Value.able

-

Is the bubble bursting?

Roger Montgomery

December 8, 2011

In 2010 here at the Insights Blog I wrote:

In 2010 here at the Insights Blog I wrote:“a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.”

I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to bigs drops in margins for a sizeable portion of the market index…

Watch this video and decide for yourself.

Posted by Roger Montgomery, Value.able author and Fund Manager, 8 December 2011.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation, Property, Value.able.

-

Not waving drowning?

Roger Montgomery

December 3, 2011

This is a retail business that I’ve known for a long time, indeed in a past life I influenced one of its largest shareholdings.

This is a retail business that I’ve known for a long time, indeed in a past life I influenced one of its largest shareholdings.At that time the company was leveraging its 90% brand awareness; increasing its return on equity every year, from 40% to ultimately more than 70%, without any debt; it was rolling out stores; it appeared to have perfected its buying strategy; and the share price had risen from $2.40 to a high of $18.60.

More than a year since I wrote that The Reject Shop shares were among the most expensive retail stocks and they touched their high, the performance has been somewhat unsurprising: declining to a closing low of $9 recently – a fall of just over 50%.

For those of you who have been fortunate enough to have been following us since 2009, you may recall in September 2009 when I wrote about the reasons why I decided to sell The Reject Shop:

“I can’t stop thinking that the value of the business just cannot rise at a fast enough clip to justify the current price. I really don’t like trading things that I have bought but I don’t think the value of the business can continue to rise indefinitely. With a share price of $13.45 (intraday today) and a valuation of $11.27, the shares are 24% above their intrinsic value. This combination of factors tells me we are safer in cash.”

Today the shares trade at about my current estimate for intrinsic value (see graph) of $9.22 and in anticipation of a possible big discount being presented, it’s worth reviewing our stance to determine whether we need to change it for this company.

Since I last wrote about the Reject Shop, a number of events have served to deliver sufficient concerns to market participants – analysts as well as investors – that they have turned their back on this once market darling.

First, the Queensland floods closed the Queensland distribution centre, seriously denting any supply chain efficiencies the company had built. Second, the company has doubled its equity base since 2006, from $26.6 million to $53 million, and this has been entirely due to the retention of earnings rather than less-desirable capital raisings. In the absence of an equivalent increase in profits, return on equity would be expected to decline. One way to stave off a decline in the all-important return on equity measure of performance is to increase leverage. The problem for the Reject Shop’s intrinsic value is that leverage has indeed increased – 34-fold – and yet return on equity next year is forecast to be lower next year than in 2006.

The Reject Shop still enjoys its high brand awareness but, as is typical in many store roll out stories, as the offer matures the later sites are less profitable than the early sites.

This doesn’t fully explain the fact that during a period in the economy where one would expect a bargain offering to shine, it hasn’t. Eighty percent of Australians still know the brand but I believe consumer experience and mismanagement has done it some damage.

According to one report, 20% of the population believe the company offers rubbish – cheap Chinese junk that quickly breaks after use and fills our tips. It’s the very reputation China itself is trying, but frequently failing, to shake off.

The other reason for damage to the brand is confusion brought on by mismanagement. Several years ago the average unit price was about $9 and basket size was $11, but over the years one cannot help but have noticed many higher-priced items creeping into the stores.

The Reject Shop was originally the place you went to for discounted seconds and end-of-line items. Under lauded retailer and merchant Barry Saunders, The Reject Shop successfully transitioned to a discount variety retailer, offering everyday lines at cheaper prices than the incumbents. Grey market (“parallel import”) Colgate toothpaste for $2 a tube and toilet paper for a few cents a roll ensured repeat business, higher inventory turnover and higher margins from consumers filling their baskets with other higher-margin items.

The company had successfully implemented the Walmart and Woolworths profit loop. Adding more expensive items, some in the $30, $40 and $50 bracket, confuses the offer and damages the brand. Simultaneously, inventory turnover falls and working capital costs increase.

Higher-priced items should at least partly explain why the company has not been performing well in the two-speed economy (I prefer to call it the one-cylinder economy) that would normally lend itself to the “bargain” offer. The other reason for the declining performance, including declining same-store sales growth, is the enthusiastic emergence of competitors. It’s really a second wave: The Reject Shop had put an end to Millers and the Warehouse Group previously. But now BIG W, Kmart, Target, Bunnings, a reinvigorated Mitre 10 and Masters will compete directly with The Reject Shop; you may have already seen some of their aggressive Christmas advertising.

If The Reject Shop’s offering had not been confused by the inclusion of higher-priced items, the company would have been in a much better position to defend its turf. The misguided product mix, however, appears to have left the gate open and the well-funded competitors have rushed in, as have Crazy Clarke’s, Sams Warehouse, Chicken Feed, GO-LO and more than 35 others. Of course these competitors will also compete for sites, potentially relegating The Reject Shop to less preferred sites or having to pay more for the best of the remaining locations.

That, and the possibility of a fall in the Australian dollar, represents the bad news. The good news is that The Reject Shop still has terrific brand awareness, many more stores to open, a reinvigorated marketing campaign and the reopening of the Queensland Distribution Centre ahead of the Christmas peak selling period.

On balance, if the company can hit its targets it could increase its intrinsic value by more than 15% per annum over the next three years and many believe the bad news and bearish case is factored into the share price. But I would like to see a decline in debt or a greater margin of safety or both, before buying its shares.

Rest assured that a rising tide (a rally in the stock market) will lift the price of the company’s shares. To be certain of a good return rather than be hopeful of an excellent one, we simply need a bigger discount, as the graph illustrates.

Posted by Roger Montgomery, Value.able author and Fund Manager, 3 December 2011.

by Roger Montgomery Posted in Value.able.

- 55 Comments

- save this article

- POSTED IN Value.able

-

Are you sitting down?

Roger Montgomery

November 3, 2011

I have just returned to the office after appearing on CNBC with my old friend Matthew Kidman. We were in agreement on virtually all points (which perhaps surprisingly made the program very interesting). If the market does indeed provide a once-in-a-lifetime opportunity, in the next 12 months, to buy excellent value industrial companies, then you may want to be aware of the companies that are either really poor quality or extremely overpriced now.

I have just returned to the office after appearing on CNBC with my old friend Matthew Kidman. We were in agreement on virtually all points (which perhaps surprisingly made the program very interesting). If the market does indeed provide a once-in-a-lifetime opportunity, in the next 12 months, to buy excellent value industrial companies, then you may want to be aware of the companies that are either really poor quality or extremely overpriced now.Stay tuned over the next few days, as I will be publishing our list of companies whose shares are in the hot seat. Some of them may shock you.

If you would like to pre-empt the report, with some of your own suggestions, go right ahead and list them by clicking on the Comments link below.

Posted by Roger Montgomery, Value.able author and Fund Manager, 03 November 2011.

by Roger Montgomery Posted in Value.able.

- 94 Comments

- save this article

- POSTED IN Value.able

-

Can you feel it?

Roger Montgomery

October 28, 2011

There’s something in the air…. And you may be able to assist.

There’s something in the air…. And you may be able to assist.Skaffold® is set to go live and I am incredibly proud of what Team Skaffold have achieved.

Before Skaffold, the stock market was noisy and confusing. Very soon, all that will change. Skaffold will reinvent and reignite the way you invest.

The data that automatically updates Skaffold each day is from arguably the world’s most reputable source (that’s right, not all data is the same!). With customers that spend hundreds of millions of dollars a year for our provider’s data, we have been delighted with their fascination and interest in Skaffold.

As you may already know, Skaffold’s designers and developers have been recognised by design awards and industry accolades and already work for Nintendo, EA Games – the world’s biggest games company, Google, HTC, and Porsche. Like us, they are immensely proud of Skaffold and are putting together their own video for the launch to showcase Skaffold to international IT media and judges. Their Managing Director is even flying to Sydney for the launch!

Here at home, we are building a team with amazing international credentials and their task is simple: make sure Skaffold stays at the cutting edge of stock market applications.

Here is how you could help: We’re still searching for someone super smart, who can mentor, teach and lead a team, who knows, understands and loves the stock market, can be RG 146 compliant and is truly passionate about talking one-on-one with and helping private and professional investors. If that’s you, or you know someone that fits the bill, we want to hear from you!

A1 or C5, Skaffold’s Quality Scores are powered by more than 40 years of published academic research into the predictors of company failure and and investment returns. And the secret herbs and spices in Skaffold’s valuations – and the ways they change – have won me over time and time again.

I must confess to having a bit of fun recently… I uploaded some international data, and looked at IBM, Apple, Google and Microsoft and… nothing surprising. Skaffold just worked. No whacky valuations either like the $800 for Apple or $400 for IBM or $60 for Microsoft that I have seen elsewhere. In time, I imagine we’ll be able to switch on Turkish stocks, if that’s what you want!

The team and I have been genuinely encouraged by your excitement. What’s also been really amazing is the anticipation, not only from private investors like you and me, but from brokers, other fundies, planners and advisers who have expressed a real need to independently ’stress test’ their own research or the stocks on their approved lists.

One friend recently said we had developed a Ferrari that Volvo drivers will love to drive. I reckon that’s about the sum of it. And congrats, by the way, to Ian – one of very first investors who jumped the gun, sent in his cheque and guaranteed himself Member #2 status for life.

Get ready to enjoy looking at the Australian stock market like you have never seen it before. Put 1 November 2011 in your diary to Join Skaffold and be part of our mission to make every investor a professional.

Skaffold is the world’s most reputable company data married to half a century of leading investment thinking and the world’s most exciting and easy-to-use interface for investors. We can’t wait to hear what you think of Skaffold after you have made it part of your investment routine.

Posted by the Skaffold Team, 28 October 2011.

Skaffold® is a registered trademark of Skaffold Pty Limited

by Roger Montgomery Posted in Companies, Value.able.

- save this article

- POSTED IN Companies, Value.able

-

Is Australian manufacturing dead, or just in need of a cuddle?

Roger Montgomery

October 13, 2011

With high salaries, higher rents, a strong Aussie dollar and ‘level-playing-field’ policies, are Australian manufacturers being unwillingly and inexorably dragged to doormat status?

We are in a race to the bottom and run the risk of ultimately being chewed up and spat out when our commodities are no longer required with such urgency.

Driven by a belief that economists are right and the way to measure happiness is by the consumption of “stuff”, government policy in Australia is set to keep the masses happy by making that “stuff” as cheap as possible.

Our way of life, and the quality of that life for our kids, is at risk if we continue to be apathetic. Driving around Sydney’s Eastern Suburbs and Lower North Shore, its apparent there isn’t a communal approach to the solution. Instead there is an individual race to accumulate more “stuff” to protect oneself. “Forget about the neighbours”. “Look after number one”. “If I have plenty in the bank, the kids and grandkids will be set up. What do I care if the rest of Australia goes to pot?”

It’s like watching seagulls fighting over a Twistie.

When competing against a country with an ethos that puts ‘the people’ first, what hope does a country whose constituents are clambering over each other for the next short-term dollar have?

Manufacturing in Australia needs help. I am not suggesting protection or a hand out. I am suggesting a leg-up.

Singapore rolls out the red carpet for new businesses with tax-free holidays for the first few hundred thousand in profits. What does the Australian government do for new businesses in Australia? A TAFE course? R&D tax breaks are a start, but helping big business roll out classrooms at $5000 per square metre helped who exactly?

Unemployment in Australia’s wealthiest suburbs is creeping up because we don’t need so many bankers and Merger & Acquisition experts when there aren’t any businesses left to merge and acquire.

Can our current way of life survive without manufacturing? It seems we may just find out. What will we do without manufacturing?

The commodity boom will end one day and we are selling large tracts of arable land to foreign investors. Without manufacturing, will we be running around serving each other lattes? Is that it?

Australia is still the home of ingenuity. Just look at programs like the ABC’s New Inventors. The best and brightest should be receiving generous awards and access to incubator programs that ensure the international success and that the commercial benefits flow back to Australia.

One American recently lamented “10 years ago we had Steve Jobs, Bob Hope and Johnny Cash. Now we have no jobs, no hope and no cash”. If we don’t want to end up in the same place, Australia needs to do more to help incubate, nurture, commercialise and protect our best ideas.

And what are we doing bringing the brightest foreign students into Australia, giving them some of the world’s best education and sharing our IP and then, when they graduate, telling them they cannot work here and sending them home to compete with us?

“Go Australia”? Or “Go, Get Out of Australia”?

We also have some amazing established manufacturing businesses – paint, water heaters, bull bars, truck tippers, caravans, mattresses, wine, beer, pharmaceuticals, chemicals, anoraks, toilets.

The list of those producing attractive products and results is nothing short of A1.

A company that…

1) Has built a brand and or reputation for quality, value or innovation;

2) Is vertically integrated – owning the distribution channel;

3) Is manufacturing a highly specialised or customised product and not competing solely on price;…has a chance to succeed in manufacturing in Australia. And while it’s a shame our government has gradually allowed manufacturing to ‘die’, there are pockets within which Value.able Gradutes can find extraordinary businesses, especially when the market’s manic phase turns to depression.

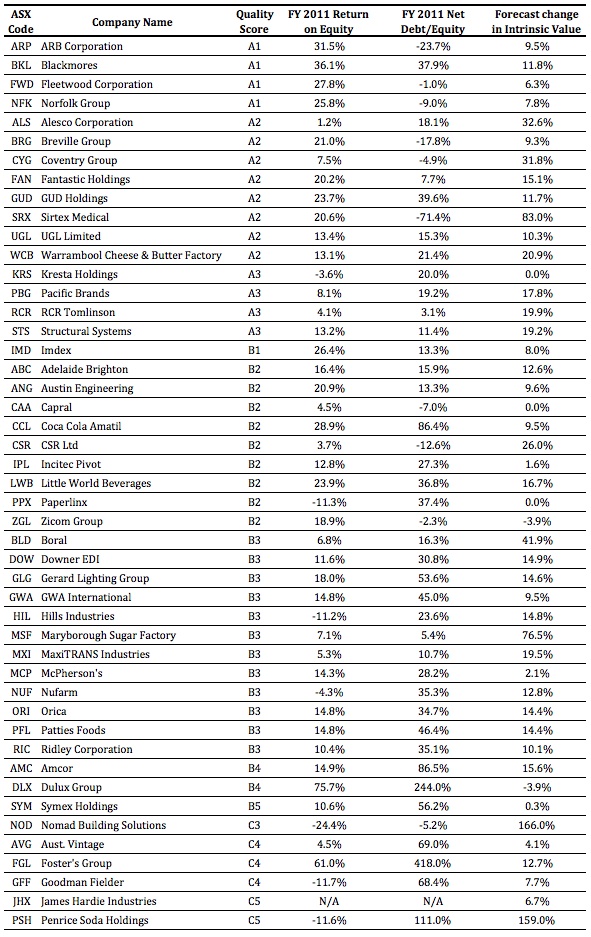

Many of the manufacturers listed in the following table have a long history of operating through a variety of economic conditions. They are ranked from A1 down to C5 – you can immediately see the broad spread of quality. I find looking at the ‘tails’ to be particularly insightful.

While declining in volume, manufacturing in Australia is not dead. Indeed some businesses are positively ‘raking it in’.

Manufacturing is tough and because inflation is always running against a business with a high proportion of fixed assets, smart managerial decisions are constantly required.

Ironically, with so many winds against manufacturers, those that have little or no debt, high rates of return on equity, bright prospects for future growth in intrinsic value and are trading at substantial discounts to current intrinsic value, may just prove to be Value.ablely positioned to leverage a broader economic recovery, locally and globally.

Who’s your top pick for Australia’s best manufacturer? I also want to hear your stories about manufacturing here. Are you a business owner that makes something we should be proud of? How is government policy or a monopoly customer affecting you? What changes need to be made to give Australia a fighting chance?

The universe of great businesses to invest in will inevitably decline unless something is done.

I look forward to your stories. They will be read by the who’s who in banking, management and government, so jot down your thoughts and share your Value.able experiences.

Posted by Roger Montgomery and his A1 team (courtesy of Vocus Communications), fund managers and creators of the next-generation A1 stock market service, 13 October 2011.

by Roger Montgomery Posted in Insightful Insights, Manufacturing, Value.able.

- save this article

- POSTED IN Insightful Insights, Manufacturing, Value.able

-

What closed Sydney Harbour Tunnel last night?

Roger Montgomery

October 11, 2011

Vocus Communications is in the business of selling bandwidth. The company resells it on the cable that runs under the Pacific between Sydney and the US. Last night they laid some of their own under another sea; Sydney Harbour. The company – in which I have previously disclosed I own a small number of shares – sent me these photos of the process. As we have met with management as part of our analysis, we were delighted they remembered our interest in everything they are up to. I thought these photos were fascinating and given its something most of us wouldn’t ever get a glimpse of, I thought you’d be interested too.

There’s no investment merit in the photos so don’t go rushing off to buy shares (certainly not without conducting your own research and after seeking and taking personal, professional advice).

Think of this post as a Value.able photo essay of what some people are up to while you were sleeping.

Meeting point and briefing at the North end of the Tunnel

A closed Sydney Harbour Tunnel

A very empty Sydney Harbour Tunnel

Hauling starts about 900mtrs from the South Exit. It’s a single piece of fibre from end to end

3kms of conduit installed the previous few nights

First meter of fibre coming off the drum

Energy Australia, the RTA and the other carrier’s fibre exiting the tunnel on the South Side

Fibre coming out of the Tunnel on the North side

Posted by Roger Montgomery and his A1 team (courtesy of Vocus Communications), fund managers and creators of the next-generation A1 stock market service, 6 October 2011.

by Roger Montgomery Posted in Companies, Investing Education, Technology & Telecommunications, Value.able.

-

Which A1 twin is outperforming?

Roger Montgomery

October 6, 2011

This journey began with the simple question Will David beat Goliath?

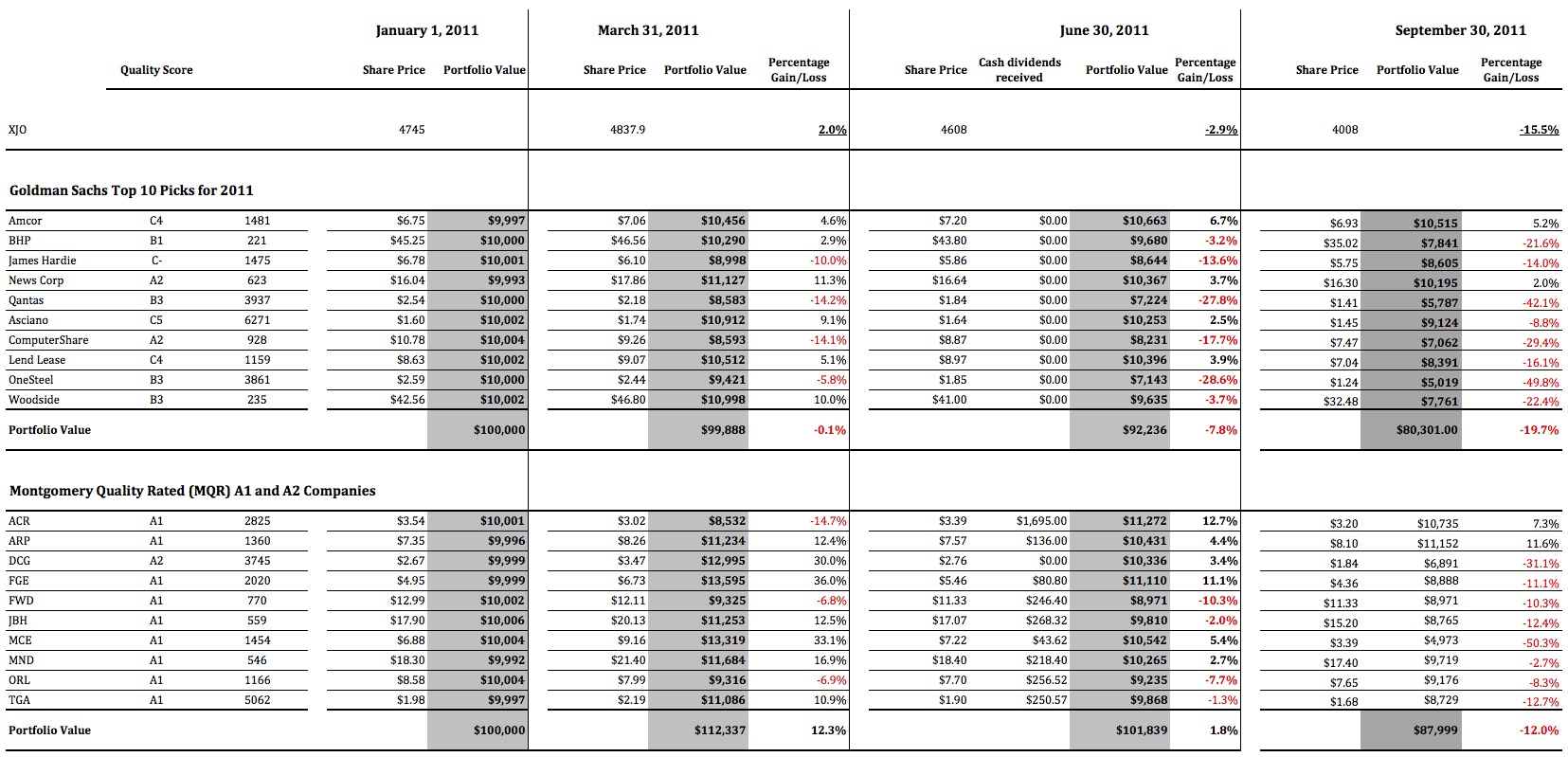

This journey began with the simple question Will David beat Goliath?Value.able Graduate Scott T resolved to take up a fight with conventional investing, by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings.

By 30 June 2011 the A1 portfolio was up 1.8 per cent compared to the XJO, which was down 2.9 per cent. As for the conventional ‘institutional’ portfolio, the bankers were down 6.2 per cent.

Over to Scott T for his third quarter update…

“For new readers to Roger Montgomery’s Insights Blog, welcome. Here at Roger’s blog we are conducting a 12-month exercise measuring the performance of a basket of 10 stocks recommended by Goldman Sachs, against a basket of 10 A1 or A2 businesses that were selling for as big a discount to Intrinsic Value as we could find.

“Nine months have now passed since our twin brothers each invested their $100 000 inheritance, and it has been a very turbulent time in the market.

“Our Queensland regional accountant has had his head down at the office for the entire quarter. The end of the financial year had come and gone and hundreds of clients where sending in their tax documentation, calling with questions and chasing their refunds. Time flew by in the office, and he hardly had time to try to attract new clients, let alone watch the daily gyrations of the global equities markets. By the end of September when he was finally able to take a breath and look at the performance of his portfolio.

“He was surprised at how poorly his portfolio of A1 and A2 companies, acquired at prices less than they were worth, had faired. But he quickly realised the overall market had done even worse. Loosing 12 per cent, or $12 000, YTD was bad. But it could have been worse, much worse.

“His twin brother was in a world of pain. The federal department he worked for felt like it was under attack. The mood in the department was that the media seemed hell bent on criticising everything the government did. No initiative was well received and every announcement was instantly compared to last months failure. To top it all off, every night he would check his portfolio, to see how much more of his inheritance had vanished. The red negative number on his spreadsheet just seemed to steadily increase. With little information to go on, and a feeling of helplessness washing over him, he thought seriously about visiting his financial advisors, desperately seeking reassurance, and perhaps changing the mix of the stocks held. He resounded, “Buying what they advised would be good for 2012”.

“As per the first half of the year, dividends will be picked up in the fourth quarter, when shares have finished going ex-dividend and the dividends have actually been received.

“In summary for the nine months to 30 September 2011:

The XJO is DOWN 15.5 per cent

The Goldman Sachs Portfoliois DOWN 19.7 per cent

The A1 and A2 Portfolio is DOWN 12.0 per cent

The A1 and A2 Portfolio has achieved an OUTPERFORMANCE of 3.5 per cent over the XJO and 7.7 per cent over the Goldman Sachs portfolio.“Here are the portfolios in detail, including cash dividends received in the first half (click the image to enlarge)

“We will visit the brothers again at the end of December for a final wrap up of their first year, and discuss their strategies for 2012

“All the Best

Scott T”Thank you Scott.

How is your A1 portfolio performing?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 6 October 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are your profits recurring?

Roger Montgomery

September 30, 2011

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.Stability and predictability are two key words that many investors are unlikely to have heard in recent times and two important components of the ‘toolkit’ that may have gone astray. But at all junctures of the business cycle, stability and predictability are helpful investment partners.

Irrespective of whether you are building a portfolio from the ground up or are reviewing your current holdings, it is vital that you ensure your portfolio is always pointed in the right direction. Few, if any are able to reliably and predictability predict short-term share prices so there is relevance, if not necessity, in ensuring the very best opportunity is given to your portfolio. When a recovery transpires and investors are willing to accept risk again, the portfolio constructed from businesses with some stability and predictability to their revenues and earnings streams will have an excellent chance of outperformance.

While there are many definitions of what constitutes ‘stable’ and ‘predictable’, in terms of business analysis, recurring revenue would be the one I would use. And if you built a portfolio of such businesses, would it matter if this week a country defaulted on its debt or another had its credit rating downgraded? These issues are both temporary in nature and only likely to impact share prices, not the economics of the business.

Long-term contracts are the best form of recurring revenues and these contracts take many forms; There are of course the obvious long-term contracts, such as a mobile phone plan, internet or TV subscription, a car lease or a property tenancy, but less obvious are the long-term contracts we have with our own bodies to feed them, clean them and take out the waste. We have a long-term contract with our teeth, our cutlery and our toilets and these contracts ensure Coles and Woolworths, Kelloggs, Procter & Gamble and Kimberley Clark have millions of customers buying their consumables frequently and with monotonous regularity. In other words – recurring revenue.

Knowing that a percentage of revenue can be relied upon to come in the door each year allows a business to budget, rewarded staff consistently and plan expansions with fewer surprises.

And if you are buying a small piece of such a business, you can sleep more comfortably at night ‘knowing’ that your share will always have value even if the share price halves or worse.

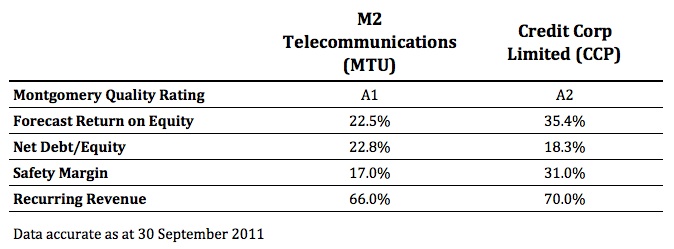

The following two businesses are examples of companies we hold in The Montgomery [Private] Fund, and that we believe display the characteristic discussed.

M2 Telecommunications is a reseller of telecommunications equipment and services into the $6 billion SMB Telecommunications market. While dominated by Telstra (ASX:TLS) with 80 per cent market share, M2 is the seventh largest Telco in Australia with a 4.5 per cent share.

Two thirds of the business’s revenue is recurring via traditional fixed voice services, mobile (phone and broadband) and wholesaling services. Typically, contracted revenue is on 2-4 year terms giving management a significant amount of predictability.

It is due to this predictability that management have forecast 15 per cent earnings growth for FY12 and have the ability to self-fund a couple of large acquisitions, which Vaughn Bowen has moved aside from day-to-day duties to focus on.

Credit Corp – With new management installed and a demonstrated focus on transparency and sustainable growth, 70 per cent of collections are now on recurring payment arrangements.

This frees up collection staff to focus on those clients that are finding it harder to repay their liabilities and drives efficiencies across the group. Not only this, but the degree of certainty has allowed management to invest in even more self-funded ledger purchases and forecast earnings of $21m-$23m in FY12.

Additionally, the businesses offer the following financial metrics:

High Montgomery Quality Ratings (MQR), high forecast ROE’s, low debt levels, a Safety margin and high, recurring revenues have attracted us. After conducting your own research and seeking and taking personal professional advice, I’d be interested to know whether these companies or any others meet your recurring revenue test.

Go ahead and use this blog post as the beginning of a thread listing companies with solid recurring revenue and earnings.

Given the time to be interested in stocks is when no one else is, now is the time to go through your portfolio and determine those holdings that have a component of revenues that are recurring.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 30 September 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Have you truly made up YOUR mind?

Roger Montgomery

September 23, 2011

I’m always looking for Value.able contributions that will enahnce the value of our Insights blog.

I’m always looking for Value.able contributions that will enahnce the value of our Insights blog.Scott’s comparison of the performance of a Value.able A1 portfolio and a conventional portfolio promoted by a large bank over the last six months is one such example. Nick’s contribution here about independent thinking is another. Take it away Nick…

“Most people would rather die than think, in fact they do so.” Bertrand Russell

The title of this post which Roger has kindly let me write for his blog may seem like such elementary and common sense advice that it need not be written at all – kind of like telling a friend to make sure he looks both ways before crossing the freeway.

Is thinking independently when it comes to investing really so obvious? And do people practice it consistently? I would say not. Just because something is obvious does not mean it will be practiced and not thinking independently, by which I mean not thinking for yourself and making up your own mind on an issue (not necessarily having a contrary opinion for the sake of having a contrary opinion), is one of the surest ways to destroy wealth and end up dissatisfied as an investor (aside from the strong likelihood of losing money you will also lack autonomy over your future). I have made this mistake in the past and can speak from experience.

Ben Graham once said “You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.”

And in the 1985 Berkshire Hathaway Annual Letter to Shareholders, Warren Buffett shares with his readers this story passed down from Ben Graham which illustrates the lemming-like behaviour of the crowd: “Let me tell you the story of the oil prospector who met St. Peter at the Pearly Gates. When told his occupation, St. Peter said, “Oh, I’m really sorry. You seem to meet all the tests to get into heaven. But we’ve got a terrible problem. See that pen over there? That’s where we keep the oil prospectors waiting to get into heaven. And it’s filled – we haven’t got room for even one more.” The oil prospector thought for a minute and said, “Would you mind if I just said four words to those folks?” “I can’t see any harm in that,” said St. Pete. So the old-timer cupped his hands and yelled out, “Oil discovered in hell!”. Immediately, the oil prospectors wrenched the lock off the door of the pen and out they flew, flapping their wings as hard as they could for the lower regions. “You know, that’s a pretty good trick,” St. Pete said. “Move in. The place is yours. You’ve got plenty of room.” The old fellow scratched his head and said, “No. If you don’t mind, I think I’ll go along with the rest of ’em. There may be some truth to that rumour after all.”

This is not the fate you want for yourself!

And don’t let hubris get in the way. Intelligence alone will not keep you away from the dangers of crowd behavior and emotion. One of history’s most gifted minds and scientists, Sir Isaac Newton, was caught up in the emotion and chaos of crowd behavior which resulted in him losing his fortune in the South Sea Shipping Company Bubble. Sir Isaac Newton had previously made a packet on this very same company although after selling and watching the share price continually keep rising, he reinvested everything he had before the crash. For as long as he lived he forbid the words South Sea Shipping Company to ever be mentioned in his presence. It was not a lack of intelligence which brought Sir Isaac unstuck, it was, I argue, his lack of independent thought on the merits of the South Sea Shipping Company as a suitable investment.

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Ben Graham.

Once you have determined to think independently and make up your own mind on a company’s current strengths and weaknesses, and its current and future earnings prospects, how do you best do this? Perhaps the most effective way is to follow the advice of the famous algebraist Carl Jacobi who said ‘Invert, always invert.’ So if from your reading you believe company XYZ to be possible investment material (either from Roger’s blog, the newspaper, a friend, your stockbroker) read everything you can and formulate as strong a case as you can on why it would make a lousy investment. If, after having made as strong a case against the company as the information allows, it still looks pretty good and is selling at an attractive price, then it is worthy of further consideration. It has also been useful to me in the past having friends help me out with this. Usually before making an investment I’ll ask my most intelligent and able friends for their opinion on why I shouldn’t invest in company XYZ. This will not mean that you’ll never make a mistake again, although when you do at least you’ll be able to understand why (having studied the reasons against making the decision in the first place).

“I want to be able to explain my mistakes. This means I do only the things I completely understand.” Warren Buffet

Charlie Munger, in a speech given at USC (which you can all view on YouTube) says “I have what I call an iron prescription that helps me keep sane when I naturally drift to preferring one ideology over another and that is I say I am not entitled to have an opinion on this subject unless I can state the arguments against my position better than the people who are supporting it.” This is great advice, and to tailor it to investing all you need to do is replace the word ‘subject’ with ‘company.’

Charlie Munger also likes to talk about the importance of having a latticework of mental models in your head and how the big ideas from across a broad range of disciplines can often be used in sync to best analyse a particular problem. I won’t expand on this now, although can recommend his speeches and essays which are easily available on the internet.

Having a great interest in investing, I find this blog is a wonderful source of ideas and learning and really enjoy reading the comments written every day. That said, one way in which I believe it could be improved is for there to be more argument and questioning, something which is happening more and more as the share price of recent blog favorites has dropped. If someone says they believe XYZ to be a great quality company without providing reasons they should be held to account and asked why? If the only response is that Roger has it as an A1 then a fail grade would be mandatory. If someone says they believe that company XYZ has excellent earnings prospects they should again be asked why? And if their response is that the analysts consensus on Comsec says so then again, another F.

I hope that this post may have been of some interest and if you have some stories of success as a result of independent thinking, I would be very interested in reading them.

Nick Mason

Roger’s Note: And if you have a similarly lucid and instructive idea that you would like share here at our Insights blog, go ahead and submit. Not every contribution can be published as a post, but we will certainly post those we like.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 23 September 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

How much capital intensity does it take to sell seats?

Roger Montgomery

August 30, 2011

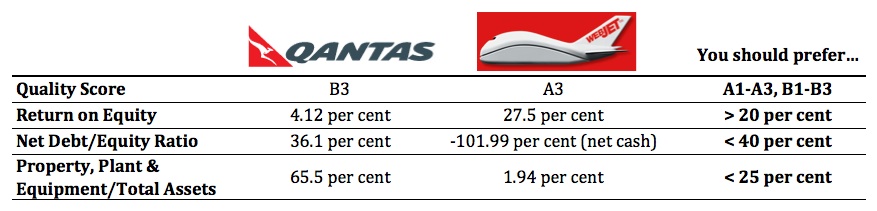

Did you know some of Qantas’ planes are more than twenty years old? And our estimate is that they fly, on average, 14 hours per day. The rest of the time they mimic that expensive bit of fashion in your garage, earning no income. That garage/hangar time has expensive ramifications for the economics of airlines, just as your decision to buy an expensive but garaged ‘fashion’ item has expensive ramifications for you.

Did you know some of Qantas’ planes are more than twenty years old? And our estimate is that they fly, on average, 14 hours per day. The rest of the time they mimic that expensive bit of fashion in your garage, earning no income. That garage/hangar time has expensive ramifications for the economics of airlines, just as your decision to buy an expensive but garaged ‘fashion’ item has expensive ramifications for you.Capital-intensive businesses, such as airlines, erode shareholder wealth. Inflation ensures their maintenance and replacement is a significant proportion of cash flow, which could otherwise be paid out to shareholders. Parts plus labour, which protect the business assets from wear and tear, actually causes wear and tear on shareholders’ funds.

Raising capital and increasing debt, has hitherto been easy for Qantas, but the market is slowly coming to the realisation that it cannot continue. The market capitalisation of Qantas – the ‘value’ the market ascribes – is less than all the equity that the company has raised – much less.

As a result of the market’s slow migration to understanding the economics of airlines, fresh management have had to respond quickly.

The best measure of economic performance is Return on Equity (ROE). This year QAN achieved a ROE of just over four per cent. Meanwhile, Oroton shareholders have been enjoying eighty per cent returns. Did you know there are 267 companies that earn more than 15 per cent returns on equity?

The business of selling seats is an expensive one for Qantas, and while the business of selling the hope-of-getting-a-seat (the Frequent Flyer program) is extremely profitable, owning planes means the cash is always inhibited – it can’t be distributed to shareholder owners.

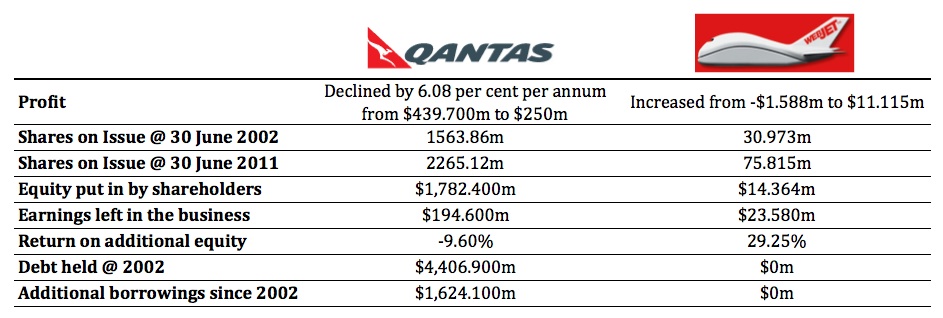

Qantas however isn’t the only seller of seats on planes. Indeed there are businesses that sell seats on planes and they don’t have any planes. Let’s compare two seat-sellers: Qantas and Webjet.

I believe the very best businesses online are lists – lists of jobs, lists of apps, lists of songs, lists of cars, lists of houses, list of flights and lists of seats. What is particularly attractive is that a business with a list of seats doesn’t have any planes. Sure its revenue is going to be lower, but what about its profit?

Let’s compare…

Now, lets take a look the economics of these businesses over the past ten years.

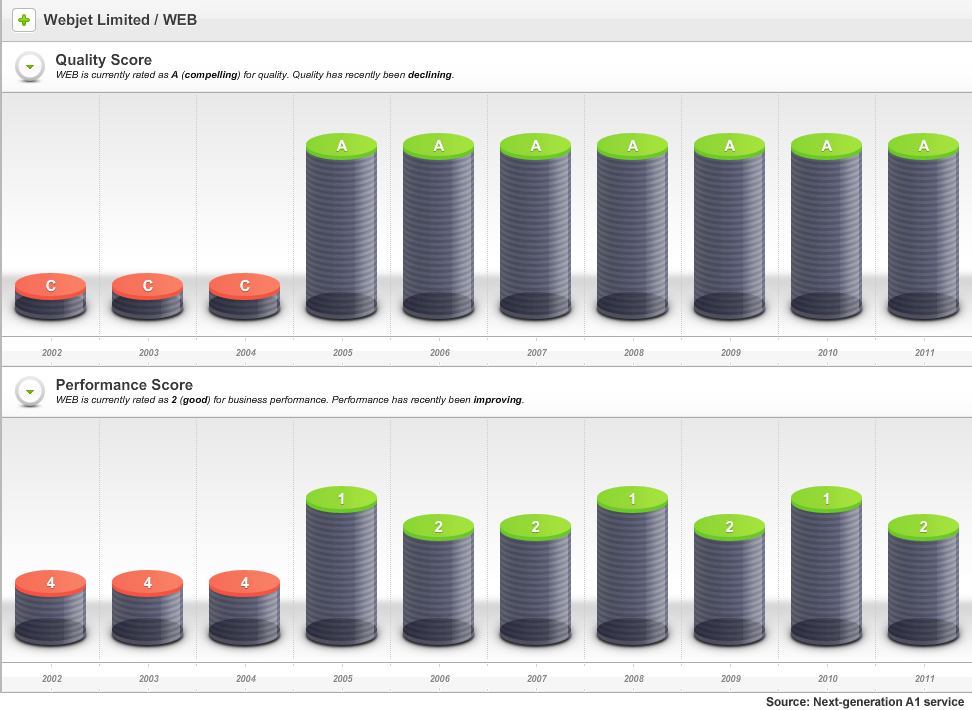

As the following sneek peek charts from our soon-to-be-released next-generation A1 stock market service display, Webjet has scored, on average, an A2 since 2005.

In this example, the Quality Score information tells us that something dramatic happened in the 2004/2005 financial year.

Webjet was once called Roper River Resources Company and in July 1999 the shares, under the ASX code; RRR, were trading at 25 cents. By March 2000 – near the peak of the internet bubble – RRR shares were trading at $1.38.

The reason is now obvious, although at the time it may have been a bit of a mystery.

In January 2000, Roper received a ‘speeding ticket’ from the ASX to which it responded on 14 January with the following statement:

“1. There are no, matters of importance, about to be released to the market.

“2. The Company is not aware of any information to explain the recent trading in the shares.

“3. The Company can offer no other explanation for the price change and increase in volume in the securities of the Company.”

“4. I confirm that the Company is in compliance with the listing rules, in particular, listing rule 3.1.”

On 27 January 2000 however – less than two weeks later – Roper River Resources (ASX:RRR) announced it was issuing 50 million shares to acquire Webjet Pty Ltd.

By June 2004 the shares were still trading at 15 cents, however the company announced the previous October that it was trading in the black for the first time. By November 2004, it was reporting 400 per cent monthly increases in sales. Almost every month to its full year results in June 2005, it continued to report 400 plus percentage increases in monthly sales.

And in that year Webjet’s Quality Score jumped from C4 to A1. As you can see, Webjet has maintained an A1 or A2 quality rating since.

By comparison, Qantas’s Quality Score profile has been more marginal. This should be unsurprising to many, if not most Value.able Graduates, who understand the downside of capital intensity. Lots of property plant and equipment results in more equity for a given profit, and that means lower returns.

So, what do you think?

With reporting season about to end, your mission, if you choose to accept it, is:

Source the latest Annual Report for each business in your portfolio. Go to the Balance Sheet and under ‘Non-Current Assets’ find ‘Property, Plant and Equipment’.

If you have any, how many capital-intensive businesses are hiding in your portfolio?

Making this process simple and easy is something we have been working on for you. We created our next-generation A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. The above graphics are just one

It’s an A1 service that is like nothing you have ever seen before.value

Value.able Graduates – your invitation to pre-register is coming soon.

If you haven’t graduated to guarantee your invitation, click here to order your copy of Value.able immediately. Once you have 1. Read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team, fund managers and creators of the ext-generation A1 stock market service, 30 August 2011.

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights, Value.able.