Investing Education

-

Merry Christmas from the Value.able Graduate class of 2010

Roger Montgomery

December 21, 2010

It is my great pleasure to present a very special tribute (thank you to my team) for the Value.able Graduate Class of 2010.

Thank you Jesse, Michael (Bali), Young Les, Michael (Aussie Battler), Matthew, Justin, Lior, John, Rad, Gary in Paris, George, Dan’s Mum, Steven & Sophie, the Master Chefs, John and Paul for sharing your Value.able journey with our community. And a second thank you to Steven for posting his Value.able 12 Days of Christmas at Facebook!

Thank you for your support this year. We have created an incredibly valuable community of investors that share sound ideas and mentor those just beginning their value investing journey.

Thanks to you – the Value.able community – 2010 year has been a year of firsts…

The First Edition of Value.able was released, went global and sold out in just 14 weeks.

- – Montgomery Quality Ratings (MQR) are appearing in conversations all over the world.

– My value investing YouTube channel hit #2 Most Viewed in Australia.

– In aggregate, the companies I listed at my Insights blog, which met all the Value.able criteria, outperformed the market by a satisfactory margin.

Most excitingly, Value.able Graduates have applied their new skills and produced over 6,000 extraordinarily insightful comments here at the blog!

And one more thing… for those who have requested holiday homework, my soon-to-be-released blog post will most certainly provide a challenge.

Thank you once again for joining the Value.able community. I wish you and your family a safe and peaceful Christmas and a prosperous 2011.

Posted by Roger Montgomery, 21 December 2010

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Who made the Value.able grade?

Roger Montgomery

December 16, 2010

The Value.able class of 2010 is indeed all class.

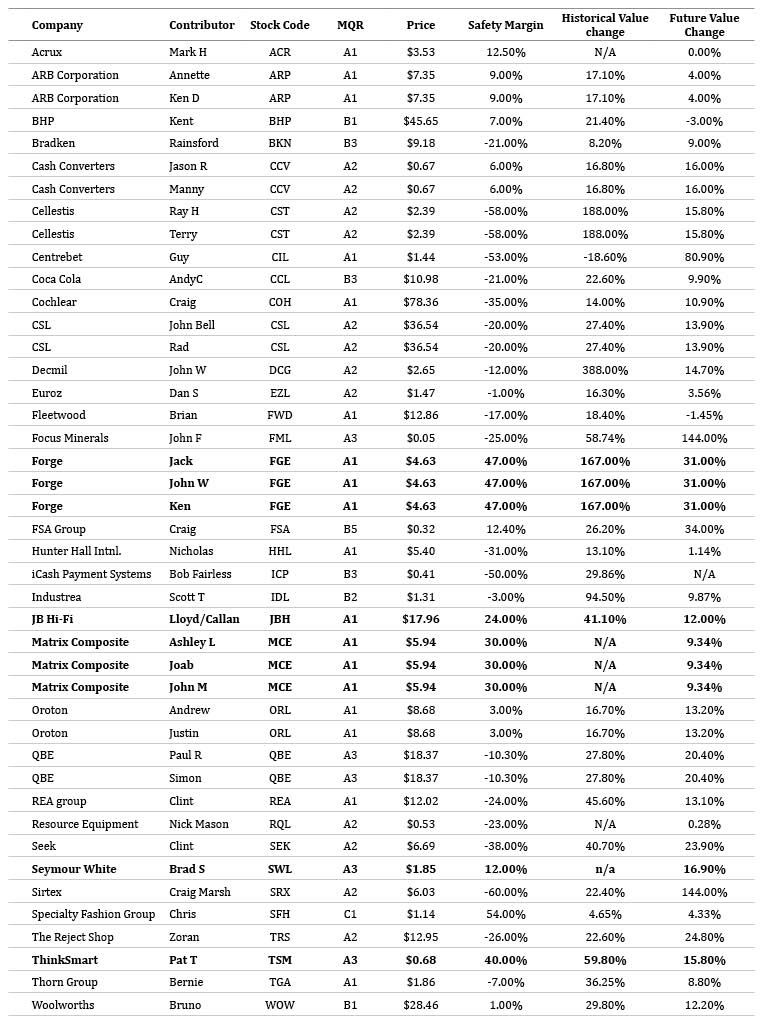

The Value.able class of 2010 is indeed all class.Your nominations for the A1 stocks to watch in 2011 are fine examples of the sorts of companies that I eagerly seek for my own portfolio (with the exception of the odd recalcitrant student who diverged from the lessons learned).

I haven’t yet decided which will be revealed on Sky’s Twelve Shares of Christmas special tonight at 7pm, although the shortlist may be obvious from the numbers presented in the table below.

If we presume that all A1s have equally bright prospects – they don’t – then the job of picking the top stock comes down to the one that offers the highest return when combining the discount to intrinsic value and the prospective change to intrinsic value over the next two or three years.

One difficulty with such a simplistic approach is that firstly, varying degrees of certainty about the future cloud the picture. I have also used consensus numbers to produce the valuation changes and these are notorious for being optimistic at precisely the wrong points in the business cycle.

To avoid this dilemma for the purposes of the exercise (but perhaps not for the purposes of investing), I could elect to go with the choice that received the most recommendations. The winner of that contest would be a tie between Matrix Composite & Engineering (MCE) and Forge Group (FGE) and the equal runners up would be Oroton (ORL), ARB Corp (ARP), Cash Convertors (CCV), Cellestis (CST) and CSL (CSL). The remaining contributions include Acrux (ACR), BHP (BHP), Bradken (BKN), Centrebet (CIL), Coca Cola (CCL), Decmil (DCG), Euroz (EZL), Fleetwood (FWD), Focus Minerals (FML), FSA Group (FSA), Hunter Hall (HHL), iCash Payment Systems (ICP), Industrea (IDL), JB Hi-Fi (JBH), QBE (QBE), REA Group (REA), Resource Equipment (RQL), Seek (SEK), Seymour White (SWL), Sirtex (SRX), Speciality Fashion Group (SFH), The Reject Shop (TRS), ThinkSmart (TSM), Thorn Group (TGA) and Woolworths (WOW).

Whilst I have identified a universe of A1 companies trading at discounts to intrinsic value that have slipped under your radar, the objective of the exercise was to ask for your picks and now that I have the list, choose a winner I must.

On tonight’s Summer Money program on Sky Business at 7pm I will reveal the ONE stock that you have selected as the relatively best prospect for 2011. It won’t be Roger Montgomery’s pick. It will be the top pick by the Insights Blog Community – the Value.able Graduate Class of 2010!

Posted by Roger Montgomery, 16 December 2010.

by Roger Montgomery Posted in Companies, Investing Education.

-

What are your Twelve Stocks of Christmas?

Roger Montgomery

December 9, 2010

I have an assignment for you.

Before we start, two things…

1. If you are looking for a gift that keeps on giving in 2011, give your loved ones a copy of Value.able. To guarantee your gift makes it into Santa’s sleigh, you must order before 5pm next Monday, 13 December.

2. Put Thursday 16 December @ 7pm in your diary. Sky Business has invited me to appear on their Summer Money program.

Within Summer Money, Sky is running a series called The Twelve Stocks of Christmas and I have been asked to present one of the twelve stocks. What I would like to do is let everyone on Sky Business know about you – the Value.able Graduate class of 2010!

You have been instrumental in contributing to the knowledge and awareness of value investing and I would like to say thank you by reviewing your suggestions on air.

So, what will it be? You can nominate one of the companies we have already discussed. More points can be earned by contributing a company of which you have industry-level knowledge. Think about your industry or business:

– Who is the strongest [listed] competitor in your industry?

– Who would you like to see out of business because they are an emerging threat?

– What are their competitive advantages, their opportunities for growth and why do you think they will sell more of their product or services in the future or at higher prices?

– Perhaps they are out of favour in the share market, but you believe it’s a case of a temporary set back being treated like a permanent impairment?

I encourage you all to post your contribution. There are just two rules:

1. One stock (your best pick) per Value.able Graduate. The more detailed your information, the better; and

2. Ideas must be submitted by Wednesday 15 December

Before the live show at 7pm next Thursday, 16 December, I will run my valuation eye over every suggestion and give each my Montgomery Quality Rating (MQR). But the list will be yours – a contribution from the Value.able Class of 2010.

Whilst only one stock will make it to the show, EVERY SINGLE STOCK contributed on this post with sufficient supporting detail will be subsequently listed in my final pre-Christmas post for 2010, complete with MQRs, current valuations and prospective valuations (I have decided to called these MVEs – see below).

Embrace this opportunity to practice what you have learned over the past twelve months, and get the official Montgomery Quality Rating (MQR) and Montgomery Value Estimate (MVE) for your favourite stock. You never know, your stock may just be the one I contribute on national television to The Twelve Stocks of Christmas.

Post your suggestion here at the blog by Wednesday 15 December 2010.

I look forward to reviewing your insights and hearing what you think of your classmates’ suggestions. Simply click the Leave a Comment button below.

Posted by Roger Montgomery, 9 December 2010.

Postscript: thank you for your kind words and birthday wishes. I’m thoroughly enjoying my time away and am very much looking forward to reading and replying to your comments when I return to the office next Monday.

Postscript #2: Steven posted his own Value.able 12 Days of Christmas at my Facebook page last Friday – brilliant!

On the twelfth day of Christmas,

My independent analyst’s blog gave to me

12 A1s humming

11 valuations piping

10 C5s a-sleeping

9 forecasts prancing

8 capital raisings milking

7 floats a-sinking

6 CEOs praying

5 golden A1s!!

4 C5 turds

3 emerging bubbles,

2 editions of Value.able

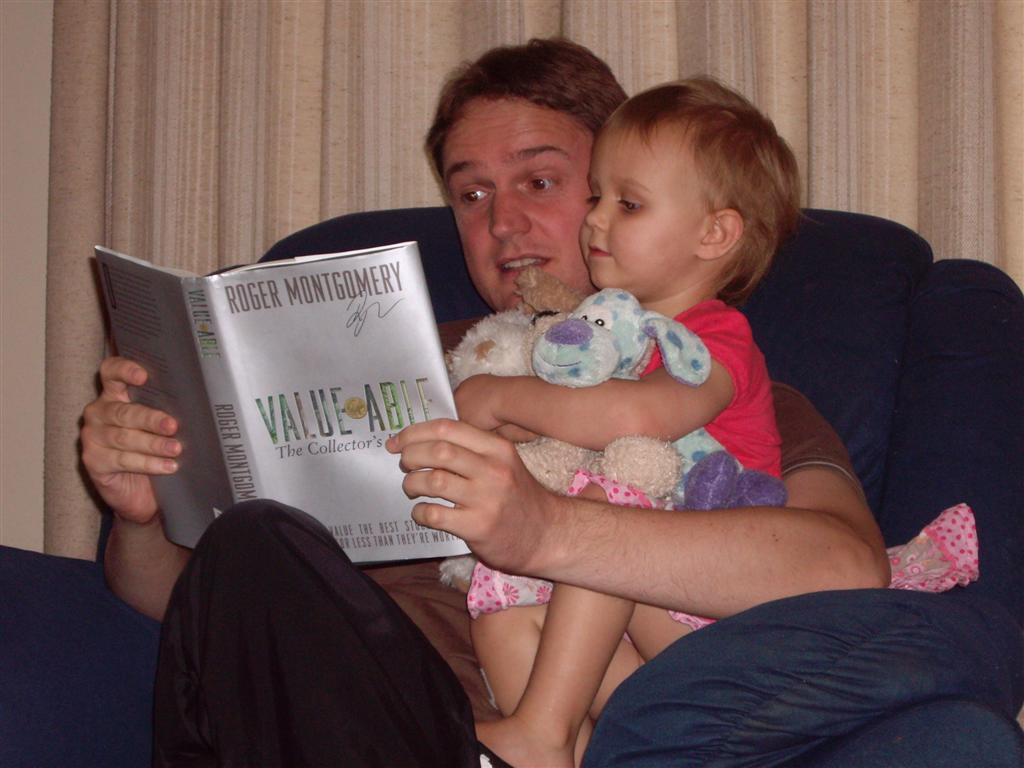

And a market leader with a high ROE!Here is Steven with his daughter Sophie.

Roger, you were good enough to sign my book…

“To Steven, Your guide to avoiding the dogs you told me you were so worried about, RM”.

Here I am reading Value.able to my little two year old Sophie at bedtime, holding her toy dogs. The moral of the story for Sophie? Roger shows dogs make fun toys and pets but must be avoided at all costs when investing in great businesses!”

Steven

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Has 2010 been a good year for Value.able investing?

Roger Montgomery

December 7, 2010

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.Does the Value.able approach to investing, as advocated some of the world’s leading investors, have merit?

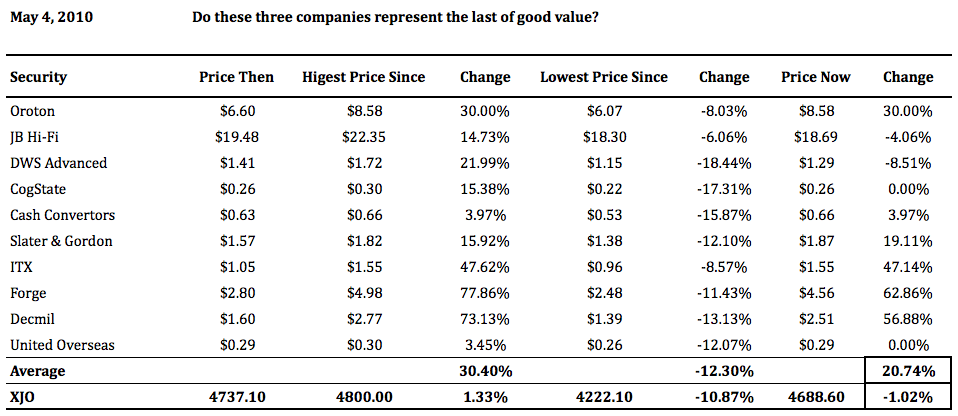

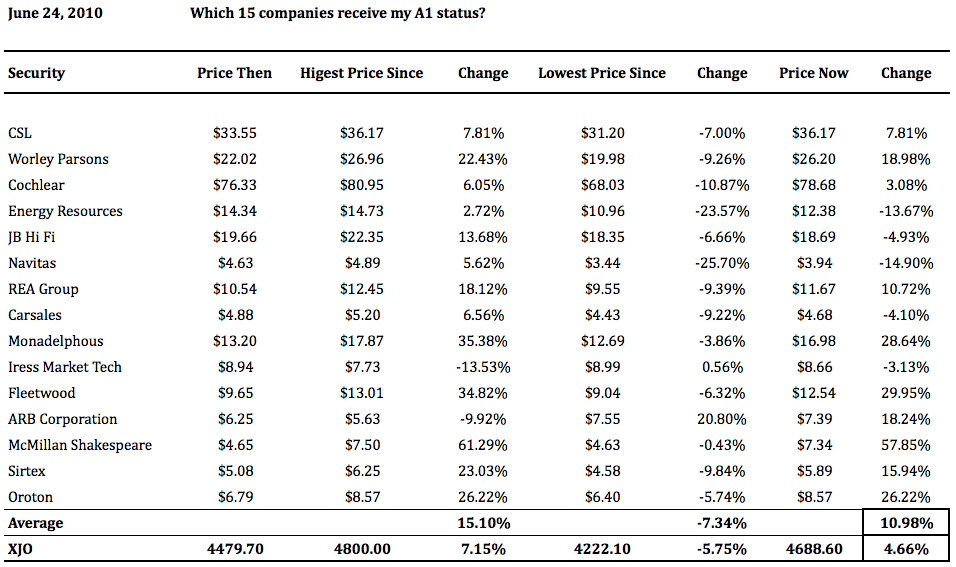

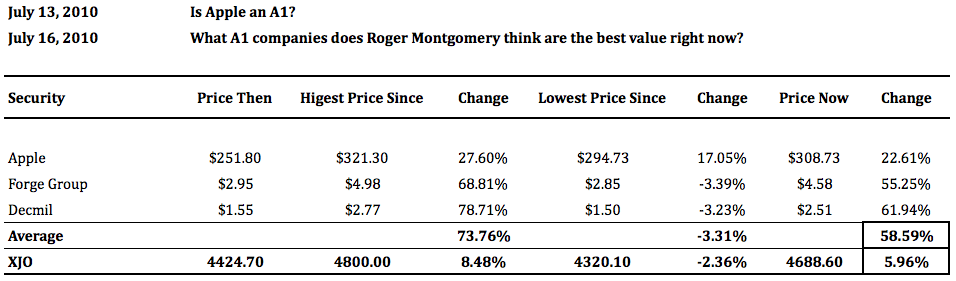

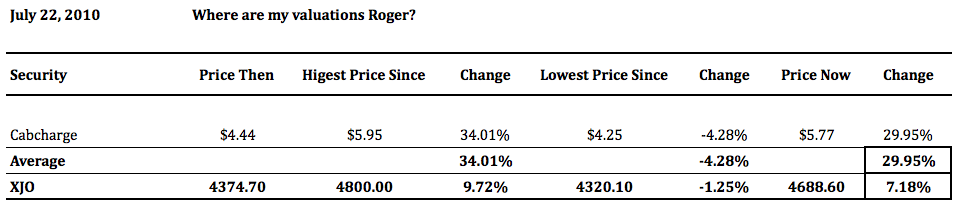

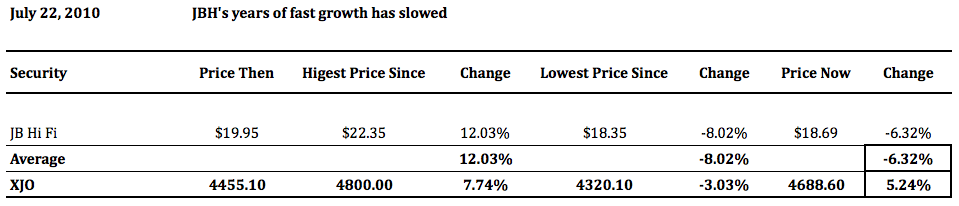

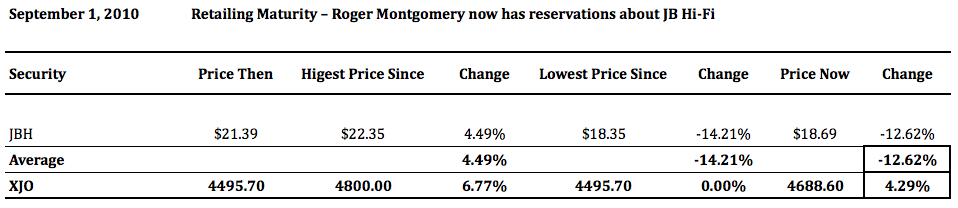

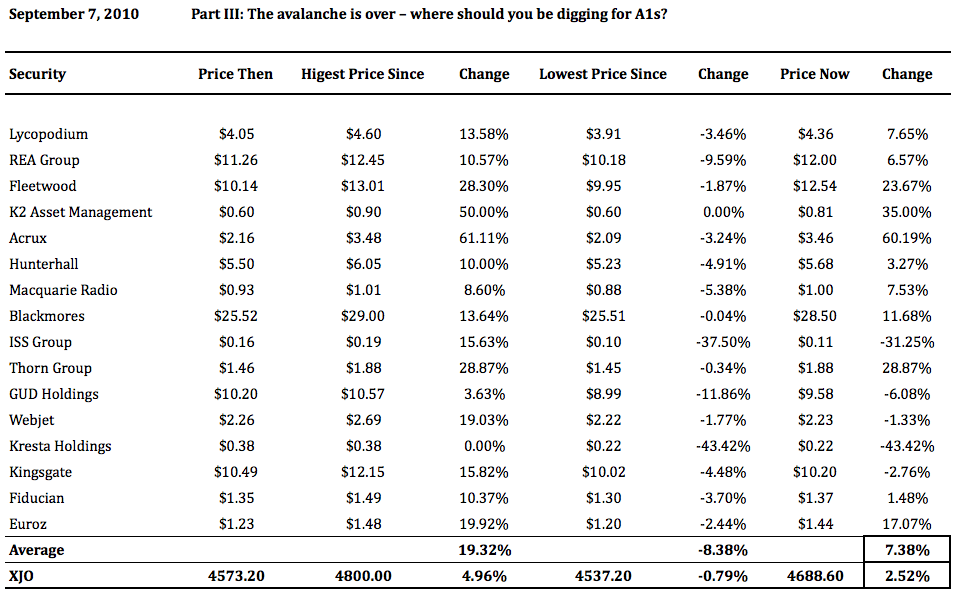

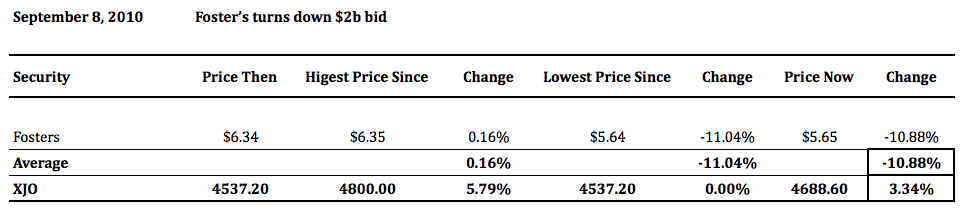

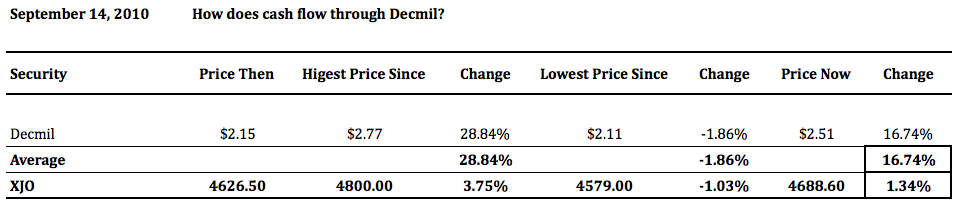

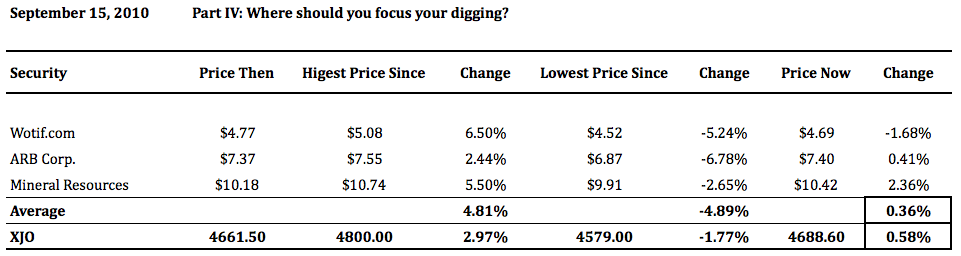

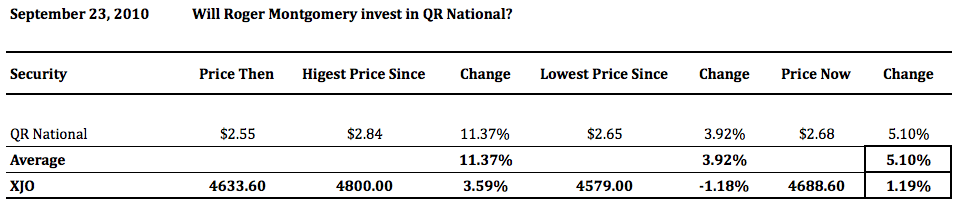

First Edition Graduates may not be surprised by the results posted below. The higher quality businesses, those scoring A1 and A2 Montgomery Quality Ratings (MQRs), and those at larger discounts to intrinsic value have, in aggregate, beaten the index. Some have trounced it. And with the exception of QR National, the companies that were labeled as poor quality (C4 and C5 MQRs) and overpriced, have under-performed. Some of the maturing higher quality companies (think JB Hi-Fi) have indeed performed.

The following tables present some of the blog posts and the stocks that I have listed, mentioned or discussed in them. I have consistently suggested investigating an approach that seeks the highest quality businesses and prices that offer the biggest discounts to value.

Whilst the results are short-term (therefore nothing should be taken from them), they are nevertheless encouraging. The approach advocated in Value.able is worth investigating.

Many Value.able Graduates have suggested I start a newsletter or a stock market advice service. Thank you for the encouragement. I do enjoy the cross pollination of ideas and look forward to 2011 attracting even more investors to the patient and rational approach shared here at my blog.

Here are the tables (DO YOUR HOMEWORK AND RESEARCH. ENSURE YOU ARE COMPREHENSIVELY INFORMED. SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE).

Do these three companies represent the last of good value? Oroton, JB Hi-Fi, DWS, Cogstate, Cash Converters, Slater & Gordon, ITX, Forge, Decmil and United Overseas

Which 15 companies receive my A1 status? CSL, Worley Parsons, Cochlear, Energy Resources, JB Hi-Fi, Navitas, REA Group, Carsales, Mondaelphous, Iress, Fleetwood, ARB, McMillian Shakesphere, Sirtex, Oroton.

Is Apple an A1? What A1 companies does Roger Montgomery think are the best value right now? Apple, Forge and Decmil.

Where are my valuations Roger? Cabcharge.

JBH’s years of fast growth has slowed.

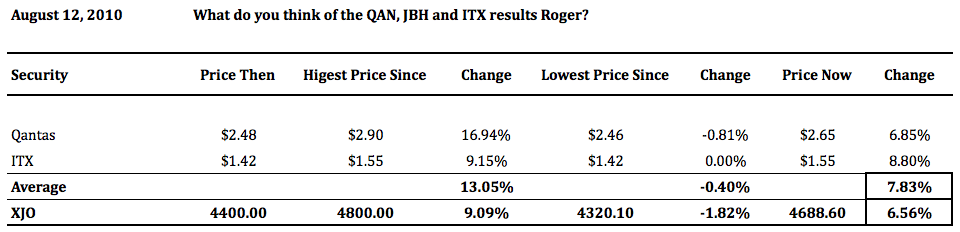

What do you think of the QAN, JBH and ITX results Roger? Qantas and ITX

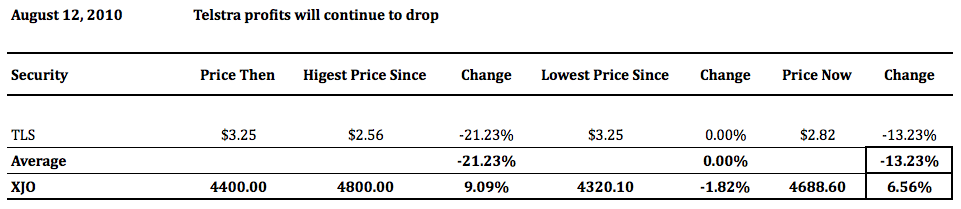

Telstra profits will continue to drop

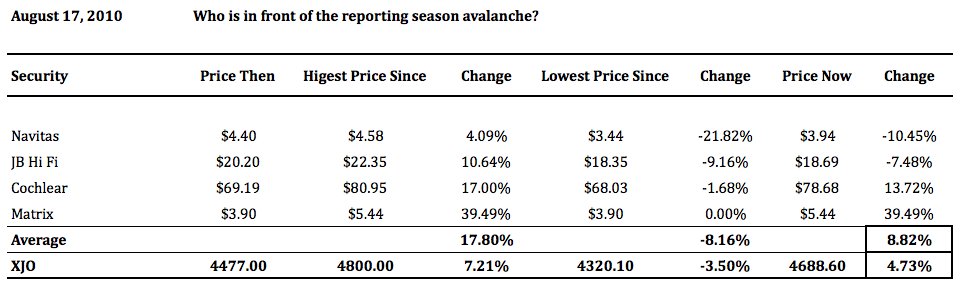

Who is in front of the reporting season avalanche? Navitas, JB Hi-Fi, Cochlear and Matrix.

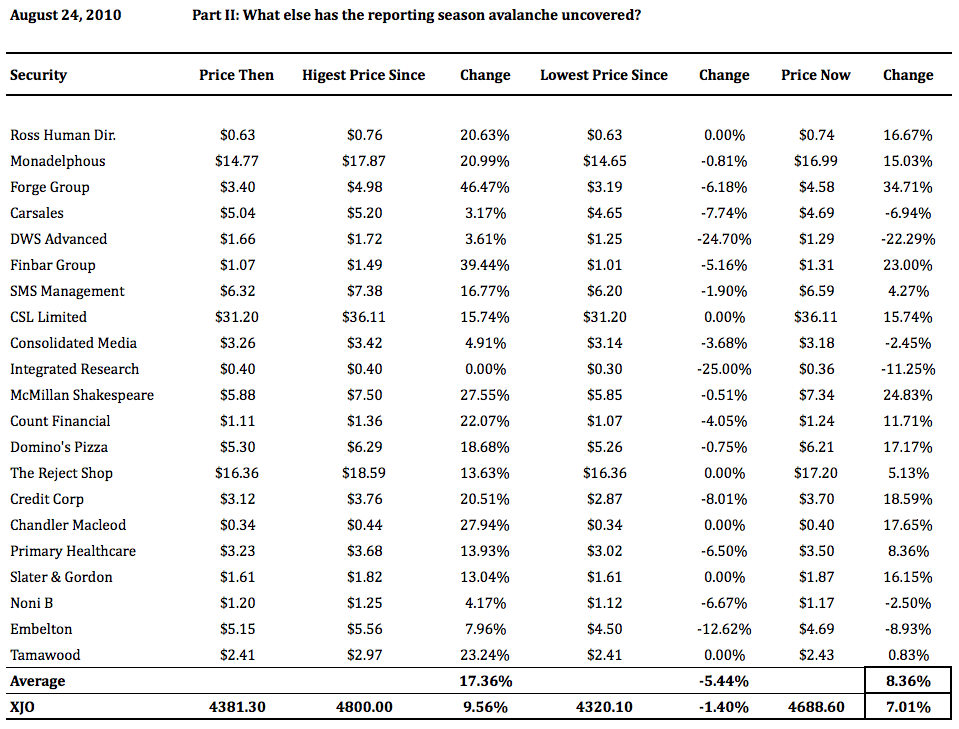

Part II: What else has the reporting season avalanche uncovered? Ross Human Directions, Monadelphous, Forge, Carsales, DWS, Finbar, SMS Management, CSL, Consolidated Media, Integrated Research, McMillian Shakesphere, Count Financial, Domino’s Pizza, The Reject Shop, Credit Corp, Chandler Macleod, Primary Healthcare, Slater & Gordon, Noni B, Embelton and Tamawood.

Retailing Maturity – Roger Montgomery now has reservations about JB Hi-Fi.

Part III: The avalanche is over – where should you be digging for A1s? Lycopodium, REA Group, Fleetwood, K2 Asset Management, Acrux, Hunterhall, Macquarie Radio, Blackmores, ISS Group, Thorn Group, GUD Holdings, Webjet, Kresta Holdings, Kingsgate, Fiducian and Euroz.

How does cash flow through Decmil?

Part IV: Where should you focus your digging?

Will Roger Montgomery invest in QR National?

I thought the performance of Fosters after the wine bid was knocked back was interesting, but only another year or two will confirm whether the opportunity to add value was passed up. Some higher quality businesses also underperformed the market, thanks in part to deteriorating short-term prospects rather than deteriorating quality.

Remember to look for bright long-term prospects. Of course, in the short-term prospects will swing around – that is business, but longer-term prospects of businesses with true sustainable competitive advantages tend to win out.

Keep an eye on the blog before Christmas as I will be posting a couple of very handy lists (and possibly some homework) before the annual Montgomery Family Christmas break.

Posted by Roger Montgomery, 7 December 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Is that the Second Edition of Value.able?

Roger Montgomery

November 19, 2010

Walking into the stores of some of my ‘A1’ MQR companies lately, it is clear that Christmas is just around the corner. Here at Montgomery Inc, Value.able Second Edition has just arrived.

Walking into the stores of some of my ‘A1’ MQR companies lately, it is clear that Christmas is just around the corner. Here at Montgomery Inc, Value.able Second Edition has just arrived.At under $50, Value.able is not only easy to wrap, it’s the gift that keeps on giving all year round (and you don’t have to brave the local shopping centre)!

Many First Edition Graduates have asked me the question “what’s new in the Second Edition?” Aside from an added Appendix, the Second Edition contains all the information of the First Edition that had such a positive impact on people like Graham, who wrote;

“I’m somewhat of a minimalist and love it when I get a book where it makes me feel like I can throw away all the other books I have on a subject – this is such a book!!”

Value.able Second Edition is $49.95. The price includes GST and postage to anywhere in Australia (allow 7 business days). You may be able to claim a tax deduction, although you’ll probably want to check.

Visit my website to purchase your copy. And after reading it, please share your thoughts about Value.able, at Leave a Comment here at the blog.

Posted by Roger Montgomery, 19 November 2010

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

-

Have you been getting your daily dose?

Roger Montgomery

November 9, 2010

If only it worked that well all the time!

If only it worked that well all the time!Last Thursday evening (4 November) on Peter’s Switzer TV I listed, amongst other companies, Credit Corp and Forge Group as two I would have in the hypothetical Self Managed Super Fund Peter challenged me to set up that day.

Why did I nominate CCP and FGE? Both receive my A1 or A2 MQR and both have been trading at a discount to their intrinsic value.

If you are a regular reader of my blog you would have read my insights for some months on these companies. And if you saw today’s announcements, you can imagine why I am a little happier than usual.

Credit Corp’s previous 2011 NPAT guidance was $16-$18 million. Today the company announced FY11 would likely produce an NPAT result of $18-$20 million.

Forge Group’s announcement states “The Board wishes to advise that the company forecasts net profit before tax for the half year ending 31st December 2010 to be in the range of $25-$27 million. This represents an improvement on the previous corresponding period (pcp $19.04m) of up to 42%.”

As I fly to Perth for a presentation and company visit, I am encouraged that several of the companies Value.able graduates mentioned in our lists are also hitting new 52-week highs. In a rising market that lifts all boats, it is perhaps unsurprising, but nevertheless it should be an encouragement to Value.able graduates and value investors that companies like FLT, DCG, MIN, FWD, FGE, CCP, NCK, DTL, MCE, MTU and TGA have all hit year highs – some of them yesterday. More importantly those prices are perhaps justified by their intrinsic values.

Of course I am not here to predict where those prices will go next, because I simply don’t know. Short-term prices are largely a function of popularity and the market could begin a QE2-inspired correction, an Indian infrastructure-inspired bubble or a China liquidity-inspired bubble tomorrow. I have no way of telling and instead, I focus on intrinsic values and only pay cursory attention to share prices.

So, as I always say, seek and take personal professional advice before taking any action and remember that 1) I don’t know where the share price is going 2) I am under no obligation to keep you up-to-date with my thoughts about these or any company, my Montgomery Quality Ratings or my valuations and I might change my views, values and MQRs at any time so don’t rely on them and 3) I may buy or sell shares in any company mentioned here at any time without informing you.

And so I remind you one more time. Please seek and take personal professional advice and always conduct your own research.

Posted by Roger Montgomery, 9 November 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are you drowning in a sea of complexity?

Roger Montgomery

November 3, 2010

I don’t know if you have noticed but some of my recent posts and comments have been getting a little technical. I am sorry about that, I get a bit carried away sometimes.

I don’t know if you have noticed but some of my recent posts and comments have been getting a little technical. I am sorry about that, I get a bit carried away sometimes.Of course on this blog, I am not alone. Joab’s brilliant heads-up on the forthcoming changes to the treatment of leases and the impact on the financial statements is exactly the sort of thing that excites those of us who make investing a full time occupation.

In this field it’s easy to want to prove how much detail one can accumulate about a company or what one knows about valuations or credit analysis. Then of course debates and polite but pointed arguments begin about whose mousetrap is better.

Yet for most of us, it’s a storm in a tea cup, and meanwhile someone has made a million dollars quietly accumulating a few shares in the recently listed company XYZ Ltd.

In most cases there is one pearl that counts and the rest is noise. Our job is to find the pearls. Of course with so much rubbish to sift through it can be challenging to pluck up the enthusiasm to even start searching. For many investors, time is of the essence and short cuts are needed.

Well, I am here to deliver. But this not a post about buying the next hot uranium or gold explorer – tips I do receive and some I even regret missing sometimes. Today’s post is about a shortlist of A1 companies, their proximity to intrinsic value, my expected change in those intrinsic values and the associated net debt to equity ratios.

Why? It’s about getting back to basics.

Investing is simple. Not easy, but simple. Much work went into the classification process to come up with my A1, A2, C5, etc Montgomery Quality Ratings using, for example, industry specific KPI’s to ensure that future sweat was reduced.

And recently one Value.able Graduate Ken, reinforced my resolve to keep it all very simple. Ken D wrote:

Hi again Roger,

Out of curiosity, last week I constructed 2 hypothetical portfolios: 1) with your A1 stocks in equal proportion; and 2) the same with your A2 stocks. I have attached some numbers. I was impressed by the average past performance (i.e. investment performance) from both portfolios and also noted quite a difference between the A1 and A2 portfolios (attached). I doubt whether the result is fortuitous. Without asking you to outline your ranking process, I was wondering whether the strong past performance might be expected as a direct result of criteria used in the A1, A2 classification process – e.g. reference to historical earnings growth for instance, or perhaps more interestingly, a product of the inherent quality of the business as measured by current performance measures.

Ken

In answer to Ken’s question and for everyone’s benefit, remember Ben Graham’s quote about short-term voting machines and long-term weighing machine? Over longer periods of time, price follows intrinsic value and because my Value.able method of calculating intrinsic value is related to the performance of the business, one should expect price to follow performance. Over time A1 businesses should do better and a portfolio filled with just A1s purchased at big discounts to intrinsic value, should, in theory, do best.

Ken looked at all the A1s that I had mentioned on the blog and went backwards (I’ll ignore survivor bias for now) to have a look at the annual returns a portfolio of A1s would have produced.

While there is more refinement required, the early results are impressive. Over the last ten years Ken’s portfolio of 16 A1 company stocks returned 24 per cent, per annum. The same 24 per cent per annum result was produced with a portfolio of 23 stocks over five years and there were 31 A1 stocks in the last year that combined, returned 31 per cent.

Thanks for putting in the time Ken.

With all that in mind, here is my latest list of A1 companies, their proximities to intrinsic values and a few other salient stats.

What I would like to see as comments here are your thoughts or insights about any of these companies. Go right ahead and share whatever you know or think. But only about the companies in the list. Keep the comments to the topic set and we will build a useful library of insights. Just click the Leave a Comment link below.

Posted by Roger Montgomery, 3 November 2010.

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

-

How will the New Lease Accounting Standards impact my view of retailers?

Roger Montgomery

October 29, 2010

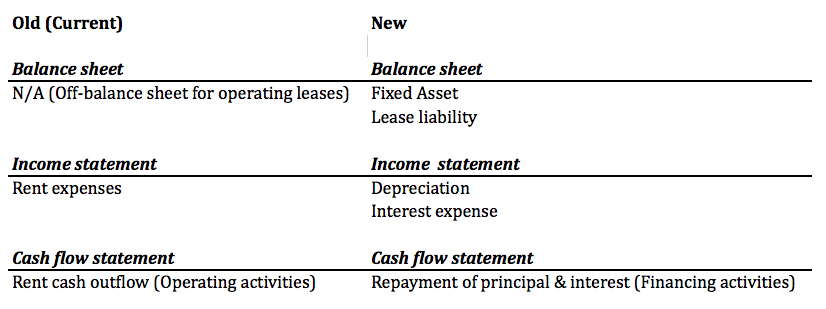

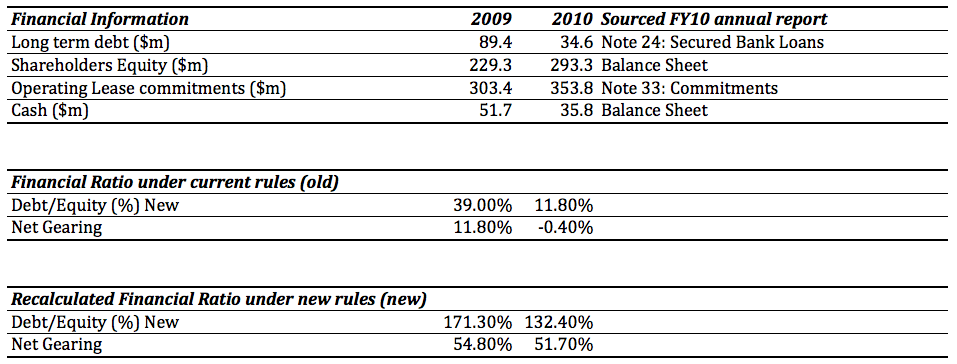

Joab is a regular visitor and commentator on my Insights blog and he’s a Value.able PHD graduate. Joab has put together an elegant summary of the impact – on retailers particularly – from the proposed changes to accounting standards for reporting lease liabilities to better reflect the contingent liability that is an operating lease.

No need to thank Joab. He’s delighted to help and I am delighted he went to the very great effort and time to contribute.

Why are the changes important? The impact of a bigger asset and a bigger liability will have no change on equity, but when you compare a bigger debt to the same equity, you will get a higher Debt to Equity figure. This will impact my Montgomery Quality Rating (MQRs) next year.

So here are Joab’s thoughts (with the community’s thanks):

Current State:

A draft proposal on accounting standard for leases was issued recently. This proposal could still be subjected to change as it is not yet finalised. That said, the principle of what it is trying to achieve is not expected to change.

Estimated timing:

Target date is to issue a finalised standard in 2011.

Key changes:

The information below focuses on the lessee’s perspective and has been simplified to highlight key impacts.

1. Operating leases will be on balance sheet as a lease liability (there will no longer be a distinction between operating and finance leases);

2. A corresponding asset will be recognised, separately on balance sheet, which offsets the operating lease liability;

3. Rent expenses will be replaced with depreciation and interest expenses;

4. Operating cash flow will no longer include cash outflow on rent. Instead, rental cash flow will be in the Financing Activities category as ‘Principal and Interest repayment’.

The table below compares the current and the new accounting rules on the financial statements.

Standard setters are open to feedback before end of this year.

Key Impacts:

– Financial ratios on gearing will suffer with more debt on balance sheet. For example: debt/ equity ratio, gearing ratio, interest cover ratio.

– Cash flow from operating activities will improve because rent will be presented in financing activities

– EBIT or EBITDA will improve as rent expense is replaced with depreciation and interest.

– Operating earnings will have a slightly different profile. Rentals expenses will no longer be a straight line expense.Using JB Hi-Fi as an example

Note:

– I have excluded discounting on Operating lease commitment to simplify the calculation

– Debt/ Equity = Debt / Equity

– Net Gearing = (Debt – cash) / (Debt + Equity)Posted by Roger Montgomery, on behalf of Joab, 29 October 2010.

by Roger Montgomery Posted in Insightful Insights, Investing Education.

-

Where will Value.able appear next?

Roger Montgomery

October 11, 2010

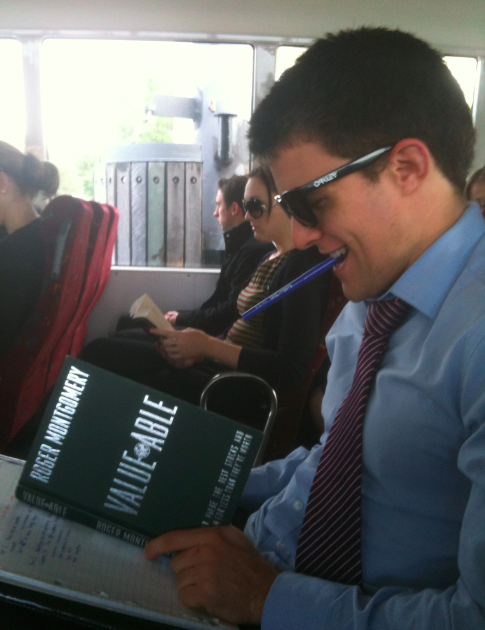

We have seen Value.able being applied on an offshore oil rig, in a deck chair on one young man’s private island and also a plunge pool in Bali. Here are two more stories from Graduates showing how they are applying Value.able in practice.

Roger,

I was recently in Galle, Sri Lanka, and was able to share some of your insights with a local spice trader, Yasiru. He was particularly interested in your comments on quality businesses and was happy to say that he maintained a competitive edge by controlling costs – he grinds and mixes the spices himself. I can report that his product is excellent and sells at bargain prices (I have no shares or other interest in his business).

Justin

And from Michael…

I felt compelled to shine light the legion of your followers that are not simply reading Value.able while sitting in lazy pacific island deck-chairs, exotic pools-with-a-view or even far reaching oil rigs. I give you the Montgomery Aussie Battler: An 8am-6pm, 5-day-week worker, traveling to and from work via a crammed and smelly public transport system (namely Brisbane’s CityCat). Who smiles to themselves knowing ‘the final salvation’ is possible – an early retirement thanks to Value.able, intrinsic value, margin of safety and high ROE to name a few. Thanks for starting a revolution!

Michael

P.S. Note the studious working scribbles underneath Value.able.

Please keep sharing your Value.able adventures with our community. We are enjoying the journey.

Posted by Roger Montgomery, 11 October 2010.

UPDATE: 13 October 2010

Here is another pic from Matt I received today… ‘Operating Value.Able’

Hi Roger, I don’t have a tropical or relaxing environment from which to share my experience of Value.Able – I send you this picture from the Trauma theatre at 2am after an emergency operation on a car accident victim. Not a place normally associated with relaxing thoughts. However, you may not know how good an operating theatre can be for reading. After all, it has the two most important ingredients: very good lighting and plenty of fresh air (via the ultra clean ventilation systems of course). Your book has been an excellent addition to my investing education and I look forward to meeting you at one of your upcoming presentations.Cheers, Matt

P.S. the patient is doing just fine

UPDATE: 14 October 2010

I was just reading up on the “formula” when some of the guys were curious. Then, just before the game started I was trying to explain to my team mates the difference between a company’s yeild, PE and ROE. Told them to just get the book.

Cheers….Rad

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

No more Value.able Roger?

Roger Montgomery

October 7, 2010

The First Edition of Value.able has sold out.

The First Edition of Value.able has sold out.Thank you. Thank you for purchasing copies for your family and friends. And thank you for allowing me to share my way of investing with you.

If you haven’t yet purchased your copy, don’t worry. I plan to release a Second Edition paperback in November. The manuscript is with the designers and will soon be on the printing press.

You can pre-order and secure your copy at my website, www.rogermontgomery.com. Or if you haven’t yet done so, join up to my mailing list and I will let you know when then Second Edition is available.

I have received a few emails from investors who purchased their First Edition copies in early September and are patiently waiting for them to arrive. The books are delivered by Australia Post. If no one is home at the time of delivery, a parcel reminder will be left at your front door or in your letterbox and your book will be taken to your local post office. Unfortunately I have heard of occasions where no reminder note was left.

If you haven’t yet done so, please check with you local post office and if you don’t have any luck, please let me know.

Posted by Roger Montgomery, 7 October 2010.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.