Value.able

-

Guest Post; A letter from Harley

Roger Montgomery

March 21, 2012

On 1 March, Harley sent me an email. Right in the guts of reporting season with up to 93 companies reporting in a single day, I have to confess to prioritising our work for the fund. But Harley put a lot of thought into his letter to me about Allmine Group and I would hate to see it not receive some feedback from the wider community. The price hasn’t changed so one suspects the arguments he puts forward remain unchanged also. Here’s Harley’s letter(s) in full. Remember Harley is not providing any advice nor are we. For those interested in researching the company and referring it to their advisor, you can find Allmine’s latest investor briefing Allmine March2012 Investor Presentation.

Hi Roger,

I have followed the blog virtually since inception and have written to you a few times (about NST when it was 42c and ZGL when it was 32c – Emails are below as proof. Just thought I’d point that out! :P)

I’ve said it before but thanks again for how open you are with what you practice and for being willing to teach those that are willing to learn. It is much appreciated and has made a significant impact on my own development both as an investor and in what I aim to do as a career.

In this email I just wanted to point out an interesting little stock. I have done a lot of homework on this one (and I promise it isn’t a stock ramp!) but I thought it was worth letting you know about it and writing my view, even though it is likely you are already aware of the company.

The company is called Allmine Group, (ASX:AZG), and is composed of three divisions: Arccon which is in mining services, Construction Industries Australia and Allmine maintenance. I apologise if this email becomes too long but the company has a very interesting story and I believe it is incredibly cheap.

Firstly, just looking at the numbers, the company reaffirmed its 2012 profit numbers of around $16.5m which puts it on a fully diluted EPS of around 5.5c. The SP is currently sitting at 15c. On my numbers, the per share value of Net Receivables, Net Cash and tangible assets for FY12 is 14c. The company is most certainly cheap on a number of metrics, and when using the formula from Value.able it becomes even more attractive.

The issue the market had with the company, and one that I believe is being resolved, is cashflow. The Sep quarter 4C showed OCF was negative and the company appeared to be relying on the banks to keep running. The obvious assumption was that a capital raising was on its way, something I didn’t agree with but believed still needed to be considered. Around that time I actually gave the company a call and spoke to Scott Walkem, CEO, about their CF situation. He basically said that the company was “essentially cash flow positive” and that short term negative CF was a result of the huge step change in the business, which I’ll expand upon in a moment.

I tried to gauge when he saw CF turning positive and his exact words were “I see no reason why we won’t be in a net cash position by June 2012.” While encouraged by this I didn’t want to act solely upon his words and so have waited until recently to take a position in the company (and am looking to buy more after the company reports). More encouraging was the fact that weeks after I spoke to Walkem he purchased $50k in shares, adding more skin in the game.

What I find most important is the fact that in the latest 4C the company was OCF positive. They were also able to establish a number of new contracts across all divisions and secured a new bank facility last December. So while I am not overly bullish on mining services as a whole in the short term, I am of the view that the value in AZG is enough to warrant an interest.

Even more interesting is the qualitative side of AZG. AZG acquired Arccon, a company founded by Robert Wilde and John McGowan, two highly successful and well respected men in the industry. Arccon was the brain child of these two men, and Construction Industries Australia (CIA) was born out of Arccon and these two companies have significant relationships with two of the Chinese giants in mining – MCC and China Non Ferrous Metals.

Basically what happened was that Robert Wilde went to MCC and told them he could promise substantial savings on their Sino Iron project. He ended up saving them $100m+ (according to Scott Walkem) and out of this CIA was born. As a result the two companies have strong relationships with MCC and its sister company China Non Ferrous Metals. As a result of this relationship Arccon and CIA are able to not only have access to some of the projects MCC and China Non Ferrous are working on (evident in recent contract announcements), but also have access to cheap project financing via the Chinese banks. In the meantime the Allmine maintenance division announced a new contract with Downer EDI worth $10m p.a. which is a substantial amount based on the $30m odd revenue of the previous year.

Since following the blog I have learnt so much and been given so many investment opportunities and ideas, that if possible, hopefully I can return the favour! AZG in my view is worth a look. It appears to me to be very cheap, has only recently become OCF positive and I believe there is minimal risk of a capital raising. Obviously one must consider some of the risks: slowdown in China, weakness in the Chinese banks impairing the relationship with MCC and NFC, commodity prices falling. In my view in an ironic way, thanks to the relationship with MCC and NFC Allmine is less exposed to a slowdown in China than other mining services companies. The Chinese desire for resources is not a short term play and without further lengthening this email I do not see Chinese exploration/acquisitions of resource projects slowing in the event of a commodity price fall, in fact I expect the opposite as they see cheap assets as an opportunity.

In terms of catalysts for SP appreciation if Allmine can reconfirm a $16.5m profit this month and put it on a PE of 3 I think that will be a shock to the market. The latest report will reveal a substantially different company to that shown in the previous report with the 100% acqusitions of both Arccon and CIA now being fully accounted for, and Skaffold will likely rerate the company too if I am correct!

Thanks again Roger.

Regards,

Harley

…Seperately Harley also wrote the following about the company…

Overview

Allmine Group provides a life of mine service to its clients via three divisions: engineering, construction and fixed and mobile maintenance services. The company is comprised of Allmine Maintenance, Arccon and Construction Industries Australia (CIA). But there is much more to Allmine Group than meets the eye. At first glance it is just another mining services company, but the story behind this company is an exciting one and one that completely changes your view of the company when you begin to understand it.

When AZG listed in March of 2011 they were entirely a maintenance services company. I remember looking at the prospectus when they listed at 20c and thinking it was an ok company but nothing outstanding. Since that time Allmine have made two significant acquisitions that have substantially changed the nature, growth profile and outlook of the group.

Firstly, Allmine bought Arccon Mining Services, an EPC/EPCM contractor for a maximum consideration of $22.8. The acquisition will be paid for in two tranches. The first tranche has been paid and involved an equity deal of 75 million shares at 20c/share, a total consideration of $15 million. The second tranche is performance and loyalty based, whereby Arccon must achieve NPAT of $5.55m in 2012. If the target is achieved another $7.8m worth of shares will be issued at the 5 day VWAP at June 30 2012. For the Arccon shareholders to receive this payment they will have to hold 75% of the shares issued to them in Allmine.

The second acquisition was for Allmine to purchase the remainder of Construction Industries Australia (CIA), which was 50% owned by Arccon and 50% by the original founders. The total consideration paid was $3m paid in shares at 20c strike price. In 2011 CIA achieved $10.5m NPAT. Yes, you read that correctly.

Now at first glance it seems impossible that such acquisitions could be made so cheaply, to good to be true in fact. The truth is that the initial payments being made do not fully reflect the price that will ultimately be paid for these companies. Instead, the rest of these payments will come through in the performance incentives program which provides for substantial benefits for management and original Arccon shareholders should they achieve key objectives. The details of the performance incentive plan are quite complex and are explored in depth later in this report.

Background

I took a closer look at this company around September last year. At the time it was very cheap based on its forecast earnings, but its operating cashflow (OCF) was negative. There was fear of an imminent capital raising as it appeared upon looking at the financial statements that the company was relying on the banks for survival. But that wasn’t the case.

What the market was missing was the company was essentially cash flow positive, but that cash flow timing issues were causing OCF to come out negative. I looked into the company and thought it’s story (which I will get into in a moment) was one of a company with incredible opportunity and its current share price was ridiculously cheap. So I got in contact with the company and, luckily enough, was able to speak to the CEO, Scott Walkem, over the phone. Much of the story that follows is direct from the CEO himself.

Allmine Group’s Story: Not Your Everyday Mining Services Company

When AZG bought Arccon and CIA they substantially changed the makeup of the company. Arccon and CIA have two significant competitive advantages: access to cheap project financing from Chinese banks and management with a proven track record.

Arccon was founded in 2003 by Robert Wilde and John McCowan, the two founders of the hugely successful Minproc Engineers which was taken over by AMEC plc., the UK mining services giant. These guys have a proven track record in growing a successful company, and they have significant ownership in AZG as well as performance related incentives. And shareholders can be more or less assured that they will remain at the company for at least the next three years, as the details of the acquisition state they must do so to receive their performance and loyalty bonuses.

It is their experience, as well as their connections to the Chinese companies China Metallurgical Group Corporation (MCC) and China Non-Ferrous Metal Industry’s Foreign Engineering Construction Co. Ltd (NFC), and as a result their access to cheap project financing from the Chinese banks, that presents a fantastic opportunity.

The story goes like this. Robert Wilde, then working at Arccon, got in contact with MCC and told them he could help them achieve sizable savings on the Sino Iron Ore project in the Pilbara (which MCC owns 20% and which AZG works on to this day). They agreed and in the end Arccon was able to save MCC $100m USD on the project. From this demonstration of ability CIA was born, and the company was introduced to MCC’s sister company, NFC.

MCC and NFC are big companies. They work on big projects around the world with Tier 2 (or below) mining companies. They are able anywhere between 70-100% of the project requirements through the Chinese banks at relatively cheap rates. Arccon now has a “significant pipeline of work across next the 1-4 year time horizon” (most recent Half Yearly Report) as a result of this relationship, while CIA is currently undertaking projects on a lump sum and cost recovery basis with MCC. Many of these big contracts involve financing arrangements through Chinese banks, something no other Western mining services company can offer their clients.

Allmine Group now has two clear competitive advantages:

1) Management with a proven track record.

2) Key relationships with MCC and NFC allowing large projects to be financed via the Chinese banks.

These two factors, particularly the latter, in my mind represent something the market may just latch onto when it realises how significant these competitive advantages are. I encourage you during the process of researching this company to look closely at some of the projects AZG has lined up as a result of these arrangements as they are indeed quite large and begin coming through in Q4 of this year.

Of course the maintenance division, while not as attractive as Arccon and CIA, is still a strong business. It is experiencing labour shortages, as Walkem said “the business could be twice as large tomorrow if we could find the people.” The company announced it had initiated an in-house training program to help alleviate this issue and that first signs were encouraging.

CIA is in the process of diversifying its client base away from MCC to reduce the reliance on the Chinese company, with positive news coming from its contract win with UGL. At the moment CIA is heavily dependent on contracts at the Sino Iron Ore Project, which as many of you will know has had its fair share of negative press, so any diversification can only be positive.

The Allmine Advantage

The main difference between Allmine and competitors is indeed the connection to the Chinese companies and through them the cheap financing of the Chinese banks. Firstly, mining companies will be attracted to the prospect of cheap financing on offer from MCC and NFC. In the past, and in recent news, Australian companies have not been satisfied with the performance of MCC, as was made clear when CITIC Pacific complained about the cost blow-outs on the Sino Iron Ore Project. It is therefore in the interests of MCC and NFC to have Arccon (and CIA) covering some of their contract requirements in Australia, as projects need to be completed to Australian standards. If MCC were to lose their relation with Arccon they would greatly reduce their chance of future contract wins (and therefore opportunities to secure resources) in Australia. The Chinese company relationship is very important to Allmine Group, but don’t think it’s a one way street as MCC and NFC benefit too.

From a client’s perspective working with MCC/NFC and Allmine Group offers project financing, access to cheaper Chinese materials and work completed according to Australian standards. To demonstrate this competitive advantage in action, read the following from an announcement by Reed Resources:

“The involvement of both NFC and Arccon in the EPC consortium enables Reed to access the cost benefits of a Chinese contractor, whilst retaining appropriate Australian expertise and experience, to ensure Australian standards and work practices are adhered to and construction of the Project can be executed smoothly.” (Nov 11 2010)

As has been demonstrated the management of Allmine clearly have a few things to show the big Chinese engineering companies when it comes to efficiency and cost management. For a small to mid tier company looking to go from explorer to producer, in an environment like today where the future of potential project financing seems uncertain (whether true or not), this is an attractive option.

It is also important to note that the projects Arccon tenders for via their relationship with MCC and NFC are not limited to Australia. In fact some of their biggest projects are overseas with two examples being the Yandera project in Papua New Guinea and the Citronen project in Greenland.

The goal of the Chinese is to eventually source half its imports of iron ore from owned or co-owned mines by 2015. They want to diversify away from their reliance on BHP, RIO and Vale, for obvious reasons. For this to occur the Chinese will need to continue to invest money into iron ore and other commodity projects worldwide, and to do so by buying/financing projects. If this is to occur, as I expect it will since the Chinese have made it a priority, then Allmine is well positioned to benefit from increased Chinese investment into iron ore and related commodity projects. Remember the Chinese will need more than just iron ore. Zinc, vanadium, copper, molybdenum, all are resources the Chinese need to secure. I expect to see more stories along the lines of small-medium sized Australian companies partnering up with companies like MCC to secure project financing while MCC (or other Chinese companies) take large stakes in the projects/companies themselves.

Then of course you have the proven track record of Wilde and McCowan, which should translate into further contract wins for Arccon and CIA outside of MCC and NFC. Continued diversification is a positive and it seems a focus of Allmine management.

The maintenance division, while smaller, should not be forgotten. If labour issues can be kept under control the business should stay relatively profitable. On top of this the synergies will only increase as the volume of work for Arccon and CIA picks up.

Cashflow Turnaround

Cash flow is key for this business. As it stands the balance sheet is not strong enough to withstand a significant shock should something unexpected occur. When OCF was negative last year, Scott Walkem insisted there was no need for a capital raising saying the company is essentially cash flow positive and backing it up by purchasing shares for his own account. He said that the company was undergoing a step change in growth and the changes in working capital were temporary and beneficial long term.

In the latest 4C he was proven right when OCF was reported as positive, albeit by only $2m. At December 31 2011 AZG had $2.5m cash at bank but had drawn down their bank overdraft to the tune of $7.7m. While they have plenty of room to draw down this facility under normal operating circumstances, should something unforeseen occur then the company will have little room to move.

Negating these risks somewhat are three key factors. The first is that the CEO is purchasing shares. He purchased $50k last year and another $100k earlier this year. Insider buying is always a good sign. The second is that the potential for cash flow to turn around, and to do so quickly, is certainly there. Around $36m in cash is coming in each quarter, and that is expected to increase in future. In the most recent quarters the company experienced significant growth, increasing total engineers from 5 to 50 as well as a significant jump in total employees.

And finally, the company has forecast for working capital needs to normalize in the fourth quarter of FY12 and for cash to start building up on the balance sheet. They still maintain their forecast of $17m cash by the end of FY12.

Is There An Issue With Dilution?

If you are going to invest in Allmine you need to be aware of the almost inevitable increase in total shares on issue. It is true that the total share count will likely increase substantially. What is not correct is the idea that this is a net negative for shareholder value.

While a number of new shares will likely be issued it will not cause a significant reduction in the value of this company so long as current performance is maintained. Today there are 280m shares on issue. There are 40m options at 20c, 2.5m at 25c and 2.5m at 30c. Each represents a price that is above current equity per share! Thus if these options were to be exercised it would actually be value accretive! As I write this the 20c options are at the money while the rest are out of the money and thus are unlikely to be exercised before a substantial share price rise.

One must keep in mind that if options were to be exercised it would inject over $8m into the company, which would entirely remove the negative cash flow position of the company. Options being exercised is actually a net benefit to the value of the shares!

The next issue of possible dilution relates to the second tranche of payment for the Arccon acquisition. Should Arccon achieve NPAT of $5.55m in FY 2012 $7.8m of shares will be issued at the 5 day VWAP as at 30/6/12. It is difficult to determine how many new shares will be issued because it depends on what the share price is at the time the VWAP is calculated. If the company can continue its strong performance it is entirely possible that the share price is substantially higher by June than it is today. But at the same time it could be cut in half tomorrow! It really is anyone’s guess. So for now let us assume the 5 day VWAP at 30/6/12 is near enough the current share price, or 20c. At 20c 39m shares will be issued, taking the fully diluted share count to 360m. Remember the total number of shares to be issued in this second tranche payment for the Arccon acquisition is highly sensitive to the share price in the 5 trading days prior to 30/6/12.

The final source of dilution relates to the performance incentives to be paid out to management and the CEO. In a moment we will look more closely at this, but for now take it that the maximum number of shares on issue for FY12 will be 400m. Provided the $16.5m NPAT is achieved, EPS will come to 4.1c and the current share price represents a PE of 4.8.

Performance Incentives For Key Management

On face value the total considerations paid for Arccon and CIA are ridiculously low, especially considering the calibre of management. The truth is that these acquisitions will be paid for over time and provided Robert Wilde and John McCowan achieve key objectives for the company. Personally I prefer this approach to simply overpaying upfront for a company, as at least this way any shareholder dilution is a trade off for increased performance.

The CEO, Scott Walkem, has his incentives tied to total market cap. According to the plan he receives no performance incentive if market cap is below $60m, $1.8m between $60 and $80m, $2.4 between $80m and $100m. If market cap is over $100m Walkem receives $3m plus 1% of the total market cap up to $200m. Again the payment is made in shares at the 5 day VWAP as of June 30 2012. Currently the market cap sits at $56m, but it I would not be surprised if options were exercised if the market cap does not break the $60m mark between now and then.

Robert Wilde is rewarded according to the NPAT achieved by Arccon in FY12. He receives $2.474m if NPAT is between $7m and $12m; and $4.2m if NPAT if it is above $12m. Again it is tied to the 5 day VWAP at 30/6/12. Unlike the shares to be issued upon exercise of options these shares will not result in any cash being injected into the company.

So let’s now calculate the maximum total of shares to be issued. We will assume the 5 day VWAP at the relevant time is equal to the current share price, or 20c.

45m shares can be issued through exercise of options, 39m shares will be issued for the second tranche payment for Arccon, the maximum realistic payout to Scott Walkem is 9m shares (since the CEO is rewarded based on market cap his bonus relies on the share price increasing, which would ultimately increase the VWAP used and thus reduce the total new shares to be issued.) and the maximum payout to Robert Wilde is 21m. This brings the maximum realistic total to 394m shares.

It is difficult to forecast the total shares to be issued, simply because no one can forecast the share price. But even assuming 394m shares are on issue by the end of this year, it would mean profit came in near guidance, or around $16.5m, which still puts the company on a PE in the 4’s. There are risks to this company but provided the profit numbers are hit dilution is not one of them.

Risks

As with any company there are some key risks one should consider. They are as follows:

Cashflow: This risk has been covered above. Some may avoid this company as cash flow in the recent past has been weak, which admittedly makes them vulnerable to key project risk. If this is you, consider waiting for the next few cash flow reports before investing.

Key Project Risk: This is in my view the biggest risk for Allmine. They are strengthening their balance sheet but are not in a solid enough position to withstand a number of key projects being delayed or cancelled. They have had one major project delayed due to weak vanadium prices already, which is something to keep an eye on. (In regards to this project the company is still in informal negotiations with Arccon and the project will likely go ahead. In what form will be revealed in April.) Because the big key projects don’t start coming through until FY13 the FY12 profit number is still uncertain and reliant on timing of projects. It is my view that this risk is negated by those big projects in the pipeline, but it does not prevent the possibility of a project delay causing the FY12 profit forecast to be missed.

Chinese Connection: While a significant strength, the risk of losing the relationship with MCC and NFC is indeed a risk and would damage the billions of dollars worth of projects in the pipeline. However, it is important to remember that the benefits are mutual, and MCC/NFC do indeed benefit from working with Arccon and CIA.

Profit Guidance Being Missed: As with any company the risk exists that profit falls short of guidance. This is true with Allmine. However, the margin of safety on offer reduces this risk. The company made clear they expect the second half of FY12 to be stronger than the first. If we consider the possibility that this doesn’t occur, and instead profit continues at the same pace as the first half then NPAT will come in around the $12-$13m mark, the increase in the second half being due to the profits from CIA having a full 6 months to come through, unlike in the first half. In this case, and assuming the maximum possible share dilution occurs EPS will come in at around 3.2c and if you were to purchase today you would still be paying a PE of only 6, which isn’t too bad for a downside scenario.

The Financials And A Valuation

Ok, here is where it gets really interesting. When I first noticed this company it had announced earnings guidance of $16.5m. As I have made clear if this were to be achieved the company is currently very cheap, which reflects its doubling in price since then.

In the latest half yearly report AZG reported NPAT around $5m in the half, but the key to the report was the reaffirmed earnings guidance. They stuck with the original $150m revenue and$16.5m NPAT but separated the guidance into two key parts. The company announced $13m from construction and maintenance services, with an additional $4-$8m in ‘at risk’ income due to uncertainty regarding timing of contracts. $13m NPAT for 2012 would represent a continued rate of performance over the first half, as the acquisition of CIA comes through to the bottom line. And there is now potential for upside as according to the company there is the possibility that NPAT comes in as high as $21m.

Forecasting profit for an EPC/EPCM services company is very difficult, and for the sake of company valuation I would rather be conservative and right than optimistic and wrong. So when valuing this company I have decided to assume NPAT of $15m, which would mean falling short of guidance by 10%. For me this takes into account the recent project delay as well as any other unforeseen risks. It also assumes $150m revenue comes through but that margins fall from historical levels, which is not impossible considering the labour issues currently present in the industry. The numbers that follow are in my opinion quite conservative. Suffice to say that if the upside of profit is achieved this company is ridiculously cheap, so in using conservative numbers I hope to demonstrate that even in such a case the company still presents value.

So assuming $15m NPAT let’s forecast equity per share. Equity was $54.4m at December 2011. Since no dividend will be paid retained earnings would increase by $9.8m. We will assume that the 40m options at 20c are converted, which is likely if the share price rallies going into reporting season. If this were to occur it would inject $8m into equity. Equity would now be equal to $73.6m and equity per share on a fully diluted basis (394m shares) would come to 18.6c. This means that if $15m NPAT is achieved (which would mean they are short on guidance, upside exists) that on a fully diluted basis the book value of the company is near the current share price. Average ROE would come to 23.4% and would be likely to remain stable or increase in future years as the larger projects with MCC and NFC start to come online. EPS will be 3.8c putting the current share price on a PE of 5.25.

So what does this mean for the value of the company?

Using these numbers and based on an average of three valuation models, I value Allmine Group at 40c.

Thanks Harley …As always be sure to conduct your own research and do not engage in any securities transactions of any description without seeking and taking personal professional advice.

by Roger Montgomery Posted in Energy / Resources, Investing Education, Skaffold, Value.able.

-

MEDIA

Thinking of speculating in the stock market?

Roger Montgomery

March 17, 2012

Participation in the stock market is at a low ebb – in this Australian article published 17 March 2012 Roger Montgomery explains how when you decide to re-enter the stock market his Value.able strategy will allow you to invest for value, and entirely avoid speculation. Read here.

by Roger Montgomery Posted in In the Press, Investing Education, Value.able.

- save this article

- POSTED IN In the Press, Investing Education, Value.able

-

GUEST POST: A PRIMER ON GOLD EQUITY INVESTING

Roger Montgomery

March 7, 2012

By Praveen J on 9th January 2012 and updated Feb 20 2012

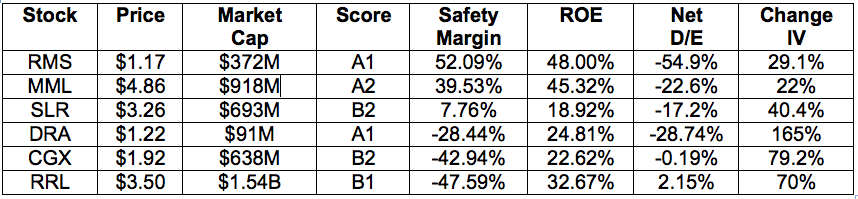

By Praveen J on 9th January 2012 and updated Feb 20 2012This year I have been given an opportunity to write about my experiences in applying what I have learnt as a Value.able graduate and Skaffold member. At the moment I am looking to invest in stocks with a market capitalisation under $2 billion (small to micro caps). Key MINIMUM criteria for me include: Return on Equity > 15%, Net Debt/Equity < 50%, and forecast change in Intrinsic Value > 5%. I will also be focussing on investment grade companies across ALL Industry Sectors/Groups that have Skaffold Quality Scores between A1 to A3, and B1 to B3. This will encompass my “investment universe” of stocks on the ASX. I will of course require a decent margin of safety, but I will be watching stocks that are trading close to their Intrinsic Value or at a small premium, in the event of a decline in price over the next 3 to 6 months. Initial screening using Skaffold reveals over 100 stocks, a more aggressive filter would reduce this number even further. Amongst the results are 10 stocks in the Basic Materials Sector and Gold & Silver Group, 6 of which are predominantly involved in gold exploration, development and production:

• Ramelius Resources (ASX:RMS)

• Medusa Mining Limited (ASX:MML)

• Silver Lake Resources (ASX:SLR)

• Dragon Mining (ASX:DRA)

• CGA Mining (ASX:CGX)

• Regis Resources Limited (ASX:RRL)Table 1. Stocks listed by safety margin (highest to lowest, 9th January 2012) (Source: Skaffold):

Although Ramelius Resources (RMS) meets my initial screening criteria and is an A1 company, it has a NEGATIVE forecast EPS growth. So in this blog post I will be discussing and comparing Medusa Mining Limited (MML) and Silver Lake Resources (SLR). Here we have two companies that have commenced production of gold (they are making money), they are fundamentally healthy, they have good prospects for Intrinsic Value appreciation, AND are both trading at a discount to their Intrinsic Value. Being commodity businesses, the question I have to ask is whether either really have any competitive advantage. I will discuss this later.

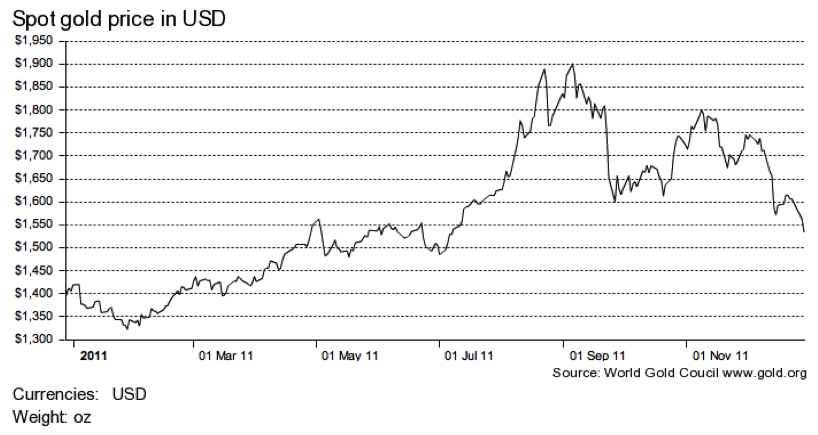

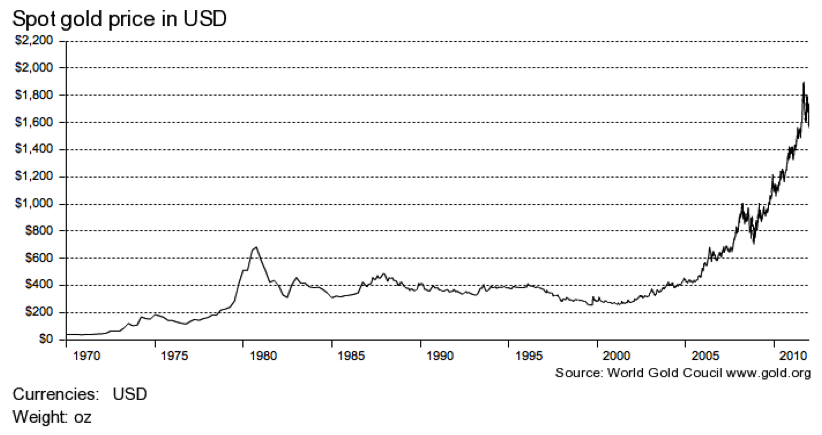

Now in the context of the European sovereign debt crisis, anaemic growth in the US, and concerns of a slowdown in the Chinese economy, I am wary about investing directly in a small cap Australian mining company. However, in this case we are dealing with a commodity that may benefit in this time of uncertainty, with gold long being regarded as a “safe-haven”. Having said that, the future price of gold is still a significant element of risk. At the time of writing the price had dropped down to around US$1600/ounce, after a peak of close to US$1900/ounce in September 2011. Below are some charts of historical gold prices, I’m not going to try and analyse them, but they may serve as a point of discussion. Certainly investing in gold equities requires a bullish stance on the future price of gold in the medium to long term.

Figure 1. Spot gold price chart last 1 year:

Figure 2. Spot gold price chart long-term:

GOLD PRIMER:

Annual reports and AGM presentations for gold and other mining companies assume a level of pre-existing knowledge. Without this, they really make no sense at all. So let me start with some bare basics before I discuss each stock in detail:

What is an Element? An element is a pure chemical substance. You may have heard of something called the periodic table (maybe in your high school science class), this is actually a list of all chemical elements. Examples of elements include carbon, oxygen, aluminum, iron, copper, lead, and of course gold.

What is a Mineral? A mineral is a naturally occurring solid chemical substance that is a combination of elements.

What is an Ore? An Ore is a type of rock that contains minerals. Most individual elements are found in the form of a mineral, though there are some elements that can be found in their elemental state, gold is one of them. Gold is also found in combination with silver and occasionally copper.

What is an Ore Deposit? This is an accumulation of Ore.

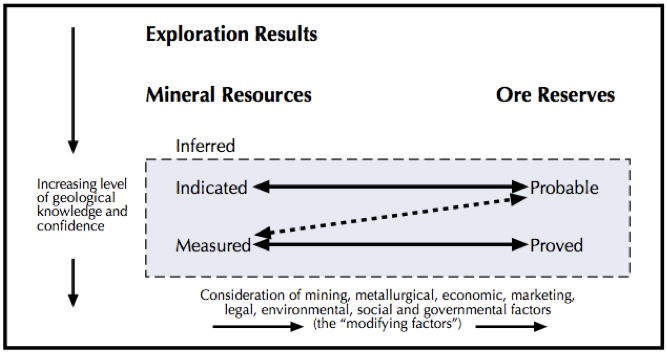

JORC? This is the Joint Ore Reserves Committee. The Code for Reporting of Mineral Resources and Ore Reserves (the JORC Code) is widely accepted as a standard for professional reporting purposes.

What is a Mineral “Resource” and what is an Ore “Reserve”? These terms are often incorrectly used interchangeably, the exact JORC definitions are below:

Figure 3. Resources versus Reserves (Source: JORC):

RESOURCE; “A CONCENTRATION OR OCCURRENCE OF MATERIAL OF INTRINSIC ECONOMIC INTEREST IN OR ON THE EARTH’S CRUST IN SUCH FORM, QUALITY AND QUANTITY THAT THERE ARE REASONABLE PROSPECTS FOR EVENTUAL ECONOMIC EXTRACTION. THE LOCATION, QUANTITY, GRADE, GEOLOGICAL CHARACTERISTICS AND CONTINUITY OF A MINERAL RESOURCE ARE KNOWN, ESTIMATED OR INTERPRETED FROM SPECIFIC GEOLOGICAL EVIDENCE AND KNOWLEDGE. MINERAL RESOURCES ARE SUB-DIVIDED, IN ORDER OF INCREASING GEOLOGICAL CONFIDENCE, INTO INFERRED, INDICATED AND MEASURED CATEGORIES.”

RESERVE; “THE ECONOMICALLY MINEABLE PART OF A MEASURED AND/OR INDICATED MINERAL RESOURCE. IT INCLUDES DILUTING MATERIALS AND ALLOWANCES FOR LOSSES, WHICH MAY OCCUR WHEN THE MATERIAL IS MINED. APPROPRIATE ASSESSMENTS AND STUDIES HAVE BEEN CARRIED OUT, AND INCLUDE CONSIDERATION OF AND MODIFICATION BY REALISTICALLY ASSUMED MINING, METALLURGICAL, ECONOMIC, MARKETING, LEGAL, ENVIRONMENTAL, SOCIAL AND GOVERNMENTAL FACTORS. THESE ASSESSMENTS DEMONSTRATE AT THE TIME OF REPORTING THAT EXTRACTION COULD REASONABLY BE JUSTIFIED. ORE RESERVES ARE SUB-DIVIDED IN ORDER OF INCREASING CONFIDENCE INTO PROBABLE ORE RESERVES AND PROVED ORE RESERVES.”What is the difference between high and low-grade gold Resource? There aren’t any fixed definitions that I could find, but generally < 4.0 grams/tonne is low-grade, >8.0 grams/tonne is high-grade, and everything in between is about average. A large amount of low-grade gold could be just as profitable as having high-grade gold, as it could be cheaper and easier to mine the low-grade gold (for example low-grades in “open pit” or near surface mines, versus high-grades in “narrow vein” or deep underground mines).

Stages of mining: exploration, development, or production? Exploration involves primarily drilling activity in order to discover ore deposits and then define the Resource and Reserve levels, as well as feasibility studies, development involves primarily engineering / construction work, and production involves the mining, processing at the mill, and selling of the commodity.

Junior, mid-tier, or senior gold producers? Junior gold producers are generally considered as those producing under 200,000 ounces per annum of gold, seniors over 1,000,000 ounces, and the mid-tier producers in between.

What is a mining tenement? This is basically a license/permit granted by the Government to undertake exploration, development, and/or mining activities in a specific area.

What are royalties? Royalties are an expense that needs to be paid to the State Government in Australia for any minerals that are mined. In Western Australia for example, royalties are 2.5% of the value of gold produced.

What are cash costs? This is the operating cost required to produce one ounce of gold. Average worldwide cash costs are around US$620/ounce. Cash costs do not include capital expenditure. TOTAL cash costs include royalties.

What is hedging? Agreeing on the sale price of a certain volume of gold ahead of producing it, it is done to protect the company from the short-term volatility of the market gold price, but will reduce return when the price is rising.

Quick comparison of gold producing companies… First of all, make sure you compare similar companies, i.e. a junior producer with another junior producer, not a junior with a senior. Look at the total amount of resources they have, quoted in ounces, look at the cash costs, and look at how much ounces they have produced per year, and what level is expected in the future. Look for companies that are actively drilling to expand their resource base and find new ore deposits. A company may have one site producing gold, another being developed, and several others under exploration. This ensures that when Resources deplete at one site, there are other potential mines in the wings.

ANALYSIS: MEDUSA MINING LIMITED (ASX:MML)

MML is an un-hedged gold producer listed on the ASX and LSX and is currently operating in the Philippines.

Figure 4. MML’s Skaffold Line (Source: Skaffold 6th January 2012):

Looking at the figure above we can see that the share price has been on the climb since early 2009. The ACTUAL Intrinsic Value (which is based on analyst forecasts) has also followed suit since then, and has generally remained above market price. Market price reached a peak of $8.35 in September 2011 but has since been on a downward slope. More importantly though, the ACTUAL Intrinsic Value is expected to continue rising. In this instance however, the AVERAGE Intrinsic Value (a more conservative estimate), which is based on past performance with an emphasis on the last 3 years, is not expected to rise as strongly. As this value does not necessarily take into account all possible future events, what I need to find out is what future prospects the company has that could have contributed to the analyst’s forecasts. Another important thing to consider is why has the market price dropped almost 50% in just a few months? I’ll come back to this last point later…

Currently MML’s production is focussed on the Co-O mine in the Mindanoa Island area. A second potential gold production centre is under exploration at the Bananghilig deposit. MML currently have JORC code compliant mineral Resource of 21.3 million tonnes, at a grade of 9.6 grams/tonne (g/t) at Co-O and 1.3 g/t at Bananghilig, for a total of 2.6 million ounces (mOz). The company aims to keep Resource and Reserve levels at the Co-O mine stable year to year (by replacing whatever is used up each year), and in doing so avoid spending too much money on expanding this base to levels that will not get mined for several years. Exploration budget for 2012FY is US$27 million. Gold production for 2011FY was 101,474 ounces. Total cash costs for 2011FY were an extraordinarily low US$189/ounce (includes royalties). This could be due to the fact that mining is done predominantly via hand-held equipment, and labour costs are low. The site is also adjacent to a highway with close access to the port, and has grid power via hydropower.

Production for 2012FY was expected to be around 90,000 to 100,000 ounces. This will be ramped up to 200,000 ounces per annum by 2014FY after completion of the Co-O mine expansion. Exploration continues at Bananghilig, MML are targeting production of 200,000 per annum at this site by 2016FY. Near future expansion related capital expenditure will be funded from existing cash rather than through capital raisings and debt facilities, which is great and not surprising given their huge operating margins. Having said that, with regards to Bananghilig, no announcement has been made yet regarding whether feasibility studies are to take place, and whether this deposit will go into production phase at all. Further to this, based on current Reserves at Co-O, its mine life is only about 5 years. The risk here is if they are unable to continue replenishing the Resource and Reserve base over the coming years to extend the mine life further. However published analyst research reports are suggesting a possible mine life of over 25 years, indeed a similar mine south of Co-O (Diwalwal) has been mining for 20 years. There is also the risk of political/social instability in this country. MML is targeting 400,000 ounces per annum of production of gold by 2016FY.

Figure 5. Production timetable in ounces (Source: MML AGM Presentation November 2011):

ANALYSIS: SILVER LAKE RESOURCES (ASX:SLR)

SLR is also an un-hedged gold producer that currently operates in 2 key regions of Mount Monger and Murchison in Western Australia, approximately 50km south east of Kalgoorlie.

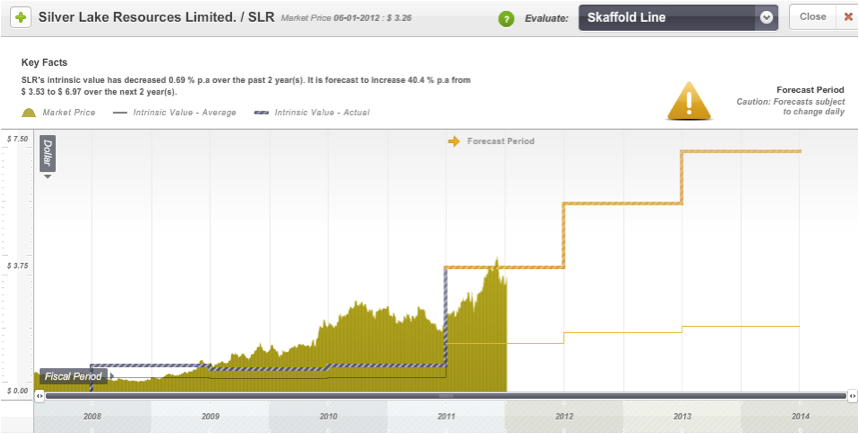

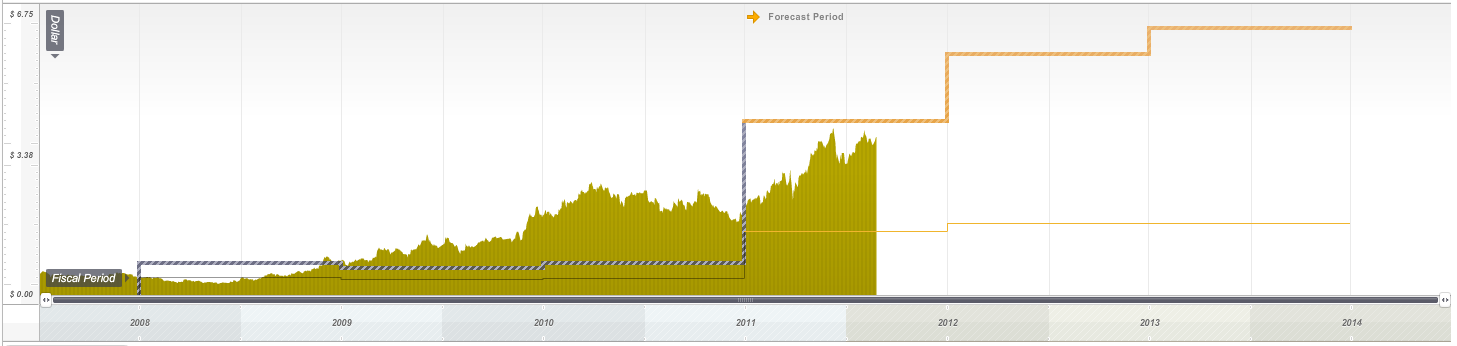

Figure 6. SLR’s Skaffold Line (Source: Skaffold 6th January 2012):

From the figure above what I can see is that the market price has generally been above the ACTUAL Intrinsic Value, although it appears that a great opportunity to buy would have been at the start of 2011. The ACTUAL Intrinsic Value has increased significantly since then, and looks like rising quite rapidly over the coming few years. Market price reached a peak of $3.87 in December 2011, and in fact SLR was one of the best performing stocks on the ASX for the year, significantly outperforming the S&P ASX 200 Index. However, the market price has since dipped down, and a buying opportunity has once again presented itself! The AVERAGE Intrinsic Value is also rising, but as with MML, the growth here is more conservative. Note that as these two lines become closer together, our confidence in the Intrinsic Value estimate is increased.

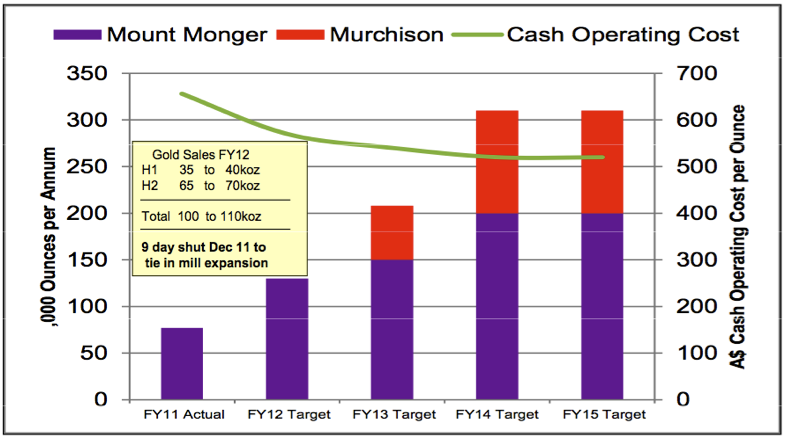

SLR currently has 24.1 million tonnes of JORC Resource at grades of 8.9 (g/t) at Mount Monger and 2.8 g/t at Murchison for a total of 3.3 mOz as at June 2011. The company is aiming to build the Resource base for 2012FY to 5 mOz. In the last 2 financial years, they have increased this Resource base by 1 mOz each year. This has been via an extensive drilling programme each year that is part of their long-term exploration budget ($18 million per annum). Total production of gold for 2011FY was 63,425 ounces. Total cash costs for 2011FY were US$674/ounce (includes royalties). The Mount Monger operations are targeting production of 100,000 to 110,000 ounces for 2012FY. The company expects to ramp up production here to 200,000 ounces per annum by 2014, with an expected mine life > 10 years. The Murchison operations will start production in Q3 2013FY, and is expected to produce 100,000 ounces per annum (from 2014FY) with an 8-10 year mine life. Mining at these locations is predominantly underground. Open pit productions have recently commenced at their Wombola Dam site. SLR has also recently reported high-grade copper discoveries at their Hollandaire site within the Eelya Complex that could provide added value. SLR is targeting 300,000 ounces per annum of production of gold by 2014FY.

Figure 7. Production timetable in ounces (Source: SLR AGM Presentation November 2011):

REVENUE, NET PROFIT, CASH FLOW, RETURN ON EQUITY:

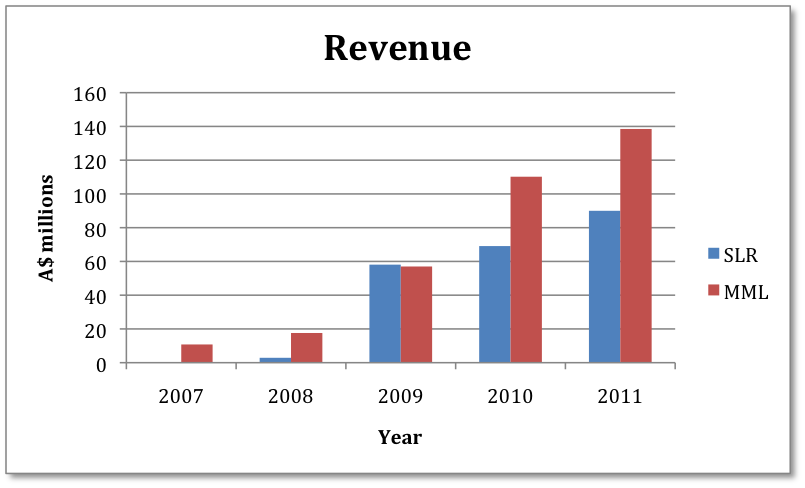

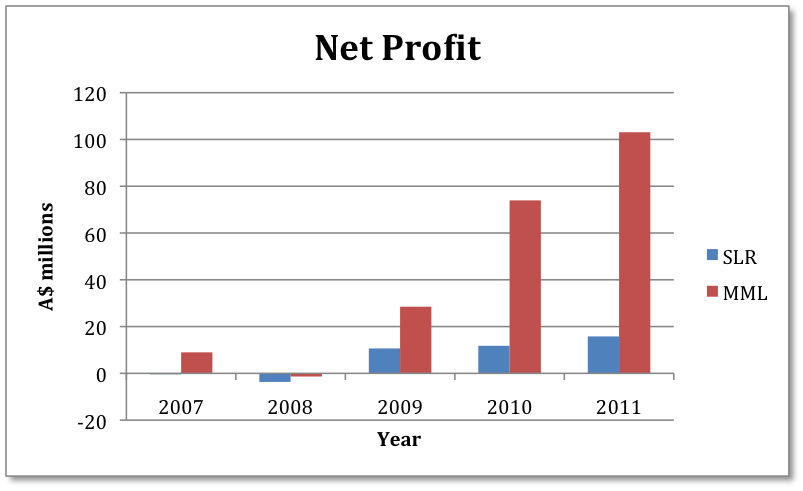

Figures 8 & 9. Comparison of Annual Revenue & Reported Net Profit:

Revenue levels for both companies look excellent, but we can clearly see that MML’s net profit figures are significantly larger than SLR’s, and is a reflection of their low operating costs. But as with any business, we need to delve deeper and look at their overall cash flow. With an impending “credit crunch” in 2012, and a degree of caution in the market with equity investing, a healthy cash flow could be essential in order for junior companies to be able to confidently fund their exploration and development activities.

Figure 10. MML Skaffold Cash Flow (Source: Skaffold 30th December 2011):

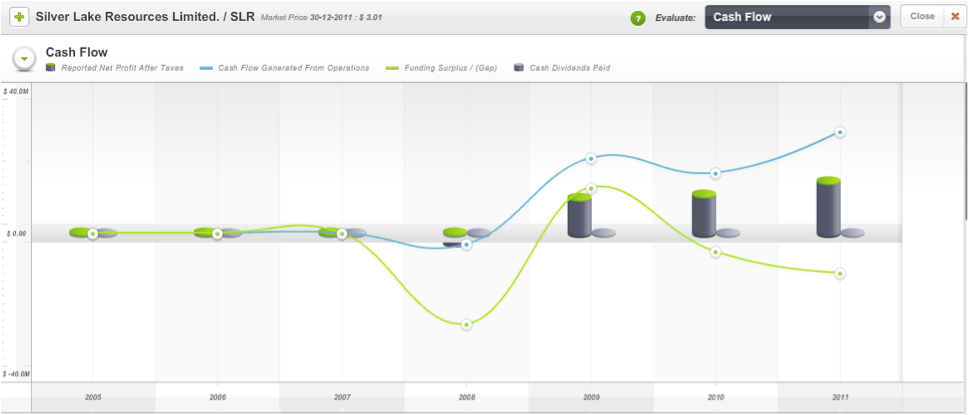

Figure 11. SLR Skaffold Cash Flow (Source: Skaffold 30th December 2011):

Both companies have rising levels of cash flow from operations (blue line). MML has an overall funding surplus (green line) that is increasing, and has also managed to pay dividends for 2011FY. Whilst at SLR the overall funding surplus is decreasing, to the point that there is now a funding GAP. This suggests that they have used up more cash in investments and financing than they have received directly from their operations. According to Skaffold, money to account for this spending has come from shareholder equity raisings and increased debt or a reduction in the cash at bank (if there is any). Looking at the Skaffold Data Table sheds more light on recent cash movements for each company…

MML generated a net cash flow of $90 million from its operating activities for 2011FY. However, it also spent a net cash flow of $49 million on investment activities, as well as $18 million for dividend payments (un-franked, low payout ratio). Investment activities were predominantly capital expenditure related to exploration, evaluation, and development activities. Despite the large amount of cash flow invested outside operating activities, after taking into account foreign exchange effects and equity capital movements (add ~ $5 million total), the company was able to increase it’s Bank Account balance by $28 million dollars. This left a 2011FY balance of $58 million (UP from $30 million 2010FY). SLR generated a net cash flow of $33 million from its operating activities for 2011FY. It also spent a net cash flow of $46 million on investment activities, clearly more than it’s operating cash flow. This is once again predominantly capital expenditure related to exploration, evaluation, and development activities. Consequently, despite a rise in revenue, net profit, and operating cash flow, the company actually had a net decrease in its Bank Account balance of $13 million, which left the 2011FY balance at $16million (DOWN from $29 million 2010FY).

MML’s last capital raising was in February 2009 for $20 million, about 3 years ago now. SLR’s last capital raising was as recently as November 2011 for $70 million, this was to help develop their Murchison project and accelerate copper exploration activities. Prior to this it had conducted capital raisings of $19 million during 2010FY and $30 million during 2008FY. Although neither company has significant debt, I think this reiterates that MML is in a better cash flow position at this stage. It appears that continued capital raisings have been required by SLR to help meet ongoing investment demands, unfortunately this could dilute shareholder ownership. Even if capital raisings were issued at a price above equity per share, I would prefer if they were able to fund their investments predominantly from existing cash flow.

A LITTLE ABOUT CAPITAL EXPENDITURE:

As I learnt with these examples, gold mining companies spend a great deal of their retained earnings and cash flow on exploring for gold and developing new mines. These expenses do not go immediately into the Income Statement, instead you will see the total expenditure in the Balance Sheet, as an Asset! These companies may have exploration happening at multiple different sites at any one time, if drilling results prove unsatisfactory, or mining is deemed not technically or financially feasible, part of these expenses will be written-down, and will affect future reported Net Profit. Similarly, cumulative exploration and development expenses will become incurred or amortised only once the mine goes into production. All this capital expenditure is not yet generating any profit, yet it adds to the equity. So unless the company is generating sufficiently higher profits each year from the mines that are in production (e.g. by producing more ounces of gold, at a higher average price, or doing it more efficiently), the Return on Equity will decline. From looking at the annual reports, I noted that MML had listed capital expenditure of US$116 million for 2011FY, and SLR A$76 million. Cleary these are highly capital-intensive businesses, though at the very least it gives their competition a high barrier to entry.

RETURN ON EQUITY:

Figure 12. MML Skaffold Capital History (Source: Skaffold 6th January 2012):

Figure 13. SLR Skaffold Capital History (Source: Skaffold 6th January 2012):

The Skaffold Capital History for MML tells me that although its Net Profits (green line) are forecast to rise over from the next few years, the shareholder equity is expected to rise even more, and thus Return on Equity (blue line) is forecast to decline from 45% 2011FY to 33% in 2014FY. Although a Return on Equity of 33% is still excellent. On the other hand, SLR’s Return on Equity is forecast to rise from 19% 2011FY, and remain stable at around 36% until 2014FY. I suspect that a stable Return on Equity is difficult to achieve in this industry given that there are often several projects on the go at different stages, some generating profits and others not, but at the very least the overall returns must always be high.

FINAL COMMENTS:

What attracts me to MML are its high margins and excellent cash flow that should insulate it against any significant changes in the gold price. A number of things may have contributed to the fall in market price, macroeconomic factors aside. Certainly the market price plunge happened not long after a mining fatality in October 2011. This, along with increased development to prepare the Co-O mine for higher production has resulted in lower production guidance for 2012FY. There was also some weather damage from a tropical storm to parts of their mill in December 2011, the scope of the effect on production will be available in the December 2011 Quarterly. Regardless, these are abnormal once-off events that should not impact on the long-term prospects of the company. For me the key is whether the Bananghalig deposit has a large enough Resource base, and whether it will be mined, as this will determine whether MML can grow from a junior to a mid-tier producer.

The advantage that SLR offers is that it already has a second mine that has progressed further in the development phase, and will commence production earlier. Though there are two things that concern me at this stage. The first being the relatively high operating costs that make SLR far more sensitive to gold price volatility. And the second is the company’s cash flow, and in particular its requirement for capital raisings to fund exploration and development activities. Having said that, forecast EPS Growth is 217%, and I expect that this should improve cash flow over the coming few years. Further to this, as with MML, the management team appears to have significant experience behind it, and in SLR’s case I noted that all the Directors hold significant shareholdings in the company, each owning over 4 million fully paid ordinary shares each.

But is either of these companies truly extraordinary? What does this mean? Well Chapter 5 in Value.able tells me that in an extraordinary business I must find the following factors; Bright long-term prospects, high Return on Equity driven by sustainable competitive advantage, solid cash flow, little or no debt, and first-class management. I think that MML comes closest to meeting all these factors, but others might disagree. The key factor for me is having a sustainable competitive advantage. In the Co-O mine they are sitting on a Resource that could last over 25 years, is extraordinarily low in operating cost, and could generate an enormous amount of cash that could easily fund future expansions, and perhaps even acquisitions. In a business that can be highly capital-intensive, the ability to fund exploration and development with cash flow rather than capital raisings and debt is a great advantage. The question mark of course is how sustainable this will be. And of course, I am no Geologist! What I do know is that this is a fundamentally healthy and profitable business, and despite this, the market is significantly undervaluing it. If I were to invest in this business, I would need to accept that there is level of risk involved, but by buying it at a significant margin of safety, and allocating such an investment in a reasonable manner within my portfolio, I think this risk could be significantly reduced.

POD’s (points of discussion):

1. Has gold’s bull run come to an end, or will it rise to new highs?

2. In your opinion, do MML or SLR have any sustainable competitive advantage?

3. What are the benefits/risks of mining in the Philippines versus Australia?Since writing this post there have been a number of key announcements made by each company. Their share price’s and safety margins have also changed. Most notably, MML has now downgraded its 2012FY production guidance to 75,000 ounces, citing delays due to effects of tropical storms and torrential rain in December 2011 and January 2012. Also, SLR has announced a the acquisition of Phillips River Mining.

LINKS:

Skaffold

www.skaffold.comWorld Gold Council

www.gold.orgJORC

www.jorc.orgDISCLOSURE:

I do not hold any shares in any of the companies mentioned in this blog post.

by Roger Montgomery Posted in Insightful Insights, Value.able.

-

MEDIA

What future prospects does Roger see for Seek, Bluescope Steel and BHP Billiton?

Roger Montgomery

February 29, 2012

Do BHP Billiton (BHP), Fortescue Metals (FMG), Seek (SEK), Bluescope Steel (BSL), GR Engineering (GNG), CSL (CSL), Peak Resources (PEK), Harvey Norman, (HNN), Buru Energy (BRU), The Reject Shop (TRS), ASG Group (ASZ), Tatts Group (TTS) and Webject (WEB) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 29 February 2012 to find out. Watch here.

by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, TV Appearances, Value.able.

-

An important milestone for us.

Roger Montgomery

February 29, 2012

We are pleased to make the following Announcement. Chris Mackay, Hamish Douglass and I worked patiently to bring this together. I am delighted to see it announced. By way of background, in addition to their roles at Magellan Financial Group, Hamish Douglass is a member of the Foreign Investment Review Board and a member of the Takeovers Panel. Chris Mackay sits on the Financial Sector Advisory Council that is one of the main conduits of industry insights to the Treasurer and is on the board of James Packer’s Consolidated Media. Thank you.

We are pleased to make the following Announcement. Chris Mackay, Hamish Douglass and I worked patiently to bring this together. I am delighted to see it announced. By way of background, in addition to their roles at Magellan Financial Group, Hamish Douglass is a member of the Foreign Investment Review Board and a member of the Takeovers Panel. Chris Mackay sits on the Financial Sector Advisory Council that is one of the main conduits of industry insights to the Treasurer and is on the board of James Packer’s Consolidated Media. Thank you.Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 29 February 2012.

by Roger Montgomery Posted in Value.able.

- 40 Comments

- save this article

- POSTED IN Value.able

-

Gold Bugs…Nah

Roger Montgomery

February 26, 2012

Their is something prescient in the name John Deason and Richard Oates gave to their 1869 gold nugget the ‘Welcome Stranger’ and the one Kevin Hillier gave to his 875 troy ounce find ‘The Hand of Faith’. Today’s gold price is indeed very welcome to gold bugs and there is plenty of faith needed that prices will rise even further. But gold bugs have received a terse warning from none other than Warren Buffett who has just released Berkshire’s 2011 letter. For those of you who believe gold (A.K.A. the barbarous relic) is the best investment you won’t find any more support from Warren this year than any other (with the exception of his 1999 dalliance into silver) . You can find his complete letter here: Berkshire 2011 Annual Report.

Here’s the section on gold:

“The second major category of investments involves assets that will never produce anything, but that are purchased in the buyer’s hope that someone else – who also knows that the assets will be forever unproductive – will pay more for them in the future. Tulips, of all things, briefly became a favorite of such buyers in the 17th century.

This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further. Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis.

As “bandwagon” investors join any party, they create their own truth – for a while. Over the past 15 years, both Internet stocks and houses have demonstrated the extraordinary excesses that can be created by combining an initially sensible thesis with well-publicized rising prices. In these bubbles, an army of originally skeptical investors succumbed to the “proof” delivered by the market, and the pool of buyers – for a time – expanded sufficiently to keep the bandwagon rolling. But bubbles blown large enough inevitably pop. And then the old proverb is confirmed once again: “What the wise man does in the beginning, the fool does in the end.”

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A. Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge).

Can you imagine an investor with $9.6 trillion selecting pile A over pile B? Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices.

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B.”

Before simply believing Warren WILL be right…There’s this in the annual report as well: “Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong”

A much older quote that summarizes Buffett’s long-held view is this one “It gets dug out in Africa or some place. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

In my earlier post on this subject HERE, I note; “But I trust you can see the irony in claiming gold is ‘useless’ and yet it can buy [all the agricultural land in the United States, sixteen companies as valuable as Exxon and a trillion dollars in walking-around money].

For those of you who are interested in two alternative perspectives, (assuming the debasing of fiat money across the globe is not enough to encourage you), I thought you might find some of what you need in the following points, and also Warren Buffett’s father’s views. (Note: we only own three or four gold stocks all of which have rising production profiles and do not require ever increasing gold prices to support the returns on equity that justify much higher valuations. So we aren’t quite in the ‘carried-away’ camp even though some have doubled in price. This latter development delights us in this market).

And now a short commercial break…

Here are two Skaffold screenshots, each gold stocks we currently own. If you are a member of Skaffold, you should be able to pick them right away. If you aren’t a member, what are you waiting for? Head over to www.skaffold.com and become a member today.

And now back to our regular programming…

From gold’s mouth itself;

Let’s start with the basics of my enduring characteristics. I have some characteristics that no other matter on Earth has…

I cannot be:

Printed (ask a miner how long it takes to find me and dig me up)

Counterfeited (you can try, but a scale will catch it every time)

Inflated (I can’t be reproduced)I cannot be destroyed by;

Fire (it takes heat at least 1945.4° F. to melt me)

Water (I don’t rust or tarnish)

Time (my coins remain recognizable after a thousand years)I don’t need:

Feeding (like cattle)

Fertilizer (like corn)

Maintenance (like printing presses)I have no:

Time limit (most metal is still in existence)

Counterparty risk (remember MF Global?)

Shelf life (I never expire)As a metal, I am uniquely:

Malleable (I spread without cracking)

Ductile (I stretch without breaking)

Beautiful (just ask an Indian bride)As money, I am:

Liquid (easily convertible to cash)

Portable (you can conveniently hold $50,000 in one hand)

Divisible (you can use me in tiny fractions)

Consistent (I am the same in any quantity, at any place)

Private (no one has to know you own me)From an entirely different perspective on gold it may be worth reading the Hon. Howard Buffett. Congressman Buffett argues that without a redeemable currency, an individual’s freedoms both financial and more broadly is dependent on politicians. He goes on to observe that fiat (paper) money systems tend to collapse eventually, producing economic chaos. His argument that the US should return to the gold standard was not adopted.

Human Freedom Rests of Gold Redeemable Money

Posted Thursday, May 6, 1948By HON. HOWARD BUFFETT

U. S. Congressman from Nebraska

Reprinted from The Commercial and Financial Chronicle 5/6/48Is there a connection between Human Freedom and A Gold Redeemable Money? At first glance it would seem that money belongs to the world of economics and human freedom to the political sphere.

But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty.

Also, when you find that Lenin declared and demonstrated that a sure way to overturn the existing social order and bring about communism was by printing press paper money, then again you are impressed with the possibility of a relationship between a gold-backed money and human freedom.

In that case then certainly you and I as Americans should know the connection. We must find it even if money is a difficult and tricky subject. I suppose that if most people were asked for their views on money the almost universal answer would be that they didn’t have enough of it.

In a free country the monetary unit rests upon a fixed foundation of gold or gold and silver independent of the ruling politicians. Our dollar was that kind of money before 1933. Under that system paper currency is redeemable for a certain weight of gold, at the free option and choice of the holder of paper money.

Redemption Right Insures Stability

That redemption right gives money a large degree of stability. The owner of such gold redeemable currency has economic independence. He can move around either within or without his country because his money holdings have accepted value anywhere.For example, I hold here what is called a $20 gold piece. Before 1933, if you possessed paper money you could exchange it at your option for gold coin. This gold coin had a recognizable and definite value all over the world. It does so today. In most countries of the world this gold piece, if you have enough of them, will give you much independence. But today the ownership of such gold pieces as money in this country, Russia, and all divers other places is outlawed.

The subject of a Hitler or a Stalin is a serf by the mere fact that his money can be called in and depreciated at the whim of his rulers. That actually happened in Russia a few months ago, when the Russian people, holding cash, had to turn it in — 10 old rubles and receive back one new ruble.

I hold here a small packet of this second kind of money – printing press paper money — technically known as fiat money because its value is arbitrarily fixed by rulers or statute. The amount of this money in numerals is very large. This little packet amounts to CNC $680,000. It cost me $5 at regular exchange rates. I understand I got clipped on the deal. I could have gotten $2½ million if I had purchased in the black market. But you can readily see that this Chinese money, which is a fine grade of paper money, gives the individual who owns it no independence, because it has no redemptive value.

Under such conditions the individual citizen is deprived of freedom of movement. He is prevented from laying away purchasing power for the future. He becomes dependent upon the goodwill of the politicians for his daily bread. Unless he lives on land that will sustain him, freedom for him does not exist.

You have heard a lot of oratory on inflation from politicians in both parties. Actually that oratory and the inflation maneuvering around here are mostly sly efforts designed to lay the blame on the other party’s doorstep. All our politicians regularly announce their intention to stop inflation. I believe I can show that until they move to restore your right to own gold that talk is hogwash.Paper Systems End in Collapse

But first let me clear away a bit of underbrush. I will not take time to review the history of paper money experiments. So far as I can discover, paper money systems have always wound up with collapse and economic chaos.

Here somebody might like to interrupt and ask if we are not now on the gold standard. That is true, internationally, but not domestically. Even though there is a lot of gold buried down at Fort Knox, that gold is not subject to demand by American citizens. It could all be shipped out of this country without the people having any chance to prevent it. That is not probable in the near future, for a small trickle of gold is still coming in. But it can happen in the future. This gold is temporarily and theoretically partial security for our paper currency. But in reality it is not.Also, currently, we are enjoying a large surplus in tax revenues, but this happy condition is only a phenomenon of postwar inflation and our global WPA. It cannot be relied upon as an accurate gauge of our financial condition. So we should disregard the current flush treasury in considering this problem.

From 1930-1946 your government went into the red every year and the debt steadily mounted. Various plans have been proposed to reverse this spiral of debt. One is that a fixed amount of tax revenue each year would go for debt reduction. Another is that Congress be prohibited by statute from appropriating more than anticipated revenues in peacetime. Still another is that 10% of the taxes be set aside each year for debt reduction.

All of these proposals look good. But they are unrealistic under our paper money system. They will not stand against postwar spending pressures. The accuracy of this conclusion has already been demonstrated.The Budget and Paper Money

Under the streamlining Act passed by Congress in 1946, the Senate and the House were required to fix a maximum budget each year. In 1947 the Senate and the House could not reach an agreement on this maximum budget so that the law was ignored.On March 4 this year the House and Senate agreed on a budget of $37½ billion. Appropriations already passed or on the docket will most certainly take expenditures past the $40 billion mark. The statute providing for a maximum budget has fallen by the wayside even in the first two years it has been operating and in a period of prosperity.

There is only one way that these spending pressures can be halted, and that is to restore the final decision on public spending to the producers of the nation. The producers of wealth — taxpayers — must regain their right to obtain gold in exchange for the fruits of their labor. This restoration would give the people the final say-so on governmental spending, and would enable wealth producers to control the issuance of paper money and bonds.

I do not ask you to accept this contention outright. But if you look at the political facts of life, I think you will agree that this action is the only genuine cure. There is a parallel between business and politics which quickly illustrates the weakness in political control of money.

Each of you is in business to make profits. If your firm does not make profits, it goes out of business. If I were to bring a product to you and say, this item is splendid for your customers, but you would have to sell it without profit, or even at a loss that would put you out of business. — well, I would get thrown out of your office, perhaps politely, but certainly quickly. Your business must have profits.

In politics votes have a similar vital importance to an elected official. That situation is not ideal, but it exists, probably because generally no one gives up power willingly.

Perhaps you are right now saying to yourself: “That’s just what I have always thought. The politicians are thinking of votes when they ought to think about the future of the country. What we need is a Congress with some ‘guts.’ If we elected a Congress with intestinal fortitude, it would stop the spending all right!”

I went to Washington with exactly that hope and belief. But I have had to discard it as unrealistic. Why? Because an economy Congressman under our printingpress money system is in the position of a fireman running into a burning building with a hose that is not connected with the water plug. His courage may be commendable, but he is not hooked up right at the other end of the line. So it is now with a Congressman working for economy. There is no sustained hookup with the taxpayers to give him strength.

When the people’s right to restrain public spending by demanding gold coin was taken from them, the automatic flow of strength from the grass-roots to enforce economy in Washington was disconnected. I’ll come back to this later.

In January you heard the President’s message to Congress or at least you heard about it. It made Harry Hopkins, in memory, look like Old Scrooge himself.

Truman’s State of the Union message was “pie-in-the-sky” for everybody except business. These promises were to be expected under our paper currency system. Why? Because his continuance in office depends upon pleasing a majority of the pressure groups.Before you judge him too harshly for that performance, let us speculate on his thinking. Certainly he can persuade himself that the Republicans would do the same thing if they were In power. Already he has characterized our talk of economy as “just conversation.” To date we have been proving him right. Neither the President nor the Republican Congress is under real compulsion to cut Federal spending. And so neither one does so, and the people are largely helpless.

But it was not always this way.

Before 1933 the people themselves had an effective way to demand economy. Before 1933, whenever the people became disturbed over Federal spending, they could go to the banks, redeem their paper currency in gold, and wait for common sense to return to Washington.Raids on Treasury

That happened on various occasions and conditions sometimes became strained, but nothing occurred like the ultimate consequences of paper money inflation.

Today Congress is constantly besieged by minority groups seeking benefits from the public treasury. Often these groups. control enough votes in many Congressional districts to change the outcome of elections. And so Congressmen find it difficult to persuade themselves not to give in to pressure groups. With no bad immediate consequence it becomes expedient to accede to a spending demand. The Treasury is seemingly inexhaustible. Besides the unorganized taxpayers back home may not notice this particular expenditure — and so it goes.Let’s take a quick look at just the payroll pressure elements. On June 30, 1932, there were 2,196,151 people receiving regular monthly checks from the Federal Treasury. On June 30, 1947, this number had risen to the fantastic total of 14,416,393 persons.

This 14½ million figure does not include about 2 million receiving either unemployment benefits of soil conservation checks. However, it includes about 2 million GI’s getting schooling or on-the-job-training. Excluding them, the total is about 12½ million or 500% more than in 1932. If each beneficiary accounted for four votes (and only half exhibited this payroll allegiance response) this group would account for 25 million votes, almost by itself enough votes to win any national election.

Besides these direct payroll voters, there are a large number of State, county and local employees whose compensation in part comes from Federal subsidies and grants-in-aid.

Then there are many other kinds of pressure groups. There are businesses that are being enriched by national defense spending and foreign handouts. These firms, because of the money they can spend on propaganda, may be the most dangerous of all.

If the Marshall Plan meant $100 million worth of profitable business for your firm, wouldn’t you Invest a few thousands or so to successfully propagandize for the Marshall Plan? And if you were a foreign government, getting billions, perhaps you could persuade your prospective suppliers here to lend a hand in putting that deal through Congress.

Taxpayer the Forgotten Man

Far away from Congress is the real forgotten man, the taxpayer who foots the bill. He is in a different spot from the tax-eater or the business that makes millions from spending schemes. He cannot afford to spend his time trying to oppose Federal expenditures. He has to earn his own living and carry the burden of taxes as well.But for most beneficiaries a Federal paycheck soon becomes vital in his life. He usually will spend his full energies if necessary to hang onto this income.

The taxpayer is completely outmatched in such an unequal contest. Always heretofore he possessed an equalizer. If government finances weren’t run according to his idea of soundness he had an individual right to protect himself by obtaining gold.With a restoration of the gold standard, Congress would have to again resist handouts. That would work this way. If Congress seemed receptive to reckless spending schemes, depositors’ demands over the country for gold would soon become serious. That alarm in turn would quickly be reflected in the halls of Congress. The legislators would learn from the banks back home and from the Treasury officials that confidence in the Treasury was endangered.

Congress would be forced to confront spending demands with firmness. The gold standard acted as a silent watchdog to prevent unlimited public spending.

I have only briefly outlined the inability of Congress to resist spending pressures during periods of prosperity. What Congress would do when a depression comes is a question I leave to your imagination. I have not time to portray the end of the road of all paper money experiments.