Market Valuation

-

Are investors giving up?

Roger Montgomery

December 20, 2011

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.If your portfolio still has some rubbish in it, then being able to identify it is a key part of preparing for cheaper prices if they eventuate.

I recently wrote a column for the ASX and pondered the possibility of a climactic event coinciding with a complete throwing in of the towel by equity investors who are simply fed up with poor medium term returns and increased volatility recently.

The ASX200 hasn’t generated a positive capital return since 2005 but quality companies have. The ASX200 contains stocks that are rubbish so it is no wonder that an index based on that rubbish has gone nowhere. Step 1 then is to clean up the portfolio and step 2 is to be ready for quality bargains when they arise.

This is just one of many scenarios and frameworks I am operating with and I wonder what would transpire if the poor returns or the recent heightened volatility continues for a little longer? Will investors simply throw in the towel, leave equities and believe all those advisors offering their own brand of ‘safe’, ‘secure’ and stable investments? On the one hand, I hope so. It would mean certain bargains.

Here’s the Column:

As global sharemarkets decline, remain volatile and produce poor historical returns compared to other asset classes, it will be easy to be swayed by the latest investment trend – to move out of shares. I believe the trend away from shares will gather pace soon as more and more “experts” use the rear-view mirror to demonstrate why sharemarket investors would have been better off somewhere else.

In 1974 US investors had just endured the worst two-year market decline since the early 1930s, the economy entered its second recessionary year and inflation hit 11 per cent as a result of an oil embargo, which drove crude oil prices to record levels. Interest rates on mortgages were in double digits, unemployment was rising, consumer confidence did not exist and many forecasters were talking of a depression.

By August 1979, US magazine BusinessWeek ran a cover story entitled ‘The Death of Equities’ and its experts concluded shares were no longer a good long-term investment.

The article stated: “At least 7 million shareholders have defected from the stockmarket since 1970, leaving equities more than ever the province of giant institutional investors. And now the institutions have been given the go-ahead to shift more of their money from stocks – and bonds – into other investments.”

But be warned. The time to get interested in share investing and make good returns is precisely when everyone else isn’t.

Your own once or twice-in-a-lifetime opportunity may not be that far away and Labor’s promised tax cut on interest earnings may sway even more to give up shares and put their money in a bank, providing the opportunity to obtain even cheaper share prices.

If prices do fall further – and they could – you will need to be ready and will need some cash. The very best returns are made shortly after a capitulation. Cleaning up your portfolio becomes crucial and this article looks at how to do that.

Rule one: Don’t lose money

The key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently. Sure, good companies will see their shares swing but the poor companies see the downswings more frequently.

Therefore, the easiest way to avoid losing money is to avoid buying weak companies or expensive shares. One of the simplest ways I have avoided losing money this year in The Montgomery [Private] Fund has been to steer clear of low-quality businesses that have announced big writedowns.

These are easy to spot using Skaffold.

Not-so-goodwill

I have often seen companies make large and expensive acquisitions that are followed by writedowns a couple of years later. Writedowns are an admission by the company that they paid too much for an asset.

When Foster’s purchased the Southcorp wine business in 2005 for $3.1 billion, or $4.17 per share, my own valuation of Southcorp was less than a quarter of that amount. Then in 2008 Foster’s wrote down its investment by about $480 million, and then again by another $700 million in January 2009 and a final $1.3 billion in 2010.

When too much is paid for an acquisition, equity goes up but profits do not and you can see that too much was paid because that ratio I have worked so hard to make popular, return on equity (ROE), is low.

These low rates of return are often less than you can get in a bank account, and bank accounts have much lower risk. Over time, if the resultant low rates of return do not improve, it suggests the price the company paid for the acquisition was well and truly on the enthusiastic side and the business’s equity valuation should now be questioned. If return on equity does not improve meaningfully, a large writedown could be in the offing. This will result in losses if you are a shareholder, and you have also paid too much.

Just remember one of the equations I like to share:

Capital raised + acquisition + low rate of return on equity = writedown.When return on equity is very low it suggests the business’s assets are overvalued on the balance sheet. That, in turn, suggests the company has not amortised, written down or depreciated its assets fast enough, which in turn means the historical profits reported by the company could have been overstated.

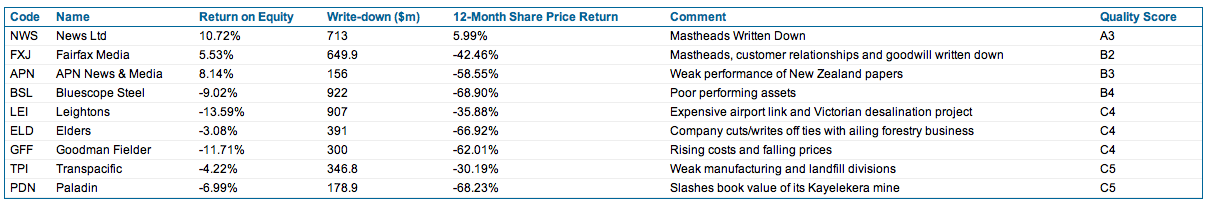

Scoring bad companies: B4, B5, C4 and below…

These sorts of companies tend to have very low-quality scores and often appear down at the poor end of the market – the left side of the screen shot in Figure 1 below.

Figure 1. The sharemarket in aerial view (Source; Skaffold.com)

Each sphere in Figure 1. represents a listed Australian company and there are more than 2000 of them. The diagram is taken from Skaffold. Their position on the screen can change daily as the price, intrinsic value and quality changes. The best quality companies and those with positive estimated margins of safety (the difference between the company’s intrinsic value and its share price) appear as spheres at the top right.

Companies that are poor quality (I call them B4, C4 and C5 companies, for example) are found on the left of the screen and if they have an estimated negative margin of safety, they are estimated to be expensive and will be located towards the bottom of the screen.

Highlighted with blue rings in Figure 1 are eight of the companies that announced this year’s biggest writedowns. Notice they tend to be at the lower left of the Australian sharemarket, according to my analysis.

If your portfolio contains shares that are red spheres and on the lower left, you could also be at risk because these companies tend to have low-quality ratings and are also possibly very expensive compared to their intrinsic value.

As is clear from Figure 1, this year’s biggest writedown culprits were all already located in the area to avoid.

The impact of owning such a business outright would be horrendous. Table 1 below reveals the size and details of these writedowns and as you can see, collectively the losses to shareholders amount to $4.6 billion.

Table 1. Predictable losses?

Warren Buffett once said that if you were not prepared to own the whole business for 10 years, you should not own a piece of it for 10 minutes.

Clearly you would not want to own businesses that pay too much for acquisitions and subsequently write down those assets. If you are not willing to own the whole business, don’t own the shares. Although in the short run the market is a voting machine and share prices can rise and fall based on popularity, in the long run the market is a weighing machine and share prices will reflect the performance of the business. Time is not the friend of a poor company, and companies Skaffold rates C4 or C5 are best avoided if you want the best chance of avoiding permanent losses.

Look at Figure 2 below. Those big writedown companies not only performed poorly but so did their shares. These companies (shown collectively as an index in the blue line below) produced bigger losses for investors than the poorly performing indices of which they are part. And that’s just over one year.

Figure 2. The biggest writedowns compared to the market

Take a look at the companies in your portfolio. Do they have large amounts of accounting goodwill on their balance sheet as a portion of their equity? Have they issued lots of shares to make acquisitions and are they producing low and single-digit returns on equity? If the answer to all these questions is yes, you may have a C5 company.

Cleaning up your portfolio not only lowers its risk but will produce cash that may just prove handy in coming months.

If you have made it this far then here’s evidence of the giving up I referred to in the column: http://www.smh.com.au/business/investors-turn-to-term-deposits-in-shift-away-from-equities-20111219-1p2ir.html

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

Returning to regular programming shortly…we hope!

Roger Montgomery

December 16, 2011

Continuing on our hypothecation theme, David Stockman, former Director of the White House Office of Management and Budget during the Reagan Administration penned the following to Mrs Lee Adler of the Wall Street Examiner. Stockman is currently writing a book on the financial crisis and some of the thoughts he expresses in his exchanges with Adler relate to the ideas he is developing in the book.

Continuing on our hypothecation theme, David Stockman, former Director of the White House Office of Management and Budget during the Reagan Administration penned the following to Mrs Lee Adler of the Wall Street Examiner. Stockman is currently writing a book on the financial crisis and some of the thoughts he expresses in his exchanges with Adler relate to the ideas he is developing in the book.Those you hoping for a quick end to the ructions in Europe and a return to normal levels of volatility may wish to ponder Mr Stockman’s thoughts on why European Banks are on the verge of collapse:

“The real story of the present is the shadow banking system, the unstable and massive repo market, and the apparent daisy chain of hyper-rehypothecated collateral. It looks like the sound bite version amounts to the fact that the European banking system is on the leading edge of collapse for the whole system. These institutions are by all evidence now badly deficient of the three hallmarks of real banks—deposits, capital and collateral.

BNP-Paribas is the classic example: $2.5 trillion of asset footings vs. $80 billion of tangible common equity (TCE) or 31x leverage; it has only $730 billion of deposits or just 29% of its asset footings compared to about 50% at big U.S. banks like JPMorgan; is teetering on $500 billion of mostly unsecured long-term debt that will have to be rolled at higher and higher rates; and all the rest of its funding is from the wholesale money market , which is fast drying up, and from repo where it is obviously running out of collateral.

Looked at another way, the three big French banks have combined footings of about $6 trillion compared to France’s GDP of $2.2 trillion. So the Big Three [F]rench banks are 3x their dirigisme-ridden GDP. Good luck with that! No wonder Sarkozy is retreating on France’s AAA and was trying so hard to get Euro bonds. He already knows he is going to be the French Nixon, and be forced to nationalize the French banks in order to save his re-election.

By contrast, the top three U.S. banks which are no paragon of financial virtue—JPM, Bank of America, and Citigroup—have combined footings of $6 trillion or 40% of GDP. The French equivalent of that number would be $45 trillion. Can you say train wreck!

It is only a matter of time before these French and other European banks, which are stuffed with sovereign debt backed by no capital due to the zero risk weighting of the Basel lunacy, topple into the abyss of the shadow banking system where they have funded their elephantine balance sheets. And that includes Germany, too. The German banks are as bad or worse than the French. Did you know that Deutsche Bank is levered 60:1 on a TCE/assets basis, and that its Basel “risk-weighted” assets are only $450 billion, but actual balance sheet assets are $3 trillion? In other words, due to the Basel standards, which count sovereign and other AAA assets as risk free, DB has $2.5 trillion of assets with zero capital backing!

This is all a product of the deformation of central banking and monetary policy over the last four decades and the destruction of honest capital markets by the monetary central planners who run the printing presses. Furthermore, this has fostered monumental fiscal profligacy among politicians who have been told for years now that the carry cost of public debt is negligible and that there would always be a central bank bid for government paper. Perhaps we are now hearing the sound of some chickens coming home to roost.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 December 2011.

by Roger Montgomery Posted in Financial Services, Market Valuation.

-

Is the bubble bursting?

Roger Montgomery

December 8, 2011

In 2010 here at the Insights Blog I wrote:

In 2010 here at the Insights Blog I wrote:“a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.”

I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to bigs drops in margins for a sizeable portion of the market index…

Watch this video and decide for yourself.

Posted by Roger Montgomery, Value.able author and Fund Manager, 8 December 2011.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation, Property, Value.able.

-

Should you be readying yourself?

Roger Montgomery

September 23, 2011

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.I know of seasoned market practitioners that have deferred the upping of stumps to set up new businesses because they believe there is worse to come. I also know of prominent Australians that are cashing up and I have met with many professional investors who liken the current conditions to those preceding a severe recession or even depression. Berkshire Hathaway shares are trading below $100,000 for the first time in a while (not that it matters). And Bill Gross at Pimco reckons the fact that you can get a better yield over two years by ‘barbelling’ – putting 10 per cent into 30 year bonds and 90 per cent into cash – and beat the yield on 2yr T-Notes is destroying credit creation and so low yields are having the opposite effect to the stimulation they are intended to generate.

Ok. So what do I think?

These are the times to prepare yourself for the possibility of another rare opportunity to buy extraordinary businesses at even more extraordinary discounts to intrinsic value. You have to be ready, you have to have your Value.able intrinsic valuations prepared and your preferred safety margins calculated.

In the short term (6-12 months), on balance, I think shares could get even cheaper (As I write those words, I log on to see the European markets down five per cent and the Dow Jones opening down more than 3 per cent and I am conscious of the fact that an outlook can be tainted by the most recent price direction). But our large cash proportion/position in The Montgomery [Private] Fund since the start of the calendar year has reflected for some time the impact of this possibility on future valuations and our requirement for larger discounts to intrinsic value.

Longer term, I like some of the research put out by McKinsey. The new infrastructure, such as roads, ports, railways and terminals that developing countries such as China, India and South America will need, will require tens of trillions of dollars. McKinsey Global Institute analysis reckons that by 2030 the supply of capital could fall short of demand to the tune of $2.4 trillion – a credit crunch that will slow global GDP growth by a percentage point annually. Even if China and India cool off, a similar gap could occur.

Back to the immediate outlook and there is a simple mental framework that I have been using to think independently about all the ructions impacting our portfolios.

I am no economist, but its pretty easy to see that if trend line US economic growth is barely 1 per cent, then any slowdown in the business cycle will push the economy towards the zero growth line. One per cent is quite simply very close to zero and the business cycle can push growth rates around more than the difference between them. Every time there is a whiff of a slowdown, there will, at the very least ,be fears of another recession. Again, I am not forecasting a recession nor am I forecasting slow growth. Indeed, I am not forecasting at all. I am simply pointing out the fact that tiptoeing on the edge of a precipice (the US at 1 per cent growth) is more frightening than doing circle work in a paddock a long way from any edge at all (China at 7, 8 or 9 per cent growth). Bill Gross’s comments about the destruction of credit further feeds the idea of a slowdown.

On balance I believe there will be some very attractive buying opportunities in the next six to twelve months. Before you read too much into this statement, I should alert you to the fact that I say it every year.

Analysts are prone to optimism too.

I think it’s also appropriate to remember that analysts typically are generally optimistic about earnings forecasts at the start of a financial year. This can be seen in another McKinsey research note (as well as thousands of other similar studies), where analysts commented:

“No executive would dispute that analysts’ forecasts serve as an important benchmark of the current and future health of companies. To better understand their accuracy, we undertook research nearly a decade ago that produced sobering results. Analysts, we found, were typically overoptimistic, slow to revise their forecasts to reflect new economic conditions, and prone to making increasingly inaccurate forecasts when economic growth declined.

Alas, a recently completed update of our work only reinforces this view—despite a series of rules and regulations, dating to the last decade, that were intended to improve the quality of the analysts’ long-term earnings forecasts, restore investor confidence in them, and prevent conflicts of interest. For executives, many of whom go to great lengths to satisfy Wall Street’s expectations in their financial reporting and long-term strategic moves, this is a cautionary tale worth remembering.”

And concluded: “McKinsey research shows that equity analysts have been overoptimistic for the past quarter century: on average, their earnings-growth estimates—ranging from 10 to 12 percent annually, compared with actual growth of 6 percent—were almost 100 percent too high. Only in years of strong growth, such as 2003 to 2006, when actual earnings caught up with earlier predictions, do these forecasts hit the mark.”

Demand bigger discounts

Those thoughts provide the ‘Skaffolding‘ in my mind around which I construct an opinion of where the landmines and risks may be for an investor. I tend to 1) look for much bigger discounts to intrinsic values that are based on analyst projections for earnings and 2) lower our own earnings expectations for those companies we like best.

Cochlear is one example of this. Many analysts have forecast a 10-20 per cent NPAT decline from the recent recall of their Cochlear implant. Only one analyst has considered and forecast a 40-50 per cent NPAT decline. The truth will probably be somewhere in between. Such a decline however would come as a shock to many investors if it were to transpire. And so it is important to be aware of that possibility when calibrating the size of any position in your portfolio. In other words, be sure to have some cash available for such an event because intrinsic value based under that scenario is between $23 and $30.

Your “Top 5”

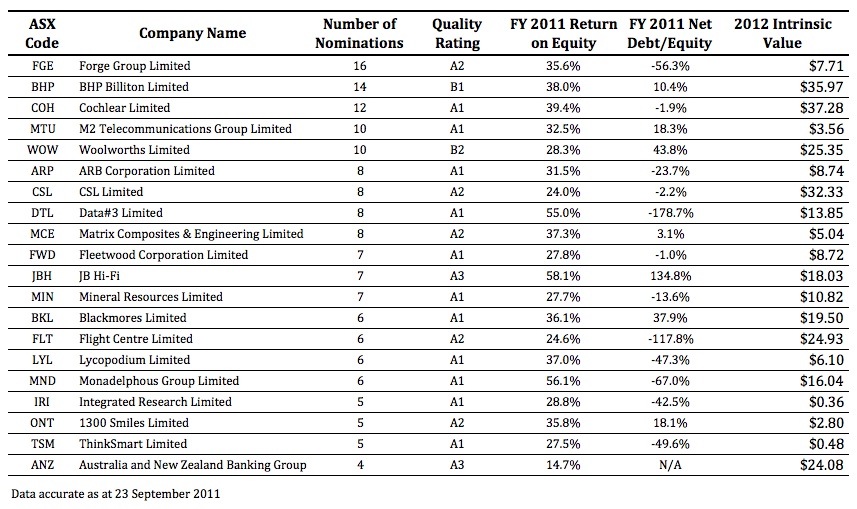

Earlier this month I asked you to list your “Top 5” value stocks – those that you believed represented good value at present. I was delighted to receive so many contributions.

On behalf of the many Value.able Graduates and stock market investors who read our Insights blog thank you for sharing with us the result of all your fossicking, digging and analysis.

There were more than 115 suggestions. The most popular was Forge Group with 16 mentions.

The following table presents the Quality Score, FY2011 ROE, FY2011 Net Debt/Equity and 2012 Value.able Intrinsic Value for Forge Group (FGE), BHP, Cochlear (COH), M2 Telecommunications (MTU), Woolworths (WOW), ARB Corp (ARP), CSL , Data#3 (DTL), Matrix (MCE), Fleetwood (FWD), JB Hi-Fi (JBH), Mineral Resources (MIN), Blackmores (BKL), Flight Centre (FLT), Lycopodium (LYL), Monadelphous (MDN), Integrated Research (IRI), 1300 Smiles (ONT), ThinkSmart (TSM) and ANZ.

As you know these quality scores and the estimates for intrinsic values can change at a moments notice (just ask those working at Cochlear!) so be sure to conduct your own research into these and any company you are considering investing in and as I always say, be sure to seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 23 September 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation.

-

What’s happening to the US?

Roger Montgomery

June 1, 2011

As a young child growing up, the United States was the world’s policeman and Australia was a friend. Part of that picture will change in the lifetime of my children. The US no longer seems to command the authority it once did.

As a young child growing up, the United States was the world’s policeman and Australia was a friend. Part of that picture will change in the lifetime of my children. The US no longer seems to command the authority it once did.Its waning imperialism is at least partly reflected by last weeks visit to China by Pakistani Prime Minister Yousef Gilani. He described Beijing as Islamabad’s “best and most trusted friend”. Meanwhile, a petition in Pakistan’s High Court has called for the expulsion of the US ambassador.

Its waning imperialism is also reflected in recent news that major Australian miners are taking an interest in China’s promotion of its local currency, the Yuan, for trade settlement.

These are the first furtive steps towards a switch away from the US Dollar. Global reserve currency is moving towards the Chinese Yuan. Once hedging is made easier, the floodgates will be open and the Yuan’s appreciation will ensure the tide cannot be stopped.

China will continue to leverage its massive foreign reserves – reflecting fiscal power – and its military might, whenever old ties between the US and others flounder. As regime change in the Middle East continues, new leaders look to China rather than the superpower that funded and abetted their old foes.

India’s PM (and a US ally) recently visited Afghanistan, offering half a billion dollars for development while simultaneously saying “India is not like the United States”.

We are witnessing history. Sure there will be speed bumps and set backs, but the die has been cast.

In the absence of a World War, the US influence and more worryingly, its role as global cop and providore of reserve currency, appears now to have commenced a drawn-out death spiral.

As Jim Roger’s noted; “the 19th century was the era of the British Empire, the 20th belonged to the US Empire but the 21st will be the era of the Chinese Empire.”

The impact of this shift cannot be overstated.

Meanwhile, back at the ranch…

Last year Lakshman Achuthan explained his Economic Cycle Research Institute’s view that A) a US slowdown is already a done deal and B) the US faces the unfortunate prospect of more frequent recessions over the next decade.

Evidence of a slowdown is now emerging and Achutan was recently interviewed on the subject here and here.

Let me say at the outset, I am not an economist. And don’t worry, I’m not turning into one. Indeed, even if I was, it still may not help me invest any better than I can following the Value.able methodology.

I have, however, been trying to find a reason to expect to find value sometime soon.

And thanks to Lakshman Achuthan, I have found a reason to become a little optimistic, if not about the economy, then about the prospect of finding value, soon.

Longer-term, Achuthan thinks more frequent US recessions are a given.

In economics, a recession is a business cycle contraction or a general slowdown in economic activity. During recessions, economic indicators such as production – as measured by Gross Domestic Product (GDP) – employment, investment spending, capacity utilisation, household incomes, business profits and inflation all tend to fall. Conversely, unemployment tends to rise, along with the number of employers no longer able to afford them.

In a 1975 New York Times article, economic statistician Julius Shiskin suggested a definition for a recession. In Australia we seem to have adopted it; two quarters of negative growth and a recession is in place.

Because of the stigma for a political party associated with a recession, not to mention the economic hardship associated with one, recessions are something best avoided.

The two ways to do it are to either to raise the trend rate of growth, such that the dips in the business cycle never fall into the area of growth below zero, or lessen the peaks and troughs of the business cycle itself.

Raising the trend rate of growth, however, does not appear to be an option (for the US at least) because the trend rate of growth in employment, GDP, personal income and industrial production has been down since the end of World War II. As the trend rate of growth declines, and heads closer to zero, the dips in the business cycle need not be very severe to dip below zero.

Reducing the peaks and troughs of the business cycle such that the dips never result in an economic ‘backward step’ has been claimed as a new norm by economic managers who believe the use of monetary policy has been perfected, and also by those who have put their faith in economic globalisation. Monetary policy however is a rather blunt tool and its success in helping us avoid recessions may just be blind luck.

With trend growth declining for 50 years, each dip in the business cycle gets closer to regularly falling below zero. And with luck largely determining the success of policies attempting to smooth out the business cycle, its likely luck will run out, just as the globalisation of the supply chain causes the business cycle to whip even more violently than ever before.

Governments usually respond to recessions by adopting expansionary macroeconomic policies. They can increase the money supply, increase government spending and decrease taxation. But with a flood of US dollars that only Noah could survive, and government deficits already at historic extremes, these measures would only make the situation worse.

If you are investing in equities, the message is simple. Only buy the best quality businesses. And only when large discounts to your estimate of their Value.able intrinsic value are present.

The Value.able recipe is simple and it works. And you don’t need to be an economist to make it work. Whether the idea of more frequent recessions is right or not, the dearth of value suggests one should applaud the fact that markets may react to the risk of more frequent recessions, offering the best stocks for prices less than they’re worth in the process.

Posted by Roger Montgomery, author and fund manager, 1 June 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation.

-

Where to next?

Roger Montgomery

May 18, 2011

You may have noticed my recent posts are not filled with stock ideas. Don’t worry. The drought will end, once the market resumes serving up mouthwatering opportunities

For many businesses, Australia may not seem like the ‘lucky country’ right now. A litany of evidence suggests the economy is cool. Recent bank results reveal credit growth is slowing, if not stalling. Significantly fewer homes are being put to auction and of those that are, clearance rates are not inspiring.

Australia’s savings rate has risen and thanks to rising fuel costs and utility bills, we haven’t got as much to spend as we used to. Then there’s the prospect of rising interest rates. I wonder, given all anecdotal evidence of weakness, whether an interest rate cut would be more justified?

Some of Australia’s ‘blue chips’ have reported weakness or downgrades. Seven West Media reported a softer advertising market, which has also affected Fairfax and APN. OneSteel cited a strong Aussie dollar, as did BlueScope. And you can almost guarantee food manufacturers are going to complain about higher commodity input prices.

Indeed higher input prices, combined with pressure on consumers to pay more for daily essentials – gas, electricity and petrol – means many companies have lost their ability to pass on rising costs. Naturally, this leads me to think that this is precisely the combination of influences that will reveal which companies have a true competitive advantage?

The Value.able community has spent a great of time exploring, discussing and naming competitive advantages – retailers, Apple, your insights. The current economic headwind will reveal who actually has one.

Take a look at the companies in your portfolio. Can they pass on rising costs in the form of higher prices, without a detrimental impact on unit sales? Can they grab market share from competitors whose margins are slimmer, by cutting prices? Is your portfolio overflowing with A1 businesses, or are there some C5s in there that may struggle through post-reporting season?

Now despite current pressures, which of course you must refrain from believing is permanent (and indeed cease focusing on), analysts haven’t brought down their earnings expectations.

Macquarie’s equity analysts are forecasting aggregate profit growth of 19 per cent and according to JP Morgan, non-resource companies are expected to grow profits by 13 per cent this year. These growth rates are a significant revision down from 6 months ago. Are more downgrades to come? Thirteen to nineteen per cent does seem more appropriate for a rosier economic environment…

Lower profits have a real impact on intrinsic values. For companies generating attractive rates of return on equity (at last count, 187 listed on the ASX generate a ROE greater than 20 per cent. Of those 103 are A1/A2), lower profits reduce the quantum of that return, as well as the amount of retained earnings and therefore the rate of growth in equity. All of those changes are negative. If Ben Graham was right and in the long run, price does follow value, that means either lower prices or prices that cannot justifiably rise much more. And this is where Value.able Graduates’ attention should be focused, not on the bailout of Greece or Portugal.

What does this all mean?

I don’t have a crystal ball, so I simply don’t know where the market is headed. Thankfully it isn’t a brake on market-beating returns.

What I do know, is that of approximately 1849 listed entities, 1175 made no money last year. Of the remainder, 56 are A1s and of those, just 13 are trading at a discount to our estimate of intrinsic value. Six are trading at a discount of more than 20 per cent and of those six, The Montgomery [Private] Fund owns two. We have been decidedly slothful in buying and, as a result, while the market has been falling, the Fund’s value hasn’t.

Steven wrote on my Facebook page yesterday “Who cares? this market is… only ugly!” It’s only natural to want to throw up your hands in dismay, but this is where the rubber hist the road – Keep Calm and Carry On Value.able graduates. Look for extraordinary businesses at prices far less than they’re worth.

Just under 11 per cent of The Montgomery [Private] Fund is invested in extraordinary businesses. Even with 89 per cent of the Fund in cash, we are outperforming the S&P ASX/200 Industrials Accumulation Index by 5.29 per cent since inception.

My team and I continue to be inspired by the 1939 poster in which England advised its citizens to “Keep Calm and Carry On”.

Low prices should not bring consternation, but salivation. As sure as the sun rises, low prices for A1 companies will not be permanent.

Beating the market does not mean positive performance every week, every month or even every year. I have no doubt that some investments I will make for myself and the clients we work for will not perform as expected. Not every A1 at a discount will prove spectacular. We can however mitigate some of the risks of course. Sticking to a diversified basket of the highest quality companies (A1s perhaps?) purchased at big discounts to intrinsic value, won’t prevent the market value of the portfolio declining in the short term, but it can help to generate an early, eventual and more satisfying recovery.

With a falling market (and falling prices for A1 companies too) the daggers will come out, so also be prepared for those of weak resolve. They may try to discredit our Value.able way of investing.

A contest isn’t won by watching the score board, looking in the rear view mirror or mimicking those with a demonstrated track record of success. You have to play. And play your own game. Over long periods of time, sticking to good quality A1 companies works. Given that returns are dependent on the price you pay, lower prices (and greater value) works even better!

The issue of course is not the reliability of the Value.able approach, but the patience required to execute it. Remember the ‘fat pitch’? Irrespective of the turmoil that impacts markets, we must Keep Calm and Carry On.

So what do you think? Where do you think the market is headed? What are the factors you are watching? Have you picked up something in your research that you’d like to share? Go for it!

Posted by Roger Montgomery, author and fund manager, 18 May 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation, Value.able.

-

Are we in bubble territory?

Roger Montgomery

May 11, 2011

Less than an hour ago, Microsoft Corp. agreed to buy the Internet telephone company Skype SA for $8.5 billion. The company was started by Niklas Zennstrom (who remained CEO until September 2007) and Janus Friis (one of Time Magazine’s 100 Most Influential People 2006) in 2002 and they sold it to eBay in 2005 for $3.1 billion.

Less than an hour ago, Microsoft Corp. agreed to buy the Internet telephone company Skype SA for $8.5 billion. The company was started by Niklas Zennstrom (who remained CEO until September 2007) and Janus Friis (one of Time Magazine’s 100 Most Influential People 2006) in 2002 and they sold it to eBay in 2005 for $3.1 billion.eBay bought Skype in 2005 for $3.1 billion and sold 70% to private equity for $2 billion in late 2009. Up until yesterday, it was owned by private equity, the Canadian Pension Plan Investment Board and eBay. Now Microsoft is buying the company for three times what private equity paid —an increase in value of more than $5.5 billion in about 18 months. Skype’s original founders also ended up in the syndicate through their company Joltid.

It is the biggest deal in Microsoft’s history. Some of that 36-year history includes a friendship between former CEO Bill Gates and Warren Buffett. One wonders if Warren was consulted because the initial metrics are staggering. Some may argue the high price is because Microsoft was competing against an imminent IPO. With more than $50 billion in cash (much held offshore for tax purposes), Microsoft merely needs to beat the aggregate cash return, which in the US is somewhere just north of zero.

Skype’s ‘customers’ made 207 billion minutes of voice and video calls last year – up 150% on 18 months ago. Most of those calls however are free. Less than 9 million customers per month, or a little more than five percent, paid Skype anything.

The company did produce revenue of $860 million last year, but Skype lost $7 million. $8.5 billion is quite staggering. I think Skype is great and I know many who use it to avoid paying anyone for phone and video calls.

You may recall Microsoft has previously bid $47.5 billion for Yahoo Inc. Yahoo rejected Microsoft’s advances and Microsft dodged a bullet; Yahoo is now available at half the price.

Perhaps we are not in bubble territory? Perhaps it all works out? Perhaps its just a repeat of Foster’s purchase of Southcorp – on a much grander scale? Or perhaps Microsoft will start charging everyone for a call? A charge of 1 cent per minute – and no loss of customers – would be worth $2.07 billion in revenue… What percentage of Skype’s free riders do you think would submit credit cards etc. to subscribe and be willing to be charged?

Posted by Roger Montgomery, Value.able author and fund manager, 11 May 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation, Takeovers, Value.able.

-

The market still seems expensive

rogermontgomeryinsights

January 8, 2010

These iPhones are marvellous things. I can write while preparing dinner for our friends, heading down to the local airport to enquire about flying a sailplane over the southern alps or while sitting at the edge of the Kiewa River. I have seen some great posts and will reply to them all on my return at the end of January.

In the meantime I have heard from my editors that my book is coming along and will be printed right after Chinese new year. If you haven’t registered please do, at www.rogermontgomery.com. I am going to do my best at running a J.I.T. inventory system. That means I won’t be carrying stock and will only print copies for those that have pre-registered. After that there will be a wait. As the book will not be available in stores you will have to pre-register, so if you are interested in a copy from the first run, let me know by registering through the website. You can click the link on this website which is over on the right hand side of this post under the menu heading called “Blogroll”.

In the meantime, the market still seems expensive, but remember that valuing companies is not the same as predicting their short term share price direction. The market can get more expensive just as an individual share might trade at double its valuation or even higher! Of the shares I own that were purchased below intrinsic value and whose valuations are expected to rise significantly in coming years, I have not sold. Those whose values are flattening out and whose prices are well above intrinsic value – I have sold.

If you are also still on your annual break, I hope you enjoy it and if you have worked through or have returned to work, my sincerest hope that I can do something this year to make your next holiday more philanthropic, more adventurous, more luxurious or more of whatever it is you seek from your own holidays.

Posted by Roger Montgomery, 8 January 2010

by rogermontgomeryinsights Posted in Insightful Insights, Market Valuation.

-

Wishing you a safe and happy Christmas

rogermontgomeryinsights

December 24, 2009

I am away for Christmas and January and will only be publishing thoughts to the blog on a spasmodic basis.

If you go to my website, www.rogermontgomery.com, and register for my book or send a message to me, I will let you know via email when I am back on deck.

I expect 2010 will be a very interesting year on the inflation, interest rate and commodity fronts so stay tuned and focus on understanding what is driving a company’s return on equity and how to arrive at its value.

Before doing anything seek always professional advice, but zip up your wallet if you hear the words “only trade with what you can lose”. I don’t like losing money at any time and neither should you.

Posted by Roger Montgomery, 23 December 2009

by rogermontgomeryinsights Posted in Companies, Energy / Resources, Insightful Insights, Market Valuation.

-

Am I selling?

rogermontgomeryinsights

December 18, 2009

The following article first appeared in Alan Kohler’s Eureka Report on December 9, 2009.

Stocks in aggregate are no longer cheap. They were much earlier in the year, but based on the present levels of profitability they are not cheap any more. Those buying today are doing so in a patently perfunctory manner or are simply motivated by the fear of continuing to miss out. In the short term, losses rather than profits are more likely to ensue for those buying today. Before you go selling your holdings in a fit of panic, remember there are always at least two views about the market’s short-term direction.

In one corner are the bulls, who say that the equity market’s recent strength is the beginning of a multi-year rally that owes its ongoing support to the fact that looming inflation will deliver negative returns from cash, which, combined with the massive expansion of the monetary base, represents a free, low-doc loan from the government.

In this environment many suggest that asset class inflation is assured. Indeed, just under $20 billion a week has been creeping out of the bomb shelters and into assets such as shares and gold.

In the other corner sit the economic bears, such as Nouriel Roubini, David Rosenberg and Marc Faber, who say the same inflationary and expansionary balance sheet policies of the West have given the US dollar an intrinsic value of zero, which will bankrupt America and produce a complete horror show that makes the last downturn look like a picnic.

Yield Curves.

So who was it that said two people looking at the same set of facts could not arrive at vastly different conclusions? Listening to and reading the apologetics and protestations of these extraordinarily successful investors must make the morning chat with your broker about whether AMP is paying too much for AXA seem inane. (Postscript: AMP was paying too much for AXA – Nab’s purchase is even more ridiculous).

Perhaps more importantly, to whom do you listen? You cannot base that decision on who is smarter because both groups have geniuses in their ranks; nor can you base your decisions on previous successes because both groups have extremely wealthy proponents.

The answer does not lie with replicating the financial and reputational bets taken by the economists, strategists and traders. Indeed, it lies in not taking a view at all but allowing an entirely different group of facts to dictate your actions.

Those facts are the book values or the equity of companies on a per-share basis, the anticipated profitability of those book values, the manner in which profits are currently retained and distributed (in others words, capital allocation by management) and a reasonable required rate of return.

On these measures most companies are no longer cheap and many are downright expensive. This has occurred for two reasons, that combined, reflect the typical short-term focus of both professional and amateur investors.

The first reason is that share prices have obviously risen. They have risen because Australia has sidestepped a recession, interest rates remain accommodative, our output is in demand and overseas markets have recovered.

The second reason is that shareholders who may have stayed on the sidelines, have pumped money into attractively priced dividend reinvestment plans, placements and rights issues as many of Australia’s largest companies collectively raised $90 billion in the 2009 financial year.

And who can blame the investor who bought shares in Wesfarmers at $29 for wanting to bring down their average price and participate in an entitlement offer to buy three more shares at $13.50 when the rest of the shares they own are trading at $16?

But while the reduction of debt, associated strengthening of balance sheets and stag profits are attractive, there is a nasty downside to all of this. If I have a company with $100 of equity on the balance sheet and 100 shares on issue, each share is entitled to $1 of the net book value of the assets. If, however, my company’s shares are trading at 10¢ because of the global financial crisis and my bankers ask me to reduce my $100 of debt to $50, I may choose to issue 500 shares at 10¢ to raise the required $50.

The first thing that happens of course is that company equity rises by $50 but more disturbing is that there are now 600 shares on issue. Where once each shareholder owned $1 of equity for every share they held, they now own just 25¢ worth of equity.

And if you are a small shareholder from whom the company couldn’t conveniently raise money, your holding has just been diluted because the institutions got the lion’s share of the placement.

Further, the money raised went to pay down debt rather than investment, so the earnings will only increase by the post-tax interest saved. As a result, the return on equity declines as well and because the true value of a company is inextricably related to the profitability of its book value, company valuations decline.

Valuations have thus declined and yet share prices have risen. As Benjamin Graham said, in the short term the market is indeed a voting machine. And I am not talking about one tiny or obscure corner of the market. Rights issues and placements, according to Paterson’s research, now account for more than 6.5% of total market capitalization: the highest level in more than 20 years. (Postscript: figures compiled by trade-futures.com show that 80% of small traders are bullish – the same level as when the market peaked in November 2007).

In the current environment, many value investors will succumb to temptation and their lack of discipline and reduce their discount rates. In doing so they try and keep their valuations from looking out of touch with ever-increasing share prices but really they’re playing catch-up. And when share prices fall slightly, value apparently and suddenly appears.

But the margin of safety is illusory and with returns from stocks unlikely to sustain returns so far out of whack from everything else, real value is some distance below. Only a demonstrated track record can prove otherwise.

Posted by Roger Montgomery, 9 December 2009

by rogermontgomeryinsights Posted in Insightful Insights, Market Valuation.