In this example, the Quality Score information tells us that something dramatic happened in the 2004/2005 financial year.

Webjet was once called Roper River Resources Company and in July 1999 the shares, under the ASX code; RRR, were trading at 25 cents. By March 2000 – near the peak of the internet bubble – RRR shares were trading at $1.38.

The reason is now obvious, although at the time it may have been a bit of a mystery.

In January 2000, Roper received a ‘speeding ticket’ from the ASX to which it responded on 14 January with the following statement:

“1. There are no, matters of importance, about to be released to the market.

“2. The Company is not aware of any information to explain the recent trading in the shares.

“3. The Company can offer no other explanation for the price change and increase in volume in the securities of the Company.”

“4. I confirm that the Company is in compliance with the listing rules, in particular, listing rule 3.1.”

On 27 January 2000 however – less than two weeks later – Roper River Resources (ASX:RRR) announced it was issuing 50 million shares to acquire Webjet Pty Ltd.

By June 2004 the shares were still trading at 15 cents, however the company announced the previous October that it was trading in the black for the first time. By November 2004, it was reporting 400 per cent monthly increases in sales. Almost every month to its full year results in June 2005, it continued to report 400 plus percentage increases in monthly sales.

And in that year Webjet’s Quality Score jumped from C4 to A1. As you can see, Webjet has maintained an A1 or A2 quality rating since.

By comparison, Qantas’s Quality Score profile has been more marginal. This should be unsurprising to many, if not most Value.able Graduates, who understand the downside of capital intensity. Lots of property plant and equipment results in more equity for a given profit, and that means lower returns.

So, what do you think?

With reporting season about to end, your mission, if you choose to accept it, is:

Source the latest Annual Report for each business in your portfolio. Go to the Balance Sheet and under ‘Non-Current Assets’ find ‘Property, Plant and Equipment’.

If you have any, how many capital-intensive businesses are hiding in your portfolio?

Making this process simple and easy is something we have been working on for you. We created our next-generation A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. The above graphics are just one

It’s an A1 service that is like nothing you have ever seen before.value

Value.able Graduates – your invitation to pre-register is coming soon.

If you haven’t graduated to guarantee your invitation, click here to order your copy of Value.able immediately. Once you have 1. Read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team, fund managers and creators of the ext-generation A1 stock market service, 30 August 2011.

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights, Value.able.

- 36 Comments

- save this article

- 36

- POSTED IN Airlines, Companies, Insightful Insights, Value.able.

-

What has probing the reporting season avalanche revealed?

Roger Montgomery

August 24, 2011

With reporting season in full swing, I would like to share my insights into whose Quality Score has improved, and whose has deteriorated. Remember, none of this represents recommendations. It is intended to be educational only. You must seek and take personal professional advice before acting or transacting in any security.

To date, 232 companies have reported their annual results. I am sure you can understand why we feel snowed under. With almost 2,000 companies listed on the ASX, the avalanche still has a way to roll.

We have updated all of our models for each of the 164 companies that we are interested in. As you know, we rank all listed companies from A1 down to C5. The inputs for those rankings always come from the company themselves. I would hate to think how bipolar they would be if we allowed our emotions and personal preferences to infect those ratings (or be swayed by analyst forecasts)!

Rather than arbitrary and subjective assessments, we download some 50-70 Profit and Loss, Balance Sheet and Cash Flow data fields from each annual report to populate five templates. All of these templates employ industry specific metrics to calculate the Quality Scores. This allows us to rank every ASX-listed business from A1 – C5. Its our objective way to sort the wheat from the chaff.

For Value.able Graduates not familiar with our scoring system, company’s that achieve an A1 Score are those we believe to be the best businesses, and the safest. C5s are the poorest performers and carry the highest risk of a possible catastrophic event.

A1 does not mean nothing bad will ever befall a company. A1 simply means to us that it has the lowest probability of something permanently catastrophic. Further, ‘lowest probability’ doesn’t mean ‘never’. A hundred-to-one horse can still win races, even though the probability is low. Similarly, an A1 business can experience a permanently fatal event. In aggregate however, we expect a portfolio of A1 businesses to outperform, over a long period of time, a portfolio of companies with lesser scores.

With that in mind, we are of course most interested in the A1s and – on a declining scale – A2, B1 and B2 businesses.

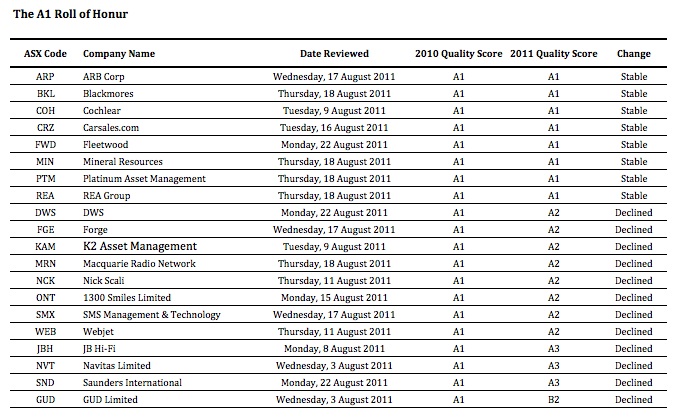

So, who has managed to retain their A1 status this reporting season? And which businesses have achieved the coveted A1 status? If you hold shares in any of the companies whose scores have declined (based of course on their reported results), please read on.

Of the companies that have reported so far, last year 20 of them were A1s, 28 were A2s, one was a B1 and 13 scored B2. That’s an encouraging proportion, although we tend to discover each reporting season that the better quality businesses and the better performing businesses are generally keen to get their results out into the public domain early.

Its towards the end of every reporting season where the quality of the businesses really drops off. This is always something to watch out for – companies trying to hide amongst the many hundreds reporting at the end of the season. It’s always a good idea to turn up to a big fancy dress party late, if you aren’t in fancy dress.

This year we have seen the number of existing A1s fall to nine from 20, A2s from 28 to 24, B1s rise from one to two and B2s fall from 13 to six.

The first table shows all twenty 2009/2010 A1 companies that have reported to date. You’ll see a number of very familiar names in here, including ARB Corp (ARP), Blackmores (BKL), Cochlear (COH), Carsales.com (CRZ), Fleetwood (FWD), Mineral Resources (MIN), Platinum Asset Management (PTM), REA Group (REA), DWS (DWS), Forge (FGE), K2 Asset Management (KAM), Macquarie Radio Network (MRN), Nick Scali (NCK), 1300 Smiles Limited (ONT), SMS Management & Technology (SMX), Webjet (WEB), JB Hi-Fi (JBH), Navitas Limited (NVT), Saunders International (SND) and GUD Limited (GUD). Nine have maintained their A1 rating this year.

Now, before you go jumping up and down, a drop from A1 to A2 is like downgrading from Rolls Royce to Bently. When we talk about A2s, its not a drop from RR Phantom to a Ford Cortina, not that there’s anything wrong with the old Cortina (if you are too young to know what I am talking about Google it!).

The only big rating decline is GUD Holdings, which made a large acquisition (Dexion) during the year. Indeed, a common theme amongst the higher quality and cashed up businesses this reporting season has been the deployment of that cash towards, for example, acquisition or buybacks (think JB Hi-Fi).

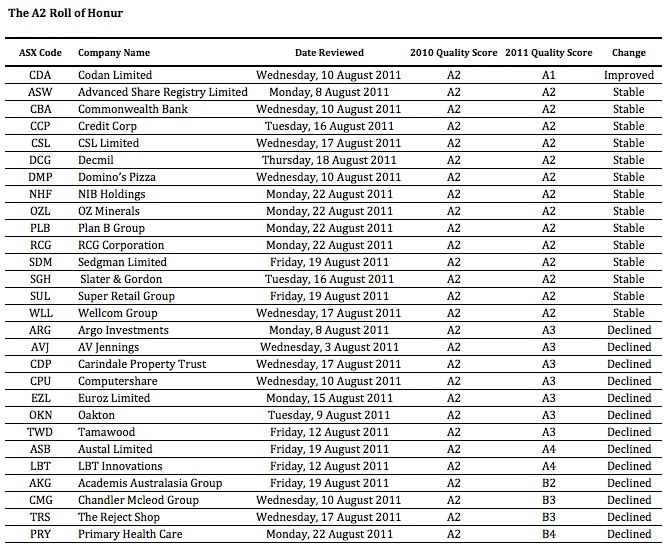

Moving onto the 2009/2010 A2 honour roll: Codan Limited (CDN), Advanced Share Registry Limited (ASW), Commonwealth Bank (CBA), Credit Corp (CCP), CSL Limited (CSL), Decmil (DCG), Domino’s Pizza (DMP), NIB Holdings (NHF), OZ Minerals (OZL), Plan B Group (PLB), RCG Corporation (RCG), Sedgman Limited (SDM), Slater & Gordon (SGH), Super Retail Group (SUL), Wellcom Group (WLL), Argo Investments (ARG), AV Jennings (AVJ), Carindale Property Trust (CDP), Computershare (CPU), Euroz Limited (EZL), Oakton (OKN), Tamawood (TWD), Austal Limited (ASB), LBT Innovations (LBT), Academis Australasia Group (AKG), Chandler Mcleod Group (CMG), The Reject Shop (TRS) and Primary Health Care (PRY).

The businesses that make up this list showed slightly more stability. The biggest fall in quality this year was Primary Healthcare (PRY),which is still struggling to digest the large purchases it made a few years ago. The Reject Shop (TRS) also declined, to B3. TRS is still investment grade and we would lean towards believing this is a short-term decline, given the floods in QLD that caused the complete shutdown of their new distribution center and the massive disruptions subsequently caused. As the company said, you can’t sell what you haven’t got!

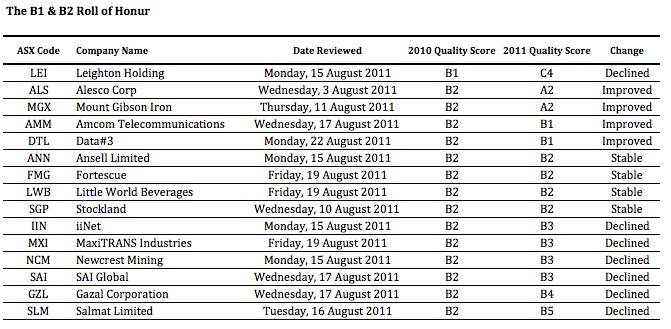

Finally, B1 and B2 companies: Leighton Holdings (LEI), Alesco Corp (ALS), Mount Gibson Iron (MGX), Amcom Telecommunications (AMM), Data#3 (DTL), Ansell Limited (ANN), Fortescue (FMG), Little World Beverages (LWB), Stockland (SGP), iiNet (IIN), MaxiTRANS Industries (MXI), Newcrest Mining (NCM), SAI Global (SAI), Gazal Corporation (GZL) and Salmat (SLM).

About half the companies in the B1/B2 list retained or improved their ratings from last year. Mind you, half also saw their rating decline!

The clear fall from grace is Leighton Holdings, whose problems have been well documented in the media and via company presentations.But once again, like The Reject Shop, this could be a temporary situation. If the forecast $650m profit comes through, I expect LEI’s quality score will improve. What the dip will do, however, is remain a permanent reminder that Leighton is a cyclical business. Getting the quote right on a job is important, even more a massive enterprise like Leightons.

Are you surprised by any of the changes? We certainly were!

Sticking to quality is vitally important. That’s what my team and I do here at Montgomery Inc, and its what our amazing next-generation A1 service is all about. Value.able Graduates – your invitation is pending.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Remember, you must do your own research and remember to seek and take personal professional advice.

We look forward to reading your insights and will provide another reporting season update soon.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 24 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are there really five bargains to research further?

Roger Montgomery

July 29, 2011

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.As you would know from reading Value.able, I am not a fan of the Price to Earnings Ratio. Nothing has changed on that front. Nevertheless, value may just be in the eye of the beholder and not only is the P/E Ratio common in literature about investing and in market commentary, it is, whether rightly or wrongly, in wide use.

Indeed, if you are like many Baby Boomers now on the cusp of selling your business, you will be spending a great deal of time in negotiations and assisting in due diligence to arrive at a simple multiple of earnings.

The humble P/E Ratio may be misused, misunderstood and relied on far too heavily, but popular it remains.

One version of the earnings multiple that is adopted for comparison purposes by private equity buyers is the enterprise model. The enterprise model takes the market value of the equity (market cap) and debt, less cash, and divides the whole lot by the EBITDA (earnings before interest tax depreciation and amortisation). Of course, if you have a company with high operating margins but lots of property, plant and equipment (PP&E) to maintain, you may find the results a little optimistic.

Simply take a standard price to earnings approach, but subtract the cash the company has in the bank.

If you were to buy a business outright, you may take into account the cash the company has in its bank accounts. After buying the business you may be able to access this cash and withdraw it to lower the purchase price. Alternatively, if you are selling a business, in an IPO for example, you may be just as keen to take the cash out before selling it to maximise the return to you and reduce the return available to otherwise anonymous share market investors (this latter strategy is very popular).

The arithmetic result of taking out the cash is a lower P/E multiple. And that is what I thought you may be interested to discuss.

Are there any companies listed in Australia that are trading on very low multiples of earnings once their cash is taken into consideration? The broad based market declines have ensured there are indeed a few.

Step 1

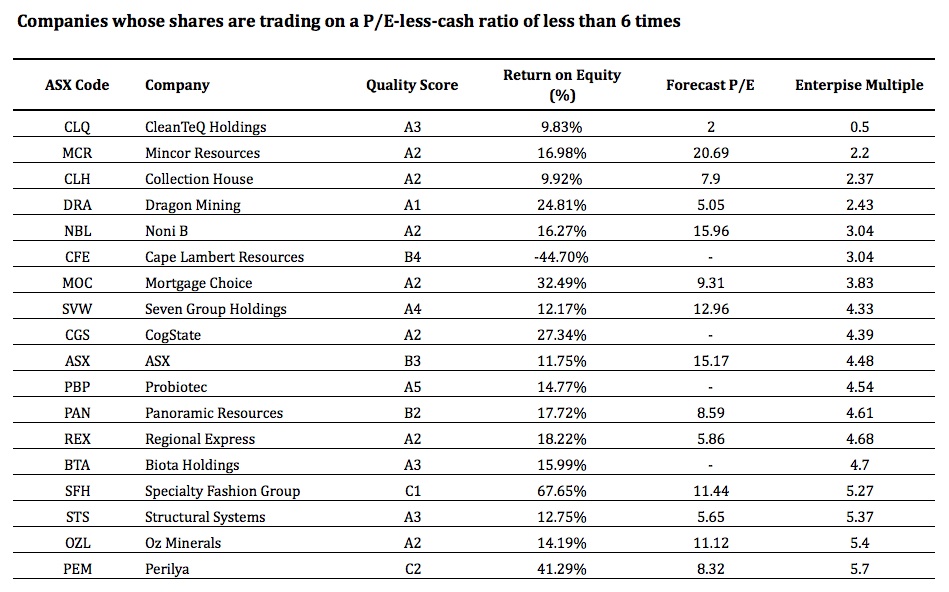

My search began by opening our next-generation A1 service (Value.able Graduates – your exclusive invitation to pre-register is not far away). I applied a filter to discover those companies whose shares were trading at a P/E-less-cash ratio of less than 6 times. From the more than 2000 companies reviewed, there are 18 such companies that meet the criteria today. Keeping in mind some businesses have cash on their balance sheet that would NOT be accessible to a buyer (legislated, regulation or simply working capital needs), here are the eighteen:

Step 2

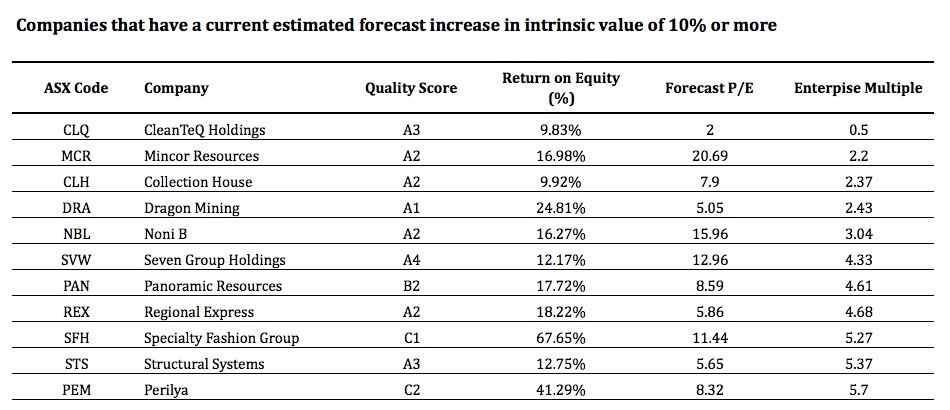

Next, I retained only those companies that have a current estimated forecast increase in intrinsic value of 10% or more. This filter reduced the field to just 11 companies, removing ASX, OZL, CGS, CFE, BTA, PBP AND MOC. Here are the eleven:

Step 3

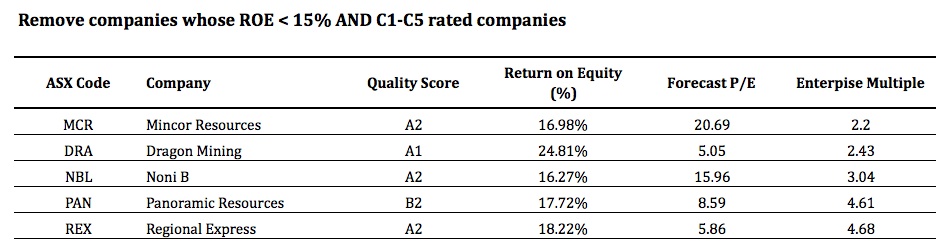

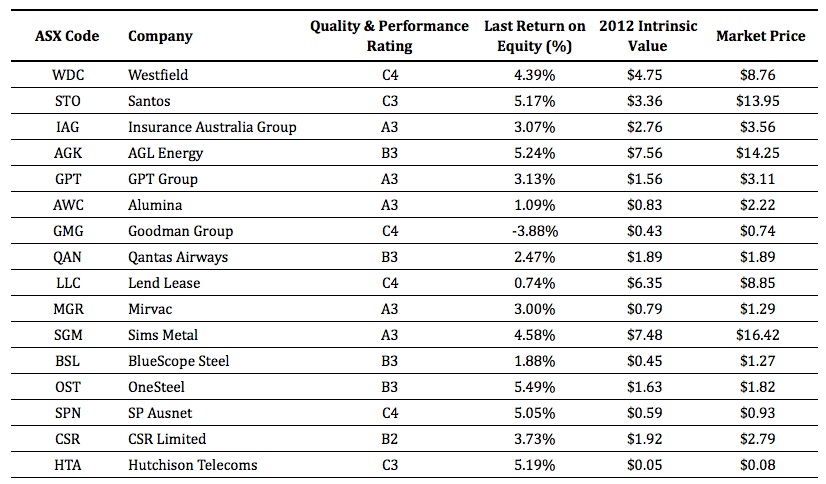

Finally, I removed companies whose previous year’s ROE was less than 15%. I also removed any companies with a C1-C5 Quality Score. Low ROE stocks removed were; CLQ, CLH, SVW AND STS and C-rated companies removed were; SFH AND PEM. That left just five companies. Here they are:

And there you have it, companies trading at enterprise multiples that may be attractive to a buyer who could potentially use the cash on the balance sheet to reduce their purchase price.

Amazing, incredible simple. No manual calculations required (ever again).

Remember, this exercise did not incorporate any of the traditional Value.able investing considerations we usually discuss at the Insights Blog… safety margin, intrinsic value.

For the record, only two of the listed businesses look cheap on the Value.able score today. With reporting season about to begin in ernest, keep in mind the results and cash balances of these companies will all change.

You must do your own research into their prospects and remember to seek and take personal professional advice.

Very soon, finding extraordinary A1 companies offering large safety margins will become simple and even fun. Our next-generation A1 service that my team and I have been tirelessly working on will inspire your investing and re-energise your portfolio.

Value.able Graduates – stay tuned. Your exclusive invitation to pre-register will arrive in your inbox very soon. If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Back to the program… this reporting season, who do you think will surprise with better than expected earnings?

Who do you think will struggle?

And what stocks are looking cheap to you right now?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 29 July 2011.

by Roger Montgomery Posted in Companies, Investing Education.

- 87 Comments

- save this article

- 87

- POSTED IN Companies, Investing Education.

-

Property heading into a storm, banks to feel pain

Roger Montgomery

July 1, 2011

Baby boomers have boosted the property market, but what’s going to happen when they retire? Investment expert Roger Montgomery says he isn’t encouraged by comments by the housing industry. Listen to the podcast.

by Roger Montgomery Posted in Media Room, Radio.

- save this article

- POSTED IN Media Room, Radio.

-

What if the sell-off is just a Flash?

Roger Montgomery

June 23, 2011

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?In the short run prices move independently of the underlying business, so let’s encourage the market to decline further!

For those truly concerned about Australia’s prosperity, relax. Be comfortable in the knowledge that short-term share price moves are unlikely to impact the employment policies of Australia’s largest listed businesses.

Looking over the financials of fifty-six A1 companies, little has changed. While Telstra and Fosters share prices are beating to the drum of hoped-for franked dividends and a takeover, the fundamentals of many other companies, particularly A1s (and indeed A2 and B1), are resolute. Are these businesses worth 10% to 26% less than they were worth before? No chance. The Value.able intrinsic valuations of companies that were cheap before haven’t changed.

So what has changed?

Only investors’ perceptions. Perceptions about the global economic outlook; perceptions about a US slowdown becoming a recession; perception about a Chinese slowdown causing a global rout the world cannot afford; and hope that Australian house prices will fall to levels people can actually afford.

Think about that for a moment. Baby boomers own $1m + homes that they will be forced to liquidate to fund their retirements and health care. Meanwhile, Generation Y is struggling to afford a property. Something has to give. Economics 101 suggests price declines.

Investors have simply been reducing their appetite for risk.

Armageddonists are spouting scenarios similar to those that followed Britain’s exit from the gold standard in 1931.

But this fear may be unfounded. It’s most certainly not a cause for permanent worry. Even if a recession does transpire, it will not be permanent.

Our job as Value.able Graduates is not to guess the gyrations of the economy – while they are vital in determining the sustainability of a given return on equity, many of the world’s very best investors do not even employ economists (they employ former US Federal Chairmen).

Your mantra is to simply put together a list of ten extraordinary businesses that you believe will be much more valuable in five, ten or twenty years time.

Of course trying to fit all this into your daily life can be a challenge. Completely eliminating the drudgery, and making it simple and fun, is something my team and I have been working on for you. We created our A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. We have worked really hard to create our next-generation service because its what we all want to use. We are its first members! Soon, you will be able to make your investing life simpler too (remember, Value.able Graduates will be invited first – have you secured your copy?). It’s an A1 service that is like nothing you have ever seen before.

You may sense our excitement…

… back to the regular program.

So, here it is. Our list of out-of-favour-but-extraordinary businesses. WARNING: out-of-favour does not always mean ‘bargain’.

Steve Jobs once said; “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully.”