Value.able

-

Why are we Celebrating?

Roger Montgomery

August 17, 2011

Congratulations are in order at our office.

Congratulations are in order at our office.Not to Forge or ARB for their full year results released today but to Chris B. our resident Albert Einstein, data integrity guru and valuation formula genius. Chris became a CFA today.

Well done Chris.

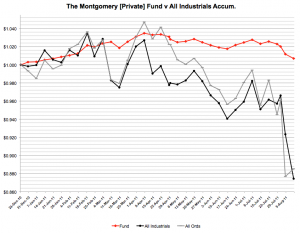

Thanks for all your hard work and keep it up – its working! Just look at the chart.

We are all excited to have you on the team.

(note: Yes everyone the results ARE due to significant amounts of cash (inflows) that the process Chris helped developed DID NOT deploy into the market) Well done Chris and on behalf of our investors thank you.

Posted by Roger Montgomery, 17 August 2011, with sincere thanks.

WARNING: This publication has been prepared by Montgomery Investment Management Pty Ltd ABN 73 139 161 701 AFSL 354 564 (“Montgomery”) for the purpose of providing general information, without taking into account your particular objectives, financial circumstances or needs.

An Information Memorandum (“Offer Document”) for the Fund(s) is available from Montgomery. Potential investors should consider the Offer Document in deciding whether to acquire, or to continue to hold, units in the Fund(s). Montgomery, its officers, employees and agents believe that the information is correct at the time of compilation, but no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors or omissions (including responsibility to any person by reason of negligence) is accepted by Montgomery, its officers, employees or agents. This online blog contains general information only and is not intended to represent general or specific investment or professional advice. The information does not take into account an individual’s financial circumstances. An assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial or other professional adviser before making an investment decision. No guarantee as to the capital value of investments in the Fund(s) nor future returns is made by Montgomery.

by Roger Montgomery Posted in Value.able.

- 93 Comments

- save this article

- POSTED IN Value.able

-

Is iiNet worth two Bob?

Roger Montgomery

August 15, 2011

iiNet’s full-year results have been released. I have taken particular interest because communications and data is one sector of the marketplace I believe is relatively less affected, in terms of share-of-wallet, by the ructions in the US Europe.

iiNet’s full-year results have been released. I have taken particular interest because communications and data is one sector of the marketplace I believe is relatively less affected, in terms of share-of-wallet, by the ructions in the US Europe.The results released today (15 August 2011) were marginally below the expectations of several analysts we correspond daily with. Underlying EBITDA was up just shy of 30 per cent to $104.8 million (some analysts were expecting $106 million and a little more).

With DSL (Digital Subscriber Line) – the technology that significantly increases the digital capacity of ordinary telephone lines, and excluding HFC (Hybrid Fiber-Coax network – CABLE) – iiNet is now the number two competitor and the leading “challenger “in the Australian residential telecommunications market. As an investor, I am always interested in the number 1 or 2 player in town. However the gap between number 1 (Telstra) and iiNet (#2) is enormous. iiNet have 641,000 paid DSL subscribers (up 19 per cent). Telstra has 2.4 million.

The company reported its underlying Net Profit After Tax was $39.0m, up 12.4 per cent on FY10, while reported NAPT fell 3.7 per cent to $33.4m (FY10 $34.7m). On a quick glance, I reckon underlying profit was $37 million (you have to add back $3.9 million in deal costs, redundancy costs of $1.2 million and legal costs of $1.4 million but tax effect it). Stripping out the impact of the acquisition, I also estimate cash flow was close to $40 million.

The reason for the less than stellar growth in reported net profit was because iiNet’s tax bill was much higher than last year. The increase in tax wiped out all of the increase in the net profit before tax.

Whilst many analysts will look at the growth in operating profit (EBITDA), I’d look at the net profit before tax. If I add the legal costs in 2010 back to that year’s profit-before-tax and then add the one-offs for 2011, I get a jump in net profit before tax from $43.85 to $53.4 million and a reduction in margins from 9.25 per cent to 7.6 per cent. Hopefully the company’s expected ‘synergies’ (an extra $10 million from porting AAPT customers across to the iiNet billing system?) raise this to 8.5 per cent.

Net debt increased to $96.4m from $56.3m as a result of the AAPT Consumer division. This has had an impact on our Quality Score (the A1-C5 system), which was B2 previously. Gearing will be 40 per cent. And the the balance sheet? It now contains $302 million of goodwill compared to $242 million of equity.

Revenue and operating cash flow was up significantly with the full year’s benefit of the Netspace acquisition and a nine month benefit of the AAPT consumer division. What really would be interesting however is an estimate of what like-for-like revenue and operating cash flow is. Sure iiNet has no ‘stores’, but acquisitions and synergy extraction doesn’t have the same whiff of sustainability as a business that can grow organically. I would like to see how the old business (excluding the acquisitions) is travelling. Value.able Graduates – would you?

And when I hear company say that it is “Ideally positioned for the future“, I want answers as to whether they were previously ideally positioned for ‘now’.

The 19 per cent growth in DSL subscribers includes AAPT’s consumer division, so it doesn’t give us much insight into the organic growth of the company. With ARPU (Average Revenue Per User) largely unchanged, yet network and carrier costs up 56 per cent – above the 47 per cent increase in revenue – some insights into organic growth would be helpful. I suspect subscriber growth will reflect slow organic growth in FY12, and any margin/profit improvement will come from ‘synergies’. While these may be significant ($9 – $12 million from migrating AAPT customers onto iinet billing system), they are not a long-term delivery platform for profit growth.

It is clear that management’s confidence is high. They have significantly increased the dividend from $12.1 million last year to $16.7 million this year and have announced separately a share buy-back of up to 7.6 million shares, or about 5 per cent of the issued capital (about $17 million at current prices), despite the fact that debt has risen substantially by a net $52 million. Perhaps when you have $766 million coming through the door you can afford to be a bit fancy-free with your capital allocation? Thoughts anyone?

I hear whispers in the background… Roger, how do you know all this? Yes, I do listen to company presentations and we do read investor briefings. But nothing compares to the clarity that comes from using our A1 service. It is, quite literally, extaordinary. And we can’t wait to share it with you. Value.able Graduates – expect to receive your invitation very soon. Now, back to the program…

If organic growth is slow and acquisitions begin to thin out, one would expect debt repayment followed by an increase in the payout ratio. Or perhaps the other way around, if share price support is contemplated?

The prices paid for acquisitions does not immediately cause concern for me, because the returns on equity being reported aren’t poor. But they aren’t A1 either.

Investors have tipped in $223 million and left in $15 million. On those amounts, iiNet’s Return on Equity is about 16 per cent.That’s not bad, but are there better opportunities out there. Before you suggest Telstra, keep in mind it is 140 per cent geared and profits are boosted by the failure of the company to recognise software development expenses in the year they are incurred.

The old fashioned Value.able investor in me doesn’t like looking at a balance sheet that reveals the debt-funded acquisition of goodwill. I have witnessed far too many examples of this turning out poorly. Sure, some of you may say that MMS did the same thing? But while debt rose significantly there, the corresponding asset was PP&E, not goodwill. You may instead point out that interest cover is still high at 9 times (20 times last year). That, I accept.

Finally, the NBN. What does it mean for iiNet?

First, some background. An ‘Off-net’ customer is provided a DSL service through another network – usually Telstra wholesale. An ‘On-net’ customer is one that is provided a DSL service through the iiNetwork (iiNet’s own broadband network). The NBN is expected to reduce the average monthly cost of broadband + Voice bundling to $33, which compares favourably to the current off-net cost of $57. This is a potentially major saving, but the reason I am not as excited about this as the company is because as the transition is made, there will be some leakage. It will occur over an unexciting period of time and any number of offsetting factors could adversely impact revenues, costs and profits during that time.

I am more excited about other companies at the moment. A growth by acquisition strategy may offer wonderful potential in the short-term, but it can also be used to mask slow organic growth. The buy-back can be a sign that cashflow will be strong, but it can also be used to merely ‘display’ confidence and support the share price. At Montgomery HQ, we reckon the shares are very close to their Value.able intrinsic value, but iiNet’s fall in quality, from A3 to B2, suggests shifting your attention to other opportunities.

You should be practising your own Value.able valuations. So what do you get for iiNet for 2011, 2012 and 2013?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 15 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Technology & Telecommunications, Value.able.

-

What’s your stock market survival story?

Roger Montgomery

August 10, 2011

Last night, First Edition Value.able Graduate Scotty G shared his stock market story at our blog. Scotty’s story is far too value.able to not receive its own, very special post! Over to you Scotty…

A Tale of Two Crashes

by Scotty G

2008/2009

An ‘investor’, whom we’ll call Scotty G for anonymity purposes, has woken for work at 05:00 to see that the Dow is off 700 points. He nervously heads in to work to check what it means for his portfolio of ‘blue chips’. He’s down badly and it’s only made worse by the fact that he is in a margin loan, which he kept at a ‘conservative’ 50 per cent level of gearing.

His ‘great’ stock picks are not holding up well in this environment and his ‘genius’ ‘value plays’ like buying Babcock and Brown at $7 because ‘its fallen from $28 and surely at a quarter of the price it represents value’ no longer looks like genius at all. He had imagined himself some sort of Buffet-ian hero, stepping into a falling market and making the tough buy call that would surely pay off. No actual analysis is done to back up these calls.

Finally he is 1 per cent off a margin call. He is tense at work, snapping at friends and chewing a red pen so hard it stains his lips and chin. He capitulates, calls his broker and sells out, including his ‘value pick’ Babcock and Brown at 70c. He feels relieved to be out, but is bruised and jaded by his experience. He vows to return to the stock market some day and do better, but doesn’t know how.

2010

Our ‘hero’ comes across a beacon of light in a sea of information. It is the Value.able column in Alan Kohler’s Eureka Report, penned by a knight known as Roger M (name changed to protect the innocent). He follows the link to the Insights blog and is astounded that the information he has been searching for is all here. He eagerly orders the Tome of Wisdom (known as Value.able to some). Upon receiving it, he reads it in one sitting. Wheels click in his head and light shines in the dark. Could it be so simple? Knowing what something is worth and then refusing to pay above it? In fact, demanding a discount? He set off onto his journey for the Grail.

2011

Our hero is now equipped with a spreadsheet devised from the Value.able rule book. He can value companies quickly and decisively. Many don’t make it onto the spreadsheet, as he can now spot a ‘Babcock and Brown’ coming from a mile away. Stock ‘tips’ from colleagues can now be waved away. When they ask why, he tells them. If they say he’s crazy, he smiles and feels at peace. He knows he is still not perfect, but he’s a darn sight better than he was three years back.

The markets turn down. The spreadsheet is rechecked. MCE and FGE are added as they shift below his 20 per cent discount rate. JBH is added soon after. The markets shift lower. But reassured by the facts this time, and not the hype, he buys more of the above.

Markets shift lower still. Figures are checked and rechecked as more great businesses come within range. The panic of a fall is now replaced by a calmness and certainty that an anchor of value provides.

The market finally slides steeply over several days.

Finally! Some of his best targets are in range.

VOC falls, then MTU (a company he has waited ages to acquire), and finally DCG. Sadly, ARP refuses to come within range, but he his patient and does not chase it.

He retires to his castle (lounge/bar), content with the work he has done and happy to await the next chance to hunt and switches on the sport, deftly ignoring the news and business channels hosting ‘experts’ eager to proffer their take on why things were the way they were. He feels at peace and sleeps soundly that night.

“Ok, stripping out all the ‘poetic’ and imaginative stuff, this is pretty much how it went in real life. I suffered a loss due to poor decisions with no research. I found Value.able, I converted (or got innoculated as some of the greats say) and took advantage of the recent situation. And I do sleep soundly at night.

“Thank you Roger for your willingness to share and to all on the blog for the same spirit of camaraderie. I look forward to many years of sleeping soundly at night.

To Value.able and to Value!”

Thanks Scotty.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have; 1. read Value.able and 2. Like Scotty, changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our very-soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team (on behalf of Scotty G), fund managers and creators of the next-generation A1 service for stock market investors, 10 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Is JB Hi-Fi cheap (and still an A1)?

Roger Montgomery

August 9, 2011

The changing retail environment that JB Hi-Fi must negotiate has taken a back seat in the minds of investors, many of whom are almost singularly focused on events unfolding in the US and Europe. Value.able Graduates, I am proud to report, remain focused on the business.

Australia’s retail environment is in a state of flux. The only thing that is permanent is that the retail environment is always in a state of flux!

Success however for retailers who don’t own their own brands is always based on the same recipe – low costs, the right products and the right prices irrespective of what the market is doing.

JBH doesn’t shift its brand positioning. It is known as the “value” player in the electronics retail market. Its sells exactly the same big brands as its rivals, such as Harvey Norman and the Good Guys, but has won mind share as the low-price alternative. Its low-end branding and cheap shop fittings is particularly helpful when consumers start zipping up their wallets.

JBH sold $2.9 billion dollars worth of gadgets, music and games in 2011, up 8.35 per cent from $2.73 billion the year before. The company’s headline profit was down 7.6 per cent to $109 million (at the lower end of its guidance range) and compares to $118.7 million the previous year. Excluding the Clive Anthony’s write-down, the result was $134.4 million, which is up 13.3 per cent. EBIT grew by almost 12%. Like for like hardware sales were up about 4%, which compared to the industry-wide number being down about 4% suggests the company is continuing its habit of winning market share. The final dividend of 29 cents per share ensures the payout ratio remains at 60 per cent. Aggregate sales grew 8.3 per cent while same store sales were down 1.2 per cent (Australia was down -0.5 per cent and New Zealand up 2.4 per cent). Second half like-for-like sales were up 0.1 per cent for JBH, but down 14.8 per cent for Clive Anthony’s.

Costs remain under control with the CODB (Cost of doing business) at 14.5 per cent – unchanged for the year (but up from 13.2 per cent in the recent past), and the EBIT margin rising to 6.6 per cent. Gross margin rose to 22 per cent – but I have to confess I prefer to see gross margin falling as it further entrenches competitive advantage.

Sales and marketing expenses rose by 8.2% – in line with group sales but occupancy expenses rose by 13%. This could suggests the tail end of store openings – second tier and the company is not getting as attractive terms.

A $73.4 million increase in inventory – largely due to new stores (but requires more investigation because the company says $49.1 million was invested in new store inventory but last year the jump was just $10 million) – resulted in cash flow from operations of $109.9 million compared to $152.1 million last year. Capex of $45.1 million relating to the opening of 18 new stores also needs to be considered in any cash flow analysis. The buyback of 10 million shares pushed borrowings up from $70 million to $232 million, which will have an impact on free cash flow for the next few years, but contributed to the fact that $260 million was returned to shareholders this year.

My business cash flow is a positive $71.2 million and then $88 million was paid in dividends.

Eighteen stores were opened and four Clive Anthony stores were converted. The expectation is that there are another 62 stores to open, at a rate of 13-15 stores per year. If we assume 2-3 per cent sales growth and another 4-5 years before reaching the targeted number of stores, sales in 2016 could be $4.5 billion. And if current NPAT margins are maintained, JB Hi-Fi could be reporting profits of $204 million, which is equivalent to a compounded growth rate of 11% per annum and earnings per share of $2.08 per share in four years. And that expectation assumes no improvement in retail conditions (nor any deterioration either).

The big story however is that Terry Smart will need to start looking beyond this organic growth to other strategies if JB Hi-Fi is to avoid developing the profile of another mature Australian retail business like Harvey Norman.

On that front, JB Hi-Fi will release a streaming music service by the end of the year – a challenger for iTunes. They already have 800,000 unique weekly visits to their website so before you dismiss its chances, remember this: consumers will be unlimited in terms of the devices that music can be “streamed” to. The service will be a ‘playlist’ service much like GrooveShark, which is discussed regularly amongst the team here at Montgomery HQ. There will be 6-8 million tracks from 100,000 artists at launch and one expects, if it catches on, a small investment could lead to deals with concert promoters and outdoor entertainment events – wherever teens congregate to listen to music. JB Hi-Fi needs to establish new and emerging business models to try and counter the shift away from physical music unit sales.

Having said that, the current sales environment is probably not representative of the future. Share market investors generally use the rear view mirror when assessing the future. I have previously discussed the “economics of enough”, which David Bussau from Opportunity International introduced me to many years ago. As it applies to consumers generally, they will get sick of trying to keep up with the latest technology, be happy with their TVs and replace everything less often – opting instead to ‘experience’ travel, food, adventure and other cultures. That of course doesn’t mean JB can’t grow its share-of-wallet. In the face of declining retail sales volume growth over the last five to ten years and deflation, JB is proving it is already the market leader.

The announcement was overshadowed by the July stats. Being ‘actuals’ the company was in a position to report them. Same store sales were negative 3.3 per cent, but aggregate sales were up 6.4 per cent. The like-for-like decline was partly attributed to the company ‘cycling’ the release of the iPhone 4.

As I have said before I don’t think the current retail malaise will continue forever and JB will emerge stronger and with more market share when we come out the other side of this consumption ‘funk’.

JB Hi-Fi’s quality score dropped from A1 to A3 and interestingly, this was only partly due to the increase in debt. (We really need to know whether it was just timing issues and new stores that contributed to the jump in inventory).

Furthermore, our estimated valuation for 2012 is now $17.30, rising to $20.30 in 2013.

Your Job:

- Investigate what the sales growth (decline) rates were specifically for music/DVD and games ( I actually have it but want you to find it), and

- Offer some suggestions on that change in inventory!!!!

Then come back here to our Insights blog and share your findings.

Very soon, finding extraordinary companies offering large safety margins will become simple and may I even suggest, enjoyable. The next-generation A1 service my team and I have created will inspire your investing and re-energise your portfolio. (Value.able Graduates – your invitation to pre-register is imminent).

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have; 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our next-generation A1 service).

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 9 August 2011.

by Roger Montgomery Posted in Value.able.

- 92 Comments

- save this article

- POSTED IN Value.able

-

What did Ash and the team talk about?

Roger Montgomery

July 7, 2011

Yesterday we had the pleasure of meeting Ash in person. If you scroll through any of the threads on our blog, you will no doubt find some extraordinary insights from one of Value.able’s founding Graduates.

Indeed, Ash’s generosity and willingness to share his experience and insights with new investors has fostered a spirit of camaraderie that has become integral to the Value.able community.

What did we talk about? It’s been a hot question at the Facebook page!

…Matrix, the recovering Lockyer Valley, cotton, gas explorers, an exciting new float, Lloyd, rugby and the 2GB podcast about a small cap gold stock that resulted in 170 comments and the thought to shut this blog down!

Thanks again Ash. We look forward to catching up with you again when you are next in Sydney.

Now to the photo… can you spot some familiar faces?

The first four of six framed artworks are now featured at the entrance of our office.

It was a proud moment indeed. We will publish some more photographs of the artworks in coming days.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 7 July 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Value.able.

-

Is shale gas ‘drilling fast and conning Wall Street’?

Roger Montgomery

June 27, 2011

For those interested in Shale Gas stocks, an interesting article was published in the New York Times at the weekend.

For those interested in Shale Gas stocks, an interesting article was published in the New York Times at the weekend.Here’s an excerpt or two from the article…

“Money is pouring in” from investors even though shale gas is “inherently unprofitable,” an analyst from PNC Wealth Management, an investment company, wrote to a contractor in a February e-mail. “Reminds you of dot-coms.”

“And now these corporate giants are having an Enron moment,” a retired geologist from a major oil and gas company wrote in a February e-mail about other companies invested in shale gas. “They want to bend light to hide the truth.”

…and here is the link to the story: http://www.nytimes.com/2011 and a link to more than 480 pages of leaked insider emails and reports: http://www.nytimes.com/interactive

And more recently, in this e-mail chain from April 2011, United States Energy Information Administration officials express concerns about the economic realities of shale gas production.

I am not allowing any comments on this subject. Do your own research and seek personal professional advice.

Please continue contributing to the two prior posts, listing the companies you think we should be watching this reporting season (Scroll Down).

Posted by Roger Montgomery, author and fund manager , 27 June 2011.

by Roger Montgomery Posted in Energy / Resources, Investing Education, Value.able.

-

What are you cooking up Roger and team?

Roger Montgomery

June 23, 2011

I am working tirelessly to generate superior returns for the Montgomery [Private] Fund. That is the number #1 goal. But stay tuned, because I am also writing a post for next week that will list some of the companies you should be seriously watching this reporting season (and there may be a few gems). Stay tuned and keep checking in.

I am working tirelessly to generate superior returns for the Montgomery [Private] Fund. That is the number #1 goal. But stay tuned, because I am also writing a post for next week that will list some of the companies you should be seriously watching this reporting season (and there may be a few gems). Stay tuned and keep checking in.Today’s earlier post (What if the sell off is just a Flash?) lists some out-of-favour A1 companies.

If you have a company that you believe investors should be watching this reporting season, please start posting them here. Check in next week to see if they’re on our list too.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

…You can’t touch this?

Roger Montgomery

June 13, 2011

“Yet you do not know about what may happen tomorrow. What is the nature of your life? You are but a wisp of vapor that is visible for a little while and then disappears“. James 4:14

“Suddenly a mist fell from my eyes and I knew the way I had to take.” Edvard Grieg

“Fog and smog should not be confused and are easily separated by color.” Chuck Jones

With apologies to 90’s rapper M.C Hammer, today I plan to lift the lid, ever so slightly, on a misconception about the value of tangible assets. I’ll throw in a few Value.able intrinsic valuations for you too.

Were you as fascinated recently, as I was, to read Harvey Norman suggesting that the price premium to book value of JB Hi-Fi compared to that of itself was unjustified? The company pointed out – and allow me to paraphrase – that the market capitalisation of JB Hi-Fi ($1.9 billion) against just $365 million of book value is high, when Harvey Norman’s market capitalisation is $2.7 billion and its book value is expected to be $2.2 billion at the end of this financial year.

The attachment to physical assets held by many is not unusual, nor is the belief that intangible assets are akin to a puff of smoke. Premiums to book value however are justified when that ‘book’ generates above average rates of return. And it is assets of the intangible variety – the economic goodwill (rather than the accounting variety) – that are more valuable anyway. Physical assets can be replaced, imitated and replicated. Any competitor (with deep enough pockets) can purchase almost all of them. Ultimately, any unusual returns these generate will be competed away as competitors secure the same machines, tools, equipment etc. Many in the printing game experience this phenomenon. A new machine gives them a marginal advantage only for as long as it takes their competitor to make the same investment.

Assets of an intangible nature are less easily copied and so high rates of return can be sustained longer, and are therefore worth more.

A company’s book value is the net worth of its assets. Book value is made up of both tangible assets and intangible assets. Tangible assets are physical and financial and include property, plant & equipment, inventory, cash, receivables and investments. Intangible assets aren’t physical or financial and may include trademarks, franchises and patents.

To demonstrate the difference in value between intangible and tangible, have a look at Google; That company’s market capitalisation is US$165.5 billion and yet its book value is just US$48.6 billion. Its price to book value is 3.42 times. JB Hi-Fi’s price to book value is 5.2 times and Harvey Norman’s is 1.22 times. But Google’s ‘book’ generates returns of 19.16%, JB Hi-Fi; 41.5% and Harvey Norman; 11.6%. There is indeed a relationship between the price premium to ‘book’ and the profitability of that ‘book’ (‘ROE’). A business is worth much more than its net tangible assets when it produces profits well in excess of market-wide rates of return.

I wrote about the capital intensity of airlines in Value.able (re-read Pages 60-63, 122, 164, 172-3), so you should know my thoughts about this already (You can also read any of these articles and transcripts for a refresher: Taking-off or crash-landing?, Qantas cuts costs to stay in profit, Qantas cuts staff, flights to counter fuel price hit and Flights reduced, jobs cut at Qantas).

When it comes to physical assets, less is more. For a business to double sales and profits, there is frequently the requirement to increase the level of physical assets. The higher the proportion of physical assets compared to sales that are required, the less cash flow available to the owner. This is the antithesis of the intangible-heavy business that continually produces profits without the need to spend money on maintenance, upgrades or replacements.

Let me demonstrate with an admittedly rudimentary example. Take two companies Rich Pty Limited and Poor Pty Limited. Both companies earn a profit of $100,000. Rich Pty Limited has net assets of $1 million. Intangible assets, such as patents and a brand, represent six hundred thousand dollars while physical assets, including machinery running at full capacity and inventory, represent $400,000. Poor Pty Limited also has a net worth of $1 million, but this time the intangible/intangible mix is reversed and eight hundred thousand dollars represents tangible assets and $200,000 is intangible.

Rich P/L is earning $100,000 from tangible assets of $400,000 and Poor P/L is earning $100,000 from tangible assets of $800,000.

If both companies sought to double earnings, they may also have to double their investment in tangible assets. Rich P/L would have to invest another $400,000 to increase earnings by $100,000. Poor P/L would have to spend another $800,000.

For many investors a large proportion of physical assets – also reflected in a high NTA – is seen as a solid backstop in the event something catastrophic should befall a company. I would suggest that the opposite may just be true. A high level of physical assets may be a drag on your returns.

Physical assets are only worth more if they can generate a higher rate of earnings. Any hope that they are worth more than their book value is based on the ability to sell them for more, and that, in turn, is dependent on either finding a ‘sucker’ to buy them or a buyer who can generate a much higher return and therefore justify the higher price.

With these ideas in mind, its worth looking at a list of companies that further investigation may show have very high levels of tangible assets compared to their profits. Let’s also throw in those companies that have highly valued intangible assets too. If they are generating low returns on these, the auditors should arguably take a knife to their stated ‘book’ values.

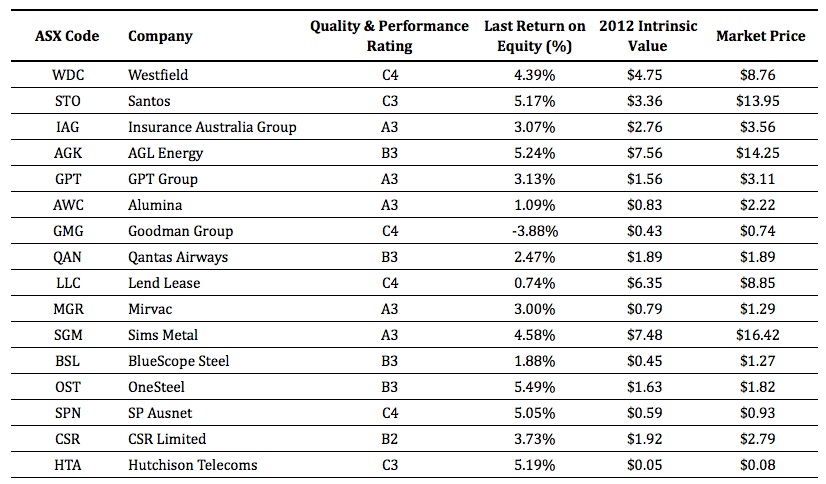

Starting with those companies whose market captitalisation is more than $1 billion (156), I then ranked them by return on equity (return on book value) in ascending order. 49 (31 per cent) companies generate returns less than your bank term deposit. The 16 largest (based on market capitalisation) companies with low ROE, possibly indicating either high levels of tangible assets or possibly overstated intangible assets carried on the balance sheet, are:

I have excluded resource companies. For while there are plenty that qualify, their returns are dependent on commodity prices.

Something to remember about the Quality & Performance Rating…

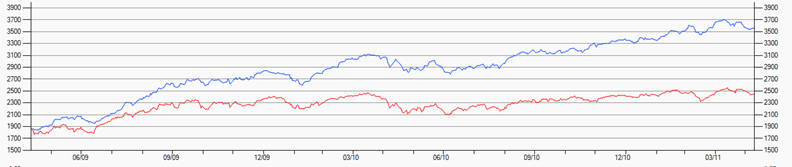

Rated A1 to A5, B1 to B5 and C1 to C5, every listed company is rated based on a series of over 30 discrete metrics, measured at both a point in time and over time. Most importantly, the Quality and Performance Rating is applied without any subjectivity. All companies are judged according to the metrics they generate. A1s have the lowest probability of a liquidation event. “Lowest probability” however doesn’t mean a liquidity event won’t occur. It just means far fewer A1s will have a liquidity event imposed on them compared to C5s. A liquidity event includes a capital raising, debt default or renegotiation, administration, receivership etc. An A1 company could of course raise capital if it needs to fast track construction of a new factory. MCE is an example of a high quality company whose cash flow has needed supplementation for this reason. Sticking to A1s and avoiding C5s should, over time, produce better returns. I demonstrate in the following chart:

The above chart shows the performance of a portfolio of the 20 biggest companies listed on the ASX rated ‘A1’. The red line is the poor old ASX 200.

There is merit with sticking to A1s (just as those who like the taste of Coca-Cola don’t settle for Pepsi). My team and I are fine-tuning something that will make the identification of A1s extraordinarily simple. So ignore those ‘Beat-the-tax-man’ pre-June 30 ‘special’ offers from various investing experts and other ‘helpers’. Avoid the temptation of an extra one, two or three month ‘subscription’, a show bag full of tips, a free magazine, DVD, or even a set of free steak knives.Wait for an A1 opportunity instead. Your patience will be rewarded.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 13 June 2011.

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights, Value.able.

-

Is The Price Now Right?

Roger Montgomery

June 9, 2011

There’s a lot in this post. So sit back and relax. Put up your feet, pull down the blinds and get comfortable.

There’s a lot in this post. So sit back and relax. Put up your feet, pull down the blinds and get comfortable.Billionaire Oilman J. Paul Getty famously advised; “Buy when everyone is Selling and Hold until everyone is Buying”. Knowing what price to pay most certainly helps to enhance returns in the long run.

An investor without the knowledge to estimate Value.able intrinsic valuations is surely blind to the opportunities presented by a sea of red ink. Without it, one cannot see beyond today. And without intrinsic values one sees only falling prices and fears further declines – frozen in the spotlight of a market collapse.

Even though they told themselves they would buy if prices dropped, now they can’t. Tomorrow, they reassure themselves, will be a better day.

Focus instead on business quality. Seek out those whose prospects are bright and whose Value.able intrinsic values you expect to rise 10, 15, 20 per cent over the years. Identify those whose returns on equity puts your term deposit to shame and whose balance sheet can survive the next GFC, should it occur.

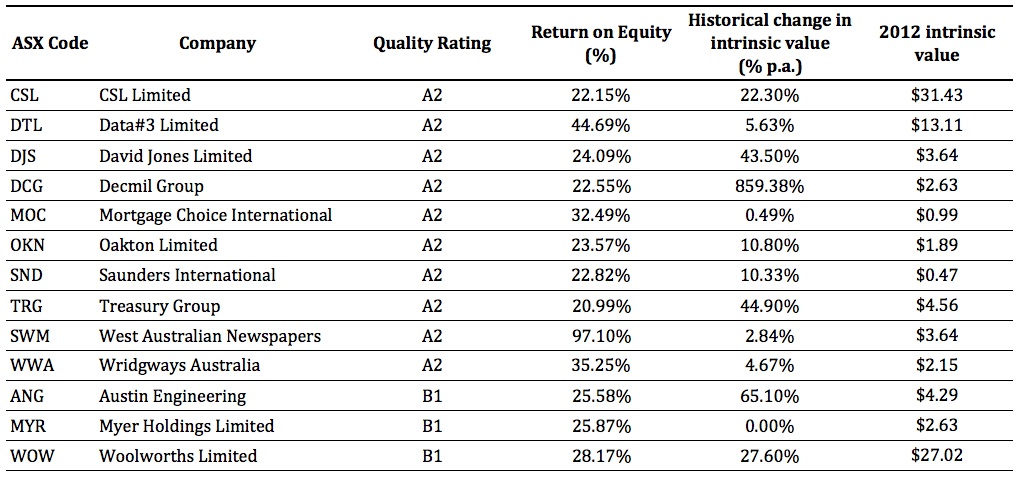

With the downturn in the US’s business cycle triggering fears of recession, I would like to share with you a list. It’s not a list of A1s, and it’s not a list of all companies trading at prices less than they’re ‘worth’.

It is instead a Value.able watchlist of companies that achieve some of our higher quality and performance ratings – A2 or B1 (I shared a list of A1s here a couple of weeks ago) and includes CSL, Data#3, David Jones, Decmil, Mortgage Choice, Oakton, Saunders International, Treasury Group, West Australian Newspapers, Wridgways Australia, Austin Engineering, Myer and Woolworths.

Each business reported return on equity greater than 20 per cent last year and may or may not be demonstrating a safety margin. Some have a track record of extraordinary performance; whilst others, well, won’t (p.s. that’s a clue)

Your Long Weekend Study Guide

The watchlist forms part of your Value.able education. Like the Insights blog itself, it is for educational purposes only. If you haven’t reviewed Value.able lately, I encourage you to spend some time over the long weekend (between periods of relaxation of course) reviewing Part Two – Identifying Extraordinary Businesses, then research your answers to the following questions for each company.

1. Extraordinary prospects: Does the future look bright? Or, if you don’t believe the future will be as extraordinary as the past, why not?

2. Competitive Advantage: What sets this business apart from its competitors?

3. Debt/Equity: How has management managed capital? What is the evidence?

4. Cashflow: Track record of cash flow? Use my quick back-of-the-envelope calculation to asses the true cash power of the business.

5. Which three are going straight to the top of your Value.able watchlist, and why?

Lets build a body of ideas under this post that adds value. If you complete the questions for one or all the companies listed, or if you have identified another company you would like included, go ahead and add it in. Please try and keep your comments under this post consistent with the above, five-part format.

And if all that seems like too much work, keep calm. My team and I are fine-tuning something that will knock your value investing socks off.

Those who have already had a private screening don’t want to be without it, and some Graduates are happy to pre-pay for it, sight unseen!

So ignore those ‘Beat-the-tax-man’ pre-June 30 ‘special’ offers from various investing experts and other ‘helpers’. Avoid the temptation of an extra one, two or three month ‘subscription’, a show bag full of tips, a free magazine, DVD, or even a set of free steak knives.

Wait for an A1 opportunity instead. Your patience will be rewarded.

If you like the taste of Coca Cola, you don’t settle for Pepsi. Even if Pepsi throws in more – an extra 300ml, an extra can or bottle, or even a free holiday – it’s just not the real thing.

Nothing matches what we are putting the finishing touches on for you.

We have been told it is the ‘next-generation’. Actually, its five generations ahead of anything else we have seen. It is A1, it is world leading with global plans and soon it could be yours.

So save your pennies because it won’t be discounted and we won’t need to fill a show bag full of other stuff to convince you.

If Value.able is the menu, then our next-generation A1 is the entire fine-dining kitchen.

Value.able Graduates will be offered first priority, followed by the loyal Facebook community.

So if you haven’t yet ordered your copy of Value.able, now is not the time to procrastinate. Remember, Value.able Graduates will be offered first priority.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 9 June 2011.

by Roger Montgomery Posted in Companies, Value.able.

- 130 Comments

- save this article

- POSTED IN Companies, Value.able

-

Have you submitted your photograph to the Value.able Graduate Album?

Roger Montgomery

June 9, 2011

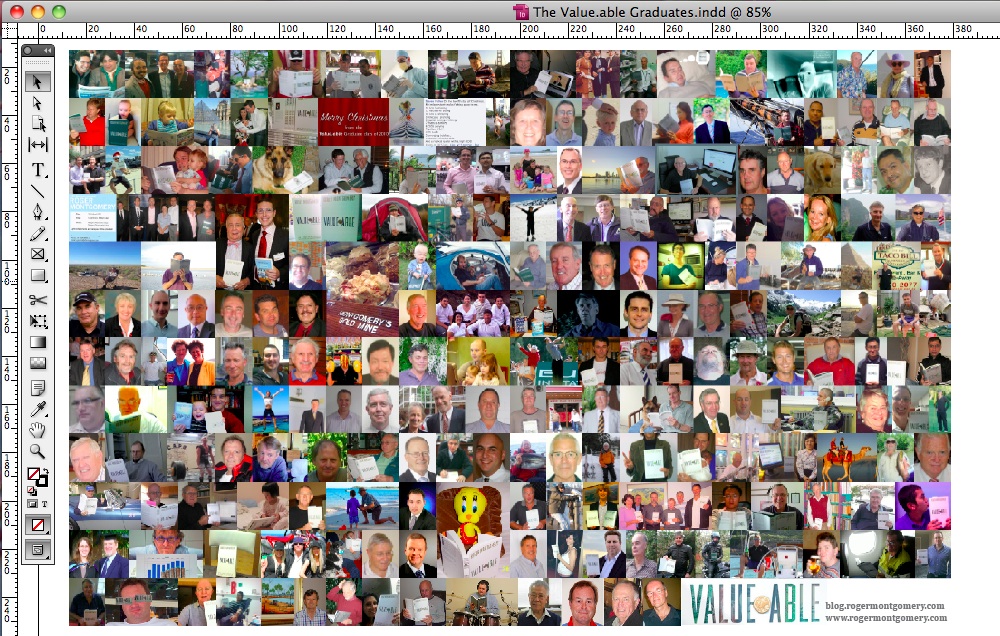

Jesse, Michael, Young Les, Justin, Matt, Rad, John, Ron, Young Max, Gary, Dan’s mum, Gary, George, Steven, JohnM, Paul, Steven and Sophie, Michael, Alya, Martin, Bernie, Amit, RBS Morgans Gosford, Jim Rogers, Daniel, Keith, Gavin, Graeme, Nick, Gelato Messina, Chris, Rodger, Phil, Vikki, Mark, Hien, Kenneth, Greg, Peter, Bernie, Paul, John, Bill, Bryan, Di and Lesley, Craig, Scotty, Chris, Main Amigo Stan, Charles, Fred, David, Mark, Collin, Nevada Cody and Winston, Peter, John, Nathan, Mal, John, Tony, Les, William Grant, Greg, Mike, Paul, Roger, Mike, David, Paul, Sinaway, Anders, Frank, Jake, Johan, Mark, Rob, Ian, Joan, Claude, Toni, Richard, Matt Jnr, Indrash, Sara, Garry, Jonathan, Ganesh, James, Kevin, Jim, Peter, Greg, Stuart, Craig, Eric, Robert, Ermin, Mike, Syed, Wilma, John, Alf, Tony, Phillip, Robyn, James, Carolyn, Roy, Peter, Jack, Kevin, Howard, Leo, Jonathan, Carole, Eileen, James, John, Martin, Ordan, Warren, Andrew, Liz, Jim, Anthony, Bob, Douglas, Christine, Frank, Martyn, Michael, John, Dave, Peter, Darrell, Jeffrey, David, Joof, Tom, Leigh, Mervin, Paul M, Paul K, Noel, Bob, George, Leigh, Bob, Steve, Monica, Richard, Frank, Brett, Steven, Colin, Wayne, Joanne, Dan, Garry, Lin, Judi, Allan, Stephen, Garth, John, Joab, Phillip, Kevin, John, Robert, Tweety and Bert, Peter, Mike, Patrick, Eugene, Brian, Harold, Russell, Brad, Rajest, Tim, Gemma, William, Bill, Robert, Geoff, Gary, Emily, Kent, Lucas, Neil, Peter, Rowley, Jason, Simon, Charles, Russell, Grahame, Lester, David, John, Richard, Mitra, John, Dave, Peter, Geoff, Paul, Derek and Rod have already submitted their photographs for inclusion in the Graduate album. My team – Russell, Vanessa, Rachel and Chris, will add theirs shortly.

Jesse, Michael, Young Les, Justin, Matt, Rad, John, Ron, Young Max, Gary, Dan’s mum, Gary, George, Steven, JohnM, Paul, Steven and Sophie, Michael, Alya, Martin, Bernie, Amit, RBS Morgans Gosford, Jim Rogers, Daniel, Keith, Gavin, Graeme, Nick, Gelato Messina, Chris, Rodger, Phil, Vikki, Mark, Hien, Kenneth, Greg, Peter, Bernie, Paul, John, Bill, Bryan, Di and Lesley, Craig, Scotty, Chris, Main Amigo Stan, Charles, Fred, David, Mark, Collin, Nevada Cody and Winston, Peter, John, Nathan, Mal, John, Tony, Les, William Grant, Greg, Mike, Paul, Roger, Mike, David, Paul, Sinaway, Anders, Frank, Jake, Johan, Mark, Rob, Ian, Joan, Claude, Toni, Richard, Matt Jnr, Indrash, Sara, Garry, Jonathan, Ganesh, James, Kevin, Jim, Peter, Greg, Stuart, Craig, Eric, Robert, Ermin, Mike, Syed, Wilma, John, Alf, Tony, Phillip, Robyn, James, Carolyn, Roy, Peter, Jack, Kevin, Howard, Leo, Jonathan, Carole, Eileen, James, John, Martin, Ordan, Warren, Andrew, Liz, Jim, Anthony, Bob, Douglas, Christine, Frank, Martyn, Michael, John, Dave, Peter, Darrell, Jeffrey, David, Joof, Tom, Leigh, Mervin, Paul M, Paul K, Noel, Bob, George, Leigh, Bob, Steve, Monica, Richard, Frank, Brett, Steven, Colin, Wayne, Joanne, Dan, Garry, Lin, Judi, Allan, Stephen, Garth, John, Joab, Phillip, Kevin, John, Robert, Tweety and Bert, Peter, Mike, Patrick, Eugene, Brian, Harold, Russell, Brad, Rajest, Tim, Gemma, William, Bill, Robert, Geoff, Gary, Emily, Kent, Lucas, Neil, Peter, Rowley, Jason, Simon, Charles, Russell, Grahame, Lester, David, John, Richard, Mitra, John, Dave, Peter, Geoff, Paul, Derek and Rod have already submitted their photographs for inclusion in the Graduate album. My team – Russell, Vanessa, Rachel and Chris, will add theirs shortly.Have you emailed yours?

We plan to frame the album and hang it at the entrance of our office, next to another invaluable piece – Stay Calm and Carry On.

Posted by Roger Montgomery and his A1 team, fund managers and Value.able Graduates, 9 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.