First base.

US jobs data was stronger than expected and resulted in global equity markets following the US reaction higher. But is all as it seems?

US jobs data was stronger than expected and resulted in global equity markets following the US reaction higher. But is all as it seems?

The increase in jobs was 243,000 but 490,000 were said to be temporary jobs. The employment number is now the same as a decade ago but a decade ago there were 30 million fewer people living in the US!

Charles Biderman notes that “Either there is something massively changed in the income tax collection world, or there is something very, very suspicious about today’s BLS hugely positive number,” adding, “Actual jobs, not seasonally adjusted, are down 2.9 million over the past two months. It is only after seasonal adjustments – made at the sole discretion of the Bureau of Labor Statistics economists – that 2.9 million fewer jobs gets translated into 446,000 new seasonally adjusted jobs.” A 3.3 million “adjustment” solely at the discretion of the BLS? And this from the agency that just admitted it was underestimating the so very critical labor participation rate over the past year? Perhaps with a hint of conspiracy theorist (all hints of which we run from as fast as possible) Biderman wonders whether the BLS is being pressured by the Obama administration during an election year to paint an overly optimistic picture. Hmmmmm…

For those of you who have seen the amazing Abbott and Costello skit ‘Who’s on first’, here’s another take on it:

COSTELLO: I want to talk about the unemployment rate in America.

ABBOTT: Good Subject. Terrible Times. It’s 8.3%.

COSTELLO: That many people are out of work?

ABBOTT: No, that’s 16%.

COSTELLO: You just said 8.3%.

ABBOTT: 8.3% Unemployed.

COSTELLO: Right 8.3% out of work.

ABBOTT: No, that’s 16%.

COSTELLO: Okay, so it’s 16% unemployed.

ABBOTT: No, that’s 8.3%…

COSTELLO: WAIT A MINUTE. Is it 8.3% or 16%?

ABBOTT: 8.3% are unemployed. 16% are out of work.

COSTELLO: IF you are out of work you are unemployed.

ABBOTT: No, you can’t count the “Out of Work” as the unemployed. You have to look for work to be unemployed.

COSTELLO: BUT THEY ARE OUT OF WORK!!!

ABBOTT: No, you miss my point.

COSTELLO: What point?

ABBOTT: Someone who doesn’t look for work, can’t be counted with those who look for work. It wouldn’t be fair.

COSTELLO: To who?

ABBOTT: The unemployed.

COSTELLO: But they are ALL out of work.

ABBOTT: No, the unemployed are actively looking for work… Those who are out of work stopped looking.

They gave up and if you give up, you are no longer in the ranks of the unemployed.

COSTELLO: So if you’re off the unemployment rolls, that would count as less unemployment?

ABBOTT: Unemployment would go down. Absolutely!

COSTELLO: The unemployment just goes down because you don’t look for work?

ABBOTT: Absolutely it goes down. That’s how you get to 8.3%. Otherwise it would be 16%. You don’t want to read about 16% unemployment do ya?

COSTELLO: That would be frightening.

ABBOTT: Absolutely.

COSTELLO: Wait, I got a question for you. That means there are two ways to bring down the unemployment number?

ABBOTT: Two ways is correct.

COSTELLO: Unemployment can go down if someone gets a job?

ABBOTT: Correct.

COSTELLO: And unemployment can also go down if you stop looking for a job?

ABBOTT: Bingo.

COSTELLO: So there are two ways to bring unemployment down, and the easier of the two is to just stop looking for work.

ABBOTT: Now you’re thinking like an economist.

COSTELLO: I don’t even know what the I just said!

While we are not waiting around for the swallows to sing – then spring will be over – we are buying stocks in a slow and measured way. We haven’t added any new stocks to our portfolio so we are adding to existing holdings.

In Australia, the situation may not be much better. Last year here at the blog we discussed the impending job losses at banks, manufacturers and retailers and all of that appears to be rolling along as predicted. But as my friend Bob Gottliebsen noted today; “At the weekend, Roy Morgan Research reported a big jump in unemployment during January. Almost certainly that will be reflected in the official figures when they are released later this month. Morgan uses a different method to calculate unemployment to the statisticians and Morgan’s December unemployment was 8.6 per cent, compared with the statisticians’ 5.2 per cent. But now Morgan estimates that January unemployment has skyrocketed from 8.6 to 10.3 per cent – the highest level since Morgan began calculating unemployment.”

“There is no doubt there are seasonal issues as those leaving tertiary education try to join the labour force. They are usually not employed until February or later months. A rise of the proportion shown by Morgan reflects much greater forces than seasonal influences and in 2012 it will be much harder for students to gain employment than in 2011.”

“There is no doubt there are seasonal issues as those leaving tertiary education try to join the labour force. They are usually not employed until February or later months. A rise of the proportion shown by Morgan reflects much greater forces than seasonal influences and in 2012 it will be much harder for students to gain employment than in 2011.”

What does it all mean for value investors – remember, we are not economists and macro economics is not part of the value.able bottom-up approach to investing? The implications are that we should be seeking deeper discounts to intrinsic value estimates and those estimates could decline further.

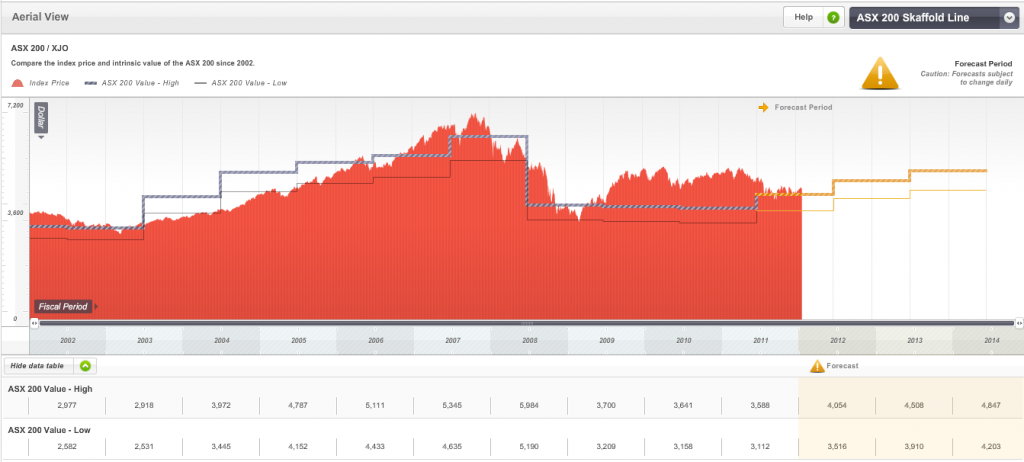

Given Skaffold (click here to Join) is currently suggesting the ASX200 is not cheap, we tend to be cautious even though my learned peers are betting with the world’s central banks that their printing of money and associated reduction in interest rates will force the world out of being defensively cash weighted and into equities and commodities.

We reckon gold makes sense in these times of destabilised fiat money. As you know we own a number of gold stocks (some of which have returned nearly 100%) and I bought more gold (physical) before Christmas.

Here is the latest chart of the ASX200 plotted against Skaffold’s estimates of intrinsic value. You can see that the market is trading a little higher than the estimated intrinsic value for the index. That doesn’t mean it can’t go a lot higher, just that if you are a genuine bargain hunter, you may need to be patient. In light of the unemployment situation noted above and the painfully strong Australian dollar, that makes sense.

Here is the latest chart of the ASX200 plotted against Skaffold’s estimates of intrinsic value. You can see that the market is trading a little higher than the estimated intrinsic value for the index. That doesn’t mean it can’t go a lot higher, just that if you are a genuine bargain hunter, you may need to be patient. In light of the unemployment situation noted above and the painfully strong Australian dollar, that makes sense.

In addition to the powerful benefit of such a chart as the ASX 200 Skaffold line, which by the way, is automatically keeping you up-to-date daily for changes in analysts estimates of earnings and dividends for each of the 200 indices’ constituents, Skaffold members will enjoy an unprecedented level of interactivity in upcoming updates. By the way, I trust you are enjoying the enhanced search functionality the team delivered last week.

My team noted a few wanna-be competitors trying to plagiarise little aspects of Skaffold recently and I explained that they and you should “be flattered” and I told the team; “if you can see the competition, you aren’t at the front of the race”. Concentrate on staying in front by looking ahead and not at those trying to catch up. They respect Skaffold members too much to insult them by delivering second-hand ideas or technology. Skaffold keeps you in front with world beating ideas – remember the team that works on Skaffold works for Nike, Porsche, EA Games and Google. What possible hope do the competitors have? We’ve retained one of the world’s decorated design and development teams so Skaffold is.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 6 February 2012.

Ash Little

:

Thanks Roger,

The Abbott & Costello joke was so funny

But it’s only funny because it’s close to the truth, so it’s funny but it’s not funny ………How to you tell if a politician is lying?….He/she has his/her mouth moving.

Cheers