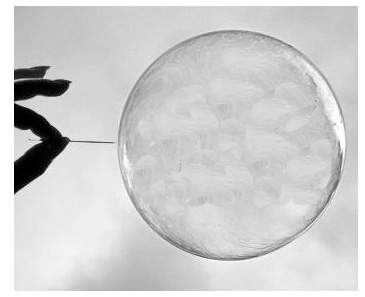

Are we in bubble territory?

Less than an hour ago, Microsoft Corp. agreed to buy the Internet telephone company Skype SA for $8.5 billion. The company was started by Niklas Zennstrom (who remained CEO until September 2007) and Janus Friis (one of Time Magazine’s 100 Most Influential People 2006) in 2002 and they sold it to eBay in 2005 for $3.1 billion.

Less than an hour ago, Microsoft Corp. agreed to buy the Internet telephone company Skype SA for $8.5 billion. The company was started by Niklas Zennstrom (who remained CEO until September 2007) and Janus Friis (one of Time Magazine’s 100 Most Influential People 2006) in 2002 and they sold it to eBay in 2005 for $3.1 billion.

eBay bought Skype in 2005 for $3.1 billion and sold 70% to private equity for $2 billion in late 2009. Up until yesterday, it was owned by private equity, the Canadian Pension Plan Investment Board and eBay. Now Microsoft is buying the company for three times what private equity paid —an increase in value of more than $5.5 billion in about 18 months. Skype’s original founders also ended up in the syndicate through their company Joltid.

It is the biggest deal in Microsoft’s history. Some of that 36-year history includes a friendship between former CEO Bill Gates and Warren Buffett. One wonders if Warren was consulted because the initial metrics are staggering. Some may argue the high price is because Microsoft was competing against an imminent IPO. With more than $50 billion in cash (much held offshore for tax purposes), Microsoft merely needs to beat the aggregate cash return, which in the US is somewhere just north of zero.

Skype’s ‘customers’ made 207 billion minutes of voice and video calls last year – up 150% on 18 months ago. Most of those calls however are free. Less than 9 million customers per month, or a little more than five percent, paid Skype anything.

The company did produce revenue of $860 million last year, but Skype lost $7 million. $8.5 billion is quite staggering. I think Skype is great and I know many who use it to avoid paying anyone for phone and video calls.

You may recall Microsoft has previously bid $47.5 billion for Yahoo Inc. Yahoo rejected Microsoft’s advances and Microsft dodged a bullet; Yahoo is now available at half the price.

Perhaps we are not in bubble territory? Perhaps it all works out? Perhaps its just a repeat of Foster’s purchase of Southcorp – on a much grander scale? Or perhaps Microsoft will start charging everyone for a call? A charge of 1 cent per minute – and no loss of customers – would be worth $2.07 billion in revenue… What percentage of Skype’s free riders do you think would submit credit cards etc. to subscribe and be willing to be charged?

Posted by Roger Montgomery, Value.able author and fund manager, 11 May 2011.

Ash Little

:

Hi Roger,

I am trying to post this question under the most appropriate Blog so I hope this is OK.

I have been looking at TPM and find that they wont get my money at the moment but I was just wondering what the MQR was.

I would guess B2 but that is just a guess

Thanks in advance

Roger Montgomery

:

Hi Ash, worse than a B2, much worse. But ask me again after FY11 results are out. And trading almost 20 cents above my 2013 intrinsic value too.

Ash Little

:

Thanks Roger,

Yes it is expensive

Liz

:

It is not unusual to see fluctuations in commodity purchases on a monthly basis but it’s the YOY that is the real indicator. Further, when the PRC Govt. instructs banks to tighten credit, or, it increases the timeframe for funding approvals, this can have an immediate impact.

In terms of pricing on monthly and quarterly basis, there is one point to consider from the Chinese perspective. Imagine what it must be like for steel mills trying to price products to their clients. There comes a time where the user says, “I can’t pay more because my customers can’t pay more”.

China will consolidate with resultant monolithic steel enterprises. It may take some time as existing operators try to hold on to their power as long as possible.

In terms of domestic production two points a) their quality in some instances is so low that the cost of mining makes it more economic to buy offshore b) they want to hold onto the reserves they have. Internationally, they will continue to buy /build commodity projects across the globe. Australia will need to worry when China have built up their supply chains, to an extent that they can control pricing.

Some general points on China; it is big and it is many realities. There will be demand for more highways and infrastructure. The desire for cars, for example, is massive yet Beijing is already clogged despite massive road construction and ring route expansion; Similarly the highways leading into Beijing often move at a snail’s pace. (On the other hand I’ve witnessed literally hundreds of housing developments on the outskirts of satellite that are finished but half empty). No one seems to be able to explain except to say, “maybe they’re too expensive.”

Where Australia is really losing is manufacturing; from clothing to mining equipment. Within their own market, in some instances, there is still distrust of the quality of locally manufactured goods but this is changing very very quickly. A trade show in China is an eye opener!

My view is that the sun is still shining for Australian commodities for a few years at least, in part because of the lead times from exploration to production. The big miners with large reserves who can produce at low cost will still do well for a while; particularly brownfields expansion projects. If there is a downturn in commodity prices many of the smaller explorers simply won’t be able to produce economically. In mining size and quality matters, more so in AU where distances from ports, and, costs are high.

One point not mentioned – but in Australia’s favour – is India. They too want our mining commodities including Fe, Coal and Mn in increasing quantities. Like the Chinese, they are actively seeking supply through existing channels and capital investment. This competition is good for our miners.

I don’t think China is in bubble territory but that’s not to say there won’t be glitches, beyond our control, that will affect us. China’s challenges, (social, demographic, political and environmental) are enormous but an often overlooked fact is that parents, and their children, are driven to do better; especially to succeed economically. (Remember Australia after WW2 as a developing nation, aspiring to grow and prosper. Evolution has some patterns).

Finally, our high AU helps importers but it is not helping our exporters one bit and is a contributing factor to higher commodity prices because we sell in USD. The sooner it drops the better!

Roger Montgomery

:

Thank you for taking the time to add so much to the discussion!

Glenn

:

I have worked in the IT industry for the last 20 years and have observed the trends and waves in the industry. Microsoft is playing an incumbent role in the industry and has done so for the last 5-8 years. They are affectively no longer the innovators but are playing a defense game. The PC market is still huge but it is no longer a jewel in the crown. Mobile technologies are the new king and Microsoft are not even close to dominating in the new era. I am not sure how skype fits into the strategy? Are another line in their defensive measures possibly?

Rici Rici

:

Skype’s acquisition by Microsoft is very interesting.

On face value its appears to have been a glaring mistake. How could a standalone business with minimal net income sell for $8.5 billion.

But i think the ‘rational’ of the purchase needs to be evaluated on other factors. The acquisition of skype is not about purchasing a standalone business, but rather the potential to integrate skype into microsofts product ranges. The end goal being that the ‘sum is worth much more than the individual components’.

There was an interesting interview with John Chambers of CISCO recently. In the interview John Chambers highlighted the importance of offering an integrated product range. The value of the individual products are of less value to the customer than the combined product range.

A similar viewpoint must be used when analysing the ‘value’ of Skype. The endpoint value of Skype will be its ehancement value in complementing and adding value to microsoft’s product range (Xbox, windows/office products, and Windows phone).

Therefore the ‘value’ of Skype will be equal to the summation of the standalone value of Skype (ie as an individual product) plus the marginal value add to microsoft’s other products.

I think this ‘total value’ will only be known in the future. In eithercase, the acquisition cost relative to the market cap of microsoft is quite small. In my opinion microsoft is trading at a discount to its instrinsic value (which is rising over time even if the share price is stagnant), and i hold it in my portfolio.

Steve Potts

:

Re Chinese and Iron Ore price debate – having spent a month travelling the mid and outer Chinese Provinces a few months ago, ‘on ground’ observations suggested to me that the Chinese build out will last many years yet. One example – I had used a 5 year old Lonely planet guide (2005 Edition) that NOT ONCE mentioned the existence of High Speed Trains in China. In the intervening period, the Chinese Gov. had built 10,000k klms of 240 kph track and had services up and running on all lines. The Plan to construct that much track again by 2015 carrying over 400 kph services has at least 1,000 kms of service now in existence (undoubtedly now more. Some of you may have used the Shanghai Airport Train service during Shanghai World Expo – 420 kph). The evidence of this building was obvious. New Freeways are also everywhere and under construction big time. Millions of displaced households from this buildout require new residences. Masses of new apartment blocks in all Western Cities in particular are a standout feature of the landscape. And these are not just ‘high cost’ Apartment speculators at work – the Chinese are ‘urbanising’ at a very rapid clip with the Chinese Gov. very much aware that it needs to keep people employed and enjoying an increasing standard of living. It was a mind boggling experience to actually see it all first hand.( And we have been attempting to build one High Speed rail connection (Sydney/Melb. VFT) for over 25 years without success.)

We can speculate endlessly over the Chinese situation and it’s implications for Australia’s future. But all over Asia, the rapid buildout by populations lifting themselves off the lower rungs of economic wellbeing assures Australian Resources a bright future for many years albeit with bumps. As mentioned in previous blogs here, the next GFC will be a huge unwinding of the Sovereign Debt bump that somewhere along the way, I feel will offer compelling value in the longer term for patient investors. And Resources will be a big part of that value.

cheers Steve P.

Note – can someone help with this. When a Company carries short term debt that can be roughly matched with Cash and Debt Holdings on hand, do we still include Current Liabilities in the Equation “Total Assets – (Current Liabs. plus Non Current Liabs.) = Shareholder Equity.? (as Peter Lynch in ‘One up on Wall Street’ advocates). It’s not always clear in Co. Reports that “Total Assets” includes Cash at Bank and Debt Holdings .

Ron shamgar

:

Talking bubbles, theres no better than Grantham:

http://www.gmo.com/websitecontent/JGLetterPart2_1Q11.pdf

Latest GMO letter. There will be some interesting opportunities later this year. Make sure ur cashed up and ready to take advantage.

If he is right together with Marc faber, bill gross and Jim chanos…

Keith

:

Hi Roger and Others

I am an academic who also sits on a couple of company boards. For years I have been a Skype user, particularly when overseas but also frequently for conferencing calls with both business and academic colleagues. In my academic role much of my teaching is to external and international students and for the last six years I have been making increasing use of virtual classroom software – Elluminate Live in my case – alongside online learning management software – Blackboard in my case. Over the last few years I have noted with interest convergence in the features of Skype,(particularly in the premium versions), with those of Elluminate Live. Incidently Elluminate Live was recently taken over by the owners of Blackboard. We are clearly seeing some consolidation in this space. And would I pay 1c a minute to use Skype? – absolutely; and probably somewhat more given the alternatives.

Roger Gibson

:

Bloggers,

Can anybody help me out on a definition? I can’t seem to to find what is meant by Net Debt/Equity. Its obviously not the normal published Debt/Equity ratio.

RogerG

Matthew R

:

LONG TERM DEBT minus CASH divided by EQUITY

Many companies have some long term debt, but they have more cash than that debt. Therefore, in a pinch they could clear that debt with their available cash

Joab Soh

:

Hi Roger G,

Net Debt is debt net of cash. That is (Debt Less Cash) / Equity

At least that’s my understanding.

Mike

:

Hi Roger,

It’s actually (Short term Debt + Long Term Debt – Cash) / Shareholders Equity.

Many companies you’ll find will quote Debt/Equity ratio as Net Debt / (Net Debt + Equity), which makes the ratio look much better (read lower).

Roger Montgomery

:

Always use total borrowings aka ‘interest bearing liabilities’

David Martin

:

This is an unbelievable amount of money – they are effectively paying 10 times revenue on a loss making business. Unless there is something we are missing i wonder how they can justify this.

Regardless of who own it and who is in the chair, they business will still be a loss making business tomorrow as it is today.

Perhaps Darren’s thoughts of moving it into the operating system thereby forcing people back to MS is the plan.

i am no techno wizard but i can’t imagine it is a particularly complex soft ware to develop and for $8 bill i would imagine they could develope their own skype and inlcude it on their own operating systems.

I don’t see why they need the data base of skype users. THe majority (i am one) still use MS as their operating system and therefore they would already be on their own data base.

I look at Fairfax who have done nothing to reinvest themselves and then this deal and am not too sure whch is worse.

Scott W

:

Roger I was prompted by this post to log into my Skype account. When I did a light bulb went on. As soon as I logged in I was prompted by Skype to download an upgrade, and just like Apple with their product bundling of itunes and other unrelated products Skype wanted me to also download an piece of ‘free’ software. Google Chrome Browser!

It seems that perhaps the play by microsoft is to knock google their arch rival, out of the picture? I read an article of Google staff leaving to move to facebook a few months back and one of the reasons for the top developers running off was that their pet project had been canned. That pet project mentioned in the article was in fact a google chat and communication app. I suspect it was something like Skype and google canned it in the absence of needing to recreated Skype if they simply partnered with them.

Skype has a MASSIVE user base world wide and it is really widely used in business. In my background of international trade many customers and traders that I meet around the world use Skype constantly. It is applied into many millions of mobile phones around the world and I already use it in other countries to make ‘local’ calls all around the planet. Skype is no longer a hyped up product because it is so widely used that it does not have to be hyped up, people use it and they like it and it many many cases yes they do already pay to use some type of premium skype service, no skype is not just totally free for all users currently

Roger Montgomery

:

Thank you for your insights Scott.

Scott W

:

Roger there is an interesting article in The Age online today discussing the launch and heavy push that Google in putting into their Google Chrome operating system at the moment. Being that OS is the home group of microsoft you can see how they will need to do all they can to break any bundling and potential market penetration advantage that Google could develop and making Skype their own could just be a major part of that overall market position.

In the comments from Steve Balmer the Microsoft CEO he is totally correct when he stated that Skype has becoming synonymous with communication for many millions now. But let’s just see what they make of it, they probably overpaid but still bought a great brand with very deep reach.

Simon Anthony

:

Perhaphs we should focus on the Swann budget and its dependance on the China bubble not popping before 2012/2013.

According to data compiled by Bloomberg China, the world’s biggest iron ore buyer, cut purchases by 11 percent in April 2011 from the previous month as higher iron ore prices deterred purchases.

Chinese Imports totaled 52.88 million metric tons of ore in April, down from 59.48 million tons in March, according to China’s General Administration of Customs.

So what is happening in China to caused such an about face?

One theory is that corporations within China have seen the writting on the wall and have forcast iron ore demand going forward for the next two years. Estimates by Baosteel Group Corp. for the 2011 second-quarter were to surge 25 percent compared to the prices paid during the same quarter last year.

China, the world’s largest steel producer and iron ore consumer, has less say in its annual price talks with the big three global miners – Vale, BHP and Rio Tinto – because of the low concentration of its steel industry.

In January this year BHP had moved to a monthly set pricing after the three miners abandoned a 40-year tradition of annual iron ore negotiations with China each March instead voted to turn to quarterly pricing.

Hu Kai, an analyst from Umetals.com, said Chinese steel companies had to pay an extra $200 million this January for iron ore imported from BHP since it made that shift.

The central government aims to create several steel giants with an annual production capacity of over 50 million tons through mergers and acquisitions to reverse the situation.

Hebei province- where 60 percent of the capacity comes from small private steel mills – is drafting a plan to reduce the number of its steel mills from 88 to 10 during the next five years.

According to the 12th Five-Year Plan the Chinese government will accelerate the restructuring of the steel industry that is focused on China’s coast – with Anshan Steel in Liaoning province; Shougang in Caofeidian, Hebei province; Baosteel in Zhanjiang, Guangdong province; and Wuhan Iron and Steel Group in Fangchenggang, in the Guangxi Zhuang autonomous region.

For instance, China’s second-largest steelmaker by output, Baosteel, is expected to acquire Guangdong steel enterprises as part of its Zhanjiang project plan, a steel-production base with a planned annual capacity of 10 million tons along the coast of Guangdong province.

Another target of the plan is to increase the proportion of Chinese steelmakers’ self-supplying of iron ore by expanding domestic ore production and acquiring more overseas resources, he said.

Chinese steelmakers have been looking in recent years for more overseas ore assets to cut their reliance on expensive imports.

Deng Qilin, chairman of China’s third-largest steelmaker, Wuhan Steel, said his company will become self-sufficient in iron ore supplies in the next five years.

Perhaps many local Chinese steelmakers were encouraged to buy iron ore in March before the proposed price increase. Such stockpiling has been used in the past during the GFC as a short term cap on spiriling prices for the steel industry in China. Think of it as the ebb and flow of a tide, at the moment the tide has gone out as local production has softened over April and prices firmed. In other areas attempts by the China government to control inflation has lead to commodity traders speculate over the market outlook over iron ore prices in the face offurther tightening on the economy. The results speak for themselves with the cash price of iron ore arriving at China’s Tianjin port has gained 4.2 percent to $179.70 a ton since April 1, according to the Steel Index. That’s a annual increase of 50.2%! So is this a mere speed bump or a hic-up as China continues to gorge on raw materials from our sandy shores? The answer isn’t clear on the one hand Chinese exports have dropped 3% over the last quarter but were 17% higher than the same time last year . This can only be explained by either China stock piling its exported product on mass, or their has been a step change within the China government concerning domestic consumption of locally produced steel. This is the real problem facing China’s government to damp demand for both public & private housing, a major user of steel. If China can’t slow the production at home of new dwellings by increasing interest rates and forcing its banks to hold larger and larger reserves of cash than its only other avenue to to turn the tap off is at the production source.

The People’s Bank of China on May 3 said that controlling inflation is its top priority, even after a manufacturing index slid in April, which indicates that growth may slow in the second-biggest economy. I however believe that China is trying to keep a lid on iron ore prices by curtailing its own steel production and redirecting that steel to its own domestic projects. According to SouFun Holdings Ltd. China’s home prices rose for the eighth consecutive month in April, and Premier Wen Jiabao said May 1 that the nation is “determined” to bring down housing prices in some cities to a “reasonable” level. That may require future stockpiling of iron ore and further cuts to steel exports as a measure of controlling inflation for the Peoples Republic.

In light of these resent events it appears that our budget returning to surplus by 2012/2013 is based on China keep-on-keeping on with its production of new building after new building. Our current budget relies on income from non-rural commodity exports (is forecast) to rise by about 15 per cent over the next two years, to a staggering $203 billion.Such optimism made by our government at home is at best described as a bubble waiting to be popped…………..!

Roger Montgomery

:

Could everyone please pay attention…

This is the kind of comment that will be encouraged here at the INSIGHTS blog. High quality comments only please. Also, comment related to the topic will be preferred.

Ilya

:

Good stuff, Simon. I too couldn’t help but notice the rosy assumptions about China’s growth in the new budget. It is also a real shame that Australia finds itself in a position of fiscal deficit in the time of the biggest commodity boom in history. Even Lord Keynes in his day only advocated running deficits during downturns and return into surplus during the good times. I would describe my economics as Austrian, which is a total opposite of Keynesianism, yet I cannot help but notice how modern politicians have corrupted his original theories to run big deficits during good times and enormous deficits during bad times.

David Edmondson

:

Simon, Roger, Ilya,

I think I’m on the same page. Even if this scenario doesn’t occur, or the timeframes are different, what do you think the implications are for such a ‘bubble’ bursting? Such an impact would clearly impact on government revenue (as Simon alludes), and therefore (depending on you economic philosophy) government’s options and capacity to respond to the necessary contraction. I also not that this has an impact for commodities and related sectors, but wonder how this will effect/not effect other sectors of the economy that aren’t that hot at the moment anyway. I’m a lay person – educate me, what do you think?

Ash Little

:

Hi Guys

This is just my view but I think we should be running huge surpluses and squirreling the money away for the next inevitable downturn. The next one is likely to be worse than the last as world governments have no more bullets to fire

Ilya

:

Hi David, I am actually very bullish on China. I agree with Jim Rogers that Chinese boom has a long way to run, but as was the case with every other country in the history of the world, China will encounter short-term setbacks, booms and busts along the way. Nothing goes up in a straight line.

The problem with the budget is that it treats the money from China as a given in a short term, which is dangerous. For example, say as investor, I own BHP shares and I think BHP will go up by 10% next year. I still wouldn’t go and get a loan or buy a car on the assumption that BHP will be up by 10%. What if BHP goes down? What if it’s up only 3%? But this is what our government is doing in the budget.

What the government should do is treat China boom as a temporary phenomenon and use it to build a future fund. They then can use the returns generated by the fund for spending. Instead they simply spend the proceeds of the boom, so when it goes bust we are no better off and possibly worse off because every bit of government spending creates a new constituency that becomes dependent on the spending and fights hard to keep it coming. Moreover, like all good Keynesians our politicians would say: “Oh no, things are so bad now, we have spend even more. Otherwise all hell will break lose! Don’t worry that we haven’t saved any money, we’ll just borrow it”.

As far as the danger signs for China… There have been some suggestions that there is a bubble in coastal real estate, which I cannot confirm nor deny, but I don’t think it is anything similar to the US housing boom. Inflation is a huge problem in China and the only way they can deal with it is to stop buying US treasuries and let Yuan appreciate against the dollar. This will be a huge long-term positive for China. There is a also a long-term political danger inherent in a one party state. Who knows what the next president of China is like and what their economic agenda will be?

Rob S

:

Hi David,

Obviously government revenue will drop in the event of a Chinese slow-down, likely delaying the return to surplus. Keep in mind however that the government’s deficit is only 7% the size of total mortgage debt in Australia, and compared to most other countries our deficit is tiny (not entirely because of the mining boom, but more because we haven’t yet bailed out our banks). The government’s fiscal policies will have a modest effect on the economy, but nowhere near the effect changes in the global economy will have on the budget.

As it stands today the high aussie dollar is, it appears having a particularly nasty effect on Austrialian manufacturing firms (for example, see Paperlinx’s revised outlook and subsequent 27% stock price dump today). Retail and consumption are also in a funk thanks to the reverse-wealth effect of a stagnating and slowly-rolling-over housing market and the preference for online spending. The only thing holding our economy (and subsequently the AUD) up at the moment is the mining boom.

The aussie dollar is considered a proxy-play on China – as long a China is growing and consuming our rocks, the RBA will be under pressure to tighten, or atleast maintain higher interest rates. As long as our interest rates are high, the AUD will remain strong as leveraged players can borrow in USD or Yen for 1%, and invest over here at >5%. This is known as a carry trade – like many forms of leveraged speculation it works, until it doesn’t. As an interesting aside, take a look at the correlation between the AUD/JPY and the ASX 200 – makes me go hmmm…

If a Chinese slowdown hits commodities hard, the RBA might not have any choice but to lower interest rates. If this happens, expect the AUD to drop and drop HARD. This could be beneficial for companies with significant overseas revenue, preferrably those that sell to non-discretionary customers. It may also benefit local manufacturers who have struggled under rising input costs. Cunsumers may be forced to spend locally as US/UK trinkets don’t look so cheap – which could benefit retailers. If the government comes in with spending bonuses like it did last time, this could also kick start the retailers. Lower interest rates may help indebted households out, and could even give the housing market (and banks) a boost – but given the size of mortgage debt in this country already I think it would be suicidal for households to take on more debt. To the contrary, I suspect that a commodity collapse could trigger a housing collapse – and we’ve seen just how catastrophic that can be to an economy.

All that said, this is an entirely unknown situation – it hasn’t ever happened before (China hasn’t experienced negative growth for >40 years) so it is hard to say what will happen. Nevertheless, an absence of precedent is not a valid ground for preclusion.

John M

:

Hi Roger,

I remember thinking in the year leading up to the GFC, that if Private equity keeps buying company’s at the same rate, there will be no market left. It doesn’t quite feel the same as last time, but saying that, I have only been watching the market for one cycle.

Another thing I noticed leading up to the GFC was that I always had trouble buying the weekend Fin Review. It always seemed to sell out really early, whereas at the moment the stack of papers is always pretty full.

The last observation that I have picked up is from the lectures at the Investing and trading Expo. A lot of the people speaking there (you might have been one of the people that mentioned it) said that toward the end of a bull market, the lectures were always jam packed and after the crash the lectures were very lightly attended.

Saying that, I look to the world economy and wonder how some of the fiscally challenged countries out there are going to work their way out of their predicaments.

The Microsoft aquisition seems to be a risky transaction for shareholders. Maybe some of Phillip Fisher’s ’15 points’ need to be checked. Does anyone volunteer to give Bill Gates a call and find out what he is thinking?

I have never used skype so I don’t understand the business model but I do know people who have used it to keep in contact with relatives that are overseas.

Zac

:

I doubt M$ would start charging for skype even if it was dirt cheap, or perhaps even a subscription fee. ie $10 year.

There would be a fair percentage of people that would subscribe to it as its basically become a necessity for them.

With the PSN debacle thats happening right now (77 million credit card details potentially stolen) I dont think too many people will be too keen to enter personal details online.

I wonder if this means M$ have plans to revolutionise Skype. When Google bought Youtube it was easy to see the potential there and youtube is truly a success story.

Having said that (My background is IT) I think its a matter of time when mobile data networks can support VOIP calls, so therefore Skype/VOIP type phone calls would be possible over ordinary mobile phones and there truly is benefit in that as it will be a total game changer. ie imagine all your calls in the future are either free or the cost of a local call where local can be anywhere to anywhere.

Nick Mason

:

Hey Roger,

I was watching Bloomberg this morning and they had a short section on the recent slew of internet IPO and the incredibly high P/E ratios they were trading on. It reminded me of the last tech bubble although this time the bubble seems contained to certain stocks rather than a whole sector.

It’s been interesting reading the general reaction to the Microsoft takeover of SKYPE. Many people have said, if it happens which it has, they will stop using SKYPE. Also, if Microsoft were to start charging for SKYPE, SKYPE would lose their competitive advantage which makes it so popular with clients, that its free.

I cannot understand the reasons for the purchase myself and it will be interesting to see how it plays out.

Roger Montgomery

:

Hi Nick,

Many talk about the $50 billion in cash Microsoft has (Apple has a similarly large nest egg). Unfortunately, these funds remain overseas because a 35% US tax rate discourages them from being repatriated. It is one possible motivation for the high multiple of profits (losses) paid. The price paid on an after tax equivalent basis, is lower.

Paul Rehill

:

Are these funds the same funds used to buy back shares?

ron shamgar

:

Lol

when eBay bought Skype for so much money i was laughing!

now that Microsoft paid almost 3 times, I’m just shocked!

its not funny anymore its just DUMB!

kostas

:

Hi all.I reckon microsoft is trying to get into the market again.They lost all there good reputation after apple has unveiled Iphone,ipod and ipad.They have tried bringing out there own phone which has failed.Maybe xbox with skype brings in a lot of revenue with some kind of gaming.Will be interesting to see how they will be making money out of this deal.Dont forget now u can buy a tv and use skype camera in the lounge and talk .Personally i use it a lot.My mother(lives overseas) has no computer skills and we communicate via skype.Easy to use and has no big competitors .So even if they do charge 1 cent per call it will still be worth having.

Andrew

:

Forgot about Xbox, i can definitley see some uses for that. Everyone seems a bit perplexed so it will be interesting to see where this goes.

I think as per the bubble question, maybe if a few more companys that are similar go off for a huge illogical some. I read that Ellerston wants to buy part of Groupon or something similar.

Roger Montgomery

:

I understand there is an exit from the meat industry and there does appear to be increased investment in the online retailing space by one our resident billionaires.

Ron shamgar

:

I do think packer is paying a full price for 40% of catchoftheday and scoopon for $80mil. But than again look at the values ascribed to groupon etc.

Ash Little

:

Hi Roger

If that investment was by his late father I might be getting excited but track record of the resident is not flash.

That said, more and more is going to the online stores.

Ron shamgar

:

To give James credit, he’s done well on the Internet side.

The casinos was the big flop.

fred

:

Hi Roger,

A company like Apple might decide that Skype might improve the Apple brand and help Apple customers, so the moat thickens!

I don’t even know how Skype works but being a Apple customer I am sure I will soon.

Thanks always Roger

Andrew

:

It does seem to be a bit puzzling, especially when broken down as you have, and could like you say be another fosters/southcorp but on a bigger scale.

Perhaps Microsoft see a chance to add value to its existing products by using skype in some form or another or will enhance it in a way that they can charge a fee for the service by linking it to its professional products. I can see perhaps an opportunity there for a microsoft professional/powerpoint and skype and offering it as a subscription service to companys that will frequently need video conferencing. But this is all speculation, apart from that i am unsure as to where the 8.5 billion value is.

I read with interest the other day that EA sports bought the developing company behind iphone/ipad games such as flight control. It would be interesting to see what type of price was paid for that.

On the one hand the over the top exuberance in buying companys for far more than they are worth based on little facts would pretty much indicate that a bubble is forming. I am not sure whether it is necessarily a bubble however but i think it might come down to people/businesses getting too carried away with the story of these internet companys and forgetting the fickle nature of their users and the low barriers to entry for competition. Newcorp and Myspace comes to mind, the company was a relic when they bought it and i think it comes down more to Rupert not necessarily understanding the internet. I would hope that microsoft would have a better grasp but you never know.

I think it just simply comes down to people not necessarily understanding the business. Internet businesses can be a difficult beast to get a handle on as they could be the biggest company in the world one minute and irrellevant the next and a little knowledge can sometimes be more dangerous than no knowledge.

Will be interesting to see what future microsoft results are like.

Steve I

:

I think MSFT is grasping at straws. I think they can see their business gradually being eroded and are failing to innovate and keep pace. Therefore they are willing to make some gambits at any price in order to find a miracle cure.

I’m not sure that Bill Gates really has much input to MSFT any more, which has shown that he was the driving force behind the company. I guess when Steve Jobs leaves AAPL due to ill health there should be similar concerns. Bill Gates has proven to be a canny operator and has spent considerable time with Buffett, therefore I’d be surprised if he had any input.

I’m not sure about bubble, as there is little retail investor participation and the moment – some stocks have 50% less volume to this time last year (in the US) and there is also the influence from the free money injections from the US Fed which is strong given the low volume.

I think in this case it comes down to a desperate MSFT. Maybe they have a great innovative idea and will be using Skype to integrate. I’ll be siding with a bad move and bad price given their past move for Yahoo.

Bruce D

:

I think you have summed it up very well Steve. I think it has been a while since Microsoft has done anything very innovative. In the early days there was a rush to go to the new versions of Windows and/or Office but these days it’s all a bit ho hum. Vista probably didn’t help. Now instead of innovation, MS seems desperate to survive through aquisition.

Paul Rehill

:

Bill Gates is Chairman of the Board and the Board signed off on this from press reports! $8.5bn USD for a company that makes a loss? That speaks volumes.

David Edmondson

:

(Roger/blog editors,

I’m not sure my post really adds anything insightful. Mainly rambling speculation really. So don’t post it if you don’t want to!)

I don’t immediately understand this move from Microsoft. This could be because it’s a dumb acquisition, or a smart aquisition at a dumb price…or there’s something I/we don’t know. Microsoft has its (effective) monopoly in operating systems, but hasn’t been at the forefront of anything really revolutionary for a while, technology wise or business wise (though perhaps I’m wrong – brains trust illuminate me!). Sounds a bit like they were desperate to do something, anything…to make next year’s annual report more exciting.

If Microsoft did start charging for skype, revenue might rise but I suspect customer base will fall. When I travelled a few years ago I stayed at hostels where everybody would be sitting in the lounge chatting on skype. These are people whose travelling was supported by free hostel pancake breakfasts (which they would make last until dinner) and clothing from goodwill stores, people who were, in sense intrinsically alternative. Any fee would be extremely unattractive to this kind of demographic – who I suspect contribute a significant chuck of the skype pie. They would be turned off by a more complicated registration sequence, let alone providing billing details and paying!

So, how DOES Microsoft make money out of this? Or does Microsoft make money just by taking skype out of the equation, and then doing their own funky thing.

Darren

:

Hi David , Just off the top of my head maybe Microsoft would like to take back a little of Apple’s pie so to speak and move the skype application into part of windows operating system core apps so that to be on skype you have to be running (i.e buy windows) and keep more PC people from swapping to Apple ??? or something along those lines……..they used not have to worry to much about people choosing windows/PC but now with so many good alternatives (Apple OS, linux etc) maybe they want to but apps that everybody loves and incorparate them into windows to keep the windows os enticing………….no idea if I’m correct but just a thought that popped into my head!

Cheers

Darren

Paul Rehill

:

Anti-trust trouble with that?

Andrew

:

i am sure that MS has a plan…just watch this space….

Michael

:

Hello Roger and David.

My two bobs worth… If I owned Skype and I didn’t want to destroy its current user demographic (who expect free use) I would look to implement the following:

1. Sell advertising banner space and mandatory advertising time before every call within the Skype Application like YouTube and Google etc has in their businesses;

2. Sell licences or charge people at low rates per minute or a monthly to remove these adds; and

3. Sell commercial licences for large business users.

What are other peoples thoughts?

Regards,

Michael

David

:

Dont know what they are up too but they just bought 170 million database for $44 a record, is it expensive, probably, but they do have the cash!

David Edmondson

:

This is interesting. I agree there is a capacity with skype (as with facebook) to keep skype free, accessable, but to introduce the kind of targetted advertising facebook and google are successful with. And, as David points out, they have now acquired a dynamic database which apple, google, facebook leverage and derive their success from. And they haven’t even started to mine that database, really.

But all this is speculation really, just trying to look for reasons for this purchase…time will tell is this is the last stretchy moments before a bubblelicious explosion into reality. And, come reporting season next year and the year after that, we’ll see whether skype has done anything to transform MSFT other than make it…larger.

Ash Little

:

Hi Michael,

I think skype is fantastic and I am sure MS has thought of all your sugestions plus many others of there own

Michael

:

Hello David and Roger.

My two bobs worth… If I owned Skype and I didn’t want to destroy its current user demographic (who expect free use) I would look to implement the following:

1. Sell advertising banner space and mandatory advertising time before every call within the Skype Application like YouTube and Google etc has in their businesses;

2. Sell licences or charge people at low rates per minute or a monthly to remove these adds; and

3. Sell commercial licences for large business users.

What are other peoples thoughts?

Regards,

Michael

Andrew

:

Maybe they see the introduction of “Facetime” by Apple a real threat to the future business of both Skype and also the whole mobility future.

Microsoft is struggling to try and make themselves relevant in a fast paced mobility environment as Android basically came into the fray and stole any potential base that MS was trying to capture, and even their deal announced with Nokia in my mind will do nothing more than bring about the decay of Nokia itself.

MS are probably very fearful of the fact that Apple are starting to dominate this market and with seamless integration between the iphone, ipads, and imacs it is not hard to see how direct free communications from one apple user to another will only serve to further lock in apple as the market leader and in the moderm age, information is power and those companies that will control the information of the future stand to hold the corporate power.

This purchase by MS will not be able to achieve anything in my opinion as they don;t have the product infrustructure to make total use of skype in the way Apple is doing with Facetime.

Pat gavin

:

For those of you that have or have not used Skype it does charge for calls.Its only free skype to skype.For a fee(very cheap call rate) you can call any phone mobile or landline in the world.Skype on mobile has been around about 4 years and is free to another mobile that has skype.Used it myself.There are a number of other providers like skype just as good but not as well known.Perhaps this will give them some air.

Its no big deal voice is only data transmission like any other data and it takes up very little bandwidth after compression.

Peter Kruckow

:

Hi Pat and everyone

As well as the services listed by Pat, you can for a small monthly fee, have your own phone number, matched to the area where you live, so people can call you off a landline or mobile without the need to have access to a computer to be able to talk. We have used this successfully for the last 12 months keeping in touch with our daughter who didn’t have a landline and lives out of mobile range,the only downside is you’re not allowed to call 000 for reasons unknown

Cheers

Pete