Why aren’t you answering my comments or emails Roger?

At 7.30am this morning after inspecting a property, I found myself on the street being presented with a sealed envelope and cryptic directions to a taxi suspiciously parked just 10 metres from where I was standing.

At 7.30am this morning after inspecting a property, I found myself on the street being presented with a sealed envelope and cryptic directions to a taxi suspiciously parked just 10 metres from where I was standing.

Turns out my family thought my upcoming 40th was a pretty good reason to celebrate and surprise me! They have whisked me away for a few days, as one of mates put it, for a ‘birthday soriee’.

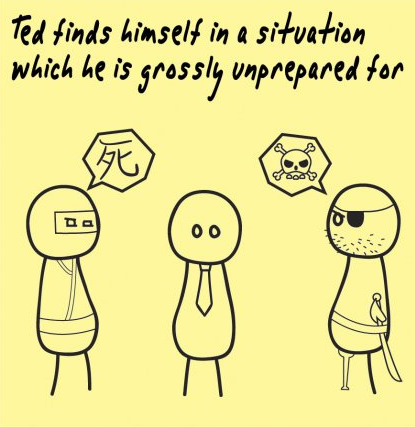

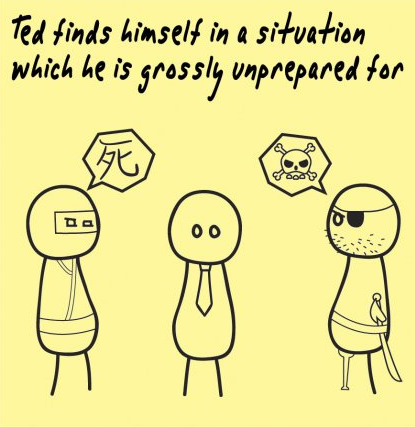

I am completely unprepared. My laptop sits idle on my desk and iPhone charger is still in the power point (not turned on). I have been told there is an internet café where we are staying, however I’m not certain how reliable the connection will be.

I was planning to publish a new post today: What are the twelve stocks of Christmas? Thankfully all the post requires is one final proof read and then a click on ‘Publish’. I’ll venture down to the internet café this evening.

Please keep posting your comments here at the blog and on Facebook over the next few days and I will reply upon my return. I will be back in the office on Monday 13 December

Thank you in advance for your understanding and patience.

Posted by Roger Montgomery, 8 December 2010.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking.

Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

At 7.30am this morning after inspecting a property, I found myself on the street being presented with a sealed envelope and cryptic directions to a taxi suspiciously parked just 10 metres from where I was standing.

At 7.30am this morning after inspecting a property, I found myself on the street being presented with a sealed envelope and cryptic directions to a taxi suspiciously parked just 10 metres from where I was standing.

grant

:

BHP 13th March Low in place trend will continue up to 13th April completing first swing .

SP500 : 26th March Significant Turning Point could mark Bear Market Low .

Roger Montgomery

:

Thanks for sharing Grant

Bill Welton

:

Can a person buy a book without putting there c/c on the computer.

Can I call?

Roger Montgomery

:

Of course you can Bill. Send through an email to me at roger@rogermontgomery.com and include your phone number and we will give you a call. Just mention in the email you are ordering a book over the phone.

Greg Mc

:

Happy 40th birthday Roger, hope you are having/have had a great few days.

Thanks again for all that you have done in the past year or two to help us improve our investing prowess.

Greg

:

Happy Birthday Roger

It is impressive what you have achieve in your 40 years, I dips me lid to ya.

What a change you have made to so many people.

Merry Christmas to you and your family

Regards Greg

Peter

:

Happy birthday Roger. If, as Ashley says, life begins at 40, you’ve got another 10 years to go because 40 is the new 30.

Wishing you everything of the very best.

Peter

Roger Montgomery

:

Thanks Peter,

Well that’s seems to be what those in their forties think. I bet those hitting 30 don’t think that about 40 year olds though!

Ashley Little

:

Happy Birthday Roger,

Life Begins at 40 they say

Brian

:

Happy Birthday Roger. Aren’t we supposed to hold stocks we can sleep on for a long time? If the boss can’t take time off on his birthday what hope is there. I think TRS sent you a birthday present today.

Wing

:

Happy Birthday Roger! Sure you will have a great one.

zoran

:

Does anybody understand your book Roger?You have 10 guys arriving to 10 different IV’s every single time.

Enjoy your holiday

Roger Montgomery

:

Hi Zoran,

First Zoran, you exaggerate when you say every single time. Regarding differences in valuation generally, thats inescapable Zoran. Buffett as explained that even he and Charlie (Minger) inevitably arrive at different valuations after looking at the same information. You understand that we are thinking about the future and not the past. The future is uncertain and so estimates are bound to differ. On historical information and the same discount rate, everyone has been able to match. Thanks for the alert Zoran.

Lloyd

:

Roger,

Gee what did you do to offend Zoran?

The screw you, happy holiday message was a bit uncalled for, if not downright rude!

I guess you cannot please everyone, but you do a pretty good, diplomatic job of trying. My response to Zoran would have been far less restrained, a bit more problematic from the publishing perspective.

All the best.

Regards

Lloyd

Mick

:

Hi Zoran

I think it’s just because no two people are the same and we all have different (individual) attitudes toward risk.

See Ken’s response to my post re TRS and it’s IV – I felt it was less risky than Ken and used a lower RR, and got a very different result. Even though I’d say we used very similar inputs (annual report), our individual interpretation is different, so we will get different IV’s.

Even tiny rounding differences will affect IV’s, especially when you are dealing with so many variables, and don’t forget analyst forecasts don’t match precisely every single time either.

Maybe if we had a perfectly efficient market filled with rational investors (no speculators), sharing exactly the same attitude toward risk, and interpreting everything in precisely the same manner, we might all get matching IV’s.

If that were the case though, would anyone actually trade?

Kathy

:

Happy birthday Roger! Hope you have an A1 time :D

Kathy

Satbir

:

Guys

Enjoy your time off Roger. Happy birthday. What’s happening with the Reject Shop. Anyone one got any input.

Satbir

Ken Milhinch

:

Satbir,

Profit downgrade, with a rather poor excuse attached.

Regards, Ken

Roger Montgomery

:

Hi Satbir and Ken,

I will write about it on my return. The company may not have been 100% transparent with its reasons for the downgrade and I will explain on my return. if you have access to the Eureka Report, I wrote back in September last year the reasons for selling the stock out of the Valueline portfolio that I run for Alan Kohler’s newsletter.

Mick

:

Got smacked after that downgrade didn’t it Satbir?!

Using 10% RR, 70% DPO and analyst inputs, I had it at circa $18/19 for 2011. New info and IV now in the ballpark at current price. No safety margin for me as yet though.

DPO% is a concern for IV calculations – if they try and maintain $Div, then DPO% increases and IV decreases. Price deflation was mentioned, so profitability will get hurt too (ROE).

However, if things are just quiet for this Xmas, then potentially good future gains in IV? Maybe as a retailer of lower ticketed items they will do better in these fiscally conservative times? TRS did well throughout some tough years, just trying to suss out what bodes for the next few…

And if TRS is struggling, what is happening to other (higher priced) retailers? Are they next with 20% profit downgrades too? Maybe they are just the first to call it, and there’s more to come – it will be interesting to hear the post-Xmas noise and guidance changes from the retailers!

The TRS announcement did also say new stores expected to help, and being the new ‘bargain’ store on the block may give them a short term competitive edge. A new store opening in NQ soon, I don’t think they have one there yet, so maybe stores in ‘virgin’ regions will prove more helpful?

Brain dump completed – and that’s all it was. Take it with a good pinch of salt!

Roger Montgomery

:

Hi All,

On TRS, I would be delighted to provide some insights on my return.

Ken Milhinch

:

Mick,

My IV for 2011 is $9.14 using 12% (discretionary retailer rate). As I have written previously, they have lost the best retailer they had in their chairman, and have changed CEO’s in recent times too. Their excuse about interest rates does not hold water, because it is things like that which usually push customers in their direction.

Regards, Ken

Mick

:

Thanks Ken

I get $9.60 IV if I use 12% and assume LY POR% (pay-out ratio).

I thought TRS might need to hang on to a bit more cash for expansion and thus reduce the POR, so I used 70%. I used 10% RR as I thought leaner times would augur well for them, but great to see your RR; I may have been a little generous.

Agree with you re interest rate excuse being a bit poor, but I can’t help think about new CEO’s spreading doom and gloom early on, so that in the not-too-distant future they can spruik how well they have done ‘saving’ or ‘growing’ the company. So much easier to get good rate increases off low bases, and helpful if that determines your remuneration!

Appreciate all your posts Ken, keep ’em coming.

Roger Montgomery

:

Hi Mick,

I know Chris (Bryce). He’s dedicated and hard working as well.

Steve

:

TRS – A profit downgrade of around 19% sending shares down 21% today. Company blames it on rate rises.

Oh and happy birthday Roger!!!!

Roger Montgomery

:

Thankfully Steve it has been out of the portfolio for a while. I wrote about that sale previously for Alan Kohler and will write some more about it in the next week or two.

David King

:

Happy Birthday Roger. The world can wait till next week. Just enjoy your 40th, and forget everything else for a while.

Best Wishes. Anna and David.

Jim

:

Happy 40th Roger

Thanks for all your help over the year. Am eternally grateful and enjoy your well deserved break. Merry Xmas

Cheers

Jim

Matthew R

:

Happy Birthday Roger, I hope you have a great time with your family and friends and don’t hurry back – enjoy the time away!

Grant Duggan

:

All the best Roger! the unplanned trips usually turn out the best anyway. Enjoy and many thanks again for a very educational year.

Rob

:

Oh no …. Your poor laptop! Who’ll love it while you’re gone? Have a great time! Cheers Rob

John M

:

Happy 40th Roger,

Enjoy the time off, you have deserved it.

David Sinclair

:

Happy birthday Roger! Enjoy your unexpected holiday and don’t spend too much time at the internet cafe.

David S.

Roger Montgomery

:

Thanks David,

I don’t intend to.

markh

:

too funny.

Enjoy your celebration! Just forget about technology for a few days and it will do you the world of good!

Regards,

MarkH

Roger Montgomery

:

Thanks for the advice Mark. I will try.

Mick

:

Happy Birthday Roger

I really hope you do post the 12 stocks of Xmas tonight; that way I can read them tomorrow on my birthday!

Congratulations on your efforts – Vino Collapso all round I say ;-)

william gill

:

HAPPY BIRTHDAY

Don,t rush enjoy the spoils of battle while you can

Roger Montgomery

:

Thanks Will. Enjoying the spoils will begin shortly!

Roger Montgomery

:

Thanks for those well wishes and sentiments William. Have ducked in to enjoy an air-conditioned respite so won’t linger long.

Gavin

:

It is good to see you have a life,,,,have fun,,,the market will wait

Gavin 2

Roger Montgomery

:

Thanks Gavin

Sean Saul

:

Indeed congrats on achievements this year and best birthday wishes; everyone deserves to sit back and smell the roses and relax every now & then; I raise a glass to you. Your insights blog and the ideas shared in it by yourself and fellow contributors (not advice of course!) is educational and addictive and I’ve caught myself loitering more than I should. Oops; better get back to work now!

Andrew

:

Happy birthday then Roger. May you receive A1’s trading at enormous discounts to IV as a present. Hope you have a great couple of days and i for one would not begrudge you at all if you kept us waiting until you are back home.