-

MEDIA

Ausbiz – 2026 outlook and opportunities in small-caps

David Buckland

January 8, 2026

I joined Juliette Saly on Ausbiz to reflect on how markets closed out in 2025 and what may lie ahead in 2026. Last year was again dominated by artificial intelligence (AI) and the Magnificent Seven (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla). However, with valuations now stretched amongst these technology leaders, there may be opportunities for investors beyond the headlines. Continue…

by David Buckland Posted in Companies, Market commentary, Small Caps, Stocks We Like, TV Appearances.

-

Are U.S. rate cut expectations reasonable?

Roger Montgomery

November 28, 2025

The U.S. Federal Reserve (The Fed) has two main mandates: supporting employment and controlling inflation. Until Friday, it looked as if the two were almost perfectly balanced against each other, suggesting that the Fed would keep rates on hold in December.

Last week, Wall Street decided that a December cut was off the table. On Wednesday, the Chicago Mercantile Exchange (CME) Fedwatch futures index placed the probability of a cut at just 30 per cent.

Meanwhile, JPMorgan published a note predicting a January cut. Markets sold off dramatically, with the Nasdaq 2.74 per cent lower, and the S&P 500 losing 1.95 per cent last week. And there were of course, fears of a bubble in the artificial intelligence (AI) theme, which we have written about here copiously. Continue…

by Roger Montgomery Posted in Economics, Global markets, Market commentary.

- save this article

- POSTED IN Economics, Global markets, Market commentary.

-

MEDIA

Why the AI boom could leave investors licking their wounds

Roger Montgomery

November 28, 2025

With 30 per cent of the U.S. S&P 500 index trading at more than 10 times sales, and 13 per cent of the S&P 500 by index weight trading at 20 times price-to-sales (P/S) (a level that now surpasses the tech boom of 1999-2000), we’ll take a break this week from commenting further on market valuations and leave it to you to decide whether it’s wise to be fully invested in equities, or diversified.

This article was first published in The Australian on 21 November 2025.

by Roger Montgomery Posted in In the Press, Technology & Telecommunications.

-

MEDIA

Fear + Greed Podcast – what investors might expect in 2026

Roger Montgomery

December 22, 2025

2025 has been an eventful year, with some strong returns – but what comes next? I joined Sean Aylmer from Fear and Greed for their Summer Series to break down the forces that shaped markets this year. Looking ahead to 2026, I explain why investors should expect higher volatility, limited future gains given today’s stretched valuations, and why rebalancing portfolios into alternative offerings that are uncorrelated to markets should be considered.

by Roger Montgomery Posted in Economics, Global markets, Market commentary, Podcast Channel.

-

The calculus of madness: Part 1

Roger Montgomery

December 3, 2025

Sir Isaac Newton is enshrined in history as the saint of rational thought. He decoded the laws of gravity, invented calculus, and parsed the rainbow. Yet, in the spring and summer of 1720, the arguably most intelligent man in the British Empire made a series of financial blunders, recorded for posterity, and so catastrophic they have become a cautionary legend in economic and investment history.

Newton’s entanglement with the South Sea Company serves as a stark reminder: in the face of collective delusion and market mania, even a genius can be led astray. Continue…

by Roger Montgomery Posted in Investing Education, Market commentary, Technology & Telecommunications.

-

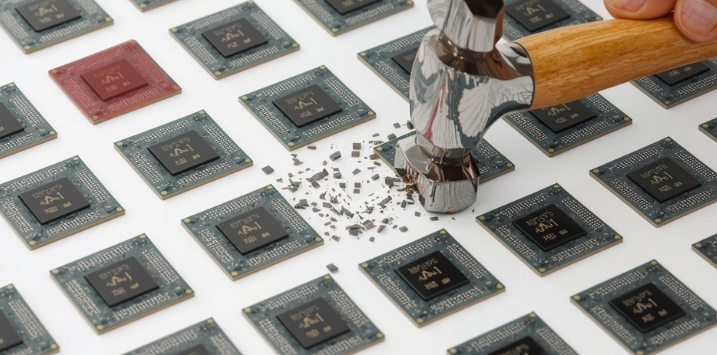

Is the creative destruction phase beginning?

Roger Montgomery

February 6, 2026

Last year, I posted a blog entitled ‘But Nothing’s Changed’, describing how the artificial intelligence (AI) bubble and market boom could end. I explained how investors will realise that even though AI technology – hailed as the 4th Industrial Revolution – will change the course of human history, it probably won’t do so tomorrow. And therefore, share prices were at risk of setbacks because there will be commercial bumps (delays in data centre builds, changes in interest rates, shortages of energy and water, and not all companies can win) along the way to an AI ‘utopia’. While timing a change in sentiment is impossible, the hype surrounding general-purpose technologies, including AI, makes such a change inevitable. It’s always been so. Continue…

by Roger Montgomery Posted in Manufacturing, Market commentary, Technology & Telecommunications.

-

MEDIA

Fear + Greed Podcast – Small caps are back. Can they keep going?

Roger Montgomery

January 9, 2026

I joined Sean Aylmer from Fear and Greed’s Summer Series to discuss the strengthening performance of Australian small caps, why quality matters, and where opportunities are emerging. I shared a number of small-cap examples across different sectors to illustrate these points, including ZIP (ASX:ZIP), a buy-now-pay-later business growing strongly in the United States; Megaport (ASX:MP1), a key technology provider connecting data centres where a recent acquisition is yet to be fully recognised by the market; Codan (ASX:CDA), which manufactures gold detectors and continues to benefit from solid demand supported by elevated gold prices; and MA Financial Group (ASX:MAF), a private credit manager seeing strong inflows as investors seek more reliable income.

The key takeaway from this episode was the importance of being selective and backing quality businesses.

by Roger Montgomery Posted in Investing Education, Podcast Channel, Small Caps, Stocks We Like.

-

MEDIA

ABC News – Are AI investors causing tech companies to be overvalued?

Roger Montgomery

December 12, 2025

Last night, on ABC’s 7.30 news report with Michael Rowland, I discussed whether surging investment in artificial intelligence (AI) is pushing large technology companies to unsustainable valuations. I noted that investors often become highly enthusiastic when new technologies emerge that are believed to reshape the world, but history shows this can inflate expectations. In the case of AI, the scale of spending by tech hyperscalers is immense, and to justify it they would need extraordinary levels of revenue.

Watch the full segment here: ABC News – Are AI investors causing tech companies to be overvalued?by Roger Montgomery Posted in Insightful Insights, Market commentary, On the Internet, Technology & Telecommunications, TV Appearances.

-

MEDIA

How AI investors could lose everything and still win

Roger Montgomery

December 30, 2025

Who would have thought that asset bubbles are a necessary part of humanity’s advancement through technology?

While most currently consider bubbles a dangerous precondition for a stock market crash, they can also be better navigated by appreciating they’re a necessary step on the road to humanity’s advancement.

As I have noted previously, there’s a myriad of definitions for asset bubbles, but most fall into two camps: those that measure overvaluation and those that observe the behaviours and conditions that typically give rise to it.

This article was first published in The Australian on 20 December 2025. Continue…by Roger Montgomery Posted in In the Press, Investing Education, Market commentary, Technology & Telecommunications.

-

MEDIA

ABC Newcastle Mornings – rates hold steady

Roger Montgomery

December 9, 2025

I joined Paul Turton on ABC Newcastle Mornings today to discuss the broader economic backdrop, including why interest rates are likely to remain steady for now, how household spending and cost pressures are shaping the outlook, and why global sharemarkets are being driven less by local conditions and more by international themes such as investment in artificial intelligence (AI), with long-term returns ultimately depending on earnings and business fundamentals.

Tune in from 37:54 to hear the full segment: ABC Newcastle Mornings. Continue…

by Roger Montgomery Posted in Radio.

- LISTEN

- save this article

- POSTED IN Radio.

To visit the February 2026 reporting season calendar Click here .

Buy and hope.