Search Results for: bubble

-

Have you been getting your daily dose?

Roger Montgomery

November 9, 2010

If only it worked that well all the time!

If only it worked that well all the time!Last Thursday evening (4 November) on Peter’s Switzer TV I listed, amongst other companies, Credit Corp and Forge Group as two I would have in the hypothetical Self Managed Super Fund Peter challenged me to set up that day.

Why did I nominate CCP and FGE? Both receive my A1 or A2 MQR and both have been trading at a discount to their intrinsic value.

If you are a regular reader of my blog you would have read my insights for some months on these companies. And if you saw today’s announcements, you can imagine why I am a little happier than usual.

Credit Corp’s previous 2011 NPAT guidance was $16-$18 million. Today the company announced FY11 would likely produce an NPAT result of $18-$20 million.

Forge Group’s announcement states “The Board wishes to advise that the company forecasts net profit before tax for the half year ending 31st December 2010 to be in the range of $25-$27 million. This represents an improvement on the previous corresponding period (pcp $19.04m) of up to 42%.”

As I fly to Perth for a presentation and company visit, I am encouraged that several of the companies Value.able graduates mentioned in our lists are also hitting new 52-week highs. In a rising market that lifts all boats, it is perhaps unsurprising, but nevertheless it should be an encouragement to Value.able graduates and value investors that companies like FLT, DCG, MIN, FWD, FGE, CCP, NCK, DTL, MCE, MTU and TGA have all hit year highs – some of them yesterday. More importantly those prices are perhaps justified by their intrinsic values.

Of course I am not here to predict where those prices will go next, because I simply don’t know. Short-term prices are largely a function of popularity and the market could begin a QE2-inspired correction, an Indian infrastructure-inspired bubble or a China liquidity-inspired bubble tomorrow. I have no way of telling and instead, I focus on intrinsic values and only pay cursory attention to share prices.

So, as I always say, seek and take personal professional advice before taking any action and remember that 1) I don’t know where the share price is going 2) I am under no obligation to keep you up-to-date with my thoughts about these or any company, my Montgomery Quality Ratings or my valuations and I might change my views, values and MQRs at any time so don’t rely on them and 3) I may buy or sell shares in any company mentioned here at any time without informing you.

And so I remind you one more time. Please seek and take personal professional advice and always conduct your own research.

Posted by Roger Montgomery, 9 November 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Just a little patience… is that all QBE needs?

Roger Montgomery

August 5, 2010

Turn on the TV, your computer or Mail on your iPhone and you are inevitably bombarded with news and data. And if you are following the financial markets, there is no shortage of headlines to grab your attention.

Take QBE’s recent profit downgrade and how the media bided for your attention; “QBE savaged after downgrade” and “QBE’s worst storm”. I bet amid all this news you missed IAG’s conveniently-timed announcement, the very next day; “IAG tips profit to be halved”.

There is a good reason for such bleak headlines… bad news sells.

Money is a very personal asset. We spend our lives working hard to earn it, make sacrifices to save it and when we invest it, some watch it like a hawk. These headlines rely on your strong ties to it. The by-product of course is that driven by emotions, the headlines create activity, which means transactions and remuneration, in turn funding advertising and marketing, fuelling more headlines.

Those waiting for good news from QBE might feel a little like Guns N’ Roses frontman Axl Rose when he penned the band’s 1988 hit ‘[need a little] Patience’. But it is patience that is the hallmark of the world’s best investors. So let’s focus on the long-term.

QBE’s recent profit downgrade was driven by falling investment income on its ‘float’, not a broken business model as the media headlines might suggest. Sure new equity issuance, the rising Australian dollar and sharp declines in global interest rates have conspired to depress QBE’s earnings and profitability, but the investment community’s current focus on movements in QBE’s investment income is likely to be short-term. Invariably the incessant focus on cause and effect relationships will switch to something else. It may even turn 180 degrees.

Over 90% of QBE’s investment portfolio (US$20b) is held cash and cash-like investments (highly liquid). These are currently depressed by low interest rates and lower foreign currency gains. This will be mitigated in the future as QBE moves from $AUD to $US reporting. And keep in mind that some very successful investors believe bonds are in a bubble. If thy’re right and the bubble bursts, yields will rise. (don’t ask me what I think, I don’t forecasts markets or the economy).

The remaining 10% of the insurer’s investment portfolio is in equity markets and although the collapse in the Elders share price (in which QBE has a strategic holding) may be a more permanent situation, other holdings should recover or emerge to offset the losses in time.

Looking through the headlines, QBE’s core insurance business continues to perform well. With industry-leading Combined Ratios and Insurance Margins, QBE has cemented itself in a position that is well ahead of its Australian competitors. This is what investors should be focusing on.

The remaining issue is the intrinsic value. The current value has fallen by a couple of dollars and the lower profits means the equity in the business will now grow more slowly. This has the effect of reducing future intrinsic values as well. QBE however was only trading at a small discount previously, not the very large discounts that I seek. The current valuation declines indicate that only small discounts to intrinsic value exist now so be sure to discuss that with your advisor.

QBE’s investments will inevitably rise and fall with the markets in which it invests, but making a profit on its underwriting business means the float represents very cheap funds. Throw in industry-leading management and the long term prospects remind me of what its like to take off in a plane during a storm.. .only to discover the sky is blue above the clouds.

Posted by Roger Montgomery, 5 August 2010.

by Roger Montgomery Posted in Insurance.

- 42 Comments

- save this article

- 42

- POSTED IN Insurance.

-

BHP and MCC – which is a Roger Montgomery A-class business?

Roger Montgomery

May 27, 2010

In the final part of his appearance on Your Money Your Call, Roger Montgomery discusses Macarthur Coal and BHP. MCC’s value is expected to rise to over $12 in 2012 and BHP’s value by a more impressive clip. But what happens if China’s property bubble bursts? Roger believes China’s story is a very good one, for decades to come, although there may be a few speed bumps along the way. Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

Whose Intrinsic Values will rise the most?

Roger Montgomery

May 15, 2010

It was as a young boy that I became enamoured with the outdoors and the unique landscape of Australia. I discovered the easiest way for me to experience it was by participating in cubs and scouts. I will never forget the motto “be prepared”. It has served me well in many ways, and while nothing is ever failsafe, it is sound advice when it comes to investing.

It was as a young boy that I became enamoured with the outdoors and the unique landscape of Australia. I discovered the easiest way for me to experience it was by participating in cubs and scouts. I will never forget the motto “be prepared”. It has served me well in many ways, and while nothing is ever failsafe, it is sound advice when it comes to investing.The market and its associated commentary is on tenterhooks. You can attribute that to the supertax’s contribution to a foreign investing exodus, nerves surrounding the property bubble in China, rising interest rates, or whatever else seems to be fashionable on the day with which to attribute the market’s conniptions to. I believe however, quite simply, that prices are generally expensive compared to my estimates of intrinsic value. That means that the performances of the underlying businesses do not justify current prices.

Of course if you are a trader of stocks valuations don’t matter. You will sell on the emergence of the Greek storm-in-a-teacup and buy the day after, when another bail-out package is revealed. Alternatively, you will buy when one newsletter says the coast is clear and sell when yet another contradicts it. The people pointing out worries about China today are those that said the banks would rise to $100 before the GFC hit. One of the easiest things to observe in the markets is that predictions of a change in direction are far more frequent than they are accurate. And anyone can explain what has happened, but few seem to be able to look far enough ahead to be positioned well.

With arguably the exception of my warnings earlier this year about the impact of a decline in infrastructure spending in China (thanks to an unsustainable commercial property and capital investment scenario) on the demand for Australian resources, I don’t try to predict the direction of markets or the macro economic determinants. I simply look at whether there are many or any good quality businesses available to purchase below intrinsic value. If there aren’t many or any great businesses to buy cheaply, the only conclusion must be that the market is not cheap.

I cannot predict what the market will do next, but its worth being prepared. When the market is expensive compared to my valuations, one of two things can happen. On the one hand, share prices can drop. That is more likeley to be the case if values don’t rise – which of course is the second scenario. Valuations could rise and make current prices represent fair values (or even cheap if values rise substantially).

In the event that prices fall (remember I am NOT making any predictions), I thought its worth looking at some of the big cap stocks (not necessarily A1’s) and how much their current intrinsic values are expected to rise over the next two years. These estimates of course can change, and its worth noting that none of the companies are trading at a discount to their current intrinsic value.

Big names and their estimated changes in intrinsic value Company Name Current Margin of Safety Estimated change in intrinsic value 2010-2012 RIO Tinto No 8% p.a. Commonwealth Bank No 16% p.a. National Aust. Bank No 22% p.a. Telstra No 2% p.a. Woolworths No 7% p.a. QBE No 10% p.a. AMP No 9% p.a. Computershare No 5% p.a. GPT No 3% p.a. Leightons No 13% p.a. My estimates of intrinsic value don’t change anywhere nearly as frequently as share prices, but they do change. I expect some adjustments to start flowing through as companies begin what is called ‘confession season’ – that period just ahead of the end of year and the release of full year results, when companies either upgrade or downgrade their guidance to analysts for revenues, market shares and profits. These adjustments could, in aggregate, make the market look cheap, but that will require 2011 valuations to rise significantly.

If prices fall (I am not predicting anything), and one is not overly concerned about quality, then one strategy (not mine) may be to buy the large cap companies expected to lead any subsequent recovery. Many investors and their advisers still subscribe to the idea that ‘blue chips’ exist and are safe. They tend to think of the largest companies as blue chips (I don’t) and if they are going to buy any after a correction, we might expect they will buy those whose values are going to rise the most. Of course, they may not know nor care about my valuations, nor do they know which companies are going to rise the most (in intrinsic value terms), but over the long term, the market is a weighing machine and prices tend to follow values. It follows on this basis then that Telstra’s value increase of just a couple of percent per year over the next two years may not put it in an as attractive a light as, say NAB.

I think you get the idea. To share your thoughts click “Leave a Comment”.

Posted by Roger Montgomery, 15 May 2010

by Roger Montgomery Posted in Companies, Investing Education.

- 28 Comments

- save this article

- 28

- POSTED IN Companies, Investing Education.

-

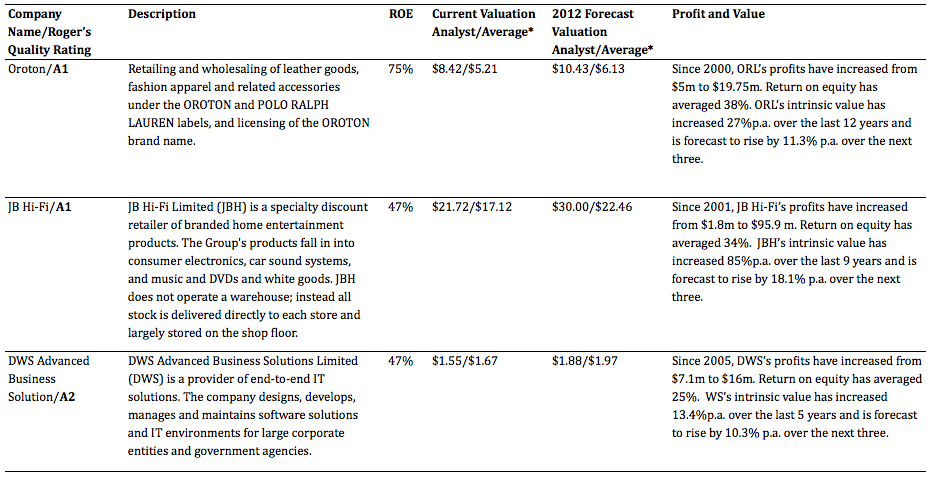

Do these three companies represent the last of good value?

Roger Montgomery

May 4, 2010

Fifteen months ago I was shouting it from the rooftops; “we will look back on this time as one of rare opportunity”. Since then, and as the All Ordinaries Accumulation Index rallied 61 per cent, there has been a fall in my enthusiasm for the acquisition of stocks.

Now, let me make it very clear that I have no idea where the market is going, nor the economy. I have always said you should never forego the opportunity to buy great businesses because of short-term concerns about those things. Even my posts earlier this year about concerns of a property bubble in China need to be read in conjunction with more recent reports by the IMF that there is no bubble in China. Take your pick!

My reluctance to buy shares today in any serious volume comes not from concerns about the market falling, or that China will cause an almighty slump in the values (and prices) of our mining giants. It comes from the fact that there is simply not that many great A1 businesses left that are cheap.

So here’s a quick list of companies that do make the grade for you to go and research, seek advice on, and on which to obtain 2nd, 3rd and 7th opinions.

* Note: Valuations shown are those based on analyst forecasts and a continuation of the average performance of the past.

In addition to these companies, investors keen to have a look at some lesser-known businesses, that on first blush present some attractive numbers, could research the list below. I have not conducted any in-depth analysis of these companies, but my initial searches and scans are suggesting at least a second look (I have put any warnings or special considerations in parentheses).

- CogState (never made a profit until 2009)

- Cash Convertors (declining ROE forecast)

- Slater&Gordon (lumpy earnings profile)

- ITX (trying to identify the competitive advantage)

- Forge (Clough got a bargain now 31% owner and a blocking stake)

- Decmil (only made a profit in last 2 years and price up 10-fold)

- United Overseas Australia (property developer).

What are some of the things to look at and questions to ask?

- Is there an identifiable competitive advantage?

- Can the businesses be a lot bigger in five, ten, twenty years from now?

- Is present performance likely to continue?

- What could emerge from an external force, or from within the company, to see current high rates of return on equity drop? For example, could a competitor or customer have an effect or are there any weak links in the balance sheets of these companies?

Of course I invite you again – as I did in last week’s post entitled “What do you know?” – to offer any insights (good, bad or in-between) that you have about these or any other company you know something about, or even about the industry you work in.

Posted by Roger Montgomery, 4 May 2010

by Roger Montgomery Posted in Companies, Consumer discretionary, Investing Education.

-

Will the coal bubble pop? Roger Montgomery says yes

Roger Montgomery

April 27, 2010

A wave of activity is emerging in the coal sector: CEO’s are making acquisitions at silly prices and analysts are forecasting straight-line growth. What is the problem with that? China is in the midst of a property bubble that is set to pop. Roger Montgomery reveals his 2012 intrinsic valuations for Macarthur Coal and Centennial Coal, but once again warns investors to be very cautious when investing in commodity businesses. Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

Can a bubble be made from Coal?

Roger Montgomery

April 19, 2010

Serendibite is arguably the rarest gem on earth. Three known samples exist, amounting to just a few carats. When traded at more than $14,000 per carat, the price is equivalent to more than $2 million per ounce. But that’s serendibite, not coal.

Serendibite is arguably the rarest gem on earth. Three known samples exist, amounting to just a few carats. When traded at more than $14,000 per carat, the price is equivalent to more than $2 million per ounce. But that’s serendibite, not coal.Coal is neither a gem nor rare. It is in fact one of the most abundant fuels on earth and according to the World Coal Institute, at present rates of production supply is secure for more than 130 years.

The way coal companies are trading at present however, you have to conclude that either coal is rare and prices need to be much higher, or there’s a bubble-like mania in the coal sector and prices for coal companies must eventually collapse.

The price suitors are willing to pay for Macarthur Coal and Gloucester Coal cannot be economically justified. Near term projections for revenue, profits or returns on equity cannot explain the prices currently being paid.

To be fair, a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.

Swimming against the tide is not popular. Like driving a car the wrong way down a one-way street, criticism and even abuse follows the investor who seeks to be greedy when others are fearful and fearful when others are greedy. Right now, with analysts’ projections for the price of coal and iron ore to continue rising at high double digit rates, and demand for steel, glass, cement and fibre cement looking like a hockey stick, its unpopular and decidedly contrarian to be thinking that either of these are based on foundations of sand or absent any possibility of change.

The mergers and acquisitions occurring in the coal space now are a function of expectations that the good times will continue unhindered. I hope they’re right. But witness the rash of IPOs and capital raisings in this space. Its not normal. The smart money might just be taking advantage of the enthusiasm and maximising the proceeds from selling.

A serious correction in the demand for our commodities or the prices of stocks is something we don’t need right now. But such are the consequences of overpaying.

Overpaying for assets is not a characteristic unique to ‘mum and dad’ investors either. CEO’s in Australia have a long and proud history of burning shareholders’ funds to fuel their bigger-is-better ambitions. Paperlinx, Telstra, Fairfax, Fosters – the past list of companies and their CEO’s that have overpaid for assets, driven down their returns on equity and made the value of intangible goodwill carried on the balance sheet look absurd is long and not populated solely by small and inexperienced investors. When Oxiana and Zinifex merged, the market capitalisations of the two individually amounted to almost $10 billion. Today the merged entity has a market cap of less than $4 billion.

The mergers and takeovers in the coal space today will not be immune to enthusiastic overpayment. Macarthur Coal is trading way above my intrinsic value for it. Gloucester Coal is trading at more than double my valuation for it.

At best the companies cannot be purchased with a margin of safety. At worst shares cannot be purchased today at prices justified by economic returns.

Either way, returns must therefore diminish.

Posted by Roger Montgomery, 19 April 2010.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.

-

What will happen when China’s property bubble bursts

Roger Montgomery

March 11, 2010

When China’s property bubble bursts, what will be the consequences for BHP and RIO? In the first part of his appearance on Your Money Your Call with Nina May Roger Montgomery also discusses Centennial Coal (CEY), Mortgage Choice (MOC), Virgin Blue (VBA), Santos (STO) and Woodside (WPL). Unfortunately none of these companies make Roger’s A1 grade. Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- 4 Comments

- save this article

- 4

- POSTED IN Media Room, TV Appearances.

-

Is The TV Your Investment Strategy?

Roger Montgomery

March 5, 2010

Mark Twain (1835 – 1910) said; “I Am Not So Concerned With The Return On My Money As The Return Of My Money.” It may surprise you to know he was quite the investor and liked to make comment about his observations. His quips always revealed a deep understanding of the nonsense that goes on in the stock market. What fascinates me is that the mistakes Twain observed during his lifetime are being repeated today.

I am occasionally asked why I spend so much time offering my insights when many observe that there is neither an obligation nor financial need. The reason is quite simple, I enjoy the process and of course, the proceeds of investing this way. I find it reasonably undemanding and so I have a little time to share my findings. And there’s the ancillary benefit of seeing hundreds of light-bulb moments when people ‘get it’. I note Buffett’s obligations and financials are even less necessitous and yet he has devoted decades to educating investors and students. I really enjoy my work. It is fun and thank you for making it so.

Investing badly in stocks is both simple and easy. But while investing well is equally simple – it requires 1) an understanding of how the market works, 2) how to identify good companies and finally, 3) how to value them – investing well is not easy.

This is because investing successfully requires the right temperament. You see you can be really bright – smartest kid in the class – and still produce poor or inconsistent returns, invest in lousy businesses, be easily influenced by tips or gamble. I know a few who fit the “intelligent but dumb” category. Because you are bombarded, second-by-second, by hundreds of opinions and because stocks are rising and falling all around you, all the time, investing may be simple but its not easy.

Buffett once said; “If you are in the investment business and have an IQ of 150, sell 30 points to someone else”.

Everyone reading this blog is capable of being terrific investors. But it is important to know what you are doing and to do the right things.

To this end I have asked a couple of investors with whom I have corresponded for permission to discuss their correspondence because it provides a more complete understanding of the research that’s required before buying a share.

I regularly warn investors that what I can do well is value a company. What I cannot do well is predict its short-term share price direction. Long-term valuations (what I do) are not predictions of short term share prices (what I don’t do).

Generally the scorecard over the last 8 months is pretty good. The invested Valueline Portfolio, which I write about in Alan Kohler’s Eureka Report, is up 30% against the market’s 20% rise. I have avoided Telstra and Myer, bought JBH, REH, CSL and COH. Replaced WBC with CBA last year and enjoyed its outperformance. Bought MMS and sold it at close to the highs – right after a sell down by the founding shareholder – avoiding a sharp subsequent decline.

But this year, there have been a couple of reminders of the inability I admit to frequently, that of not being able to accurately predict short term prices. And it is understanding the implications of this that may simultaneously serve to warn and help.

Even though I bought JB Hi-Fi below $9.00 last year, its value earlier this year was significantly higher than its circa $20 price. And the price was falling. It appeared that a Margin of Safety was being presented. And then…the CEO resigned and the company raised its dividend payout ratio. The latter reduces the intrinsic value and the former could too, depending on the capability of Terry Smart.

The point is 1) You need a large margin of safety and 2) DO NOT bet the farm on any one investment – diversify.

You can see my correspondence about this with “Paul” at http://rogermontgomery.com/what-does-jb-hi-fis-result-and-resignation-mean/

The second example is perhaps more predictable. Last year, Peter Switzer asked me for five stocks that were high on the quality scale; not necessarily value, but quality. We didn’t then have time to reveal the list, so I was asked back, in the second half of October 09. By that time, the market had rallied strongly, as had some of the picks. The three main stocks were MMS, JBH and WOW.

But because I didn’t have five at that time, I was asked for a couple more. I offered two more and warned they were “speculative”. “Speculative” is a warning to tread very, very carefully – think of it as meaning a very hot cup of tea balanced on your head. You just don’t need to put yourself in that position! But I was aware that viewers do like to investigate the odd speculative issue. A company earns the ‘speculative’ moniker because its size or exposure (to commodities, for example) or capital intensity render its performance less predictable or reliable, earning it the ‘speculative’ moniker. Nevertheless, based on consensus analyst estimates they were companies whose values were rising and whose prices were at discounts to the intrinsic values at the time – a reasonable starting point for investigative analysis. ERA was one and SXE was the other. Both speculative and neither a company that I would buy personally because their low predictability means valuations can change rapidly and in either direction.

My suggestions on TV or radio should be seen as an additional opinion to the research you have already conducted and should motivate investors to begin the essential requirement to conduct their own research. Unfortunately, I have discovered to my great disappointment, that some people just buy whatever stocks are mentioned by the invited guests on TV. Putting aside the fact that I have said innumerable times that I cannot predict short-term movements of share prices, it seems some investors aren’t even doing the most basic research.

As I have warned here on the blog and my Facebook page on several occasions:

1) I am under no obligation to revisit any previous valuations.

2) I may not be on TV or radio for some weeks and in that time my view may have changed in light of new information. Again, I am not obligated to revisit the previous comments and often not asked. Only a daily show could facilitate that. An example may be, the suggestion to go and investigate ERA because of a very long term view that nuclear power is going be an important source of energy for a growing China followed by a more recent view (see the previous post) that short term risks from a Chinese property bubble could prove to be a significant short-term obstacle to Chinese growth.

3) I don’t know what your particular needs and circumstances are.

4) I assume you are diversified appropriately and never risk the farm in any single investment

5) The stocks that I mention should be viewed, in the context of other research and your adviser’s recommendations, as another opinion to weigh up – to go and research not rush out and trade…rarely is impatience rewarded.

There are further warnings that are relevant and described in the correspondence related to the post you will find at http://rogermontgomery.com/what-does-jb-hi-fis-result-and-resignation-mean/

One investor wrote to me noting he had bought ERA and it had dropped in price. This should not be surprising – in the short run prices can move up and down with no regard or relationship to the value of the business. But like JBH before it, ERA had of course made a surprise announcement that would affect not only the price but the intrinsic value. In this case, it was a downgrade and a rather bleak outlook statement relating to cash flows. Analysts – whose estimates are the basis for forecast valuations here – would be downgrading their forecasts and as a result the valuations would decline just as they did when JB Hi-Fi increased its payout ratio. Over the long-term the valuations in ERA’s case, continue to rise (these valuations are also based on earnings estimates – new ones but which it should be noted are themselves based on commodity prices that are impossibly hard to forecast), but all valuations are lower than they were previously.

Our correspondence reminded me to regularly serve you with NOTICE that there is serious work to be done by you in this business of investing. In a rising market you can pretty much close your eyes and buy anything but you should never conduct yourself this way. If you work appropriately during a bull market, you will be rewarded in weaker markets too. And while many may complain when I say on air “I can’t find anything of value at the moment”, I would rather you complain about the return ON your money than the return OF your money.

Posted by Roger Montgomery, 5 March 2010.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 41 Comments

- save this article

- 41

- POSTED IN Companies, Insightful Insights.

-

Isn't the price all that matters?

rogermontgomeryinsights

December 3, 2009

Today I had an interesting piece of correspondence from ‘Victor’. Victor writes:

You talk about value of a Company, but reality is the value of an asset is what a buyer will pay for it, so is it not true that at any moment in time, the value of a Company is what the market is willing to pay for it. During the .com days, that was all that counts, there were no intrinsic value at all.

What Victor is suggesting that the value of an asset is simply what someone else will give you for it. In other words the price. But an asset is not worth what someone else will pay you for it. What someone else will pay you for something is the Price. Price and Value are two different things. Go and research the company NetJ.com. Its IPO price was 50 cents, it listed in November of 1999 on the OTCBB in the US around $2 and at the peak of the internet bubble traded at a price of more than $8.00 but according to its prospectus, it actually “conducted no substantial business activity of any description” and “had no plans to conduct any substantial business activity of any description”. So was NetJ.com ever worth $2, or $8.00? Of course not. The price was $8.00 but the value was much, much lower.

Price is not value. Your job as an investor is to buy great businesses when their price is less than the value you receive. The difference between a price that is lower than the value, is known as the Margin of Safety. Warren Buffett and Benjamin Graham argue that those three words are the three most important words in investing.

Posted by Roger Montgomery, 3 December 2009

by rogermontgomeryinsights Posted in Insightful Insights.

- 3 Comments

- save this article

- 3

- POSTED IN Insightful Insights.