Search Results for: property

-

Legend builds its reputation

Roger Montgomery

September 18, 2012

Some smaller manufacturers have good momentum in a tough market.

The media often portrays Australia’s manufacturing sector as on its knees. The high dollar, rising wage and input costs, and soft demand are clearly taking a toll. But to suggest all manufacturers are struggling is wrong. Some smaller listed manufacturers are performing well.

Transport parts manufacturer Maxitrans Industries almost tripled net profit to $12.3 million in FY2012 and its shares have rallied from 40 cents in January to 79 cents. Another parts manufacturer, Supply Network, said in July it expected full-year earnings before interest and tax (EBIT) to rise $2.2 million to $6 million. Its shares have almost doubled this year to $1.26.

Engineering solutions manufacturer, Legend Corporation, also has good momentum. In August it reported full-year net profit after tax (NPAT) grew 18.2 per cent to $9.4 million, for its fourth consecutive year of profit growth. Legend’s total shareholder return over one year (including dividends) is 8.1 per cent. Over three years, the average annual total shareholder return is 49 per cent.

by Roger Montgomery Posted in Manufacturing, Whitepapers.

- 7 Comments

- save this article

- 7

- POSTED IN Manufacturing, Whitepapers.

-

Is it all FUN and Games?

Harley Grosser

September 9, 2012

The following article was contributed by Harley, and gives a very detailed account of Funtastic as a possible turnaround story. If you have the skill to identify them, turnarounds can be very profitable investments, although its not an area of focus for us at Montgomery Investment Management. In 2006, Funtastic fell to a B5 on our quality and performance ratings, and since that time has been outside the range that we would normally consider “investment grade”. However, as Harley points out, Funtastic may enjoy better times ahead if its portfolio of toys appears on enough Christmas shopping lists.

Funtastic is in the business of fun. As a leading toy distributor with domestic and international operations, as well an entertainment arm, Funtastic (ASX:FUN) make money by selling products that make us happy. The question is, would an investment in Funtastic at today’s prices set us up for pleasant future returns or is this one turnaround story that is worth avoiding?

by Harley Grosser Posted in Companies, Insightful Insights, Manufacturing.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Insightful Insights, Manufacturing.

-

Mining swings from profit to loss quickly and without fear or favour. Its always been this way.

Roger Montgomery

September 6, 2012

You might recall back in December (Dec 8, 2011) with FMG trading at $4.84 (now $2.94), BHP at $37.00 ($31.36 today) and RIO at $66.09 ($50.19 today) we warned

“I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to big drops in margins for a sizeable portion of the [Australian stock] market index…”

Since the start of 2012, commodities have, on average, fallen more than 20%, and in some cases much more. This is a pace of decline matched only by that experienced during the financial crisis of 2008.

At current prices many mining companies will now be making losses. As analysts we question the viability of some companies and Atlas Iron for example, one of the largest Iron Ore producers outside of BHP and RIO, may not be without outside help – should prices remain at or below present levels.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.

-

China Impact

Roger Montgomery

August 31, 2012

From: http://www.bloomberg.com/news/2012-08-28/australia-mining-slowdown-hitting-economy-never-down-on-its-luck.html

“China’s iron-ore imports are going to slow down dramatically,” Xie, a former World Bank economist who researched globalization and bubbles, said in an interview from Hong Kong. “It’s not just because of the economic downturn; it’s because construction of property and infrastructure has peaked” in Australia’s No. 1 customer, he said.

Premier Wen Jiabao in March cut the government’s growth target for China to 7.5 percent for this year, the lowest since 2004, as policy makers there seek to reduce the role of large- scale fixed-asset investment in favor of greater consumer demand. China also has applied limited stimulus relative to 2008-09, as officials rein in property market speculation.

“I don’t think there’s ever been a miracle economy that ultimately lived up to its billing,” said Dylan Grice, global strategist at Societe Generale SA (GLE) in London, who cited the Japanese experience of the 1980s, Thailand before the 1997-1998 Asian financial crisis and Ireland’s “Emerald Tiger” period last decade. “This year’s miracle is next year’s disaster.”

by Roger Montgomery Posted in Energy / Resources, Insightful Insights.

- save this article

- POSTED IN Energy / Resources, Insightful Insights.

-

Good things to come at ASR?

Tony Featherstone

August 24, 2012

Like many Australian industries, the share registry sector is dominated by two giants: Computershare and Link Market Services. The much smaller Advanced Share Registry (ASR) barely rates by comparison, but is well positioned for faster growth when the sharemarket recovers.

A weak sharemarket is a big headwind for share registries, which update and manage company share registers. Fewer initial public offerings (IPOs) and corporate actions, such as rights issues and meeting notices, means less demand for additional share registry services.

ASR’s challenge is compounded by its exposure to smaller resource companies. The Perth-based share registry might struggle if more listed explorers go into their shell, to preserve cash.

Share registries can be great businesses. Computershare’s return on equity has averaged 28.1 per cent over its last four financial years and it is capitalised at $4.2 billion, Skaffold data shows. However, its average annual total shareholder return over five years is negative 3.2 per cent.by Tony Featherstone Posted in Companies, Whitepapers.

- 3 Comments

- save this article

- 3

- POSTED IN Companies, Whitepapers.

-

Living in a Material World

Roger Montgomery

August 6, 2012

When pop singer Madonna wrote Material Girl in 1985 I suspect she wasn’t thinking about BHP or FMG. But nearly thirty years later that is exactly the material world that will determine whether you retire materially well-off or not. BHP’s share price has fallen 30 per cent in the last twelve months so it’s easy to say the shares are now cheap but does BHP represent value or is it a value trap? What I can tell you is that consulting geologists who spend their days planning exploration programs for large miners are in no doubt about whether we have seen the peak of the resources boom.

Six months ago these experts were being told by their major-miner clients that money is not an issue, that the issues were resourcing – labour and drill rigs. “Just make it happen” the geologists were being told “there’s $80 billion of planned infrastructure spending in the pipeline”.

by Roger Montgomery Posted in Whitepapers.

- 8 Comments

- save this article

- 8

- POSTED IN Whitepapers.

-

Is this the fate that awaits Australian Iron Ore Producers?

Roger Montgomery

July 26, 2012

Could it get any worse for Iron Ore? It Just did!

Could it get any worse for Iron Ore? It Just did!News Flash! Shipping more iron ore volumes at lower prices is the same as JBH and HVN selling more TV’s a lower prices. Margins compress and profits don’t meet expectations.

Back in April, when we began more urgently warning investors to look carefully at profit assumptions for the big material stocks, our theory was that iron ore prices would decline because of a massive supply response. It really was basic supply and demand. Economics 101. You can read our warning here: http://rogermontgomery.com/is-the-bubble-bursting/

Back on December 8 2011, with BHP trading at more than $37.00 we again warned:

“I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to big drops in margins for a sizeable portion of the [Australian stock] market index…”

The doubters and many analysts that cover the sector however told us that lower prices would just mean that BHP, RIO and FMG would simply ship more volume. Remember share price performance over the long run follows profitability not profit.

And here’s the latest…

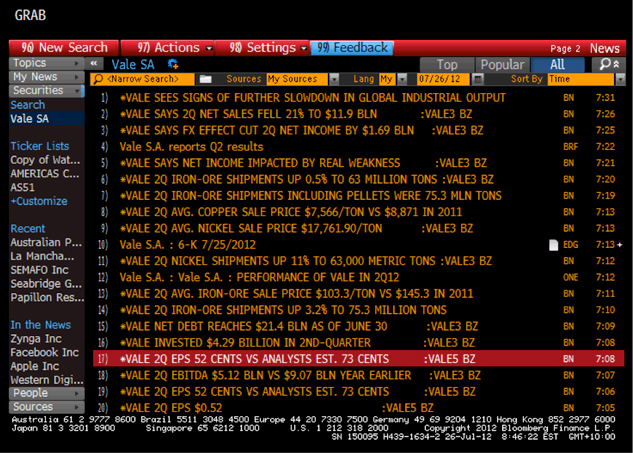

According to a news article that landed in the Bloomberg terminal this morning (see screenshot), Rio de Janeiro-based Vale, the world’s largest iron- ore producer, said second-quarter profit plummeted 59 per cent after prices for iron ore, nickel and copper declined.

Net income dropped to $2.66 billion, or 52 cents per share, from $6.45 billion, or $1.22 per share a year earlier. Vale was expected to post per-share earnings of 73 cents. The selling price of iron ore and most of Vale’s main products is lower than in 2011. This explains the decline in earnings.

Net sales fell 21 percent to $11.9 billion despite an increase in supply / production at Carajas, its biggest mine. Vale reportedly sold its iron ore at an average $103.29 per metric ton, down from $145.30 last year – something we have been warning for 6 months may happen. Nickel’s average sales price dropped 31 percent and copper declined 15 percent.

The stock has fallen 24 percent in the past 12 months, twice the 12 percent decrease in Brazil’s benchmark Bovespa Index. Management has put the focus of the fall squarely on slowing economic growth in China, the world’s biggest steel producer.

Returning to BHP, just 12 months ago, analysts had forecast 2012 net profits of almost $22b rising to $23b in 2013.

Those forecasts now stand at $17b and $18b respectively, representing a massive 22%-23% downgrade. And like Vale, BHP has also materially underperformed the ASX 200 index.

And given the significant miss by Vale analysts this morning, we reckon forecast earnings for BHP, RIO, FMG, MIN, AGO, BCI might disappoint again in the near future.

The answer in future periods may in fact lie in the Shanghai Re-bar prices and we have been watching this closely. Why? Because this is the most-traded steel futures contract and last week it hit a 2012 low.

Are iron ore prices, currently trading around China’s cost of production of $120/t, about to follow Re-bar prices despite most predicting the price simply cannot fall past this point?

The last time Re-bar prices were at this level, iron ore prices were also significantly lower.

When I was last on the ABC’s Inside Business program (watch it here: http://rogermontgomery.com/an-important-announcement/), we discussed Fortescue Metals CFO stating that their long-term iron ore price target is $100/t. I wonder how long we will have to wait until that forecast is also revised lower? As always, time will tell. Vale’s news is not a good omen.

by Roger Montgomery Posted in Energy / Resources, Market Valuation.

- save this article

- POSTED IN Energy / Resources, Market Valuation.

-

What’s the big Idea?

Roger Montgomery

May 21, 2012

Matthew was so disappointed about the April takeover offer for a company he owned, that he wrote a letter to his rep – the CEO

More of us should be doing likewise, remembering the words of Richard Puntillo; “in theory, publicly traded corporations have shareholders as their kings, boards of directors as thesword–wielding knights who protect the shareholders and managers as the vassals who carry out orders. In practice, in the past decade, managers have become kings who lavish gold upon themselves, boards of directors have become fawning courtiers who take coin in return for an uncritical yes-man function and shareholders have become peasants whose property may be seized at management’s whim.”

Has a company you owned shares in been taken over and left you disappointed rather than elated? Its simplistic and a sign of immaturity as an investor to celebrate a takeover when the price paid does not justify the prize. Its far too easy for investors to do the ‘Wall Street walk’ when a bid is received. Matthew’s actions serve as a reminder that their are issues beyond the immediate return that must also be considered.

Hi Roger and team,

I sent the following letter to the CEO of a company today that I am a shareholder in called IDEAS International. They are a small company but very successful and operate in an area that is experiencing huge growth. They are little known, very thinly traded and not appropriate for most investors. Perfect for me!

IDEAS International was formed in 1981 and listed on the ASX in 2001. The IDEAS business is essentially one of analysing computer resource usage. This is important for companies who operate servers because this information allows these companies to increase efficiency and get value for money from their IT purchases. In a commodity like business (i.e. cloud servers) companies that can assist you to squeeze out another 1% in efficiency or when buying $20m of hardware to buy the correct servers for the job, paying a small fee to a company like IDEAS is a no-brainer. They provide independent advice based on real-world scenarios. They collect this information from the other part of their business which is in providing independent monitoring and analysis services to the same companies. Cloud computing is a huge growth area at the moment and it will get bigger. IDEAS is only just making a dent in this business and the demand for their services will grow as the cloud computing business is increasingly commoditised.

On wednesday they went in to a trading halt pending the release of information regarding a control transaction. Today they released a takeover bid by a large international IT outfit called Gartner with the full support of the board. No premium to current prices has been offered, the takeover is at $1.40, the same as the trading price for the last month. The quality of this company is high, it is cheap and Gartner are getting away with robbery.

The below letter doesn’t fit the theme of the recent “Guest Posts” but I thought you might consider it anyway. I won’t be at all concerned if you don’t think it is appropriate.

Kind Regards,

Matthew Rackham

**********

IDEAS InternationalASX Code: IDE“Takeover Disappointment”

Dear Mr Bowhill,

I read with interest the takeover proposal by Gartner for IDEAS released to the ASX this morning.

I am a private investor and I will be up front and say that I am very disappointed to hear that you are recommending the proposal.

IDEAS is a fantastic business. There are very few businesses as good as IDEAS in Australia, let alone on the ASX. Not only is this a fantastic business but by what I have read it seems to be run very well by management. Overlay this on the growth in the server space which IDEAS is in and my impression is this company has many exciting years of growth ahead of it.

In comparison Gartner looks to me to be a lousy business. Significant debt, slim profit margins and poor return on assets are the lot of Gartner’s management and shareholders.

But maybe these could be forgiven if the sale price rewarded current shareholders equally to future shareholders. Sadly however, it does not. If something close to recent performance continues I expect IDEAS to be worth in excess of $3 per share and maybe up to $4.20 in four years time. If the AUD drops this figure will be higher. Looking at your financial statements IDEAS will have the capacity to pay much larger dividends in the very near future as well. Net of cash Gartner are buying our company for $13.1 million and with earnings of $1.9 million and cash flow of $2.8 million – Gartner are making a steal. I expect Gartner will get their purchase outlay back within 4 years, and much earlier when they leverage their much larger distribution network.

I have to ask the question: Why if Gartner are so keen to use the resources of IDEAS do the management of IDEAS not license Gartner as a reseller/agent/partner ? This would ensure the value of IDEAS stays with the shareholders of IDEAS, allow IDEAS management to achieve their aspirations of making IDEAS a globally significant business and Gartner can continue on as, albeit slightly less so than before, a lousy performing business. In this scenario everyone gets the value they are entitled to.

Longstanding shareholders of IDEAS may feel that the performance of IDEAS share price has not been all that great for many years and this is a chance to “cash out” at a good price. What I would say to them is that (1) this is not the time to “cash out” given IDEAS is on the cusp of a large ramp up in use of it’s services – if they have waited this long surely they can hold on a few more years to realise the benefits of their patience and (2) higher share prices in normal circumstances result in greater liquidity in the shares so if they want to cash out they will be able to in a few years anyway. New shareholders from the GFC period have nothing to lose either way (good luck to them!).

I am very frustrated by this opportunistic offer for our company,

Kind Regards,

Matthew Rackham

by Roger Montgomery Posted in Insightful Insights, Value.able.

- 26 Comments

- save this article

- 26

- POSTED IN Insightful Insights, Value.able.

-

The G-8 or a win in Race 7 at Moonee Valley?

Roger Montgomery

May 20, 2012

Its hard to tell from the photo, but these are the world’s leaders – those at the centre of the current financial crisis anyway – at the weekend’s G-8 Summit at Camp David Maryland USA.

Its hard to tell from the photo, but these are the world’s leaders – those at the centre of the current financial crisis anyway – at the weekend’s G-8 Summit at Camp David Maryland USA.Sadly structural change, when foisted on a country, industry sector or company is often hard to discern from the usual cyclical changes. Hopes of a near term recovery persist but are nothing but hope.

The G-8 didn’t agree on next steps to calm the euro zone debt crisis (although money printing has to be on the agenda).

As Famed hedge fund founder Ray Dalio noted at the weekend in an interview with Barrons: “At the moment, there is a tipping toward slowing growth and a question of whether there will be a negative European shock, and that will favor low-risk assets. But to whatever extent we have negative conditions, central banks will respond by printing more money. There will be a big spurt of printing of money, and that will cause a rally and an improvement in the stock markets around the world. It’s like a shot of adrenaline: The heart starts pumping again and then it fades. Then there is another shot of adrenaline. Everybody is asking, “Are we going to have a bull market or a bear market?” I expect we will have both with no big trend. Typically, in these up and down cycles, the upswing will last about twice as long as a down swing. We are now in the higher range of the up-cycle.”

You can read more of Ray’s interview here:

Back to Camp David and the forthright language of point 31 seems sufficiently united to suggest its a topic that we may see in the headlines more because it has a tone of imminence to it…

Here’s the official statement for your ‘leggera’ reading pleasure.

Camp David Declaration

Camp David, Maryland, United States

May 18-19, 2012

Preamble

1. We, the Leaders of the Group of Eight, met at Camp David on May 18 and 19, 2012 to address major global economic and political challenges.

The Global Economy

2. Our imperative is to promote growth and jobs.

3. The global economic recovery shows signs of promise, but significant headwinds persist.

4. Against this background, we commit to take all necessary steps to strengthen and reinvigorate our economies and combat financial stresses, recognizing that the right measures are not the same for each of us.

5. We welcome the ongoing discussion in Europe on how to generate growth, while maintaining a firm commitment to implement fiscal consolidation to be assessed on a structural basis. We agree on the importance of a strong and cohesive Eurozone for global stability and recovery, and we affirm our interest in Greece remaining in the Eurozone while respecting its commitments. We all have an interest in the success of specific measures to strengthen the resilience of the Eurozone and growth in Europe. We support Euro Area Leaders’ resolve to address the strains in the Eurozone in a credible and timely manner and in a manner that fosters confidence, stability and growth.

6. We agree that all of our governments need to take actions to boost confidence and nurture recovery including reforms to raise productivity, growth and demand within a sustainable, credible and non-inflationary macroeconomic framework. We commit to fiscal responsibility and, in this context, we support sound and sustainable fiscal consolidation policies that take into account countries’ evolving economic conditions and underpin confidence and economic recovery.

7. To raise productivity and growth potential in our economies, we support structural reforms, and investments in education and in modern infrastructure, as appropriate. Investment initiatives can be financed using a range of mechanisms, including leveraging the private sector. Sound financial measures, to which we are committed, should build stronger systems over time while not choking off near-term credit growth. We commit to promote investment to underpin demand, including support for small businesses and public-private partnerships.

8. Robust international trade, investment and market integration are key drivers of strong sustainable and balanced growth. We underscore the importance of open markets and a fair, strong, rules-based trading system. We will honor our commitment to refrain from protectionist measures, protect investments and pursue bilateral, plurilateral, and multilateral efforts, consistent with and supportive of the WTO framework, to reduce barriers to trade and investment and maintain open markets. We call on the broader international community to do likewise. Recognizing that unnecessary differences and overly burdensome regulatory standards serve as significant barriers to trade, we support efforts towards regulatory coherence and better alignment of standards to further promote trade and growth.

9. Given the importance of intellectual property rights (IPR) to stimulating job and economic growth, we affirm the significance of high standards for IPR protection and enforcement, including through international legal instruments and mutual assistance agreements, as well as through government procurement processes, private-sector voluntary codes of best practices, and enhanced customs cooperation, while promoting the free flow of information. To protect public health and consumer safety, we also commit to exchange information on rogue internet pharmacy sites in accordance with national law and share best practices on combating counterfeit medical products.

Energy and Climate Change

10. As our economies grow, we recognize the importance of meeting our energy needs from a wide variety of sources ranging from traditional fuels to renewables to other clean technologies. As we each implement our own individual energy strategies, we embrace the pursuit of an appropriate mix from all of the above in an environmentally safe, sustainable, secure, and affordable manner. We also recognize the importance of pursuing and promoting sustainable energy and low carbon policies in order to tackle the global challenge of climate change. To facilitate the trade of energy around the world, we commit to take further steps to remove obstacles to the evolution of global energy infrastructure; to reduce barriers and refrain from discriminatory measures that impede market access; and to pursue universal access to cleaner, safer, and more affordable energy. We remain committed to the principles on global energy security adopted by the G-8 in St. Petersburg.

11. As we pursue energy security, we will do so with renewed focus on safety and sustainability. We are committed to establishing and sharing best practices on energy production, including exploration in frontier areas and the use of technologies such as deep water drilling and hydraulic fracturing, where allowed, to allow for the safe development of energy sources, taking into account environmental concerns over the life of a field. In light of the nuclear accident triggered by the tsunami in Japan, we continue to strongly support initiatives to carry out comprehensive risk and safety assessments of existing nuclear installations and to strengthen the implementation of relevant conventions to aim for high levels of nuclear safety.

12. We recognize that increasing energy efficiency and reliance on renewables and other clean energy technologies can contribute significantly to energy security and savings, while also addressing climate change and promoting sustainable economic growth and innovation. We welcome sustained, cost-effective policies to support reliable renewable energy sources and their market integration. We commit to advance appliance and equipment efficiency, including through comparable and transparent testing procedures, and to promote industrial and building efficiency through energy management systems.

13. We agree to continue our efforts to address climate change and recognize the need for increased mitigation ambition in the period to 2020, with a view to doing our part to limit effectively the increase in global temperature below 2ºC above pre-industrial levels, consistent with science. We strongly support the outcome of the 17th Conference of the Parties to the U.N. Framework Convention on Climate Change (UNFCCC) in Durban to implement the Cancun agreements and the launch of the Durban Platform, which we welcome as a significant breakthrough toward the adoption by 2015 of a protocol, another legal instrument or an agreed outcome with legal force applicable to all Parties, developed and developing countries alike. We agree to continue to work together in the UNFCCC and other fora, including through the Major Economies Forum, toward a positive outcome at Doha.

14. Recognizing the impact of short-lived climate pollutants on near-term climate change, agricultural productivity, and human health, we support, as a means of promoting increased ambition and complementary to other CO2 and GHG emission reduction efforts, comprehensive actions to reduce these pollutants, which, according to UNEP and others, account for over thirty percent of near-term global warming as well as 2 million premature deaths a year. Therefore, we agree to join the Climate and Clean Air Coalition to Reduce Short-lived Climate Pollutants.

15. In addition, we strongly support efforts to rationalize and phase-out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption, and to continue voluntary reporting on progress.

Food Security and Nutrition

16. For over a decade, the G-8 has engaged with African partners to address the challenges and opportunities afforded by Africa’s quest for inclusive and sustainable development. Our progress has been measurable, and together we have changed the lives of hundreds of millions of people. International assistance alone, however, cannot fulfill our shared objectives. As we move forward, and even as we recommit to working together to reduce poverty, we recognize that our task is also to foster the change that can end it, by investing in Africa’s growth, its expanding role in the global economy, and its success. As part of that effort, we commit to fulfill outstanding L’Aquila financial pledges, seek to maintain strong support to address current and future global food security challenges, including through bilateral and multilateral assistance, and agree to take new steps to accelerate progress towards food security and nutrition in Africa and globally, on a complementary basis.

17. Since the L’Aquila Summit, we have seen an increased level of commitment to global food security, realignment of assistance in support of country-led plans, and new investments and greater collaboration in agricultural research. We commend our African partners for the progress made since L’Aquila, consistent with the Maputo Declaration, to increase public investments in agriculture and to adopt the governance and policy reforms necessary to accelerate sustainable agricultural productivity growth, attain greater gains in nutrition, and unlock sustainable and inclusive country-led growth. The leadership of the African Union and the role of its Comprehensive Africa Agriculture Development Program (CAADP) have been essential.

18. Building on this progress, and working with our African and other international partners, today we commit to launch a New Alliance for Food Security and Nutrition to accelerate the flow of private capital to African agriculture, take to scale new technologies and other innovations that can increase sustainable agricultural productivity, and reduce the risk borne by vulnerable economies and communities. This New Alliance will lift 50 million people out of poverty over the next decade, and be guided by a collective commitment to invest in credible, comprehensive and country-owned plans, develop new tools to mobilize private capital, spur and scale innovation, and manage risk; and engage and leverage the capacity of private sector partners – from women and smallholder farmers, entrepreneurs to domestic and international companies.

19. The G-8 reaffirms its commitment to the world’s poorest and most vulnerable people, and recognizes the vital role of official development assistance in poverty alleviation and achieving the Millennium Development Goals. As such, we welcome and endorse the Camp David Accountability Report which records the important progress that the G-8 has made on food security consistent with commitments made at the L’Aquila Summit, and in meeting our commitments on global health, including the Muskoka initiative on maternal, newborn and child health. We remain strongly committed to reporting transparently and consistently on the implementation of these commitments. We look forward to a comprehensive report under the UK Presidency in 2013.

Afghanistan’s Economic Transition

20. We reaffirm our commitment to a sovereign, peaceful, and stable Afghanistan, with full ownership of its own security, governance and development and free of terrorism, extremist violence, and illicit drug production and trafficking. We will continue to support the transition process with close coordination of our security, political and economic strategies.

21. With an emphasis on mutual accountability and improved governance, building on the Kabul Process and Bonn Conference outcomes, our countries will take steps to mitigate the economic impact of the transition period and support the development of a sustainable Afghan economy by enhancing Afghan capacity to increase fiscal revenues and improve spending management, as well as mobilizing non-security assistance into the transformation decade.

22. We will support the growth of Afghan civil society and will mobilize private sector support by strengthening the enabling environment and expanding business opportunities in key sectors, as well as promote regional economic cooperation to enhance connectivity.

23. We will also continue to support the Government of the Islamic Republic of Afghanistan in its efforts to meet its obligation to protect and promote human rights and fundamental freedoms, including in the rights of women and girls and the freedom to practice religion.

24. We look forward to the upcoming Tokyo Conference in July, as it generates further long-term support for civilian assistance to Afghanistan from G-8 members and other donors into the transformation decade; agrees to a strategy for Afghanistan’s sustainable economic development, with mutual commitments and benchmarks between Afghanistan and the international community; and provides a mechanism for biennial reviews of progress being made against those benchmarks through the transformation decade.

The Transitions in the Middle East and North Africa

25. A year after the historic events across the Middle East and North Africa began to unfold, the aspirations of people of the region for freedom, human rights, democracy, job opportunities, empowerment and dignity are undiminished. We recognize important progress in a number of countries to respond to these aspirations and urge continued progress to implement promised reforms. Strong and inclusive economic growth, with a thriving private sector to provide jobs, is an essential foundation for democratic and participatory government based on the rule of law and respect for basic freedoms, including respect for the rights of women and girls and the right to practice religious faith in safety and security.

26. We renew our commitment to the Deauville Partnership with Arab Countries in Transition, launched at the G-8 Summit last May. We welcome the steps already taken, in partnership with others in the region, to support economic reform, open government, and trade, investment and integration.

27. We note in particular the steps being taken to expand the mandate of the European Bank for Reconstruction and Development to bring its expertise in transition economies and financing support for private sector growth to this region; the platform established by international financial institutions to enhance coordination and identify opportunities to work together to support the transition country reform efforts; progress in conjunction with regional partners toward establishing a new transition fund to support country-owned policy reforms complementary to existing mechanisms; increased financial commitments to reforming countries from international and regional financial institutions, the G-8 and regional partners; strategies to increase access to capital markets to help boost private investment; and commitments from our countries and others to support small and medium-sized enterprises, provide needed training and technical assistance and facilitate international exchanges and training programs for key constituencies in transition countries.

28. Responding to the call from partner countries, we endorse an asset recovery action plan to promote the return of stolen assets and welcome, and commit to support the action plans developed through the Partnership to promote open government, reduce corruption, strengthen accountability and improve the regulatory environment, particularly for the growth of small- and medium-sized enterprises. These governance reforms will foster the inclusive economic growth, rule of law and job creation needed for the success of democratic transition. We are working with Partnership countries to build deeper trade and investment ties, across the region and with members of the G-8, which are critical to support growth and job creation. In this context, we welcome Partnership countries’ statement on openness to international investment.

29. G-8 members are committed to an enduring and productive partnership that supports the historic transformation underway in the region. We commit to further work during the rest of 2012 to support private sector engagement, asset recovery, closer trade ties and provision of needed expertise as well as assistance, including through a transition fund. We call for a meeting in September of Foreign Ministers to review progress being made under the Partnership.

Political and Security Issues

30. We remain appalled by the loss of life, humanitarian crisis, and serious and widespread human rights abuses in Syria. The Syrian government and all parties must immediately and fully adhere to commitments to implement the six-point plan of UN and Arab League Joint Special Envoy (JSE) Kofi Annan, including immediately ceasing all violence so as to enable a Syrian-led, inclusive political transition leading to a democratic, plural political system. We support the efforts of JSE Annan and look forward to seeing his evaluation, during his forthcoming report to the UN Security Council, of the prospects for beginning this political transition process in the near-term. Use of force endangering the lives of civilians must cease. We call on the Syrian government to grant safe and unhindered access of humanitarian personnel to populations in need of assistance in accordance with international law. We welcome the deployment of the UN Supervision Mission in Syria, and urge all parties, in particular the Syrian government, to fully cooperate with the mission. We strongly condemn recent terrorist attacks in Syria. We remain deeply concerned about the threat to regional peace and security and humanitarian despair caused by the crisis and remain resolved to consider further UN measures as appropriate.

31. We remain united in our grave concern over Iran’s nuclear program. We call on Iran to comply with all of its obligations under relevant UNSC resolutions and requirements of the International Atomic Energy Agency’s (IAEA) Board of Governors. We also call on Iran to continuously comply with its obligations under the Nuclear Non-Proliferation Treaty, including its safeguards obligations. We also call on Iran to address without delay all outstanding issues related to its nuclear program, including questions concerning possible military dimensions. We desire a peaceful and negotiated solution to concerns over Iran’s nuclear program, and therefore remain committed to a dual-track approach. We welcome the resumption of talks between Iran and the E3+3 (China, France, Germany, Russia, the United Kingdom, the United States, and the European Union High Representative). We call on Iran to seize the opportunity that began in Istanbul, and sustain this opening in Baghdad by engaging in detailed discussions about near-term, concrete steps that can, through a step-by-step approach based on reciprocity, lead towards a comprehensive negotiated solution which restores international confidence that Iran’s nuclear program is exclusively peaceful. We urge Iran to also comply with international obligations to uphold human rights and fundamental freedoms, including freedom of religion, and end interference with the media, arbitrary executions, torture, and other restrictions placed on rights and freedoms.

32. We continue to have deep concerns about provocative actions of the Democratic People’s Republic of Korea (DPRK) that threaten regional stability. We remain concerned about the DPRK’s nuclear program, including its uranium enrichment program. We condemn the April 13, 2012, launch that used ballistic missile technology in direct violation of UNSC resolution. We urge the DPRK to comply with its international obligations and abandon all nuclear and ballistic missile programs in a complete, verifiable, and irreversible manner. We call on all UN member states to join the G-8 in fully implementing the UNSC resolutions in this regard. We affirm our will to call on the UN Security Council to take action, in response to additional DPRK acts, including ballistic missile launches and nuclear tests. We remain concerned about human rights violations in the DPRK, including the situation of political prisoners and the abductions issue.

33. We recognize that according women full and equal rights and opportunities is crucial for all countries’ political stability, democratic governance, and economic growth. We reaffirm our commitment to advance human rights of and opportunities for women, leading to more development, poverty reduction, conflict prevention and resolution, and improved maternal health and reduced child mortality. We also commit to supporting the right of all people, including women, to freedom of religion in safety and security. We are concerned about the reduction of women’s political participation and the placing at risk of their human rights and fundamental freedoms, including in Middle East and North Africa countries emerging from conflict or undergoing political transitions. We condemn and avow to stop violence directed against, including the trafficking of, women and girls. We call upon all states to protect human rights of women and to promote women’s roles in economic development and in strengthening international peace and security.

34. We pay tribute to the remarkable efforts of President Thein Sein, Daw Aung San Suu Kyi, and many other citizens of Burma/Myanmar to deliver democratic reform in their country over the past year. We recognize the need to secure lasting and irreversible reform, and pledge our support to existing initiatives, particularly those which focus on peace in ethnic area, national reconciliation, and entrenching democracy. We also stress the need to cooperate to further enhance aid coordination among international development partners of Burma/Myanmar and conduct investment in a manner beneficial to the people of Burma/Myanmar.

35. We recognize the particular sacrifices made by the Libyan people in their transition to create a peaceful, democratic, and stable Libya. The international community remains committed to actively support the consolidation of the new Libyan institutions.

36. We condemn transnational organized crime and terrorism in all forms and manifestations. We pledge to enhance our cooperation to combat threats of terrorism and terrorist groups, including al-Qa’ida, its affiliates and adherents, and transnational organized crime, including individuals and groups engaged in illicit drug trafficking and production. We stress that it is critical to strengthen efforts to curb illicit trafficking in arms in the Sahel area, in particular to eliminate the Man-Portable Air Defense Systems proliferated across the region; to counter financing of terrorism, including kidnapping for ransom; and to eliminate support for terrorist organizations and criminal networks. We urge states to develop necessary capacities including in governance, education, and criminal justice systems, to address, reduce and undercut terrorist and criminal threats, including “lone wolf” terrorists and violent extremism, while safeguarding human rights and upholding the rule of law. We underscore the central role of the United Nations and welcome the Global Counterterrorism Forum (GCTF) and efforts of the Roma-Lyon Group in countering terrorism. We reaffirm the need to strengthen the implementation of the UN Al-Qaida sanctions regime, and the integrity and implementation of the UN conventions on drug control and transnational organized crime.

37. We reaffirm that nonproliferation and disarmament issues are among our top priorities. We remain committed to fulfill all of our obligations under the Nuclear Nonproliferation Treaty and, concerned about the severe proliferation challenges, call on all parties to support and promote global nonproliferation and disarmament efforts.

38. We welcome and fully endorse the G-8 Foreign Ministers Meeting Chair’s Statement with accompanying annex.

Conclusion

39. We look forward to meeting under the presidency of the United Kingdom in 2013.

Indeed!

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 20 May 2012.

by Roger Montgomery Posted in Economics.

- 9 Comments

- save this article

- 9

- POSTED IN Economics.

-

Guest Post: Who’s on the Phone?

Roger Montgomery

April 29, 2012

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.Take a look at any of the financial media channels or websites and you will likely notice the prevalence of brokers, advisors and commentators claiming that Australian stocks are currently cheap when viewed on a P/E basis. There is no denying that at the present time investors in the Australian stock market are willing to pay considerably less for the earnings of a company than they were just a few years ago. There are a number of possible explanations for this from the risk of external shocks to the increased demand for fixed income securities but there is no doubt that one of the main drivers of the lower market multiple is that investors are pricing in an expectation of lower growth rates in the majority of industries. The earnings of companies in retail, mining, property and construction just to name a few are all expected to experience low to moderate growth, if not stagnation, in the foreseeable future.

In an environment where opportunities for growth are sparse, when a true opportunity presents itself investors have demonstrated their willingness to pay up. There is no better example of this than the substantially higher industry average P/E in the telecommunications sector, where internet growth and new technological developments are driving rates of growth unrivaled elsewhere in the market. As a result investors have their eyes set on discovering the next rising star in the telecommunications world. My Net Fone Ltd may be about to have its turn in the limelight.

My Net Fone (ASX:MNF)

In the words of the company:

“My Net Fone Limited, (ASX:MNF) is Australia’s leading provider of hosted voice and data communications services for residential, business and enterprise users. My Net Fone was first founded in 2004, was listed on the ASX in mid 2006, has 52.5 million shares on issue, has operated profitably since 2009 and has paid dividends to its shareholders every six months since September 2010.

The company has a reputation for quality, value and innovation, having won numerous awards including the Deloitte Technology Fast 50 (2008, 2009, and 2010), PC User Product of the Year (2005), Money Magazine Product of the Year (2007) and many others.

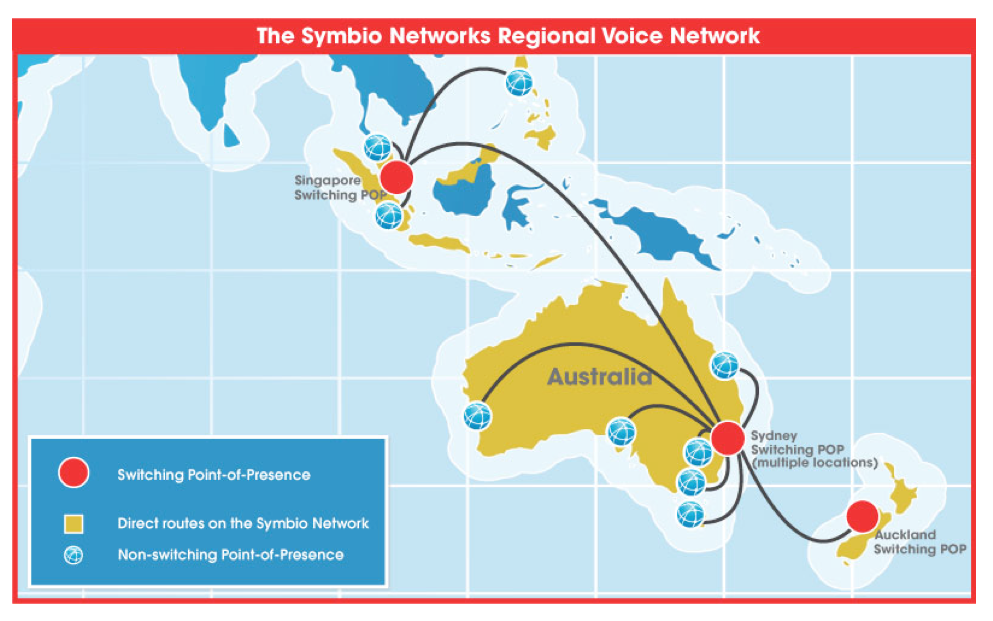

My Net Fone’s wholly owned subsidiary, Symbio, owns and operates Australia’s largest VoIP network, providing wholesale carrier services to the Australian industry, including number porting, cloud‐based hosted PBX services, call termination, call origination and many other infrastructure enabled services. The Symbio network carries over 1.5 Billion minutes of voice per annum.”

What is VoIP? A Look At The Industry

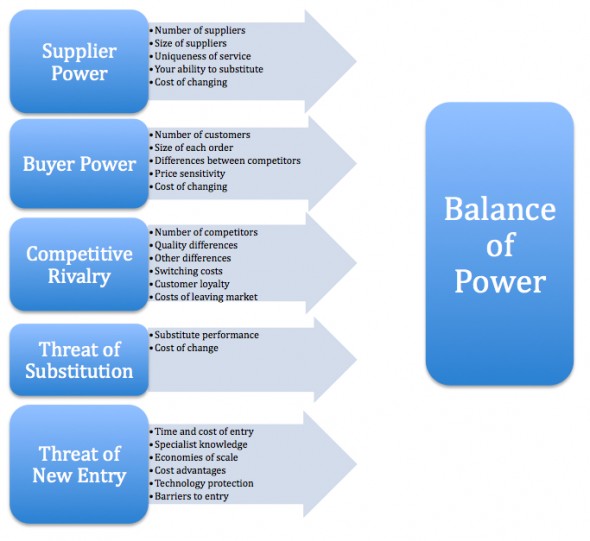

Before looking closer at MNF, it is helpful to have a sound understanding of the industry in which the company operates. Indeed one should first gain a complete and comprehensive understanding of the injdustry and the competitive landscape.

VoIP, or Voice Over Internet Protocol, in its simplest form refers to the group of services that use the internet as a means for communication rather than the standard phone line. A phone call via VoIP involves the call conversation being split into data packets, transmitted over the internet and then reassembled at the other end. The primary benefit as a result is that there is no need for line rental, which provides significant savings to consumers and businesses alike. While cost reduction is generally seen as the most attractive feature of VoIP services the benefits are not limited solely to reduced expenses with a range of other products and services offered by MNF including Virtual PBX, number porting, SIP trunking and hosted services. While their terms may sound complicated they all fit under the catch all term of ‘VoIP.’

The VoIP market is highly competitive and the battle is generally fought over price. For a retail customer, the main reason you would choose VoIP over your traditional provider would of course be the cost savings that occur as a result. But for small and medium businesses, while cost is also of primary importance, other factors come into consideration including product offering, service quality and the ability of the provider to continually innovate and develop new products and services.

VoIP is not new nor is it only just now gaining popularity. If you have ever used Skype or a similar service, you have used VoIP (in fact Skype is a client of MNF’s wholesale division). But there are different VoIP service types and the kind you use when you Skype your family while away on holiday is very different to the kind you would install in your small to medium sized business of 50 full time employees. The two do not directly compete with each other. Sure, businesses may use Skype for video conferencing, but they will still need a communications system, multiple phone numbers, 1300 numbers, fax over IP, remote access to their VoIP number and a host of other services provided by MNF and their competitors. Customers of MNF have reported cost savings on phone bills of up to 50% and in the current business environment it seems likely that businesses will continue to look at ways to reduce costs while still maintaining or even increasing productivity. VoIP services have much to offer small to medium businesses in this regard.

In the early years of VoIP the main restriction was (and at times still is) the issue of low quality broadband. If the broadband connection was weak then the quality of the VoIP service would follow suit, thus making the adoption of VoIP unworthy of the investment for anyone without the highest quality broadband connection. It is no surprise then that in the case of Europe those countries with a high rate of strong broadband connection to homes and businesses (eg France) saw a higher uptake of VoIP than European countries with lower rates of high quality broadband access.

As broadband speeds improve, so too will the quality and available range of VoIP services in Australia. The roll out of the NBN will provide significant opportunities for MNF across all divisions of their business. As more people have access to fast, high quality broadband the potential market for MNF will grow. In the transition period there is likely to be a strong push for new customer acquisition by service providers as retail and business customers alike consider changing from their service type and/or service provider (See MNF’s current marketing program offering significant savings for customers to sign up prior to the roll out of the NBN). While this could result in greater competition in the business and retail markets, as we will see the wholesale division is well positioned to benefit from more service providers setting up shop creating higher demand for wholesale services.

Historic Performance – A Demonstrated Track Record Of Growth

Many investors require a demonstrated track record, which is seen as a way to further reduce the risk one takes in any given investment. As a result there are those who will take one look at the financial reports of MNF, notice the accumulated losses and be frightened away, preferring to wait until MNF has had a few years of strong returns, improving margins and profit growth under its belt. For some, turnaround stories are no go zones.

There is nothing wrong with this method of investing, in fact it can be incredibly successful (witness one W.E. Buffett) but in the case of MNF it is important to understand why the company experienced losses in its early years and why the profits are about to start rolling in.

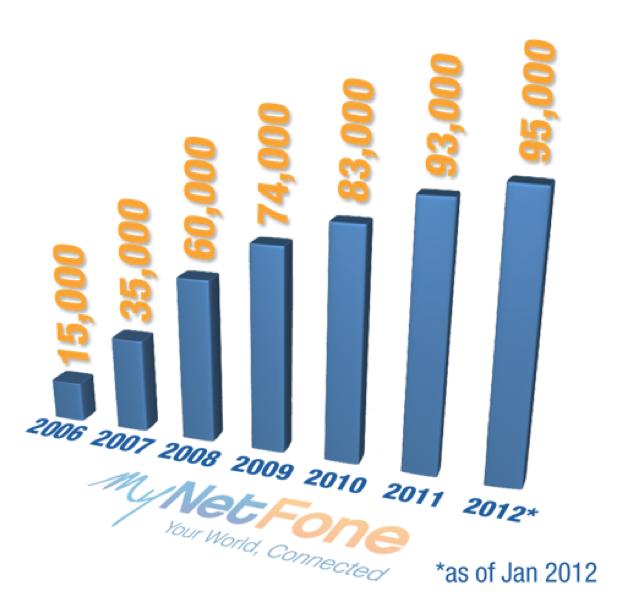

First of all, MNF does possess a proven track record in regards to consistent revenue growth. MNF was started from scratch and has since grown to become a company that currently has 95000 subscribers. Any business owner will know that in the early years of operation profits can take time to come to fruition and a period of investment and cash outflows inevitably precedes growth in scale and subsequent cash inflows. In the case of MNF the company was operating in a brand new industry where the majority of individuals and businesses were still becoming aware of the potential for VoIP services, not to mention the fact that only the tech savvy had the necessary high speed broadband connection to make VoIP worthy of investment in the first place. In 2006, a year that VoIP uptake experienced rapid growth, 19 percent of small to medium businesses in Australia used VoIP services. But of those that didn’t, 35% were completely unaware it existed and another 7% did not understand how it could be implemented into their business.

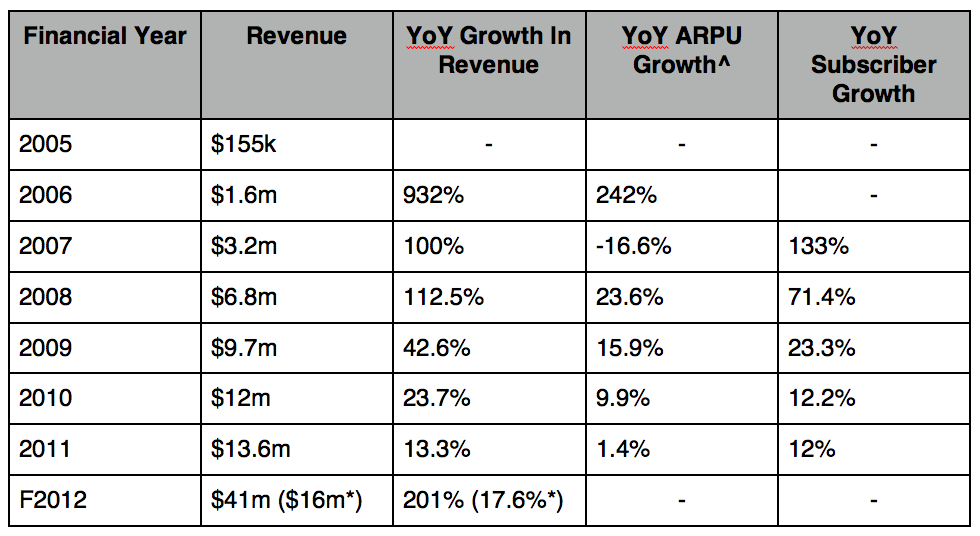

Having said that the growth in revenues (shown in the table below) since MNF listed as a public company is very impressive.

^Provides general summary; figures are not broken down into individual or small to medium business customers

*Minus the contribution of the newly acquired Symbio Networks

Similarly impressive is the year on year growth in MNF’s total customer base, as shown both in the table above and below in a graphic from the company’s website.

Today consumer awareness regarding VoIP is strong and growing. The uptake amongst small and medium businesses is gaining considerable traction due to the significant cost savings and continually developing services on offer. While MNF’s subscriber growth rate is declining from its dizzying heights the company now has access to the potentially lucrative wholesale market through their acquisition of Symbio Networks. And to top things off the government is about to gift MNF with a once in a lifetime opportunity.

NBN – Opportunities Abound For MNF

As previously mentioned, in the past one of the restrictions holding back individuals and businesses from subscribing to VoIP based services was the lack of access to high quality broadband. While broadband penetration in Australia is not particularly low (we were ranked 21st out of OECD countries for fixed broadband penetration and 8th for wireless broadband penetration as at 30 June 2011) the roll out of the National Broadband Network (NBN) will only serve to increase the equality of access to high speed broadband across Australia. What this means is that MNF’s potential market will grow as the NBN roll out progresses.

The capability of MNF’s services are enhanced by any increase in computer power, software/hardware development or internet speeds. Furthermore since product innovation is a demonstrated strength of the company, as technology progresses the range of potential product and service offerings that MNF can deliver to their market will increase. Product and service innovation is a vital differentiating factor in any highly competitive market.

The NBN, in the company’s own words is “a once in a lifetime opportunity” for new customer acquisition as their is a mass transition from the current copper fibre network to the NBN. If the NBN achieves its objectives 93% of Australian households, schools and businesses will have access to broadband services. This will increase the up take potential for residential and SMB VoIP services significantly, and while MNF will likely have to deal with the arrival of many, many new competitors as a result of the expanding market, their wholesale division is likely to benefit from general growth of the VoIP market regardless of which service providers win market share.

(on the flip side, note the higher costs to all competitors/participants after the NBN rolls out and consider the implications of the NBN possibly becoming fibre to the node if Labour loses the next election)

The Importance Of Scale and Differentiation

As an investor it is certainly advantageous to focus on industries experiencing rapid growth. As they say, ‘A rising tide lifts all boats’ and to an extent this will be seen in the performance of internet and VoIP service providers for years to come as the tremendous growth rates are forecast to continue into the foreseeable future. But a market experiencing rapid growth breeds intense competition and if a company cannot differentiate itself from the pack it will be left to fight solely on the basis of being the lowest cost provider, which very rarely ends well for those involved.

There are two things that can separate a company from the pack and ensure it achieves financial performance above the industry average. The first is the presence of scale. MNF’s margins have historically been quite tight, but as revenue grows the margins will naturally improve. The VoIP service industry, while intensely competitive, is such that those who are able to achieve economies of scale have the potential to experience strong margin expansion as each incremental dollar of revenue generates a higher proportion of value to the bottom line. Symbio Networks, the wholesale division of MNF, currently operates at 50% utilisation leaving significant room for margins to be increased at little incremental cost to the company. So while revenue growth will likely taper off to more sustainable growth rates it is highly likely that NPAT growth will outpace revenue growth over the next few years.

In order to reach and sustain a level where economies of scale begin to benefit the bottom line, a company like MNF needs to be able to differentiate itself from competitors. There needs to be a reason why individuals and businesses will choose MNF over other VoIP providers if we, as investors, can be confident that the current high rates of return being generated by the company can be sustained.

The first differentiating factor relates to the vision of MNF management and their focus since the founding of the company. Unlike some of their larger competitors who are being forced to make the transition from older technologies and offer VoIP in addition to their current services, MNF is coming off a lower cost base and with sole focus on New Generation Networks and innovation within the VoIP market. Since the founding of MNF the goal has been “to be the leading VoIP provider in Australia.” The acquisition of the owner of the largest supplier of VoIP wholesale and managed services in Australia also helps separate MNF from the pack.

A quick read through MNF’s past annual reports will give you an idea of the demonstrated ability of the company to come up with new and innovative product offerings. In the past this has no doubt served to enhance the ability of MNF to grab market share, and is reflected in their many industry awards for exceptional products and services. As an investor your job is to determine whether or not MNF will be able to sustain the current high rates of return well in to the future. Start by researching the company’s product offering, read testimonials and compare it with those of MNF’s competitors. Sometimes the best way to form a view over the future of a company is not to approach things as an investor, but to view the business from the perspective of a potential customer.

Perhaps the most attractive feature of MNF’s business model and that which most effectively differentiates MNF from its competitors is the fact that the company is not simply a reseller of VoIP services. A large proportion of VoIP providers are in the business of buying from a wholesaler and reselling the product to the end consumer. Prior to the acquisition of Symbio, this is what it appeared as though MNF was doing when Symbio Networks was external but in actual fact the company was creating these voice services using Symbio’s VoIP technology, adding value through internally developed software and delivering a unique product offering to their customers. The company places a great deal of importance on the development of software and intellectual property to ensure they add value to the services they sell to customers. In the words of the CEO, Rene Sugo, “Today our advantage is largely technical – in terms of scalability, quality, reliability and innovative intellectual property. That is what has driven our growth, and will continue to do so in the medium term.”

Ultimately there is no negating the fact that for a company like MNF (where product development and technological advancement happens faster than most of us can fathom) we are heavily reliant on the competence of management.

The Founders – Interests aligned with shareholders

The two founders, Andy Fung and Rene Sugo, own just over 50% of the company between them. In the first quarter of this year Andy Fung retired from his position as CEO and Rene Sugo took his place. Fung is staying on as a non-executive director and retains his significant holding in the company. Both have strong backgrounds in the telecommunications industry, as well as experience and in depth knowledge in the area of Next Generation Networks. In the ever developing industry of VoIP service providers, experienced and business savvy management is integral to a company’s success.

There is more than just their significant shareholdings in the company that indicates management’s strong desire for MNF to succeed. In the early stages the directors performed services for the company at no or low cost and salaries were kept artificially low as the company dealt with the low capital base nature of a start up business. Similarly, the company was “supported by the low cost provision of services, technology and business support from Symbio Networks Pty Ltd during the start up and early growth phase of the business.” Andy Fung and Rene Sugo were the founders of Symbio Networks, and the company is now wholly owned by My Net Fone after the (related party?) acquisition was finalised earlier this year.

When MNF listed in 2006 they raised $2.5m. Unlike so many of the companies that list on the ASX these funds were not used to repay loans to related parties or to line the pockets of directors, but to fund an expanded marketing program and increase sales and support staff, which was no doubt a raging success evidenced by the growth in total customer numbers of those early years.

Management have also shown their ability to innovate and stay one step ahead of the market. They were the first to remove the pay-for-time model of pricing on international calls and pioneered the move to the now prevalent flat charge for international VoIP calls. The development of ‘On-the-Go’ services which allowed customers to access VoIP services on their mobile in 2007, ‘Meet-Me Conferencing’ in 2010 and the regularly introduced new service plans available to customers are all examples of MNF’s commitment to continually innovating their product offering.

In the process of conducting your research on MNF, do as Roger has suggested frequently here and read each financial report from the prospectus through to the most recent half yearly report. No doubt you will notice the trend of management promising something one year and delivering the next. This is, I believe, exactly what you should be looking for in the management of companies you choose to invest in. In the announcements regarding the Symbio acquisition, and in related articles, the CEO of MNF regularly described the increase in growth that he believed the company was about to experience. On the 23rd of April the company delivered yet again with a profit upgrade that they attributed to the “outstanding performance across the group,” particularly in the March quarter.

The interests of management appear strongly aligned with those of shareholders and as investors our money seems in more than capable hands. Do take the time to read the past annual reports of MNF. Not only will you better understand the growth path that management have in mind for the company but you will most certainly notice the way in which management come across as genuinely interested in the future of the company, its customers and its shareholders, something which is unfortunately rare in many ASX listed companies.

Symbio Networks – A Game Changer For My Net Fone

In September of last year MNF announced they were acquiring Symbio Networks for a maximum consideration of $6m. Symbio Networks is Australia’s largest supplier of VoIP wholesale and managed services. The company was founded by Andy Fung and Rene Sugo, the same founders of My Net Fone. The acquisition of Symbio significantly changes the dynamics of MNF as it means the company is now positioned to benefit from the entry of more VoIP providers.

Management plans to run Symbio as a wholly owned subsidiary, separate to the day to day business of My Net Fone. This is important as some of Symbio’s customers are direct competitors with the retail and business division of MNF. Symbio is actually larger than My Net Fone when comparing on the basis of revenues, with $25m of MNF’s FY12 revenue expected to come from Symbio.

The wholesale operations Symbio brings with it is a game changer for MNF. It means that the company is effectively diversified from the inevitable increase in competition that is sure to arise if and when VoIP uptake continues to grow. While the business and retail division benefits only if customers choose MNF over its competitors, Symbio, as the owner and operator of Australia’s largest VoIP network, is positioned to benefit from any overall increase in competition.

Because Symbio has clients across the Asia Pacific the company will not only benefit from the NBN in Australia, but are also positioned to do well from any further increase in broadband penetration or VoIP uptake in Singapore, New Zealand and Malaysia. As such the growth potential for Symbio, and thus MNF, is not limited solely to the Australian market.

The story of both Symbio Networks and My Net Fone are evidence of in my opinion, the visionary skills of the founders of both companies, Andy Fung and Rene Sugo. What we are seeing in the market today with increased uptake of VoIP, new VoIP related products and services being developed and the beginnings of the transition of VoIP to mobile applications, were all envisioned by Fung and Sugo as early as 2002. Today, Rene Sugo is the CEO of the merged entity and Andy Fung will remain as an advisor, consultant and significant shareholder. If their current views on the potential growth in the wholesale, retail and business divisions of their company is half as accurate as their views from ten years ago then it appears MNF is well positioned for the future.

Key Risks (may not be exhaustive)

While the prospects for MNF appear very attractive, like any investment there are risks one needs to consider:

- The NBN: While the NBN is expected to be a fantastic opportunity for MNF there are risks that surround its ultimate effect on the company. These risks include potential increases in costs that favour the larger ISPs, the possibility of substantial changes to the NBN between now and final rollout and of course the fact that the opposition intends to scrap the plan altogether. The first of these risks is reduced by the merger of My Net Fone and Symbio and the fact that MNF’s customer base, while not among the largest, is substantial at around 100,000 customers. The risk of any changes to the details of the NBN that may negatively impact MNF is negated somewhat by management’s active and ongoing correspondence with government and the fact that as the largest VoIP network operator in Australia MNF does indeed have some say in negotiations. And finally if the NBN were to be scrapped, business would go on as usual and if the recent past is anything to go by MNF will continue to grow both revenues and subscribers.

- With the acquisition of Symbio, MNF is liable to pay up to $6m depending on the performance of the now wholly owned subsidiary. The risk here is that if cash flows are impaired for whatever reason the company may need to reduce its dividend payment to fulfill its obligations. With current strong operating cash flows, growing profits and no debt this risk appears minimal.

- External shocks. While MNF is not immune to financial crises occurring in Europe, China or even here in Australia, to some degree their business is defensive in nature. The worse the economic environment becomes the more likely businesses and consumers will decide to cut costs. MNF’s services offer cost reductions in conjunction with improved efficiency and so will benefit from more Australian businesses looking to reduce their overheads.

- VoIP failing to grow and/or the introduction of a new disruptive technology. VoIP itself is a disruptive technology and one that old generation service providers are now finding themselves forced to deal with. But that does not mean a new, more efficient technology won’t come along and steal some of VoIP’s market share, so this risk is certainly one to keep in mind.

- Some other risks may be covered by watching for director’s selling of stock

The Financials

As outlined earlier MNF have grown revenues consistently since listing on the ASX. This year they are forecast to generate $41m in revenue, with $25m coming from the recently acquired Symbio Networks. In their recent earnings upgrade management forecast FY12 NPAT to come in between $2.75m and $3m, with FY13 NPAT guidance for $4m (Note: as a result of past losses the company has tax assets of $930k). If we assume the lower end of guidance then on a fully diluted basis MNF will earn around 5c per share in FY12. In the past the company has paid a dividend around half of the total earnings and with operating cash flows remaining strong there seems no reason why that will stop any time soon. Under these assumptions the company is currently trading on a PE of 7.5 and is paying a respectable dividend. What multiple should the market attribute to a company undergoing strong growth in earnings, paying a healthy dividend and operating in the rapidly expanding internet industry? That is anyone’s guess but there are numerous examples of similar companies currently trading on the ASX that the market has priced on a P/E multiple in the mid-teens, and there is no reason why MNF will not or should not be priced accordingly.

While the company appears to be cheap on a P/E multiple basis the most attractive feature of MNF’s financial performance for me, is its ability to continue to generate fantastic returns on incremental capital for many years to come. The current returns on equity are unsustainably stratospheric – a result of the accumulated losses on the balanced sheet. But even if we calculate return on equity with total contributed capital from shareholders, ignoring the reduction in equity that has resulted from accumulated losses, the company will still generate a return on equity in excess of 50% for FY12 and FY13. The nature of this business is such that provided success continues, high returns on equity can be sustained.

I believe the market is yet to factor in that MNF is now a significant player in the wholesale VoIP market and while its business and retail division will continue to face growing competition, the company has demonstrated its ability to differentiate itself from its competitors. With what seems like highly competent management, bright industry prospects and the ability to sustain current high rates of return My Net Fone currently appears to tick all of my value investing boxes.

Let Harley know what you think of his work and share your own insights. Please note the views of the author are his own and may not represent those of the publisher. It is a must that you conduct your own research and seek and take personal professional advice before undertaking any security transactions. The sources of data Harley relied upon to produce this post may or may not be accurate so readers must investigate and satisfy themselves that are are completely aware of and accept all risks before undertaking any securities transactions they conduct after they have sought advice from a licence adviser familiar with their needs and circumstances.

Authored by Harley and posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 29 April 2012

by Roger Montgomery Posted in Insightful Insights, Technology & Telecommunications.

-

Sinking like a brick? Are house prices really going to crash?

Roger Montgomery

April 20, 2012

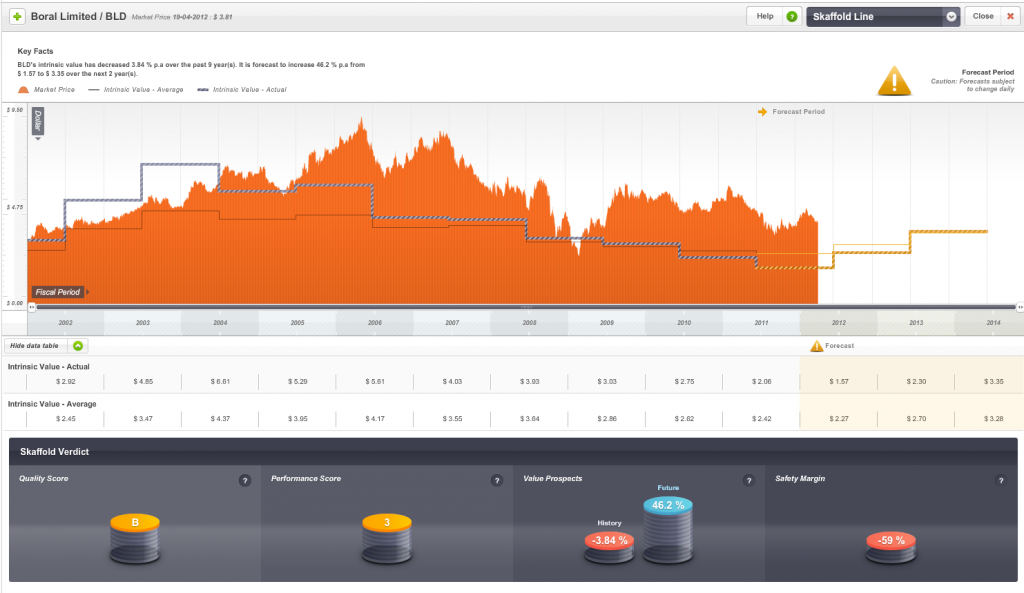

One of the companies that is bound to suffer amid the western world’s slump in house prices, home starts and weak credit growth is Boral.

One of the companies that is bound to suffer amid the western world’s slump in house prices, home starts and weak credit growth is Boral.Today, Boral (BLD) cut their full year profit guidance by $22m after weak house activity and heavy rain in NSW and QLD have impacted their operations. BLD had forecast profit to be $150m-$175m and now expect $128m-$153m. Boral’s Mark Selway noted that Australia’s residential building sector is “aweful” and the construction and building materials company blamed continued wet weather and slow housing starts for cutting its profit forecast by the $22 million noted. In an interview with Dow Jones today Selways said; “The residential housing market looks tough and, by the way, I think it’s going to get a whole lot tougher,” and 2013 was likely to be “the tough year”.

Below: Skaffold.com estimated Intrinsic Value for Boral.

The consensus analysts estimates that produce Skaffold’s current intrinsic value estimate will now decline further as will the estimate of value itself. Since 2003 Boral’s estimated intrinsic value has been in decline as can be seen in the Skaffold Line Evaluate Screen. You should also note the hockey stick – like increase from analysts earnings optimism.

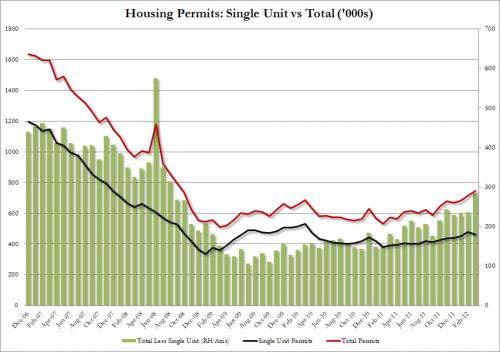

Over in the US the situation isn’t much better. After Warren Buffett noted his 2010/11 prediction of a bottom in housing “was dead wrong” one analyst said “March, housing starts, expected to print at 705K (which is crawling along the bottom as is, so it is all mostly noise anyway, but the algos care), came at a disappointing 654K, the lowest since October 2011, and a third consecutive decline since January. Want proof that the record warm Q1 pulled demand forward? This is it. As the chart below shows, the all important single-unit housing starts have not budged at all since June 2009. So was there any good news in today’s data? Well, housing permits, which means not even $1 dollar has been invested in actually ‘building’ a home soared to 747K, from 715K in February, and well above expectations of 710K – the highest since September 2008. That a permit is largley meaningless if unaccompanied by a start, not to mention an actual completion goes without saying.”

Total starts versus unit starts.

Apparently Harry S. Dent the author of various predictions of impending doom (and someone who’s rpredictions have been wrong as frequently as they have been right, is on Australia and said that we have a real estate bubble that is set to burst. He thinks there’ll be another worldwide economic downturn in 2012, and this will cause Australian real estate values to fall back to where they were 10 years ago.

“People in places like Sydney or Tokyo or Miami say, ‘Hey, real estate can never go down here, we’re a great place, everyone wants to move here, there’s not much land for development’, and what I say is that is exactly the kind of place that bubbles.” “Outside Hong Kong and Shanghai, Australia is the most expensive real estate market in the world compared to income.”

Thanks Harry! My own definition of a bubble is a debt fuelled asset purchasing binge where the income from the asset cannot pay for the interest on the debt that is funding it. Actually…that does sounds a whole lot like negative gearing????

Of course, some observers reckon the empty houses in Brisbane as sellers wait for prices to improve is a sign that the market is already crashing. Others suggest for a crash to happen home owners have to be willing to sell their property at that lower price. A lot of home owners are removing their property from the market if they can’t get the price they want. Whether the lower price gets a print or not however is not relevant. If my neighbour cannot sell his house for the price he wants, then the market price must be lower. We don’t need a transaction to occur to confirm it.

Gone are the days when the dream was to have one nice house with a Clark Pool, a BBQ and a new Holden in the carport. Now everyone wants to be a millionaire DIY developer and fixer-upper with his and hers BMW X5s. That simple progression leads to more volatility in the prices of assets those investors pursue. So what’s the impact on QBE and the banks now that Genworth have pulled their float? Would love to hear your thoughts, insights and observations. What are property prices doing in your area?

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 20 April 2012.

by Roger Montgomery Posted in Property.

- 124 Comments

- save this article

- 124

- POSTED IN Property.

-

Building Heaps & Piles at BHP

Roger Montgomery

April 18, 2012

PORTFOLIO POINT: Given the outlook for Chinese growth and iron ore prices, is it time to cast a critical eye over your BHP holding?

PORTFOLIO POINT: Given the outlook for Chinese growth and iron ore prices, is it time to cast a critical eye over your BHP holding?The 2001 merger of BHP Limited and Billiton Plc created the world’s largest diversified resource company. The company is also one of the largest in the world by market capitalisation and I would guess one of the longest-held stocks in many investors’ portfolios, as well as one of the most likely to have been inherited by superannuants from their parents.

Operationally, the company is nothing like it once was. Seriously underperforming assets and overpriced acquisitions had to be written off in the late 1990s, and since then external candidates including Paul Anderson, Brian Gilbertson, Chip Goodyear and, most recently, Marius Kloppers have taken the top job at the Big Australian. Under their sound stewardship – and the biggest mining boom in history – BHP’s share price has risen from less than $10 when the merger was consummated to almost $50 prior to the GFC, and again a year ago. But since then, BHP’s share price has crashed 30%.