What did Ben Graham get right?

If you are new to our Value.able community, Ben Graham’s concepts may be foreign to you. Ben is the author of Security Analysis. He is regarded as the father of security analysis and the intellectual Dean of Wall Street.

If you are new to our Value.able community, Ben Graham’s concepts may be foreign to you. Ben is the author of Security Analysis. He is regarded as the father of security analysis and the intellectual Dean of Wall Street.

I support Ben’s revered status and what he has to say on the subject of investing, but perhaps controversially, I also believe that, had he access to a computer that allowed him to properly test his ideas, he may not have reached all of the same conclusions.

It is exactly one year since I first penned some of my thoughts about Ben Graham on this blog here: http://rogermontgomery.com/should-a-value-investor-imitate-ben-graham/

There are many things that Ben said that not only make sense, but has also made significant contributions to investment thinking. Indeed they have become seminal investment principles. These are the things to which Value.able investors should hold firm.

Ben Graham authored the Mr Market allegory and also coined the three most important words in value investing: Margin of Safety. In fact Ben said this: “Confronted with the challenge to distill the secret of sound investment into three words, I venture the motto: Margin of Safety”

These are two concepts that value investors hold dear and which have, in many different ways, become a formal part of our Value.able investing framework.

Mr. Market is of course a fictitious character, created by Ben to demonstrate the bipolar nature of the stock market.

Here is an excerpt from a speech made by Warren Buffett about Ben Graham on the subject:

“You should imagine market quotations as coming from a remarkably accommodating fellow named Mr Market who is your partner in a private business. Without fail, Mr Market appears daily and names a price at which he will either buy your interest or sell you his.

“Even though the business that the two of you own may have economic characteristics that are stable, Mr Market’s quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favorable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains…

“Mr Market has another endearing characteristic: He doesn’t mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow.

Transactions are strictly at your option…But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr Market is there to serve you, not to guide you.

“It is his pocketbook, not his wisdom that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence.”

If you have read Value.able you will understand Margin of Safety, know exactly what a suitable Margin of Safety is and also how to apply it to Australian stocks.

Despite the high profile of these two enduring lessons, I believe there is a third observation of Graham’s, which is equally important. Fascinatingly, with the benefit of computers, I can also demonstrate that Graham was spot on.

Graham was paraphrased by Buffett in 1993 thus:

“In the short run the market is a voting machine – reflecting a voter-registration test that requires only money, not intelligence or emotional stability – but in the long run, the market is a weighing machine”

What Graham described is something that, as both a private and professional investor, I have observed myself; in the short term the market is a popularity contest – prices often diverge significantly from that which is justified by the economic performance of the business. But in the long-term,prices eventually converge with intrinsic values, which themselves follow business performance.

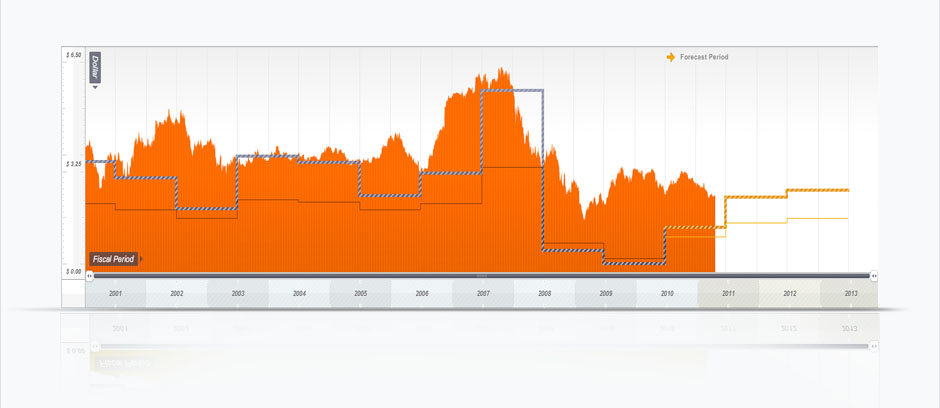

Have a look at the amazing chart below.

(c) Copyright 2011 Roger Montgomery

Its Qantas (ASX:QAN, MQR: B3, MOS-44%): – its my ten-year history of price and intrinsic value (and three year forecast of intrinsic value which updates daily). Now right click on the chart and open it in a new tab. Zoom in. Now stand back from your computer screen. What do you see?

First you will notice two intrinsic values – a range is produced. Next you might notice that there have been short term bouts of both optimism and despondency and this is reflected in the short term share price changes. The final observation you might make and which the charts make most powerfully, is that since 2001, the intrinsic value of Qantas, which is based on its economic performance has, at best, not changed. Look closer and you will notice that the intrinsic value of Qantas today (2011) is lower than it was a decade ago. Even by 2013, intrinsic value is not forecast to be materially different from that of 2002.

Just as Ben Graham predicted, the long-term weighing machine has correctly appraised Qantas’ worth. Unsurprisingly, the share price today of Australia’s most recognised airline, is also lower than it was a decade ago. And unbelievably, the total market capitalisation of Qantas today is less than the money that has been ‘left in’ and ‘put in’ by shareholders over the last ten years!

These charts aren’t just easy or nice to look at, they are incredibly powerful. If you can calculate intrinsic values for every listed company, you can turn the stock market off and simply pay attention to those values. Then, during those times that the market is doing something irrational, you can take advantage of it or ignore it, just as Ben Graham advised.

Unless you can see a reason for a permanent change in the prospects of Qantas, the long-term trend in intrinsic value gives you all the information you need to steer well clear of this B3 business.

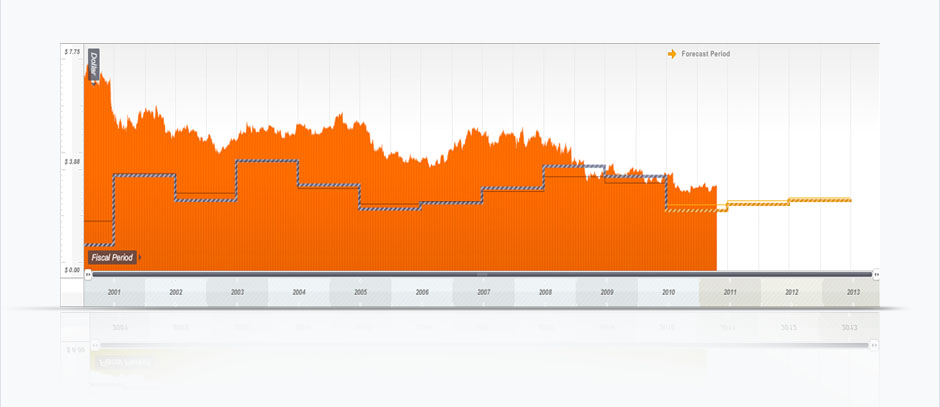

Now have a look at the second chart. What does it tell you?

(c) Copyright 2011 Roger Montgomery

There have been short-term episodes of price buoyancy, but over the long run the weighing machine has done its work. The intrinsic value has not changed in ten years so, over time, the share price has once again reflected the company’s worth and gradually but perpetually fallen until it reaches intrinsic value. This is my ten-year historical price and intrinsic value chart (and three year forecast) for Telstra (ASX:TLS, MQR: B3, MOS:-32%).

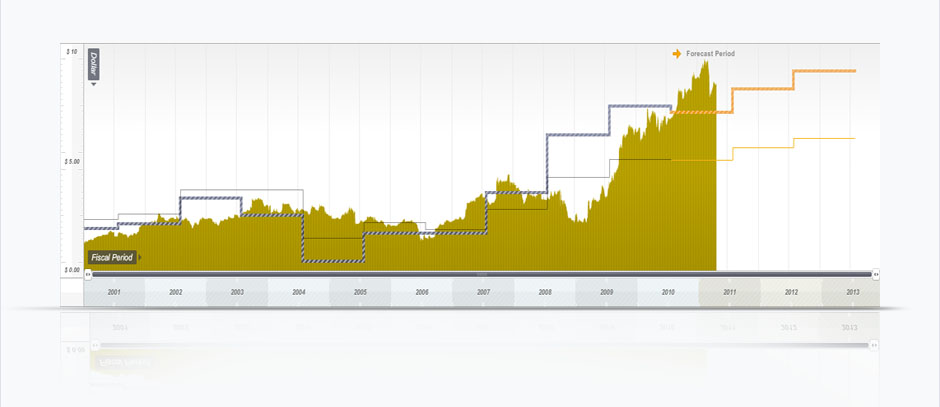

What about an extraordinary A1 business?

Sally Macdonald joined Oroton (ASX:OTN, MQR: A1, MOS:-17%) as CEO in 2005/06. Observe the strong correlation between price and value since Sally’s appointment.

(c) Copyright 2011 Roger Montgomery

I acknowledge that there are critics of the approach to intrinsic value we Value.able Graduates follow. But like me, you should be delighted there are. Indeed, we should be encouraging departure from this approach!

The critics are necessary. Not only do they help refine your ideas, but without them, how else would we be able to buy Matrix at $3.50, Forge at $2.60, Vocus at $1.60 or Zicom at $0.32! And how else would we be able to navigate around and away from Nufarm or iSoft, and not fall into the trap of buying Telstra at $3.60 because the ‘experts’ said it had an attractive dividend yield? If it was universal agreement I was after, I would just keep writing about airlines.

The Value.able approach works. If you have been visiting the blog for a while, you will know this only too well.

The above charts (automatically updated daily – and I have one for every, single, listed company) confirms what Ben Graham had discovered without the power of modern computing; In the short run the market is indeed a voting machine, and will always reflect what is popular, but in the long run the market is a weighing machine, and price will reflect intrinsic value.

If you concentrate on long-term intrinsic values and avoid the seduction of short-term prices, I cannot see how, over a long period of time, you cannot help but improve your investing.

…And in case you are wondering about the link between Ben Graham and the photograph of Comanche Indian ‘White Wolf’… the photo of White Wolf was taken in 1894 – the year Ben Graham was born.

HOMEWORK RESULTS: I will publish the holiday results homework on Monday. Thank you to all who participated. It is vital what you continue to practice your technique. With repetition you’ll get to the point where you can simply ‘eye-ball’ Value.able intrinsic value.

Posted by Roger Montgomery, author and fund manager, 29 April 2011.

Chris B

:

Hi Roger,

I want to mention my general beleifs, influences and experiences I’ve had investing.

I’ve been studying and investing in the sharemarket for 7 years. Spending at least 20 hours a week for 7 years reading and investing and analysing. I love it.

I think to be very good at investing, you must spend more than 20 hours a week on it and be very dedicated and analyse business models and markets thoroughly.

Most people I find want quick answers, they want a quick way of working out if a share is a buy or not. Unfortunately, it doesn’t work like that. You must have in-depth knowledge of different types of business models and be constantly reading the market. You must also be flexible in your investment style like the great investors.

Two great influences for me are Peter Lynch and Warren Buffett.

I think Peter Lynch is underrated, Warren Buffett gets all the attention but Peter Lynch did very well. He returned something like 28% running the Magellan Fund from 1977-90. This is slighly less than Buffett in his early days.

I want to mention a couple of similarities between Lynch and Buffett. They both read lots and lots of annual reports. They both adapt to market situations constantly. I don’t beleive Buffett buys only shares that he is willing to hold forever, while he is waiting and looking for shares to hold forever, he is doing a lot of other trades that he holds for a year or 10 years but not forever. You need these trades as well because $100k turns into $200k and then when he finds a share he can hold forever, he can invest $200k in it and not just $100k to double the impact of the investment in the brilliant business.

Lynch and Buffett look for treasures amongst the wreckage, they will have a look at junk bonds when all junk bonds are really cheap and they will pick out the best companies that they know won’t go bankrupt but pay great returns.

Because they both can adapt to market conditions, they are able to find bargains in any market condition.

Lynch and Buffett are always looking for the brilliant companies where they make most of their money.

They both can read financial statements very very well and know all the tricks that companies use to hide the truth, and they know what to look for in various different situations to find undervalued companies. I guess this happens with practice.

They both speak to analysts, journalists and people in the company often to get more idea about the situation of the company. They both use their phone a lot.

They both like companies that buy back shares (if it is cheap enough and nothing better to do with the money.

They both look at 10 year records.

But Lynch does more shorter term investments than Buffett. Lynch does some investments that Buffett would never do such as Ford and General Motors. However, they both assess companies in similar ways, they look for value eg if a company is selling for $7 and it has $3 in cash on its balance sheet, it may well be undervalued. They both like utility companies that return nice dividends. They both look for companies with high ROE. Lynch sometimes flirts a bit more with companies with high debt but in a controlled way. However, the unique thing with Buffett is that he looks very very deeply into a company, he analyses companies in a way no-one else can. When he makes a big investment in a company, he covers everything completely, he turns over every stone to find answers to every part of the business. If you ever heard Buffett talk about how much sugar in one can of coke and the fact that they can buy aluminium and sugar cheaper than every other competitor and go deeply into Coke’s sales figures, you’d be very impressed. I don’t think I’d ever be able to analyse a company the way he does even if I work for that company. He sets a very high standard. His letters to shareholders and annual meetings are great learning material.

Lynch takes a few hours at most to analyse a company. He likes the 2 minute drill, you should be able to give a good summary of a company in a 2 minute talk if you buy it. Lynch often held a large number of stocks whereas Buffett doesn’t hold many. Lynch doesn’t hold forever, Buffett’s prefered holding period is forever.

Lynch gets more 10 baggers and has more diversified “value” investments.

Buffett looks more deeply and buys less companies but bigger stakes in great companies. He likes to get financial control of the company.

Lynch didn’t do as well in the later years when the fund got bigger, but he still had a very impressive record, Buffett’s record over 50 years is brilliant.

Buffett would buy small amounts in a company if it is on his radar, he’d buy small amounts so he can get sent the annual reports sent to him. Lynch did the same thing but for a slightly different reason, he’d buy small amounts in a company to put it on his “tune in later” list.

Lynch would get great returns on “cyclicals”, companies in industries that are out of favour. Buffett does some similar sorts of investments, it is a fallacy that Buffett only looks for stocks that he wants to hold forever. You can get great returns on cyclicals. Lynch goes for about 20% of the portfolio in cyclicals.

They both only go for companies that are earning money, although Lynas made good gains, it hasn’t made a profit and would be out of the question.

I am not smart enough to be like Buffett. And I don’t think anyone out there is smart enough to invest to the degree Buffett does (I don’t just think about money). But all these great investors are drinking the same water. They are value investors just in different flavours. They read lots of annual reports and they adapt to the market. To adapt to the market, you must know the different business models and how different industries work. You must know very well the different profit margins within retail companies, who the cheapest producers are, what is going to happen to food prices in the future and why.

Peter Lynch has written 2 classic books I highly recommend. Both are brilliant.

Another great book I’ve read is “The Little Book that still beats the market” by Joel Greenblatt. It talks about Graham’s principles, its a great read in understanding value investing principles.

My best advice – if you don’t understand the business well, don’t buy it, don’t risk it.

There have been some good companies with very nice profit growth that have been hit badly in the last few years, Macquarie Group, Nufarm, Downer EDI and Leightons to name a few. I don’t understand Macquarie Group and will never invest in it, Nufarm I was going to look into but would of had a problem with generic competition and I wouldn’t of invested despite their great record before 2009. Leightons was too highly priced but honestly didn’t see the downturn coming despite a few signals. I required a margin of safety before I would buy it, so I avoided Leighton.

I’ve done quite well so far out of the sharemarket, averaging 20% returns over the last 4 years, I’m very conservative, I won’t take risks, if I don’t understand it, I won’t buy it. I’ve saved a lot of money that way.

I need to read more annual reports, but there is so much to read and keep up on.

Chris

Robert Double

:

Great post Chris. I thoroughly enjoyed reading it and got a couple of new reads for my book list.

Mark

:

To all ye value investors who embrace Graham’s law that price shall follow value in the longer term, but tend to depart from value in the short term, I ask: But why is it so? Why should price follow value in the longer term? And why should price not always follow value in the shorter term?

Price should be dependent on value due to the law of supply and demand – the more valuable something is, the more people will want it and the more they will bid for it; the less valuable something is, then less people will want to pay to have it and so the price the seller offers for it will have to be reduced if a sale transaction is to occur.

So the curiosity is not that price follows value in the longer term as Graham said – that is to be expected. What is less clear is why price wouldn’t parallel value over the short term.

Imagine driving due east along the freeway during a storm at night. Although you know you’ll end up east of your departure location (assuming good enough management of your vehicle), but due to winds, fatigue, poor visibility, slippery road, overtaking of slower vehicles, etc, at any random moment in time, who would be able to predict whether your vehicle would be a few centimetres north or south of its random average easterly path (and sometimes you might stray even further away due to detours, bypasses, incorrect turnoffs, etc)

Hope this helps you believe the investing laws of nature.

Roger Montgomery

:

“the more valuable something is, the more people will want it” presumes they all know the value of it in the short term and that they are all rational and profit motivated. None of that is true.

Mark

:

I agree – the fact that none of that is true in the short term is because although price is approaching value over a longer period of time, the journey from past IVs through current IV towards future IVs is a path that’s being modified by the jostling of the market participants of the day who buy and sell for whatever personal reasons. Over longer periods of time, the journey from previous IVs to future IVs becomes more visible.

I like the use of ROE as the input for calculation of IV (as in Value.able) as it reflects the true value of the company for the investor (return on equity = the return relative to the equity from shareholders in the company, ie. for 20% ROE (assuming all things equal), X input of shareholders’ funds, they receive an output of 120% of X).

ROC is useful in assessing the quality of the company (as it tells you something about how well the company uses all of its available funds, including its debt), but should not be the input for calculating IV.

Other inputs such as debt ratios, etc are useful in estimating any potential future changes to ROE (eg. high debt/equity might increase the ROE in the short term, but might also risk damaging the ROE later on). However, the IV relates most accurately to the ROE as ROE measures the return on an investor’s investment (which is what is of value to any investor). Hence price tends to head towards value (as it is calculated in Value.able) over longer periods once short term influences average out.

Matthew R

:

Do you know the Mr Market analogy of Graham?

The same applies to health – sensible people want to live a long, satisfying & enjoyable life. However, human psychology often gets in the way and for whatever reason sensible well educated people can do crazy things that don’t align with achieving these simple goals.

Emergency departments & police stations always contain a variety of young people who for however so briefly failed a simple psychological test that day

But in the long run, despite possibly a few false starts, most people work it out & settle down. The share market is no different!

jeremy

:

Greetings fellow bloggers,

Im interested to in the Graduate’s views on CSL. I have an IV of $26.47 using R/R of 10%, POR of 42% and ROE of 21.74%. The high Aus$ and share buybacks above IV must surely reduce its future IV? Am i way off?

Thanks heaps

John P

:

Hi Jeremy,

Your CSL IV looks ok , I have it a bit $25 when I last valued the stock.

Cheers

jeremy

:

Thanks for your replys John P & Jonesy, very much appreciated. I dont own a great deal but i would like to stick to Rogers and the vaule able principles of selling if the price is above IV, particularly with the $Aus concens.

Thanks heaps again guys.

Jonesy

:

Share buybacks above intrinsic value are never good and I agree that they would be detrimental to future IV. However, CSL is a great company and the intrinsic value is continuing to increase in future years (although not to the extent it may have done without the buyback.) As a lot of earnings are in $US then I agree, a continued high $A will not be helpful. However, should the $US improve against the $A then you’re onto a winner and in this scenario, owning a company with a large proportion of earnings in $US will be a good hedge. This just leaves the question about future currency movements – who knows where it will go, I suspect flipping a coin will give you the best guess!

Paul Rehill

:

There are often posts from concerned graduates about falling prices and questions about why when no recent news has been released or suggestions that the price is below IV so it is time to buy.

So based on the facts available to you, assuming your analysis of IV now and in the future is correct and you make an investment, what is a reasonable timeframe for value investors to expect price to catch up to IV (providing nothing major changes to cause IV to fall)?

From what I have read, 3 to 5 years is a reasonable timeframe to make great returns post analysis. If Mr. Market becomes extremely moody, that is great as price can catch up to value sooner. But if that doesn’t happen, is 3 to 5 years about right or is that too long for you to wait?

ron shamgar

:

well if you have to wait 3-5 years for price to catch up to current IV you’re in trouble. you assume that if the company’s performs to expectations price should follow closer to IV. you can check the price history of a company and their past IV to see how they both trend or even better if u have software like rogers one above. (though it does help if roger mentions it on TV) :-)

Paul Rehill

:

Hi Ron

Why would you be in trouble? Are you relying on the margin of safety gap to be your major source of return and for this gap to close quickly rather than just requiring your return to be at least your required rate of return over a long investment holding period?

If a purchase is an asset play (a Graham cigar-butt investment), then a one-bagger would produce a 26% pa return over 3 years or 15% pa return over 5 years. All the more if the asset play turns out to be a 2, 3 or 4 bagger.

If the security purchase is a growth play with high earning power, then the IV is expected to rise each year so the investment can still rise in value in line with the rising earnings whilst still trading below IV. The margin of safety is supposed to provide a buffer for IV errors, unforeseen circumstances that reduce IV etc. but if these don’t occur and the gap between IV and price narrows, then it will provide an extra return over rising IV.

So putting talking your own book aside to narrow the gap between price and IV, what is a reasonable period? A short timeframe would make you captive to Mr. Market and less subject to the performance of those wonderful businesses whose IV rises rapidly over time.

Andrew

:

I agree Paul, the market is a weighing machine in the long term. I don’t think 1-2 years fits into this category. I think i remember Roger saying that it took telstra 10 years or something like that to reach its IV.

I think anyone who is coming on here and expects the share price to match the IV in a short period of time will be headed for dissapointment.

Roger Montgomery

:

Here, here!

Gavin

:

My Idea of investing is swapping a lump sum for an income stream. The best swaps are justifiable without ever having to rely on swapping the income stream back into a capital amount. It’s what you don’t pay for up front in relation to the conversion of cash flow back to capital that you have the greatest probability of benefiting from in the long run.

Matthew R

:

I don’t follow…..

Gavin

:

Sorry Mathew

What I was saying was in relation to Paul Rehill’s question and following discussion on how long is reasonable to wait for the market to catch up to IV.

I answer that question for myself by going right back to what it is that I believe I’m trying to do. That is: Swapping lump sums for a cash stream.

Specifically to shares – when I buy, I swap a lump sum of cash for a right to that company’s future earnings stream. What I was trying to say is that if I get the purchase right I can rely on the earnings stream to deliver my required return. I do not need to sell to realise my required return, the price could stay cheap or even get cheaper and it wouldn’t matter because I’m not dependent on selling to realise my required return.

The last point I was trying to make: If your purchase is justified solely on the earnings stream –you haven’t paid anything up front in the expectation of being able to convert the earnings stream back into cash. The opposite is say gold where you pay say $1500 upfront and get no earnings stream so that $1500 is the price you pay for the expectation that you can convert gold back into cash at some future date for a higher price.

Where you pay nothing for the right to convert in the future – you are in a much stronger position to ignore a down market and wait to take advantage of a high market.

I suspect that when people are thinking I can buy now for X and sell later for XX their underlying approach to investing is different to mine. This is of course fine. I hope this helps to clarify a bit what my approach is – but it probably doesn’t – I guess there’s probably a lot of supporting thinking that I have left out.

Roger Montgomery

:

..and why quality is so important.

Matthew R

:

Thanks Gavin, i thought I would ask you to expand your ideas because I didn’t quite get them the first time!

Brad J

:

I currently have most of my portfolio in the following companies. To follow are the companies and the reasons –

VOC – I believe this company has the greatest opportunity for percentage growth in revenue and size. It is just about guaranteed with the current contracts they have for the next two years.

MCE – It has the best moat. With the price it is today it offers an absolute opportunity to pick it up at a large discount. Too bad the traders don’t look at the fundamentals of a business and only focus on price.

FGE- Its in the right space and the mining boom will continue. It’s well run and has a history of delivering increased profits. Currently at a 35-40% discount to IV.

I would love to know where you are investing and why.

Paul Rehill

:

Hi Brad

It’s interesting to observe that these 3 stocks have a short ASX listed company history. Graham recommended only in investing in stocks that have at least a 10-year listed history and Buffett and Munger generally followed this with their investing. Roger is a master of investing in small cap stocks that have hardly any listed history so if you invest in stocks that Roger doesn’t invest in after doing your own research, it’s worth considering this 10-year rule (or maybe make it 5 years for Australia) to find companies with great proven historical performance that are also undervalued. I do own Forge because of its high incremental ROE and negligible debt in the mining services sector.

Brad J

:

Great points Paul, totally agree.

Tim

:

Hi,

Purchased AGK awhile ago prior to finding out about Roger’s book. Still practicing but wondering if anyone here can confirm my 2011 IV of AGK at $8.62.

Cheers,

Tim

Tim Phelps

:

Hi Tim,

I have it at $8.85 using RR 10%, ROE 7.37% and POR 62.88%. Looks like we’re pretty close.

Last I saw, Roger rates it B3. That ROE isn’t very healthy though, and looks very expensive at the moment!

Tim

:

Hi Tim,

Thanks for your reply and info. I agree!

Cheers.

Paul Rehill

:

Hi Roger

I am unsure if anyone coined the terms “intrinsic value” and “earning power” in books pre-Graham but they are important contributions to value investing.

Another important 3 words from Graham worth mentioning is “Safety of Principal” from “an investment operation is one which, upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

Your MQR filters help you find stocks that offer a greater safety of principal. Purchasing A1/A2/B1 stocks at an adequate margin of safety assists in achieving adequate returns.

There isn’t much in Graham’s work that isn’t outstanding. Even though his common stock valuation approach is outdated, it does convey Graham like most investors (not your graduates of course) did then, do now and will in the future value dividends over capital growth income. Some things are unlikely to change.

Ilya

:

I was musing about MOS during my waking hours last night and it occurred to me that MOS is not only a great tool for finding undervalued businesses but also to time the market. I know that value investors are not supposed to time the market but good MOS can only develop under two conditions:

1 – the business is genuinely undervalued during normal market conditions (this can occur for many reasons)

2 – the market as a whole declines reducing the price of all stocks (e.g. during the GFC).

In the second scenario the by-product of MOS is to assist us timing the market. Obviously, MOS cannot tell us the top or the bottom of the market but when the stocks decline across the board a juicy MOS would only develop closer to the bottom. “It’s about being approximately right, rather than absolutely wrong”.

Brad J

:

Hi llya,

Great idea in theory but extremely hard in practice. My experience is that the wealthiest investors don’t try to time markets. They do take advantage though of lower prices. Time is the friend of the wonderful business and if you stay with a good business it will reward you.

jeff

:

Loving all this talk about being value investors and not worrying about the market fall, waiting for the correct time to buy etc..it is a comfort. Just wondering… Is there any validity in selling out at “high” levels when it is becoming apparent that Mr Market is becoming irrational, and buying back in to the same stock when he is totally irrational and the price is much lower?

Obviosuly the risk is Mr Market gets over his irrational behaviour sooner rather than later, and the price rises more quickly than expected, but it does provide food for thought.

I would be interested in graduates comments

jeff

Ron shamgar

:

Jeff, I wrote about this under the when to sell post several weeks ago.

Andrew

:

It can be Jeff. One reason for selling, at least for me is that i have been offered a price that is too good to refuse. I have done the exact thing you are talking about with JBH a few times as it was suffering irrational swings from low $8 to high $14 in very short time frames. It was the closest i ever came to being a trader. However now i look back at that and i actually see a missed opportunity and displeased with my actions.

Had i known a bit more and read value.able i would have held as i would have been able to work out the value was around $20 and instead of selling i would have bought more and been able to make a bigger profit but the principle worked for me and i made some good profit.

Brad J

:

Is the AUD a good reason for MCE and FGE to be sold off by 10 to 15% or more?

My answer –

Just Mr Market behaving irrationally. A lot of people are getting scared and are cashing out, which has nothing to do with the business. In the mean time MCE and FGE are having trouble keeping up with all the orders they are getting. Profits are increasing at an alarming rate and this is creating a buying opportunity. MCE will also have huge cost benifits from their new facility which could offset the increase in the AUD.

Prices could rebound strongly, stay the same or go down further. What matters is what will these companies will be worth in a few years time. My personal opinion is a lot more.

We are buying part of businesses and should not be distracted by market movements. If we get distracted by price movements we will behave irrationally and this will cost us all enormously in the long run.

I personally hope the prices go down much more so I can increase my holdings. There is no way I will sell at bargain prices.

Time is the friend of the wonderful business. Oroton dropped by 50% in 2009 to $2 and Coke dropped by 50% in the early 19th century and you would have still done extremely well if you had held on and not sold, even if paying the high price before they dropped. You would certainly be a lot richer than the many sellers who sold as the price was dropping.

Do Warren Buffett, Jim Rogers and Roger Montgomery sell when prices of their holdings go down. No they buy more and take advantage of lower prices. We now need to work out if we want to be part of the herd or act as business owners.

Paul Rehill

:

Hi Brad

We’ll have to wait for FGE’s full year results to make sure its earning power is intact. FGE is on an international search for a new Managing Director with engineering and/or construction experience. I think Clough instigated this. Clough seems like an ordinary business so their interference in FGE could be a risk to Forge’s future earning power.

Brad J

:

Hi Paul,

In my opinion highly unlikely to affect their earning power. Not impossible but unlikely. Probably just another opportunity to buy their shares at lower prices.

Steve I

:

Well said Brad!

Ron shamgar

:

One thing to keep in mind when investing in the mining services companies are labour costs. The unions are flexing their muscles and this will put huge costs on the contractors to absorb. You will start noticing this in the next 12 months or so. Watch this space.

Callan

:

Ron, i agree and labour and materials have been increasingly becoming more difficult. If the demand remains high for the Good mining service companies. Do you think it is out of the question for Mining service companies to pass on the additional cost?

Also could the shortage of staff and equipment be a deterrent for new competitors?

zoran

:

Hi Ron

You heard it here first.

After NEXT RESULTS MCE’s IV will be $11.01 for 2012 and $ 13.26 for 2013.

Buy more now ( $ 7.60)before its too late.

Cheers

Zoran

Paul Rehill

:

Hi Zoran

James Montier makes a good point about value investors jumping in too early (about 2 months I think) when Mr Market does his thing. With some patience, the discount to IV could be greater for MCE, especially with excess stock floating around from the placements. Perhaps some institutions are selling down. Acorn Capital recently reduced its substantial shareholding. How about a buyers’ strike for a greater discount to IV?

Roger Montgomery

:

H Paul, You might like to check that with a lawyer familiar with the Corps Act before suggesting again!

Paul Rehill

:

Sorry, I forgot my ;).

Joab Soh

:

All,

First of all, the graphs looks fantastic. It’s a visual explanation of what we do. Once again a timely post to remind us that in the long run price follows value.

Seems like Mr Market is abit concern over currency movements which may have affected some of us. Here’s a story for you.

During the GFC, market volatility was very similar (if not worse). In a company where commodities and currency prices has a direct impact to earnings, the company has a team of financial risk managers who has a long track record and reputation of making sound risk management decisions. However, some senior management became more interested about getting updates on where market prices are today rather than whether the company is making more sales. Because of such focus by senior management, everyone down the chain got distracted. So much so that operations team spends time worrying about how today’s currency rates are impacting their sales. And no one was concern about sales volume and no one was focusing on how the company should strategically respond in the long run. As a value investor, what would your view of management be?

As much as these are distractions to management, they are distraction to us as investors.

As owners of great businesses, I would very much rather management focus on operations and its growth strategy rather than what currency are doing tomorrow. At worst, even if currency is having a negative impact to earnings this year, great companies will be determined enough to find a solution for the future. And for us, it’s another opportunity to buy great businesses and a cheap price.

Tim

:

Hi graduates,

some A1’s/A2’s and B1’s/B2’s that Roger has mentioned before on Switzer I think are FGE,MCE,CDA,TSM,ZGL and VOC.

Interested in other graduates thoughts on these companies and how current IV and 2012 IV compare.

I appreciate the knowledge shared here!

Cheers,

Tim.

Greg Mc

:

Now you all know I’m not one to piff a grenade into a pavlova shop, given the recent opinions expressed regarding gold, but…..

Excerpts from tonight’s Eureka report, from Michael Feller:

“The world is full of problems, including economic imbalances in China, unrest in the Middle East, climate change and a looming shortage of food and arable land. Yet at $US1500 an ounce, safety through gold comes at a price too dear. Unlike assets such as oil, food and fertiliser, the only thing gold insures you against is the straw man of US currency default”

“Yet for many the move only underscored a suspicion that investment in gold is now being dominated by the same shrill and irrational voices that urge it on.”

“And while Bass was correct about US subprime, his more recent investment ideas – including comparing America to Zimbabwe – has become increasingly unhinged. So too the commentary from other prominent gold bugs such as Marc Faber and Max Keiser, now on TV even more regularly thanks to bullion’s record levels. But while the personal ratings of these gurus are soaring, their forward arguments stink.”

and to top it off:

“I’ve been a fan of precious metals until recently, but now with tinfoil hats from Texas carrying the trade, I can’t stay enthusiastic. Much like Australian property (see Property boom’s Chinese foundations), gold and silver have been hijacked by a morass of highly emotional investors and pundits. There are better ways to be a bear, and that’s in oil and food. Leave gold and silver for the fools.”

Strong opinions expressed there. My personal opinion is that someone will be very right and someone will be very wrong, I’m just not certain enough who – and so I will retreat to my comfortable position on the fence.

Roger Montgomery

:

fortunately I own oil too.

darrin

:

HI Greg

Great to have another view of everything. I must say I have been looking at the precious metals to go long. Never thought about other areas. What would be your best ones for oil and food?

cheers

darrin

Steve I

:

Greg,

I’d just like to point out that those comments from Michael are very emotional and say more about his psychology than anything else. It does not present any real information.

Brad J

:

Hi Greg,

I am like you as I just don’t fully understand gold, so I will stay out. Even Jim Rogers would prefer at present to buy food commodities like rice, soy beans and cotton. I understand these as I can see there will be shortages and prices are likely to go up. A lot of investors here on the blog are arguing it is a inflation hedge. But if you think about it if we are in a long term commodity bull market then the Aussie dollar will act as an inflation hedge. Not to say gold won’t go up, but I wouldn’t touch it.

Andrew

:

Another thing i thought i would add to help show either my ignorance or what i prefer to call my hesitation about owning gold is that rice and soy beans have a disticnct use which means i can see there will be a need for it. I am still yet to see a really good use for gold. Inflation hedge or currency at the end of the day i don’t really think there is much of a purpose for it.

Ron shamgar

:

Don’t forget the weather guys! One good year and crops aplenty…..

Too bad gold doesn’t grow on trees.

Brad J

:

Hi Ron,

A couple of good years and hopefully we will be able to keep up with the rapidly growing demand. Highly unlikely in the long run I would imagine.

kostas

:

Hi all.Watching the price of MCE drop .Is it caused from the capitol raising or from the US dollar?Time to buy more or has something changed?

Ash Little

:

Hi Kostas,

I posted a few days ago that the company has said in the past that $a higher the $us will have an impact.

As it is my biggest holding I have no need to add ATM and will wait the June accounts

Just my view

Michael

:

When the MCE share price was rising, I couldn’t get anyone to agree with me that the AUD/USD rate would be a threat. I see the rate as a threat to anyone that has 80% of its sales in USD.

Now the share price is declining, there is some caution creeping in. This is the opposite reaction of a value investor. Value investing can be easy to understand, but hard to implement.

Steve I

:

What will matter most will be their ability to increase prices on the back of a declining USD. A high oil price should allow this to happen I would imagine.

Peter M (Mully)

:

In relation to Coke, Buffet apparently once said something to the effect of “mirror mirror on the wall, how much can Coke charge this fall?” and the mirror said “more”. Hopefully, Aaron Begley would get the same response :)

Sin G

:

Thats a good question, only if we all knew the answer as to what the market will decide over the next few days or weeks but we dont. One thing I have learnt over the past 12 months or so is to do your own research and valuations and make decisions based on your findings.

I use to ask others how much should I pay, when should I buy, or should I sell, and then tell myself I should have bought on what I read a week ago. The best thing I did was to start making my own decisions which allowed me to gain confidence within myself. This has paid off imensely as I cant blame anybody else for my mistakes making me take responsibility for my own decisions. This has made me a more astute investor.

However I cant stress the thanks to Roger and this blog for the turn around as this site offers great insights and helps with my decision making.

ron shamgar

:

hi,

i hope everyone here has followed my advice and not participated in the MCE SPP offer. you can buy these shares today at less than $8.

good thing we’re only simple unsophisticated retail investors! :-)

darrin wong

:

HI Ron

Are they still a good buy and under $8?

cheers

darrin

Ash Little

:

LOL Ron,

Lots of people must have followed your advise because I got a call from Austock tonight asking if I would participate in the SPP.

As the underwritter they must be getting sweaty.

Peter M (Mully)

:

Hi Ash,

If my memory serves me correctly, the SPP component isn’t underwritten. At the risk of sounding cynical, I can’t help but wonder how the share might have performed had it been underwritten.

Ash Little

:

You are right Mully, it is no underwritten.

I would imagine any shortfall will be placed with the insto’s at a nice discount

Tim Phelps

:

Really Ash? Wow, that’s surprising, I think most of us here were expecting the purchase plan to be well and truly oversubscribed, unless I missed something!

I owned MCE before the capital raising and I got in again last week at $8.40 thinking I was very clever for getting a better price than in the placement…….. then Mr Market decided to have an even bigger mood swing than I’d anticipated!

Greg Mc

:

If you’re lucky Tim, it might drop another dollar or two and you can add a few more.

Brad J

:

Stay with it Tim and the chances are you will be rewarded. Buying at $8.40 was a good move if you have a long term view.

Tim Phelps

:

Absolutely, Brad. Having a long term view really does make you feel better about it, and I have to thank Roger for introducing me to the value investing concept. I think trying to anticipate Mr Market would send you absolutely mental if you spent too long at it!

darrin

:

HI Ron

What is your IV for MCE?

cheers

darrin

Ron shamgar

:

Check out roger’s valueline portfolio. MCE IV is listed there. You should go with that or preferably try and work it out urself. If ur not sure, post ur figures here and I’ll be happy to provide feedback. Cheers.

darrin

:

HI Ron

I am on it.

10.21 but it was valued last in Feb 2011. Don’t know the USD rate at that time.

cheers

darrin

Greg Mc

:

Not to mention the current capital raising, darrin. Having said that, I feel that Roger’s valuation at the time was conservative.

Christopher

:

Hi Ron,

I was happy to buy at $8.50, and I am now even happier to buy again at $8.

I certainly won’t be complaining about being given another opportunity by Mr Market.

darrin wong

:

HI Chris

What is your IV for MCE and ROE?

cheers

darrin

Christopher

:

Hi Darrin,

Depends which forecasts you use.

For 2012, around $8.80 for MCE, and around $8.50 for FGE

darrin

:

Hi Chris

With FGE at 5.92 yesterday and MCE at $8.00.

Is the MOS greater enough for us to jump in yet?

cheers

darrin

Christopher

:

Hi Darrin,

I am very comfortable with a MOS of that size.

There are still a few things to consider, such as the high Australian dollar (in the case of MCE anyway) which as Ash says could have a double digit % effect on profits. MCE have hedging of A$0.88 for US$1.00, and as far as I know this is in place til towards the end of FY12. They won’t get such a good deal next time. I am aware of a couple of analysts who have been lowering their profit forecasts purely for this reason.

You might also want to consider if we are in for a bit of a bear run, giving us much lower prices across the board. I’m terrible at predicting the direction of the market and so I generally ignore it.

Ian

:

I am also not good at predicting the short term direction of the market but somone is selling MCE and it is dropping on reasonable daily volumes.

Around $7 would seem to me to be a nice opportunity to buy if Mr Market gives the offer.

In the meantime I will be patient and just watch. I don’t see any point in rushing in at the moment when the direction of MCE and the market seems to be down.

The market overshoots upside and downside in the short term and you never know where the short term top or bottom is until after it has happened but there can be nice surprises for the patient.

Greg Mc

:

Good stuff Christopher. I think that with the rising dollar and falling MCE share price there has been a shortening of the focus, even on this blog. Keep the big picture in mind. I expect that I’ll still be holding MCE in 2-3 years time, at least. The effect of the recent rise in the AUD and its effect on the full year MCE results is largely irrelevant to me – My timeframe is longer than that. The space the company is in and the improvements in efficiency are far more important IMO than the exchange rate.

MCE close to $7 is a gift in my mind to anyone with more that a 3 month outlook.

Ron shamgar

:

Hi christopher, that’s great. In investing, I have learnt that u need to be happy with the decisions u make. Good luck.

Peter A

:

Has anyone else received a call asking their intentions re: the Matrix Share Purchase Plan?

I was called tonight, supposedly from the selling broker (Austock). I told him I was planning to purchase on market, and he said that he understood.

Sounds like they’re (understandably) having a bit of trouble getting takers at the moment. Will be interesting to see if others receive the call. Since my surname starts with A, I may have been amongst the first.

Peter A

Roger Montgomery

:

I wonder whether the terms allow a repricing? Will have to have a look tomorrow…

Ron shamgar

:

Hi Roger,

If u can put in a call to Aaron and ask if he can reprice it at $7, I’m sure the SPP will be oversubscribed just from this blog!

Cheers

Adam W

:

Clause 11 of the terms and conditions state that ‘MCE may change, suspend or terminate the SPP or these Terms and Conditions at any time whether becuase of … any other circimstance relevant to the SPP or MCE.’ The issue price is set out in clause 4, so arguably clause 11 allows the issue price of the SPP to be amended.

Adam W

Brad J

:

I would be very surprised if the share price fell a lot below $7 as this is where the next major resistance level is for traders. If they lower the SPP it will probably be a further catalyst to drive the share price down lower, so I have a feeling they won’t. Soon the traders will be out and the investors will be left. If we concentrate on the business it will reward us in the long term.

Steve

:

Many seem to ignore Ben Graham’s discussions and thoughts regarding intelligent speculation. This is the only way I can see how value investors can hold gold. It earns nothings so how can it be valued? According to Roger’s five sell criteria, because it has no intrinsic value or performance criteria, you can only use “sell if there is a better opportunity”. But how do you know when to sell if you don’t know what it is worth as opposed to alternative investment?

If someone can tell me its current intrinsic value, then I can set a price at which to purchase some.

In addition to this, I am also unable to reconcile those value investors who proffer that they “ignore the market/macro issues”. So why are you buying gold?

However those who gold might be right but for the wrong reasons.The following argument is based more on Graham’s intelligent speculation rather than outright value investing.

Gold may rise simply because of “true” supply-demand shortages but not because of money printing and inflation concerns (See Paul De Grauwe and Magdalena Polan “Is Inflation Always and Everywhere a Monetary Phenomenon). In brief, the study shows that money printing is not an inflationary problem for those economies where inflation is below 10%.

I believe we need to think differently about commodities. We tend to think they are all the same. But they are not.

China’s growth and the pressure it places on resources in not an issue of future population but current population. For all the talk of China, there are still 800 million poor Chinese in comparison to the “wealthy” 400 million. China already uses approximately 50% of all minerals so imagine how much is required to bring the “other” 800 million up to the same standard of living. Then add to this India, Indonesia, South America and the Middle East and if you think that we have enough of ALL commodities then you need to do some sums.

There are only 2 metals that have sufficient supply – that is aluminum and iron ore. All the others are in a shortage, will be for some time and may be insufficient to sustain a global population of 7 billion or higher. Indeed, the growth of the emerging markets may actually reveal that there is not enough to go around full stop. For example, there is enough lithium globally (per capita) for each person to have one iPhone. That’s it, no iPad, no electric batteries etc.

Rare earths and other rare metals (such as zirconium, tantalum dysprosium and others) are critical metals for a range of products. So in order to build a wind generator you need a certain quantity of specific rare earth metals. So if you wish to build a wind generator, you may have enough iron ore but without the essential rare earth like dysprosium you can not build wind generators. It’s like building a car and then finding that there is no materials for the steering wheel – no steering wheel, no car. This is the critical factor that those who believe there are enough resources miss. Iron ore – yes, rare earths and other technology metals (including gold and silver) – no.

The issue is also one of economics – the economics of scarcity not abundance. Imagine you want oil. You can choose between 20 separate little scattered buckets holding 1 litre which must each have a well, etc or one big bucket which holds the same amount (20 litres). The big one is more economic and extraction from the 20 may be feasible if oil is $400 a barrel.

So we will need to consider how these strategic metals are allocated between competing uses. Imagine choosing between using 1000 tonnes of a rare metal to produce 1000 solar or wind generators which will supply energy to 1 million people. But this same amount will also build one nuclear generator that supply clean energy for 10 million. There are only 2 ways that I can see to determine who gets what – government regulation or the price mechanism. Who decides?

In all my investment I try to avoid confirmation bias, so I spend considerable time looking for facts and figures which will refute my concerns and research about the limited amount of resources. I am yet to find a logical argument based on facts, figures and rigorous analysis rather than speculations about productivity or population numbers or history.

So we need to think in terms of supply and demand of each individual commodity, not as a big bunch. Because not all commodities are the same, then Gratham may well be right – this time it MAY be different.

A crash in China sometime in the future leaves Australian investors panicking and selling everything associated with resources. However if my argument above is solid, the deeper fundamentals (which reflect a true resource shortage based on actual supply/demand numbers, not speculation about inflation and money printing) will quickly show that resource prices are/were functioning on supply/demand characteristics (think oil since 2008) and not money printing or inflation hedges.

So if one does the appropriate amount of research then Ben Graham’s intelligent speculation philosophy and methodology can be applied and those who profess to be value investors can then apply the other genius’s great philosophy – be greedy when others are fearful.

Steve I

:

Steve,

Your thoughts are very thorough but I’m not sure what point you are trying to convey.

You say that you always try to avoid confirmation bias but it also depends on the facts that you are using for inputs. Statistics can be altered significantly to achieve a desired outcome. Case in point: you mention that monetary inflation is not a problem below 10%. US inflation is currently over 10% as measured by the traditional method and tracked by Shadowstats. The current CPI is less due to hedonics, geometric weighting and substition, with the headline around 6%.

This sort of inflation is not a problem until it is a problem. You can’t just ‘fix’ inflation when it is moving towards hyperinflation. In the past, when governments have annual deficits over 40% and they start monetising debt, which they are, it leads to hyperinflation. The delay in this case is reserve currency status, but this is only a delay.

I have no problem with your comments about supply/demand and they have a lot of merit. However your comments about money printing are, to be frank, naieve. To say that gold won’t rise due to money printing is just plain wrong. This is the exact reason why AUD is currently rising against USD. If gold is money and there are no alternative safe havens (ultimately) at this point in time, then there will be massive adjustments. Try and think about supply/demand mechanics when you have a significant increase in supply of paper money, the demand of alternative stores of wealth will inevitably increase.

Ash Little

:

Hi Steve & Steve,

I largey agree with the second steve. But the first steve makes come good points about supply and demand for commodities.

The mistake I made in the past was to view gold as a commodity. It may have been at some stages in the past but the truth is it is a currency.

Once I viewed gold as a currency not a commodity I had a lightbulb moment.

Steve I makes a good point. It is not really $A strength but the weakness of all the other major currencies who are printing money and making their currency worth less.

My personal view for what it is worth is that there is no way the S&P500 or world commodities would have reached the level they have without QE2

yavuz

:

A couple of small corrections to first Steve’s comments:

In the list of elements Steve provided only Dysprosium is rare earth, others are not. Rare earths are not so rare as their name suggest. Lithium is also not a must for batteries, etc… There are substitute elements for all. They all become more cost effective to use at some price point. Also China’s intensity of metal usage is not as high as it was in today’s major industrialized countries, such as USA, Japan, Germany, England. Also there is one issue people may forget when discussing gold. Marginal cost of production has risen significantly, industry cost curve has shifted to the right (more expensive) in the last decade or so. There are not many large producers producing at a cash cost of $300 or $400 or even $600. Add to amortisation , depreciation, rehab, closure, costs, total cost of production goes up significantly higher. This may not help if the price of gold should or should not go up but it needs to be taken into account in the supply-demand equation, in the long run.

Yavuz

Steve

:

Steve I,

I stated the study’s finding to show that there is credible evidence that money printing does not lead to inflation. If you are able to get the paper it may be worth a read. In addition to that, you may want to have a look at Richard Koo’s Balance Sheet Recession regarding Japan. Both provide counter evidence.

I need someone to explain that when the private sector banks print money (pre 2007) there was little inflation or concerns but when governments print everyone goes off about inflation.

I can not see any hyperinflation on the horizon but happy to consider it if there is solid evidence available.

Gold may well be rising because of a true supply/demand characteristics, but I see a lot of people simply stating that we are going to have inflation so therefore buy gold. That’s not value investing in my book, that is speculation – you may be correct but it is speculation none the less.

Gold’s rise looks a lot like irrational exuberance. Here is an excerpt from Howard Marks, from Oaktree Capital – a value fund manager:

“I’ve said it many times: no asset can be considered a good idea (or a bad idea) without reference to its price. How can we evaluate whether the price of gold is right?

As with oil, you can list gold’s attractions as enumerated on page two. But how do you turn them into a price? And don’t you have to be able to turn them into a price in order to invest intelligently? Consider this conversation:

Howard: How do you feel about gold here at $1,400 an ounce?

Gold bug: Great. I ’m sure it will hold its value from here and keep up with inflation

Howard: Would you be equally sure if it were $2,000?

Gold bug: A little less, but yes.

Howard: At $5,000?

Gold bug: That’s a tough one.

Howard: And at $10,000?

Gold bug: No; there it would be ahead of itself.

Howard: So the price of gold matters?

Gold bug: Sure. Howard: Then how can you be sure it’s fairly priced at $1,400?

Gold bug: Hmm . . . . .

The point is, in investing, price has to matter. Nothing can be a good buy solely on the basis of its attributes alone, without considering the value they give rise to and the

relationship of price to that value. And there’s no quantifiable value against which to compare price in the case of gold. There; that’s it. Either you agree with those statements or you don’t.”

Yavuz – I have heard this point about rare earths several times and it has also being mentioned by Roger – rare earths are not rare. But please consider this: to mine a resource you need a sufficient amount in one place to make it economic. You need to first find it, have water and other infrastructure, separate and refine all the different types of rare earths and then process it to the client requirements. That is my point about oil – yes it may well be everywhere but that is the problem. Some rare earths (Heavy rare earths) and rare metals are not in sufficient quantities to allow economies of scale mining.

Please provide a list of substitutes for these elements. When China withheld supply from Japan, he Japanese stated that they were working on substitutes to rare earths. Let’s observe their actions after this. They took a $350million stake in Lynas securing an 8 year supply – 8 years …….does not sound like the substitutes are here soon.They have taken various other stakes in other countries as well.Then the Japanese government announced a very serious recycling program for rare earths. Substitution here soon?

In addition to that, why is the price of rare earths skyrocketing (if you argue it’s a bubble then the rise in the gold price must be “frothy”); why are acknowledged experts stating that there is a supply shortage until at least 2015; why has China stated that they will start importing these materials themselves after 2015 if they provide 95% of current production? Could it be because there is not enough to go around?

Ash – what should the price of oil be if there was no QE2? Was $140 prior to the GFC/pre QE2 about shortages because there was no QE! or 2 then?

Many here supported Jim Rogers regarding his statements about commodities.

My argument is that what people may believe is that commodity prices are a result of money printing and inflationary expectations. You may want to consider that it could also be simply a supply/demand dynamic – just what Gratham (and Rogers) are saying.

Steve I

:

Steve,

You really need to change your way of thinking about currencies 180 degrees.

You mention the price of gold and focus on this side when the whole story is not the value of gold, but the value of the currency used to purchase it. Therefore, it is not exuberance of gold, but the realization that the currency used to purchase has little value. Therefore the theorical price of gold (in paper currency terms) is infinite and the theoretical price of fiat currency is zero.

Don’t look at Japan. It has different characteristics (historical high savings, positive terms of trade, goby debt funded via citizens etc). Look at Weimar Germany, look at France, particularly south America. Hyperinflation is associated with unsustainable government deficits, debt monetization and credit expansions. We have had a massive credit expansion via the fractional reserve banking system. By itself it is not always a inflation problem as without government intervention it also has an equal and opposite amount of credit destruction (eg great depression).

Remember, gold is currency, not a commodity. There is no fair price, it is all about relativity. We have a massive amount of paper money and derivatives and a very small gold market. Consider that supply demand dynamic.

You are on the right about rare earths but you should, in my opinion, improve your understanding about monetary systems as you have some wrong fundamental premises that cloud your thinking. A lot of people have different views on this matter so you need to have a strong BS filter and ultimately some people will never agree. Some people don’t think there is a problem until it hits (gfc), but others can and do see the writing on the wall.

Paul Rehill

:

Hi Steve I

Out of interest, can you share how you have exposure to gold and oil, when you entered those positions (market timing), your holding position time horizon and if there are key indicators that you monitor that would trigger closing your exposure?

Thanks Paul

Steve I

:

Hi Paul,

Gold: MML RMS FML (aug/sept 2010)

Oil: HOG (March & May 2011) & MCE (sept 2010)

I’ve managed my positions somewhat, so have been a little bit active depending on the value I’ve seen.

I only want to invest via stocks (no futures etc) as I want to have leverage via profitable companies with no debt that are increasing output and I can apply the value investment framework. I didn’t start earlier as I didn’t have the ‘light-bulb’ moment until last year. However I continue to devour as much information as I can digest.

Time frame is approximately 3-5 years, however i may increase or decrease exposure during this time. If things go too well, I’ll look to gradually de-risk.

Key indicators that ill watch are not necessarily price. The primary motivation will be the resolution of the issues that we face – ie removal of excessive inflation via significantly positive real interest, sound fiscal policies world-wide and a change to the monetary system. With regards to the oil side of it, I see it fitting in during the same period and will probably continue to be an issue for longer than gold as there are supply demand issues when it comes to cheap fuel.

Paul Rehill

:

The World Bank seems to have revamped their commodity price data that you might find useful to match your thinking to past events and their impact on prices. You can access monthly, quarterly or annual price data and download it as an Excel file through the Databank link on:

http://data.worldbank.org/data-catalog/commodity-price-data

Steve I

:

Paul,

This sort of transition is completely different, in my opinion, to events that have transpired between 1960 and 2011 (the data series). I don’t think we have ever experienced a world reserve fiat currency losing its status combined with worldwide inflation.

yavuz

:

Steve,

On Lithium; depending on who you listen to, there is (or will be) either shortage or excess of supply. Obviously substitutes will not come into effect until such time price of the metal in question becomes too prohibitive to use for a specific application. I am not going to provide a list of substitutes for every application of these metals as it does not nake sense to discuss in generalized terms. However I will give some examples. For example for there is plenty of Lithium to go around for laptops, ipods, etc.. The real excitement around for Lithium is for electric car batteries, because this is where it will be used mostly. Alternatives to LiMH batteries are Sodium Nickel Chloride batteries or Zinc-Air batteries. There is a lot of Zn & Ni to go around for this application, if we ever run out of Lithium. On rare earths; users will consider every alternative to ease shortage, if there one. There are two important projects, that I know of, at the study phase currently with the objective to start production in a short time frame. One is the Nolans project of Arafura Resources. Second is Kvanefjeld project of Greenland Minerals And Energy Ltd. Kvanefjeld project has been known for very long time, however because of pricing and supply/ demand issues, it has not been progressed to project stage so far. It is now; with plans to process 7.2 million tons per annum of ore. Then there is Mountain Pass rare earth’s plant (of Molycorp) project that was shut down prior to the current crisis. This plant is also being brought back into production as we speak. Then consider also antother rare earths projects that will be brought into investors attention via an IPO this month (Kimberley rare Earths). As you can see all of these projects are at different phases (some advanced, some exploration). I am sure higher a price signal will speed up all these projects, just like the wave of iron ore projects around the world now.

Yavuz

Steve I

:

Steve,

Check the deflation or hyperinflation viewpoints expressed by FOFOA.

Simon Anthony

:

FGE down 15% over last 3 weeks! Interested if any Value.able graduates have re-purchased FGE as a result of this recent Mr Market mania?

Roger Montgomery

:

Buy stocks like you buy groceries not diamonds….But pay in Aussie dollars not US ones!

Jonesy

:

Exactly. I’m a real hoarder when it comes to specials at Coles / Woolies and this is the mentality we should use when it comes to slices of great businesses we own as well. The only difference is that you don’t tend to break out in a sweat or get butterflies in your stomach when you hit the “Buy” button on 6 tubes of toothpaste or 2 dozen cans of cat food…

Simon Anthony

:

Agreed! However I may put some of these FGE shares on lay-by for now and pay at the end of the month :)

Ash Little

:

Haven’t you heard Roger,

Bin Laden is dead and they are celebrating in the streets in America.

The US dollar is rallying and the press reports that the US will return to it’s former glory.

BTW I also believe in the tooth fairy.

darrin wong

:

HI Ash

When do we jump into FGE?

I can’t find out any reason why it is been sold off.

cheers

darrin

Ash Little

:

Hi Darrin,

This is a very hard question to answer because I don’t need to jump into FGE because I allready hold.

It is starting to be of interest to me again but I can’t recommend it to you because I don;t know your presonal cercumstances

Hope this helps

darrin

:

HI Ash

I hold no FGE at the moment but would like to based on my research for 2012, 2013. Question is how do I know when to buy?

cheers

darrin

ron shamgar

:

i suggest you go back and read roger’s book. the answers are all there. no one here will tell you to buy anything. if you believe FGE has excellent prospects and is trading at a large enough MOS, than maybe you should buy. i hope that helps. cheers.

darrin wong

:

HI Ron

Sounds good. I will re read Rogers Book.

thanks

cheers

darrin

Rob

:

Darrin,

Only you can answer that. It’s your level of comfort, your MOS and your portfolio. None can do it for you.

As Ron says reread Roger’s book, do your research and with practise the decision will come more easily.

Cheers

Rob

Rob

:

“None” should be “Noone”.

Hey Roger I have a request of your IT guys. can they allow you to edit your own posts before they are moderated?

Roger Montgomery

:

Good one Rob. I’ll ask my team to add it to the list.

darrin wong

:

HI Rob

That is true am I able to sleep at night from my decisions.

Rereading rogers book over and over.

Thanks

cheers

darrin

Steve I

:

Also interesting to hear that he is already burried out to sea. I thought this a bit odd. The US dollar safe haven story will probably be tried, but will be very weak I think.

Jeff Burnett

:

they buried him at sea so that his grave would not become a shrine…….that is, a place of pilgrimage for terrorists!

jeff

Rob

:

Listened to ABC tonight. Expert said burying @ sea was best thing to do to prevent a shrine or mausoleum being built around his remains and being an ongoing focus for his followers. I guess like Lenin etc.

darrin

:

HI Simon

I have been watching FGE the past few weeks. I don’t know why there is a sell off.

haven’t decided whether to jump in yet or not.

Patience is very difficult card to hold all of the time when facing Mr Market offers.

cheers

darrin

Steve I

:

Darrin,

FGE is not unique in the case of this sell-off. Therefore consider whether Mr Market is being silly or knows something that you don’t.

Simon Anthony

:

If FGE falls to $5.50 then I’ll grab my pole for a little bit of bottom fishing!

Ron shamgar

:

It’s been a bit quiet on the contract winning front lately…plus markets are a bit jittery at the moment. Maybe an opportunity soon.

Greg Mc

:

G’day Simon,

I already have a fair few of these bought between 2.47 and 4.95. I’m interested in their decline but I think I will wait and see for a bit longer. I think there is a reasonable MOS now, mind you, but as it is already one of my larger holdings, I’m not inclined to add to it unless things start getting really silly.

Simon Anthony

:

It’s a bit like shooting fish in a barrel, once your MOS gets out beyond 45%, so what do I recommend bring along a extra gun and extra ammo!

Steve I

:

Simon,

I actually exited FGE a little while back due to my personal concerns about rising input costs (such as fuel etc) which I think could risk reduced margins and i therefore saw value in other areas. However, this probably won’t be noticed yet and is something to consider when forecasting IV for future years.

ken fraser

:

Simon, I am fully invested unfortunately. The argument to always keep a certain percentage of cash available is sensible but I find it hard to do when I see opportunities available at discounts to IV. My last buy price for FGE was $6.30 and I have already committed to the spp of MCE. When a share purchase plan is offered we should always wait until the closing days before committing to take up the allocation. This is a good lesson.

Tony C

:

HI Ken

All we need is for 400 other people to have put there Cheque in the post straight away and MCE could announce the spp was overscribed. My dad did the same ohh well hes read the book done the numbers hes not worried

ken fraser

:

Tony, Great, thanks.

Stephen

:

Hi Simon,

Yep, I stepped in today and purchased another packet of Forge shares.

At $5.79 they were trading at a MOS of about 22% to my forecast 2011 IV.

They may drop again tomorrow but I’m not fussed if they do.

Greg Mitchell

:

Hi Roger,

Having recently finished your book, I Just want to thank you for opening my eyes to a methodology for valuing shares, for the interesting views provided in the blog and for the homework as it has helped me put the theory in to practice.

Look forward to seeing the homework results.

Regards

Greg

Roger Montgomery

:

Thanks Greg. Delighted it has changed your view.

frank h

:

Hi Roger, I am in a slight quandary on how to value mining stocks with this $A being so high .after reading valuable which i found very informative ,i couldn’t find a reference.Since most the stocks i own were bought before buying the book so i am fine there .I only hold one mining stock since i find them mostly overvalued and unpredictable plus earn nothing.I bought RMS at $1.05 ,at the time i thought may have been a good price,but now i am not quite so sure watching them lose roughly 25p.c.in 2 weeks,with this $A cont. to go higher i suspect they will come down more.Any insight would be appreciated,as i am tempted to buy more. Kind Regards,Frank

Roger Montgomery

:

Hi Frank,

There are some highly qualified resource company investors right hear reading this blog. Pop your stocks up and other investors will give you their thoughts (but never advice).

Jonesy

:

That’s Market for you again. A couple of weeks back you’re “pretty sure” your valuation is good. However, add a few days of market pessimism and it becomes infectious with you now questioning your previous judgement. What is important to remember here is that the value if the company may not have changed but due to a number of factors, which all transpire to make other owners of the business more depressed, they are willing to sell you their stake for less than what it’s worth. Luckily these are the same people who will buy your shares off you when the share price has rallied over intrinsic value and they feel “safe” getting back into the market. Gotta love emotions, but without them we’d all be like Mr Spock (who I consider would have given Warren Buffet a run for his money)

Greg Mc

:

You’ve just produced a fair chunk of truth there, Jonesy.

Steve I

:

Frank,

I think you need to settle down a bit and stop worrying about price. One of the great benefits of being a value investor means that we don’t need to panic when price changes, as long as we constantly think about value.

Now, has the value changed? Your concern is with regards to the AUD being high. Well, its actually mostly just high against the USD, which is going to die a slow death. It also won’t be in a straight line and it is also relative to all fiat currencies. The Euro has also been strong relative to the USD in recent periods, just not as strong as the AUD.