Search Results for: bubble

-

Premature talk of bubble trouble

Roger Montgomery

November 14, 2013

First published in Cuffelinks newsletter on 8 November 2013

Amid the recent emergence of rising prices, all the talk of bubbles in stocks or in property is simply premature. We’ll leave US Treasury bonds and the US Federal Reserve out of this discussion until the Postscript and focus on Australia for now.

That is not to say that prices will not decline. They may fall, but any drop from current levels would not be due to the presence of a bubble, nor evidence of it bursting. Continue…

by Roger Montgomery Posted in Insightful Insights.

- 9 Comments

- save this article

- 9

- POSTED IN Insightful Insights.

-

Stick to the knitting

Roger Montgomery

November 6, 2013

We have discussed previously the ingredients required to invest successfully over the very long run. And it is encouraging that the two essential ingredients, the ability to value a business and understanding how the market works -particularly its bipolar nature and tendency to treat temporary events as permanent – can be taught. Continue…

by Roger Montgomery Posted in Insightful Insights, Montgomery News and Updates.

-

The status of the Australian stock market

Roger Montgomery

November 1, 2013

In these highlights from Your Money Your Call, broadcast on Sky Business, Roger Montgomery discusses how volatility is affecting the Australian stock market at the moment, upcoming IPOs, whether Australia is in a property “bubble”, and which stocks are cheap to buy right now. Watch it here.

by Roger Montgomery Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

A mini bubble warning?

Russell Muldoon

October 30, 2013

Between 1995 and 2000, the mere mention of the word ‘internet’ in your business plan, IPO or marketing material was enough to set your stock on fire. Over that five-year period, the Nasdaq climbed from under 1,000 to 5,000 despite few businesses in the index actually making any money. Continue…

by Russell Muldoon Posted in Insightful Insights.

- 10 Comments

- save this article

- 10

- POSTED IN Insightful Insights.

-

Reinhart to Fed: don’t taper!

David Buckland

October 17, 2013

One of the world’s leading experts on debt cycles, Professor Carmen Reinhart, recently warned of a substantial policy mistake if the US Federal Reserve begins to “taper” its asset purchase program. Continue…

by David Buckland Posted in Economics.

- 8 Comments

- save this article

- 8

- POSTED IN Economics.

-

Bubble trouble (15/10/2013)

Roger Montgomery

October 15, 2013

by Roger Montgomery Posted in Video Insights.

- watch video

- 4 Comments

- save this article

- 4

- POSTED IN Video Insights.

-

Dear Property Investor…Your Best Warning!

Tim Kelley

October 2, 2013

The Australian residential property market has had a spring in its step recently. Auction clearance rates have been healthy, and rising prices have prompted media commentary on the possibility of an emerging housing “bubble”.

I’m no property expert, and so it may be wise to avoid putting an oar in on this debate, but let’s put wisdom aside for a moment and think about whether the application of value investing principles can add anything to a discussion on house prices. Continue…

by Tim Kelley Posted in Property.

- 26 Comments

- save this article

- 26

- POSTED IN Property.

-

Inspecting the Car Industry

Ben MacNevin

August 23, 2013

Automotive Holdings (ASX: AHE) is Australia’s largest automotive retailer and transporter of refrigerated food. While AHE sits outside our investment universe, we enjoy following the company’s performance as management is well placed to comment on the health of the domestic car industry (which has implications for the broader economy). In our latest discussion at the full year results, management noted three key pressures that the company is closely monitoring. Continue…

by Ben MacNevin Posted in Insightful Insights.

- 3 Comments

- save this article

- 3

- POSTED IN Insightful Insights.

-

US jobs recovery?

Roger Montgomery

August 6, 2013

Despite enthusiasm by equity investors in a US economic recovery, we have been reading a great deal about the changing face of the US workforce. Our view is that some of the changes – along with automation – have produced a rosier outlook for business profitability but possibly a less prosperous country. Continue…

by Roger Montgomery Posted in Insightful Insights.

- 4 Comments

- save this article

- 4

- POSTED IN Insightful Insights.

-

China doomsayers getting louder…

Roger Montgomery

April 20, 2013

As you know, we have been barking loudly about a deterioration in China for two years. For investors however, it is often less important that fundamentals are deteriorating, and more important that sentiment isn’t. But sentiment does appear to be deteriorating too.

Continue…by Roger Montgomery Posted in Economics, Insightful Insights.

- 11 Comments

- save this article

- 11

- POSTED IN Economics, Insightful Insights.

-

The view from the top of Australia…

Roger Montgomery

April 16, 2013

It was interesting to read in yesterday’s Australian Financial Review that auction clearance rates surged past 70% at the weekend. There’s almost an air of desperation at some auctions. The fear of missing out is a much greater influence on investor behaviour than the fear of loss.

Continue…by Roger Montgomery Posted in Insightful Insights, Property.

- 1 Comments

- save this article

- 1

- POSTED IN Insightful Insights, Property.

-

Chinese bubble on the brink…..

Roger Montgomery

March 13, 2013

Question to the world’s biggest property developer: Is there a bubble [In China]?

Answer: Yes of course.

Watch this video broadcast by CBS last week.

Watch here.

by Roger Montgomery Posted in Insightful Insights, Property.

- 2 Comments

- save this article

- 2

- POSTED IN Insightful Insights, Property.

-

Wylie E. Coyote or Road Runner?

Roger Montgomery

March 7, 2013

You will have to forgive the rather startling image we have chosen for this blog post. Its really been selected for dramatic effect only.

You may not realise this but all the way back in August 2010 we were BHP bulls, writing; “If you take on blind faith a A$22b profit, BHP’s shares are worth AUD $45-$50 each.”

But then in February 2011 we became a little more circumspect. You can read about the change here.

Continue…by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, Value.able.

-

Should we Zig or Zag this week?

Roger Montgomery

March 4, 2013

The world’s financial markets are awash with change, the experts are only guessing and data, when released today, triggers a completely different and unpredictable response to the one triggered by the same data released previously. You are left in the position that John Maynard Keynes described in 1936: “We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be”.

Finding a place of permanence is necessary and that place, for us, is based on a simple principle; that we cannot predict shifting sentiment with any degree of accuracy or consistency.

Continue…by Roger Montgomery Posted in Insightful Insights.

- 1 Comments

- save this article

- 1

- POSTED IN Insightful Insights.

-

Changes in the car market – enduring or short-term?

Roger Montgomery

November 12, 2012

AMA, MXI, AHE and ARP share prices are all booming on the back of surging demand in an under supplied car market, causing a shortage of capacity which is driving up margins for the sector’s operators.

You can read one of our recent post on the subject here.

Naturally we have been drawn to the operators in the sector on the back of this capacity shortage. The ability to charge higher prices in a capacity-constrained environment is great if they are enduring, but I must ask, is the entire sector in a little bubble? A bubble in profitability and short-term market growth?

Continue…by Roger Montgomery Posted in Companies, Insightful Insights, Manufacturing.

- 1 Comments

- save this article

- 1

- POSTED IN Companies, Insightful Insights, Manufacturing.

-

Bond holders performance outlook? More punishment to come

Russell Muldoon

October 4, 2012

Following on from Tuesday’s 0.25% rate cut, economists expect the Reserve Bank of Australia to again cut by 0.25% in November 2012. The cash rate would then stand at 3.00% which is the same rate we saw at the low point of the GFC. This should give readers some insights into the slowdown being recorded at present. And as some commentators are predicting Australia’s terms of trade to soon decline by 15%, year on year, there is no pickup in sight.

This is reflected in Australia’s ten year Government Bonds currently yielding 2.93% which compares with ten year Government bond yields in Japan, Germany, the US and the UK of 0.8%, 1.5%, 1.6% and 1.7%, respectively. Whilst this is great news for anyone with debt, savers are being punished and are earning less than the long term rate of inflation. Worse when taxation is taken into account. We believe investors in Australian and indeed the world are in one of the greatest bubbles in the financial markets today. One in which they are happy to take negative returns but yet still face the risk of losing a lot of their capital when inevitably one day economies get moving again.

This to us is not a viable investment strategy.

by Russell Muldoon Posted in Insightful Insights.

- 4 Comments

- save this article

- 4

- POSTED IN Insightful Insights.

-

Mining swings from profit to loss quickly and without fear or favour. Its always been this way.

Roger Montgomery

September 6, 2012

You might recall back in December (Dec 8, 2011) with FMG trading at $4.84 (now $2.94), BHP at $37.00 ($31.36 today) and RIO at $66.09 ($50.19 today) we warned

“I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to big drops in margins for a sizeable portion of the [Australian stock] market index…”

Since the start of 2012, commodities have, on average, fallen more than 20%, and in some cases much more. This is a pace of decline matched only by that experienced during the financial crisis of 2008.

At current prices many mining companies will now be making losses. As analysts we question the viability of some companies and Atlas Iron for example, one of the largest Iron Ore producers outside of BHP and RIO, may not be without outside help – should prices remain at or below present levels.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.

-

China Impact

Roger Montgomery

August 31, 2012

From: http://www.bloomberg.com/news/2012-08-28/australia-mining-slowdown-hitting-economy-never-down-on-its-luck.html

“China’s iron-ore imports are going to slow down dramatically,” Xie, a former World Bank economist who researched globalization and bubbles, said in an interview from Hong Kong. “It’s not just because of the economic downturn; it’s because construction of property and infrastructure has peaked” in Australia’s No. 1 customer, he said.

Premier Wen Jiabao in March cut the government’s growth target for China to 7.5 percent for this year, the lowest since 2004, as policy makers there seek to reduce the role of large- scale fixed-asset investment in favor of greater consumer demand. China also has applied limited stimulus relative to 2008-09, as officials rein in property market speculation.

“I don’t think there’s ever been a miracle economy that ultimately lived up to its billing,” said Dylan Grice, global strategist at Societe Generale SA (GLE) in London, who cited the Japanese experience of the 1980s, Thailand before the 1997-1998 Asian financial crisis and Ireland’s “Emerald Tiger” period last decade. “This year’s miracle is next year’s disaster.”

by Roger Montgomery Posted in Energy / Resources, Insightful Insights.

- save this article

- POSTED IN Energy / Resources, Insightful Insights.

-

Steve Keen has his supporters…..

Roger Montgomery

July 31, 2012

In late 2008 Steve Keen, Associate Professor of Economics and Finance at the University of Western Sydney had a bet with Rory Robertson, who at the time was Interest Rate Strategist at Macquarie Bank. The bet was Australian housing prices would decline by 40% in two years, and the loser would walk 200km from Canberra to Mt Kosciuszko. Despite losing the bet, Steve Keen still has his supporters. Last week, Dean Baker the co-founder of US based the Centre for Economic and and Policy Research said the housing bubbles of the United Kingdom, Canada and Australia, are larger, relative to the size of their economies, than the one that collapsed and wrecked the US economy. In each county, there has been a sharp increase in the sale price of homes that has not been matched by a corresponding increase in rents. In Australia’s case, Baker claims house prices rose by more than 80 per cent between 2001 and 2009, a period when rents rose by roughly 30%. Baker argues the price of the median house in Australia is 225 per cent of the median house in the US. Given that wages in the US are higher it is difficult to see how this huge gap in house prices can make sense, said Baker.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able.

-

Is this the fate that awaits Australian Iron Ore Producers?

Roger Montgomery

July 26, 2012

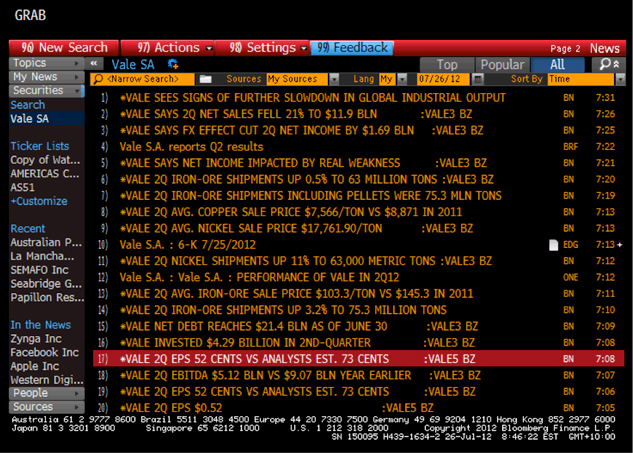

Could it get any worse for Iron Ore? It Just did!

Could it get any worse for Iron Ore? It Just did!News Flash! Shipping more iron ore volumes at lower prices is the same as JBH and HVN selling more TV’s a lower prices. Margins compress and profits don’t meet expectations.

Back in April, when we began more urgently warning investors to look carefully at profit assumptions for the big material stocks, our theory was that iron ore prices would decline because of a massive supply response. It really was basic supply and demand. Economics 101. You can read our warning here: http://rogermontgomery.com/is-the-bubble-bursting/

Back on December 8 2011, with BHP trading at more than $37.00 we again warned:

“I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to big drops in margins for a sizeable portion of the [Australian stock] market index…”

The doubters and many analysts that cover the sector however told us that lower prices would just mean that BHP, RIO and FMG would simply ship more volume. Remember share price performance over the long run follows profitability not profit.

And here’s the latest…

According to a news article that landed in the Bloomberg terminal this morning (see screenshot), Rio de Janeiro-based Vale, the world’s largest iron- ore producer, said second-quarter profit plummeted 59 per cent after prices for iron ore, nickel and copper declined.

Net income dropped to $2.66 billion, or 52 cents per share, from $6.45 billion, or $1.22 per share a year earlier. Vale was expected to post per-share earnings of 73 cents. The selling price of iron ore and most of Vale’s main products is lower than in 2011. This explains the decline in earnings.

Net sales fell 21 percent to $11.9 billion despite an increase in supply / production at Carajas, its biggest mine. Vale reportedly sold its iron ore at an average $103.29 per metric ton, down from $145.30 last year – something we have been warning for 6 months may happen. Nickel’s average sales price dropped 31 percent and copper declined 15 percent.

The stock has fallen 24 percent in the past 12 months, twice the 12 percent decrease in Brazil’s benchmark Bovespa Index. Management has put the focus of the fall squarely on slowing economic growth in China, the world’s biggest steel producer.

Returning to BHP, just 12 months ago, analysts had forecast 2012 net profits of almost $22b rising to $23b in 2013.

Those forecasts now stand at $17b and $18b respectively, representing a massive 22%-23% downgrade. And like Vale, BHP has also materially underperformed the ASX 200 index.

And given the significant miss by Vale analysts this morning, we reckon forecast earnings for BHP, RIO, FMG, MIN, AGO, BCI might disappoint again in the near future.

The answer in future periods may in fact lie in the Shanghai Re-bar prices and we have been watching this closely. Why? Because this is the most-traded steel futures contract and last week it hit a 2012 low.

Are iron ore prices, currently trading around China’s cost of production of $120/t, about to follow Re-bar prices despite most predicting the price simply cannot fall past this point?

The last time Re-bar prices were at this level, iron ore prices were also significantly lower.

When I was last on the ABC’s Inside Business program (watch it here: http://rogermontgomery.com/an-important-announcement/), we discussed Fortescue Metals CFO stating that their long-term iron ore price target is $100/t. I wonder how long we will have to wait until that forecast is also revised lower? As always, time will tell. Vale’s news is not a good omen.

by Roger Montgomery Posted in Energy / Resources, Market Valuation.

- save this article

- POSTED IN Energy / Resources, Market Valuation.