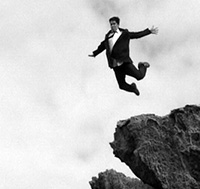

Into the unknown

According to the Department of Education, Employment and Workplace Relations, job advertisements on the internet fell by 2.8 per cent in June.

The Internet vacancy index fell to a seasonally adjusted 59.6 points in the month to be 23.8 per cent lower than a year earlier!

While all eight occupational groups monitored by the department fell in June, we think the biggest declines were reflecting the changes in the mining and mining services space that we have been discussing here for over a year.

The biggest monthly declines were labourers (-6.8 per cent) and machinery operators and drivers (-5.5 per cent).

Geographically there were no surprises to us, or anyone following our musings here at The Insights Blog either; job ads fell in all states and territories in June and over the year (except for Tassie) with the NT at -7.2 per cent and Western Australia posting the largest annual drop (down 41.9 per cent).

As you know, we believe that there are real risks of a recession in Australia, spreading out from the unwinding of the mining construction boom. Consumer confidence and business confidence could be affected next and those buyers of mining services stocks – because they appear cheap today – are participating in a very risky sport and not one we care to participate in.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Greg McLennan

:

Your heading rings a bell as I look at MMS this morning before the open of the market. It looks like having a big spill at the open.

Their fortunes hang heavily on the outcome of the election. One part of their announcement yesterday caught my eye, that which related to staffing – MMS is keeping their staff on rather than turning them loose like a number of other similar companies. This gives me the impression that they expect a change of government at the election and should that occur (given the Libs oppose the changes) they may pick up market share while other companies find themselves understaffed. I think that if Rudd gets rolled it would be unlikely that either party would tinker with this for a long time and ultimately this will be a temporary hiccup.

It could end up being a blessing in disguise for MMS – albeit a very good disguise. On the other hand, if Labor wins the election, MMS gets kneecapped.

Roger Montgomery

:

Excellent point and add to that the news has made a ton more people aware of the benefits of salary packaging…

Keep an eye out for the next post today Greg….