Market Valuation

-

MEDIA

Does crunching the numbers pay-off?

Roger Montgomery

June 9, 2012

Roger Montgomery certainly thinks so – and he explains why Value Investors need to do their homework to experience exceptional returns in this Australian article published on 9 June 2012. Read here.

by Roger Montgomery Posted in In the Press, Intrinsic Value, Investing Education, Market Valuation.

-

MEDIA

What does Roger Montgomery think of Gina Rinehart’s Fairfax shareholding?

Roger Montgomery

May 30, 2012

Learn Roger’s insights into the near-term future for Fairfax Media (FXJ) as Gina Rinehart increases her shareholding in this discussion with 2GB’s Ross Greenwood broadcast 30 May 2012. Listen here.

by Roger Montgomery Posted in Companies, Investing Education, Market Valuation, Radio.

- save this article

- POSTED IN Companies, Investing Education, Market Valuation, Radio

-

Germany v France and the future of your SMSF.

Roger Montgomery

May 29, 2012

“The more European leaders talked at a dinner last Wednesday, the grimmer Angela Merkel looked. One after another, they spoke out in favor of the joint assumption of debt and against the strict austerity course Berlin is calling for. The chancellor stared silently at the man who was responsible for this change of mood — France’s new president, François Hollande, who noted with satisfaction that there was “an outlook for euro bonds in Europe.”

“The more European leaders talked at a dinner last Wednesday, the grimmer Angela Merkel looked. One after another, they spoke out in favor of the joint assumption of debt and against the strict austerity course Berlin is calling for. The chancellor stared silently at the man who was responsible for this change of mood — France’s new president, François Hollande, who noted with satisfaction that there was “an outlook for euro bonds in Europe.”Merkel disagreed, saying that euro bonds are not the right tool, but to no avail. Only a minority stood behind the German leader. Even European Council President Herman Van Rompuy said, at the end of the dinner, that there should be “no taboos,” and that he would examine the idea of euro bonds. “Herman,” Merkel blurted out, “you should at least say that some at this table are of a different opinion.”

…..

The fight has only just begun, and so it comes as no surprise that the roar of battle is drowning out everything else at the moment. But there are also signs of rapprochement. During his first official visit to Berlin, Pierre Moscovici, the new French minister of economics and finance, revealed some sympathy for the German line. He confirmed the new French government’s intention to reduce the national deficit in the coming year to below the upper limit of 3 percent of GDP, and to eliminate all new borrowing starting in 2017. He also underscored how important healthy budgets are for growth and employment. Those who have too much debt become impoverished, he said. And those who are poor, he added, cannot invest.”

From: http://www.spiegel.de/international/europe/merkel-preparing-to-strike-back-against-hollande-with-six-point-plan-a-835295.html

I like Greg’s post on this subject here on the Insights Blog earlier today:

“With respect to Eurobonds, investors should understand that what is really being proposed is a system where all European countries share the collective credit risk of European member countries, allowing each country to issue debt on that collective credit standing, but leaving the more fiscally responsible ones – Germany and a handful of other European states – actually obligated to make good on the debt.

This is like 9 broke guys walking up to Warren Buffett and proposing that they all get together so each of them can issue “Warrenbonds.” About 90% of the group would agree on the wisdom of that idea, and Warren would be criticized as a “holdout” to the success of the plan. You’d have 9 guys issuing press releases on their “general agreement” about the concept, and in his weaker moments, Buffett might even offer to “study” the proposal. But Buffett would never agree unless he could impose spending austerity and nearly complete authority over the budgets of those 9 guys. None of them would be willing to give up that much sovereignty, so the idea would never get off the ground. Without major steps toward fiscal union involving a substantial loss of national sovereignty, the same is true for Eurobonds.”

At worst your SMSF hangs in the balance. At best expect a wild ride.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 29 May 2012.

by Roger Montgomery Posted in Global markets, Market Valuation.

-

Is Japan the Next Black Swan?

Roger Montgomery

May 22, 2012

Forget Europe. That’s old news. The next surprise might just be a bursting of Japan’s bond bubble. Nay, a bursting of Japan itself?

Forget Europe. That’s old news. The next surprise might just be a bursting of Japan’s bond bubble. Nay, a bursting of Japan itself?According to Fitch, gross general government debt of Japan is likely to reach 239 percent of GDP by end-2012, the highest for any Fitch-rated sovereign. Moreover, Japan’s Fiscal Management Strategy envisages declines in the government debt/GDP ratio only from fiscal year 2021.

Would you lend Japan money (or any country with these financials) at rates approaching zero?

Strong private savings contribute to the country’s persistent current account surpluses. But that’s all going to change as ageing baby boomers (who the government has been borrowing money from at near zero rates – its called financial repression) start to ‘dissave’. As they get older they will stop saving and start needing the cash to finance retirement and healthcare. The result is that the government will need to turn to foreign investors for cash and they are not going to accept zero rates when the country has debt of 240% of GDP.

According to Bloomberg: “How low can bond yields go without triggering a meltdown?

“This question gains urgency as 10-year government yields disappear before the world’s eyes. At 0.83 percent, the lowest level since 2003, they hardly compensate investors for the risks inherent in buying IOUs from the most indebted nation. Public debt is more than twice the size of the $5.5 trillion economy. Worse, it’s still growing. Fitch Ratings today lowered the sovereign-credit rating by one step to A+ with a negative outlook because of Japan’s “leisurely” efforts to cut debt.

“Ignore news that gross domestic product rose an annualized 4.1 percent from the final three months of 2011. The only reason Japan is growing at all is excessive borrowing and zero interest rates. The moment Japan trims its debt, growth plunges, deflation deepens and politicians will demand that the Bank of Japan do more. That’s been Japan’s lot for 20 years now.

Yet what if the BOJ isn’t just setting Japan up for the mother of all crises, but holding the economy back?“A bizarre dynamic is dominating Japan’s financial system, one evidenced by two-year debt yields falling to about 0.095 percent. That is below the upper range of the BOJ’s zero-to-0.1 percent target for official borrowing costs. It’s below the 0.1 percent interest rate the BOJ pays banks for excess reserves held at the central bank. Such rates raise serious questions.

“The BOJ does reverse auctions where it buys government debt from the market. Last week, it failed to get enough offers from bond dealers. Now think about that: The BOJ prints yen and uses it to buy government debt from banks, which typically hoard the stuff. Last week, banks essentially said: “No, thank you. We’d rather have these dismal interest-bearing securities than your cash, because there’s really nowhere to put that cash anyway.” Banks certainly aren’t lending.

“Politicians are pounding the table demanding that the BOJ expand its asset-purchase program. That, of course, isn’t possible. The BOJ can hardly force banks to swap their bonds for cash. So Japan is left with a problem unique to modern finance. Banks like to keep more cash on deposit at the BOJ than they need to in order to earn a 0.1 percent rate of return, which is pretty good by Japan standards. To pay that rate, the BOJ creates new money, which does nothing to help the economy.

“This dynamic keeps Japan’s monetary engine in neutral at best, and at times running in reverse. Japan’s central bank is essentially now there to support bond prices. It’s a huge intervention that gets little attention. Headlines roll every time the Ministry of Finance sells yen in currency markets. The BOJ’s debt manipulation barely registers.”

Why today?

Last year it was Iron Ore and recently it was minings services for which we suggested conventional wisdom should be questioned. I am posting this topic today because Fitch Ratings lowered Japan’s credit ratings citing rising risks to the sovereign credit profile due to higher public debt ratios.

The long-term foreign and local currency Issuer Default Ratings were lowered to ‘A+’ from ‘AA’ and ‘AA-‘ respectively. The Negative outlook on ratings was maintained.

“The country’s fiscal consolidation plan looks leisurely relative even to other fiscally-challenged high-income countries, and implementation is subject to political risk,” Andrew Colquhoun, Head of Asia-Pacific Sovereigns at Fitch.

The agency warned that a lack of new fiscal policy measures aimed at stabilizing public finances amid continued rises in government debt ratios could lead to a further downgrade.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 22 May 2012.

by Roger Montgomery Posted in Foreign Currency, Global markets, Market Valuation.

-

MEDIA

Are we in the middle of another US share market bubble?

Roger Montgomery

March 19, 2012

On ABC Radio’s ‘The World Today’ Roger Montgomery discusses with David Taylor why he can foresee a corrections to the US equity markets. Read/Listen here.

This program was broadcast on the 19th March 2012.

by Roger Montgomery Posted in In the Press, Market Valuation, Radio.

- save this article

- POSTED IN In the Press, Market Valuation, Radio

-

MEDIA

Value Investing ‘on air’.

Roger Montgomery

March 11, 2012

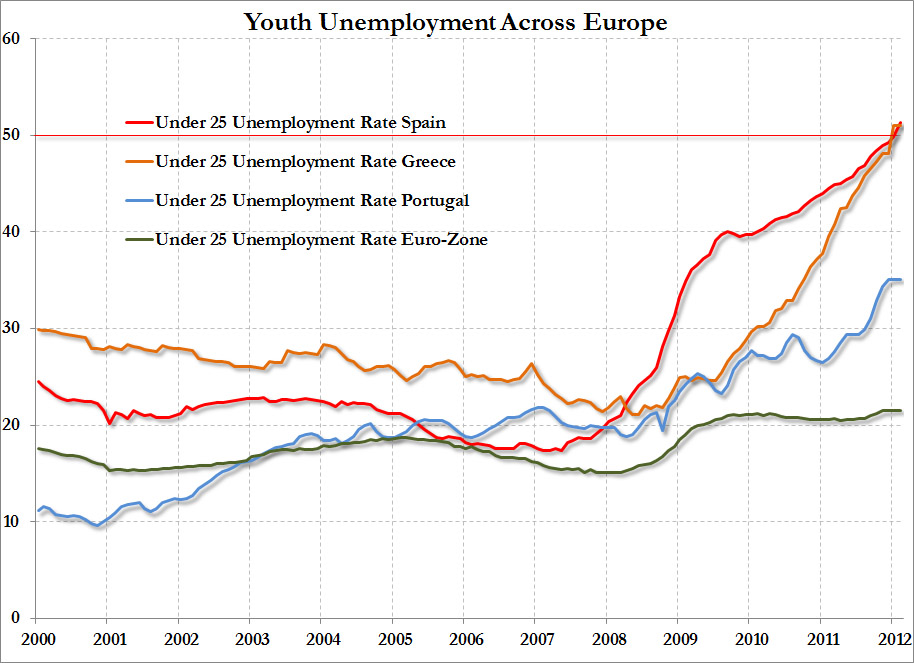

A busy week last week for value investing. Presenting in Perth for the ASX and in Melbourne as well as chatting to Ross Greenwood and Ticky Fullerton as I do regularly has cemented in my mind the idea that the case is building for a protracted de-leveraging (Click the European youth unemployment chart at left). I will bring you more about this de-leveraging vs recession idea soon as well as what I believe it means for share portfolios but for now I thought you might like a shortcut to some of the chats. And of course, all proudly brought to you by my very good friends at Skaffold.

A busy week last week for value investing. Presenting in Perth for the ASX and in Melbourne as well as chatting to Ross Greenwood and Ticky Fullerton as I do regularly has cemented in my mind the idea that the case is building for a protracted de-leveraging (Click the European youth unemployment chart at left). I will bring you more about this de-leveraging vs recession idea soon as well as what I believe it means for share portfolios but for now I thought you might like a shortcut to some of the chats. And of course, all proudly brought to you by my very good friends at Skaffold.The subject came up with Alan Kohler last weekend on the ABC’s Inside Business. You can watch it by clicking here

It also came up on the ABC’s The Business with Ticky Fullerton, which airs at 8.30pm and just after 11pm Monday to Thursday. You can watch it by clicking here

And finally, here is the talk I gave recently for the ASX Investor Hour. You can simply click on the video below to watch the seminar or click HERE to view the seminar with slides.

There’s plenty to think about and stay tuned to find out what stocks we have been buying in the most recent quarter. If you are looking for hot tips you are at the wrong blog, as we may have bought the stocks I mention as being worthy of careful study as many as three months ago. And sadly, we have already benefited greatly from someone spruiking some of these stocks online and I am told by one CEO that they have been reported to ASIC.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 11 March 2012.

by Roger Montgomery Posted in Market Valuation, TV Appearances.

- save this article

- POSTED IN Market Valuation, TV Appearances

-

Is the rally over?

Roger Montgomery

March 8, 2012

At the outset, let me say I am not going forecast anything. I don’t know whether the market will rise or fall next. Andy Xie however, in his column entitled; A world flying blind wrote: “Playing with expectations works temporarily. The risk-on trade is in a mini bubble, as today’s, buyers want to be ahead of the slower ones. The buying trend is sustainable only if the global economy strengthens, which is unlikely. The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings. Banks are cheap for a reason. Internet stocks suggest another bubble in the making. The Fed is trying to inflate an expensive asset. The rally, hence, is quite fragile. As soon as a shock like Greece defaulting or bad economic news unfolds, the market will quickly head south.”

At the outset, let me say I am not going forecast anything. I don’t know whether the market will rise or fall next. Andy Xie however, in his column entitled; A world flying blind wrote: “Playing with expectations works temporarily. The risk-on trade is in a mini bubble, as today’s, buyers want to be ahead of the slower ones. The buying trend is sustainable only if the global economy strengthens, which is unlikely. The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings. Banks are cheap for a reason. Internet stocks suggest another bubble in the making. The Fed is trying to inflate an expensive asset. The rally, hence, is quite fragile. As soon as a shock like Greece defaulting or bad economic news unfolds, the market will quickly head south.”In the great de-leveraging we are witnessing, cutting interest rates (monetary policy) doesn’t spur economic activity because businesses and individuals are simply trying to get out from under a mountain of debt first. The next option is to simply hand over money (quantitative easing) and then if that doesn’t work expand budget deficits through government spending (fiscal policy). A positive by-product of the money printing is that lower long-term bond rates guarantee a negative real yield – How can bonds be seen as ‘safe’ if they are 100% guaranteed to result in less purchasing power? – and investors are forced to buy other assets like stocks and pile into the “risk on” trade referred to above. Sadly, just as the money being printed isn’t finding its way into the economy – its being hoarded by the zombie banks who should have been allowed to collapse and/or write off their bad loans – the rally in the stock market isn’t helping the masses and indeed may itself be fading.

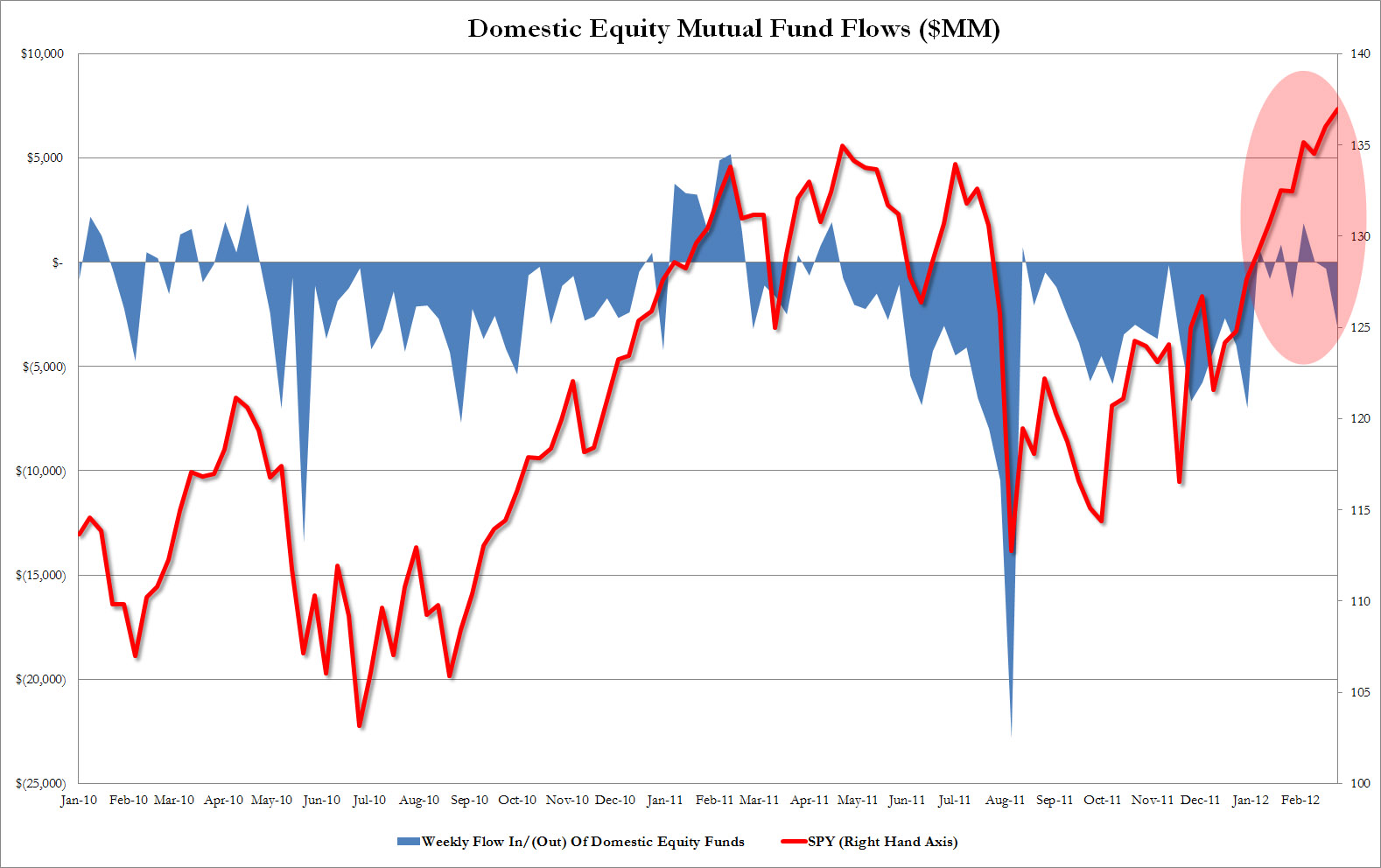

Chart 1 suggests to some investors that the latest attempt to encourage participation in the stock market hasn’t worked.

Chart 1 reveals that not only have retail investors continued to pull out cash from US equity mutual funds (about $66 billion since October), but the market peak of the week of February 29 coincided with the biggest weekly outflow for 2012 – $3 billion.

The Globe&Mail reported: “Retail investors, after gutting it out through years of awful returns, have finally fled. In a normal market, retail participation – Mr. and Mrs. Public trading their personal accounts – should be about 20 per cent. That plunged in November and December, traders say…

Traders Magazine noted: “On Wall Street, risk is suddenly a four-letter word. Retail investors can’t stomach it. Pension plan sponsors are allocating away from it.

“That’s bad news for stocks. Volume has been dropping almost nonstop for three years and shows no signs of improvement. The situation is worse than it was following the crash of 2000. It’s worse than it was after the crash of 1987. Fearful of the future and still wincing from 2008, investors are moving funds into bonds, commodities, cash, private equity, hedge funds and even foreign securities-anything but U.S. stocks.

“Our bread and butter is the retail investor,” Scott Wren, a senior equity strategist at Wells Fargo Advisors, one of the country’s four largest retail brokerages, told Bloomberg Radio recently. “They’re not jumping into the market. They’re not chasing it. Those who have been around for a little bit have been probably burned twice here in the last 10 years or so. They’re definitely gun-shy. They’re not believers. I’m not sure what it’s going to take to get them back in the market.”

As an aside, the reference to declining volumes over the last three years reminds me to republish the chart that I first published here: http://rogermontgomery.com/perhaps-one-of-the-most-important-charts/

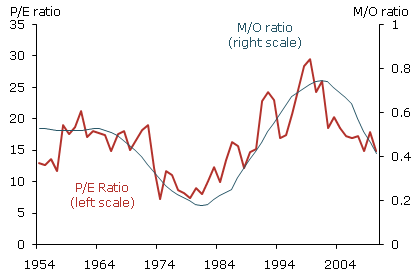

We wrote back in February; “A key demographic trend is the aging of the baby boom generation. As they reach retirement age, they are likely to shift from buying stocks to selling their equity holdings to finance retirement. Statistical models suggest that this shift could be a factor holding down equity valuations over the next two decades.

“The baby boom generation born between 1946 and 1964 has had a large impact on the U.S. economy and will continue to do so as baby boomers gradually phase from work into retirement over the next two decades. To finance retirement, they are likely to sell off acquired assets, especially risky equities. A looming concern is that this massive sell-off might depress equity values.”Chart 2. Ratio of accumulators to dissavers plotted against P/E ratios

Back to more recent observations and the 20% stock market rally over the last four months has been described as a completely artificial “ramp” by some and has been driven entirely by the global liquidity injections of the US, UK, European and Japanese central banks. The conclusions for some investors is that the smart money – those that have bought in anticipation of retail ‘follow-through’ will soon scramble for the exits. What do you think?

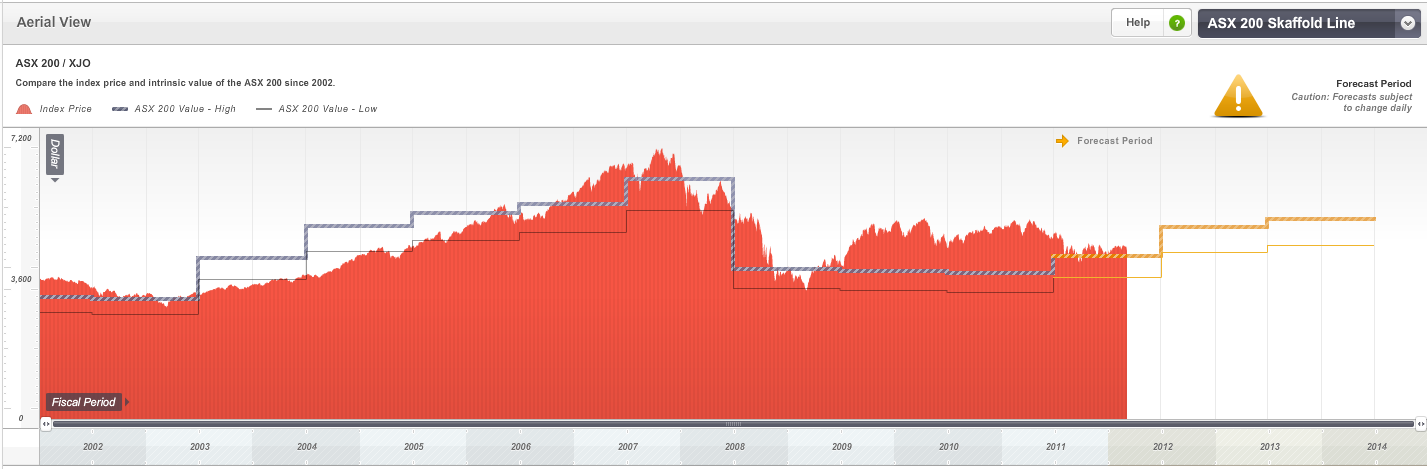

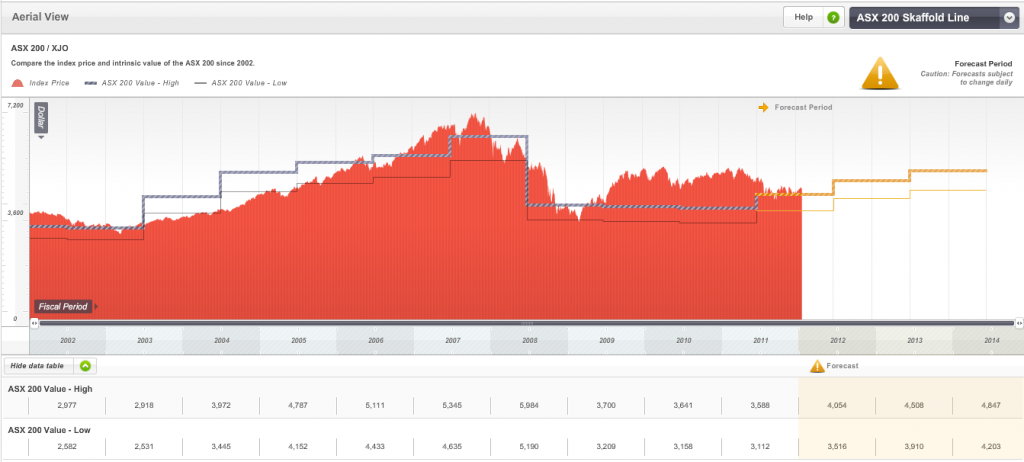

Skaffold’s ASX200 Value Indicator is a live and automatically-updated valuation estimate of the ASX200. It updates and changes every day. The future valuation estimates are based on the the constantly updated forecasts for earnings and dividends of the biggest 200 companies. You can’t beat it as a guide to the overall market level and whether you should be enthusiastic or not about looking more deeply for value.

Chart 3. ASX200 Value Indicator

Source: Skaffold.com

Based on current forecasts for 2012 you can see that the market looks about fair value. It isn’t overly expensive but neither is it, in aggregate, cheap. Based on 2013 forecasts however the market appears to be reasonable value. So the question is whether those 2013 forecasts are reasonable. Typically, forecasts are optimistic. We have previously written here of the persistence of optimism in forecasts by analysts. If that is again the case for 2013, then you wouldn’t be getting overly enthusaistic about our market unless there was a pull back. And according to those referenced above, a pull back is on the cards. What do you think?

I believe there are individual companies that have produced amazing results this reporting season and in an upcoming post we will list the very best. I also think that there is still some value among these companies. The challenge for those new to long term value investing is to be able to stick to your guns, accumulate positions in extraordinary companies at deep discounts to rational estimates of intrinsic value and stand apart from the daily gyrations of fear and rumour about default, money printing and recession.

Looking forward to your comments.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 8 March 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation.

-

Is your portfolio filled with quality and margins of safety?

Roger Montgomery

February 20, 2012

Click on the image at left to see a close up of the stocks we like.

Click on the image at left to see a close up of the stocks we like.I reckon 2012 will be the year to get set and fill your portfolio with high quality businesses, demonstrating bright prospects for intrinsic value growth and a margin of safety. That will be the topic of my talk today as I kick off the ASX’s 2012 Investor Hour series. Here are the details:

Topic: Buying opportunity

When: Tuesday 21 February

Where: Wesley Conference Centre, 220 Pitt Street, Sydney (venue location)

Time: 12 noon – 1pm. Please arrive by 12.00 noon for start

Details:The time to get interested in share investing and make good returns is precisely when everyone else isn’t. But know that the key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently.

At this event Roger will set out his principles for stock selection.

Roger Montgomery is a highly-regarded value investor, analyst and author and a regular contributor and commentator across the media. Roger is an analyst at Montgomery Investment Management Pty Ltd.

Presenter(s): Roger Montgomery, www.Skaffold.com, www.Montinvest.com

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 21 February 2012.

by Roger Montgomery Posted in Companies, Investing Education, Market Valuation.

-

First base.

Roger Montgomery

February 6, 2012

US jobs data was stronger than expected and resulted in global equity markets following the US reaction higher. But is all as it seems?

US jobs data was stronger than expected and resulted in global equity markets following the US reaction higher. But is all as it seems?The increase in jobs was 243,000 but 490,000 were said to be temporary jobs. The employment number is now the same as a decade ago but a decade ago there were 30 million fewer people living in the US!

Charles Biderman notes that “Either there is something massively changed in the income tax collection world, or there is something very, very suspicious about today’s BLS hugely positive number,” adding, “Actual jobs, not seasonally adjusted, are down 2.9 million over the past two months. It is only after seasonal adjustments – made at the sole discretion of the Bureau of Labor Statistics economists – that 2.9 million fewer jobs gets translated into 446,000 new seasonally adjusted jobs.” A 3.3 million “adjustment” solely at the discretion of the BLS? And this from the agency that just admitted it was underestimating the so very critical labor participation rate over the past year? Perhaps with a hint of conspiracy theorist (all hints of which we run from as fast as possible) Biderman wonders whether the BLS is being pressured by the Obama administration during an election year to paint an overly optimistic picture. Hmmmmm…

The BLS however constantly ‘adjust’ its numbers and an January overadjustment occurs annually. Without the BLS smoothing calculation, the real economy lost 2,689,000 jobs, while net of the adjustment, it actually gained 243,000. So are conditions really getting better in the US or only in the adjustment column on an analyst’s spreadsheet?For those of you who have seen the amazing Abbott and Costello skit ‘Who’s on first’, here’s another take on it:

COSTELLO: I want to talk about the unemployment rate in America.

ABBOTT: Good Subject. Terrible Times. It’s 8.3%.

COSTELLO: That many people are out of work?

ABBOTT: No, that’s 16%.

COSTELLO: You just said 8.3%.

ABBOTT: 8.3% Unemployed.

COSTELLO: Right 8.3% out of work.

ABBOTT: No, that’s 16%.

COSTELLO: Okay, so it’s 16% unemployed.

ABBOTT: No, that’s 8.3%…

COSTELLO: WAIT A MINUTE. Is it 8.3% or 16%?

ABBOTT: 8.3% are unemployed. 16% are out of work.

COSTELLO: IF you are out of work you are unemployed.

ABBOTT: No, you can’t count the “Out of Work” as the unemployed. You have to look for work to be unemployed.

COSTELLO: BUT THEY ARE OUT OF WORK!!!

ABBOTT: No, you miss my point.

COSTELLO: What point?

ABBOTT: Someone who doesn’t look for work, can’t be counted with those who look for work. It wouldn’t be fair.

COSTELLO: To who?

ABBOTT: The unemployed.

COSTELLO: But they are ALL out of work.

ABBOTT: No, the unemployed are actively looking for work… Those who are out of work stopped looking.

They gave up and if you give up, you are no longer in the ranks of the unemployed.

COSTELLO: So if you’re off the unemployment rolls, that would count as less unemployment?

ABBOTT: Unemployment would go down. Absolutely!

COSTELLO: The unemployment just goes down because you don’t look for work?

ABBOTT: Absolutely it goes down. That’s how you get to 8.3%. Otherwise it would be 16%. You don’t want to read about 16% unemployment do ya?

COSTELLO: That would be frightening.

ABBOTT: Absolutely.

COSTELLO: Wait, I got a question for you. That means there are two ways to bring down the unemployment number?

ABBOTT: Two ways is correct.

COSTELLO: Unemployment can go down if someone gets a job?

ABBOTT: Correct.

COSTELLO: And unemployment can also go down if you stop looking for a job?

ABBOTT: Bingo.

COSTELLO: So there are two ways to bring unemployment down, and the easier of the two is to just stop looking for work.

ABBOTT: Now you’re thinking like an economist.

COSTELLO: I don’t even know what the I just said!While we are not waiting around for the swallows to sing – then spring will be over – we are buying stocks in a slow and measured way. We haven’t added any new stocks to our portfolio so we are adding to existing holdings.

In Australia, the situation may not be much better. Last year here at the blog we discussed the impending job losses at banks, manufacturers and retailers and all of that appears to be rolling along as predicted. But as my friend Bob Gottliebsen noted today; “At the weekend, Roy Morgan Research reported a big jump in unemployment during January. Almost certainly that will be reflected in the official figures when they are released later this month. Morgan uses a different method to calculate unemployment to the statisticians and Morgan’s December unemployment was 8.6 per cent, compared with the statisticians’ 5.2 per cent. But now Morgan estimates that January unemployment has skyrocketed from 8.6 to 10.3 per cent – the highest level since Morgan began calculating unemployment.”

“There is no doubt there are seasonal issues as those leaving tertiary education try to join the labour force. They are usually not employed until February or later months. A rise of the proportion shown by Morgan reflects much greater forces than seasonal influences and in 2012 it will be much harder for students to gain employment than in 2011.”

“There is no doubt there are seasonal issues as those leaving tertiary education try to join the labour force. They are usually not employed until February or later months. A rise of the proportion shown by Morgan reflects much greater forces than seasonal influences and in 2012 it will be much harder for students to gain employment than in 2011.”What does it all mean for value investors – remember, we are not economists and macro economics is not part of the value.able bottom-up approach to investing? The implications are that we should be seeking deeper discounts to intrinsic value estimates and those estimates could decline further.

Given Skaffold (click here to Join) is currently suggesting the ASX200 is not cheap, we tend to be cautious even though my learned peers are betting with the world’s central banks that their printing of money and associated reduction in interest rates will force the world out of being defensively cash weighted and into equities and commodities.

We reckon gold makes sense in these times of destabilised fiat money. As you know we own a number of gold stocks (some of which have returned nearly 100%) and I bought more gold (physical) before Christmas.

Here is the latest chart of the ASX200 plotted against Skaffold’s estimates of intrinsic value. You can see that the market is trading a little higher than the estimated intrinsic value for the index. That doesn’t mean it can’t go a lot higher, just that if you are a genuine bargain hunter, you may need to be patient. In light of the unemployment situation noted above and the painfully strong Australian dollar, that makes sense.

Here is the latest chart of the ASX200 plotted against Skaffold’s estimates of intrinsic value. You can see that the market is trading a little higher than the estimated intrinsic value for the index. That doesn’t mean it can’t go a lot higher, just that if you are a genuine bargain hunter, you may need to be patient. In light of the unemployment situation noted above and the painfully strong Australian dollar, that makes sense.In addition to the powerful benefit of such a chart as the ASX 200 Skaffold line, which by the way, is automatically keeping you up-to-date daily for changes in analysts estimates of earnings and dividends for each of the 200 indices’ constituents, Skaffold members will enjoy an unprecedented level of interactivity in upcoming updates. By the way, I trust you are enjoying the enhanced search functionality the team delivered last week.

My team noted a few wanna-be competitors trying to plagiarise little aspects of Skaffold recently and I explained that they and you should “be flattered” and I told the team; “if you can see the competition, you aren’t at the front of the race”. Concentrate on staying in front by looking ahead and not at those trying to catch up. They respect Skaffold members too much to insult them by delivering second-hand ideas or technology. Skaffold keeps you in front with world beating ideas – remember the team that works on Skaffold works for Nike, Porsche, EA Games and Google. What possible hope do the competitors have? We’ve retained one of the world’s decorated design and development teams so Skaffold is.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 6 February 2012.

by Roger Montgomery Posted in Insightful Insights, Market Valuation, Skaffold.

-

MEDIA

Why does Roger Montgomery think 2012 may be our toughest year yet?

Roger Montgomery

February 1, 2012

Roger Montgomery discusses why the global investing outlook for 2012 will be impacted by a variety of negative influences in this Money Magazine article published February 2012. Read here.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, On the Internet, Value.able.