Will David beat Goliath?

I am deviating from my regular style of post, handing over the stage to Value.able Graduate Scott T. Scott T has taken up a fight with conventional investing by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings. I reckon in the long run the A1/A2 portfolio will win, but let’s not get ahead of ourselves.

I am deviating from my regular style of post, handing over the stage to Value.able Graduate Scott T. Scott T has taken up a fight with conventional investing by tracking the performance of a typical and published ‘institutional-style’ portfolio against a portfolio of companies that receive my highest Montgomery Quality Ratings. I reckon in the long run the A1/A2 portfolio will win, but let’s not get ahead of ourselves.

Over to you Scott T…

In December 2010, a large international institution released their “Top 10 stockpicks for 2011”. Click here to read the original story.

I thought it would be interesting to compare the performance of these suggestions against an A1 and A2 Montgomery portfolio.

So I imagined this scenario…

Twin brothers in there 30’s each inherited $100,000 from their parent’s estate. One was a conservative middle manager in the public service; he had little interest in the stock market or super funds and the like, so he decided to go to an internationally renowned, well-credentialed and highly respected firm to gain specific advice. Goldman Sachs advised him of their top ten stocks for 2011, so he decided to achieve diversification by investing $10,000 in each of the ten stocks he had been told about.

His twin had a small accounting practice in a regional Queensland and was a keen stock market investor. Specifically he was a student of the Value Investing method, and liked to think of himself as a Value.able Graduate. He too thought diversification would be a suitable strategy so decided to invest $10,000 in each of 10 stocks that were A1 or A2 MQR businesses and that were selling for as big a discount to his estimate of Value.able intrinsic value as he could find.

For this 12-month exercise, running for a calendar year, we shall assume that neither brother is able to trade their position. One brother has no inclination to, and his regional twin is fully invested, and more inclined to hold long anyway.

For the companies who have declared dividends in this quarter, most are now trading ex-dividend, but only 2 or 3 have actually paid. Dividends will be picked up in Q2 and Q4 of this study.

Now after just 3 months let’s look at the how the two portfolios have performed…

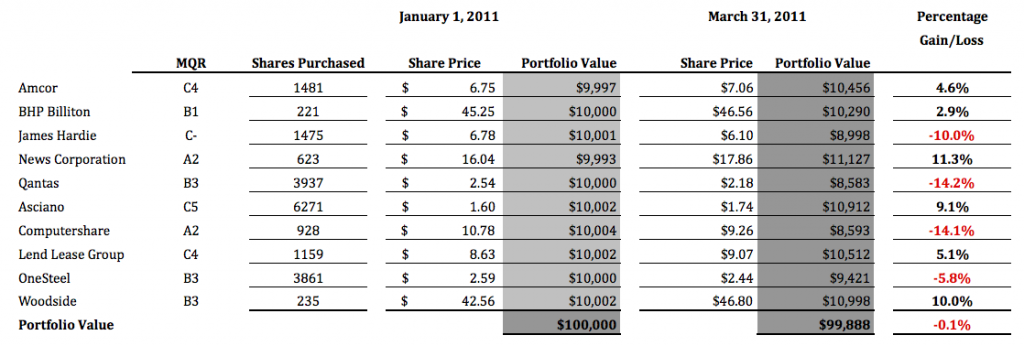

Institutional Bank Top 10 Picks for 2011

Montgomery Quality Rated (MQR) A1 and A2 Companies

We will visit the brothers again in 3 months on 30/6/2011 to see how they are fairing.

All the best

Scott T

How has your Value.able portfolio performed compared to the ASX 200 All Ords?

Posted by Roger Montgomery, author and fund manager, 6 April 2011.

Hi Roger

Just wondering if there has been a complete 12 month comparison of the David vs Goliath story? I am interested to know.

Regards

Martin

Hi Martin,

We have got the stats for the end of Jan but because we don’t have a new portfolio we’ll measure the whole year at the end of March.

Hi,

Must admit to not having read Value,able as yet. I have my money in 18 companies in the ASX top 40.

So far since 1 January 2010, I have had a return (excluding dividends) of -0.76%.

This year has been better 0.46% profit.

On $200,000, I was hoping for a bit better. :-(

Regards,

Peter

Valu,able will be a big help I think Peter.

That said nothing id jumping out at me

Hi everyone,

Many thanks for all your comments and encouragement.

Many thanks too to Roger for posting this project, I really appreciate it.

Lets see what the next 3 months brings, next post 30/6/2011.

All the best

Scott T

Time for something which i enjoy doing. Not sure if people enjoy reading but here goes. Random Thoughts from Andrew on value investing (which you probably already know) and other related illogical ranting.

There are many things that can affect a companys value. The daily price movements of the market isn’t one of them.

The market is kind of like the wizard in the Wizard of Oz. You may think it is this all powerful being but really it is just an overweight guy behind a curtain with a megaphone.

it simply is a marketplace where person A buys something from person B. Or in the words of the classic aussie band TISM in their song BFW, it is a place where people rip eachother off.

That person who is selling or buying your shares could be the guy at the weekend BBQ telling you about the latest hot tip one minute and then collapesed drunk on the lounge the next after a few two many amber lemonades. Picture that and it will surely help you overcome part of the psychological element of investing when people or price movements are telling you that your wrong.

Also, i consider Hersheys to be far more superior to any chocolate made by See’s Candies despite what Warren Buffet thinks. That has lead me to having a quick look at Hersheys (NYSE: HSY- Latest market Price US$55.63).

The company appears to be a good one, i would consider it A class, not sure about A1 but could be close. I have ROE for 2010 at around 60% and like i said they make a great tasting product (my favourite chocolate of all and so happy i can get two bars for $5 at Sugarfix). Their products are iconinc i think, especially in the states, this will allow them to be able to raise prices and not lose market share or customers. After looking at the cash flow statement it didn’t seem as capital intensive as i thought it would be and they have so much free cash.

After running a quick valuation adopting a 12% RR although i would consider 11% as i think the external risks to the company are minimal, i have come up with a valuation of US$33.97 a share. So a great company in my opinion making a great product but alas trading at a premium of around 63%.

Now the point of all this, everyday we are exposed to great companys, when we are on the train, in the supermarket and even watching TV or at a sporting event. Is there a product that you love and would travel accross town to get if needed? Do you know other people who feel the same way, more than likely they are owned by a listed company and if they have that pulling power could definitley be a great company so stay aware (but not at the expense of family and enjoyment).

However, as we have seen with krispy kreme, people were happy to line up originally for twenty minutes to get their donuts but now is in administration, so watch the cash.

Great blog. Almost gave up reading after some previous issues.I hope this form of discussion continues into the future.Perhaps Roger ,you or some other graduates could lead some future blog more towards sustainable earnings into the future and less on what future price may be-after all if we have made the correct choices in company selection,the price will follow.Another topic that interests me is risk.

Have enjoyed and learnt much from your book.

Tony

Hey Roger,

I saw the Facebook update about having dinner with Jim Rogers. I was just wondering if you could reply with a few thoughts or highlights that you took away from dinner?

Jim’s new Index fund goes along with a lot of the same ideas that were mentioned in your monster post earlier in the year (Basically, diminishing quantities of everything useful) so I was wondering if he introduced you to any new ideas or changed an idea you previously believed?

Also, to everyone else in the room, Jim talks about what I guess could be called “peak everything”. For anyone that was investing or can remember, how does the 2011 version of these scarcity shocks compare to past shocks such as peak oil in the 70s or others that you remember?

Being relatively younger this is one of the things I’m finding hardest to gauge and quantitatively measure (Worst case media speculation vs eventual outcomes)

(I know you need to invest through the front windscreen not the rear view mirror but I think it would still be helpful to try and understand the basis of previous examples)

Will post something as soon as the photos of Jim and I holding each other’s books come back from the professional photographer that attended.

You need to shoot that professional photographer. Either that, or buy him a pair of spectacles.

Hi All,

I just noticed that James Hardie does not even get a rating of C5

it is just C-.

Go have a look at the balance Sheet and you will find out why.

Avoiding bad businesses are easy when you look at this less than harmonic financial position

Ash, you could say it’s Hardie worth the effort to look in to.

LOL

Good one Jason.

Scott,

Great post.

The twins had a little known uncle who also was conservative and followed Value.Able principles. In his late 40’s he was more conservative than his younger nephews and was a big subsriber to the “doing your own research” and not buying until he was happy. As such he freely admits he missed some of the best gains on a number of his stocks. He also chose not to pursue a number of other opportunities that have done very well.

He invested in a suite of high MQR companies – although different from twin brother 2. Over the same three month period his portfolio increased 32%.

“Uncle” loves the fact that there are people who don’t follow Value.Able as it creates many opportunities for him – even if he takes a while to do his checks and balances.

Thanks Stuart,

That is what makes a market isn’t it!! There are plenty of people who choose to sell when others want to buy.

Thanks for your post

All the best

Scott T

Hi everyone,

Roger – great post…I am quietly confident that in the long run, your A1s and A2s will triumph!

I have a question that may be basic/easy to most of you, but I am struggling with working out future equity per share values – in order to calculate FUTURE estimated IVs.

I understand that Forecast Year EQ Per Share = Previous Years EQ Per Share + Forecast EPS – Forecast DPS + new share capital (per share) – buybacks (per share)…

So the Forecast EPS and DPS is easy to find, but where can the new share capital and buybacks info be found?

Also, would anyone be interested in detailing their inputs for MCE for the years 2011 and 2012 (just for the purpose of comparing).

I have (for 2010-2011)

equity per share: $0.96

POR: 15%

ROE: 30%

RR: 10%

IV: $6.33

I have (for 2011-2012)

equity per share: $1.38

POR: 15%

ROE: 30%

RR: 10%

IV: $9.04

I believe I am using the wrong equity per share value (especially because I understand that many of you are using a higher RR and you are still obtaining IV > $9.04)

I got my equity per share for the 2010-2011 year from the half year report (Period ending on 31 December 2010).

Any info/advice would be so greatly appreciated.

Thanks to who ever feels inclined to help,

Chris B

Hi Chris,

Have you read the below blog. It may help

http://rogermontgomery.com/how-do-value-able-graduates-calculate-forecast-valuations-2/

Roger, regarding iPads, I saw this the other day

http://online.wsj.com/article/SB10001424052748704259704576033941846942596.html

(and in the Wealth Section of The Australian, 6 April 2011).

Just wanted to share it out.

P.S. As a pugilist myself, I have seen many people both underrate and overrate particular or “popular” fighters within different weight divisions at various stages of a bout. Given that the stockmarket is an “open-weight” division makes for an interesting match-up.

When the final bell is rung after fifteen rounds, only then can you really know. Sometimes, all it takes is one good shot to turn around a battle or put someone out of commission, heavyweights may punch harder but lighter weights can dodge, move and maybe even punch faster.

The parallels to the stockmarket are easy to draw.

Thanks for this Scott. I will follow developments with interest.

As an ex public servant, I must though admit to being mildly miffed at your choice of occupation for the first twin, who I’m sure will come off second best.

As an accountant in the middle management of a large public service agency, I don’t quite know how I should take this stereotype! I guess the fact that I put myself in the Valu.able camp should win one over the other.

Backing David to leave Goliath FUMing (apologies for the bad pun).

Hi Matt and Gale,

Sorry about the stereotype, but the truth is my wife is a middle manager in the federal public service, and some of her colleagues led me make this choice.

The fact that you guys are on this blog and reading Value.Able certainly means you don’t fit my generic and slightly unkind stereotype.

All the best

Scott T

Great idea for a post Scott T, I laughed loud when I read the concept.

I appreciate why Roger ends many of his posts by stating that everyone needs to do their own research and seek professional advice, I agree that everyone needs to do their own research, but seek professional advice??

Here’s a story my friend told me recently relating a conversation he’d had with his broker.

Broker: I think Telstra at $2.90 is a good buy, especially considering the future upside from the NBN.

Friend: Really?? I was thinking of selling my Telstra shares.

Broker: No, you’re right, Telstra could experience some downside from current levels, perhaps selling is the best option.

I look forward to following the results over the year.

P.S There was recently an excellent article on the GMO website

“The Seven Immutable Laws of Investing – James Montier” which readers may be interested in.

Hi Nick, I am glad you liked it. Thanks for your comments.

All the best

Scott T

Well! What can you conclude from that? Very disappointing if true.

Hi Nick

I went to my first broker wanting to invest a small amount in two stocks, he recommended two, I purchased them and they both went into liquidation. I have a worse example that happened to a friend but I will not mention it here. In my opinion brokers put their large clients before their small clients and therefore I see no reason for small investors to use brokers.

The broker was thinking “buy or sell, well either way i get a commission so thats fine with me”.

A financial planner from a leading bank wanted me to borrow against the equity in my home to buy shares. They suggested that Babcock and Brown was good buying at $5. I told them there was no way I would buy Babcock and Brown shares. Not listening to advice I have been given is why I still have a home to live in.

Hi Michael,

Good call,

During the noughties it was common practice for financial planners to recommend gearing as a wealth creation strategy. I don’t think they are talking about it as much now and if you hear one mention it ……………RUN.

Last weekend there was an article in the Sunday Mail in Qld about CFD’s (which is the ultimate form of gearing) the article was about this guy who did $500,000 trading CFD’s. The concluding line was that luckily the person could afford to lose this sum because he was a financial planner

I have seen leverage do some terrible things in my time. If you’re smart you don’t need it and if you’re not then you have no place using it.

Sage advice Ash, I’ve heard some horror stories involving derivatives

I have seen horror stories with pure margin loans.

I saw someone’s wealth go from $3m to $300K with 50% gearing…

Not pleasant and as you say derivatives could be much worse.

A disclaimer here. I have used CDF’s profitably in the past but I could not possible recommend them to anyone

Ive also used CDF’s in the past betting on the rise of Gold and can say that its not worth the worry. The more $$$ I made the more salt and less pepper I had left in my hair.

LOL,

They are certainly not for the feint hearted and now i think about it is probably why I am now starting to see grey hairs when I get my hair cut

Hi Scott,

Nice post. I particularly liked your reference to the Qld regional accountant!

Notwithstanding Rici Rici’s comment about short term results being irrelevant (which I do agree with), it would also be interesting to include index performance on your table (eg ASX 200 or All Ordinaries).

Peter A (the Value.Able reader formerly known as Peter)

Hi Peter A,

I thought I had the ASX index numbers in that spreadsheet, maybe I cut it off inadvertently when I sent it to Roger. For every ones reference here is how the XJO looked over the same 3 month period.

1/1/11 31/3/11

4745 4838 +2%

So the ASX index only grew 2% in the 3 months and the Investment Bank portfolio underperformed that.

Thanks for your comments.

All the best

Scott T

Looks like ZGL is going 200 km/h at the moment as we speak, perhaps after Roger’s article re ZGL in the EurekaReport. This happens almost everytime with small caps with limited liquidity. I saw similar issues with David Haselhurt’s stock selections. The day after he mentions something price goes up by at least 20-30% and a hude success at end of year, but for whom? This cannot be value investing, it is speculation. Value cannot change in one night.

Yavuz

Hi yavuz,

Thanks for your comment. Of course you are right value does not usually change in one night. People piling into a stock doesn’t change its value. People may be buying the stock because the significant variation between price and estimated IV has been brought to their attention. However regardless of what new information a person has received they must always do their research and obtain licenced advice to ensure their next investment is appropriate for them.

All the best

Scott T

Hi Yavuz,

You are absolutely 100% correct. The value has not changes at all. Only the price has changed.

Thanks Sccott/ Roger,

It just was interesting to watch ZGL, yesterday. Volumes traded were more than three times previous high, which was again after Roger’s previous mention. Price stopped almost at Roger’s IV estimation, which was interesting again. Quite a bit of wealth transfer occurred from the patient to the not so patient. I think some people have become long terms investors automatically, unless IV rises quickly.

Regards,

Yavuz

Yavuz,

You absolutely nailed it with the comment that “I saw similar issues with David Haselhurt’s stock selections. The day after he mentions something price goes up by at least 20-30% and a huge success at end of year, but for whom? ”

This is a classic example of the self fulfilling prophesy for the illiquid, small cap, speculative stock “gurus” like the named speculative mining celebrity. They make their reputation based on the theoretical gains in a portfolio, the performance of which is largely determined by the upward pricing pressure generated by their avid, naive followers. The more followers, then nominally the greater the price pop and the greater the success of their speculative pick…… a virtuous circle from the perspective of the celebrity making the call.

But who makes the money, other than the stock picking celebrity and his immediate cronies who position in advance of the celebrity’s announcement. How many people do you know that have got rich from David Haselhurt’s outstanding 30 year record of speculative stock picking? I suspect there is only one in this case.

Nice idea to track all of this but there might be something to consider. Not sure how the institutions make their picks but many of those funds I believe have many restrictions. Such as they only can buy stocks within a certain market cap. Forge and Matrix were prob too small for many funds to pick up(depending on the funds setup for compliance). I also think they are suppose to have 60% invested in equities at all times but that may be completely wrong. Roger is prob better to answer some of these thoughts. I’m just using this from my own experience with managers who have to stay within the guidelines of the funds and are too scared to move away from the top 200 anyway bc of instutions taking money out of their funds if they underperform. Nothing to take away from Roger though because I’ve learned heaps from his book and his writings…..plus the great posts from others on this blog.

The self imposed restrictions in the industry of managing funds produces absurdities as you have pointed out. In some cases managers have to be 90 per cent invested. I could probably be managing a team of fifteen people and have a billion or two under management if I just stayed fully invested and bought the relatively (instead of the absolutely) cheapest mid caps…hey, there’s a thought…

Wash your mouth out with soup Roger

Sorry Typo again

Wash you mouth out with SOAP Roger

Soup and Soap at the ready. Do I eat the soup or the soap? Thanks Ash. Hope you are well.

How about a CAKE of soap ? :)

LOL,

I have decided to be more vigilant with typos and will put my comments through a spell check before I post. Not promising miracles though.

Don’t do it Ash!

Your typos crack me up sometimes.

Soup or Soap…both were spelled correctly…. so much for spell check.

I’ve studied a lot of psychology over the years and more recently have been looking at the psychological processes associated with investing. After reading Rico Rici’s post below, this highlights a good example of confirmatory bias. This is the tendency for people to favour information that confirms their preconceptions, regardless of whether this is true. As a result, people tend to gather evidence and recall information from memory selectively, and interpret it in a biased way. The biases appear in particular for emotionally significant issues and for established beliefs.

For example, the majority of people on this blog want Rogers investment style to work and Scott has provided a good example that will be 99% certain to achieve the inevitable result. Equally, someone who supports the investment bank may compare a different list of their best ideas against the list if A1/A2 (overvalued) wish list Roger published last week and in 1 years time reach their own conclusion about which is the better investment style.

Explanations for the confirmatory bias include wishful thinking and the limited human capacity to process information. Another proposal is that people show this bias because they are pragmatically assessing the costs of being wrong, rather than investigating in a neutral, scientific way.

Confirmation biases contribute to overconfidence in personal beliefs and can maintain or strengthen beliefs in the face of contrary evidence. Hence they can lead to disastrous decisions.

Just some food for thought. I’m not saying this investment style is wrong (I hope not as I’m practicing it) but we should be very careful what conclusions we jump to regarding how good it really is.

It would be better for me too if you all disagreed and went off and followed some other approach for a time! As Buffett said, we should endow chairs to [for example] the teaching/study of the EMT. If we can breed a generation of people who think it isn’t even worth trying to beat the market, so much the better for value investors.

I think there is also the aspect of thinking if an investment goes up, that means you are right, if it goes down, the market is wrong.

You are neither right nor wrong because others agree or disagree with you…

I believe that is the problem with chartists that when the market moves against them they maintain that that is the nature of the market. Yet when they make a 40% profit over a two day period they say (with hindsight) that it was obvious if you knew how to analysis charts.

Hi Simon,

Good call,

As they say every sunken ship had a chart

You’re right Michael – we’re psychologically predisposed to attribute success to our personal actions, whereas failures will tend to be blamed on external factors. Rogers point is also very important, just because others agree with you (and price goes up) doesn’t mean you are correct. Constantly being aware of psychological aspects regarding investing is hugely important.

Roger, this is an incredibly insightful blog with great input of which I have been an avid reader. I thought it would be good to provoke thoughts outside IV which seems to be a focus. Yes you always need a target to base decisions on. People seem to be looking for a holy grail and so far your work is close but why not look at investment as a business which needs to utilise an array of tools of which IV is only one,and it is only the end of one process. I for one only own one stock mentioned in this blog but the result is enough

Hi Lachie,

Not Roger, but you will find that IV is only one of the criteria. We like to buy great quality business with good prospective at a discount to its intrinsic value.

in terms of great quality business, I believe Roger mentioned before that he used more than 30 ratios in his MQR. I think a number of value.able graduates have developed their own models and for me, assessing quality of the business is much more time consuming than calculating IV.

I have a few comments to make regarding this whole topic.

Firstly:

I think it is very naive to apply a one year time horizon to justify the success or otherwise of an investment methodoligy. Markets go through different pyschological characteristics (ie different seasons).

There seems to be too much focus by some posters on this blog that just because a stock is highlighted as being either ‘quality’ or that its perceived intrinsic value is under the current market price, that suddenly Mr Market will give these stocks a level of performance that outperforms the index as a whole.

I very much look forward to the day when a number of Roger’s ‘picks’ underperform the market. Not because i dont believe in Rogers philosophy (i am very appreciative of the knowledge i have learned), but because i fear that far too many people on this blog believe that Roger has created some magical elixir for short term outperformance.

Secondly with due respect to the investment bank discussed in The Australian column, i think one needs to be following their conviction portfolio also, if one is looking for a fair benchmark comparison. These type of portfolio’s are more trading orientated so they obviously dont take into account tax or commission costs.

Just out of curiosity i looked up yesterdays Investment Bank end of day trading report. I couldnt find anything on their ‘conviction list’ (but they dont publish every day, however there was commentary on their ‘structural leaders focus list’. The return from 22/11/10 to 31/3 was 10.7% outperforming the ASX200 by 4.9%

Again my point here being that different portfolio’s are created with different investment/trading objectives in mind.

Their ‘conviction’ portfolio has also outperformed the ASX signifcantly over multiple time frames (but again without taking into account trading and tax consequences).

Good stuff Rici Rici,

Value investing requires patience (not “sudden” movements). Think sloth rather than cheetah and the speed with which some stocks have reached their intrinsic value and beyond is atypical. It can take years for intrinsic value and price to merge and I do feel far too much emphasis is placed on intrinsic value estimates rather than business quality. Inevitably the impatient will sell, driving the share price down and you will get your hoped-for underperformance. For me the share price is not the focus. If you delight in the underperformance however Rici Rici, then you are no less smitten by short term share price performance than someone who delights in it going up. My focus is on business performance not share prices and more importantly, whether the prospects are bright for rising intrinsic values over long periods of time.

To be balanced however Rici Rici, some people are less interested in the process than they are the proceeds. That is why I always explain, you must conduct your own research and you MUST seek and take independent, personal and professional financial advice. I am delighted that you have been able to supply a different portfolio for comparison purposes. Perhaps you would like to track the performance of this one for the blog?

Firstly Roger, again i thank you for your book, it provided the missing link for me between alot of Buffett’s explanations over the years of the importance of stock picking (if ones objective is to invest and not trade), and attempting to understand a sound fundamental basis for ‘valuating’ a share. (Before i had read your book i received broker information regarding ROE, but i failed to understand the link between ROE, payout ratio and current share price, for example look at CPU, a great underlying company with great long term ROE, but when broker research article highlights great ROE, hows does one link that to current share prices, now i have a much greater understanding, so thanks again).

In regards to your comment re the impatient selling down which can generate short term underperformance. That was not so much my point. My point was that at the end of the day a stock represents two characteristics:

(a) a proportional ownership in the underlying business;

(b) a financial security.

Characteristic (a) is what you emphasise in your analysis. The investor owns a proportional piece of the underlying company. The decision to invest or otherwise depends on the attractiveness of the price of that proportional ownership relative to the underlying current and future intrinsic value (and with regards to the underlying quality of the company).

But characteristic (b) is where the real excitement lies. Sure a stock represents proportional ownership of the underlying business. But it is also a financial instrument. Hence its perceived value (emphasis here on perceived), in the short to medium term is greatly emphasised by the popular thinking of the day at hand. The popular thinking at any point in time is significantly impacted by the ‘street’, and by near term data bias (refer to Soros’s work on reflixivity, essential reading in my opinion if one wants to understand the pyschology of stocks).

Therefore there is a periodic circular relationship between (a) & (b). Over the longer term (a) dictates the long term movement of stocks. But in the short to medium term (b) can have a greater impact on stock prices.

Further evidence of this can be seen in Warren Buffetts biography. There is a section relatively close to the front of Alice Schroeders book on Warren. I dont have the book in front of me, so i cant remember the exact page. But basically warren is in a meeting of some sort in the late 1990’s, he provides an insight into the future prices of stocks, his estimate is for stocks to show a relatively poor performance given their recent historical climb (from that point, ie the late 1990’s), and for expectations of future performance to underperform.

In regards to your statement about short term price underperformance which i have copied and pasted:

” For me the share price is not the focus. If you delight in the underperformance however Rici Rici, then you are no less smitten by short term share price performance than someone who delights in it going up. My focus is on business performance not share prices and more importantly, whether the prospects are bright for rising intrinsic values over long periods of time”

I am trying to understand this statement.

I agree with you that the share price is not the focus. The focus is on the underlying business and intrinsic value not just today but extrapolated into the future (and hedged with a risk matrix of the underlying quality of the company).

BUT THE DECISION TO BUY OR SELL IS VERY MUCH DEPENDENT ON THE RELATIONSHIP BETWEEN THE SHARE PRICE AND INTRINSIC VALUE (Current and future)

I see no reason to disagree Rici Rici.

Hey Rici Rici,

It’s Chapter 2 of the book when WB is at Sun Valley – July 1999.

Out of further interest i havent looked into the Investment Bank’s ‘ Structural leaders list’ before, so i pulled out my copy of their ‘Daily Cable’. The Structual leaders list is a list of 14 stocks that are suggested to provide a sustainable competitive advantage and a superior return on capital over a 3-5 year time horizon.

Interesting only Amcor and BHP cross check to the list above. More interesting still a couple of stocks discussed by others here on the blog are currently appearing in the list including CBA, CSL and Wotif.

Hi Rici Rici,

I think you have made some good points in your post and point to the same issue that many of us have raised for potential ‘blind followers’ not Graduates of Roger’s approach. Of note, my MCE and FGE shares have been underperforming the makret of late (last few weeks), however I am not going to selling them based on my current projections as I see great opportunity for price to still rise to catch up to IV.

Your comments on not picking the ‘best’ part of the institutional banks portfolio is valid, but has to balanced with teh fact that the same strategy was not applied for Roger’s portfolio which inlcudes ORL (at approx. its bottom point). Examples are just that, indicators or illustrations of a model. We could all paint a picture that illustarted the opposite (Bank beating Montgomery) by reducing the sample size and focusing on a few stocks. I think the intent here was to have a little fun and set a baseline that could be measured against for the next 12 months, rather than offereing finanical advice on which startegy was the best.

Finally, well done on rasining an objective point of view to the blog. It’s always good to see balanced discussion. The worst thing we could all do is stand in a circle and pat each other on the back in a ‘groupthink’ approach. Keep different perspectives coming.

I was personally thinking that the list might say more about the newspaper than the investment bank. It will be interesting to see why the author of the article or editor chose that particular fund. I would expect it would be more interesting to readers than a list of smallish picks and shovel businesses, an oil rig floatie company and a small data carrier that most have not heard of, which leads me to my second point.

The companies mentioned in the artice are quite interesting to a large number of people so it is nothing more than marketing to that crowd that they can invest with them in the companies they think are good (lets not forget that others disagree with us and think a lot of those companies are good), so buy our product.

I am sure as Rici Rici states there are other funds in the same institution that are more on the value.able platform.

Great post. Well done Scott T.

I have a random thought on FAQ.

What if we organise some key materials (post + comments) here based on the Chapters within Value.able. That way, anyone new can cross reference them back to the book.

Thanks for your kind comments. Joab

All the best

Scott T

I’m betting on MQR

But perhaps you could expand your spreadsheet to include dividends paid, Best if these are grossed up

Then we could adjust figures to suit our various tax positions

Don1

G’day Don,

Unless there is another Don McLennan who writes like an accountant, I suspect we might know each other rather well!

I concur that the total return would need to be used to make the comparison fairer – and even then we should all remember that this is an exercise for amusement as much as anything given the time frame involved.

….although a more careful re-read tells me that Scott already has this issue in hand.

Hi Greg Mc,

Thanks for your comments, and an excellent reminder for everyone that this whole project is just for amusement, it is quiet simplistic and may or may not be everyone’s cup of tea.

All the best

Scott T

No you are right. How many years should we run it before the results are valid? 3, 5, 10, 30? Value investors should prefer most to follow the other guy!

Great Stuff Scott T,

In the true traditional of cheering of the underdog the blog will be cheering for David.

But we all know that it really won’t be a contest.

David’s quality will beat Goliath’s size with ease

BTW

approx figures only but

Goliath market cap 244.5B

David Market cap 8.2B

Go David

Maybe Scott meant that David was the institutional bank and Roger was Goliath. I think on recent results Roger’s comments seem to influence the market more than they do :)

Thanks for your kind comments Ash, and thanks for going to the trouble of comparing the Market Cap of the 2 portfolios.

All the best

Scott T

No Problems Scott,

I think this is an excellent post and enjoyed it very much

Thanks for the time you have taken to compile it.

I put the two portfolios into my etrade watch list today and can report that Goliath is making a come back (Boo Hiss)

Goliath still has a ways to go though

Go the little guys

if you’re playing a game of poker and you don’t know who the patsy is, you’re the patsy…….

WB

…and remember that illiquid, small cap stocks make great poker chips for the one calling the bet!

Hi Tony,

Good call,

But remember we are buy businesses. Market movements are irrevevant. It is the underlying performance of the business that will count over time

Ash,

You say “Market movements are irrevevant” (sic), but this not so if you treat it as a small cap poker game…. its all about the market movements that a double bluff can create in the micro- and nanno- caps. It helps in the double bluff if you have celebrity status with a bunch of naive followers who jump on your every bet.

Hi Tony,

Price will follow value in the long term.

No matter what celebrities recommend and what happens to the price in the short term, it is the long term performance of the business that will count.

I am not a poker player sorry, Just looking for one foot hurdles

Completely agree with O’Reilly. Good to see Roger updating the warning to investors re seeking independent advice and doing your own research. Following some of these selections of late is going to leave a lot of “punters” in trouble, if they are not nimble. This is no longer about buying good stocks for the long term, this is speculation.

Your back Es!

Using the poker analogy and my own experience may i add:

“Poker is a skill game, the cards however are random. The skill isn’t winning with pocket aces or a high pocket pair, anyone can do that. It’s the ability to minimise your losses by choosing your spots carefully to maximise your winnings and folding when you know you are not in a position to win the hand”.

To translate in investment speak, remember the rule number one is to not lose money. Pick your companys wisely. Only choose high quality companys and wait for the right moment in which you can bet big and get a big payoff. Don’t go rushing into anything to try to force it.

ROGER/SCOTT T

very nice. great info.

brother number 2 seems remarkably similar to one of the blogs distinguished & regular contributors…

Spot on MattR

Thanks for your kind comments

All the best

Scott T

It will be interesting to see how this one pans out.

On a side note Roger and fellow investors what do you think of MCE’s SPP offer at 8.50 ?

I bought quite a few back at 3.40 and 4.00 and 5.00 but I am baulking a bit as i think MCE is at about IV now anyway.

Are its future prospects enough to warrant further investment?

When I reprocessed the IV based on the issue, my IV signifcantly increased as the release was issued at a value much greater than the equity per share. Does anyone else have an updated MCE IV?

My new IV is around $11- . I have used a weighted IV based on :

Low – RR 12% ROE 30% and High – RR 10% ROE 35%

Hi David

I have 2013 falling from $12.50 to $11.90

That said the future looks bright………..

Nice one Scott T,

Usually I would rather invest than gamble, but I know who my money would be on here…

I remember seeing that article at the time. Qantas, Asciano and Amcor in the same portfolio?

hmmm… what happens to the dividends?

Hi Warton and Don1,

Dividends will be picked up in the next quarter and the final quarter of the year.

Thanks for your comment.

All the best

Scott T