Is the rally over?

At the outset, let me say I am not going forecast anything. I don’t know whether the market will rise or fall next. Andy Xie however, in his column entitled; A world flying blind wrote: “Playing with expectations works temporarily. The risk-on trade is in a mini bubble, as today’s, buyers want to be ahead of the slower ones. The buying trend is sustainable only if the global economy strengthens, which is unlikely. The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings. Banks are cheap for a reason. Internet stocks suggest another bubble in the making. The Fed is trying to inflate an expensive asset. The rally, hence, is quite fragile. As soon as a shock like Greece defaulting or bad economic news unfolds, the market will quickly head south.”

At the outset, let me say I am not going forecast anything. I don’t know whether the market will rise or fall next. Andy Xie however, in his column entitled; A world flying blind wrote: “Playing with expectations works temporarily. The risk-on trade is in a mini bubble, as today’s, buyers want to be ahead of the slower ones. The buying trend is sustainable only if the global economy strengthens, which is unlikely. The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings. Banks are cheap for a reason. Internet stocks suggest another bubble in the making. The Fed is trying to inflate an expensive asset. The rally, hence, is quite fragile. As soon as a shock like Greece defaulting or bad economic news unfolds, the market will quickly head south.”

In the great de-leveraging we are witnessing, cutting interest rates (monetary policy) doesn’t spur economic activity because businesses and individuals are simply trying to get out from under a mountain of debt first. The next option is to simply hand over money (quantitative easing) and then if that doesn’t work expand budget deficits through government spending (fiscal policy). A positive by-product of the money printing is that lower long-term bond rates guarantee a negative real yield – How can bonds be seen as ‘safe’ if they are 100% guaranteed to result in less purchasing power? – and investors are forced to buy other assets like stocks and pile into the “risk on” trade referred to above. Sadly, just as the money being printed isn’t finding its way into the economy – its being hoarded by the zombie banks who should have been allowed to collapse and/or write off their bad loans – the rally in the stock market isn’t helping the masses and indeed may itself be fading.

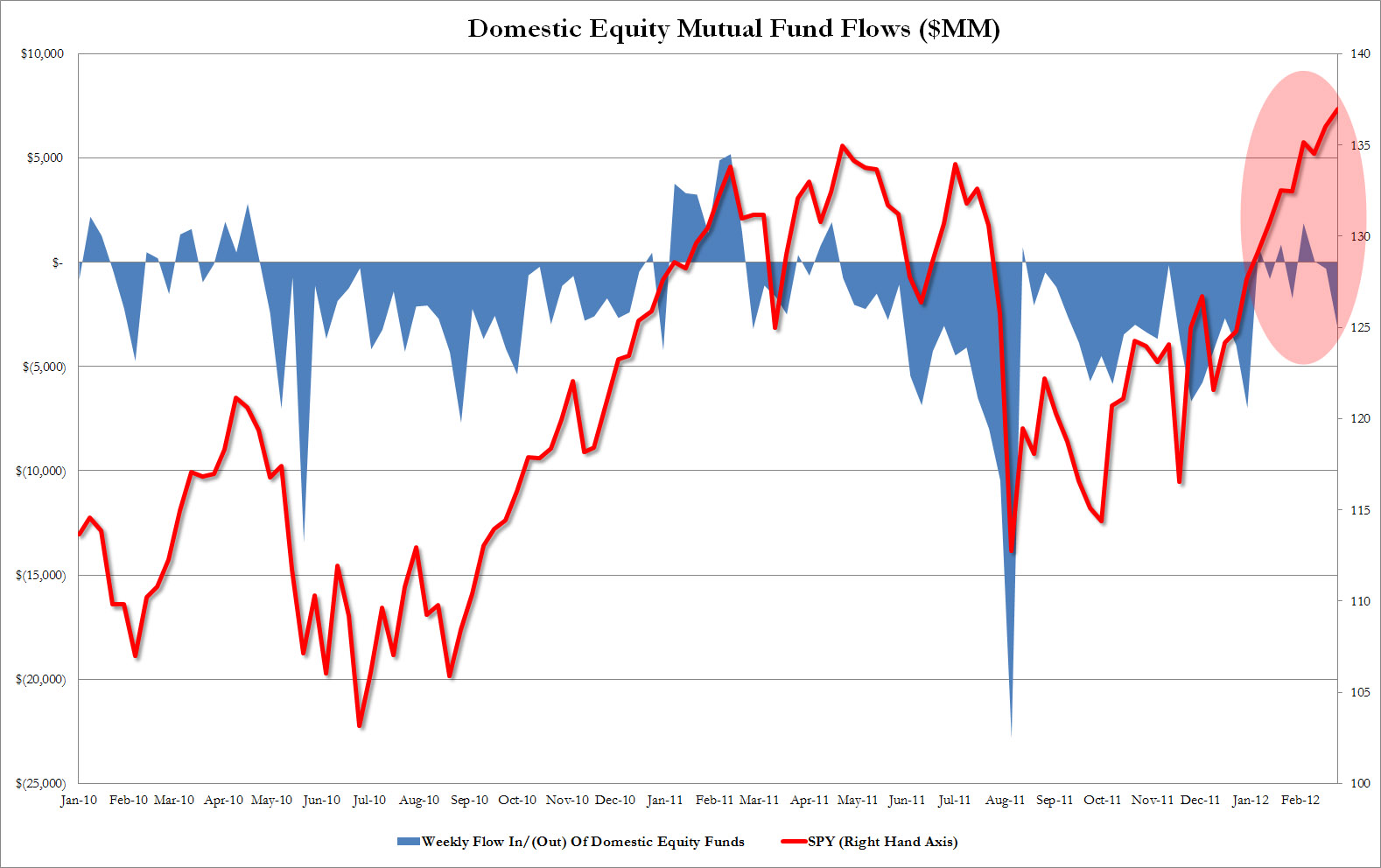

Chart 1 suggests to some investors that the latest attempt to encourage participation in the stock market hasn’t worked.

Chart 1 reveals that not only have retail investors continued to pull out cash from US equity mutual funds (about $66 billion since October), but the market peak of the week of February 29 coincided with the biggest weekly outflow for 2012 – $3 billion.

The Globe&Mail reported: “Retail investors, after gutting it out through years of awful returns, have finally fled. In a normal market, retail participation – Mr. and Mrs. Public trading their personal accounts – should be about 20 per cent. That plunged in November and December, traders say…

Traders Magazine noted: “On Wall Street, risk is suddenly a four-letter word. Retail investors can’t stomach it. Pension plan sponsors are allocating away from it.

“That’s bad news for stocks. Volume has been dropping almost nonstop for three years and shows no signs of improvement. The situation is worse than it was following the crash of 2000. It’s worse than it was after the crash of 1987. Fearful of the future and still wincing from 2008, investors are moving funds into bonds, commodities, cash, private equity, hedge funds and even foreign securities-anything but U.S. stocks.

“Our bread and butter is the retail investor,” Scott Wren, a senior equity strategist at Wells Fargo Advisors, one of the country’s four largest retail brokerages, told Bloomberg Radio recently. “They’re not jumping into the market. They’re not chasing it. Those who have been around for a little bit have been probably burned twice here in the last 10 years or so. They’re definitely gun-shy. They’re not believers. I’m not sure what it’s going to take to get them back in the market.”

As an aside, the reference to declining volumes over the last three years reminds me to republish the chart that I first published here: http://rogermontgomery.com/perhaps-one-of-the-most-important-charts/

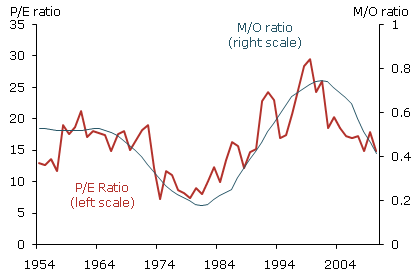

We wrote back in February; “A key demographic trend is the aging of the baby boom generation. As they reach retirement age, they are likely to shift from buying stocks to selling their equity holdings to finance retirement. Statistical models suggest that this shift could be a factor holding down equity valuations over the next two decades.

Chart 2. Ratio of accumulators to dissavers plotted against P/E ratios

Back to more recent observations and the 20% stock market rally over the last four months has been described as a completely artificial “ramp” by some and has been driven entirely by the global liquidity injections of the US, UK, European and Japanese central banks. The conclusions for some investors is that the smart money – those that have bought in anticipation of retail ‘follow-through’ will soon scramble for the exits. What do you think?

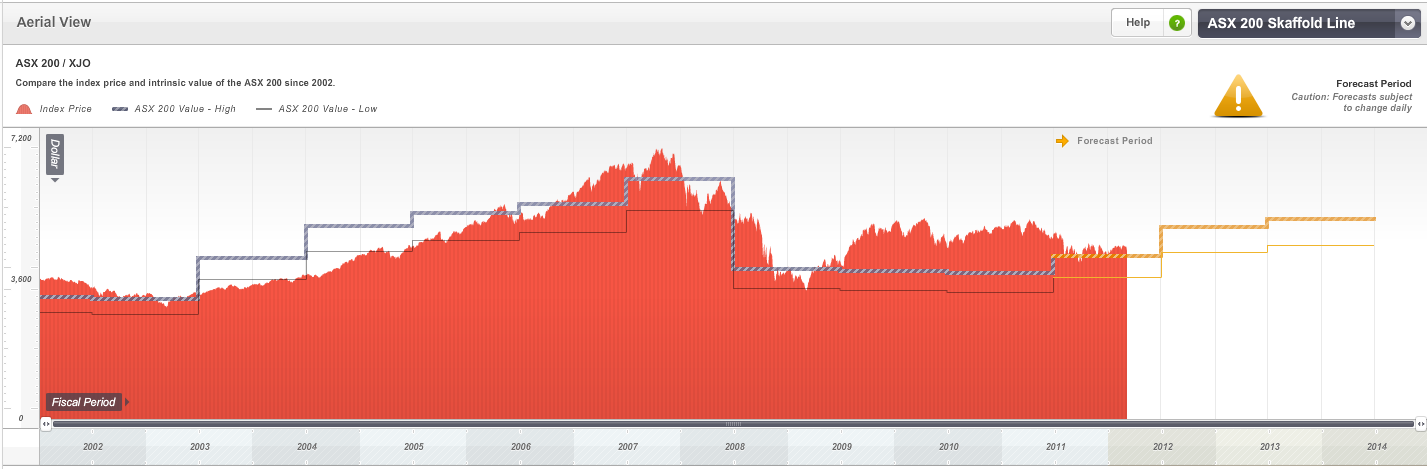

Skaffold’s ASX200 Value Indicator is a live and automatically-updated valuation estimate of the ASX200. It updates and changes every day. The future valuation estimates are based on the the constantly updated forecasts for earnings and dividends of the biggest 200 companies. You can’t beat it as a guide to the overall market level and whether you should be enthusiastic or not about looking more deeply for value.

Chart 3. ASX200 Value Indicator

Source: Skaffold.com

Based on current forecasts for 2012 you can see that the market looks about fair value. It isn’t overly expensive but neither is it, in aggregate, cheap. Based on 2013 forecasts however the market appears to be reasonable value. So the question is whether those 2013 forecasts are reasonable. Typically, forecasts are optimistic. We have previously written here of the persistence of optimism in forecasts by analysts. If that is again the case for 2013, then you wouldn’t be getting overly enthusaistic about our market unless there was a pull back. And according to those referenced above, a pull back is on the cards. What do you think?

I believe there are individual companies that have produced amazing results this reporting season and in an upcoming post we will list the very best. I also think that there is still some value among these companies. The challenge for those new to long term value investing is to be able to stick to your guns, accumulate positions in extraordinary companies at deep discounts to rational estimates of intrinsic value and stand apart from the daily gyrations of fear and rumour about default, money printing and recession.

Looking forward to your comments.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 8 March 2012.

Steve Moriarty

:

I might like to proffer a some points for consideration.

We often forget that there is very little correlation between the economy and the sharemarket. James Montier and other academic studies show that there was actually a small negative correlation! In 2009, the Australian market went up around 35%. The economy? Up about 2 or 3%. Best sharemarket return in 2010? Greece – up 90% (Ken Fisher, Markets Never Forget, 2011). Greece’s economy in 2010 – recession and going backwards.

In his book Irrational Exuberance Shiller wrote “The ’87 crash apparently had nothing to do with any news story other than the crash itself, but rather the theories about other investors’ reasons for selling and about their psychology”. Most investors appear to think that the stock market has a “life of its own”, but fail to grasp the reality that they themselves as a group determine the level of the market (Shiller, p.xxiv).

Miserable Australian market?

Australia did weather the GFC very well. It never entered recession thanks to some excellent work from RBA and Treasury.

Here is what Peter Switzer said last year –

“Now I know some of you might have been pretty peeved at what happened to stocks last year but let’s put it all into perspective. Last year we kicked off at 4758.3 on the S&P/ASX 200 index and we finished the year at 4056.6 — down a whopping 14.7 per cent. However on a financial year basis, which I always argue is the most important, as we pay tax on our investments and super on that basis, we have gone from 4612.2 to Friday’s close of 4288.4. So we are down around seven per cent. And this included the Greek and EU inspired madness of August-September last year, which threatened another Lehman Brothers-style GFC and the doomsday experts told us that the USA was going into recession. Of course, they were wrong.

On a financial year basis, that is 2010-11, despite all of the anguish and gnashing of teeth, our market was up around seven per cent and if you throw in dividends, you should have made over 10 per cent, if your portfolio was as good as the index. Let’s look at the financial year before and here the market was up around nine per cent and if you throw in dividends, we’re again over 10 per cent and probably pushing 12 per cent.

So during some of the roughest times for the USA, Europe, the world economy and while we have struggled with a two-speed economy and a misguided RBA interest rate policy, our market has returned better than 10 per cent per financial year.

Defaults?

Ireland is now in recovery mode. This from Ken Fisher –

“In 2010, Irish banks were in dire straits. The government had already pumped huge amounts of money into the banks, ballooning the deficit in the process. As recapitalization attempt after attempt proved insufficient, Ireland borrowed more—and more expensive—money. Hence the government turned to the EFSF—borrowing roughly €90 billion and committing to reduce annual deficits from 32% of GDP in 2010 to 3% of GDP by 2015.

It’s been a difficult road, but Ireland’s deficit reduction program seems to be on track. Tax revenues exceeded the August target by about 1% and are more than 8% higher than one year ago—over which the deficit narrowed by more than €1.6 billion. A stark contrast to Greece, which many feel lacks a credible plan over a year after its bailout. And while Greece remains locked in recession—its economy contracted -4.8% y/y in Q1 and -6.9% y/y in Q2—Ireland’s GDP rebounded +1.3% q/q (+0.1% y/y). Q2’s growth estimate hasn’t yet been released, though much of the monthly data trended positive.

Why the difference? Most importantly, Ireland is structurally much more business-friendly and therefore, competitive. The World Bank recently rated Greece the 109th easiest country to do business in, barely squeaking by Bosnia-Herzegovina. Ireland is ninth. Greece is 149th out of 183 ranked countries in ease of starting a business. Ireland? Eleventh. Ireland’s corporate tax rate is 12.5%, about half the eurozone core’s prevailing rate (likely partly why several large international companies make their EU headquarters there). In no small coincidence, international trade has benefited Ireland greatly of late. Tellingly, when negotiating Ireland’s bailout, other eurozone members felt Ireland’s corporate rate was too low and pushed for an increase. Ireland demurred.

Ireland also had a head start on privatization, shedding over €8 billion in state-owned assets between 1991 and 2006. It also boasts more effective tax collection and lacks Greece’s rampant corruption and bloated public sector. Greece entered its crisis with hundreds of outdated government agencies bleeding cash; its government employed around 40% of the total workforce before cuts began and remains heavily centralized. Ireland’s government workforce was less than half that size entering 2011.

Granted, Ireland’s not out of the woods. Significant progress must be made, and there’s still risk its banks will need more capital injections. But Ireland isn’t Greece—nor was it at the outset of the PIIGS problems. And thus far, Ireland seems on track overall, showing there is a way back for troubled peripheral nations, provided they take the necessary and appropriate steps.

Italy Maybe?

Recent bond returns have been declining showing that the market believes there is a reducing chance of default. This is from Adam Carr – Business Spectator

“The reality is Italy could easily solve this problem without resorting to debt monetisation. As I discussed last year, debt isn’t the problem that people seem to think it is. You can be forgiven for thinking this though – the press are atrocious on this issue and to read the papers and the ‘analysis’ of some economists, you’d really think there is no hope for humanity given the levels of debt. Not true. The ECB are right to stand their ground against such corrupt practices. So, how could Italy do this? Well, they are rich and private citizens have much wealth – €9 trillion roughly. More to the point, net foreign liabilities are very low. The main problem the Italians have is political. As a worst-case scenario, a simple transfer of debt from public to private (through taxes or whatever) would ease concerns given comparatively low levels of private debt. If they can’t be bothered to pay it off (preferable), spread it out.”

If you also look at the companies that the Italian Governments owns then you would see they are in decent shape with little chance for a default. If Europeans powers would not let Greece default then there is no chance of them letting Italy default. Carr is correct is stating that it is a political problem – it stop being an economic problem a long time ago. Many forget that it is governments that are able to resolve these issues.

Recession – Other than Europe (which is actually showing signs of improvement), the US (remember it is 25% or thereabout of global GDP) is growing at 2% and improving. The Australian economy is growing about trend but all and sundry seem to think that interest rates are heading down when the RBA seems to think somewhat differently. Mining investment is over $100 billion, unemployment at less than 6% and a strong dollar to boot!

Is the rally over? It ain’t even started yet!

Roger Montgomery

:

Well done Steve! Excellent.

Kent Bermingham

:

Great theoretical post steve, noticed you referred to all the “Experts ” again but we were physically in Ireland in June last year and I don’t believe your blog would hold much water with 70% of the Irish population and a 100% of the youth who are living there.

We haven’t started to see the social and cultural upheavels to come throughout Europe yet and what impact that will have on the Economic and Political positions once these austerity measures kick in and they still will end up with the ultimate conclusion – default!

I hope you are right just the same.

Steve Moriarty

:

Kent,

I am not sure what part of my post is “theoretical”. Switzer’s figures on Australian market returns?

That there has, after 3 years, been no European default?

That Italian bond yields have declined?

US growth rates?

Australian mining investment/unemployment numbers?

I would not worry too much about the mediums of the message – experts or not, the numbers appear to be improving.

In Daniel Kahnmann latest book Thinking Slow Thinking he discusses the concept of “WYSIATI – What you see is all there is. Essentially we see what we want to see based on our pre-formed beliefs.

Whilst I am not saying that you are incorrect regarding Ireland, could it also be possible to walk around Beverly Hills and conclude that the US is doing just fine?

Is there any Fallacy of Composition – With all due respect to your observation could it be possible that you were seeking confirmation of your predetermined views? I walked around Ireland and it was bad so it must be bad as a whole?

Again, I am not saying that Ireland is a bed of roses, but the numbers show that it is improving and that is a result of the Irish doing something about it.

I must say for the last 3 years I have continued to hear the “default is coming” but it never seems to arrive. But I am constantly told that IT IS coming.

Meanwhile since March 2009, the Australian market is up around 40% and many great companies have doubled.

Dont be too patient…….

Steve

Andrew

:

I have walked around Beverly Hills and doing fine is not a word i would use for them. They are indeed a very strange lot of people, it felt like i was on a different planet.

Ignoring the overall weirdness of the Beverley Hills and Hollywood areas of Los Angeles however I thought i would just say that I have enjoyed this overall discussion quite a lot, there do seem to be some conflicting views.

It will be very interesting to see what ends up happening.

Kent Bermingham

:

Is the rally over?

Politicians tell us Australia has weathered the GFC better than any other country yet our market has underperformed the US and other European discards and many use the excuse of exchange rates etc but don’t provide the real underlying answers, maybe cheap money and interset rates in Australia but I feel it is just the financial parasites just trying to talk up Mr Market to keep them gainfully employed as the fundamentals have not changed.,

Values will change and mainly continue to fall in a recessionary environment, sure there will be some winners but not many as fellow bloggers have already pointed out.

Greece, Spain, Portugal and Ireland will all default at some stage soon.

Italy won’t be far behind so to hold most of your hard earnt in cash, term deposits etc is a very sensible way to go.

What may look Valueable today may look like someone elses trash tomorrow.

Throw in traders, Hedge Funds,Commissions on Commissions and everyone being an expert no wonder most of us bloggers are confused.

I intend to be very, very careful and patient and will wait until debt can be repaid before I invest and lose money to pay the debt of the greedy that put us here in the first place.

I sincerely believe in the Valueable Tools but it is only one piece of the decision making process to invest to ensure you obtain the best ROE on your money.

Is the rally over, I don’t believe we have hit the bottom yet.!

Roger Montgomery

:

Thanks Kent for those well articulated thoughts. Keep contributing.

Andyc

:

Hi Andrew,

I agree that psychology plays a big part in the journey we go through when prices drop. I also agree that we must always check our assumptions regularly to ensure we are not wrong with respect to valuations.

Having said that, I think taking cues from the stockmarket prices as confirmation or invalidation of your investment thesis is diametrically opposite to the kind of contrarian thinking we need to cultivate. I’m not talking about blind contrarianism for the sake of it, but rather the ability to focus on real business value whilst, to a large extent, ignoring short term news and issues.

Stock prices will respond to these superficial problems, but we shouldn’t, in fact it’s the opposite we should take advantage of this exact situation. It’s really hard to do this whilst trying to ignore prices let alone when price momentum is influencing you.

Regarding time horizon, I genuinely think that value/price arbitrage is best realized over a medium timeframe. I think it was Peter lynch stating that he often held stocks for a number of years before they came good. Traders may indeed make money but that is a whole different strategy requiring a different mindset.

In short we should use time, and short term issues (and the related price declines) to our advantage whilst continually checking our valuations and assumptions *about business fundamentals*.

Good discussion :)

Cheers

Andy

Damon

:

looking at the daily chart, recent price action shows a series of higher lows (lower blue line) but resistance is holding solid so far around $4300 ish (the top blue line) so we have an ascending triangle, it will continue to focus in to a decision point where the ascending triangle converges, it’s tight range will be challenging resistance (so for now its gathering strength to have a shot at resistance), the longer the duration of the challenge at resistance and the tighter the range at resistance the stronger the breakout will be (in either direction), one side will win, the other side will lose and get gun shy RE taking any new positions, they’ll cover existing positions that are caught on the wrong side of direction thus adding to the breakout strength and many others will have their stops outside of support / resistance and those stops will get triggered thus again adding to the strength of the breakout. anyhow, it’ll make it’s choice, up or down, if it breaks to the upside it’ll have to prove it’s merit by remaining above the former resistance line which will become a reference point of support ($4300), and if it survives it’s pullback to support and encounters more buying i would say it would begin a march toward challenging the $5000 mark as bulls will feel validated and safe to take long positions, bears will be cautious and not willing to short it (unless they see new weakness forming). if it goes to the downside, it’ll head south below $4000 and will probly stay below but i’d have to look at another chart to see where the next logical support level would be. so in short, it’s marching its way to a forced decision where that triangle converges. the series of higher lows hints toward a challenge to the upside, however me personally, i don’t think theres enuf good news around fundamentally to break and stay above $4300, it looks like it wants to challenge the line but it just seems like its going to fail to me (it may break to the upside very briefly, completely fail and then head south, this would be a fakeout, basically a failed breakout), but my bearish opinion is not really based on what i see on the chart but what i think in general, i’m a bear, i can see it wants to challenge resistance but i don’t reckon it has the legs to succeed. but.. if it does break above and succeed, it’ll break above, peak out about $4500 max and then come back down and retest support at $4300, if that retests holds, it’ll turn up and you’re headed to 5k, if it doesn’t hold, it’ll fall below $4300, make a half azz attempt to resume previouIis ranging behavior, fail and head below $4k in my estimation. this is how it looks to me, can’t predict future, but that’s how it looks to me. my feeling is 70% that it’ll be a failed shot at resistance and continue ranging or even probably head below $4k,.. and 30% that it’ll succeed in topside break out above $4300.

id’ be looking to see what pattern that reality falls into and decide my bias then, i wouldn’t make a decision beforehand, eg. i’d wait for the upside breakout (for example) to show me what direction was chosen, then i’d wait for a successful retest of support at $4300 and then long bomb it with a target of $5k (would probably take a couple of months to reach $5k tho after a successful breakout). i’ll have a look at the weekly chart next

Roger Montgomery

:

Interesting to hear Damon. I have also heard that many of the asset consultants who are responsible for allocating money to managers, are holding very high levels of cash and are concerned about the state of the Australian economy.

Damon

:

Looked at the weekly chart you know, it’s hard to tell, at first look, it looks to me like it’s going to fail and head to $3400 or even $3k before finding support (this would be a double bottom at $3k and i’d be long bombing the hell out of it there) but then i look at it and i can also seeing it breaking the little triangle and reattempting $5k. i’m kinda 50/50 but seriously Roger, if it fails, we’re headed to $3.4k and probably most likely $3k and that’ll be the end of it, 3k will mark the beginning of the new bull run as i really don’t think it will go lower than this (other than perhaps briefly spiking it). we’ll see, those are my targets, i’d be waiting to see the outcome of this triangle. The Asx 200 has tried to pass 4300 and failed 16 times. Dow is near all time highs any correction their will be magnified on our market.

Andyc

:

Hi Damon, crickey, this reminds me why I never took up technical analysis, I don’t have any clue what all this means. Hope it works out well for you! Cheers, Andy

Andrew

:

Completley in agreement with you once again Andy. Business value is the only thing that should matter. I dont care whether people disagree with investment decisions i make as long as i believe that my understanding and rationale behind them are sound. I dare say many people will disagree with some businesses i like but that is fine, i am happy to take advantage of their dislike to buy more. I do not really follow the theory of momentum investing, it brings to mind memories of the lemmings video game. If a company i like is very disliked all the better, as i believe they are quality i am sure sooner or later they will pick up and reach their value.

Short term news are in fact a great opportunity, the more surprising they are the better in a lot of cases as they will more likely be punished for it even though the long term value of the business does not change. In fact, for some companies like Cohclear you almost wish for more bad news to come around so you can get into it at a decent price.

I do not really follow the theory of momentum investing, it brings to mind memories of the lemmings video game. If a company i like is very disliked

says

:

Ronald Reagan: “Recession is when your neighbor loses his job. Depression is when you lose yours. And recovery is when Jimmy Carter loses his.”

garry

:

What i have noticed over time, is that skaffolds future and present valuations are somewhat more conservative than most analysts or brokers valuations. This appears to be more evident particularly with the large caps, and or lesser quality companys (great).

I note that last week, 3 broker buy recommendations for TCL, now trading at $5.60, whilst skaffolds valuation is at 86c for 2013 and rated C4.

So although I am more bearish on the near term future direction of the market, i would imagine that if you are using valuations that most brokers and analysts are coming up with, the market is still relatively cheap, and therefore we may see this rally continue for a little longer..

Not that the market on a whole matters entirely, ASX was down yesterday 20 points (-0.5%), Forge was up 17c (+3%).

I do agree there is still value out there,even using skaffold s valuations, but its getting harder to find.

Garry

Andrew

:

My experience is that the brokers cater to traders (of course they would, they want high trading volumes so they can get more fees). They tend to offer forecasts as to where the price goes and i think this has less to do with the business and more the beta and trading volumes of the stock etc. So there for it isn’t surprising that a system like Skaffold which values businesses would come up with a very different outlook to one that is looking at more share price direction.

I will ignore the discussion about whether a buy,hold or sell (if you ever see one) are good indicators to follow anyway.

Ron F

:

Hi Roger

The ASX 200 is the index that was created for International Investors to assess it in association with the S&P 500, Nikkei 225 indexes (etc).

I had thought the ASX 200 since the beginning of the GFC was maybe becoming influential as a guide because of heavier weightings being contributed by the likes of BHP, RIO, and the big 4 banks. Until, I did a research on it comparing it to the All Ordinaries and ASX 300 returns from FYE 2003 to FYE 2011. Interestingly, the variations of those indexes to the ASX 200 for each year ranged from -2% to +2%. Following are the variations for each financial year, respectively for The All Ordinaries and ASX 300.

2003 1%/-1%

2004 1%/-1%

2005 -1%/1%

2006 0%/0%

2007 2%/-1%

2008 1%/-2%

2009 -2%/2%

2010 1%/-1%

2011 1%/0%

From the 30/6/2002 to 30/6/11the gains for the ASX 200, All Ordinaries and ASX 300 are respectively 43%, 47%, 44%.

From the data it seems the large companies’ weightings have been influencing all the above mention indices for many years.

Benchmarks are commonly used to assess an individual return against them. Majority of the Superannuation and other Managed Funds, for Australian Shares, use the ASX 300 or Small Ordinaries as a benchmark, depending on the composition of stocks. My own preference is the All Ordinaries, because my current and past holdings stocks have been a mix relating to both the ASX 300 and Small Ordinaries.

Selecting any index as a benchmark is an individual choice that you have to feel comfortable with. But after reading Value.able I have come more inclined to think of the risk and the required rate of return as a measure to assess the return.

When selecting the measure to use, myself, I don’t invest in bonds, hedging and other derivatives, because my knowledge of them is inadequate. I have read a lot about the property market over the years, but I prefer to stay away from it, my opinion, it is a commodity sector. With all this is mind the measure I prefer to use is the CAGR average weighted term deposit rate, importantly, only if it is consistently above the inflation rate.

Preferring to use benchmarks other than indices as a measurement oppose to the return you are seeking, I believe, the return above the measurement is still an individual choice.

We have all read varying forecast estimates of what the All Ordinaries Index will be at the end of this calendar year. Several analysts from different large Global Investment Banks on a business TV program (around the end of February), except one, forecasted from 4,500 to 4,700, the exception was 4,000. Using 4,600 it implies the index will rise another 6% from the 9th of March.

I wouldn’t have a clue if the share-market will rise or fall from now, but I have believed for awhile that analysts, especially from large Global Investment Banks can be often too optimistic. Why? Looking at where some of their revenues come from, maybe they have an inherent gain to be too optimistic-talking up the markets?

The consensus for the main reason behind this year’s gain was the predicted positive swap of Greece’s toxic bonds for new ones. I am not an economist, but I am wary about it solving their problems into the future, given the tough austerity measures they have to put in place, seemingly with no chance of GDP growth which is counteractive against their bail out.

It also seems to me other European Countries- namely Italy and Spain’s debt problems have been forgotten about while the latest focus has been on Greece. Even though a recession has been predicted for Europe, apparently factored into analysts’ forecasts, the question is how deep and long will it be and how much of an impact it will have on the USA and the rest of the world?

I think these problems are difficult for any economist to predict what the outcome will be at the end of this financial year, let alone FY 2013, and for that reason I am very circumspect on analysts’ forecasts for 2013. I think one thing is certain, there won’t be any government stimulation intervention similar to when the GFC emerged.

I am a value investor, certainly don’t consider myself a high achieving one, if I wasn’t a value investor and concentrated more on PE’s I would be still cautious because the mention of stocks trading at low multiples is only based on forecasted earnings in a environment of uncharted waters – I think it is worse than the problems that occurred in the 70’s 80,s and the Asian meltdown in the 90’s.

I still think there will be opportunities for the value investor, but I will be cautious and will try to hold stocks as long as possible taking advantage of the government interest free loan (while not paying CGT). I know that a true value investor should select and invest in stocks long-term, but at the moment I prefer to be cautious, particularly with 2013 forecasted earnings-even with using a conservative estimate.

Regards

Ron F

Roger Montgomery

:

Superbly articulated Ron F.

Matthew R

:

McMillan Shakespeare – a company that hasn’t been mentioned here much recently but I know is well known to many

I have a little bit of info that may be of interest – it was announced to the asx on the 5th of March that Maxxia (MMS rebranded their offering a couple of yrs ago) would become exclusive providers of salary sacrificing to SA Government employees for the next 6 years

Well I was recently sent a letter relating to this by my salary crifice provider SmartSalary (who I chose because they were 10% cheaper) – the main points of the new arrangement being:

1) lower fees

2) Less paperwork

3) 3000 clients of SmartSalary will go to Maxxia. Remunerator are the other salary sacrifice company and I believe are smaller than SmartSalary but their clients will also go to Maxxia

Maxxia were always better at marketing – they have people at the orientation sessions, they have people once a week in the cafeteria, their office is close to the Royal Adelaide and other government buildings etc. All my colleagues signed up with them because it was just easier. Now they are the sole provider. Salary sacrifice is essentially a commodity product but the key from what I can see is getting the staff to sign up (fill in the forms etc). Maxxia were better at that. Once signed up clients are very sticky because it isnt easy to change and the perceived benefit is minimal (like banking). There is also very little ongoing work required by Maxxia to maintain the relationship. Once you have your salary sacrifice setup they then try to up sell you packaged cars, laptops etc where they make more money.

Looks like Maxxia will be maximising their profits from SA Govt employees for the next little while. It will be hard for a competitor to claw back from this I would think, assuming if in six years time another provider is allowed back in by SA Govt

Roger Montgomery

:

Well spotted Matthew and thanks for the Scuttlebutt. Legislated monopolies; don’t last forever but generate unassailable ROE while in place.

Andyc

:

We want the stockmarket to drop. There is still far too much wanting for the market to go up here? I don’t get it.

Assuming we all intend to invest for at least the next decade (for arguments sake), we would wish for the stock-market to remain as cheap as possible. Generally speaking, we benefit from the dividends in the long run (if a lack of capital appreciation does not allow us to sell to capture gains).

I understand that there’s also the possibility of intrinsic value erosion due to difficult economic environment, but that’s a separate issue that we try to mitigate by buying value and quality.

The cheaper the market (and individual companies) get, the higher dividends yields will be and, most importantly, the lower our risk of permanent capital losses. *This is a good thing* for the long term investor.

For those entering retirement (and make no mistake, I am no financial advisor) I would suggest that the market that seems scariest — due to depressed prices — may well be the safest place for your money. E.g. there has recently been a lot of commentary about the U.S. equities markets being weak etc. It has been one of the best places to search for very highest quality companies (such as Oracle, McDonalds etc) trading for reasonable prices.

One final point: The best part of this trend of baby-boomers pulling money from the markets is that, to some extent, it *artificially* keeps prices lower than they would be otherwise. As long as you don’t mind waiting patiently for dividends to grow (and compound via reinvestment), *this is a good thing*

Note: I understand that baby-boomers retiring will adversely affect some industries, but it will also beneficially affect others. This is where I’m looking — healthcare, software (business systems and consumer).

ZORAN

:

MaRKET DOWN-MARKET UP

If dividends are maintained at 5% for next ten years, would you rather have 5% of $5 or 5% of $20?

Cheers

Zoran

Roger Montgomery

:

Thanks Zoran…it’s still 5%.

Andyc

:

Hi Zoran, that’s a very big if and it confuses a simple point. I prefer to pay less for every dollar of earnings (distributed as dividends or otherwise), this is a very easy principle to grasp (hard to implement). Granted, earnings may suffer, but generally speaking history shows us that we are too pessimistic and consistently underprice securities when times are bad. These moments of underpricing are bread and butter of value investors. I can not think of anything more conducive to low risk long term investing as a market that mainstream press considers to be dangerous and scary. This is why we always need cash, because these periods may be protracted. Cheap never comes without a wall of worry. Cheers, Andy

Andrew

:

Hi AndyC

I agree with you about the price not going up is not necessary a bad thing. I think it comes down to two things, the first being your expected time horizon. I also believe that value investing is superior for dividend investors than other techniques as it is obvious that the lower you buy the higher the yield.

There may be some whose time horizon for holding a company is a lot smaller than others. Some might see 1 year as long term, others might be thinking 10 years, most are probably somewhere in between. if you have a shorter term time horizon then you need the price/value gap to close quicker and be more active than what you do if you have a longer one where you can just accumulate more and wait.

The second is the psychological side of value investing where some might use an increasing share price to confirm they made the right choice. The longer a price trades at a big discount to IV the more some might start to think that their value is wrong. ignoring the fact that a valuation can never be 100% right, their is a chance that maybe their assumptions and inputs were well off the mark and the company not as valuable as they thought but it could also be that they let the market talk them out of a good decision.

The scariest market is probably the best environment for investing as long as you stick to quality. I mentioned this to a colleague the other day and he asked if i invested during the GFC and when i answered yes he said “did you make any money?” I told him i made considerable money sometimes more than 100% on my invested capital. The key here being i bought during the GFC, i didn’t sell.

Harley

:

Hi Roger and blog followers,

I have a slightly different view to some of the those mentioned in this post, so I thought I’d post my take.

Firstly, regarding the view that lower trading volumes and less retail participation is a bad sign. I think the chart showing mutual fund outflows is only part of the picture. Where is that money going? My view is ETFs. US domestic equity mutual funds have had an outflow of $22 billion so far in 2012, but ETF equity funds have had an inflow of $20 billion. The other point regarding the general lack of business from retail investors for advisors/managers in equities I think has to be considered with the significant structural change going on. Yes, the average person is less interested in stocks at the moment due to volatility, fear, etc. but those who actually are interested now have a wealth of information at their disposal allowing them to do it themselves – online info, blogs like this, financial media, online brokers and so on.

Second, the question of US stocks being overpriced or at the very least not cheap. I am not sure that is the case. When the Dow hit 13000 recently it did it on the lowest price multiple compared to when it has ever hit 13000 in the past. Some stocks still yield up to 8% dividends in an environment offering no return on cash or bonds. Even the recent talk on Apple being way overpriced as it rose over $500 seems misplaced: it is generating great returns, has a great competitive advantage and from memory is trading on a PE of 15. It may not be cheap but talk of an inevitable crash due to overvaluation and a large number of hedge funds owning it seems exaggerated.

Third, I think the point regarding the demographic trend causing baby boomers to become net sellers of equities is an interesting one. I believe the effect will be significantly different in Australia compared to the US. Obviously it depends on their individual financial circumstances but if an individual in the US were to retire with a lump sum amount less than is required to live off, they are going to have to earn a return on their money. Selling large sums of shares upon retirement would not be the best decision as they would then have to put it into ‘safe’ assets like cash or gov bonds and they will essentially be losing money in real terms. The more likely result is to sell shares as needed but keep those that earn a decent return for as long as possible. So the effect on the stock market will not be so pronounced but more or less a slow but persistent selling down of shares amongst baby boomers, at least in my view. But we are only in the beginning phase of the boomers retiring and we have to consider the other financial decisions they will make along the way. For example, they may sell off “risky equities” as you mentioned, but move more money into high quality div paying stocks; perhaps even some money from the bond market will find its way into the so called blue chip stocks. Certainly if one takes the view that US gov debt is a bubble then the idea of money flowing out of the bond market and into stocks as protection is not a far fetched one. We would then have to consider the net inflow vs outflow of shares being sold vs money being moved into shares. So I think the net effect in the end (regarding US stocks) is yet to be confirmed.

Finally the notion that this recent rally is a ‘ramp’ or that it is suspicious or artificial in some way. I do not agree with that at all. Yes, the stock market rallied because of central bank intervention. But it did not rally because the central bank is in there manipulating stock markets. It rallied because stocks were becoming very cheap (see the rally in Australian small stocks, there were some incredibly cheap stocks late last year) and a big macro event risk (European bank collapse) was removed.

For a number of reasons I believe the US stock market is in a bull market, but I won’t go into them in this post as it is already long enough! Suffice to say that the current environment has many similarities to the beginning of past bull markets: low volume, lack of retail interest, ‘suspicion’ of those on Wall Street (very similar to the beginning of the 1920s! Check out ‘The Great Crash’ by Galbraith as an example).

Roger Montgomery

:

All excellent counterpoints Harley.

Matthew R

:

I agree Harley – low retail investor involvement for me drew the same conclusion (contrary to the one drawn by the author, Trader’s magazine)

If you look at the front page of the current issue of Trader’s magazine (available on their website) it certainly looks gloomy. (for those reading this in months/years time it is a picture of wall st with a halloween backdrop with a leafless tree & flying bats + the quote “Fear Factor: Volume Outlook Bleak as Investors Shun Stocks”

You pay a high price for a cheery consensus

Kien Trinh

:

Hi Roger. Interesting points. There is a good chance that the medium term rally is unlikely to be over although a major correction may occur in the near term. The FED and ECB will no doubt continue to flood the markets with liquidity which should help sustain risk assets (especially commodities). Furthermore, the last year of a presidential cycle has historically provided positive sharemarket returns. In the long term, the secular bear market should continue to play out. There appears to be significant downside risks to 2013 forecasts. Why do I believe this? The earnings cycle has yet to reach a low – during the latest reporting season, earnings forecasts were downgraded by 5%. The ratio of downgrades to upgrades was 2:1. Hence, it would be prudent for us to take a more conservative approach in our valuations until the cycle reaches a trough. This season we saw mining services companies benefit from strong Capex spending. Other stocks that performed well were high ROE candidates (especially among web based services like CRZ, REA, SEK, WTF, FLT). Earnings growth for the market in 2013 is expected to be about 13% but remember much of this growth comes off a low base among the cyclical industrial sectors.

Roger Montgomery

:

Thanks Kien, always value your professional views. Thanks for your reports too.

Chris

:

Roger,

The behaviour of the ‘US retail investor’ me of some of the “financially illiterate” comments made on a local radio station this week when investment was a topic.

“Why can’t super funds just go and move everything to cash when the market looks like it’s going to turn bad ?” – because they don’t know that.

“Why can’t we have a bank account that you just accumulate the funds in, you get paid interest on it, no management fees or anything like that” – because you can’t ‘save’ your way to wealth.

and the best one “If everyone moved to cash in their super funds, the Australian sharemarket would evaporate overnight” – No it wouldn’t, because even though some institutions might move to cash from the weight of their members, there would be other institutions who would not because not everyone would “move to cash”.

Likewise, I bet there are hedge funds which are betting (sic) on such wild swings in the market to happen, and if they made a mint from such an event, they would bet on the opposite taking place and everyone piling back into shares. Failing that, they would find something else to take a position on, because this is what they do in it’s purest form, nothing more.

There is a point – call it an equilibrium – at which monetary risk/returns from asset classes, be they cash, bonds, property or shares are not keeping up accordingly, and money gravitates through necessity towards a better return (note, I said “better”, not ‘the best’). Why ? Because these people (institutions) exist to make money. If they do not, their unitholders will not be happy and they may as well close the fund.

Imagine this flow of money for a moment in your head in terms of simple wave theory – the same principle as a pendulum, but swinging along more than one axis, or maybe a rubber ball, bouncing internally off all sides of a solid shape, each axis or side being ‘an asset class’, the object moving at different speeds and the length of the “swing back” or “bounce” not being related to the speed of how it gets there. It looks random, but it is not. It is the same idea as to how the general (bigger) flow of money seeks a “better” return, given risk/reward and thus influences fund flows.

Never has the sharemarket gone to a value of “zero”, because it then suggests that every business is worthless (even the tangible stuff like the properties they own).

This kind of financial illiteracy is precisely what influences fund flows. The market is not efficient (EMH), despite what people may claim, and thus neither is the flow of money. What you are seeing is just “what it does”.

Roger Montgomery

:

the short term ‘voting machine’ at it again…

Nick Mason

:

It always surprises me Roger that an investor of your knowledge and expertise continues to ponder over such questions as ‘Is the Rally Over?’

In your blog you go on to speculate about market participation rates, and future market participation rates and whether the recent 20% rally was a ramp and is the ASX fair value for 2012 and is it’s fair value increasing or decreasing?

Is this really of any importance? And worse is it possibly counterproductive to (what I consider the most important idea in investing) that is, you buy the business, not the market.

Your last paragraph is the most valuable and its shame that it was put at the end of the article and not the beginning. I hope that investors new to your blog will concentrate on that message and not whether we will see a pullback or correction over the coming weeks/months.

Best Wishes to you.

Roger Montgomery

:

Hi Nick,

Read carefully…I was just posting some of the insights I had read myself. I don’t know whether the 20% rally was a ramp. I was quoting others. I am pretty sure the last paragraph sets the record straight. Thanks again for your insights and observations.

Woody

:

So we come back to one of the main premises behind the value investor. Forget about what the index and the rest of the world is doing. It nearly always turns out to be ‘noise’ and irrelevant. Buy quality stocks that are cheap on a reliable valuation method and you will be fine. Ive been doing it for years..

Roger Montgomery

:

Spot on Mr Wood.

Mick

:

Hello Roger,

I agree with your comments it would indicate that there could be a pull back.However watching the US market I have noticed a bull in the room which appears to be the USA elections that are propping the DOW up.These elections go on for rest of 2012.In the current market if you buy value at least you are covered in some way if there is a pull back.

Roger Montgomery

:

Thanks Mick. Not necessarily my thoughts though. The last paragraph is key.

Damon

:

Hi Roger, I am more of a technical analyst as opposed to a fundamentalist, I don’t care to read company reports and achievements and try and work out what the value of a company is, I am all about which way on the chart a particular code is heading. On the stock forum I follow there are a few fundamentalists holding on to some stocks, averaging down and having a bit of a sook really that you sold out before some big retracements (MCE, JBH, ZGL and VOC).? I also sold out of a couple of those stocks at much higher prices before they corrected (JBH $18.50 and ZGL $0.35). So I am interested in the sell signals in your software program scaffold. I read on your blog that it has live data feeds, does that update the system over night or in real time? It might be another means of timing my entries and exists. One more thing DWS i got a strong sell signal a few days back and dropped 7% today, glad to be out of that one and GNG sold out close to $2 before the recent correction. Did scaffold provide any recent signals on these 2 codes? I know all of the bloggers here are FAs but a combination of FA and TA might work. Look forward to hearing from you. Thanks.

Roger Montgomery

:

Hi Damon,

If you have a method that, for example is able to time entries with positive mathematical expectancy and you added Skaffold to the mix by only taking your own buy signals when the company was also high quality and at a discount to intrinsic value, then I would take a guess that the expectancy would rise. Hope that helps. Of course don’t take my word for it ….

Rici Rici

:

by the way another interesting titbit regarding the Australian market:

historically the Australian market has performed well whenever the yield on Australian shares exceeded the 90 day bank bill rate by a margin greater than 130 basis points.

Well after the current reporting period, the yield spread was 315 basis points (which may highlight why high yielding stocks have performed well in 2012).

This measure is i useful for Australia because the risk free rate in Australia is at a reasonable level. One must give consideration between the ‘risk free’ return, and the absolute required minimum return level (ie if the risk free return is abnormally low, relative comparisons might be made from an artificially low rate)

Roger Montgomery

:

That is indeed an interest tidbit Rici. Thanks.

Rici Rici

:

Regarding Andy Xie’s comments:

Firstly this gentleman is quite intelligent, but i prefer his asian focus rather than extrapolation into global equity markets.

To coment on the specific quotes mentioned, and with a reference to the US market:

“The risk-on trade is in a mini bubble”

only in certain sectors and certain individual stocks, not accross the board. What is the earnings growth in the US. Earnings grew by 10% in 2011, yet the indexes where approximately flat. So at the start of 2012 the indexes can rise by 10% rust to maintain parity. But this still doesnt take into account earnings growth for 2012. If earnings grow in 2012, then that 10% can still rise by the earnings growth and still maintain parity on 2010 index levels.

“The buying trend is sustainable only if the global economy strengthens, which is unlikely”

I dont know about global indicators, but i do know that the US forward indicators are showing strength.

“The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings”

I would argue that US stocks are still reasonably cheap. It depends on what ones view is of cheap. Is one looking at absolute figures or is one adjusting the profit margins to their long term mean (read Buffetts and Howard Mark’s work on this). In regards to desirable consumer stocks: yes i agree they are potentially expensive. But why are they expensive? because they pay a sustainable and rising dividend yield. In a low interest rate environment this makes them very attractive. However in my opinion this also makes them risky, as their attractiveness is not based on absolute figures, but rather one of relativity (ie dividend yield relative to US govt bond yields). For those interested Howard Marks covered this well in his book ‘the most important thing’.

Banks are cheap for a reason

There is a cycle for everything under heaven. When are banks ‘cheap’, with what reference term, during a lending boom, or lending contraints etc etc. I would argue that some big US banks are cheap because they are trading under their NTA. Other comparisons looking at book value would also suggest US banks as a whole are still cheap if one looks at an ‘over the cycle approach’ to valuations.

“Internet stocks suggest another bubble in the making”

Yes some recent IPO’s suggest a bubble. But mainstream large cap internet stocks are still reasonable value: microsoft, intell etc etc.

“The Fed is trying to inflate an expensive asset”

Sorry buddy but this is a story of 2010. Look at the Feds broadest measure of money supply it hasnt increased since QE2. (why do you think Gold is underperforming in US$ terms).

Roger if you have access to the Gartman Letter, i suggest looking at this given that you are involved in Gold.

By the way isnt Morgan Stanley as an investment house still a ‘bear’.

Regarding Chart 1, this is one reason why i am still bullish. The retail investor is always the last on board. Notice in the last couple of weeks increased retail interest in the stock market.

Coppo in the Goldman Sachs afternoon report covered this well in the last few days.

Notice as well the 20% upwards/downwards call option/put option exposure to the market. There is still significant protection going on in the market (as seen by much higher put/call option positioning).

in regards to chart 3:

My belief is there is a structural repositioning happening in the Australian market away from resources.

I have requested this before but what is the Skaffold view of the ASX industrials. (the ASX200 is heavily influenced by the resource sector).

Roger Montgomery

:

Thanks Rici. Will take a look of course. I am not sure that Bernake’s words reflect his actions though with regards to QE. I think its true for the US but perhaps not globally. Printing is the only resort for central banks when in a deleveraging economic cycle because rates are already zero and cannot be lowered to stimulate activity.

Ash Little

:

The below like is the us federal reserve

http://www.federalreserve.gov/releases/h6/current/

Feb 2010 M2 =8531.0B

Jan 2012 M2=9765.4B

That looks like money printing to me

Cheers

Rici Rici

:

wrong piece of information.

Gartman refers to the St Lois adjusted monetary base as the ‘soup base’.

Now i am the first to state that i am no expert on these things, which is why i listen to a professional (but keep in mind that he is a trader i am an investor).

Here is the link that as most appropriate, and especially look at the movement over the last year: ie no movment past july 2011.

http://research.stlouisfed.org/fred2/graph/?id=BASE

Now further more overlay this over commodities, especially gold. How does this correlate to gold, notice that gold peaked in Aug 2011 and has subsequently consolidated.

Notice also the Dow/US$gold price has started to reverse (hence for the traders an exit of gold and an increased position in DOW positions). Which explains why we are seeing an increasing ‘risk on trade’ by higher equity prices and yet gold is stagnating (at least for a moment).

Underlying all of this though, gold is still in a secular bull market, its currently going through a consolidation phase, the major trend has yet to be broken. Until it does, it will remain one of the few asset classes that is still in a secular bull phase.

These are all trading issues, for myself their only relevance is to give me insights into the markets thinking. I do not participate in them. However understanding the current psychology of the market is of much value to the investor, especially if leverage is involved.

Ash Little

:

And the fed stopped reporting M3 years ago which is what Gartman is talking about.

Looking at M2 though they are printing money and heaps of it.

Time will tell Ric Ric

Cheers

Craig in Brisbane

:

The intriguing beauty of capitalism is that it always takes the hand it is dealt and finds a way to improve it. Tie that to good smart companies bought on value not on price and you’ll do well. The US market may fall back if it ran too far or just retreats over the next few months as it invariably does this time of year. Same same the Europeans. The US debt problems still exist and it’s recently sounded all exciting like Dad just got a newer higher paying job and all seems better than it was, but he’s still hocked to the eyeballs and likely to still not be able to pay his way clear. The newspapers will throw a bit of fuel on the fire as they do to sell a few papers. The headlines will worry the masses on things that have no real relevance to their patch, capitalism will find it’s measure and ride on again and we will all become bored for the interim until the cycle starts again. Regardless of the retiring hippies the good, fair-priced companies will just keep chugging along increasing their earnings and therefore their value, changing and developing all the way.

Roger Montgomery

:

AGreed Craig although I believe Capitalism would be a good alternative/solution to what we currently are seeing around the globe.

Simon

:

Rally what rally? From Aug 2011 to today the ASX 200 hasn’t breeched 4400 and stayed within a tight 4400-4000 point range. Don’t let Alan Kohler hear you calling the January effect a rally- Roger lest may you be cast out by chartists.

No what we have is central banks flooding the markets which also has forced up the $AUD above its true value of $1.03 towards $1.0685 today.

As for the loss of baby boomers closing their share market positions and retiring…. think about a see-saw if one side gets lighter you need to add more weight to counter balance, super changes from 9% to 12% will go a long way to address this problem as all workers will increase their contributions this will flow in companies BHP RIO WOW CBA etc shares being purchased by super funds in a lock step kind of way over time to increase the total size of funds under management.

For what its worth India and China and U.S.A will force our market to rise above and beyond 5500 points before FY 2013/2014 as the demand for our commodities grow from strength to strength. Iron ore prices have already shown signs of stabilising at $142/t (Fe62) BHP and RIO both look to rise from yeasterdays low and could increase by 10-12% over the next five weeks!

Roger Montgomery

:

You highlight an interesting points – its all about perspectives isn’t it? I agree about the band versus rally observation. Perspective really does count. With regards to your comment “think about a see-saw if one side gets lighter you need to add more weight to counter balance, super changes from 9% to 12% will go a long way to address this problem as all workers will increase their contributions this will flow in companies BHP RIO WOW CBA etc shares being purchased by super funds in a lock step kind of way over time to increase the total size of funds under management.” This is known as the ‘weight of money’ argument. Think about when we went to 9% and have a look at market prices since then. Also, the weight of money argument doesn’t negate the reality of corrections, which occur even in an environment of rising contributions.

Thomas

:

Hi Roger,

I find that the ASX200 index is semi-useless to our value investing as 65% of the weighting goes to the “BIG 20”. Don’t like any of them except maybe BHP.

I look out for a depressing smalldinaries index for value!!

Dan S

:

Interesting reading – what are the sources on chart 1 and 2? I couldn’t quite work out where they’re from. Thanks

Peter

:

Hi Roger,

Interesting article as always.

Coming from someone who is down for over 4 years with a top 40 company portfolio (currently about 11% down), I speak from the average person’s perspective.

I keep seeing stories of the housing market plateauing and maybe slowly falling, interest rates on deposits are low (about 5%) and I don’t really know of any other area to put ones money (not counting super).

Speaking from no knowledge base whatsoever, I think that the stockmarket is the place to be. If my portfolio is any indication, the value goes up quite well, then falls then goes up then falls, but each time, the fall is a little less and the rise is a little more.

Long-term things look ok to me.

Roger Montgomery

:

Thanks for sharing Peter. Keep posting.

Matthew R

:

Hi Peter, there is a wealth of information available here. Best of luck with your reading & if you have questions just ask