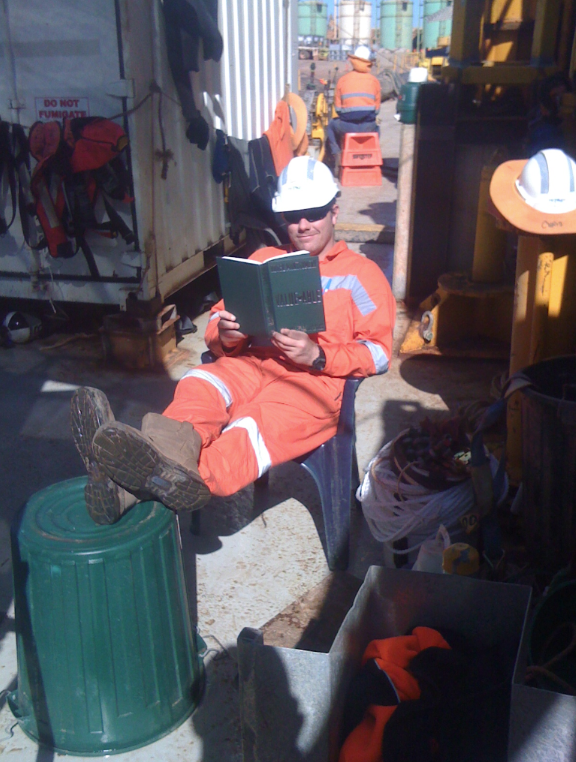

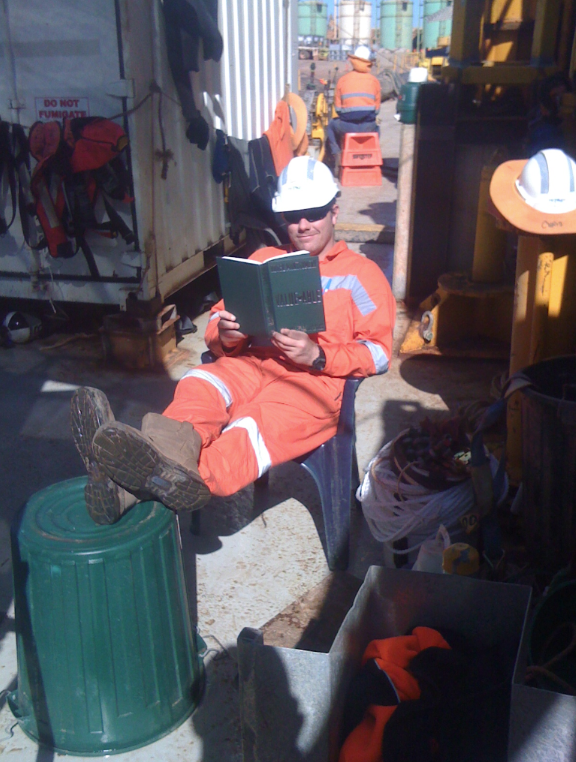

Is this the first photographic evidence of Value.able in action?

Based on your emails, blog posts and Facebook comments, I knew my Value.able lesson had spread to Asia, Canada, the UK and the US.

This morning Jesse sent the first photographic evidence of its far-reaching net.

“Becoming a value investor while working offshore!. Love it :)” Jesse works off the coast of WA and as you can see, he has set up the perfect office for analysis and investing. The only concern is that the helmet suggests he’s taking warnings of a Chinese property collapse a little too seriously!

Thank you Jesse and to everyone for the overwhelmingly supportive comments you have posted here at my blog and the positively entertaining comments you have written on my Facebook page.

Please keep adding your thoughts, inights and stories by Leaving a Comment or joining me on Facebook.

Posted by Roger Montgomery, 17 August 2010.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

baden

:

Hi Roger, love your book its helped me a lot ,I follow a lot of the shares you give the a1 to and am beginning to make a few dollars as well . eg mms and fge , you make a lot of sense mate keep up the good work,,,,,,,,,,,Baden

Peter

:

Dear Roger,

Thankyou for the book, I can now get through the day without wondering what the prices of my shares are on the ASX. I have always been a supporter of the value investing approach, but it was not until I read your book and applied your valuation method that I found myself able to switch of the “price noise” of the market. I think this is because the valuations have nothing to do with price, and everything to do with the performance of the company. I have read many books on value investing, but your is the first that finally allowed the penny to drop for me – thanks.

I still have 1 nagging concern though, and that relates to the multipliers. I understand and accept your analogy of the fisherman and the lures, and ordinarily this would be enough. Except as you know, fishermen have a tendency to exaggerate or at least they don’t provide you with their full performance data.

With your reply on the formula question seem to be essentially saying that your formula is right, and that i should accept it based on the results. The only trouble is, I don’t have access to your results and so I am left with the need to “have faith” that the formula underlying the multipliers is robust.

What would you do when presented with a story of a new “lure” that appears to meet all your needs, but the supplier doesn’t provide you with the full story of the actual catch ?

Have I missed something in your logic ? or maybe the book. I don’t want to start putting in additional fudge factors to overcome the “faith uncertainty” that may result in no opportunity is good value.

Thanks Peter