Search Results for: jbh

-

Value.able TV#4: What did Roger Montgomery find out about JB Hi-Fi?

Roger Montgomery

August 17, 2011

Following the release of their full year results, Roger spoke with senior management at JB Hi-Fi and discussed their cashflow and working capital.

JB Hi-Fi scores an A3 (down from A1) thanks to a debt-funded buy back of shares. It is nonetheless a company with great cash flow. Value.able Graduates paying close attention to Cashflow in JBH’s latest result may have been concerned by the large jump in inventory, which had a detrimental impact on Cashflow from Operations since last year.

So, what did Roger discover?

In 2010 JBH stores were cycling low inventory numbers. Arguably this resulted in a sell-out of stock, which was due to under-provisioning,

Stepping back and looking over time at a pre-store level, Roger says “If you have a look at the inventory on a per store basis, $2.2m – $2.6m per year, it’s fairly consistent. I’m not concerned.”

Roger suggests the future is interesting for JB Hi-Fi. If store growth continues at the current rate (13-16 stores per year) for the next three to four years, then by the time they reach 214 stores, there will be a lot of free cash. Extra cash from the maturity of existing stores, combined with a reduction in debt, will see a very cash rich JBH.

What will management do with the extra cash?

In Roger’s view, management have three options: increase dividends, buy back more shares or make a [silly] acquisition.

Roger’s estimate of JBH’s Value.able intrinsic value in 2012 is around $17, rising to $20 by 2013.

Will intrinsic value continue to rise after that?

“That will be largely dependent on what management does with that cashflow when it’s freed up” Says Roger, noting; “I think the future for JB Hi-Fi will prove to be a didactic experience for value investors.”

Value.able Graduates: What are your insights on Australia’s embattled retailers?

Value.able TV #4 was recorded at Montgomery HQ on 15 August 2011.

Posted by Roger Montgomery’s A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 15 August 2011.

by Roger Montgomery Posted in TV Appearances.

- 46 Comments

- save this article

- 46

- POSTED IN TV Appearances.

-

What’s your stock market survival story?

Roger Montgomery

August 10, 2011

Last night, First Edition Value.able Graduate Scotty G shared his stock market story at our blog. Scotty’s story is far too value.able to not receive its own, very special post! Over to you Scotty…

A Tale of Two Crashes

by Scotty G

2008/2009

An ‘investor’, whom we’ll call Scotty G for anonymity purposes, has woken for work at 05:00 to see that the Dow is off 700 points. He nervously heads in to work to check what it means for his portfolio of ‘blue chips’. He’s down badly and it’s only made worse by the fact that he is in a margin loan, which he kept at a ‘conservative’ 50 per cent level of gearing.

His ‘great’ stock picks are not holding up well in this environment and his ‘genius’ ‘value plays’ like buying Babcock and Brown at $7 because ‘its fallen from $28 and surely at a quarter of the price it represents value’ no longer looks like genius at all. He had imagined himself some sort of Buffet-ian hero, stepping into a falling market and making the tough buy call that would surely pay off. No actual analysis is done to back up these calls.

Finally he is 1 per cent off a margin call. He is tense at work, snapping at friends and chewing a red pen so hard it stains his lips and chin. He capitulates, calls his broker and sells out, including his ‘value pick’ Babcock and Brown at 70c. He feels relieved to be out, but is bruised and jaded by his experience. He vows to return to the stock market some day and do better, but doesn’t know how.

2010

Our ‘hero’ comes across a beacon of light in a sea of information. It is the Value.able column in Alan Kohler’s Eureka Report, penned by a knight known as Roger M (name changed to protect the innocent). He follows the link to the Insights blog and is astounded that the information he has been searching for is all here. He eagerly orders the Tome of Wisdom (known as Value.able to some). Upon receiving it, he reads it in one sitting. Wheels click in his head and light shines in the dark. Could it be so simple? Knowing what something is worth and then refusing to pay above it? In fact, demanding a discount? He set off onto his journey for the Grail.

2011

Our hero is now equipped with a spreadsheet devised from the Value.able rule book. He can value companies quickly and decisively. Many don’t make it onto the spreadsheet, as he can now spot a ‘Babcock and Brown’ coming from a mile away. Stock ‘tips’ from colleagues can now be waved away. When they ask why, he tells them. If they say he’s crazy, he smiles and feels at peace. He knows he is still not perfect, but he’s a darn sight better than he was three years back.

The markets turn down. The spreadsheet is rechecked. MCE and FGE are added as they shift below his 20 per cent discount rate. JBH is added soon after. The markets shift lower. But reassured by the facts this time, and not the hype, he buys more of the above.

Markets shift lower still. Figures are checked and rechecked as more great businesses come within range. The panic of a fall is now replaced by a calmness and certainty that an anchor of value provides.

The market finally slides steeply over several days.

Finally! Some of his best targets are in range.

VOC falls, then MTU (a company he has waited ages to acquire), and finally DCG. Sadly, ARP refuses to come within range, but he his patient and does not chase it.

He retires to his castle (lounge/bar), content with the work he has done and happy to await the next chance to hunt and switches on the sport, deftly ignoring the news and business channels hosting ‘experts’ eager to proffer their take on why things were the way they were. He feels at peace and sleeps soundly that night.

“Ok, stripping out all the ‘poetic’ and imaginative stuff, this is pretty much how it went in real life. I suffered a loss due to poor decisions with no research. I found Value.able, I converted (or got innoculated as some of the greats say) and took advantage of the recent situation. And I do sleep soundly at night.

“Thank you Roger for your willingness to share and to all on the blog for the same spirit of camaraderie. I look forward to many years of sleeping soundly at night.

To Value.able and to Value!”

Thanks Scotty.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have; 1. read Value.able and 2. Like Scotty, changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our very-soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team (on behalf of Scotty G), fund managers and creators of the next-generation A1 service for stock market investors, 10 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

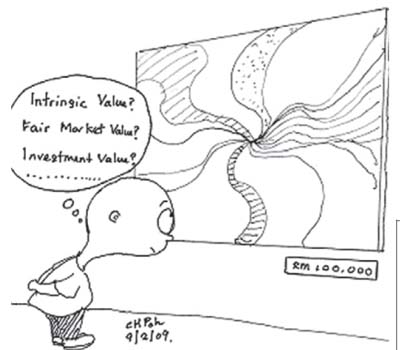

Is JB Hi-Fi cheap (and still an A1)?

Roger Montgomery

August 9, 2011

The changing retail environment that JB Hi-Fi must negotiate has taken a back seat in the minds of investors, many of whom are almost singularly focused on events unfolding in the US and Europe. Value.able Graduates, I am proud to report, remain focused on the business.

Australia’s retail environment is in a state of flux. The only thing that is permanent is that the retail environment is always in a state of flux!

Success however for retailers who don’t own their own brands is always based on the same recipe – low costs, the right products and the right prices irrespective of what the market is doing.

JBH doesn’t shift its brand positioning. It is known as the “value” player in the electronics retail market. Its sells exactly the same big brands as its rivals, such as Harvey Norman and the Good Guys, but has won mind share as the low-price alternative. Its low-end branding and cheap shop fittings is particularly helpful when consumers start zipping up their wallets.

JBH sold $2.9 billion dollars worth of gadgets, music and games in 2011, up 8.35 per cent from $2.73 billion the year before. The company’s headline profit was down 7.6 per cent to $109 million (at the lower end of its guidance range) and compares to $118.7 million the previous year. Excluding the Clive Anthony’s write-down, the result was $134.4 million, which is up 13.3 per cent. EBIT grew by almost 12%. Like for like hardware sales were up about 4%, which compared to the industry-wide number being down about 4% suggests the company is continuing its habit of winning market share. The final dividend of 29 cents per share ensures the payout ratio remains at 60 per cent. Aggregate sales grew 8.3 per cent while same store sales were down 1.2 per cent (Australia was down -0.5 per cent and New Zealand up 2.4 per cent). Second half like-for-like sales were up 0.1 per cent for JBH, but down 14.8 per cent for Clive Anthony’s.

Costs remain under control with the CODB (Cost of doing business) at 14.5 per cent – unchanged for the year (but up from 13.2 per cent in the recent past), and the EBIT margin rising to 6.6 per cent. Gross margin rose to 22 per cent – but I have to confess I prefer to see gross margin falling as it further entrenches competitive advantage.

Sales and marketing expenses rose by 8.2% – in line with group sales but occupancy expenses rose by 13%. This could suggests the tail end of store openings – second tier and the company is not getting as attractive terms.

A $73.4 million increase in inventory – largely due to new stores (but requires more investigation because the company says $49.1 million was invested in new store inventory but last year the jump was just $10 million) – resulted in cash flow from operations of $109.9 million compared to $152.1 million last year. Capex of $45.1 million relating to the opening of 18 new stores also needs to be considered in any cash flow analysis. The buyback of 10 million shares pushed borrowings up from $70 million to $232 million, which will have an impact on free cash flow for the next few years, but contributed to the fact that $260 million was returned to shareholders this year.

My business cash flow is a positive $71.2 million and then $88 million was paid in dividends.

Eighteen stores were opened and four Clive Anthony stores were converted. The expectation is that there are another 62 stores to open, at a rate of 13-15 stores per year. If we assume 2-3 per cent sales growth and another 4-5 years before reaching the targeted number of stores, sales in 2016 could be $4.5 billion. And if current NPAT margins are maintained, JB Hi-Fi could be reporting profits of $204 million, which is equivalent to a compounded growth rate of 11% per annum and earnings per share of $2.08 per share in four years. And that expectation assumes no improvement in retail conditions (nor any deterioration either).

The big story however is that Terry Smart will need to start looking beyond this organic growth to other strategies if JB Hi-Fi is to avoid developing the profile of another mature Australian retail business like Harvey Norman.

On that front, JB Hi-Fi will release a streaming music service by the end of the year – a challenger for iTunes. They already have 800,000 unique weekly visits to their website so before you dismiss its chances, remember this: consumers will be unlimited in terms of the devices that music can be “streamed” to. The service will be a ‘playlist’ service much like GrooveShark, which is discussed regularly amongst the team here at Montgomery HQ. There will be 6-8 million tracks from 100,000 artists at launch and one expects, if it catches on, a small investment could lead to deals with concert promoters and outdoor entertainment events – wherever teens congregate to listen to music. JB Hi-Fi needs to establish new and emerging business models to try and counter the shift away from physical music unit sales.

Having said that, the current sales environment is probably not representative of the future. Share market investors generally use the rear view mirror when assessing the future. I have previously discussed the “economics of enough”, which David Bussau from Opportunity International introduced me to many years ago. As it applies to consumers generally, they will get sick of trying to keep up with the latest technology, be happy with their TVs and replace everything less often – opting instead to ‘experience’ travel, food, adventure and other cultures. That of course doesn’t mean JB can’t grow its share-of-wallet. In the face of declining retail sales volume growth over the last five to ten years and deflation, JB is proving it is already the market leader.

The announcement was overshadowed by the July stats. Being ‘actuals’ the company was in a position to report them. Same store sales were negative 3.3 per cent, but aggregate sales were up 6.4 per cent. The like-for-like decline was partly attributed to the company ‘cycling’ the release of the iPhone 4.

As I have said before I don’t think the current retail malaise will continue forever and JB will emerge stronger and with more market share when we come out the other side of this consumption ‘funk’.

JB Hi-Fi’s quality score dropped from A1 to A3 and interestingly, this was only partly due to the increase in debt. (We really need to know whether it was just timing issues and new stores that contributed to the jump in inventory).

Furthermore, our estimated valuation for 2012 is now $17.30, rising to $20.30 in 2013.

Your Job:

- Investigate what the sales growth (decline) rates were specifically for music/DVD and games ( I actually have it but want you to find it), and

- Offer some suggestions on that change in inventory!!!!

Then come back here to our Insights blog and share your findings.

Very soon, finding extraordinary companies offering large safety margins will become simple and may I even suggest, enjoyable. The next-generation A1 service my team and I have created will inspire your investing and re-energise your portfolio. (Value.able Graduates – your invitation to pre-register is imminent).

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have; 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our next-generation A1 service).

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 9 August 2011.

by Roger Montgomery Posted in Value.able.

- 92 Comments

- save this article

- 92

- POSTED IN Value.able.

-

What if the sell-off is just a Flash?

Roger Montgomery

June 23, 2011

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?In the short run prices move independently of the underlying business, so let’s encourage the market to decline further!

For those truly concerned about Australia’s prosperity, relax. Be comfortable in the knowledge that short-term share price moves are unlikely to impact the employment policies of Australia’s largest listed businesses.

Looking over the financials of fifty-six A1 companies, little has changed. While Telstra and Fosters share prices are beating to the drum of hoped-for franked dividends and a takeover, the fundamentals of many other companies, particularly A1s (and indeed A2 and B1), are resolute. Are these businesses worth 10% to 26% less than they were worth before? No chance. The Value.able intrinsic valuations of companies that were cheap before haven’t changed.

So what has changed?

Only investors’ perceptions. Perceptions about the global economic outlook; perceptions about a US slowdown becoming a recession; perception about a Chinese slowdown causing a global rout the world cannot afford; and hope that Australian house prices will fall to levels people can actually afford.

Think about that for a moment. Baby boomers own $1m + homes that they will be forced to liquidate to fund their retirements and health care. Meanwhile, Generation Y is struggling to afford a property. Something has to give. Economics 101 suggests price declines.

Investors have simply been reducing their appetite for risk.

Armageddonists are spouting scenarios similar to those that followed Britain’s exit from the gold standard in 1931.

But this fear may be unfounded. It’s most certainly not a cause for permanent worry. Even if a recession does transpire, it will not be permanent.

Our job as Value.able Graduates is not to guess the gyrations of the economy – while they are vital in determining the sustainability of a given return on equity, many of the world’s very best investors do not even employ economists (they employ former US Federal Chairmen).

Your mantra is to simply put together a list of ten extraordinary businesses that you believe will be much more valuable in five, ten or twenty years time.

Of course trying to fit all this into your daily life can be a challenge. Completely eliminating the drudgery, and making it simple and fun, is something my team and I have been working on for you. We created our A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. We have worked really hard to create our next-generation service because its what we all want to use. We are its first members! Soon, you will be able to make your investing life simpler too (remember, Value.able Graduates will be invited first – have you secured your copy?). It’s an A1 service that is like nothing you have ever seen before.

You may sense our excitement…

… back to the regular program.

So, here it is. Our list of out-of-favour-but-extraordinary businesses. WARNING: out-of-favour does not always mean ‘bargain’.

Steve Jobs once said; “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully.”

With that in mind, here are my thoughts on ten businesses we have discussed over the past few months with a back-of-the-business card reason for interest…

JB Hi-Fi (ASX: JBH, MQR: A1) – Bad news across the board in retail may get worse, but it will turn around and JB Hi-Fi is not Harvey Norman. The buyback has increased intrinsic value at the same time the price slides below.

Cochlear (ASX: COH, MQR: A1) – The shining star amongst A1s (COH is one of this country’s best export successes), yet the worst performer on the share market amongst its peers. Rational, anyone? Australian dollar fluctuations doesn’t change the quality of COH’s business, only the nature or shape of its earnings. Aussie dollar appreciation may last a while, but is not permanent.

CSL Limited (ASX:CSL, MQR: A1) – Another A1 amongst A1s. Like COH, earnings are affected by currency fluctuations.

Woolworths (ASX: WOW, MQR: B1) – Trading at a premium to current Value.able intrinsic value, but a small discount to 2012. Intrinsic value has taken five years to catch up to the price and the price has complied by waiting. In the absence of further downgrades, intrinsic value for future years now rises beyond the price at a good clip.

Reece (ASX: REH, MQR: A2) – Great quality business. Wait for weaker prices or intrinsic value to catch up.

Platinum Asset Management (ASX: PTM, MQR: A1) – Whilst few businesses can compete with Platinum on an ROE and low capital intensity basis, patience is required before acquiring.

Matrix C&E (ASX: MCE, MQR: A1) – Matrix is unique amongst its small capitalisation peers also servicing the resources sector. Watch the full year results closely.

ANZ (ASX: ANZ, MQR: A3) – Short of swimming off the island, we don’t have much choice when it comes to choosing a banking partner. Thanks to fears of an ineffectual Asia roll-out, ANZ is the cheapest of Australia’s big four at the present time.

Vocus Communications (ASX: VOC, MQR: A1) – Run by some of the best in the business, the intrinsic value of Vocus has the potential to be much, much higher in five years time.

Zicom Group (ASX: ZGL, MQR: B2) – Like Matrix, Zicom is exposed to both small-cap and resource sector engineering negativity. And like Vocus, the intrinsic value could rise much higher on the back of further rises in the price of oil and demand for gas.

What’s on your list?

This market, with an increasing number of companies hitting 52-week lows, is demanding your attention!

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 177 Comments

- save this article

- 177

- POSTED IN Companies, Insightful Insights.

-

Is Oroton Australia’s best retailer?

Roger Montgomery

April 12, 2011

Oroton, JB Hi-Fi, The Reject Shop, Woolworths, Nick Scali, Cash Converters. If you have seen me on Sky Business or visited my YouTube channel recently, these names will be familiar. David Jones, Country Road, Harvey Norman, Myer, Super Retail Group (think Super Cheap Auto), Strathfield Group (Strathfield Car Radios), Noni B and Kathmandu also spring to mind, albeit for different reasons.

As a business, retailers are relatively easy to understand. The best managers are easy to spot (think Oroton’s Sally MacDonald) and it is also easy to separate the businesses with earnings power from those without (compare JB Hi-Fi and Harvey Norman).

But generally speaking even the best retailers may not be companies you want to hold forever. Why? Because they quickly reach saturation and so must constantly reinvent themselves.

Barriers to entry are low. There are always new concepts with young, intelligent and energetic entrepreneurs eager to develop a new brand and offering. Big red SALE signs are replacing mannequins as permanent window fixtures in Australian shop fronts, driving down revenue and margins. And for those who choose to defend brand value, sales revenue is also often sacrificed.

Then there’s the twin-speed economy, a string of natural disasters, soaring oil prices, growing personal savings, higher interest rates, Australia’s small population and one that is increasingly adept at shopping online for a getter price. Hands up who wants to be a retailer?

Retailers are attractive businesses – at the right price and the right stage in their life cycle. So, in retailing, who is Australia’s good, bad and just plain ugly?

Remember, these comments are not recommendations. Conduct your own independent research and seek and take professional personal advice.

Harvey Norman

ASX:HVN, MQR: A3, MOS: -19%A decade ago Gerry’s retail giant earned $105 million profit on $484 of equity that we put in and left in the business. That’s a return of around 19 per cent. Fast-forward to 2010 and we’ve put in another $117 million and retained an additional $1.5 billion. Despite this tripling of our commitment, however, profits have little more than doubled to $236 million. Return on equity has fallen by a third and is now about 12%. One decade of operating and the intrinsic value of Harvey Norman has barely changed. HVN is a mature business, but be warned… Harvey Norman is what JB Hi-Fi and The Reject Shop would see if they used a telescope to look forward through time.

OrotonGroup Limited

ASX:ORL, MQR: A1, MOS: -21%Sally MacDonald is a brilliant retailer. I highly recommend watching this interview – click here. Sally took over Oroton in 2006. In just five years she has cut loss making stores and brands, sliced overheads, improved both the quality and diversity of the range. The result? Surging revenues and return on equity in 2010 of circa 85 per cent. Try getting that in a bank account or even a term deposit! Asia offers even brighter prospects for Oroton while their product offering is sufficiently attractive and appealing that the company has the ability to weather the retail storm and protect its brand.

Woolworths Limited

ASX: WOW, MQR: B1, MOS: -17%You don’t get any bigger than Woolworths (its one of the 20 largest retailers on the planet!). It has a utility-like grip on consumers only, with earnings power that would put any utility to shame. The latter can be seen in the near 30% annualised increase in intrinsic value. Competitive position and size means suppliers and customers fund the company’s inventory. Challenges included professed legislative changes to poker machine usage (WOW is the largest owner of poker machines and any drag in revenue will have an exponential impact on profits), and the rollout of a competitor to Bunnings.

David Jones Limited

ASX: DJS, MQR: A2, MOS: -35%A beautiful shop makes not a beautiful business. I remember when David Jones floated. Shoppers who enjoyed the ‘David Jones’ experience and were loyal to the brand bought shares with the same enthusiasm as scouring the shoe department at the Boxing Day sales. Since 2007 DJS has reduced its Net Debt/Equity ratio from 108 per cent to just under 12 per cent. We are yet to see if Paul Zahra can lead DJs with the same stewardship as former CEO Mark McInnes but as far as department stores can possibly be attractive long-term investments, DJs isn’t it.

Myer

ASX: MYR, MQR: B1, MOS: -27%In 2009, following the release of that gleaming My Prospectus, I wrote:

“With all the relevant data to value the business now available and using the pro-forma accounts supplied in the prospectus, I value the company at between $2.67 and $2.78, substantially below the $3.90 to $4.90 being requested [by the vendors]. It appears to me that the float favours existing shareholders rather than new investors.”

My 2011 forecast value for Myer is just over $2. According to My Value.able Calculations, Myer will be worth less in 2013 than the price at which it listed in September 2010. If competitors like David Jones, Just Jeans, Kmart, Target, Big W, JB Hi-Fi, Fantastic Furniture, Captain Snooze, Sleep City, Harvey Norman, Nick Scali and Coco Republic were removed, Myer may just do alright.

Noni B

ASX: NBL, MQR: A2, MOS: -51%Noni B’s intrinsic value is the same as when Alan Kindl floated the company in 2000 (the family retained a 40% shareholding). Return on Equity hasn’t changed either. Shares on issue however have increased 50 per cent yet profits have remained relatively unchanged.

Kathmandu Holdings Limited

ASX: KMD, MQR: A3, MOS: -56%Sixty per cent of Kathmandu’s revenues are generated in the second half of the year. Will weather patterns continue to feed this trend? I sense premature excitement following the implementation of KMD’s newly installed intranet. The system may streamline store-to-store communications, reducing costs and creating inventory-related efficiencies for the 90-store chain, however what’s stopping a competitor replicating the same out-of-the-box system?

Fantastic Furniture

ASX: FAN, MQR: A3, MOS: -24%Al-ways Fan-tas-tic! Once upon a time it was. Low barriers to entry are seeing online retro furniture suppliers like Milan Direct and Matt Blatt are forcing Fantastic and other traditional players to reinvent the way they display, price and stock inventory.

Billabong

ASX: BBG, MQR: A3, MOS: -49%Billabong’s customers are highly fickle, trend conscious and anti-establishment. Like Mambo, as one of my team told me, Billabong is “so 1999 Rog”. Apparently Noosa Longboards t-shirts fall into the “cool” category, now. Groovy!

Eighty per cent of Billabong’s revenues are derived from offshore. Every one-cent rise in the Australian dollar has a half percent negative impact on net profits. Fans of the trader Jim Rogers believe the AUD could rise to USD$1.40! Then there’s the 44 stores affected by Japan’s earthquake (18 remain closed) and another three in the Christchurch earthquake.

Country Road

ASX: CTY, MQR: A3, MOS: -63%).Like the quality of their clothing, Country Road’s MQR has been erratic. So too has its value. Debt is low however cash flow is not attractive. Very expensive.

Cash Convertors

ASX: CCV, MQR: A2, MOS: +26%.Value.able Graduates Manny and Ray H nominated CCV as their A1 stock to watch in 2011. Whilst its not yet an A1, Cash Convertors is a niche business with bight prospects for intrinsic value growth.

Other retailers to watch

I have spoken about JB Hi-Fi, Nick Scali and The Reject Shop many times on Peter Switzer’s Switzer TV and Your Money Your Call on the Sky Business Channel. Go to youtube.com/rogerjmontgomery and type “retail”, “JBH”, “TRS” or “reject” into the Search box to watch the latest videos.

In October 2009 the RBA released the following statistics:

16 million. The number of credit cards in circulation in Australia;

$3,141. The average monthly Australian credit card account balance;

US$56,000. The average mortgage, credit card and personal loan debt of every man, woman and child in Australia;

$1.2 trillion. The total Australian mortgage, credit card and personal loan debt;

$19.189 billion. The amount spent on credit and charge cards in October 2009.Clearly we are all shoppers… what are your experiences? Who do you see as the next king of Australia’s retail landscape?

Posted by Roger Montgomery, author and fund manager, 12 April 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Value.able.

-

Will JB Hi-Fi continue to groove?

Roger Montgomery

March 3, 2011

Since listing in October 2003, JB Hi-Fi has left analysts and shareholders spellbound by the impact of its extraordinary returns on equity. As you know, the Value.able magic began to fade for me late last year.

Since listing in October 2003, JB Hi-Fi has left analysts and shareholders spellbound by the impact of its extraordinary returns on equity. As you know, the Value.able magic began to fade for me late last year.Why? Well JB Hi-Fi’s business appears to be maturing. And there are only so many stores you can put on an island!

No matter where you live in Australia, and no matter which shopping centre you walk into, you will never be too far from a JBH store – music blaring behind trademark billboard style placards screaming for your attention.

Yes, there are more stores in the pipeline (currently 153 with a target of 210). At an opening rate of 15 stores a year, that implies another 4.5 years of growth. But will the new stores be as profitable as the existing ones?

Retailers often have two, if not more, ‘Tiers’ of stores and JBH is no different. Of its target of 210 stores, 160 will be Tier-1 and 50 will be Tier-2. Tier-1 stores cost $2.5 million to set up, while Tier-2 are 20% cheaper. But Tier-2 stores generate only 70% of the revenue of a Tier-1 store.

Of the 67 stores yet to open, 31 will be Tier-2. That’s half of JBH’s newest stores less profitable! Currently Tier-2 stores account for just 13 per cent of JBH’s business.

JBH has $180 million sitting idle in the bank. With growth on the horizon, suppliers covering the cost of goods, high margins and low net debt, management’s decision earlier this year to review its capital management policy didn’t come as a surprise.

As we enter the first month of Autumn, the Chairman will no doubt be preparing to reveal the results of this review.

Whatever the company’s initiatives – buy back shares, return capital or increase the dividend payout ratio – the actions will have a material impact on my Value.able estimate of JBH’s value.

With that in mind, I would like you consider which is more valuable… one dollar in a bank account earning 45% and that figure compounds at 45% year after year, or one dollar in a bank account earning 45% and that figure is paid out in dividends each year?

If you’re a Value.able graduate, I’m certain you know the answer.

The first bank account is more valuable, and that’s precisely why any changes in JB Hi-Fi’s capital management policies will have a material impact on its Value.able value.

If JBH buys back shares (a disaster if management did that at a price higher than what the shares are worth) or lifts its dividend payout ratio, then my estimate of intrinsic value will decline.

Business maturity is generally accompanied by a leveling off of intrinsic value (followed by a serious drag if a silly acquisition is made).

Watch for how JBH reports its profit. Has return on equity stabilised, or will it continue to rise? Will your estimate of JBH’s Value.able intrinsic value continue to rise?

Whist JBH remains one of my preferred retailers, I am less optimistic it will continue to generate the returns on equity shareholders have enjoyed over the past. What are your thoughts? Feel free to chat here about other retailers too.

Posted by Roger Montgomery, author and fund manager, 3 March 2011.

by Roger Montgomery Posted in Insightful Insights.

- 95 Comments

- save this article

- 95

- POSTED IN Insightful Insights.

-

Thank you and Happy Christmas

Roger Montgomery

December 23, 2010

I am delighted that, in 2010, so many investors have found Value.able useful. Many Graduates have said the Value.able approach to investing is at once easy to understand and rational. And according to John, Scott, Brian, Peter, Andy, Martin and Steve’s feedback, Value.able!

Merry Christmas Roger! And a big thankyou for writing your book.

It never ceases to amaze me just how few professional investors actually stick to a winning investment formula. I recently reviewed the portfolio holdings of many well known Australian Equity managed funds available through a major online broker and could not find one “leading” fund manager that only invested in stocks that would come anywhere near to passing the MQR (Montgomery Quality Rating) test. Virtually all major funds hold stocks that are low ROE, highly capital intensive and debt laden. Unfortunately, I was not surprised to see that many of these funds holding large positions in non-investment grade stocks proudly highlight their 5 star ratings from asset consultants.

Have a well-earned break and may 2011 be an in-value.able year for you and yours,

Warmest regards,

JohnMerry Christmas everybody! And to you Mr Montgomery, a massive thank you.

Thanks to your wonderful book, and your insightful and thought provoking articles, posts and appearances. My SMSF has had the best year ever (that’s with 10 years of history).

In a lack lustre sideways market I was able to pinpoint and cut out the dead wood from previous poor decisions, and focus on quality businesses trading at a big discount to IV.

The difference in fund performance is simply startling.

Again thank you, I hope to be able to shake your hand again in 2011.

All the best

Scott THi Adam & Roger, … I’m pleased I’m getting the hang of these valuations. I’ve bought a few other A1’s also, MCE, SWL (A3) & FGE on my research following your valuation criteria Roger, as well as JBH. I’m getting rid of some rubbish (AMP,BFG,VMG,BYL) & feel confident I’m replacing them with quality shares. Thanks so much for sharing Roger, my retirement looks a little more hopeful now following the devastation of the GFC.

Brian

Hi Roger, Thanks for writing the book and your diligence in keeping the blog up to date. You’ve made a massive contribution to my awareness and knowledge. The book has already been paid for hundreds of times over.

Cheers, Peter

Roger, Thanks for all the great insights over the last year. I really had no idea how blindly I had been investing prior to reading your book and this blog. I’m still learning but at least I know what I should be looking at now.

Thanks again

Andy

Hi Roger, Just wanted to thankyou for sharing your knowledge and insights with everyone, your book was amazing to say the least!!! I’ve made a return of close to 20% in less than 6 months and your Value.able book has paid itself off by more than 200 times!!! Now that is what I call ROE. I would like to wish you and your family a Merry Christmas and a happy new year. Thank you so much for an extremely valuable year, congrats and best wishes.

Regards,

Martin

Hi Roger, I see many comments on the blog congratulating you on your book, but they don’t actually say why it is great. So I have done a book review.

Regards,

Sapporo Steve

If you have not already secured your copy of Value.able and want to kick 2011 off the Value.able way, go to www.RogerMontgomery.com. The First Edition sold out in just 14 weeks and with so many private and professional investors now buying multiple copies for friends and family, the Second Edition is set to sell out just as quickly. Don’t waste another minute!To the Value.able Graduates, thank you for taking the time to share with me just how much you have been impacted by my book. I am delighted to hear your amazing stories of investing success and I am pleased we can sign off 2010 with such an extraordinary investment track record.

I wish you all a safe, peaceful and Happy Christmas and my sincere best wishes for 2011. I have always been enthralled by Caravaggio’s work. The Adoration was painted in 1609.

My office will close today and reopen on Monday 10 January. I will return in late January. My team will continue to publish your comments here at the blog, post new videos to my YouTube channel and reply to your emails. Most importantly, my website will continue to accept your Value.able orders and my distribution house is working through the holiday season.

Posted by Roger Montgomery, 23 December 2010

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Who made the Value.able grade?

Roger Montgomery

December 16, 2010

The Value.able class of 2010 is indeed all class.

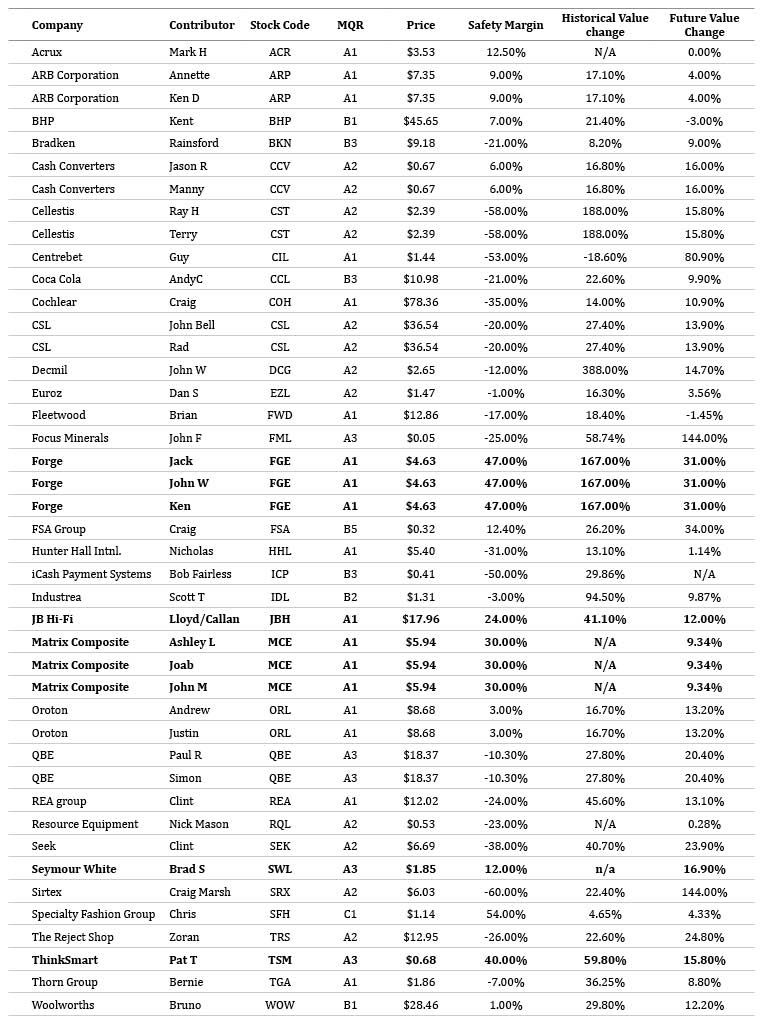

The Value.able class of 2010 is indeed all class.Your nominations for the A1 stocks to watch in 2011 are fine examples of the sorts of companies that I eagerly seek for my own portfolio (with the exception of the odd recalcitrant student who diverged from the lessons learned).

I haven’t yet decided which will be revealed on Sky’s Twelve Shares of Christmas special tonight at 7pm, although the shortlist may be obvious from the numbers presented in the table below.

If we presume that all A1s have equally bright prospects – they don’t – then the job of picking the top stock comes down to the one that offers the highest return when combining the discount to intrinsic value and the prospective change to intrinsic value over the next two or three years.

One difficulty with such a simplistic approach is that firstly, varying degrees of certainty about the future cloud the picture. I have also used consensus numbers to produce the valuation changes and these are notorious for being optimistic at precisely the wrong points in the business cycle.

To avoid this dilemma for the purposes of the exercise (but perhaps not for the purposes of investing), I could elect to go with the choice that received the most recommendations. The winner of that contest would be a tie between Matrix Composite & Engineering (MCE) and Forge Group (FGE) and the equal runners up would be Oroton (ORL), ARB Corp (ARP), Cash Convertors (CCV), Cellestis (CST) and CSL (CSL). The remaining contributions include Acrux (ACR), BHP (BHP), Bradken (BKN), Centrebet (CIL), Coca Cola (CCL), Decmil (DCG), Euroz (EZL), Fleetwood (FWD), Focus Minerals (FML), FSA Group (FSA), Hunter Hall (HHL), iCash Payment Systems (ICP), Industrea (IDL), JB Hi-Fi (JBH), QBE (QBE), REA Group (REA), Resource Equipment (RQL), Seek (SEK), Seymour White (SWL), Sirtex (SRX), Speciality Fashion Group (SFH), The Reject Shop (TRS), ThinkSmart (TSM), Thorn Group (TGA) and Woolworths (WOW).

Whilst I have identified a universe of A1 companies trading at discounts to intrinsic value that have slipped under your radar, the objective of the exercise was to ask for your picks and now that I have the list, choose a winner I must.

On tonight’s Summer Money program on Sky Business at 7pm I will reveal the ONE stock that you have selected as the relatively best prospect for 2011. It won’t be Roger Montgomery’s pick. It will be the top pick by the Insights Blog Community – the Value.able Graduate Class of 2010!

Posted by Roger Montgomery, 16 December 2010.

by Roger Montgomery Posted in Companies, Investing Education.

- 114 Comments

- save this article

- 114

- POSTED IN Companies, Investing Education.

-

Has 2010 been a good year for Value.able investing?

Roger Montgomery

December 7, 2010

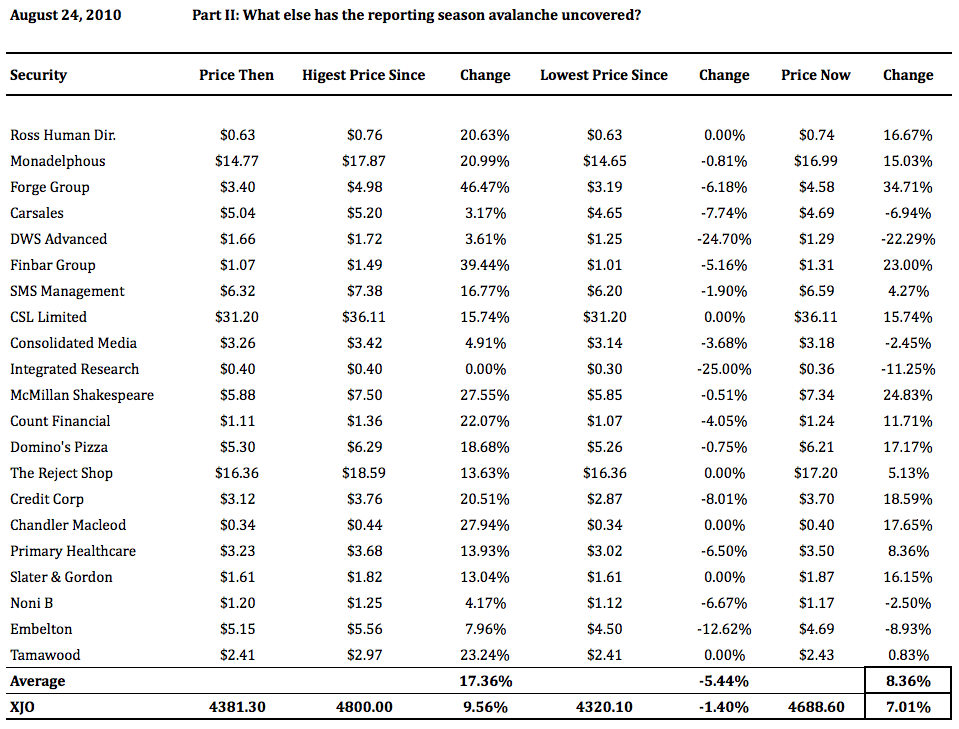

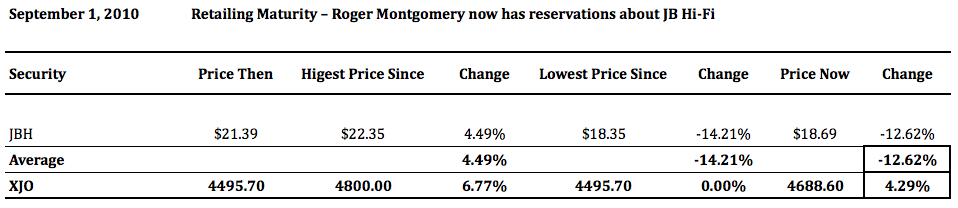

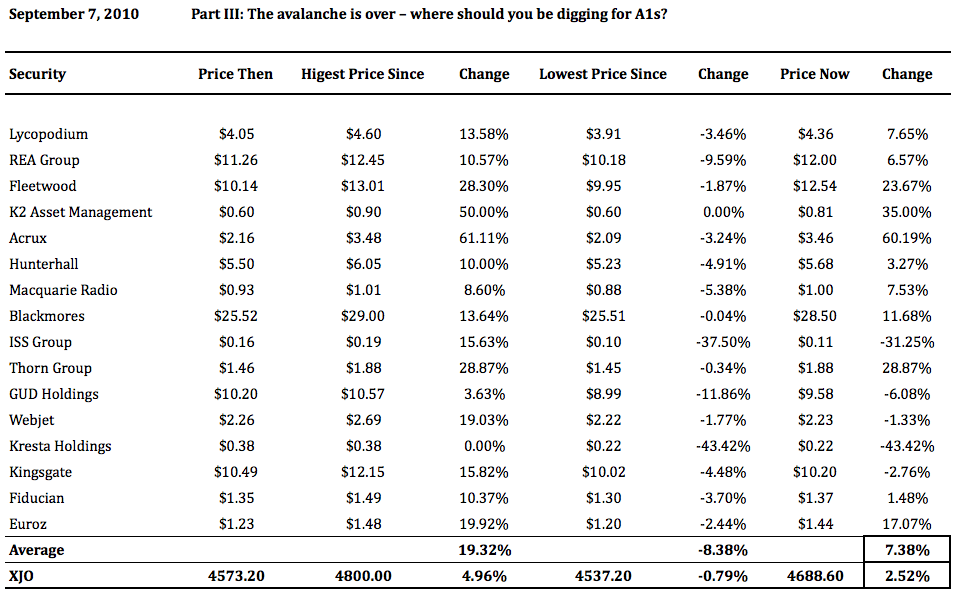

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.

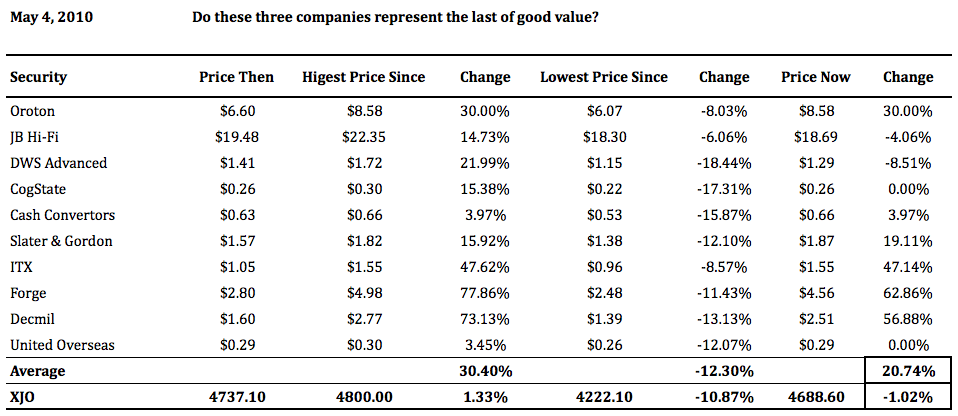

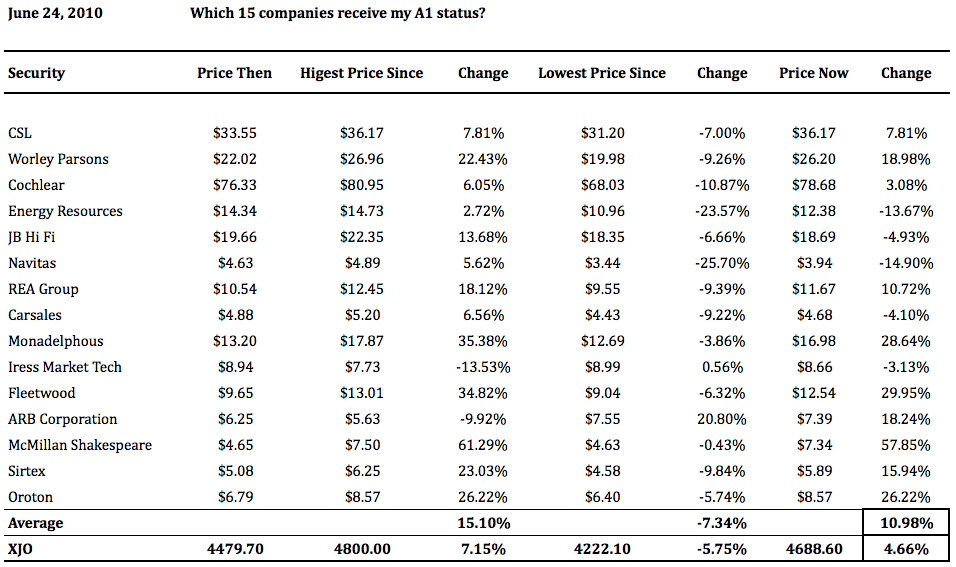

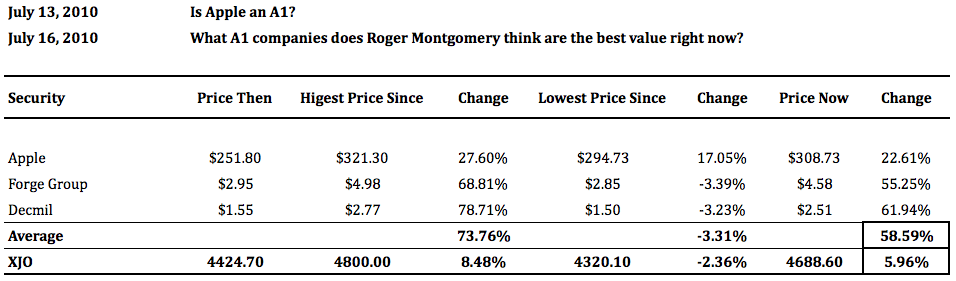

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.Does the Value.able approach to investing, as advocated some of the world’s leading investors, have merit?

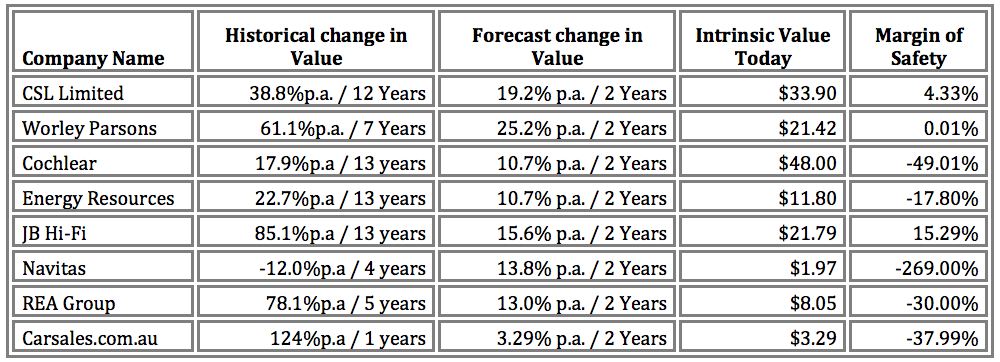

First Edition Graduates may not be surprised by the results posted below. The higher quality businesses, those scoring A1 and A2 Montgomery Quality Ratings (MQRs), and those at larger discounts to intrinsic value have, in aggregate, beaten the index. Some have trounced it. And with the exception of QR National, the companies that were labeled as poor quality (C4 and C5 MQRs) and overpriced, have under-performed. Some of the maturing higher quality companies (think JB Hi-Fi) have indeed performed.

The following tables present some of the blog posts and the stocks that I have listed, mentioned or discussed in them. I have consistently suggested investigating an approach that seeks the highest quality businesses and prices that offer the biggest discounts to value.

Whilst the results are short-term (therefore nothing should be taken from them), they are nevertheless encouraging. The approach advocated in Value.able is worth investigating.

Many Value.able Graduates have suggested I start a newsletter or a stock market advice service. Thank you for the encouragement. I do enjoy the cross pollination of ideas and look forward to 2011 attracting even more investors to the patient and rational approach shared here at my blog.

Here are the tables (DO YOUR HOMEWORK AND RESEARCH. ENSURE YOU ARE COMPREHENSIVELY INFORMED. SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE).

Do these three companies represent the last of good value? Oroton, JB Hi-Fi, DWS, Cogstate, Cash Converters, Slater & Gordon, ITX, Forge, Decmil and United Overseas

Which 15 companies receive my A1 status? CSL, Worley Parsons, Cochlear, Energy Resources, JB Hi-Fi, Navitas, REA Group, Carsales, Mondaelphous, Iress, Fleetwood, ARB, McMillian Shakesphere, Sirtex, Oroton.

Is Apple an A1? What A1 companies does Roger Montgomery think are the best value right now? Apple, Forge and Decmil.

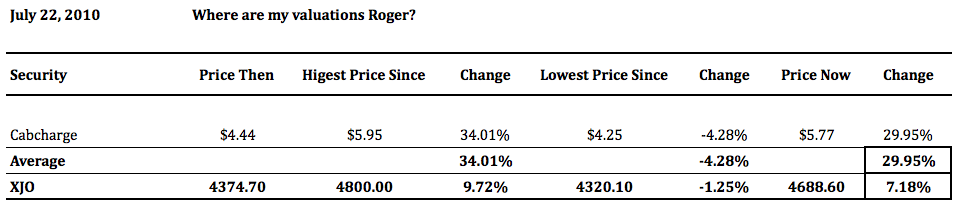

Where are my valuations Roger? Cabcharge.

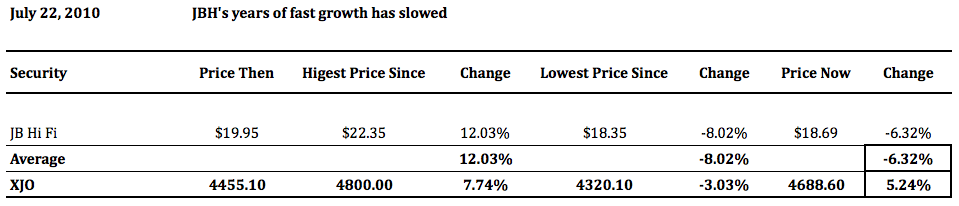

JBH’s years of fast growth has slowed.

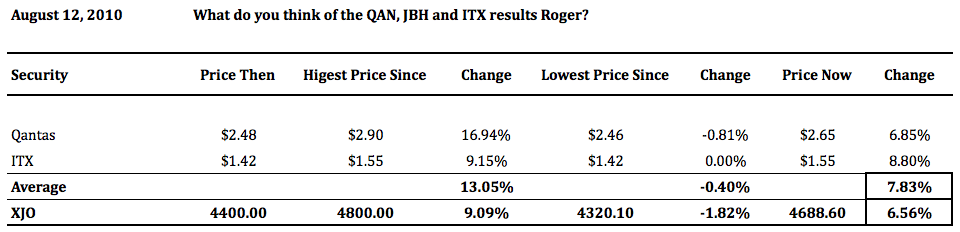

What do you think of the QAN, JBH and ITX results Roger? Qantas and ITX

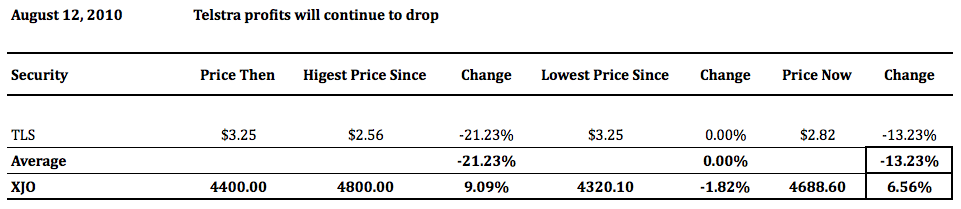

Telstra profits will continue to drop

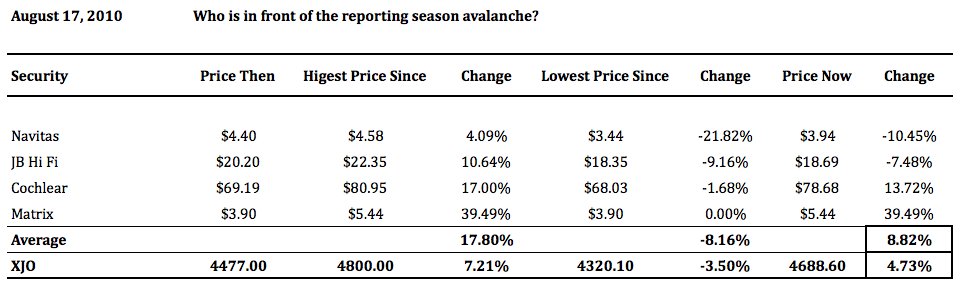

Who is in front of the reporting season avalanche? Navitas, JB Hi-Fi, Cochlear and Matrix.

Part II: What else has the reporting season avalanche uncovered? Ross Human Directions, Monadelphous, Forge, Carsales, DWS, Finbar, SMS Management, CSL, Consolidated Media, Integrated Research, McMillian Shakesphere, Count Financial, Domino’s Pizza, The Reject Shop, Credit Corp, Chandler Macleod, Primary Healthcare, Slater & Gordon, Noni B, Embelton and Tamawood.

Retailing Maturity – Roger Montgomery now has reservations about JB Hi-Fi.

Part III: The avalanche is over – where should you be digging for A1s? Lycopodium, REA Group, Fleetwood, K2 Asset Management, Acrux, Hunterhall, Macquarie Radio, Blackmores, ISS Group, Thorn Group, GUD Holdings, Webjet, Kresta Holdings, Kingsgate, Fiducian and Euroz.

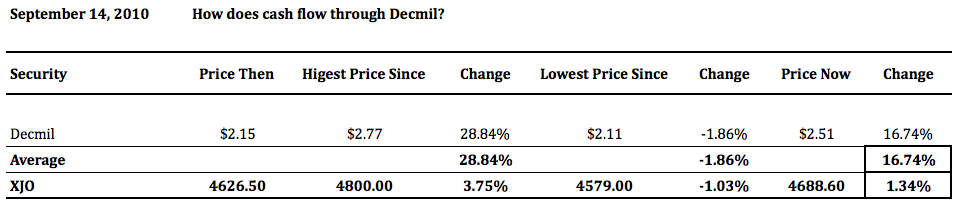

How does cash flow through Decmil?

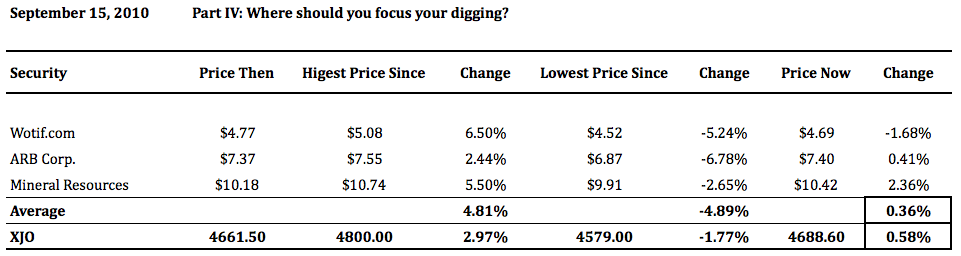

Part IV: Where should you focus your digging?

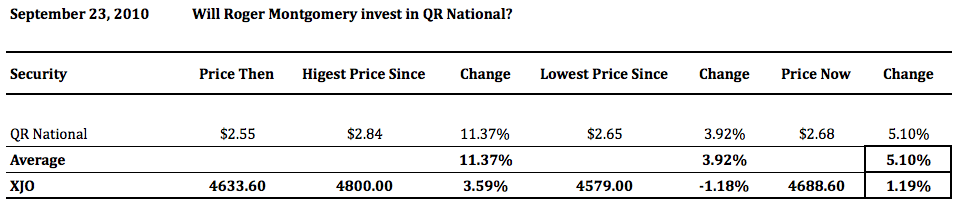

Will Roger Montgomery invest in QR National?

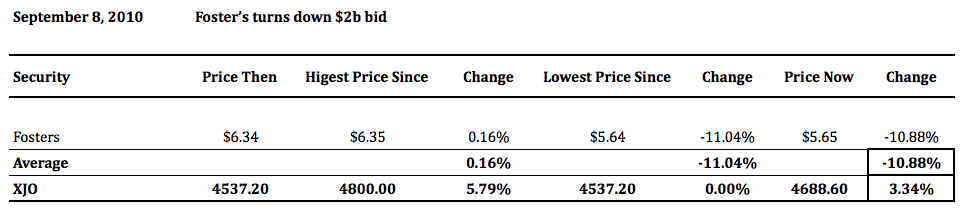

I thought the performance of Fosters after the wine bid was knocked back was interesting, but only another year or two will confirm whether the opportunity to add value was passed up. Some higher quality businesses also underperformed the market, thanks in part to deteriorating short-term prospects rather than deteriorating quality.

Remember to look for bright long-term prospects. Of course, in the short-term prospects will swing around – that is business, but longer-term prospects of businesses with true sustainable competitive advantages tend to win out.

Keep an eye on the blog before Christmas as I will be posting a couple of very handy lists (and possibly some homework) before the annual Montgomery Family Christmas break.

Posted by Roger Montgomery, 7 December 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

What are Roger Montgomery’s Value.able intrinsic valuations for his top three A1s?

Roger Montgomery

October 28, 2010

In this appearance on Your Money Your Call, Roger Montgomery reveals his Value.able intrinsic valuations for popular retailer JB Hi-Fi (JBH), hearing device manufacturer Cochlear (COH), mortgage broking company Mortgage Choice (MOC), fund manager Platinum Asset Management (PTM) and construction company Leighton Holdings Limited (LEI). Which of these businesses are trading at a discount to Roger’s Value.able intrinsic valuation? And which businesses score Roger’s coveted A1 Montgomery Quality Rating (MQR)? Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

Should I or shouldn’t I?

Roger Montgomery

October 12, 2010

QR National is the second biggest float in Australia’s history and if I, as a value investor, am to be focused on extraordinary businesses, bought at discounts to intrinsic value, then the second biggest float ever deserves some of my attention.

QR National is the second biggest float in Australia’s history and if I, as a value investor, am to be focused on extraordinary businesses, bought at discounts to intrinsic value, then the second biggest float ever deserves some of my attention.But is QR National an extraordinary business? And is it available at a discount to its intrinsic value? They are the questions I need to answer.

QR Limited reported a loss of $37 million in 2010 (The Prospectus Appendix reports the continuing operations of QR Limited lost $37 million in 2010). A company-wide restructure, combined with customers rolling off old contracts and onto new, more commercial ones, as well as continued growth in coal haulage volumes however, is expected to result in a profit of $369 million in 2012 (and possibly much higher beyond that).

QR National will start its listed life with a balance sheet that has about $6.8 billion of equity. If QR National hits its targeted profits and pays its estimated dividends over the next 18 months, that equity will grow to $7.3 billion (I have excluded the impact on equity of the proposed dividend reinvestment plan). And if QR National hits its 2012 profit forecast, return on average equity will reach 5.1 per cent.

(POSTSCRIPT; Much is being made of the profits beyond 2012 and the return on the $3 billion invested. I had the opportunity to discuss this with L.Hockridge and he pointed to the prospectus forecast for an EBITDA run rate of $170-$190 million. Aside from the fat that EBITDA is nonsense the NPAT return on capital at maximum capacity will be about 6%. I talk about this below so I am not too worried about using the 2012 for a few years beyond it. In any event if 2015 and beyond is where the rewards are; why the rush to invest today?)

Given that I can invest in companies generating 40%, 50%, 60% even 80% returns on equity, should I consider a return that is less than that which cash in the bank generates?

Because the dividend yield is so miserly (and because of negative cash flow after capital expenditure, those dividends are effectively funded out of borrowings) the company is being pitched as a growth stock and growth story. Growth in coal volumes transported is the validation for the claim. But when a company generates a 5% return on the profits they keep, you don’t want it to grow. It is better they hand all the profits back to you so that you can put the money in the bank and get a higher and safer return. Of course they can’t hand the profits back to you because the cash flow won’t support it for reasons I explain next.

QR National is a capital intensive business and even before dividends are paid, the cash flow will be negative. Between 2008 and 2012 (5 years) QR National will have expended $7.2 billion on ‘capex’ and the company will need to borrow $1.5 billion in the next few years (the prespectus explains it will draw on over $2 billion). This will partially cover the gap between the capex and the cash form operations of $3.4 billion. The returns the company will be aiming for on this debt funding could be nine per cent or more, but my estimate is that the $170-$190 million in EBITDA from its GAPE project disclosed in the prospectus will be whittled down considerably by depreciation, interest and tax, such that the additional contribution to return on equity of the whole group may not be so significant.

As an aside the prospectus spends a great deal of time focusing on EBITDA (earnings before interest, tax, depreciation and amortisation) but as Charlie Munger once observed, whats the point of looking at “earnings before costs”? And as Buffett noted, the “tooth fairy” doesn’t pay for these things. Depreciation is a very real expense even though many finance professionals treat it as a non cash accounting item. In reality when depreciation is based on the historical cost of an item, it will under-provide for the true cost of maintaining and ultimately replacing that item. This is because the depreciation is based on the purchase price of the item many years ago, but maintaining and replacing it will suffer the impact of inflation. Thinking about it another way; imagine employing a thousand people for ten years but paying for them upfront and expensing the cost over ten years – would you then say the item is non cash and can be ignored? The real cost of employing these people will be higher than the depreciation suggests – they will demand salary increases. Looking at earnings before real costs is nonsense. Buffett’s advice from his 1989 letter to Berkshire Shareholders is even less accommodating: “Whenever an investment banker starts talking about EBDIT – or whenever someone creates a capital structure that does not allow all interest, both payable and accrued, to be comfortably met out of current cash flow net of ample capital expenditures – zip up your wallet.”

One other point: it appears to me that forecast profits (and by inference the 2012 Return on equity of circa 5%), may be boosted by some permitted accounting tricks. The future profits may be boosted by the capitalisation of interest on debt used to finance assets under construction. In other words not all of the interest expense in 2012 is flowing through the forecast profit and loss statement. Some of it will be capitalised (converted to an asset on the balance sheet). Telstra has done this with software development expenses and the end result is a profit figure that looks better than economic reality. For QR National it means that $369 million profit reflects accounting reality rather than economic reality.

I appreciate two things about this float. First, some of the smartest operators and management in the country are now driving it and as they point out, quite rightly, prospectus requirements limit their ability to discuss what happens beyond 2012 (but beyond 2012 anything can change, even management themselves). If however, it is the case that returns on equity will creep towards double digits after 2012, then I must ask myself if there is there any urgency to buy today?

The risk of course is the cost associated with paying a higher price for the shares at some future date when the wonderful performance is confirmed. The second thing I appreciate is that I cannot predict what the share price will do. The vendors and their advisors are pulling out every device designed to support the price of the shares after the float. There is the loyalty bonus that incentivises retail investors not to sell until December next year, and there’s the greenshoe permit that allows the managers of the float to step in and buy shares in the aftermarket. The share price may very well perform brilliantly. I am the first to admit that I am no good at predicting what the shares will do. That is the main reason why I always say you must seek and take personal professional advice. Your adviser is the only person who understands whether QR National or any company and their shares are suitable for you.

I estimate QR National’s shares have a 2012 intrinsic value of between $1.09 and $1.48, but thats in 18 months time. Given there will be 2.44 billion shares on issue, the intrinsic value of the whole business is about $3.7 billion in 2012. The intrinsic value is necessarily less than the equity or book value on the balance sheet because the equity is forecast to produce a lower return than that which I require from a business. The vendors want you today to pay up to double the 2012 intrinsic value ($2.40-$2.80 per share – loyalty bonus and Queensland resident bonus excluded).

I may indeed miss out on some gains if I don’t participate in the float, and I may miss out on very substantial gains. Of course there is the risk of loss too if I do participate. While I might be ok with either scenario, you may not be and so YOU MUST SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE. My comments are general in nature and I have not taken into account anything about you or your financial needs and circumstances. If you want advice about what to do regarding the QR National float, speak to your advisor and if you haven’t got one, seek one out BEFORE doing or not doing anything.

Postscript: as one of my friends, Chris – also a fund manager – noted this morning: “I haven’t looked at the detail yet, but thought it was worth pointing out that the EV/EBITDA multiples they’re using might be a touch disingenuous. QR are using FY12 earnings on today’s balance sheet (i.e. current net debt of $500 million) despite the fact that they’ll have to drw down on at least $1.5 billion of further debt to generate those earnings. Essentially you might like to have someone check if they might be using today’s balance sheet and tomorrow’s earnings to lower the multiple.”

On a more navel gazing note…

Short-term price direction is not the trigger for a change of heart towards a company. Indeed, a falling price for an A1 business generally represents an opportunity. Sometimes however the nature of price changes has me sitting up and taking notice – being alert rather than alarmed.

Currently, JB Hi-Fi’s share price has been heading in the opposite direction to that of most of the A1 companies that I am following. Such determined selling has often been the precursor to an announcement. Let me make it clear that other than knowing JBH will hold its AGM tomorrow in Melbourne, I don’t know whether an announcement, for example a trading update, will be forthcoming or not. The rather unidirectional nature of the price changes however, often bodes poorly for the contents of any announcement. Keep a watchful eye therefore on JB Hi-Fi.

I found at my recent visits to a handful of JBH stores that they were busier than ever. But the recent share price changes suggests someone is nervous.

The only subsequent thought I have had is that the high Australian dollar has resulted in price deflation, which JB Hi-Fi’s competitors will take advantage of and the company will have to respond to by lowering prices, putting pressure on gross margins. JB Hi-Fi remains at a discount to my current estimates of intrinsic value and as I just mentioned, I generally take advantage of the market and its Wallet rather than listen to its Wisdom.

Keep an eye on JBH and any news from tomorrow’s AGM in Melbourne particularly about margins, deflation and the Aussie dollar at 11.30am.

Posted by Roger Montgomery, 12 October 2010.

Postscript #2: JBH AGM notes. first quarter trading has improved. Total store sales are up 12.2% but behind BUDGET (not last year comprables) by 5%. JBH expects to make it up over CHristmas but evidently they didn’t mention the previous guidance of 17% growth in sales (perhaps this IS budget). Store roll out is on track and 18 additional stores are expected to be opened in the current financial year. They DID say that they are well placed to maintain margins despite discounting. Newspapers this morning point to a raft of new games to be released (JBH is the second biggest retailer of computer games) for Christmas.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 170 Comments

- save this article

- 170

- POSTED IN Companies, Energy / Resources.

-

Who is in front of the reporting season avalanche?

Roger Montgomery

August 17, 2010

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.TLS was a clear disappointment, as it has been since it listed. I have been on the front foot for a long time saying that this is a company to avoid, I hope you took notice. My valuation has fallen now from $3.00 to almost $2.50. If anyone can turn it around however I think Thodey can.

Qantas should have come as no surprise. A $300 million cash loss and I wouldn’t be surprised to see another raising of capital or debt.

Personally though I am not interested at all in TLS or QAN as investment candidates. I am only interested in the highest quality best performing businesses available – it’s here that intrinsic value can be created rather than destroyed and with reporting season just about to kick into top gear from this week, to find them, I put each company through the same rigorous process.

My initial screening process is a vital part of the investment process as it allows me to determine those companies that deserve to retain their place in the short list and it also highlights new opportunities as they arise. But to do this for some 2,000 listed Australian companies can be a very burdensome task unless you have a systematic way of analysing and comparing results in a consistent manner.

For me, it involves pulling out some 50-70 profit and loss, balance sheet and cash flow data fields from each annual report to populate my five models. All of these models employ industry specific metrics to calculate my quality and performance scores. This allows me to rank all companies from A1 – C5 to sort the wheat from the chaff.

For those not familiar with my ranking system, A1s are the simply the best businesses and the safest to own, while C5s are the poorest performers and the least safe.

Out of the 80 companies that have reported, only 5 have achieved my coveted A1 status – around 6.25% (the best of the rest).

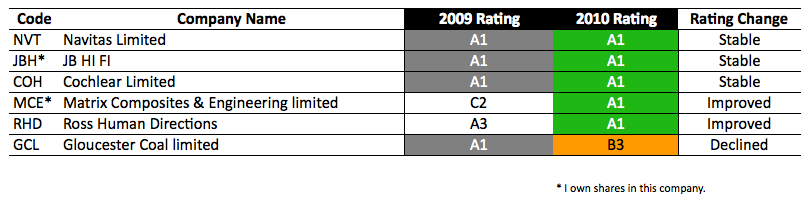

NVT, JBH and COH had my A1 rating last year and retained it this year and there are 2 new entrants in MCE and RHD, with GCL (it was an A1 last year) having a dramatic rating decline. I tend to shy away from resource companies for obvious reasons.

On my blog I have previously spoken about NVT, JBH and COH and also mentioned ITX, so please revisit those thoughts. itX is under takeover and Navitas, it was recently reported, had been approached some time ago by Kaplan – a company I have done some consulting work for and a subsidiary of Warren Buffett’s Washington Post company – so a big tick for the A1 to C5 Rating system!

That only leaves MCE, an engineering business that currently generates most of its returns from the manufacture of riser buoyancy modules for deep-sea oil rigs. Its order book is already underwriting a doubling of revenue for 2011. The 2010 result revealed profits had almost tripled and significantly exceeded prospectus forecasts and it is producing returns on equity of 49% – a rate that is unavailable generally elsewhere. Borrowings amount to about $8 million compared to equity of about $60 million (of which a little over 10% is capitalised development and goodwill intangibles). Best of all, the share price over the last week is a long way below my estimate of its intrinsic value.

If you have seen me on TV or heard me on radio in the last week or so you would have heard me mention that I had bought something, MCE is it. Please be mindful that if you act rashly and go and push the share price up, you will be helping me perhaps more than yourself. Also remember that I am not recommending the stock to you and that I cannot forecast the share price direction (although I am pleased with its performance since my purchase). The share price, I warn you, could halve, for example if there is a recession and or the oil price plunges – delaying expenditure of the construction of oil rigs globally. I simply am not recommending it to you.

Also remember that I am under no obligation to keep you informed of when I buy or sell nor answer any specific questions, which means 1) you have to do your own research and 2) you have to be responsible for your own decisions. Seek and take personal professional advice BEFORE you do anything.

Moving on, another 13 companies have achieved my second highest rating of A2. They are listed below with their prior years rating so you can compare.

Noteworthy in this list is the excellent performance of the Commonwealth Bank (which I continue to hold in my Eureka Report Value Line portfolio, along with JBH and COH) and those companies I generally classify as being in the Information Technology sector including OKN, ITX, CPU and ASW. Both sectors appear to be doing well in aggregate.

While focus should always be placed on the A1’s (the top 5-7% of the market) at any one point in time, A2’s are still very high quality businesses. The use of the two lists in tandem will therefore provide you with an excellent starting point in isolating those who have reported high quality financials and performance levels above the average business. An important first step in the Value.able Montgomery brand of investing.

It is from here that I will select candidates worthy of further analysis (qualitative and quantitative) and possibly meet with company management, if I have not already done so. Once again I have taken you to the river I fish in, you have my fishing rods and tackle box. Now up to you to catch the right priced fish.

Please use these two lists as a starting point to conduct your own research and use Value.able as a guide to estimate your own valuations. If you don’t yet have a copy you can order one at www.rogermontgomery.com so you too can do your own valuations. Remember to always focus on the highest quality and best performing business available.

If you focus on the best when they are cheap and simply forget the rest, you should avoid more (if not all) of the disasters and should be able to build a portfolio that will give you a greater chance of out-performing the market.

Happy reporting season!

To be continued… Read Part II.

Post by Roger Montgomery, 17 August 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

What do you think of the QAN, JBH and ITX results Roger?

Roger Montgomery

August 12, 2010

Here we are in the midst of reporting season and there are some reasonably predictable results. Qantas reported a profit today that was less than a quarter of its profit more than ten years ago. The airline reported a $112 million profit but that was boosted by $1 billion of revenue from its Frequent Flyer program and a $300 reduction in employment costs. For those of you interested in the real numbers, the company actually lost $302 million (see my chapter in Value.able on cash flow) and this can be explained by the very wide gap between the depreciation item in the profit and loss statement and the real expenditure on property plant & equipment. Depreciation looks backwards, but new planes cost more.

Here we are in the midst of reporting season and there are some reasonably predictable results. Qantas reported a profit today that was less than a quarter of its profit more than ten years ago. The airline reported a $112 million profit but that was boosted by $1 billion of revenue from its Frequent Flyer program and a $300 reduction in employment costs. For those of you interested in the real numbers, the company actually lost $302 million (see my chapter in Value.able on cash flow) and this can be explained by the very wide gap between the depreciation item in the profit and loss statement and the real expenditure on property plant & equipment. Depreciation looks backwards, but new planes cost more.Separately, JB Hi-Fi’s result was excellent but my concern is that its $94 million of cash flow (of which $67 million was allocated to dividends and $20 million allocated to paying down debt) is superfluous to its needs. Take a look at the biggest asset on the balance sheet – Inventory of $334 million. Then take a look at the creditors item in the current liabilities section. Almost the same amount!

Think about it this way; the suppliers are funding the inventory so the company doesn’t even need cash to pay have the stuff it sells and that are on its shelves. Actually it really does, the gap is about what is left over once we subtract the debt repayment and dividends from the cash flow. It is small though. Once the debt is gone and the cash keeps growing it may do something that could harm intrinsic value.

Now don’t get me wrong; JB Hi-Fi is an amazing business that retained its A1 status in this result and the risk associated with its plans to roll out more stores is very low. I also think intrinsic value will continue to rise at a satisfactory rate. The concern for me with all this cash (and there is no evidence of it yet) is that the company increases the dividend payout ratio again. This would mean a reduction in the rate of growth of intrinsic value. It could stop being the “compounding machine” it has been to date. Return on equity also appears to be flattening, which could mean within the next few years, the valuation may plateau (but at a higher level than the current price).

On an unrelated issue, I note that back on 4 May 2010, I put together a list of the companies that I though represented the last of value in a blog post entitled Do these three companies represent the last of good value? ITX was one of the companies listed and I note the company has announced “itX confirms that it is in discussions with an interested party regarding a preliminary non-binding indication of interest to acquire 100% of the ordinary shares in itX.”

I’m pleased to strike another one up for the quality rating and valuation approach advocated here at my Insights blog!

Posted by Roger Montgomery, 12 August 2010

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights.

- 29 Comments

- save this article

- 29

- POSTED IN Airlines, Companies, Insightful Insights.

-

Is JB Hi-Fi still a Roger Montgomery A1?

Roger Montgomery

August 12, 2010

JB Hi-Fi released its full year results in early August and Roger Montgomery has some interesting insights about the future of the retailer. Can JBH continue to generate very high rates of return on equity? Watch the interview.

by Roger Montgomery Posted in Media Room, TV Appearances.

- save this article

- POSTED IN Media Room, TV Appearances.

-

What do I think these A1 companies are really worth?

Roger Montgomery

July 6, 2010

If you recently ordered my book Value.able, thank you and welcome! You have joined a small band of people for whom the inexplicable gyrations of the market will soon be navigated with confidence and far more understanding. If you have ever had an itch or the thought; “there must be a better way”, Value.able is your calamine lotion.

If you recently ordered my book Value.able, thank you and welcome! You have joined a small band of people for whom the inexplicable gyrations of the market will soon be navigated with confidence and far more understanding. If you have ever had an itch or the thought; “there must be a better way”, Value.able is your calamine lotion.Its hard to imagine that my declaration to Greg Hoy on the 7.30 Report that Myer was expensive as it listed at $4.10, or elsewhere that JB Hi-Fi was cheap and Telstra expensive has anything to do with the 17th century probability work of Pascal & Fermet.

The geneology of both modern finance and separately, the rejection of it, runs that far back. From Fermet to Fourier’s equations for heat distribution, to Bachelier’s adoption of that equation to the probability of bond prices, to Fama, Markowitz and Sharpe and separately, Graham, Walter, Miller & Modigliani, Munger and Buffett – the geneology of value investing is fascinating but largely invisible to investors today.

It seems the intrinsic values of individual stocks are also invisible to many investors. And yet they are so important.

My 24 June Post ‘Which 15 companies receive my A1 status?’ spurred several investors to ask what the intrinsic values for those 15 companies were. You also asked if I could put them up here on my blog so you can compare them to the valuations you come up with after reading Value.able. Apologies for the delay, but with the market down 15 per cent since its recent high, I thought now is an opportune time to share with you a bunch of estimated valuations.

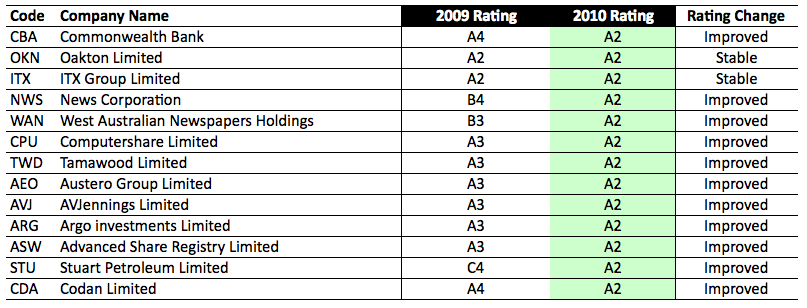

I have selected a handful from the 15 ‘A1’ companies named in my 20 June post and listed them in the table below. The list includes CSL Limited (CSL), Worley Parsons (WOR), Cochler (COH), Energy Resources (ERA), JB Hi-Fi (JBH), REA Group (REA) and Carsales.com.au (CRZ).

If you are surprised by any of them I am interested to know, so be sure to Leave a Comment. And when you receive your copy of my book (I spoke with the printer yesterday who informed me the book is on schedule and will be delivered to you very soon), you can use it to do the calculations yourself. I am looking forward to seeing your results.

The caveats are of course 1) that the list is for educational purposes only and does not represent a recommendation (seek and take personal professional advice before conducting any transactions); 2) the valuations could change adversely in the coming days or weeks (and I am not under any obligation to update them); 3) these valuations are based on analysts consensus estimates of future earnings, which of course may be optimistic (or pessimistic, and will also change). They may also be different to my own estimates of earnings for these companies; 4) the share prices could double, halve or fall 90 per cent and I simply have no way of being able to predict that nor the news a company could announce that may cause it and 5) some country could default causing the stock market to fall substantially and I have no way of being able to predict that either.

With those warnings in mind and the insistence that you must seek advice regarding the appropriateness of any investment, here’s the list of estimated valuations for a selection of companies from the 15 A1 companies I listed back on 20 June.

Posted by Roger Montgomery, 6 July 2010

by Roger Montgomery Posted in Companies, Investing Education.

- 58 Comments

- save this article

- 58

- POSTED IN Companies, Investing Education.

-

Toothpaste and lounge chairs – which is the easier investment decision?

Roger Montgomery

June 5, 2010

“Roger, would you buy Nick Scali (NCK) over the likes of TRS, ORL and JBH?” This last week, its been a frequently asked question.

“Roger, would you buy Nick Scali (NCK) over the likes of TRS, ORL and JBH?” This last week, its been a frequently asked question.Let me start by saying that I consider Nick Scali to be a high quality business. While the business listed in May 2004, I have run my ruler over the business financials since the year 2001. In every single year its been an A-Class company and an A1 in most. This is impressive. Few businesses have such an excellent track record, which speaks highly of management.

Indeed, given my tough quality and performance criteria, NCK would be in the top 5% of all companies listed on the ASX.

But are high quality financials and a good track record of performance enough to justify buying a business?

Let’s consider the businesses of NCK and The Reject Shop – another high quality retailer.

NCK is engaged in sourcing and retailing of household furniture and related accessories. The Company’s product portfolio includes chairs, lounges, outdoor, dining, entertainment – what are called ‘big-ticket’ items as well as and furniture care products. It has 28 showrooms located in New South Wales, Victoria, Queensland and South Australia under the Nick Scali brand, and additional showrooms in Adelaide under the Scali Living and Scali Leather brand.

TRS on the other hand is engaged in discount variety retailing. Its footprint of around 187 ‘convenience’ stores is focused on low price points, offering a wide variety of merchandise. Stores are spread throughout Australia.

TRS has an exceptional history of quality and performance, and in that respect is not dissimilar to NCK.

While NCK and TRS both have top tier fundamentals, there is one major difference; their business models. And this is the important difference that puts TRS far ahead of NCK in my mind from an investor’s perspective.

Consider the economic cycle and the impact it could have on each business; NCK is a retailer of ‘big ticket’ items and TRS is a retailer of ‘low price point items’. Cast your mind back just a few years to when the stock market was crashing, and depression talk filled the media. Do you think spending on big-ticket items like a sofa or a $2 tube of parallel imported toothpaste selling at a cheaper price than a major supermarket, would have been reined in first? This is where TRS offers arguably a more stable and slow-changing revenue stream. TRS of course has its own issues and risks, just as any business has, but the stability of earnings is perhaps superior to that offered by NCK.

TRS has positioned itself as providing ‘low price points’ on everyday goods. Things you always need – daily essentials. I’m guessing you wouldn’t stop brushing your teeth, even during a credit crunch, but you may defer the purchase of that new sofa or outdoor furniture. TRS gets you in by offering really low prices on the daily essentials and then tempts you to fill your basket with other cheap items that have a higher margin for the retailer.

The problem for investors deciding between TRS and NCK is therefore not the quality of each business – they are both very high quality and have excellent management teams – it lies in the cyclical nature of NCK’s earnings.

After determining the quality and risks for a business, the next step is determining its intrinsic values. If you don’t complete this step, you are not investing, you are speculating.

Now to me, investing in a business like TRS is a fairly straight-forward decision. An investment decision in NCK on the other hand requires much more thought about consumer sentiment toward big-ticket discretionary purchases and how susceptible leveraged households are to increases in interest rates. Buffett once said find the one-foot hurdles that you can step over.

I’m not saying I would never buy shares in NCK. There is always a time and a price at which even a cyclical business is cheap, provided its of the highest quality of course. I just prefer to stick to the one-foot hurdles rather than trying to jump over seven footers.

I’m off to brush my teeth. Don’t forget to leave your thoughts.

Posted by Roger Montgomery, 5 June 2010.

by Roger Montgomery Posted in Companies, Consumer discretionary.

- 40 Comments

- save this article

- 40

- POSTED IN Companies, Consumer discretionary.

-

Who has time favoured the most?

Roger Montgomery

May 21, 2010