Guest Post: Forcing Bright Prospects

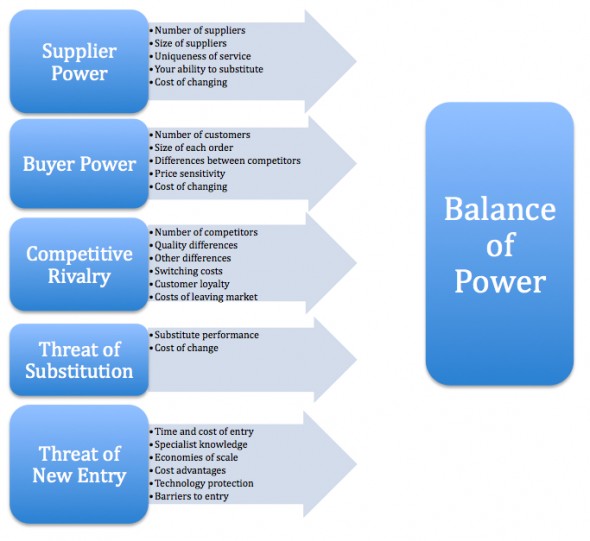

Created by Harvard Business School professor Michael Porter to analyze the attractiveness and likelihood of profitability of an industry, Porter’s Five Forces are a simple but powerful tool for understanding where power lies in any business situation. Using this tool, you can gain insight into the competitive strength of an investee candidate.

Created by Harvard Business School professor Michael Porter to analyze the attractiveness and likelihood of profitability of an industry, Porter’s Five Forces are a simple but powerful tool for understanding where power lies in any business situation. Using this tool, you can gain insight into the competitive strength of an investee candidate.

While these Five Forces are typically used by companies to determine whether new products, services or businesses may be profitable, investor’s can use them to analyze the competitive position of any industry member.

The importance of ROE and buying companies with bright prospects is sacrosanct here at the Insights Blog but why? Return on equity is an important explanatory variable for superior share price performance and so we want businesses that can sustain high rates of return. When I talk about bright prospects it is the sustainability of these high rates of return that I am referring to. Whether the bright prospects relate to a rising tide of customers, the ability to pass on rising costs, the ability to be the low cost provider or the changing competitive landscape, how these factors serve to produce a high rate of return on equity is what we care about.

Numerous economic studies have shown that different industries can sustain different levels of profitability. This can be attributed to differences in industry structures. Within those industries however there is a pecking order of companies and Kathy’s column on Porter’s five forces reinforces the need to understand where your investee candidate sits and whether that high ROE being produced today can be sustained.

Porter’s Five Forces model is made up by identification of 5 fundamental competitive forces:

Barriers to entry

Barriers to entry measure how easy or difficult it is for new entrants to enter into the industry.

Threat of substitutes

Every top decision makes has to ask: How easy can our product or service be substituted?

Bargaining power of buyers

the question is how strong the position of buyers is. For example, can your customers work together to order large volumes to squeeze your profit margins?

Bargaining power of suppliers

This relates to what your suppliers can do in relationship with you.

Rivalry among the existing players

Finally, we analyze the level of competition between existing players in the industry.

Kathy writes…

Calculating the ROE or debt levels of a company is the easy part. But how does one determine if a company has bright prospects? The Porter’s Five Forces model is a tool that I have found to be helpful when picking companies in which to invest. I came across this model while I was studying an Information Systems subject at University.

The Porter’s Five Forces model was developed by Michael Porter to help understand a company’s competitive advantage. The five “forces” that are identified by Porter are:

1) Threat of new entrants

New entrants can increase market competition between companies. In the absence of a dominant player, this can lead to erosion of profit margins.

The threat of new entrants is highly dependent on the barriers to entry. For example, it is relatively easy to start a small pizza business, but it would be difficult to compete with or replicate Cochlear’s business due to the massive R&D costs and intellectual property that is hard to obtain.

2) Power of suppliers

Suppliers can place pressure on margins if they are dominant players in the market. This can be observed in the computer chip manufacturing space where Intel and AMD are the dominant manufacturers. These two companies arguably control the technology that is available to consumers because the manufacturers of computers must build them to accommodate AMD and Intel’s CPUs.

The power of suppliers can also be witnessed in the building industry where suppliers increase their prices as a result of rising commodity costs. These price increases are difficult for builders to pass on in the current subdued climate as consumers are already stretched with high housing costs.

3) Power of customers

A profitable company depends on attracting and retaining customers. However, customers hold the power when they can easily switch to a competitor’s product or service.

In a competitive market where there is little product differentiation, particularly in industries where products have become commoditised, customers have the power to force businesses to compete on price. This is evident with online book stores, where consumers have the ability to search for and compare the cheapest prices across online retailers such as Amazon, eBay, Book Depository and Booktopia, forcing traditional bricks and mortar book stores to compete.

4) Availability of substitutes

In the majority of industries there are substitutes that a customer might use if prices become prohibitively high. Substitutes can be seen in the energy sectors, for example, petrol is increasingly being substituted with ethanol in cars.

New technologies also create substitutes. The introduction of electronic downloadable music has been very popular with consumers who wish to purchase and download music at their convenience. CD sales have dwindled much to the dismay of record labels. Companies need to be agile and adapt to new trends. Kodak is a classic example of a company that did not move with the times.

5) Existing competitors

Competitors all fight for market share by developing their brands and by attempting to attract customers. Increased competition can lead to the erosion of profit margins. Innovation can help, however this is difficult for businesses that operate in a commodity-type business. Retailers (e.g. Coles, Woolworths, Myer) typically sell the same products as their competitors, and perhaps their private label products are a means for them to differentiate themselves from their competitors.

I hope this has given everyone some food for thought. These are the things

I try to think about before I invest my hard earned money.

Thanks Kathy for your post. If you would like to list a couple of companies that you believe dominate their industry and will sustain high rates of return on equity, simply click on the Leave A Comment link below.

Steve Moriarty

:

One of the enjoyments of this blog is getting to read the thoughts and beliefs of other value investors. Sometimes we restate value investing tenets or principles held so long that they are no longer questioned.

I always like to check the facts and figures regarding my beliefs about value investing to see whether we need to revisit first principles to see if they still hold. I must admit that I can never stop asking myself – is that true/still true?

Your post piqued my interest because I am a great fan of Bruce Greenwald’s “Competition Demystified” and more recently I have purchased “Moats – Competitive Advantages of Buffett and Munger Businesses” where the author analyses the moats of 70 Buffett companies.

So with that background, I did a little checking and thought that I would share some findings.

If we use 10 years as the definition of “long term” then the following is very interesting. I checked on the returns (please note that they do not include dividends, only capital appreciation) to see how some of our “moat” companies have fared. The figures are taken from Google Finance from late March 2002 to the March 2012.

I consider the Big 4 banks to have a shared moat – that is, they all benefit from their competitive advantage which I think can be put down to the Big 4 Pillar policy of successive governments and in addition to that, the sensible regulatory regime that prevents them from doing silly things during the good times.

CBA – Up 55% over ten years.

NAB – minus 28% over 10 years.

ANZ – up 26%.

WBC – up 34%.

So the best bank performer was the CBA. It is interesting to note that it was a 100% by the government prior to going private.

CSL – up 149%. Another former 100% owned by the government.

I suspect that the winners, CBA and CSL were beneficiaries of government monopolies in industries that were heavily regulated.

Other government owned companies did not fare so well.

QAN – minus 60%.

TLS – minus 37%.

QANTAS and Telstra were in competitive industries and their results may well show this. I was always amazed that anyone would invest in Telstra when it was a stated policy of government to weaken it to ensure it broke the monopoly and faced competition.

Following are some private sector companies. I put BHP in there because many of the resources companies have been outstanding performers over the last 10 years (in fact the best performer over the last 10 and 20 years in Fortescue – up over 1000%).

COH – up 32%.

BHP – up 200%.

JBH – up 383%.

ASX – up 146%.

WOW – up 98%

One of the interesting things is that sometimes great companies like COH dont make great investments. Sometimes those that have no competitive advantage (like resources companies) can outperform even the very best companies that have moats.

Craig James from Commsec wrote an interesting article recently showing which companies were the best investment over the last 10 and 20 years. I was very surprised to see how many actually had no moat, were in competitive industries and appeared to have nothing that made them stand out. I suspect (but have not yet completely confirmed) is that it is the industry rather than the company per se that it a critical input into purchasing a “winner”. Witness current mining service companies or retail when JBH listed at the start of the consumption boom.

There is no doubt in my mind and history shows that using value investing principles has the highest probability of outperforming the market. However, we always need to be cautious to ensure that those principles still hold.

regards

Steve

Roger Montgomery

:

Good work Steve. there are indeed thousands of ways to profit in the stock market. Buying junior explorers with no track record for example can form a strategy that works, for some, very profitably. I am delighted you are constantly checking your beliefs. I have stopped checking now. I am comfortable with it and confident in it.

Andrew

:

Hi Steve, very interesting post. We seem to have a similar trait of always challenging our beliefs and ways of doing things to make sure they still work or whether there is a better way. One thing i spend some time doing is looking outside the investment world and ask “can i use this? or Can i adapt this?”. You will be surprised with some of the answers you get.

As Roger states, there are many different ways to make money and the investments that sometimes makes the best returns might go against what we believe a good investment is. Value and stock price are two completley different things and the latter is driven heavily by popularity. This is why it is important that we work out exactly what type of game we want to play and define our own investment philosophy to guide us.

As i have no power or no insight as to what a share price will do, i instead focus on competitive advantages, brand and financial strength/stability. This, i believe, will mean i invest in companies that whilst not necessarily setting records for stock price appreciation, will continue to grow and be successful over a long term time horizon with a reasonable degree of certainty. I aim to build wealth slowly but steadily.

Steve Moriarty

:

Hi Andrew,

I agree that each person needs their own style. What I find interesting is that while I support value investing and I admire Greenwald’s assessment of competitive advantage, I am also surprised at the amount of shares/companies that rise regardless of whether they have a competitive advantage or not.

I like reversion to the mean and in some cases, I have made gains from simply picking average companies that have had a bad trot and then as time goes by they revert to their long term average. I never intend to hold them for a long term (5 years in my mind) but I do see that their is what i believe is a mispricing.

For example, I recently purchased National Bank of Greece shares. My analysis was “thin” to say the least, but largely based on my belief that the Greeks will still need banks, in 5 years we will all be talking about something else, the shares are extremely cheap and the worst in in the rear view mirror (for Greece). It is only 1% of my portfolio, so I am prepared for a total loss if it comes to that.

I am also looking at Bluescope because although the current value is awful, I believe that in 5 years it will be on the way back (reverting to the mean). Again the worst is I think behind them and I think it would be a brave government (Labor or Coalition) that let Bluescope fail. It would leave Australia’s steel industry and our manufacturing base very vulnerable.

I would be interested in your thoughts.

regards

Steve

Roger Montgomery

:

Buying big names at historic lows is a strategy that has worked for some managers because of 1) the limited universe into which large sums of money must be allocated and 2) the tendency for index hugging managers to produce relative underperformance for some names that are eventually arb’d away. regarding your comment; “I am also surprised at the amount of shares/companies that rise regardless of whether they have a competitive advantage or not.” Don’t be.

Steve Moriarty

:

I agree Roger. I have in the past thought that at some stage institutional investors re-entering a company simply because it is part of the index and also that they have all that superannuation money and they get tired of looking at it and keeping a high proportion in cash so I assume they all plunge in together regardless of the company’s quality.

regards

Steve

Andrew

:

If you are comfortable with that then that is all that matters Steve. You appear to have thought through it well and i wish you all the best. I understand your point that picking big companies at low prices can produce decent results and Roger has already touched on that so i will leave that there.

Me personally, as i cannot control the share price movement, i will try to diversify this risk away by investing in companies who i believe have the ability to generate returns over a long period of time that enhance the business value and let the voting/weighing machine come into mind. I guess it also depends on the type of activity you want to be engaged in. I don’t want to particularly need to buy and sell in shortish time frames.

I think Qantas is an example of my thinking. You could have made a lot of money by buying at the historical low and let the price revert to the mean and some charts can probably prove that these opportunities have existed quite a bit in the last 10 years. But it will also show that over time both the businesses performance, value and stock price have not done a whole lot over that 10 years and if you held for this time you would arguably be better off leaving the money in the bank.

As i don’t want to be particularly active personally, i need to focus on business quality so i will ignore the bluescopes, Qantas, etc. Not saying it doesn’t work, its just not for me and i hope i have added something by explaining my position. Ben Graham made a far bit of money by value investing in companies on a purely quantatative basis so there are a number of different avenues towards being a successful value investor.

And as for the surprise that companies with no competitive advantage still rising meaningfully, i don’t think you should be. There are many different forces that come together on the market and resort in prices going up and down and if you were to survey all the buyers and sellelrs on a day for a particular stock and asked them what their rationale was, i would expect competitive advantage to be towards the bottom (although maybe linked to some of the higher ones).

Steve Moriarty

:

Andrew,

Thanks for your thoughts. Much appreciated.

regards

Steve

Hiten

:

The 5 forces are similar to what Buffett thinks of as economic franchise and talked about in his 1991 shareholders letter. He wrote

“An economic franchise arises from a product or service that:

(1) is needed or desired

(2) is thought by its customers to have no close substitute and;

(3) is not subject to price regulation.

Unfortunately, out of the top 200 companies listed on ASX very few might posses such qualities, unlike US where they have so many such companies listed on DJIA, S&P500 and NASDAQ.

But would really like to kickstart a discussion on such companies in Australia.

I believe Cochlear and Woolworths have been mentioned which I believe definitely have some economic franchise qualities but they do have risks as well.

Cochlear biggest risk IMHO is innovation. If it stops innovating or is left behind by it’s competitors it’s going to go downhill real quick. Bit like Apple.

Woolworths biggest advantage is high barriers to entry. A competitor needs to spend billions to replicate WOW store network and supplier contracts. Coles is definitely bringing WOW some competition, what is worrying as a WOW shareholder is Coles are doing it mainly on price and WOW has to respond which means it is bad for profit margins. When companies compete on price in the long run the only winners are going to be the customers while shareholders will lose. Don’t believe me, check out airlines, telcos.

I think in Australia another company with monopoly is IRESS. Among stock brokers and traders, IRESS products are desired. IRESS does not have any close competitor and it’s pricing is not regulated. I am sure IRESS has some risks mainly the profits rise and fall with rise and fall in the stock market. What other risks can you think of? And more importantly what other companies can you think of as having economic franchise? I will throw some suggessions: CSL, ARP, CAB… would love to hear others views on these companies.

Roger Montgomery

:

This is an excellent discussion to kick off Hiten. I too look forward to reading the contributions.

Nick Mason

:

Anteo Diagnostics (ADO) is set to become one of these companies over the coming years although at this stage is purely speculative. They recently signed a very important agreement with eBioscience and have secured several patents in the past months to both validate and protect their intellectual property.

Andrew

:

In regards to Iress, i remember a comment here that said something along the lines of “just the way we do business”. It is a very good example of a company that passes the 5 forces with flying colours i feel. You have also mentioned some other very good candidates.

I do agree as well that finding companies in Australia that pass this test is not as easy as some have it overseas such as the US where you have Apple, Walmart, McDonalds and the almighty Coca Cola as some examples.

I thought i would pass the following example as well that put a picture on what we are discussing here. One large scale company had to take a particular ingredient out of a salad they were offering as the costs for that ingredient shot up enormously. The reason was that McDonalds decided they were going to use that same ingredient in their products and thus compeltley changing the supplier/customer landscape. They decided it was easier to cut the ingredient than to pay the higher costs and lose profitability as they had no chance of competing with the scale of Maccas.

Ash Little

:

Hi Hiten,

Buffet would never invest in this company but I think Seek ticks his 3 Boxes.

It fails for Buffet it is knowing where the industry will be in 10 or 20 years.

I love his what he says about Wrigley’s . People will still be chewing gum in 20 years time

Cheers

Hiten

:

Hi Ash,

By Buffett would never invest in this company I guess you are referring to IRESS??

May be, may be not. From what I have learnt about Buffett is he likes to invest in companies where he first understands the business and it’s long term economics, second he likes to see some kind of economic moat/sustainable competitive advantage if you like, third competent and honest management and fourth fair or below fair price.

Coming back to IRESS. Yes it is a technology company and something Buffett doesn’t 100% understand. But I can tell you he is definitely changing that stance and getting himself familiar with technology as evident from his purchase of IBM.

So let’s try and understand IRESS business model. It provides software for share market data/news/information with analytical tools and trading software so you can place trades. So you think in 10 to 20 years times ppl will not be requiring such information or wanting to trade shares? I think not. So that covers point one.

Regarding point 2 abt moats. Let’s look at IRE overall performance. If you don’t consider 2011 year results IRESS has performed outstandingly over the last 10years in increasing Sales, Earnings, Cashflow, Book value all by more than 15% compounded. It has achieved this with zero or negligible debt, net profit margins of mid to high 20’s. ROE of more than 30. Only companies with economic moats can show such numbers for extended periods of time.

Third point being honest and talented management, I guess that’s subjective, but looking at number of shares issued over last 10years is around 25% more. So along with achieving outstanding financial performance they haven’t diluted shareholder ownership that much. So management deserve a pass here.

Fourth regarding price. That’s where you need to be patient and wait for Mr Market to offer you a good price.

Australia definitely lacks the quality of companies US has, so I guess we have to make do with whatever we get. All I can say is IRE is a hell lot better than some of the other companies we have in ASX200.

Ash Little

:

Hi Mate,

I mean Seek……….ASX.AU SEK

Irress has a huge moat…………I was adding seek into the mix

Cheers

Michael

:

Does anyone have any insights regarding the future growth opportunities for Iress – or have they hit maturity?

Roger Montgomery

:

Great Question Michael. Ultimately its dominance in Aus needs to be augmented with growth elsewhere or they can (not simply of course) raise prices. But once the market is saturated – brokers using Iress and planners using Xplan – it requires new products or higher prices to offset the inevitable cyclicality of the industry. So far Iress has been managing both because their EPS fell only in 2004 and 2007 but actually rose in 2008, 2009 and 2010.

Chris W

:

I think ARP is a definete Buffett holding

Johnnybgood

:

Great post Kathy.

In a recent interview on Switzer, Roger highlighted one of these forces when he spoke about carsales.com. A bunch of their key customers (25%) have joined together to set up a competitive business which demonstrates Porter’s Power of buyers.

Can a large group of customers get together to a) start a competitive business or b) force the business to squeeze profit margins?

This force is relatively high where there a few, large players in the market, as it is the case with retailers and supermarket stores;

Where there is a large number of undifferentiated, small suppliers, such as small farming businesses supplying large supermarket companies;

Low cost of switching between suppliers, such as from one fleet supplier of trucks to another.

Gareth

:

I just thought I’d mention another of the “forces” that Andrew Grove (CEO of Intel) added. He talks about the power of “complimentary goods”. Best example in the computer industry, Intel and Microsoft, etc.

If your product is reliant or gains market share when a complimentary industry gains, it is affected by this force.

This is a good thing to keep in mind for tech companies.

Roger Montgomery

:

Thanks Gareth. A good one to add along with ‘government’ as another possible force.

Nick

:

Hi Roger, have you ever thought of writing a weekly/monthly newsletter on companies, im sure you will get alot of subscribers

Roger Montgomery

:

Hi Nick,

At this stage we have considered it but the decision is to keep our very best ideas for our fund(s). If we can get the right team together and put Chinese walls in place, we might reconsider it. It would be very different to the voluminous examples that already exist.

Grahame Lucas

:

I believe Cochlear to be one such company

Andrew

:

Nice post kathy, i thought of doing one on this myself. I came across the 5 forces during a couple of courses i have done that have marketing as an element. I spend quite a considerable amount of time thinking about it when i am analysing a company and plays a big part in my “moat” analysis, seeing where they are the strongest and where the vulnerablities are.

This is an easy framework for people to work out a great overall picture of the company and shows the advantage of boring companies as well as their competitive landscape is quite entrenched and likely to stay the same where as technology would have a really high substitution risk for example.

I seem to come back to this one company when i think of companies that have the most attractive elements of a business and that is Woolworths. There is no doubt Woolworths is a great example of a company that has almost all these 5 factors working for them.

New entrants will need to overcome Wooloworths considerable scale advantages (supply chain etc) and prime retail locations, some of the shopping centres in whch are actually controlled by woolowrths.

I don’t think i really need to go on about power of suppliers as this has been written about in newspapers for a while. I remember reading that even CCA were having issues trying to get some type of power of woolies. If Coke doesn’t have it than who can?

The power of customers is an interesting one to look at for woolies. They can easily go over to Coles but some (most?) don’t. The customers have considerable power however it can be argued that Woolies offers the lowers price and there for customers are happy to stay.

Substitution? Well you can buy groceries online, even food and alcohol, however in this market it is likely that online will never truly gain a significant foothold as people need the products and don’t have the time to wait for the delivery.

The existing competitors are well known and entrenched and apart from Coles, has not really been able to have any decent impact on Woolies.

I would argue that Coles, Woolies do not need to attempt differentiation in their core businesses however, this market is very much about price. Woolies can achieve differention through Thomas Dux etc but these are more focus-differentiation orientated. The core goal is to offer the lowest price at the lowest cost.

Andrew

:

Just before i forget my i also reccomend to those who want to learn more abotu this side of analysis to read up on Micheal porters generic strategies and also the Value Chain concept.

Combine these three and you will have three very good tools to undertsanding a company, its compeitive landscape and the existence and sustainability of any competitive advantage.

Andrew

:

Sorry everyone, one last post.

I believe that the three cocepts that i mentioned are actually linked. The 5 forces model is used to understand the competitive landscape and to work out what the best strategy is to get ahead in that environment, you can then decide on which generic strategy is best suited to achieving this overall strategy and the value chain can be analysed so as to find the best way to achieve that generic strategy.

This can help an investor see through the whole business and whether the strategy is sound and whether they have the necessary moving parts to pull that strategy off.

I look forward to seeing what others have to say about this side of investing. It, at least to me, is so much more interesting than whether something is trading at a discount to IV or not.

Peter

:

Andrew,

In your last paragraph you made the mistake that most non-retailers make. You think that it is all about price. In actual fact, all surveys have found (in Australia) that price ranks #3 in determining where people shop for groceries. Range is #1 and location #2.

Peter

Andrew

:

I completley understand your point and do agree, i think i touched on at least number 2 in Rogers post about recurring revenue. I think when it comes to Woolworths, the only issue is number 3 as they already have numbers 1 and 2 covered.

I am a big fan of many retailers or manufacturing/retailers especially where price is not the major issue and i like them a great deal.

Chris W

:

Woolworths stack up good. But the problem with them is that they are in a saturated market and I think their management are not great. Outside of liquor and petrol stations they have no good track record. Going into hardware is a risk since they don’t have a great track record outside of grocery and liquor. I find it surprising that they have chosen a CEO that grew within Woolworths rather than someone with more worldly retail experience like Coles CEO, its worked for Coles. But I think Woolies are concerned with maintaining what they have already.