Foreign Currency

-

Is the Sky Falling?

Roger Montgomery

August 21, 2014

This morning, we read with interest the views of Chris Watling from Longview Economics, who believes the Fed is underestimating the strength of the US economy. continue…

by Roger Montgomery Posted in Economics, Foreign Currency, Insightful Insights.

-

Reserve Bank of New Zealand certainly moves quickly

David Buckland

July 25, 2014

One thing we can say about the Reserve Bank of New Zealand is they certainly move quickly when they think it is appropriate to do so.

For example, in the nine-month period between July 2008 and April 2009, the New Zealand official cash rate (OCR) was cut on seven occasions, from 8.25 per cent to 2.5 per cent.

Now the opposite is occurring and in the past four months the OCR has been increased on four occasions – each by 0.25 per cent – from 2.5 per cent to 3.5 per cent. The New Zealand economy is expected to grow by 3.7 per cent in 2014, with the recovery in construction and net migration adding to housing and household demand.

The graph below compares the New Zealand 90-day bank bill rate with the New Zealand official cash rate, which commenced life in March 1999 at 4.5 per cent.

by David Buckland Posted in Financial Services, Foreign Currency, Insightful Insights, Value.able.

-

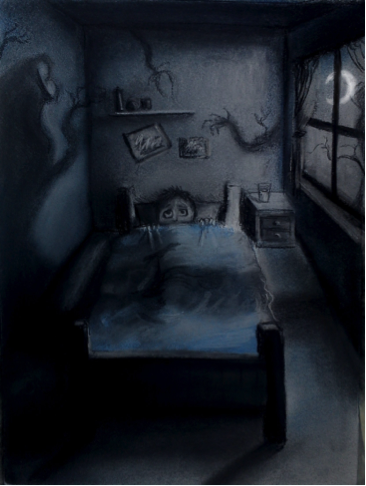

Don’t jump at shadows

Roger Montgomery

July 4, 2014

There is nothing in the dark that isn’t there when the lights are on.

It seems you can ignore warnings of an imminent stock market crash. The US Fed is happy for a bubble to form, and it’s not even worried about any subsequent bust. No longer is the US Fed beholden to fears of irrational exuberance, and commentators who point to rising risks may simply be premature, if not completely missing the point of ignoring who is in charge. continue…

by Roger Montgomery Posted in Economics, Foreign Currency, Insightful Insights.

-

Japanese CPI growth hits 23-year high

David Buckland

June 2, 2014

The make up of consumer price index (CPI) data in many countries is not necessarily closely related to the cost of living. For example, in the US, ‘everyday’ consumer expenditure on food and energy has less than a 25 per cent weighting on their CPI, and is excluded altogether from a ‘core’ inflation. continue…

by David Buckland Posted in Economics, Foreign Currency, Insightful Insights.

-

US Corporate Profit Margins at Record-High

David Buckland

April 18, 2014

I have just returned from a short trip to the US, where I saw Bubba Watson win the US Masters at The Augusta National Golf Club. While this is indeed an extraordinary sporting event, I think I now have a better idea why US corporate profit margins (as a percent of nominal GDP) are at record-high levels. continue…

by David Buckland Posted in Foreign Currency, Insightful Insights, Value.able.

-

Looking to: China Rongsheng Heavy Industries

David Buckland

April 17, 2014

We have written about China Rongsheng Heavy Industries, one of the largest shipbuilders in the world, on several occasions. (See our posts from August 2012, and July 2013). continue…

by David Buckland Posted in Companies, Financial Services, Foreign Currency, Insightful Insights.

-

The Aussie Peso Rides Again

Roger Montgomery

April 7, 2014

My friend and Joint Chief Executive of Philo Capital Advisers, Ashley Owen, recently penned this piece on the Aussie dollar. As you know, we have suggested since US$1.05 that Australia needs a lower currency. Well, according to Ashley, we’re going to get one. continue…

by Roger Montgomery Posted in Energy / Resources, Foreign Currency, Insightful Insights.

-

The story on iron ore

David Buckland

March 19, 2014

Since the beginning of 2014 the iron ore price has declined by around 20 per cent, from US$130-$135/tonne, to US$105-$110/tonne. Unusually, the Australian dollar to US dollar exchange rate has, over this period, appreciated slightly to just over US$0.90. continue…

by David Buckland Posted in Energy / Resources, Foreign Currency.

- save this article

- POSTED IN Energy / Resources, Foreign Currency

-

Iron ore crashing!

Russell Muldoon

March 11, 2014

Remember last year all those analysts saying that because the price of iron ore hadn’t gone down in 2013 that it wouldn’t? continue…

by Russell Muldoon Posted in Energy / Resources, Foreign Currency.

- save this article

- POSTED IN Energy / Resources, Foreign Currency

-

Looking at: the US Federal Funds Target Rate

David Buckland

February 12, 2014

The US Federal Reserve target rate is one of the most influential interest rates in the US economy, and is applicable to the most credit-worthy institutions when they borrow and lend overnight funds to each other. continue…

by David Buckland Posted in Economics, Foreign Currency, Insightful Insights.