To visit the February 2026 reporting season calendar Click here .

-

One more nail? Or is that it?

Roger Montgomery

February 11, 2026

Former CEO, public speaker and author, Jay Grewal once said, “When it comes to the final nail in your coffin, it doesn’t matter if it’s dull or sharp, it’ll still hold, because a lifetime of prior nails have helped seal that coffin shut.”

In what may prove to be merely another accumulated nail in the coffin of the artificial intelligence (AI) boom, the narrative on Wall Street shifted dramatically last week as the tech-driven optimism that has fueled the market for years hit a psychological and structural barrier. Continue…

by Roger Montgomery Posted in Market commentary, Technology & Telecommunications.

-

MEDIA

ABC The Business – Falling U.S. dollar and global uncertainty spark modern day gold rush

Roger Montgomery

February 10, 2026

by Roger Montgomery Posted in Foreign Currency, Market commentary, TV Appearances.

- save this article

- POSTED IN Foreign Currency, Market commentary, TV Appearances.

-

MEDIA

Ausbiz – has tech run its course?

Roger Montgomery

February 9, 2026

I joined Juliette Saly on Ausbiz to discuss how the AI trade has shifted from hype to reality. Adoption is proving more cyclical than expected, customers will not pay any price for AI tools, and data centre rollouts face delays from regulation and power constraints. At the same time, higher inflation, rising debt and the end of ultra-low rates are putting pressure on valuations. Software as a Service (SaaS) businesses are being repriced, and sectors like real estate and travel are also starting to feel the impact, prompting investors to reassess risk.

Tune into the full episode here: Ausbiz – Has tech run its course? Continue…

by Roger Montgomery Posted in Market commentary, TV Appearances.

- save this article

- POSTED IN Market commentary, TV Appearances.

-

Is the creative destruction phase beginning?

Roger Montgomery

February 6, 2026

Last year, I posted a blog entitled ‘But Nothing’s Changed’, describing how the artificial intelligence (AI) bubble and market boom could end. I explained how investors will realise that even though AI technology – hailed as the 4th Industrial Revolution – will change the course of human history, it probably won’t do so tomorrow. And therefore, share prices were at risk of setbacks because there will be commercial bumps (delays in data centre builds, changes in interest rates, shortages of energy and water, and not all companies can win) along the way to an AI ‘utopia’. While timing a change in sentiment is impossible, the hype surrounding general-purpose technologies, including AI, makes such a change inevitable. It’s always been so. Continue…

by Roger Montgomery Posted in Manufacturing, Market commentary, Technology & Telecommunications.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Decoys and lame ducks – why EV incentives miss the emissions problem

Roger Montgomery

February 6, 2026

Having returned to work after a little rest and respite, I was recently confronted, nay, berated, by headlines about Labor’s deal to slash borrowing costs for electric vehicles (EVs) as it scrambles to meet climate targets.

While I was away, I saw the chart in Figure 1 and immediately realised the futility of our efforts to influence the global climate, concluding that Labor’s schemes appear to be driven by ideology rather than evidence. Continue…

by Roger Montgomery Posted in Energy / Resources, Manufacturing, Market commentary.

-

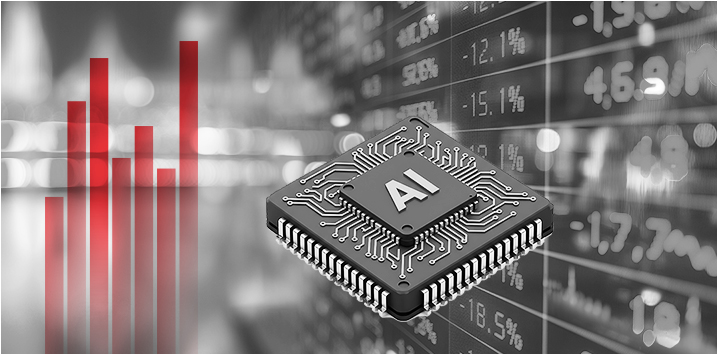

Investors are selling the disruptors and the disrupted

Roger Montgomery

February 6, 2026

On December 18, in a blog entitled Time Magazine Cover Curse, I wrote, “…Gracing the cover of the [TIME] mag isn’t a coronation but a harbinger of doom, because the moment a public figure has permeated the public discourse sufficiently to land the cover, the trajectory inevitably reverses.”

Politicians have suffered landslide defeats after being featured on the cover, as have business tycoons whose stocks plummet, and celebrities whose reputations are assassinated under sudden, intense scrutiny. Continue…

by Roger Montgomery Posted in Companies, Economics, Investing Education, Market Valuation.

- save this article

- POSTED IN Companies, Economics, Investing Education, Market Valuation.

-

MEDIA

ABC Statewide Drive – market volatility signals a shift in thinking

Roger Montgomery

February 6, 2026

On statewide drive with Jess Maguire, I explained that recent market volatility reflects investors reassessing some big assumptions, particularly after Donald Trump’s nomination of Kevin Walsh as the next U.S. Federal Reserve chair.

Many investors had been expecting lower U.S. interest rates, so the nomination caught markets off guard and forced a reversal of those bets. That led to sharp falls in gold and silver, higher bond yields, and weaker share prices. While precious metals may recover over time, I see the bigger influence on sharemarkets as the gradual unwinding of the artificial intelligence (AI) trade. For Australia, stronger U.S. growth can support some companies, but persistent inflation risks and policy uncertainty mean investors are becoming more cautious and re-evaluating risk.

Listen from 1:44:55 here: ABC Statewide Drive. Continue…

by Roger Montgomery Posted in Economics, Global markets, Market commentary, Radio.

- save this article

- POSTED IN Economics, Global markets, Market commentary, Radio.

-

MEDIA

Soaring stocks hide U.S. fragility as gold surge sends warning to investors

Roger Montgomery

February 5, 2026

The strength of U.S. stock markets would have any reasonable investor believing all is well with the world and that U.S. exceptionalism is alive and well.

Yet, the stock market’s buoyancy belies the head-spinning conga line of events over the first month of 2026 that would, at any other time in history, have caused the market to plunge or coincided with it.

Take gold’s 17 per cent ascent so far this month, which follows a 66 per cent rise in 2025. Such moves are unusual. Since gold began trading freely in the 1970s, the average annual return for gold has been roughly 6-8 per cent. January’s return doubles that annual number.

This article was first published in The Australian on 04 December 2025. Continue…

by Roger Montgomery Posted in Aura Group, Digital Asset Funds Management, Economics, Global markets, In the Press, Insightful Insights, Investing Education, Market commentary, Market Valuation.