Value.able

-

MEDIA

Is it time to sell?

Roger Montgomery

June 1, 2011

If you take your cues from price rather than values, fear may have recently set in. For Value.able investors, a market correction is a reason for celebration rather than consternation. Roger Montgomery explains why holding on may be the wiser decision. Read Roger’s article

by Roger Montgomery Posted in Media Room, On the Internet, Value.able.

- 29 Comments

- save this article

- POSTED IN Media Room, On the Internet, Value.able

-

Where to next?

Roger Montgomery

May 18, 2011

You may have noticed my recent posts are not filled with stock ideas. Don’t worry. The drought will end, once the market resumes serving up mouthwatering opportunities

For many businesses, Australia may not seem like the ‘lucky country’ right now. A litany of evidence suggests the economy is cool. Recent bank results reveal credit growth is slowing, if not stalling. Significantly fewer homes are being put to auction and of those that are, clearance rates are not inspiring.

Australia’s savings rate has risen and thanks to rising fuel costs and utility bills, we haven’t got as much to spend as we used to. Then there’s the prospect of rising interest rates. I wonder, given all anecdotal evidence of weakness, whether an interest rate cut would be more justified?

Some of Australia’s ‘blue chips’ have reported weakness or downgrades. Seven West Media reported a softer advertising market, which has also affected Fairfax and APN. OneSteel cited a strong Aussie dollar, as did BlueScope. And you can almost guarantee food manufacturers are going to complain about higher commodity input prices.

Indeed higher input prices, combined with pressure on consumers to pay more for daily essentials – gas, electricity and petrol – means many companies have lost their ability to pass on rising costs. Naturally, this leads me to think that this is precisely the combination of influences that will reveal which companies have a true competitive advantage?

The Value.able community has spent a great of time exploring, discussing and naming competitive advantages – retailers, Apple, your insights. The current economic headwind will reveal who actually has one.

Take a look at the companies in your portfolio. Can they pass on rising costs in the form of higher prices, without a detrimental impact on unit sales? Can they grab market share from competitors whose margins are slimmer, by cutting prices? Is your portfolio overflowing with A1 businesses, or are there some C5s in there that may struggle through post-reporting season?

Now despite current pressures, which of course you must refrain from believing is permanent (and indeed cease focusing on), analysts haven’t brought down their earnings expectations.

Macquarie’s equity analysts are forecasting aggregate profit growth of 19 per cent and according to JP Morgan, non-resource companies are expected to grow profits by 13 per cent this year. These growth rates are a significant revision down from 6 months ago. Are more downgrades to come? Thirteen to nineteen per cent does seem more appropriate for a rosier economic environment…

Lower profits have a real impact on intrinsic values. For companies generating attractive rates of return on equity (at last count, 187 listed on the ASX generate a ROE greater than 20 per cent. Of those 103 are A1/A2), lower profits reduce the quantum of that return, as well as the amount of retained earnings and therefore the rate of growth in equity. All of those changes are negative. If Ben Graham was right and in the long run, price does follow value, that means either lower prices or prices that cannot justifiably rise much more. And this is where Value.able Graduates’ attention should be focused, not on the bailout of Greece or Portugal.

What does this all mean?

I don’t have a crystal ball, so I simply don’t know where the market is headed. Thankfully it isn’t a brake on market-beating returns.

What I do know, is that of approximately 1849 listed entities, 1175 made no money last year. Of the remainder, 56 are A1s and of those, just 13 are trading at a discount to our estimate of intrinsic value. Six are trading at a discount of more than 20 per cent and of those six, The Montgomery [Private] Fund owns two. We have been decidedly slothful in buying and, as a result, while the market has been falling, the Fund’s value hasn’t.

Steven wrote on my Facebook page yesterday “Who cares? this market is… only ugly!” It’s only natural to want to throw up your hands in dismay, but this is where the rubber hist the road – Keep Calm and Carry On Value.able graduates. Look for extraordinary businesses at prices far less than they’re worth.

Just under 11 per cent of The Montgomery [Private] Fund is invested in extraordinary businesses. Even with 89 per cent of the Fund in cash, we are outperforming the S&P ASX/200 Industrials Accumulation Index by 5.29 per cent since inception.

My team and I continue to be inspired by the 1939 poster in which England advised its citizens to “Keep Calm and Carry On”.

Low prices should not bring consternation, but salivation. As sure as the sun rises, low prices for A1 companies will not be permanent.

Beating the market does not mean positive performance every week, every month or even every year. I have no doubt that some investments I will make for myself and the clients we work for will not perform as expected. Not every A1 at a discount will prove spectacular. We can however mitigate some of the risks of course. Sticking to a diversified basket of the highest quality companies (A1s perhaps?) purchased at big discounts to intrinsic value, won’t prevent the market value of the portfolio declining in the short term, but it can help to generate an early, eventual and more satisfying recovery.

With a falling market (and falling prices for A1 companies too) the daggers will come out, so also be prepared for those of weak resolve. They may try to discredit our Value.able way of investing.

A contest isn’t won by watching the score board, looking in the rear view mirror or mimicking those with a demonstrated track record of success. You have to play. And play your own game. Over long periods of time, sticking to good quality A1 companies works. Given that returns are dependent on the price you pay, lower prices (and greater value) works even better!

The issue of course is not the reliability of the Value.able approach, but the patience required to execute it. Remember the ‘fat pitch’? Irrespective of the turmoil that impacts markets, we must Keep Calm and Carry On.

So what do you think? Where do you think the market is headed? What are the factors you are watching? Have you picked up something in your research that you’d like to share? Go for it!

Posted by Roger Montgomery, author and fund manager, 18 May 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation, Value.able.

-

MEDIA

What new business has caught Roger Montgomery’s Value.able eye?

Roger Montgomery

May 17, 2011

Roger Montgomery and Ross Greenwood talk about the Federal budget and the legalities of the compulsory acquisition of shares in a takeover situation. Roger also shares his thoughts about the tidal wave of new floats. Has a new business caught Roger’s Value.able eye? Listen to podcast.

by Roger Montgomery Posted in Media Room, Radio, Value.able.

- 3 Comments

- save this article

- POSTED IN Media Room, Radio, Value.able

-

Can relationships be the foundation of business?

Roger Montgomery

May 13, 2011

Back on March 10 here at my Insights blog I pieced together a little jigsaw puzzle that served as a warning to Value.able Graduates researching Carsales.com.au:

“…Relationships it seems, matter. And so they should.

“In the end, it is not cars, boats and planes that bring joy, but the quality of the relationships you develop.

“This week (commencing 7 March 2011) I read that Carsales.com.au had been sold out of Nine Entertainment Co, the rebadged PBL Media (which is owned by CVC Asia Pacific).

“Reading Terry [McCrann’s] article caused a rumour I heard last year to become louder in my mind.

“The rumour was that a group of customers of Carsales.com.au (ASX:CRZ, MQR:A1, Value.able Margin of Safety; -24%) were thinking of leaving to start a rival that would be funded by News. You could understand News’ interest, given it is losing the online automotive classifieds race to Drive (Fairfax) and Carsales.

“If this is true, and if Terry is also on the mark with the intimacy of the relationships amongst Australia’s media barons, both individual and corporate (excluding Fairfax), then it would be reasonable to assume that the status quo should be maintained until after Carsales had been spun out of the former PBL, finding itself completely owned by institutions and private investors.

“Now that hurdle is out of the way, let’s see if Carsales does lose any major customers.”

That was the crux of my 10 March blog post – that Carsales’ biggest customers were about to leave to start a rival with Newscorp.

Just 2 months have passed and if you didn’t already know, guess what? Splitsville.

The Carsguide brand, owned by News Limited and a consortium of foundation dealers that includes Automotive Holdings Group Limited, A.P Eagers Group and Trivett, plus a few other dealerships representing a quarter of Australia’s car dealers, will hop into bed together in a joint venture and share Carsguide’s revenue.

Chairman and chief executive of News Limited John Hartigan told one journo, “We will be investing in the new company, doubling the number of staff and throwing our combined resources and expertise behind the joint venture, with the intent of aggressively growing the business.”

Please refrain from posting any banter as comments, just your highest quality thoughts and experiences investing in online businesses. How have you faired investing in online businesses?

Posted by Roger Montgomery, author and fund manager, 13 May 2011.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Takeovers, Value.able.

-

Is it time to clean up your portfolio?

Roger Montgomery

May 11, 2011

Stuart sent me an email yesterday that provides some insight into what investors are experiencing right now.

Stuart sent me an email yesterday that provides some insight into what investors are experiencing right now.Stuart wrote “…each time the level at which I would like to sell has seemingly been within short striking distance, somewhere around the world there has been an earthquake, tsunami, nuclear meltdown, Eurozone bailout, currency fluctuation, credit downgrade, flood, famine, pestilence, war or some other extraneous event – that spooks the markets and triggers another backslide in the portfolio valuation. The investment headwinds just don’t seem to be letting up…”

I hear you [Stuart], but what is anyone doing about it? Many investors hold verrucose portfolios of A5/B4/B5/all ‘C’ MQR companies, waiting for the price to rise back to some psychologically relevant level – their purchase price, for example.

But the market does not recognise such nostalgia. By holding onto stramineous stocks, you not only miss out on hoped-for gains. You also miss out on the gains from companies you could otherwise own – an opportunity cost! At best, the existing portfolio thus produces occultation, if not obfuscation. What are you doing this weekend? Re-reading Value.able?

When I was young, I spent time on the land fox hunting, under the tutelage of my friend’s father. I remember I had a tough time pulling the trigger. John and Ray explained to me that a single feral cat can devour more than a 100 lizards, birds and native mice in a week. The destruction wrought on native fauna by the fox is not dissimilar.

John and Ray then explained; don’t think of the fox you are aiming at, think of the many thousands of other animals you are saving. It’s a harsh reality and surprisingly, it applies to your share portfolio.

Don’t think about a perfect exit from the rubbish in your portfolio. Think about the extraordinary companies you could own if you no longer held the rubbish. The best time to clean your portfolio is always ‘now’.

What would you prefer? A portfolio of A1 businesses whose value is forecast to rise from $170.00 today to $211.39 in 2013 (yielding $8.98 this year, rising to $12.41 in 2013)? Or a portfolio of so-called ‘blue chips’ whose value has decreased 30 per cent over the past ten years and is forecast to increase just five per cent over the next three?

Take a look at the following chart. It’s the A1 Index from January 2009 to today. The constituents are the 20 biggest A1’s listed on the ASX by market capitalisation. The red line is the poor old ASX 200. As you can see, there is genuine merit to sticking with quality.

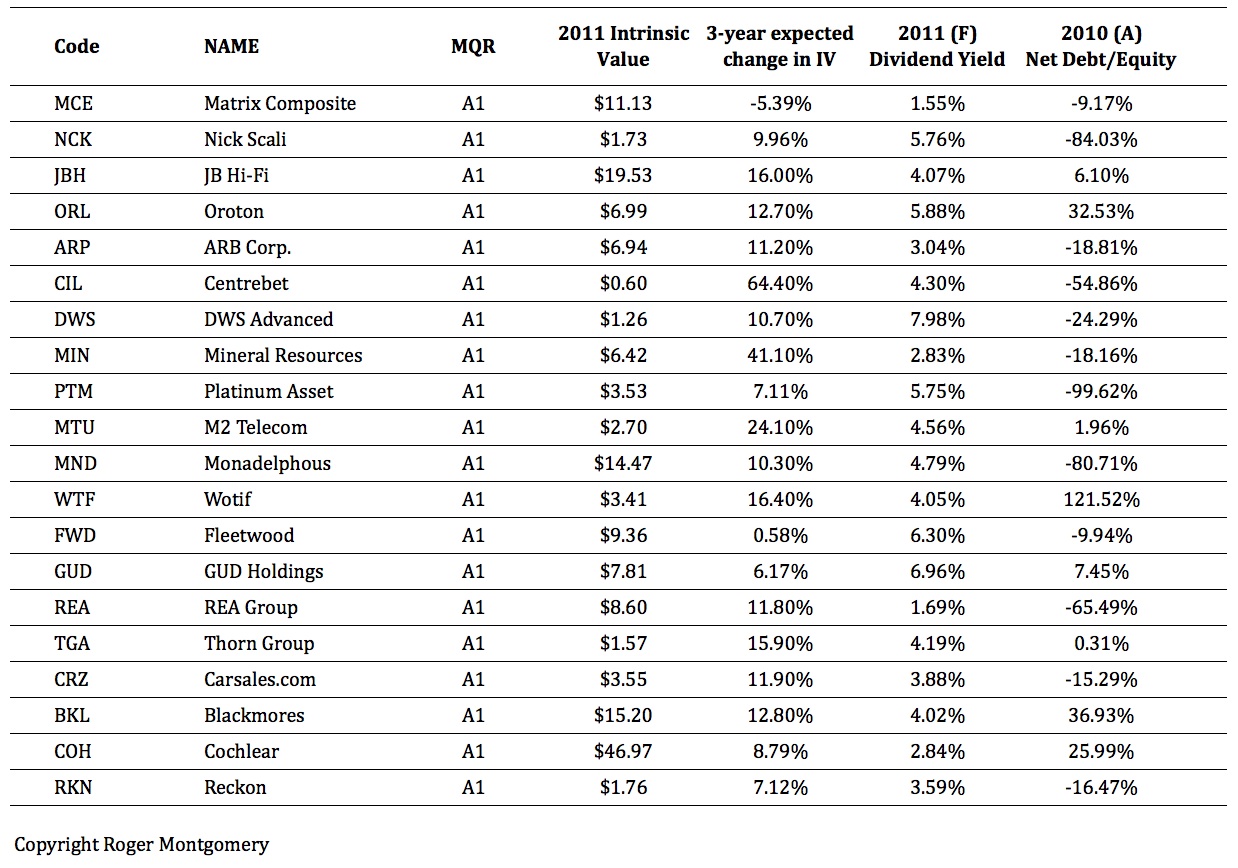

So who are A1s? It’s been a while since I last published a list of A1s with conservative valuations… Go and research the companies in this list, then return and share your comments with our Value.able community.

* MIN 2012 valuation substantially higher ($9.78). 2011 is low here because of the capital raising’s impact on ROE that year.

What makes Matrix Composite, Nick Scali, JB Hi-Fi, Oroton, ARB Corp., Centrebet, DWS Advanced, Mineral Resources, Platinum Asset Management, M2 Telecommunications, Monadelphous, Wotif, Fleetwood, GUD Holdings, REA Group, Thorn Group, Carsales.com, Blackmores, Cochlear and Reckon extraordinary?

Re-read Part Two of Value.able then come back and share your insights. Go right ahead and share whatever you know or think, but only about the companies in the above list.

Just as your portfolios need a clean out, so does my Insights blog.

Please refrain from posting any banter as comments on this post. Just your highest quality thoughts only.

1) Please keep your comments to the format below and we will build a useful library of insights.

2) Do not post any questions to me or other bloggers at this post.

Here’s the format to follow:

COMPANY NAME

Insights: If you work in the industry or have before, or perhaps you work for one of the companies or a competitor. Do you have a special or unique insight. ONLY comment if your insights are of the genuine industry variety.

Extraordinary prospects: Why does the future look bright for this business? Or if you don’t believe the future will be as extraordinary as the past, why not?

Competitive Advantage: What sets this business apart from its competitors? Don’t debate other’s comments, just post your own thoughts without reference to others.

Debt: How has management managed capital? What is your evidence?

Cashflow: Track record of cash flow?

The Value.able community, Graduates and I look forward to reading your insights.

Posted by Roger Montgomery, author and fund manager, 11 May 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are we in bubble territory?

Roger Montgomery

May 11, 2011

Less than an hour ago, Microsoft Corp. agreed to buy the Internet telephone company Skype SA for $8.5 billion. The company was started by Niklas Zennstrom (who remained CEO until September 2007) and Janus Friis (one of Time Magazine’s 100 Most Influential People 2006) in 2002 and they sold it to eBay in 2005 for $3.1 billion.

Less than an hour ago, Microsoft Corp. agreed to buy the Internet telephone company Skype SA for $8.5 billion. The company was started by Niklas Zennstrom (who remained CEO until September 2007) and Janus Friis (one of Time Magazine’s 100 Most Influential People 2006) in 2002 and they sold it to eBay in 2005 for $3.1 billion.eBay bought Skype in 2005 for $3.1 billion and sold 70% to private equity for $2 billion in late 2009. Up until yesterday, it was owned by private equity, the Canadian Pension Plan Investment Board and eBay. Now Microsoft is buying the company for three times what private equity paid —an increase in value of more than $5.5 billion in about 18 months. Skype’s original founders also ended up in the syndicate through their company Joltid.

It is the biggest deal in Microsoft’s history. Some of that 36-year history includes a friendship between former CEO Bill Gates and Warren Buffett. One wonders if Warren was consulted because the initial metrics are staggering. Some may argue the high price is because Microsoft was competing against an imminent IPO. With more than $50 billion in cash (much held offshore for tax purposes), Microsoft merely needs to beat the aggregate cash return, which in the US is somewhere just north of zero.

Skype’s ‘customers’ made 207 billion minutes of voice and video calls last year – up 150% on 18 months ago. Most of those calls however are free. Less than 9 million customers per month, or a little more than five percent, paid Skype anything.

The company did produce revenue of $860 million last year, but Skype lost $7 million. $8.5 billion is quite staggering. I think Skype is great and I know many who use it to avoid paying anyone for phone and video calls.

You may recall Microsoft has previously bid $47.5 billion for Yahoo Inc. Yahoo rejected Microsoft’s advances and Microsft dodged a bullet; Yahoo is now available at half the price.

Perhaps we are not in bubble territory? Perhaps it all works out? Perhaps its just a repeat of Foster’s purchase of Southcorp – on a much grander scale? Or perhaps Microsoft will start charging everyone for a call? A charge of 1 cent per minute – and no loss of customers – would be worth $2.07 billion in revenue… What percentage of Skype’s free riders do you think would submit credit cards etc. to subscribe and be willing to be charged?

Posted by Roger Montgomery, Value.able author and fund manager, 11 May 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation, Takeovers, Value.able.

-

Are Australian CEOs asleep at the wheel?

Roger Montgomery

May 5, 2011

Have Australia’s lauded CEO’s earned a good reputation when it comes to the impact of their bigger-is-better ambitions on the shareholders for whom they work?

Have Australia’s lauded CEO’s earned a good reputation when it comes to the impact of their bigger-is-better ambitions on the shareholders for whom they work?According to Richard Puntillo; “in theory, publicly traded corporations have shareholders as their kings, boards of directors as the sword-wielding knights who protect the shareholders and managers as the vassals who carry out orders. In practice, in the past decade, managers have become kings who lavish gold upon themselves, boards of directors have become fawning courtiers who take coin in return for an uncritical yes-man function and shareholders have become peasants whose property may be seized at management’s whim.”

When a listed company announces an acquisition, commerciality is often cited as the reason for failure to disclose the purchase price. But with Australia’s corporate graveyard littered with the writedowns of overpriced acquisitions past, it is about time companies treated their shareholders like kings.

I have long advocated the idea that companies should retain profits and reinvest them, provided they can achieve high rates of return on equity. The result? Much higher returns – indeed returns that ultimately match the rate of return on equity being achieved by the company. But the rather worse-than-patchy record of Australian Merger & Acquisitions (M&A) in creating shareholder value, gives shareholders plenty of ammunition in their calls for companies to ‘hand the money back’.

Here’s a couple of examples…

Where, MQR: Montgomery Quality Rating; Value.able IV: Value.able Intrinsic Value; Today: Value.able Intrinsic Value as at today (5 May 2011); Ten Year IV Change: Ten year change in Value.able Intrinsic Value.

Foster’s

MQR: C5; Value.able IV 2001: $2.99; Today: $3.50; Ten Year IV Change: 1.6%p.a.

Foster’s Share Price 2001 $5.71; Today: $5.51

Last week, Foster’s shareholders voted to spin off the company’s wine business. After buying Southcorp for $3.1 billion in 2005 (my valuation using the steps in Value.able was closer to $2.30 per share than the $4.17 Foster’s paid) Foster’s rejected a $2 billion private equity bid for its wine business, saying it “significantly undervalues” the Treasury Wine Estates.

When they bought Southcorp the execs were lyrical in their praise. Trevor O’Hoy said “The combination of our two great companies will create the world’s leading premium wine company”.

If you came to me to buy Southcorp in 2005, the year after it earned just $46 million in profit (the same profit as it earned ten years earlier by the way) and you wanted a margin of safety, I would advise that the right price to pay for Southcorp would be less than 65 cents. Try it yourself – plug 5% return on equity, $1.17 of equity per share and a payout ratio of just over 60 per cent into the Value.able formula. In 2005, when you came to me, the share price was $4.20 and using the price as a reference point, you would have thought I was crazy. The $3.5 billion in writedowns however since then, suggests it is the ‘too-cheap’ price for a copy of Value.able that is crazy!

PaperlinX

MQR: B2; Value.able IV 2001: $2.29; Today: $0.17; Ten Year IV Change: -23%p.a.

PaperlinX Share Price 2001: $4.93; Today: $0.28

On 9 September 2003, PaperlinX announced that it had purchased Buhrmann Paper for $1.1 billion. In June of that year Paperlinx’s share price was $3.77.

At the time, Ian Wightwick, Managing Director of PaperlinX said, “It is very pleasing that the hard work put in by our team undertaking due diligence has confirmed our initial view of the quality of Buhrmann’s Paper Merchanting Division business, its people and its assets. This business has great potential, and we are confident that the acquisition will deliver strong earnings per share growth for our shareholders.”

Ten days after the announcement the share price had shot up to $4.93. My Value.able Intrinsic Value estimation suggests it fell from $2.50 to $1.82! Nine hundred million was borrowed that calendar year and $150 million of capital was raised, to fund the acquisition.

For the year prior to the acquisition, PaperlinX earned $147 million. Since then profits have generally declined every year, and in 2009 PaperlinX lost $197 million and another $29 million in 2010. The share price has fallen from $4.93 to 28 cents today. Worse, there were 447.9 million shares on issue in 2003 and now there are almost 50% more.

AMP

MQR: A3; Value.able IV 2001: $4.01; Today: $3.97; Ten Year IV Change: 0%p.a

AMP (adjusted) Share Price 2001: $13.90; Today: $5.29

AMP launched a cash and scrip bid for AXA Asia Pacific in late 2010. Under the deal with AXA’s French parent, AMP paid more than $4 billion for AXA Asia Pacific’s New Zealand and Australian businesses. The deal valued the entire AXA company at $13.3 billion, but the Value.able intrinsic value of AXA is significantly lower.

AMP bid about $5.40 per share. And just like Southcorp shareholders, AXA shareholders wanted a higher bid. Well of course they did, and as I have said previously, I would rather receive a few million more for my house too. But AXA’s performance doesn’t justify it.

AMP’s chief executive Craig Dunn said that the deal would create an effective competitor to the big four banks and makes AMP the biggest player in all segments of Australia’s $1.2 trillion wealth management sector with 20 per cent market share.

In a bout of déjà vu (reminiscent of PaperlinX), AMP’s shares rallied after the deal was announced.

According to analyst estimates at the time, AXA would generate a return on equity of about 13 percent over the next two years. With the exception of the 2008 loss, the return on equity for the last ten years has ranged between 6.8% in 1999 and 27% in 2003. Based on the forecast ROE and a payout ratio of between 61% and 67%, AXA’s 2010 equity of $2.58 per share is worth a little more than $3.00 per share. At the time of the bid, AXA’s shares traded at $5.84.

When Oxiana and Zinifex merged to form OZ Minerals, the market capitalisation of the two individually amounted to almost $10 billion. Today the merged entity has a market cap of $4.6 billion.

The above examples are not rare. With more space, we could go through many, many more.

Overpaying for assets is not a characteristic unique to ‘mum and dad’ investors. CEOs in Australia have a long and proud history of burning shareholders’ funds to fuel their bigger-is-better ambitions. PaperlinX, Fairfax, Foster’s – the past list of companies and their CEOs that have overpaid for assets, driven down their returns on equity and made the Value.able value of intangible goodwill carried on the balance sheet look absurd, is long.

Nothing gets the blood racing more than a takeover and when blood leaves the head for other regions, common sense usually follows. You should be on your guard when your company announces an acquisition.

Posted by Roger Montgomery, author and fund manager, 3 May 2011.

by Roger Montgomery Posted in Value.able.

- 112 Comments

- save this article

- POSTED IN Value.able

-

How do your Easter holiday homework results compare?

Roger Montgomery

May 3, 2011

Your Easter holiday homework was published mid morning on Thursday 14 April. Two hours later Andrew correctly completed the cash flow component – well done Andrew.

Many Graduates have posted comments here (and sent even more emails to me) asking why Telstra made the cut. Then there’s Aristocrat with all that debt, Fortescue’s recent capital raisings, The Reject Shop’s declining Return on Equity, Coca-Cola’s dwindling competitive advantage…

I’m passing the mic to Rob, a member of the Value.able Post-Graduate elite:

“Roger usually gives us homework which contains a mix of stocks. As he said he used his discretion to come up with 14. He also said “This homework is not about finding cheap stocks – it is about understanding businesses, return on equity, debt, cashflow and identifying extraordinary prospects”. The only way for us to achieve this is to look at some B3s such as Telstra, and as Andrew said early the odd “basket case”. Working through the good and bad can be eye opening but you do need to examine all the stocks to compare how they fair according to the criteria mentioned in the above quote.”

And from Chris B:

“It has been my opinion for a while that it is kind of hard (and almost pointless) trying to assign an estimated value on a business unless you have done a lot of research about the business in question first…”

Leon was the first Value.able Graduate to post his answers, quite late in the evening on April 15. Whilst Leon’s valuations don’t match my calculations exactly, they are close. Remember your primary aim is to buy extraordinary A1 businesses at BIG discounts to your estimate of their Value.able intrinsic value. A difference of twenty cents is neither here nor there if the business is worth $8 and you can buy shares for $5!

The Results

Assignment One: Calculate the 2010 Value.able intrinsic value and 2011 forecast Value.able intrinsic value – download the results

Assignment Two: Re-read Value.able Chapter 9 on Cashflow (from page 152) and analyse the cashflow of each company using the balance sheet method – download the results

Here are Andrew’s insights on the Cashflow homework:

“Based on a simple look, Retail Food group has the best cash position of the three followed by the reject shop and then loads of daylight and then Aristocrat.

However on further digging for RFG I can see that the 85,852 worth of borrowings are now a current liability and therefore will be due in the next 12 months. They do not appear to have the assets or the cash generating abilities to service this and will therefore probably need to raise capital in some form.

Aristocrat is a basket case where cash flow was declining and borrowings rising. Doesn’t take a genius to see what is going to happen here. ROE might be high but it is debt fueled. Kind of get the feeling that Aristocrat is about as lucrative as gambling on one of their machines in the pub.

Therefore the last one standing and my pick of the three overall is actually the reject shop. It is generating positive cashflow and should be able to adequately meet its future needs.

Thank you to all who participated and if your answers where close… well done! It is vital that you continue to practice your technique. With repetition you’ll get to the point where you can simply ‘eye-ball’ Value.able intrinsic value.

Before I sign off, I would like to officially welcome Alex, Yong-Chuan, Matty, Leon, Andrew, Geoff, Justin, Peter and Margaret to the Value.able Graduate Class of 2011. If I have omitted your name, please accept my apologies. I am delighted to welcome you as a Graduate. Please send your photo with Value.able to roger@rogermontgomery.com for inclusion in the 2011 album.

For those wondering, the woman screaming in fright was looking at the stock market on Friday!

Posted by Roger Montgomery, author and fund manager, 3 May 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

What did Ben Graham get right?

Roger Montgomery

April 29, 2011

If you are new to our Value.able community, Ben Graham’s concepts may be foreign to you. Ben is the author of Security Analysis. He is regarded as the father of security analysis and the intellectual Dean of Wall Street.

If you are new to our Value.able community, Ben Graham’s concepts may be foreign to you. Ben is the author of Security Analysis. He is regarded as the father of security analysis and the intellectual Dean of Wall Street.I support Ben’s revered status and what he has to say on the subject of investing, but perhaps controversially, I also believe that, had he access to a computer that allowed him to properly test his ideas, he may not have reached all of the same conclusions.

It is exactly one year since I first penned some of my thoughts about Ben Graham on this blog here: http://rogermontgomery.com/should-a-value-investor-imitate-ben-graham/

There are many things that Ben said that not only make sense, but has also made significant contributions to investment thinking. Indeed they have become seminal investment principles. These are the things to which Value.able investors should hold firm.

Ben Graham authored the Mr Market allegory and also coined the three most important words in value investing: Margin of Safety. In fact Ben said this: “Confronted with the challenge to distill the secret of sound investment into three words, I venture the motto: Margin of Safety”

These are two concepts that value investors hold dear and which have, in many different ways, become a formal part of our Value.able investing framework.

Mr. Market is of course a fictitious character, created by Ben to demonstrate the bipolar nature of the stock market.

Here is an excerpt from a speech made by Warren Buffett about Ben Graham on the subject:

“You should imagine market quotations as coming from a remarkably accommodating fellow named Mr Market who is your partner in a private business. Without fail, Mr Market appears daily and names a price at which he will either buy your interest or sell you his.

“Even though the business that the two of you own may have economic characteristics that are stable, Mr Market’s quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favorable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains…

“Mr Market has another endearing characteristic: He doesn’t mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow.

Transactions are strictly at your option…But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr Market is there to serve you, not to guide you.

“It is his pocketbook, not his wisdom that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence.”

If you have read Value.able you will understand Margin of Safety, know exactly what a suitable Margin of Safety is and also how to apply it to Australian stocks.

Despite the high profile of these two enduring lessons, I believe there is a third observation of Graham’s, which is equally important. Fascinatingly, with the benefit of computers, I can also demonstrate that Graham was spot on.

Graham was paraphrased by Buffett in 1993 thus:

“In the short run the market is a voting machine – reflecting a voter-registration test that requires only money, not intelligence or emotional stability – but in the long run, the market is a weighing machine”

What Graham described is something that, as both a private and professional investor, I have observed myself; in the short term the market is a popularity contest – prices often diverge significantly from that which is justified by the economic performance of the business. But in the long-term,prices eventually converge with intrinsic values, which themselves follow business performance.

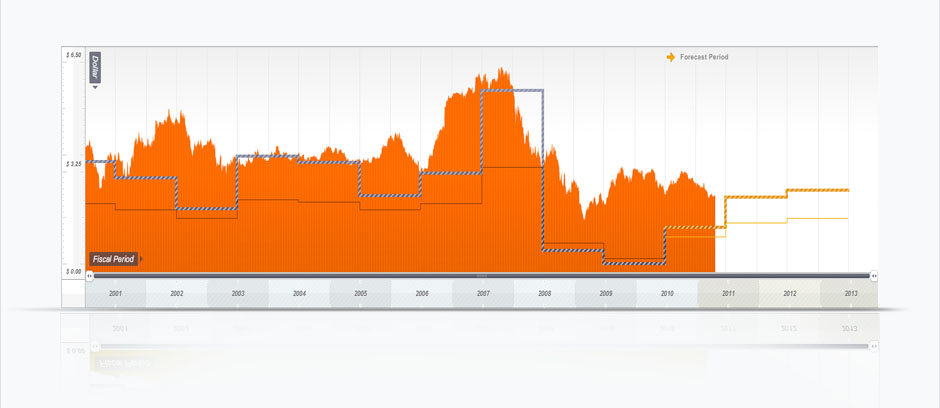

Have a look at the amazing chart below.

(c) Copyright 2011 Roger Montgomery

Its Qantas (ASX:QAN, MQR: B3, MOS-44%): – its my ten-year history of price and intrinsic value (and three year forecast of intrinsic value which updates daily). Now right click on the chart and open it in a new tab. Zoom in. Now stand back from your computer screen. What do you see?

First you will notice two intrinsic values – a range is produced. Next you might notice that there have been short term bouts of both optimism and despondency and this is reflected in the short term share price changes. The final observation you might make and which the charts make most powerfully, is that since 2001, the intrinsic value of Qantas, which is based on its economic performance has, at best, not changed. Look closer and you will notice that the intrinsic value of Qantas today (2011) is lower than it was a decade ago. Even by 2013, intrinsic value is not forecast to be materially different from that of 2002.

Just as Ben Graham predicted, the long-term weighing machine has correctly appraised Qantas’ worth. Unsurprisingly, the share price today of Australia’s most recognised airline, is also lower than it was a decade ago. And unbelievably, the total market capitalisation of Qantas today is less than the money that has been ‘left in’ and ‘put in’ by shareholders over the last ten years!

These charts aren’t just easy or nice to look at, they are incredibly powerful. If you can calculate intrinsic values for every listed company, you can turn the stock market off and simply pay attention to those values. Then, during those times that the market is doing something irrational, you can take advantage of it or ignore it, just as Ben Graham advised.

Unless you can see a reason for a permanent change in the prospects of Qantas, the long-term trend in intrinsic value gives you all the information you need to steer well clear of this B3 business.

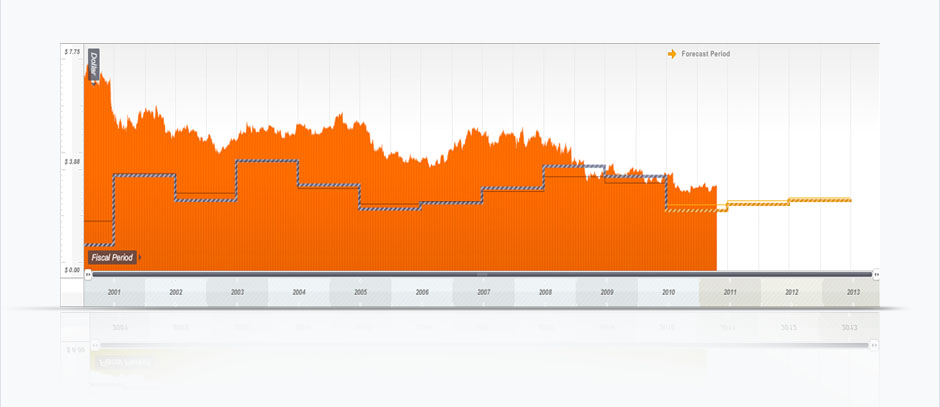

Now have a look at the second chart. What does it tell you?

(c) Copyright 2011 Roger Montgomery

There have been short-term episodes of price buoyancy, but over the long run the weighing machine has done its work. The intrinsic value has not changed in ten years so, over time, the share price has once again reflected the company’s worth and gradually but perpetually fallen until it reaches intrinsic value. This is my ten-year historical price and intrinsic value chart (and three year forecast) for Telstra (ASX:TLS, MQR: B3, MOS:-32%).

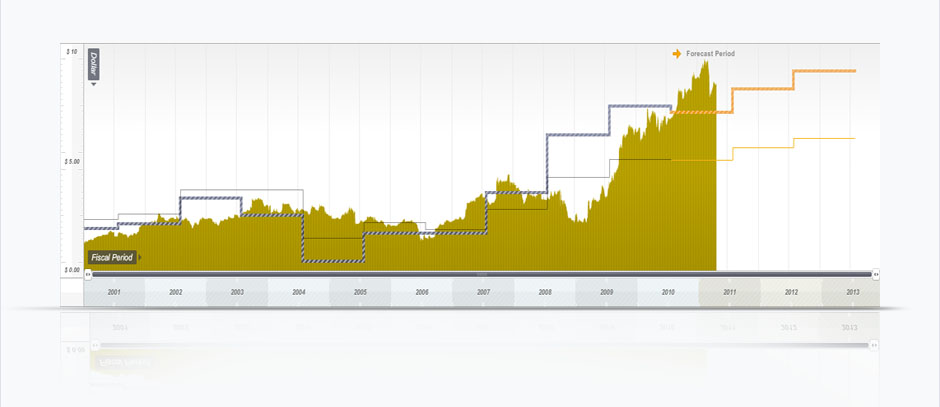

What about an extraordinary A1 business?

Sally Macdonald joined Oroton (ASX:OTN, MQR: A1, MOS:-17%) as CEO in 2005/06. Observe the strong correlation between price and value since Sally’s appointment.

(c) Copyright 2011 Roger Montgomery

I acknowledge that there are critics of the approach to intrinsic value we Value.able Graduates follow. But like me, you should be delighted there are. Indeed, we should be encouraging departure from this approach!

The critics are necessary. Not only do they help refine your ideas, but without them, how else would we be able to buy Matrix at $3.50, Forge at $2.60, Vocus at $1.60 or Zicom at $0.32! And how else would we be able to navigate around and away from Nufarm or iSoft, and not fall into the trap of buying Telstra at $3.60 because the ‘experts’ said it had an attractive dividend yield? If it was universal agreement I was after, I would just keep writing about airlines.

The Value.able approach works. If you have been visiting the blog for a while, you will know this only too well.

The above charts (automatically updated daily – and I have one for every, single, listed company) confirms what Ben Graham had discovered without the power of modern computing; In the short run the market is indeed a voting machine, and will always reflect what is popular, but in the long run the market is a weighing machine, and price will reflect intrinsic value.

If you concentrate on long-term intrinsic values and avoid the seduction of short-term prices, I cannot see how, over a long period of time, you cannot help but improve your investing.

…And in case you are wondering about the link between Ben Graham and the photograph of Comanche Indian ‘White Wolf’… the photo of White Wolf was taken in 1894 – the year Ben Graham was born.

HOMEWORK RESULTS: I will publish the holiday results homework on Monday. Thank you to all who participated. It is vital what you continue to practice your technique. With repetition you’ll get to the point where you can simply ‘eye-ball’ Value.able intrinsic value.

Posted by Roger Montgomery, author and fund manager, 29 April 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Technology & Telecommunications, Value.able.

-

10,000 Comments and Counting

Roger Montgomery

April 13, 2011

Early this month we hit a milestone worth celebrating. Thanks to your incredible interest in the value investing approach advocated and discussed here we hit 10,000 comments.

Thank you for your interest, your passion and your generosity. It is amazing and I cannot be more proud of the incredibly diverse directions you have all headed with the new found knowledge from Value.able.

Thank you also for your encouragement and taking the time to share with me just how much you have been impacted by Value.able. My team and I are delighted to hear your amazing stories of investing success.

Speaking of stories, here is one of my recent favourites. It’s from Craig, a Graduate from the Value.able Class of 2010. It’s the story of Eddie and his bike…

Twelve year old Eddie has a paper round.

He bought a bike for $10,000 (its a bloody good bike) and earns $1,000 a year, after all expenses (new tyres, chewing gum) and tax (there’s no tax as the bloke who owns the newsagency pays him cash).

Eddie’s happy, but he wants a new playstation, so he offers a 50% share in his operation to family members.

His brother’s keen but the $10 he gets for mowing the front lawn (the backyard is fake grass) means he doesn’t have the money.

His teenage sister is keen but she’s running up huge mobile phone bills which accounts for all of her pay from McDonald’s.

His old girl’s keen but she just bought a new Apple product, so she’s got no money to spare.

His old man however, has squirreled away $5,000 by doing some overtime at work, and had been shopping around for somewhere to put it to work. ING are offering 8% (this is 2013), so the old man says to Eddie: “Look son, I can get 8% at the bank.”

“You can get 10% with me dad, if you hand over that 5 grand.”

“Yeah but you might want to do something else one day, or your bike could need replacing, or you could – god forbid son – have an accident. With all that risk involved, I wan’t 12.5%, so I’ll give you $4,000 for me half share.”

“Four large? You’re killing me dad. Don’t you know banks can go broke?”

“Not in this country son. I want 12.5%.”“There’ll be another GFC, you wait, but people will still want the paper delivered.”

At that point, the boy’s mother approaches, holding her new iPad.

The husband looks at her, then back to his son: “Make it $2,500… I want 20%.”

What is your funny or amazing Value.able story?

Go ahead, Share, Encourage and Inspire. And thank you for helping so many investors value the best stocks and buy them for less than they are worth!

Did you contribute your photo to the Value.able Graduate Class of 2010? The Class of 2011 is open and accepting Graduates. Email your photo and join Bernie, Martin, Alya and Jim Rogers.

Posted by Roger Montgomery, author and fund manager, 13 April 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.