Foreign Currency

-

Which Aussie stock will benefit from European QE?

Roger Montgomery

March 13, 2015

Our good friends at UBS recently released a report with an interesting insight into the general market impact of the European Central Bank’s Quantitative Easing (QE) program.

It’s easy, if not lazy, for Australian investors to simply think Europe, the European Central Bank (ECB) and Angela Merkel are all “over there”, and therefore not relevant to Australian investors, but that is not the case. continue…

by Roger Montgomery Posted in Foreign Currency, Insightful Insights.

-

Will 2015 be the year Australia enters a recession?

Roger Montgomery

February 20, 2015

This week the question, whether 2015 will be the year Australian enters a recession, was asked by one of our subscribers, here is what I had to say in response: continue…

by Roger Montgomery Posted in Economics, Foreign Currency, Insightful Insights, Market commentary.

-

China Watch #2

Roger Montgomery

February 19, 2015

Recently Australian Financial Review Journalist Angus Grigg reported an interesting admission by a director at China’s State Administration of Foreign Exchange (SAFE). It’s a big deal for a SAFE official to be making such statements publicly.

Here’s the highlights: continue…

by Roger Montgomery Posted in Energy / Resources, Foreign Currency, Insightful Insights.

-

Will the Greeks wreck your retirement?

Roger Montgomery

February 17, 2015

On Monday night, the US markets were closed for the Presidents’ Day holiday but Greece was not sleeping comfortably.

To understand whether there are risks to your wealth from Greece’s posturing (and remember the US markets return to work tonight) it pays to understand where we are currently and how we arrived at this juncture. If you would like to know more read on. continue…

by Roger Montgomery Posted in Economics, Financial Services, Foreign Currency, Insightful Insights, Market commentary.

-

It’s Coco-nuts!

Roger Montgomery

February 16, 2015

Chasing yield, wherever it can be found, is a pastime for many baby boomers whose income returns from traditional securities and bank deposits are being decimated. The fad global and Basel III banking capital requirements are potentially legitimising some securities, that under normal interest rate settings, might not have seen the light of day. continue…

by Roger Montgomery Posted in Economics, Financial Services, Foreign Currency, Insightful Insights.

-

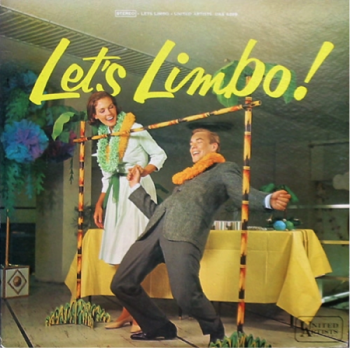

How low can you go? Deflation and negative bond rates

Roger Montgomery

February 10, 2015

With everyone getting very hot under the collar or excited (depending on whether you are a borrower or a lender) about the prospect of Australia’s cash rate falling below two per cent, we thought it might be interesting to point to something even more interesting that transpired last week in Europe. continue…

by Roger Montgomery Posted in Economics, Foreign Currency, Insightful Insights.

-

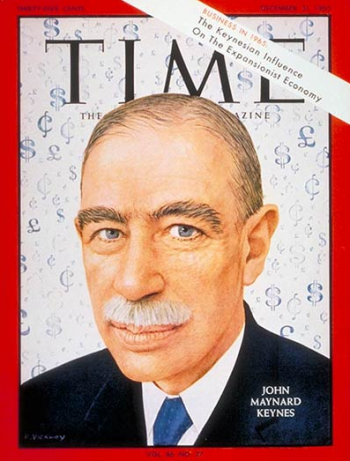

We’re all in this together

Scott Shuttleworth

February 9, 2015

For the historically minded reader you will note that this title was a famous quote attributed to John Maynard Keynes, the grandfather of Keynesian economics. The quote is said to have been made by Keynes as he commented on the harsh post-war conditions placed on Germany at Versailles in 1919. In short, one condition required that Germany repay the Allies for the cost of the war. continue…

by Scott Shuttleworth Posted in Economics, Foreign Currency, Insightful Insights, Market commentary.

-

Investing Overseas: Time to buy Greece?

Roger Montgomery

February 4, 2015

There is a definite element of contrarianism to value investing. Not always of course, but sometimes the market’s negative reaction, to news that is of a temporary nature, prices the shares of a company as if the problem were permanent. Going against the tide in these cases can produce very satisfactory investment outcomes. continue…

by Roger Montgomery Posted in Foreign Currency, Insightful Insights, Investing Education.

-

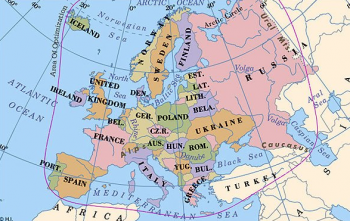

Eastern Europe – the epicenter of our next crisis?

David Buckland

January 29, 2015

It’s official. European consumer prices fell an annual 0.2 per cent in December 2014. German five-year bonds and Swiss ten-year bonds are now paying a “negative rate of interest.” European Central Bank (ECB) president Mario Draghi continues to “do whatever it takes” with last week’s announcement of the 1,100 billion euro (US$1,250 billion) bond purchase program over 2015 and 2016. Mario thinks this will steer the Euro area away from deflation by convincing investors his latest strategy is audacious enough to stimulate their relatively fragile economy. continue…

by David Buckland Posted in Foreign Currency, Insightful Insights.

-

The oil price slump and the declining rate of inflation

David Buckland

January 27, 2015

The slump in the oil price since mid-2014 has seen global inflation rates continue to trend down. European consumer prices fell an annual 0.2 per cent in December 2014 and European Central Bank president continues to “do whatever it takes” by unveiling a 1,100 billion Euro (US$1,250 billion) bond buying program over 2015-2016. continue…

by David Buckland Posted in Energy / Resources, Foreign Currency, Insightful Insights.