-

Trump’s systematic assault on U.S. democracy

Roger Montgomery

June 11, 2025

The return of Donald Trump to the presidency has brought with it a series of actions and policies that systematically undermine the foundational principles of American democracy. Continue…

by Roger Montgomery Posted in Market commentary.

- 11 Comments

- save this article

- 11

- POSTED IN Market commentary.

-

The world is in conflict but the stock market keeps going up – what am I missing?

Dean Curnow

June 23, 2025

Why is the stock market rising amid global conflicts in 2025?

In 2025, the world is grappling with significant geopolitical uncertainty. Tensions between the U.S. and China have wavered, the tragic conflict between Israel and Iran has escalated, and the ongoing war between Russia and Ukraine persists. Yet, despite these challenges, most major global equity indices have posted gains year-to-date. Continue…

by Dean Curnow Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary.

-

Scratching your head about the stock market rally? It makes perfect sense.

Roger Montgomery

May 12, 2025

With the U.S. economic picture deteriorating, you might be wondering why the market is rallying. It’s simple if you remember that hope springs eternal.

U.S. President Donald Trump’s first chaotic days in office have been economically disruptive, thanks to a whirlwind 143 executive orders, a tornado of declared emergencies, and tariffs heralding a trade war – particularly the 135 per cent levy on Chinese imports. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

Australia’s housing and cost of living crisis is hurting the less well off

David Buckland

May 30, 2025

Australia’s housing crisis is deepening, with median Sydney house prices reaching 13.8 times the median household income, placing it among the least affordable cities globally. Continue…

by David Buckland Posted in Video Insights.

- 1 Comments

- save this article

- 1

- POSTED IN Video Insights.

-

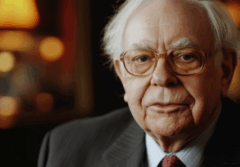

The end of an epoch. Warren Buffett retires.

Roger Montgomery

May 6, 2025

Australian investors, engrossed in the 2025 Federal Election, may have missed a seismic shift in the global financial landscape: Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, announced his retirement at the age of 94. On Saturday, during the company’s annual shareholder meeting in Omaha, Nebraska, Buffett revealed he would step down as CEO and chairman by the end of the year, handing the reins to Vice Chairman Greg Abel. Continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary.

-

Could Trump’s ideology, backed by primary school maths, cause a market meltdown?

Roger Montgomery

April 5, 2025

Could it be possible that the markets are tumbling because Trump and his team can’t add, or worse, lied to hide a warped ideology?

President Donald Trump’s administration has rolled out sweeping “reciprocal tariffs” targeting over 180 countries in a move that has sent shockwaves through global financial markets and trade networks. Announced with typical Trump fanfare in the White House Rose Garden on 4 April 2025, Trump wielded a chart (Table 1) to underscore his point, claiming his measures would level the playing field and end decades of the U.S. being “ripped off” by its trading partners. Continue…

by Roger Montgomery Posted in Market commentary.

- 6 Comments

- save this article

- 6

- POSTED IN Market commentary.

-

The Apple of Warren Buffett’s eye

Roger Montgomery

May 15, 2025

On May 3, Warren Buffett announced his retirement. Here’s my dictation (abbreviated) of his announcement:

“The time has arrived where Greg should become the CEO of the company at year end, and I want to spring that on the directors effectively [of Berkshire Hathaway]”. Continue…

by Roger Montgomery Posted in Companies.

- save this article

- POSTED IN Companies.

-

Gold-plated billionaires

Roger Montgomery

May 7, 2025

For years I have abided by the idea that gold is useless. As Charles Munger noted; if you buy an ounce of gold today, at the end of eternity, you will still own an ounce of gold. With no industrial use and producing no income, Munger’s partner, Warren Buffett, noted gold is only good for doing two things: ‘looking and fondling’. They are right in the sense that, without any ability to compound or any commercial value, buying gold is a bet that others will subsequently buy gold at a higher price. In that sense, buying gold is speculation rather than investing.

I remain convinced, buying gold is, and will always be, a bet on fear. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

Fast-food sales confirm U.S. economy is on struggle street

David Buckland

May 26, 2025

Fast-food and drive-thru sales are powerful gauges of an economy’s health because they capture real-time consumer behaviour, particularly among lower and middle-income households. Unlike government data or consumer confidence surveys, which can be delayed or skewed by sentiment rather than action, fast-food sales reflect what people are actually doing with their money. Continue…

by David Buckland Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

Going for gold?

Roger Montgomery

April 7, 2025

For decades, it was wise to heed Warren Buffet’s observation that gold has no utility and that over any 100-year period, you will be better off owning income-producing assets. Gold, he said, can only be looked at and fondled. I have previously noted that gold is merely a bet on increasing fear and anxiety, and given these are sentiments, their shifts can be rapid and impossible to predict. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

Watch our latest Ausbiz event: Private credit – calm amid market mayhem WATCH HERE.