Investing Education

-

How do Value.able graduates calculate forecast valuations?

Roger Montgomery

October 1, 2010

I know of no other book in the world that discusses the concept of calculating future intrinsic values. You may think that is a bold statement, but its true. I have seen many books that claim to reveal Warren Buffett’s intrinsic value formula, but not one that lays out, step-by-step, what investors need to look at to determine whether intrinsic value is rising at a satisfactory rate in the future.

I know of no other book in the world that discusses the concept of calculating future intrinsic values. You may think that is a bold statement, but its true. I have seen many books that claim to reveal Warren Buffett’s intrinsic value formula, but not one that lays out, step-by-step, what investors need to look at to determine whether intrinsic value is rising at a satisfactory rate in the future.I confess to chuckling recently when one investor told me that they were finding it a little difficult to source the data they needed to calculate future intrinsic values. They also believed that my book lacked an explanation for how to calculate future intrinsic values.

So I asked whether or not they had even thought about future intrinsic values before having read Value.able? Sheepishly, the investor accepted that my book was much more valuable than they had initially concluded and subsequently told other people.

I have not found any other book in the world that has taken that little Buffett quote about finding businesses growing intrinsic value at a “satisfactory rate” and making it part of a clearly explained and defined investing process.

And for those of you who are looking for a reference to forecast equity per share in Value.able…. see Page 188, Step A.

The missing worked example for future equity. It’s easy!

How can you estimate future equity if you don’t have a forecast number such as those readily available in analyst research notes? It’s easy. Take the last known equity per share figure, add the estimated profits, subtract the estimated dividends, add any capital raised through new shares issued and subtract any equity paid back to shareholders through buybacks and you have it.

Here’s an example: In the 2010 annual report for The Reject Shop, equity at 30 June 2010 was $51.543 million (click here to see) and there were 26.034 million shares on issue. Dividing the 2010 ending equity by the shares on issue ($51.543/26.034) equals equity of $1.98 on a per share basis.

According to Commsec (click here to see), consensus analyst estimates for 2011 earnings per share and dividends per share are $1.028 and $0.744 respectively.

Starting with the 2010 equity per share of $1.98, add the earnings per share of $1.028 and subtract the dividends per share of $0.744 to arrive at an estimated ending equity for 2011 of $2.26. (If you are aware of any shares issued since the end of the financial year, you may want to take the amount raised and divide it by the number of shares issued and then add that result to the $2.26)

Now that you have seen it done, how easy is that?

A global movement begins!

I couldn’t be happier that a small group of passionate Australian value investors are even contemplating future intrinsic values! Nobody in the world is presenting you with estimates for intrinsic values, two, three or four years out and I have never seen any investor ever do it. I know of nobody else in Australia doing that, nobody has written about it before and I haven’t ever come across anyone else in the international business media discussing it either.

And now you are all doing it! It has become part of your vocabulary.

Think about that for a minute… after reading Value.able, investors are now estimating future intrinsic values, posting their estimates at my blog and Facebook page,and chatting about them online in forums and in boardrooms where previously nobody was.

If before reading Value.able you weren’t discussing future intrinsic values and now you are, then my book has had a positive impact and I am delighted. And all for just $49.95!

Consider how you are now subconsciously framing your investing decisions with future intrinsic values in mind.

Warning!

Don’t blindly combine numbers with Value.able’s valuation tables to produce intrinsic values. As I say in my book, you MUST understand the business and its prospects. I devoted an entire chapter to cash flow and its calculations. Don’t ignore it. I also devoted an entire chapter to competitive advantages. Don’t ignore that either.

Recently, Buffett sold down his holding in Moody’s because it had lost some of its competitive advantage. He isn’t selling because he has recalculated intrinsic value. It’s the competitive advantage that drives the intrinsic value.

Be careful you aren’t so focused on the intrinsic value number that you ignore all the other important factors.

Its one of the reasons I have my Montgomery Quality Ratings (MQRs). They are my own filter to help narrow the universe of companies to conduct further research on.

I put a lot of effort into writing my book and making an investment plan out of the best of what the world’s most successful investors have revealed, published and taught. And I am delighted that you have allowed me to share that with you. Thank you.

Where do I get the raw data Roger?

I have previously posted a document called ‘Source Data’, where Value.able graduates contributed their solutions to obtaining the data. Because I am receiving so many requests for help finding the data, I thought it useful to republish it. Click here or click the Value.able Source Data button to the right.

I was saddened to hear that one Value.able reader thought getting the data was all too hard and gave up. That’s like knowing there’s silver and gold a metre under your feet but saying that grabbing a shovel and digging is just too hard. If you don’t want to do the work that’s fine, but please don’t blame the guy who gave you the map, the pick and the shovel.

Using the information in my Source Data document, you should now be in a rock solid position to start estimating future intrinsic Value.able values.

Take a look at the Source Data document and you will see that the raw data is freely available. Indeed every single number you need to estimate the current intrinsic value is also available in a company’s annual report, and its all free at ASX.com.au.

With sources like Commsec and the formula I have given you for future equity, you can now freely estimate the forecast intrinsic value as well. Just go to ASX.com.au, click on the announcements link, select the company code and the year you need and voila! All the information is there in the annual report.

Value.able outlines the way I invest. I don’t have a green button that I press each day that automatically goes and buys the best opportunities. Value investing requires research and analysis. We can build devices that give us some short cuts, but they don’t replace the need to understand the business and the risks.

Why are my valuations different to Roger’s?

If everyone uses exactly the same inputs, our Value.able valuations will all be identical. Any differences therefore are due to different data. Some examples of sources of variation are:

- Online brokers’ ROE numbers are calculated differently to the way I suggest in Value.able. They use ending equity and I suggest average equity.

- Generic net profit after tax figures available on various online summary lists may or may not remove abnormal/significant or non-recurring items. Intrinsic values should be based on recurring profits, revenues and expenses. (Yes there is some subjectivity in this).

- I have noticed many of you using 10% discount rates for all companies. As I suggest in Value.able, this may be too low in some cases.

There are a variety of reasons and your Value.able valuations are different to mine.

Recently on TV I indicated that my valuation of Telstra was closer to $2.30-$2.50, but one Value.able graduate produced $3.68. I suspect that the difference is simply the choice of discount rate. Many investors will use a low discount rate because TLS such a big company with plenty of liquidity and very low risk of significant change. I however might use a higher rate because I want compensation for the fact that its future prospects are opaque and its profits haven’t grown a dollar in a decade.

Thinking about differing results, I am encouraged that many Value.able graduates were able to replicate my results exactly, or within a couple of cents.

Value.able will stand the test of time because it is based on a method of investing that works. It is a method of investing that requires time to demonstrate its value. And in time I look forward to hearing many more of your success stories.

Only a few First Edition hardback copies of Value.able remain. So if you haven’t purchased your reserved copy yet, now is not the time to ponder.

There was only one print run of the First Edition hardback. The paperback Second Edition will be available in mid November.

Posted by Roger Montgomery, 1 October 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Will QR National be a Value.able company?

Roger Montgomery

September 27, 2010

Pretty soon, the QR National prospectus will hit your mailboxes. Its the biggest float since Telstra’s 2006 offering and the second largest in Australia’s history, so the PR companies and the communication consultants will be out in force doing their job for the vendors. But who will represent the buyers? We will! Value.able Graduates, sharpen your pencils! If you have any thoughts to share right now, go ahead. We already have received a number of comments:

Pretty soon, the QR National prospectus will hit your mailboxes. Its the biggest float since Telstra’s 2006 offering and the second largest in Australia’s history, so the PR companies and the communication consultants will be out in force doing their job for the vendors. But who will represent the buyers? We will! Value.able Graduates, sharpen your pencils! If you have any thoughts to share right now, go ahead. We already have received a number of comments:Lloyd says:

“Your summary of the pending QR National IPO at the start of Your Money Your Call and the parallel discussion in the Eureka Report are on target, with one exception, that of Business Leadership which is the dead elephant in the room that no one seems willing to discuss. So I’ll raise the topic here. Management at QR National are some of the same people that arguably ran BHP onto the rocks in 1998. The problem that led to the disaster was that of the arrogant culture of the “Big Australian”. The culture led to massive errors in capital allocation in a capital intensive industry with disastrous consequences for shareholders that continued for a long time. Fast forward to the QR National IPO advertising campaign. Notice the parallels in the advertising for the for the float with the “Big Australian” ethos of the nineties? And QR National is a very capital intensive business with massive structural and business cultural deficiencies that are the result of its existence to date as a Government owned sheltered workshop. The leadership ethos appears to be such that the “planets are aligned” for shareholder value destruction on yet another grand scale. Regards, Lloyd”

Lloyd’s observation that some people who ran “the big Australian” during arguably, its dark days, are those involved now with the campaign to “be involved in something BIG” at QR National is well worth thinking about and speaking to your advisor about before subscribing.

At a dinner party on the weekend the subject of QR National came up and what is interesting is that the campaign is leveraging the well-known ‘China-needs-our-coal’ theme. But outside of the financial markets sentiment towards coal is not inspiring. Many retail investors believe coal is dirty, the cause of global warming and on its way out. CEO Lance Hockridge has previously rejected invitations to discuss climate change and as Paddy Manning of The Sydney Morning Herald noted on Saturday: “In 2007 a NASA climate scientist, James Hansen, likened coal trains to ”death trains – no less gruesome than if they were boxcars headed to crematoria, loaded with uncountable irreplaceable species’‘.

While diesel trains may be better for the environment than trucks, the 200 million tonnes of coal QR National carries per annum (2/3rds of the nations export volume) is not. Perhaps the retail component of the offering may not be as easy as previously expected. Paddy Manning again:

“Last week Professor Ross Garnaut, author of Australia’s 2008 Climate Change Review, told ABC Radio he thought world coal demand would peak before 2020 unless carbon capture and storage (CCS) – or some other use for massive carbon dioxide emissions – succeeds.

Garnaut is not pessimistic about CCS being commercially viable at scale in the right locations. But the Chinese want their demand for coal to peak before 2020, and while he admits that’s ”not a certainty”, Garnaut thinks there are ”reasonable prospects of China achieving objectives along these lines”.

”China over recent years and in the years immediately ahead represents a large majority of the global growth in coal use, and with other developed countries seeking to reduce total emissions absolutely by substantial amounts, such a change in trajectory in China would be likely to be associated with a peaking over the next decade in global coal use.”

Investors want a growth story. If the idea gets about that coal demand might peak within a decade, it could seriously weaken demand for QR shares.”

On the other hand, it is noted by many that Australian coal tends to produce lower emissions per unit of energy and steel production in the case of coking coal (our coal is a higher quality). With climate change on the agenda, demand for Australian coal could increase even when coal demand globally is falling.

The marketing machine has its work cut out but if hype can get even the biggest floats over the line, our job here will be to cut through it and answer a simple question.

Should you invest in QR National long term?

Lets get the conversation going with a couple of simple bullet points:

- 1. Strongly supportive themes; privatisation, commodity demand, and a monopoly (monopolies are great businesses to own and QR National owns 2300kms of track on which it will deliver 160 million tonnes of coal annually)

- 2. ABARE says coal volumes will rise more than 9% next year

- 3. Chinese demand to peak before 2020

- 4. Private interests have already tried to buy the below rail assets for $4.85 billion and the above rail assets for $2 billion

- 5. 2011-2012 EBITDA forecast by float promoters of $1.1 billion (never ask the barber whether you need a haircut)

- 6. EBITDA for a capital intensive business is NOT what the investor owns! The company will have plenty of interest to pay on $2 billion of debt then, lots of equipment to maintain and replace and a not shortage of tax

- 7. Capital intensive business

- 8. Low return on equity forecast for 2012 – after a two year turnaround program

- 9. Moving from government ownership to private ownership should make the company more efficient

- 10. Old contracts signed on uncommercial terms will roll off and new contracts will immediately boost revenue and profits (some newspapers suggest 22% increase in profits to $1.1 billion)

- 11. Tens of thousands of job cuts have already been made – perhaps the low hanging ‘cost cutting’ fruit has already been picked?

- 12. Chinese demand for coal will always be strong?

- 13. Coal prices will always be high?

- 14. Unions campaigning against the sale of state assets note that Telstra and Brisconnections were bad floats for investors

Brokers have estimated an enterprise value of between six and a half and nine and half billion dollars. I am not sure however what debt figures they have used (whether it is the $500 million QR National will start with or the $2 billion its expected to draw down in the next couple of years). Assuming $500 million, the promoters therefore may be reckoning on a market cap of around $7 billion. Of course never ask a barber whether you need a haircut!

QR National expects to boost pre-tax profits from $204 million to $427 million this financial year, and by 35 per cent to $578 million in 2011-12. But this could at least partly be attributable to a reduction in interest from the repayment of loans. In any case, investors own post tax profits which would reasonably be estimated to be about $390 million – a 5.5% return on contributed equity?

You should ignore the comparisons of P/E that will inevitably be seen. Comparing the P/E of QR National to, for example, Asciano, may be as useful as comparing the P/E of Myer to the P/E of David Jones at the time of the float – both fell precipitously after the money was in the vendor’s pockets.

Another thing to be careful of looking at are the stats available on other large Australian Commonwealth privatisations. Bank West, CSL, CBA, GIO, SGIO, Tabcorp and Unitab were all outstandingly successful examples, generating double digit returns annually for investors and Bank West GIO, SGIO, NSW TAB and Unitab were all taken over. But Qants and Telstra have been duds and the annual return from NSW TAB was not so crash hot, despite its takeover. The message is that yes, there are profts to be made from privatisations but only from those where economic value has been added.

The prospectus for QR National will invariably focus on growth – growth in revenues, growth in profits, improvements in efficiencies.

The price to pay however will be determined by the equity and the return that equity can generate. That is something we’ll focus on here.

For now we all await your thoughts. When the prospectus is released we’ll have a good look.

In the meantime, please contribute your thoughts, valuation estimates and any other insights you have.

If you are considering an investment in QR National, be sure to seek and take personal professional advice and you can come here for insights that will generate the questions to ask your adviser.

Posted by Roger Montgomery, 27 September 2010.

UPDATE – The Sydney Morning Herald (Passengers sought for latest float) and The Sunday Age (Board QR National float with caution) have published my insights in the past week.

by Roger Montgomery Posted in Companies, Investing Education.

- 85 Comments

- save this article

- POSTED IN Companies, Investing Education

-

TV this week Roger?

Roger Montgomery

September 22, 2010

Yes! Bridie Barry, Peter Switzer and Kim Slater have invited me to appear on three shows tomorrow (Thursday) night on the Sky Business Channel.

First at 6.30pm is Market Moves with Bridie Barry.

Then at 7pm Peter Switzer and I have something very special planned. Our mission? To create the Switzer Montgomery Portfolio. Only businesses that pass the Montgomery Intrinsic Value and Quality Rating and Switzer Scaredy Cat Wise Investor Test will be admitted. This is one not to be missed.

And I will finish off the night answering your questions on Your Money Your Call. The number at the studio is 1300 303 435 (lines open at 8pm) or email your questions prior to the show to yourmoney@skynews.com.au.

Upcoming appearances are posted on the Talks page here at my blog and also on Facebook. If you miss any of the shows, I publish the highlights to my YouTube channel shortly after.

Posted by Roger Montgomery, 22 September 2010.

If you missed my appearance on Switer TV last week, here are the highlights.

Part I: How do Roger Montgomery and Peter Switzer select stocks for the Switzer Montgomery portfolio?

Part II: What stocks make it into the Peter Switzer Roger Montgomery portfolio?

by Roger Montgomery Posted in Investing Education.

- 66 Comments

- save this article

- POSTED IN Investing Education

-

Part IV: Where should you focus your digging?

Roger Montgomery

September 15, 2010

While everyone else seems to have moved on from reporting season, I’m still digging my way through a mountain of analysis. I am almost done.

While everyone else seems to have moved on from reporting season, I’m still digging my way through a mountain of analysis. I am almost done.Based on the amount of comments contributed here at my blog it seems you have enjoyed reading my insights as much as I have enjoyed sharing them.

Before I get into what I have uncovered from last week’s filings, congratulations are in order. Gavin was the first Value.able Graduate to correctly pick the three companies I omitted from Part III’s second table – congratulations Gavin. Gavin picked all three despite there being thousands of companies listed on the ASX and only having six pieces of financial data. Amazing!

Congratulations are also in order to Mike and Pat, who picked all three. Great digging fellow Value.able Graduates!

The missing companies are ARB Corporation (ARP), Wotif.com (WTF) and Mineral Resources (MIN).

As always, please undertake your own research and seek and take personal professional advice before you go rush out and buy anything.

I also wanted to say a big thank you to all who have posted comments. Our Value.able investing community has benefited greatly from your contributions and insights and I am excited by the great sense of community that you have developed. I must say a special thank you to our regular contributors – the quality of your comments are amazing, and more importantly, respectful and non-judgmental. Keep them coming!

If you haven’t yet posted a comment, now is a great time to start. The Value.able community is here to share ideas and help each other. If something is on your mind, I guarantee there is someone else with a similar question. So please contribute as much as you can or ask as many questions that you may have.

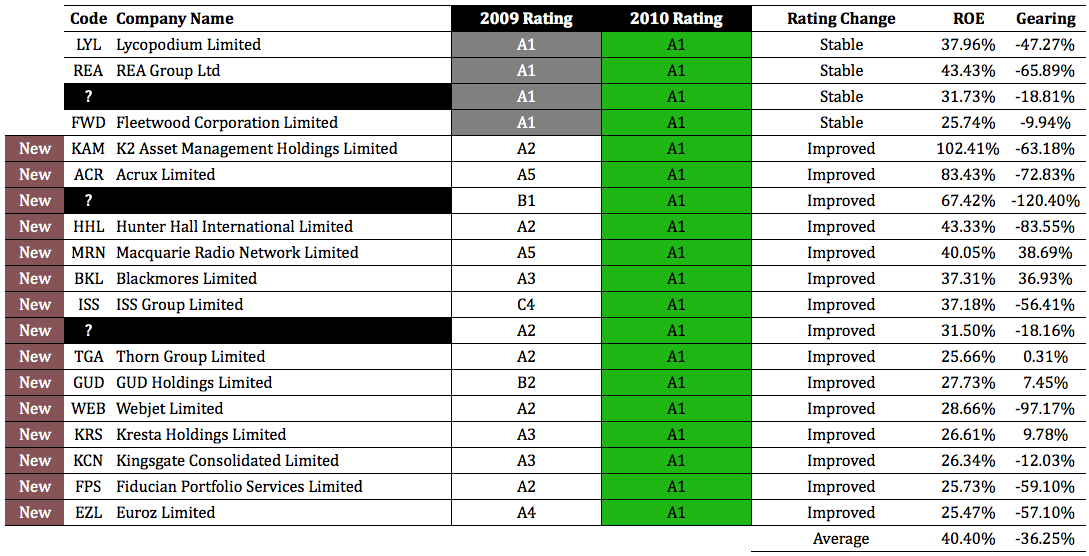

Now onto my lists – despite all my digging, there is only one new entrant into my A1 Montgomery Quality Rating this week. With three companies experiencing rating declines, on a net basis we actually lost two A1s. You can see them below.

Dominion Mining (DOM) had the largest rating decline, from an A1 to an A3. It still displays high quality metrics – with $16m in cash on the balance sheet and no debt (just watch out for those capitalised exploration expenditures), but my Montgomery Quality Rating declined. Why?

As you know, I tend to shy away from commodity businesses. It is not that they are difficult to understand, but rather difficult to forecast with a great deal of confidence – forecasting how much they will produce and when, their cost of production and/or project establishment and development costs and then ultimately, what price they will get for their production. There are simply too many variables that management can get wrong and many that are completely out of their control.

To this point I proffer Dominion (ASX: DOM), which in the most recent financial year, despite a higher average gold price, saw production slip from 98,755 ounces to 80,570 and cash production costs blow out from $438 to $697 per ounce. The combination of lower production and lower efficiencies transformed a highly profitable business into a barely profitable one in the space of 12 months. Now that’s operating leverage!

Indeed if you took all of the hitherto-labelled ‘resource evaluation and mine development expenditure’ expenses straight to the Profit and Loss account as opposed to the Balance Sheet, DOM would have made a loss of several million.

Given the many variables and accounting flexibility, if exposure to this sector is your goal, perhaps your focus could move from those who ‘look for’ and ‘produce’ to those who ‘service’ – the suppliers of the picks and shovels and those engineering businesses that install, maintain and replace all the picks and shovels. In my opinion, there are fewer variables and the economics haven’t changed since the days in 1851 when a gold rush in Ballarat saw 10,000,000 grams of gold delivered to Melbourne’s Treasury.

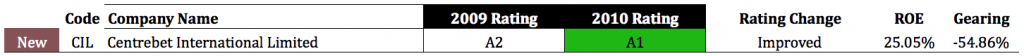

Back to my A1’s… the only entrant this week is Centrebet International (CIL). Remember that this is in addition to the 30 revealed so far in my previous posts – Part I, Part II and Part III. My A1’s now total 31.

CIL is in the business of online wagering and gaming and appears to have carved out a niche in Australia’s multi-billion dollar gambling market.

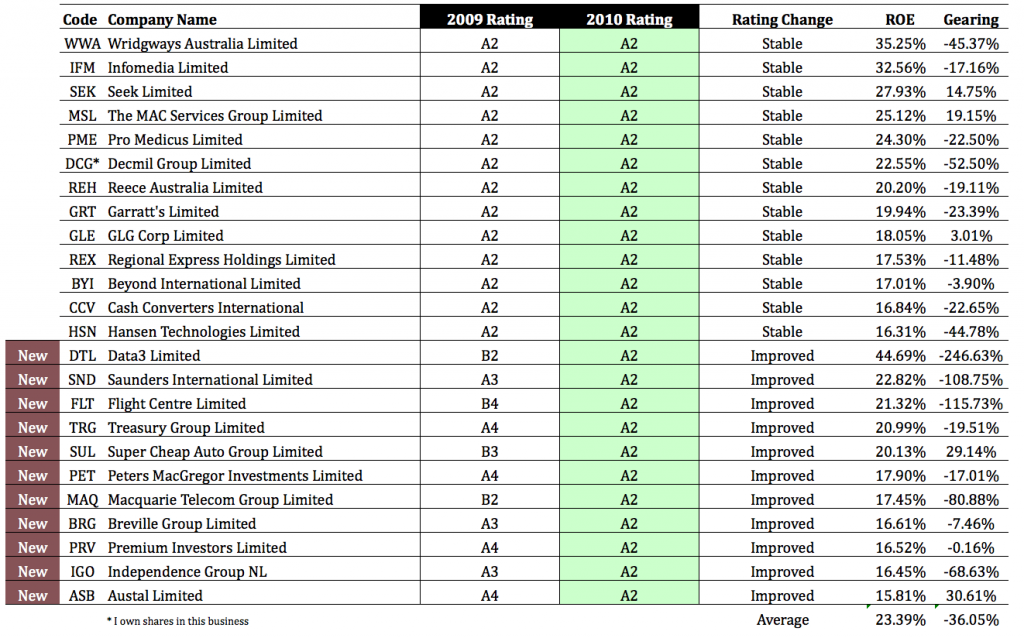

Take a look below and you will also see those companies that have achieved an A2 Montgomery Quality Rating since my previous blog post. The average ROE of this group is an impressive 23.39% (albeit around half that of my A1’s) with an average gearing level of -36.05%. There are plenty of Balance Sheets here reflecting a net cash position.

Combine my A1s and A2s (78 in total) published in the past couple of weeks and you have an excellent starting point from which to begin your own digging (by doing your own research and seeking independent personal and professional advice).

I will also mention that I may own any of the above companies and that I may buy or sell at any time – even tomorrow, and I am under no obligation to keep the list up to date in any way, shape or form. Before you do anything, YOU MUST conduct your own research and I insist you obtain independent personal and professional advice considering your needs and circumstances.

Value.able gives you the simple steps to follow to estimate a value for each company yourself and some thoughts to consider in regards to qualitative factors, such as competitive advantage. If you are not already a Value.able Graduate, why not?

Also remember that the share price may halve tomorrow. DO NOT buy shares in any company simply because I like it or own it – that is not investing, that is speculation. Speculating that I am right is not investing. That is the exact opposite of the value investing doctrine I espouse.

Reporting season will soon be a distant memory and the media, analysts and ‘investors’ will start to think about other things… the economies of the US, China and Europe will start to tickle the minds of idle analysts and commentators, but your focus should remain on great quality companies trading at very big discounts to intrinsic value.

Posted by Roger Montgomery, 15 September 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

What is my SMSF investment strategy?

Roger Montgomery

September 10, 2010

That’s what Peter Switzer asked me on Wednesday night on the Sky Business Channel. My response? I focus on A1 businesses that I need to focus on the least (just twice a year when half and full year results are released). As for the stocks… you’ll have to watch the interview.

Switzer TV with Peter Switzer was broadcast on 8 September 2010 on the Sky Business Channel. Click here to watch other interviews at my YouTube Channel.

Posted by Roger Montgomery, 10 September 2010

by Roger Montgomery Posted in Companies, Investing Education.

- 31 Comments

- save this article

- POSTED IN Companies, Investing Education

-

Part III: The avalanche is over – where should you be digging for A1s?

Roger Montgomery

September 7, 2010

More than 900 companies reported their results over the past 3 weeks and having reviewed the bulk of them, some still remain. I should have completed digging through the reporting season avalanche within the next week or two. You will have to bear with me for a little while longer.

More than 900 companies reported their results over the past 3 weeks and having reviewed the bulk of them, some still remain. I should have completed digging through the reporting season avalanche within the next week or two. You will have to bear with me for a little while longer.Rest assured that the companies that are amazing and who deserve a place in the ‘investment universe’ have been prioritised and covered first. While some of the businesses left to cover may make it in, overall I expect that I have broken the back of reporting season and already uncovered in the main those worth focusing on.

So since my last update you may be wondering what has transpired.

Firstly, Information Technology and Mining/Oil & Gas Services sectors have continued to stand out, with a number of additional companies receiving high MQRs (“Montgomery Quality Ratings”). To this we can add businesses that I generally classify as ‘financial services’, for example funds management.

Secondly, there are a number of new entrants into my A1 list this week – 19 in total. This is in addition to the 11 uncovered in my previous posts – Part I and Part II. My A1’s now total 30.

To get to the magic number of 19 for this week there are 15 outright new inclusions, four that continued to hold the rating from last year and eight businesses that experienced a MQR decline. That’s a net increase of 11 businesses with MQRs of A1.

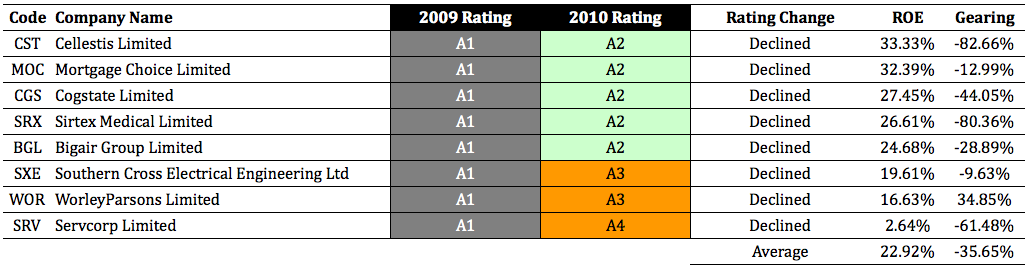

Of the eight businesses that received lower MQRs, all due to specific business issues, Servcorp (SRV) Limited saw the largest decline, followed closely by Worley Parsons (WOR) and Southern Cross Electrical (SXE).

Worley Parsons experienced a number of project delays and deferrals. In particular, services in the Canadian oil sands and minerals & metals sectors, coupled with a material downturn in the United States power markets appear to be the main issues. Also, with a large segment of the business’s operations being conducted in foreign currencies, the continued strength of the Australian Dollar impacted the translation of profits to the tune of $41 million. All these factors had a significant impact on profitability and performance. While Worley remains a very high quality company, the business’s performance slipped.

Southern Cross Electrical was also impacted by delays and project deferrals. In this case the uncertainty around the proposed Resources Super Profit Tax (RSPT) and operational issues following the resignation of the Managing Director appears to have impacted on the frequency of tendering activity and subsequently, the awarding of new projects. All of this – because of the operating leverage inherent in the business – reduced SXE’s margins and profitability.

Servcorp experienced the largest performance decline, falling from 1 to 4 (5 is the lowest). This was mostly due to the $80 million capital raising in October last year, in order to aggressively expand the business. Only time will tell if new management are able to get the business back to its former A1 status. New, wiz-bang ads alone won’t do it, although they may help.

Now don’t go panicking about these companies or their downgraded status. It’s not as though they are C5s! A2 and A3 can be regarded as investment grade (with a smaller allocation), although I would adopt a wait-and-see policy with an A4.

The second table reveals the 19 additional A1s.

If you look to the bottom right of this table you can see the average ROE reported by my A1 list of businesses is an impressive 40.40% – significantly higher than the All Ords average ROE of 9.54%.

Also impressive is the average gearing level of my A1’s at -36.25%. The negative number means that many of the businesses are debt free and have plenty of cash. If you read my McMillan Shakespeare post, you should now see why I avoid businesses that are geared; there is a ready supply of other quality players to look at that aren’t laden with debt.

At this point you may have already noticed that I have blacked out 3 of the 19 A1’s for this week. There is a good reason for that. I am currently researching a number of businesses to see if an investment opportunity is available at current prices.

I will reveal them at a later date along with whether or not I have decided to buy the shares. I have however left you with some important information – their respective ROE and net-debt to equity levels. Note they all have impressive returns on equity and net cash. If you dig hard enough, you may be able to find them before I reveal them.

Posted by Roger Montgomery, 7 September 2010.

by Roger Montgomery Posted in Companies, Investing Education.

-

Part II: What else has the reporting season avalanche uncovered?

Roger Montgomery

August 24, 2010

The second full week of reporting season has just been and gone and saw another 80-100 companies report their financial results. More than 200 have reported and yes I am working feverishly to keep up and cover them all. I am happy to report that I’m ready for another week.

The second full week of reporting season has just been and gone and saw another 80-100 companies report their financial results. More than 200 have reported and yes I am working feverishly to keep up and cover them all. I am happy to report that I’m ready for another week.So far the results have been mixed. Information Technology, Banking and Mining/Oil & Gas Services sectors have stood-out, receiving high Montgomery Quality Ratings. The remainder have been distributed somewhat randomly amongst the other sectors.

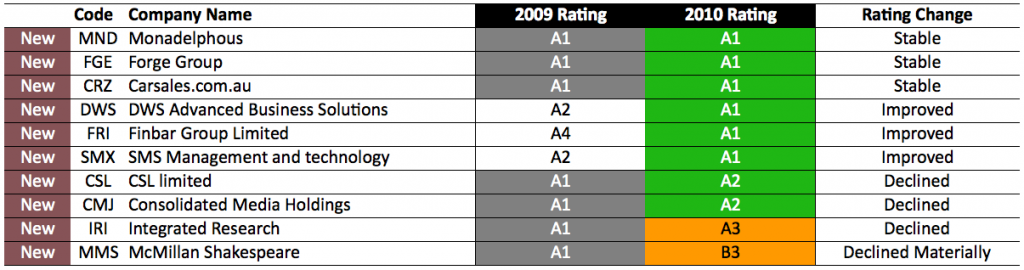

And having analysed all of them so far, I can reveal that only 11 (5.5%) of the 200 have achieved my coveted A1 status (an additional six on top of the five from my previous post). These businesses have all passed my rigorous stress tests and come up trumps.

You may be surprised that after another full week and 80-100 individual results, only six additional companies have made it. But my A1 rating system has been specifically formulated to yield only the best and it is performing its function very well.

Of the six companies, three held onto their A1 status. These are Carsales.com.au (CRZ), Forge Group (FGE) and Monadelphous (MND) which have been joined by 3 new entrants in DWS Advanced Business Solutions (DWS), Finbar Group Limited (FRI) and SMS Management and technology (SMX).

Unfortunately, on a net basis we lost one A1 this year with four other businesses experiencing ratings declines from A1. These businesses include CSL limited (CSL), Consolidated Media Holdings (CMJ), Integrated Research (IRI) and McMillan Shakespeare (MMS). While CSL and CMJ have both declined to A2 status – nothing to be sneezed at, IRI and MMS have had larger rating declines.

Most notably, MMS has declined materially in terms of quality as I predicted it might after its acquisition, and it is now a ‘B3’. The mostly debt-funded acquisition of Interleasing (Australia) is the cause of this fall which I will cover in a separate post.

There are also another 20 A2 businesses that have passed my stress tests and rate in the top 15 per cent of the market in terms of overall quality.

Don’t forget to combine these lists with the A1 and A2 businesses I highlighted last week to continue identifying the best of the rest and stay tuned, I will post my intrinsic valuations for all 11 A1 businesses soon.

Finally, an update on my Telstra valuation. Last week I said that my valuation following the annual result was $2.50. I have updated my numbers and now get $2.30.

I sincerely hope that my Telstra comments have served your research well and that you have not been caught by all of the “it’s high yield and therefore a cheap stock” talk.

While others may have been tempted to buy shares for ‘yield’, you can use Value.able to first discover the intrinsic value. To save you a little time, Telstra’s valuation has declined since it listed. Even in the past year intrinsic value has fallen from $3.00 to $2.30! And the share price has fallen from $3.55 to the current $2.77.

In reality this is a widely reported and closely tracked company and its weighting in the index ensures a level of support from the large, conventional, index-based and tracking-error-focused funds. Indeed this is one of the reasons it has taken so long for Benjamin Graham’s weighing machine to catch up to the valuation – ten years! An improvement in the clarity for Telstra (forgetting whether its profitable for the business) could be enough to result in substantial price rises. Of course as a disciplined value investor focused on only the highest quality business, I cannot let that speculation tempt me.

Posted by Roger Montgomery, 24 August 2010.

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

-

Who is in front of the reporting season avalanche?

Roger Montgomery

August 17, 2010

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.TLS was a clear disappointment, as it has been since it listed. I have been on the front foot for a long time saying that this is a company to avoid, I hope you took notice. My valuation has fallen now from $3.00 to almost $2.50. If anyone can turn it around however I think Thodey can.

Qantas should have come as no surprise. A $300 million cash loss and I wouldn’t be surprised to see another raising of capital or debt.

Personally though I am not interested at all in TLS or QAN as investment candidates. I am only interested in the highest quality best performing businesses available – it’s here that intrinsic value can be created rather than destroyed and with reporting season just about to kick into top gear from this week, to find them, I put each company through the same rigorous process.

My initial screening process is a vital part of the investment process as it allows me to determine those companies that deserve to retain their place in the short list and it also highlights new opportunities as they arise. But to do this for some 2,000 listed Australian companies can be a very burdensome task unless you have a systematic way of analysing and comparing results in a consistent manner.

For me, it involves pulling out some 50-70 profit and loss, balance sheet and cash flow data fields from each annual report to populate my five models. All of these models employ industry specific metrics to calculate my quality and performance scores. This allows me to rank all companies from A1 – C5 to sort the wheat from the chaff.

For those not familiar with my ranking system, A1s are the simply the best businesses and the safest to own, while C5s are the poorest performers and the least safe.

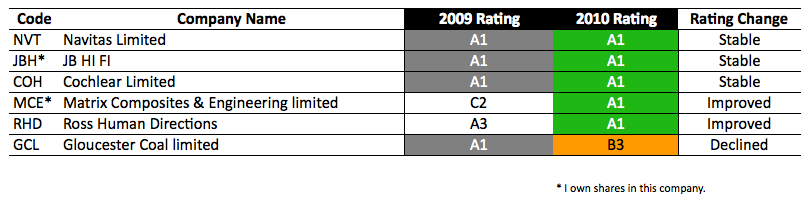

Out of the 80 companies that have reported, only 5 have achieved my coveted A1 status – around 6.25% (the best of the rest).

NVT, JBH and COH had my A1 rating last year and retained it this year and there are 2 new entrants in MCE and RHD, with GCL (it was an A1 last year) having a dramatic rating decline. I tend to shy away from resource companies for obvious reasons.

On my blog I have previously spoken about NVT, JBH and COH and also mentioned ITX, so please revisit those thoughts. itX is under takeover and Navitas, it was recently reported, had been approached some time ago by Kaplan – a company I have done some consulting work for and a subsidiary of Warren Buffett’s Washington Post company – so a big tick for the A1 to C5 Rating system!

That only leaves MCE, an engineering business that currently generates most of its returns from the manufacture of riser buoyancy modules for deep-sea oil rigs. Its order book is already underwriting a doubling of revenue for 2011. The 2010 result revealed profits had almost tripled and significantly exceeded prospectus forecasts and it is producing returns on equity of 49% – a rate that is unavailable generally elsewhere. Borrowings amount to about $8 million compared to equity of about $60 million (of which a little over 10% is capitalised development and goodwill intangibles). Best of all, the share price over the last week is a long way below my estimate of its intrinsic value.

If you have seen me on TV or heard me on radio in the last week or so you would have heard me mention that I had bought something, MCE is it. Please be mindful that if you act rashly and go and push the share price up, you will be helping me perhaps more than yourself. Also remember that I am not recommending the stock to you and that I cannot forecast the share price direction (although I am pleased with its performance since my purchase). The share price, I warn you, could halve, for example if there is a recession and or the oil price plunges – delaying expenditure of the construction of oil rigs globally. I simply am not recommending it to you.

Also remember that I am under no obligation to keep you informed of when I buy or sell nor answer any specific questions, which means 1) you have to do your own research and 2) you have to be responsible for your own decisions. Seek and take personal professional advice BEFORE you do anything.

Moving on, another 13 companies have achieved my second highest rating of A2. They are listed below with their prior years rating so you can compare.

Noteworthy in this list is the excellent performance of the Commonwealth Bank (which I continue to hold in my Eureka Report Value Line portfolio, along with JBH and COH) and those companies I generally classify as being in the Information Technology sector including OKN, ITX, CPU and ASW. Both sectors appear to be doing well in aggregate.

While focus should always be placed on the A1’s (the top 5-7% of the market) at any one point in time, A2’s are still very high quality businesses. The use of the two lists in tandem will therefore provide you with an excellent starting point in isolating those who have reported high quality financials and performance levels above the average business. An important first step in the Value.able Montgomery brand of investing.

It is from here that I will select candidates worthy of further analysis (qualitative and quantitative) and possibly meet with company management, if I have not already done so. Once again I have taken you to the river I fish in, you have my fishing rods and tackle box. Now up to you to catch the right priced fish.

Please use these two lists as a starting point to conduct your own research and use Value.able as a guide to estimate your own valuations. If you don’t yet have a copy you can order one at www.rogermontgomery.com so you too can do your own valuations. Remember to always focus on the highest quality and best performing business available.

If you focus on the best when they are cheap and simply forget the rest, you should avoid more (if not all) of the disasters and should be able to build a portfolio that will give you a greater chance of out-performing the market.

Happy reporting season!

To be continued… Read Part II.

Post by Roger Montgomery, 17 August 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

Is this the first photographic evidence of Value.able in action?

Roger Montgomery

August 17, 2010

Based on your emails, blog posts and Facebook comments, I knew my Value.able lesson had spread to Asia, Canada, the UK and the US.

This morning Jesse sent the first photographic evidence of its far-reaching net.

“Becoming a value investor while working offshore!. Love it :)” Jesse works off the coast of WA and as you can see, he has set up the perfect office for analysis and investing. The only concern is that the helmet suggests he’s taking warnings of a Chinese property collapse a little too seriously!

Thank you Jesse and to everyone for the overwhelmingly supportive comments you have posted here at my blog and the positively entertaining comments you have written on my Facebook page.

Please keep adding your thoughts, inights and stories by Leaving a Comment or joining me on Facebook.

Posted by Roger Montgomery, 17 August 2010.

by Roger Montgomery Posted in Investing Education, Value.able.

- 2 Comments

- save this article

- POSTED IN Investing Education, Value.able

-

How do your Value.able valuations compare?

Roger Montgomery

August 10, 2010

Thank you for your encouraging comments about Value.able and all of your generous feedback. You have indeed given me enough suggestions for Value.able#2, or at least a workshop/lecture. While I consider these and in the meantime, I have received a number of questions (some of which go beyond the mandate for the book) that I think, if answered, could benefit everyone. Besides, I suspect if there is one person that has written me a question, there will be others who have the same query but didn’t write. In the interest of efficiency and to avoid repetition, here are what I believe represent the most likely questions you could have and the corresponding answers.

Thank you for your encouraging comments about Value.able and all of your generous feedback. You have indeed given me enough suggestions for Value.able#2, or at least a workshop/lecture. While I consider these and in the meantime, I have received a number of questions (some of which go beyond the mandate for the book) that I think, if answered, could benefit everyone. Besides, I suspect if there is one person that has written me a question, there will be others who have the same query but didn’t write. In the interest of efficiency and to avoid repetition, here are what I believe represent the most likely questions you could have and the corresponding answers.Question 1: Historical Information

In terms of valuations, is all the requisite historical information on individual companies freely available? You mentioned you look ahead 2 or 3 years when estimating intrinsic value. How do you go about getting the information for this? Can you recommend a source of financial data.

Answer 1: I have discovered that all the data you need to estimate intrinsic value and apply the steps in Value.able is available on Commsec, Westpac and E*trade (Thanks Ashley for the latter!). Here is the link to a demonstration of where EXACTLY to find the data. Or click on the Source Data button just to the right.

Financial data is also available for free on Google Finance and Yahoo Finance and you can also purchase publications that have up to ten years of historical information (I am currently trying to negotiate a special price for owners of Value.able).

Question 2: Analyst Forecasts

Where can I get analyst forecasts?

Answer 2: Consensus analyst information is available on Commsec and E*trade. Yahoo finance also provides consensus analyst estimates for 6000 companies updated weekly and the 2 year forecast EPS and DPS growth can be found under the Key Statistics tab. Not wanting to be left behind, Google Finance also has consensus estimates for Sales Profit and Dividends. Click here, then click on “More Ratios” under Key Stats and Ratios over on the lower right hand side of the page. Of course, if you use a full service broker you should be able to ask your adviser for access to the firm’s online research repository. Given analyst forecasts come from the analysts, they will have estimates as well.

Question 3: What tools can I use?

Perhaps you may know what I can use to filter the “good businesses” from the “not so good businesses”?

Answer 3: Sure, I do it right here! For my Insights blog (and for me) to remain independent I will not discuss any third party products or services.

Question 4: The retention rate

Calculating the value of an infinite life asset that has a 100% retention rate and a lower ROE than the required return is a mathematical impossibility.

Answer 4: I wouldn’t ever buy such an abomination! The most technically adept of you have suggested that where Retained earnings =100% and ROE<RR, my estimates are not conservative enough. I can see why – in theory – some of you would like to treat it more harshly with the valuation formula. However I prefer to treat it even more harshly than you – simply throw it in the bin! Why would you want to own a business where, through your inputs, you have assumed wealth destruction? The question about whether to invest or not is made in the head instantly. You don’t need a calculator for that.

Considering a margin of safety, I look for companies likely to sustain an ROE that far exceeds my required return and avoid businesses whose management retain profits at unproductive rates.

Question 5: Is value investing becoming too popular?

My concern is if there is a possibility that the rising popularity of value investing, by purchasing at a discount to intrinsic value, could spoil this method of investing?

Answer 5: There are a lot of people who worry that finding gold will immediately mean everyone else will find it at the same time and render it valueless. Don’t worry, there are vastly more investors speculating than there are investing. Even Buffett observed that after 40 years of teaching it, he has seen no migration towards value investing.

Question 6: Forecast Equity per share

How do I calculate forecast equity per share, I cannot find it anywhere?

Answer 6: Forecast equity per share is:

Forecast Year Equity Per Share = Previous Year Equity per share + Forecast Earnings per share – Forecast dividends per share + new share capital(per share) – buybacks(per share)

The last two elements can be deduced from any announcements the company makes about capital raisings or buybacks.

Question 7: Referencing others

You refer a lot to the work of these investing giants but as a successful former fund manager, you should have had more “Roger” in it.

Answer 7: As I say in my introduction, what I have been able to accomplish has been thanks to the writings and teachings of others. In my own investing I have adopted and adapted the frameworks suggested by many investors and academics and combined them in a way that is unique, suits me and works of course! I have for example not found my final approach to valuation anywhere else – it is an amalgam of the work of those mentioned in the book. I have not read about the extension of the margin of safety concept anywhere else either and the list goes on. There is a now a rather fruitful garden but the seeds were borrowed from the great and celebrated mathematicians and investors. Indeed I think even Buffett picked up a few pointers from others, especially Walter. To that end here’s a well known Buffett quote that I should have included in the book: “I don’t think I have any original ideas… I’ve gotten a lot of ideas myself from reading. You can learn a lot from other people. In fact, I think if you learn basically from other people, you don’t have to get too many new ideas on your own. You can just apply the best of what you see.”

It is my hope that now that you have the answers to these questions, you won’t have to wait for me to try and reply to emails with the same requests.

Roger… please check my valuations!

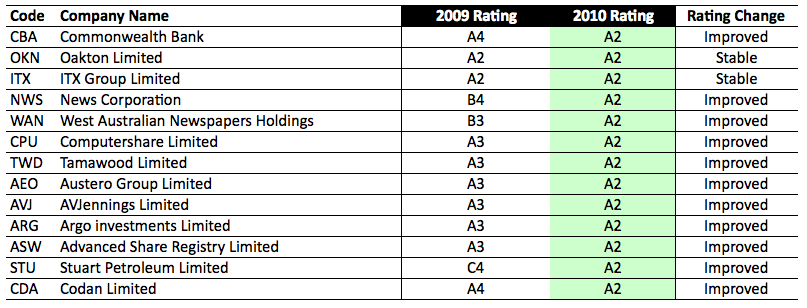

Finally, many of you asked me to check your work! I really am humbled by how many of you are launching straight into the application of value investing. Well done! Instead of going through everyone’s examples, I thought it would be much better to give you some worked examples for you to try yourself. Take these inputs and run them through the process in my book. By the end of next week I will release the answers for you to check your work against along with the substeps. The inputs are in the table. Print it and fill in the blank columns to arrive at your answers (click on the table to enlarge the image).

Ten Value.able valuations

Posted by Roger Montgomery, 10 August 2010

Click here for the answers… no cheating.

by Roger Montgomery Posted in Companies, Investing Education.