Search Results for: thorn group

-

A market view right now

David Buckland

September 18, 2013

In these highlights from Your Money Your Call, David Buckland discusses his thoughts on the iron ore sector, and stocks AGL Energy (AGK), M2 Telecommunications (MTU), Horizon Oil (HZN), G8 Education (GEM), McMillan Shakespeare (MMS), Magellan Financial Group (MFG). Watch here.

by David Buckland Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

Double edition white paper: ARB & Speciality Fashion Group

Roger Montgomery

September 13, 2013

In this month’s subscriber-only white paper, Roger analyses two companies: ARB Corporation and Speciality Fashion Group. What are the prospects for these two businesses?

by Roger Montgomery Posted in Companies, Whitepapers.

- 12 Comments

- save this article

- 12

- POSTED IN Companies, Whitepapers.

-

Seeking Perfection* (*with apologies to George Orwell)

Ben MacNevin

September 13, 2013

It was a rather gloomy week of economic data releases – total job advertisements in Australia and New Zealand were down by 2 per cent for the month of August, while unemployment rose from 5.7 per cent to 5.8 per cent over the same period. And yet the share price of Seek, Australia’s leading employment classifieds website owner, has risen by 1.7 per cent over the week. That raises the question; why are the rising unemployment headlines not having the same adverse impact on the company’s performance as they once did? Continue…

by Ben MacNevin Posted in Companies, Economics, Insightful Insights, Value.able.

- 6 Comments

- save this article

- 6

- POSTED IN Companies, Economics, Insightful Insights, Value.able.

-

Lessons of history

Roger Montgomery

September 5, 2013

As we lurch towards another election with an inevitable outcome, we at Montgomery are surprised by the expectations, held by some, that something dramatic will change next week. Continue…

by Roger Montgomery Posted in Insightful Insights.

- 13 Comments

- save this article

- 13

- POSTED IN Insightful Insights.

-

Down but not out

Russell Muldoon

September 2, 2013

Whilst we do not own the shares in the business and haven’t for some time, we previously commented on a number of headwinds we thought Blackmores was facing. Naturally we read their full year result with interest to see how things are progressing. Continue…

by Russell Muldoon Posted in Health Care, Insightful Insights, Value.able.

- 12 Comments

- save this article

- 12

- POSTED IN Health Care, Insightful Insights, Value.able.

-

Dressed to weather the retail storm

Roger Montgomery

September 1, 2013

Retail is a tricky sector for investors at the moment. But amidst the harsh conditions, there are some glimmers of opportunity. In this article, Roger Montgomery talks about where we are casting our gaze.

It takes nerves of steel to buy small fashion retailers in this market. Weak consumer confidence, sluggish retail sales growth, price discounting and the online sales threat are pounding the sector. But within the carnage are potential opportunities such as Speciality Fashion Group (SFH).

The turnaround play is in the eye of the retail storm. With 892 stores across the Millers, Katies, Crossroads, Autograph, City Chic and La Senza brands, and around 180 million interactions with Australian shoppers each year, SFH is incredibly leveraged to discretionary spending conditions.

Apparel is a tricky business at the best of times; fashion-fickle consumers and seasonal disruptions such as a warmer-than-expected winter can crunch sales. It takes great skill to sell more clothes when so many headwinds conspire to stop consumers spending.

The list of retail problems is long and growing. In the short term, interest-rate cuts are having less effect as consumers remain concerned about job security and prefer to pay down debt (or buy investment properties!) and spend less. Retail sales grew just 0.1 per cent in May, compared with market expectations of 0.3 per cent.

The lead-up to elections is rarely good for retailers and online sales continue to eat into traditional retail sales channels, albeit off a low base. Rampant price discounting has conditioned consumers to expect ever-lower prices for basic items such as cheap clothing, which the likes of K-Mart almost seem to give away.

These trends are taking a heavy toll. One of SFH’s nearest listed rivals, Noni-B, saw its share price tumble this year after reporting deteriorating conditions within and without.

Among large apparel sellers, Target has been a basket case. Parent company Wesfarmers issued a profit warning for its troubled discount store in May, blaming lower sales, shrinking profit margins, excess inventory and a late start to the winter season. Target’s woes put chills through the broader apparel sector as analysts feared higher-than- expected unsold inventory.

The apparel sector, it seems, can’t take a trick this year. The tragic factory collapse in Bangladesh this year, which killed more than 1,000 garment workers, has put the spotlight on Australian importers such as K-Mart, which source garments, directly or indirectly, from third-world countries.

But despite these problems, some, if not many, retail stocks have rallied in 2013. JB Hi-Fi, for example, has a one-year shareholder return of 105 per cent (including dividends) after touching a 52- week low of $8.34. Kathmandu Holdings is up 89 per cent over one year, and Myer Holdings is up 46 per cent.

These are remarkable performances in the context of such a weak retail market. They show how investors can badly misprice stocks when market noise peaks and everybody is focused on backward- looking newspaper headlines rather than looking forward. The market was too negative towards some high-quality retailers in late 2012, and investors, as is their wont, confused price and value.

This was true of SFH when its shares plumbed 47 cents in 2012 at the peak of the retail-gloom hysteria. Following a surprisingly strong interim profit report in February, the company soared to a 52-week high of $1.20 before retreating to a low of 78 cents in the past few months.

SFH was an easy stock to sell in 2012. As retail sales growth slowed, fewer women would buy dresses at its shops, or would seek lower- priced substitutes at the discount department stores, or so the theory went. And SFH has been a volatile, arguably lower-quality retailer at times over the past decade.

It posted a $2.8 million loss in FY12, partly from higher depreciation charges due to a store rationalisation program, did not declare a final dividend, and gave a cautious view of its outlook. But beneath the gloom were good signs of improving operational performance.

Supply-chain enhancements bolstered the company’s gross profit margin, more goods were being sold online, and operating cash flows were higher due to much better management of working capital. Simply put, SFH was rapidly improving the business to combat retail headwinds.

Those initiatives underpinned sharply improved performance in the first half of FY13. Revenue rose 1.3 per cent to $311.1 million on the same half year earlier, net profit soared from $6.1 million to $17.9 million, and basic earnings per share almost tripled to 9.3 cents.

A 62.4 per cent gross margin was the highest in the company’s history, up a whopping 477 basis points over the half. Higher selling prices, lower product and freight costs, and the benefits of investments in moving to a design and direct sourcing model are transforming SFH’s margins, with another 150 basis points in margin gains targeted for the second half of FY13.

Other cost controls also impressed. It limited cost increases to 1.2 per cent for the half despite annual wage inflation of 3 per cent. Lower base rentals on renewed store leases and the exit of underperforming stores helped contain cost increases.

Although it has done an excellent job in becoming more productive and efficient, those gains alone will not drive SFH sharply higher in the next 3-5 years. The company needs to better leverage its great,

under-recognised strength – a database of 7 million customers built over decades.

Notwithstanding the inevitable ‘returns to senders’ and ‘email address not recognised’, the power of this database, and SFH’s retail reach, usually gets scant consideration in analyst reports, even though it is the key to the company’s long-term fortunes. It is not well known that 55 per cent of Australia’s female adult population are on SFH databases, according to SFH figures.

Long-time market watchers will remember the work of Miller’s Retail Group, once a standalone ASX-listed company, in building a huge database of fashion devotees through a “club format” long before the internet made such channels a critical part of retailing.

SFH is doing a much better job mining this database and improving its customer communication and touchpoints. Its email-valid membership, now 2.5 million and rising, is a huge platform to provide targeted marketing offers to deal-hungry consumers.

A strong ‘omnichannel’ distribution platform – across physical stores and online – is critical in retailing these days, and a significant source of sustainable competitive advantage and value for SFH. The challenge now is to turn that database into sharply higher, sustained sales growth.

For all its recent achievements, SFH does not appear to have received the recognition it deserves. Although it has a volatile record, SFH is starting to look like a much more consistent, high- quality company that ticks key boxes for long-term value investors.

It had net cash of $38.6 million on the balance sheet at June 30, 2013 – down from $45.6 million on the balance sheet at December 31, 2012, which was the highest in seven years. The company repaid $6.5 million of debt in the first half, and has no outstanding debt. A 27.9 per cent Return on Equity (ROE) for FY13 also impressed, given the retail malaise.

SFH has plenty of cash for a circa $150-million company (probably too much) and firepower to make acquisitions as the troubled retail sector inevitably throws up opportunities. It has been touted as a takeover target for the fast-growing Cotton On Group, which has a 20 per cent stake and two directors on the SFH board. Cotton On emerged on the SFH register in 2010.

The key question, of course, is does value exist now?

Another interest-rate cut, a stabilisation of the Australian dollar, and the resolution of the Federal election could spur confidence and give cash registers a slightly stronger ring in the next 12 months, and also create more market focus on the retail sector.

But if conditions remain exceedingly tough, as seems likely, SFH has at least shown it has the right formula, management skill and balance sheet to weather the retail storm.

This article was written on 1 September 2013. All share and other prices and movements in prices are to this date.

by Roger Montgomery Posted in Consumer discretionary.

- save this article

- POSTED IN Consumer discretionary.

-

Mermaid or Dugong?

Roger Montgomery

September 1, 2013

As the share prices of many mining services companies performed as we have been warning they would, the question we receive from many investors is: is time to wade back in? In the context of Mermaid Marine, we address the question.

Value investors will need great skill to make money from the resource services sector. Pessimists point to $150 billion of mining and energy projects delayed, cancelled or reassessed in Australia in the past 12 months. Optimists argue that there is value aplenty in the sector after horrific share price falls.

The truth is somewhere in between. There is good reason to continuing avoiding the resource-services sector: the Bureau of Resources and Energy Economics (BREE) forecasts the worth of committed projects, or those likely to get to that stage in the next five years, will drop from $256 billion from the end of 2013 to about $70 billion in 2017.

It could get worse if falling commodity projects force a few mega projects to remain in publicly announced feasibility phases, meaning even less work for service providers. Boart Longyear’s terrible earnings result in August and talk that it could breach debt covenants reinforces the danger. Don’t be surprised if a few lower- quality mining services companies go under in the next year or two.

Resource services is not a great industry at the best of times: it is highly leveraged to projects that rely on volatile commodity prices, requires high fixed investment, suffers from rapidly depreciating equipment, and is a price taker. Shrinking profit margins are another huge risk this financial year.

But if all of that doesn’t dissuade you, the question is whether this deteriorating outlook is already priced into valuations. Monadelphous Group, for example, appears to be back in value territory, but it needs to offer a bigger margin of safety, such is

the uncertainty about resource projects. Forge Group and Decmil Group might also be considered similarly.

Then there are resource service providers rising in a falling sector. The well-run Clough group has doubled to $1.44 since late 2012 after earnings upgrades. Accommodation provider Titan Energy Service has soared fivefold in the past 12 months on the back of higher earnings, and Mermaid Marine Australia, which provides vessels for oil and gas projects, has rallied in the past year.

That shows the danger of being deafened by newspaper headlines and market noise about falling mining investments and extrapolating it to all stocks, rather than treating each company on its merits. Value investors should always focus on what matters most: buying exceptional companies at bargain prices. On this score, Mermaid Marine warrants a spot on watchlists.

A 10 per cent share fall would arguably put Mermaid within sight of value territory; and a cheaper entry point could emerge as the sharemarket moves into the traditionally weaker September and October months, and as nervousness about emerging markets and US Federal Reserve plans to ‘taper’ its stimulus program creates higher market volatility. Whatever happens, Mermaid might be worth watching.

Like Clough, Mermaid is heavily exposed to the energy sector. It provides marine logistics to offshore oil and gas projects and has supply bases in Dampier and Broome. The core operation comprises a fleet of more than 30 ships; the Dampier base has a private wharf and ship-repair facility; and the Broome supply operation is a 50/50 joint venture with Toll Holdings.

Choosing service providers with a bias towards higher-margin oil and gas projects rather than mineral developments is a smart move. Committed liquid natural gas and petroleum projects were worth more than $200 billion at April 2013, according to BREE. That dwarfs all other products (by commodity) and there are still several big energy projects in publicly announced feasibility stages.

The energy boom has been a huge tailwind for Mermaid. Over five years, the company has an average annual compound return (including dividend reinvestment) of 21 per cent. Over one year to August 30, it has returned 26 per cent – a good result in such a weak sector.

The latest profit result impressed, given cyclone-affected vessel utilisation rates in the third quarter. Revenue rose 18 per cent to $449.5 million and after-tax net profit lifted 18 per cent to $60.3 million for 2012-13. Earnings per share rose 15 per cent to

26.9 cents and a 12.5 cent full-year dividend was declared.

A flat result in the vessels division (63 per cent of revenue) was offset by strong results in the supply base and slipway (maintenance) divisions.

Another concern is the strength of Mermaid’s sustainable competitive advantage. Being the dominant vessel provider in Australia, and having an integrated offering of vessels, supply bases and maintenance gives it a significant competitive advantage over smaller rivals. It also has an excellent industry reputation.

However, this advantage is arguably hard to scale overseas and this is relevant given the company has signalled international expansion as a key strategic priority. Different union arrangements and regulatory regimes in other countries may limit growth, and currently only 2.9 per cent of Mermaid’s revenue comes from its offshore operations.

Mermaid is heavily exposed to a small number of energy projects in Australia that will start to wind down in the next few years. It still has solid, long-term earnings prospects, given these projects will require plenty of ongoing vessel and supply-base support, but growth could plateau.

Mermaid ticks plenty of boxes for value investors. Return on equity (ROE) has hovered around 17 per cent in the past seven financial years and peaked at 21 per cent in FY10. Although solid rather than spectacular, Mermaid’s ROE consistency is notable in a volatile sector.

Cash flow generated from operations has soared from $18.1 million in FY07 to $70.8 million in FY13. Gearing (net debt/equity) of 30 per cent at the end of FY13 was hardly excessive given Mermaid has invested more than $200 million in fleet renewal and infrastructure development programs over five years. And it has $58.8 million in the bank.

Mermaid said its medium-term outlook “remains strong”, with construction on mega energy projects such as Gorgon ($52 billion) continuing through FY14 and FY15, near-shore works underway for Wheatstone ($29 billion), and several other project tenders yet to be awarded or called for.

The company announced in August it had won a $100 million contract to provide tug and barge support for part of the Chevron- operated Gorgon project – an encouraging result given the risk of lower fleet-utilisation rates as construction activity at Gorgon trends lower in the next few years.

Earnings from supply bases, just over half of Mermaid’s FY13 earnings before interest and tax, look more vulnerable as energy construction slows in the next few years. This might explain why management is increasing the company’s exposure to production- support contacts and new project activity here and overseas.

Mermaid should have decent earnings momentum in FY14 and FY15, but the big question is: what happens when investment in giant energy projects tapers after that? Here at Montgomery, we don’t treat that question lightly: will Mermaid be left with a huge earnings void that is hard to replace? And when will the market price this in? New enterprise bargaining agreements and potential for rising industrial disputation are other threats.

According to its valuations, Montgomery expects Mermaid’s ROE to ease from 16 per cent in FY13 to 15 per cent over the next two years and 14 per cent in FY16, based on consensus analyst forecasts. Value investors should seek companies with rising, or at least stable, ROE, and at least above 15 per cent, for it usually leads to higher intrinsic value and ultimately a higher share price.

At $3.77, Mermaid remains overvalued. Value investors should look for companies that can deliver strong increases in intrinsic value in future years. Given the uncertainty surrounding 2015 and beyond, the jury remains out on the score for Mermaid.

Investors should also demand a higher margin of safety from resource-service stocks, given uncertainty about the project pipeline and rising earnings risks. Mermaid might need to trade closer to $3.00 to tempt long-term value investors.

Although not exceptional, Mermaid has been of high quality for a long time and after share price gains this year is only modestly overvalued.

This article was written on 1 Septemeber 2013. All share and other prices and movements in prices are to this date.

by Roger Montgomery Posted in Energy / Resources.

- save this article

- POSTED IN Energy / Resources.

-

The Australian

Roger Montgomery

August 27, 2013

We at Montgomery were delighted to be featured by The Australian’s Andrew Main in the Wealth Section this week. In an article entitled “Power team looks to long term for competitive advantage” and Photographed by Nikki Short, we enjoyed giving the leather wingback a tour of the grounds – as you can see.

by Roger Montgomery Posted in Montgomery News and Updates.

-

Earnings season: the good, the bad, the ugly

Roger Montgomery

August 22, 2013

In this interview with Peter Switzer on Sky Business’ Switzer Report, Roger analyses some of the results that have come out of earnings season, including the big banks, Magellan Financial Group (MFG), Challenger (CGF), Seek (SEK), and Fleetwood (FWD). Find out what Roger thinks by watching here.

by Roger Montgomery Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

David’s stocks to watch

David Buckland

August 21, 2013

In these highlights from Your Money Your Call, broadcast on Sky Business, David Buckland talks about stocks he’s watching or avoiding. Find out what he thinks of Carsales.com (CRZ), Woodside Petroleum Limited (WPL), Metcash (MTS), and QBE Insurance Group (QBE). Watch here.

by David Buckland Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

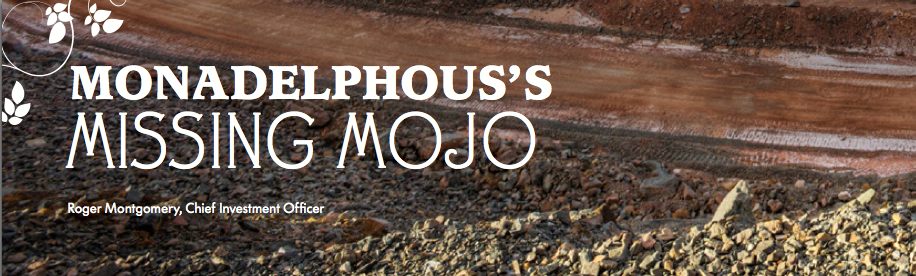

Monadelphous’s Missing Mojo

Roger Montgomery

August 19, 2013

Following a heavy share price drop earlier this year, Monadelphous Group may look like a bargain to some investors. In this article, Roger Montgomery discusses our view on the former market darling.

Successful value investors have a clear focus: buy exceptional companies at bargain prices. Mining services provider Monadelphous Group (ASX:MND) has performed exceptionally for nearly a decade, and after slumping 40 per cent this year on fears of a fading resources boom it may look like a bargain.

The market doesn’t see it that way. Broking firms have fallen over themselves this year to issue sell recommendations on MND and short sellers and even some prominent offshore investment newsletters have gone cold on the former market darling. Its share price has tanked, falling from over $27 to under $15 recently.

In turn, competition among mining service firms has intensified and led to greater price discounting and lower profit margins. At the same time, big mining companies have renewed focus on cost cutting to help counter falling revenue, meaning further pressure on service providers.

The result is poor earnings visibility for most mining services stocks. Service providers, of course, point to their pipeline of work to reassure the market. But the pipeline can dry up quickly for companies at the mercy of projects being deferred or cut back.

Seasoned value investors know the best time to buy is when everyone is selling and excessive market noise is driving stocks well below their intrinsic value. Such scenarios can create tremendous value opportunities for investors who go against the tide.

Could there even be parallels between higher-quality retail stocks and the best mining services stocks after recent price falls? Retail stocks were thumped last year amid market fears over a slowing economy and the threat of online retail sales. Six months later, the best retailers, such as JB Hi-Fi and The Reject Shop (both owned by Montgomery Funds), had soared off their lows.

Nothing had changed fundamentally for retail – if anything, the outlook has deteriorated in recent months as consumer and business confidence has waned and retail sales growth slowed. The market simply over-reacted and oversold retailers, creating opportunities for value investors like Montgomery.

True believers could argue the same situation is unfolding for MND. Not unlike JB Hi-Fi in some ways, MND is its sector’s highest-quality company, firmly in the sights of short-sellers and bearish broking analysts, and battling a perfect storm for its industry.

The mining services sector has been a sea of profit downgrades and smashed share prices this year. Mining activity has slowed sharply because falling commodity prices have forced billions of dollars of projects to be cancelled, deferred or cut back. More cancellations seem inevitable.

At the full year MND reported an ‘abnormal’ period of growth. Full year 2013 profits grew to $156.31 million from $137.34 million previously. After tax profit rose 25 per cent on the back of a 37.8 per cent rise in revenue to to $2.61 billion. The engineering construction division (booking $700 million in, mostly, new iron ore contracts) reported a 56 per cent rise in revenue, and 50 per cent growth was recorded in infrastructure division revenues. Maintenance and industrial services however remained flat.

Importantly, the company noted that operating cash flow was being detrimentally impacted by mining customers lengthening contracts and increasing their payment terms. Chairman John Rubino wrote in his Shareholder letter, “Customer sentiment has changed from an aggressive growth focus to an efficiency focus as commodity prices have normalised in a rising cost environment”, adding, “with market conditions softening…2013/14 will be a year of consolidation

with revenue levels moderating and not expected to reach those achieved in the previous year.”

This is no market for companies with even a sniff of earnings uncertainty. Fund managers have shown they will pay higher multiples for large and even small-cap companies with “annuity style” recurring earnings, and dependable growth, such as telcos, utilities and banks – and punish the rest.

The big problem is nobody knows where the resource sector malaise will end. Trying to second-guess China’s economic strength and short-term commodity price movements is a mug’s game. The best guide is history: the commodity price cycle has a habit of doing better than the market expects on the way up, and worse on the way down – and it always takes longer to play out than investors expect – or should we say ‘longer than investors forget’?

Another certainty is the resource sector being a big ship to turn. Key headwinds for the sector, notably high wages and input costs, are starting to ease as lower demand pushes down prices. The resolution of the federal election on September 7 will help

if the Coalition is elected and reduces green tape and other regulatory and taxation uncertainty (carbon) for miners. And the lower Australian dollar is helping offset falls in US-dollar-priced commodities for local miners and ease some pain.

But these trends will take time to help resource projects. Perhaps in a few years the smart money might recognise the seeds have been planted for the next boom in resource stocks. For now, we believe a slow, painful transition is ahead as the resource sector deals with its own “new normal”.

The other problem is the nature of many mining services providers: high capital investment, high fixed costs, and rapidly depreciating equipment that can sit idle for months. This is a great industry when demand is strong but the sector historically only covers

its cost of capital under boom conditions. It is a terrible sector when projects quickly stop and one must remember that service providers have little flexibility.

MND’s result was strong but such growth cannot be repeated in coming years as the resources investment boom tapers.

As the market obsesses about next year’s earnings, it is worth examining MND’s strategy during this transition period for the resources sector. With revenue slowing, it wants to recruit more of the best talent, improve efficiencies, cut costs and diversify the business into other sectors.

Newspaper reports in August suggested MND might invest in the troubled telecommunications contractor, Service Stream, but MND did not respond to the rumour. It clearly has the balance sheet power to buy weakened competitors and move into other sectors.

Essentially, MND is de-risking the business and positioning it to cope with continuing profit-margin pressure and client demands for more service efficiency. It is a smart strategy, although critics could argue the transition should have happened earlier and that it adds to investment risks.

From a sentiment point of view, strategic shifts that create efficiencies and diversify earnings are not nearly as sexy as big contract wins and can quickly bore an impatient market. But they can also lay the groundwork for the next growth spurt, and reward long term investors who can withstand short term share price pain and volatility.

Overall, the macro outlook for MND and other service provides suggests more profit downgrades and disappointments (as we have been warned about by Boart Longyear), a pick-up in mergers, and even a few companies going into in administration in FY14. It is a brave speculator (rather than investor) who believes mining services stocks cannot possibly fall any further, after savage declines this year.

Value investors must consider whether MND can navigate through these conditions and come out stronger as it uses its balance sheet strength to diversify operations, and mop up weakened competitors. If it can, today’s valuation will look, with the benefit of hindsight, like a rare opportunity.

MND’s record gives hope. The market, of course, always looks forward, but in times of great earning uncertainty it can pay to look backwards as well. Monadelphous’s return on equity, above 50 per cent for the past seven reporting periods, is exceptional.

Its management team is among the best-regarded in the mining services sector, debt is low for a company of its size, and it has a history of under-promising and over-delivering. It has all the hall marks of a Montgomery-qualified business.

The $1.5-billion service provider, involved in large engineering construction projects, maintenance and industrial services, and infrastructure, earns a big chunk of its revenue from blue-chip clients such as BHP Billiton and Rio Tinto. In this market, look for mining services companies that are leveraged to production rather than exploration projects, and to lowest-cost miners that will survive if commodity prices fall further.

The critical question, of course, is whether MND’s valuation fairly reflects these opportunities and threats. Importantly, investors also need to be satisfied that the prospects for intrinsic value appreciation are bright. Speaking with the benefit of some experience, there is a risk of further declines to estimated intrinsic values if the industry doesn’t consolidate dramatically by attrition and price competition becomes irrational.

While MND might be trading at a discount to current estimates of intrinsic value, it is only significantly underpriced if one believes valuations may stabilise from here or rise.

According to consensus forecasts, MND will have to endure falling return on equity over the next two years. Investors should always look for companies heading the other way, with big future increases in ROE and intrinsic value.

MND should have a pole position on watchlists for investors who are comfortable with higher-risk sectors, such as mining services. It is not quite value, assuming a high margin of safety is required, but further falls could be a catalyst for more aggressive fund managers to accumulate the stock.

Importantly, we believe there is time for more conservative value investors to assess the situation. The resource sector’s transition will take a few years to play out, and MND itself could have a year or two of consolidation, before (if) stronger growth resumes.

by Roger Montgomery Posted in Energy / Resources.

- save this article

- POSTED IN Energy / Resources.

-

Mining services this reporting season

Russell Muldoon

August 19, 2013

Following on from Ben’s post last week on Boom Logistics Limited (BOL), three other mining services sector-related businesses have also reported so far. Continue…

by Russell Muldoon Posted in Energy / Resources, Insightful Insights.

- save this article

- POSTED IN Energy / Resources, Insightful Insights.

-

All gloom and no boom

Ben MacNevin

August 16, 2013

The crane industry in Australia is fragmented and highly exposed to capital-intensive projects in the mining and construction sectors. As such, crane operators do not generate sustainable competitive advantages that will protect earnings during an industry downturn. At Montgomery Investment Management, we have been very vocal about the risks inherent with investment in the mining services sector, and the latest full year result from Boom Logistics has justified this concern. Continue…

by Ben MacNevin Posted in Energy / Resources.

- 3 Comments

- save this article

- 3

- POSTED IN Energy / Resources.

-

Conservative numbers from Credit Corp?

Russell Muldoon

August 12, 2013

In the past we have regularly commented on the fact that Credit Corp Limited (ASX: CCP) management has generally been conservative when providing initial guidance on the year ahead. Continue…

by Russell Muldoon Posted in Companies.

- 3 Comments

- save this article

- 3

- POSTED IN Companies.

-

Monadelphous’s Missing Mojo

Roger Montgomery

August 9, 2013

Following a heavy share price drop earlier this year, Monadelphous Group may look like a bargain to some investors. In this article, Roger Montgomery discusses our view on the former market darling.

Successful value investors have a clear focus: buy exceptional companies at bargain prices. Mining services provider Monadelphous Group (ASX:MND) has performed exceptionally for nearly a decade, and after slumping 40 per cent this year on fears of a fading resources boom it may look like a bargain.

The market doesn’t see it that way. Broking firms have fallen over themselves this year to issue sell recommendations on MND and short sellers and even some prominent offshore investment newsletters have gone cold on the former market darling. Its share price has tanked, falling from over $27 to under $15 recently.

In turn, competition among mining service firms has intensified and led to greater price discounting and lower profit margins. At the same time, big mining companies have renewed focus on cost cutting to help counter falling revenue, meaning further pressure on service providers.

The result is poor earnings visibility for most mining services stocks. Service providers, of course, point to their pipeline of work to reassure the market. But the pipeline can dry up quickly for companies at the mercy of projects being deferred or cut back.

Seasoned value investors know the best time to buy is when everyone is selling and excessive market noise is driving stocks well below their intrinsic value. Such scenarios can create tremendous value opportunities for investors who go against the tide.

Could there even be parallels between higher-quality retail stocks and the best mining services stocks after recent price falls? Retail stocks were thumped last year amid market fears over a slowing economy and the threat of online retail sales. Six months later, the best retailers, such as JB Hi-Fi and The Reject Shop (both owned by Montgomery Funds), had soared off their lows.

Nothing had changed fundamentally for retail – if anything, the outlook has deteriorated in recent months as consumer and business confidence has waned and retail sales growth slowed. The market simply over-reacted and oversold retailers, creating opportunities for value investors like Montgomery.

True believers could argue the same situation is unfolding for MND. Not unlike JB Hi-Fi in some ways, MND is its sector’s highest-quality company, firmly in the sights of short-sellers and bearish broking analysts, and battling a perfect storm for its industry.

The mining services sector has been a sea of profit downgrades and smashed share prices this year. Mining activity has slowed sharply because falling commodity prices have forced billions of dollars of projects to be cancelled, deferred or cut back. More cancellations seem inevitable.

At the full year MND reported an ‘abnormal’ period of growth. Full year 2013 profits grew to $156.31 million from $137.34 million previously. After tax profit rose 25 per cent on the back of a 37.8 per cent rise in revenue to to $2.61 billion. The engineering construction division (booking $700 million in, mostly, new iron ore contracts) reported a 56 per cent rise in revenue, and 50 per cent growth was recorded in infrastructure division revenues. Maintenance and industrial services however remained flat.

Importantly, the company noted that operating cash flow was being detrimentally impacted by mining customers lengthening contracts and increasing their payment terms. Chairman John Rubino wrote in his Shareholder letter, “Customer sentiment has changed from an aggressive growth focus to an efficiency focus as commodity prices have normalised in a rising cost environment”, adding, “with market conditions softening…2013/14 will be a year of consolidation

with revenue levels moderating and not expected to reach those achieved in the previous year.”

This is no market for companies with even a sniff of earnings uncertainty. Fund managers have shown they will pay higher multiples for large and even small-cap companies with “annuity style” recurring earnings, and dependable growth, such as telcos, utilities and banks – and punish the rest.

The big problem is nobody knows where the resource sector malaise will end. Trying to second-guess China’s economic strength and short-term commodity price movements is a mug’s game. The best guide is history: the commodity price cycle has a habit of doing better than the market expects on the way up, and worse on the way down – and it always takes longer to play out than investors expect – or should we say ‘longer than investors forget’?

Another certainty is the resource sector being a big ship to turn. Key headwinds for the sector, notably high wages and input costs, are starting to ease as lower demand pushes down prices. The resolution of the federal election on September 7 will help

if the Coalition is elected and reduces green tape and other regulatory and taxation uncertainty (carbon) for miners. And the lower Australian dollar is helping offset falls in US-dollar-priced commodities for local miners and ease some pain.

But these trends will take time to help resource projects. Perhaps in a few years the smart money might recognise the seeds have been planted for the next boom in resource stocks. For now, we believe a slow, painful transition is ahead as the resource sector deals with its own “new normal”.

The other problem is the nature of many mining services providers: high capital investment, high fixed costs, and rapidly depreciating equipment that can sit idle for months. This is a great industry when demand is strong but the sector historically only covers

its cost of capital under boom conditions. It is a terrible sector when projects quickly stop and one must remember that service providers have little flexibility.

MND’s result was strong but such growth cannot be repeated in coming years as the resources investment boom tapers.

As the market obsesses about next year’s earnings, it is worth examining MND’s strategy during this transition period for the resources sector. With revenue slowing, it wants to recruit more of the best talent, improve efficiencies, cut costs and diversify the business into other sectors.

Newspaper reports in August suggested MND might invest in the troubled telecommunications contractor, Service Stream, but MND did not respond to the rumour. It clearly has the balance sheet power to buy weakened competitors and move into other sectors.

Essentially, MND is de-risking the business and positioning it to cope with continuing profit-margin pressure and client demands for more service efficiency. It is a smart strategy, although critics could argue the transition should have happened earlier and that it adds to investment risks.

From a sentiment point of view, strategic shifts that create efficiencies and diversify earnings are not nearly as sexy as big contract wins and can quickly bore an impatient market. But they can also lay the groundwork for the next growth spurt, and reward long term investors who can withstand short term share price pain and volatility.

Overall, the macro outlook for MND and other service provides suggests more profit downgrades and disappointments (as we have been warned about by Boart Longyear), a pick-up in mergers, and even a few companies going into in administration in FY14. It is a brave speculator (rather than investor) who believes mining services stocks cannot possibly fall any further, after savage declines this year.

Value investors must consider whether MND can navigate through these conditions and come out stronger as it uses its balance sheet strength to diversify operations, and mop up weakened competitors. If it can, today’s valuation will look, with the benefit of hindsight, like a rare opportunity.

MND’s record gives hope. The market, of course, always looks forward, but in times of great earning uncertainty it can pay to look backwards as well. Monadelphous’s return on equity, above 50 per cent for the past seven reporting periods, is exceptional.

Its management team is among the best-regarded in the mining services sector, debt is low for a company of its size, and it has a history of under-promising and over-delivering. It has all the hall marks of a Montgomery-qualified business.

The $1.5-billion service provider, involved in large engineering construction projects, maintenance and industrial services, and infrastructure, earns a big chunk of its revenue from blue-chip clients such as BHP Billiton and Rio Tinto. In this market, look for mining services companies that are leveraged to production rather than exploration projects, and to lowest-cost miners that will survive if commodity prices fall further.

The critical question, of course, is whether MND’s valuation fairly reflects these opportunities and threats. Importantly, investors also need to be satisfied that the prospects for intrinsic value appreciation are bright. Speaking with the benefit of some experience, there is a risk of further declines to estimated intrinsic values if the industry doesn’t consolidate dramatically by attrition and price competition becomes irrational.

While MND might be trading at a discount to current estimates of intrinsic value, it is only significantly underpriced if one believes valuations may stabilise from here or rise.

According to consensus forecasts, MND will have to endure falling return on equity over the next two years. Investors should always look for companies heading the other way, with big future increases in ROE and intrinsic value.

MND should have a pole position on watchlists for investors who are comfortable with higher-risk sectors, such as mining services. It is not quite value, assuming a high margin of safety is required, but further falls could be a catalyst for more aggressive fund managers to accumulate the stock.

Importantly, we believe there is time for more conservative value investors to assess the situation. The resource sector’s transition will take a few years to play out, and MND itself could have a year or two of consolidation, before (if) stronger growth resumes.

This article was written on 9 August 2013. All share and other prices and movements in prices are to this date.

by Roger Montgomery Posted in Energy / Resources.

- save this article

- POSTED IN Energy / Resources.

-

Into the unknown

Russell Muldoon

July 25, 2013

According to the Department of Education, Employment and Workplace Relations, job advertisements on the internet fell by 2.8 per cent in June. Continue…

by Russell Muldoon Posted in Insightful Insights.

- 2 Comments

- save this article

- 2

- POSTED IN Insightful Insights.

-

Why are opportunities so thin on the ground?

Tim Kelley

July 18, 2013

For the last several weeks we have been looking hard to find new value opportunities, but have found very few. The reporting season just around the corner may reveal a few surprises, but for the moment we are sitting on our hands. This can be unsatisfying, but sometimes being a good musician means knowing when to stay silent. Continue…

by Tim Kelley Posted in Insightful Insights.

- 3 Comments

- save this article

- 3

- POSTED IN Insightful Insights.

-

Re-Leasing Value

Ben MacNevin

July 15, 2013

Many companies struggle when their core market reaches maturity. Some managers attempt to increase earnings through acquisitions, while others may choose to return capital to investors. But mature companies possess an asset that can be very valuable if effectively managed, and FlexiGroup is an example of a company that is attempting to use this particular asset to full effect. Continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights.

-

On yer bike

Tim Kelley

July 12, 2013

Lest you read Tim’s comments below and err by drawing the incorrect conclusion that we are against good financial advice and planning…Keep in mind, every industry has their good and bad. Sadly, because the bad get all the press so it is easy to conclude from reading the papers and watching the news that an industry as a whole is rotten. This, in my personal experience, is not true. I have met a great many planners with a passion for their clients and a strong spirit of independence. I have met those who have left their firms when they believed their clients needs were not being best served. The standard of research I have witnessed is extraordinary and the investment being made in systems and processes is in inspiring. I am delighted to be an external advisor on the investment committee of one such group…Roger Montgomery

Back to Tim…

Early this morning I went for a bike ride with a former colleague from the investment banking industry (let’s call him “Bud” for short). We rode at what is known as “conversational pace”, and chatted about a range of things along the way. Continue…

by Tim Kelley Posted in Market commentary.

- 37 Comments

- save this article

- 37

- POSTED IN Market commentary.

-

Tales of the Australian dollar

Russell Muldoon

July 8, 2013

In recent years, a steadily climbing Australian dollar has been a significant headwind for a number of businesses in Australia, hindering their annual growth rates. This trend has now reversed, meaning that the earnings effect has switched – and we are keenly watching. Continue…

by Russell Muldoon Posted in Insightful Insights.

- 3 Comments

- save this article

- 3

- POSTED IN Insightful Insights.