Market Valuation

-

MEDIA

What are David Buckland’s insights into Small Cap Mining stocks?

Roger Montgomery

November 6, 2012

Do Imdex (IMD), Sundance Resources (SDL), Woodside (WPL), Axiom Mining (AVQ), Seven West Media (SWM), Silverlake Resources (SLR), Mesoblast (MSB), Titan Energy (TTE) , Metcash (MTS), Emeco (EHL) or Magellan (MFG) achieve the coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call 6 November 2012 program now to find out, and also discover how David approaches investing in small cap mining stocks. Watch here.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, TV Appearances.

-

MEDIA

It’s a Tasty,Tempting Mix

Roger Montgomery

November 1, 2012

In his Money Magazine November 2012 article, Roger highlights the ongoing competitive advantage of Breville Group (BRG). Read here.

by Roger Montgomery Posted in Companies, Market Valuation, On the Internet.

- save this article

- POSTED IN Companies, Market Valuation, On the Internet

-

MEDIA

Go against the flow and thrive

Roger Montgomery

October 27, 2012

In this Australian article published 27 October 2012 Roger discusses how behaving counterintuitively may result in better performance for your portfolio. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Investing Education, Market Valuation.

-

Gunns collapse. If only they’d been Skaffold members!

Roger Montgomery

September 29, 2012

Chalk up another win for Skaffold members.

Substantial capital losses are difficult to make back and irrespective of whether you are still in accumulation mode, retiring or retired it is essential to avoid major losses. One way to do this of course is to diversify and ensure that losses are mitigated through position sizing. Another technique and the one we will discuss here, is to simply avoid the companies most likely to collapse.

This week Gunns (ASX:GNS), was placed into voluntary administration and happily for Skaffold members it is unlikely that anyone owned shares.

Gunn’s was never investment grade. Anyone who purchased the stock from 2003 onwards were taking a massive risk and Skaffold can explain why.

Skaffold’s Verdict (Figure. 1) is a picture of danger.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

Overnight Wednesday in Europe

David Buckland

September 28, 2012

After jumping nearly 20% over the September 2012 Quarter, Wednesday saw the leading 50 European blue chip stocks from 12 Eurozone countries, as measured by the STOXX, decline by 2.7%. The Spanish market, which had rebounded 35% from its low point in early July, fell 3.9%. On Thursday, Spanish Prime Minister Rajoy announced his fifth austerity package in nine months of Government. The target is to cut the budget deficit from 6.3 percent in 2012 to 4.5 percent in 2013.

Economists responded by saying “they’ve increased the taxes for next year and cut spending but they didn’t change the growth forecast”. Economists expect the Spanish economy to contract around 1.5%, while the Government is forecasting a contraction of only 0.5%. With their ten year bonds selling above 6%, Spain will likely need to raise the white flag and go “cap in hand” to the European Central Bank for another bail-out. Spain’s declining property market and 25% unemployment is causing a significant solvency issues for their banking system, as the contraction of private sector lending continues.

continue…by David Buckland Posted in Insightful Insights, Market Valuation, Value.able.

-

US influence on Aussie market waning. For how long?

Roger Montgomery

September 22, 2012

Recently the media cottoned onto the fact that the Australian stock market, as measured by the major indices, has not kept pace with the US market, which is now hitting all time highs (on a total return basis). You can see from Chart 1 that the US market is most certainly outperforming the Aussie market and it seems all the ‘Go Australia’ cries are falling on deaf ears. Indeed, Australia really needs to be shouting ‘Go China’ but more on that in a minute. Since June 2011 the US market has been pulling away. The reports did not go on to explain the reason for the divergence however we have previously explained that with credit growth virtually non existent the banks would not be able to justify sustained substantial gains and with our thesis on iron ore calling for much lower prices, we couldn’t see how the big material stocks were going to rise. Combined the banks and materials stocks account for a significant portion of the index weighting and without those sectors running, there is no way the All Ords can. We also think China has a little to do with it all.

Chart 1

Take a look at Chart 2, which plots the Aussie market against the Chinese Shanghai index. Since about the same time last year, the Chinese market has been falling and given that are large part of our economy is tied to the fortunes of China, it makes sense that the prices of those companies with direct (and indirect through consumer sentiment) exposure and a significant weighting to the index locally, would have an adverse influence on the Australian market.

What is also clear is that our strong Australian dollar is not reflecting foreign demand for our shares. And what does that tell you?

Chart 2

by Roger Montgomery Posted in Insightful Insights, Market Valuation.

-

It’s a Bear Trap! Be fearful when others are greedy

Roger Montgomery

September 17, 2012

Its no news we have been warning investors about the risk of declining iron ore prices since late calendar 2011. Most recently we have been warning of a bear trap – the risk associated with buying stocks when they appear to be ‘cheap’ because they have fallen a long way but poor fundamentals are likely to see prices even lower.

Figure 1 outlines how The Montgomery Funds have been thinking about China, Iron Ore and our big miners.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation.

-

New ASX Investment Talk – Beating the Index

Roger Montgomery

September 14, 2012

Join Roger as he explains how the long-standing principles of value investing can be applied so that you too can identify A1 businesses for your portfolio and beat the index. Watch here.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, Investing Education, Market Valuation.

-

Big Apple?

Roger Montgomery

September 12, 2012

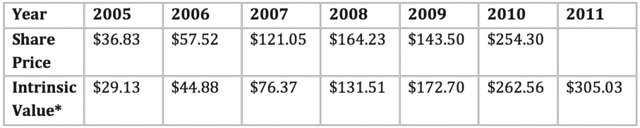

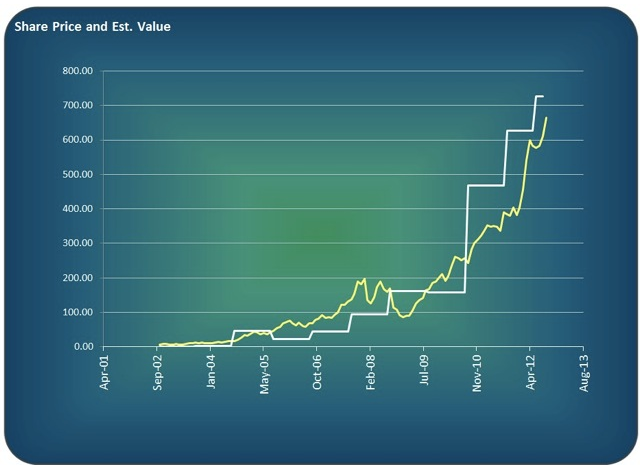

Did you know that the market capitalisation of Apple Inc. is now more than the entire equity markets of Spain, Portugal, Ireland and Greece combined? Its stunning. Surely Forrest Gump from Greenbow Alabama would be writing to Jenny with much enthusiasm. But what about its intrinsic value? Back in 2010 (http://rogermontgomery.com/is-apple-an-a1/) I wrote that Apple’s intrinsic value was higher than the share price at the time. The table below first published in July 2010 reveals the company’s pattern of rising intrinsic values. back then the price was indeed showing a small margin of safety.

A couple of blog readers have subsequently told me they purchased Apple shares and obviously they have done nicely. But what about today?

Only last year, when the share price hit $600 I wrote that I thought price had run ahead of intrinsic value (but not forecast intrinsic value) and the share price subsequently fell slightly. We also noted declining margins and market shares losses. But improving quarterly results and rising forecasts means revisions have resulted in IV estimates continuing their stellar rise so a revisit of our assumptions might be worth our time.

The graph below reveals that our ‘revised’ back-of-the-envelope intrinsic value estimate for Apple is forging ahead. If you are confident that Apple’s pipeline of products will usurp the competition, take back market share and fill Apple’s coffers towards 1000 billion dollars and that the iPhone 5 – expected to be revealed this week – will knock everyone’s socks off, then the massive rises in intrinsic value, might not seem so extreme.

Of course all intrinsic values are just estimates and while our haven’t done too badly for us – we’ve been spot on with BHP at $30 and done well on others – the reality is they can change dramatically as new information comes to hand.

So lets keep an eye on whether Apple impresses this week with its new release.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, Value.able.

-

Reporting Season – Emerging Conclusions

Tim Kelley

August 30, 2012

Reporting season is a busy time for us at Montgomery Investment Management. Studying results announcements is one of the ways we try keep on top of what is happening in the market and identify economic trends and investment opportunities.

We do this in a fairly systematic way. Every day we review, evaluate and catalogue every last results announcement made that day. As I write, we have reviewed several hundred sets of financial statements and the accompanying commentary, representing around $700B of aggregate market capitalisation, with many more still to come.

This analysis draws our attention to individual companies that are performing well, and complements the automated stock screening tools we use, including Skaffold. It also gives us a sense of broader economic trends and the relative health of different parts of the economy.

by Tim Kelley Posted in Companies, Insightful Insights, Market Valuation.