Part IV: Where should you focus your digging?

While everyone else seems to have moved on from reporting season, I’m still digging my way through a mountain of analysis. I am almost done.

While everyone else seems to have moved on from reporting season, I’m still digging my way through a mountain of analysis. I am almost done.

Based on the amount of comments contributed here at my blog it seems you have enjoyed reading my insights as much as I have enjoyed sharing them.

Before I get into what I have uncovered from last week’s filings, congratulations are in order. Gavin was the first Value.able Graduate to correctly pick the three companies I omitted from Part III’s second table – congratulations Gavin. Gavin picked all three despite there being thousands of companies listed on the ASX and only having six pieces of financial data. Amazing!

Congratulations are also in order to Mike and Pat, who picked all three. Great digging fellow Value.able Graduates!

The missing companies are ARB Corporation (ARP), Wotif.com (WTF) and Mineral Resources (MIN).

As always, please undertake your own research and seek and take personal professional advice before you go rush out and buy anything.

I also wanted to say a big thank you to all who have posted comments. Our Value.able investing community has benefited greatly from your contributions and insights and I am excited by the great sense of community that you have developed. I must say a special thank you to our regular contributors – the quality of your comments are amazing, and more importantly, respectful and non-judgmental. Keep them coming!

If you haven’t yet posted a comment, now is a great time to start. The Value.able community is here to share ideas and help each other. If something is on your mind, I guarantee there is someone else with a similar question. So please contribute as much as you can or ask as many questions that you may have.

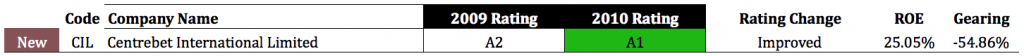

Now onto my lists – despite all my digging, there is only one new entrant into my A1 Montgomery Quality Rating this week. With three companies experiencing rating declines, on a net basis we actually lost two A1s. You can see them below.

Dominion Mining (DOM) had the largest rating decline, from an A1 to an A3. It still displays high quality metrics – with $16m in cash on the balance sheet and no debt (just watch out for those capitalised exploration expenditures), but my Montgomery Quality Rating declined. Why?

As you know, I tend to shy away from commodity businesses. It is not that they are difficult to understand, but rather difficult to forecast with a great deal of confidence – forecasting how much they will produce and when, their cost of production and/or project establishment and development costs and then ultimately, what price they will get for their production. There are simply too many variables that management can get wrong and many that are completely out of their control.

To this point I proffer Dominion (ASX: DOM), which in the most recent financial year, despite a higher average gold price, saw production slip from 98,755 ounces to 80,570 and cash production costs blow out from $438 to $697 per ounce. The combination of lower production and lower efficiencies transformed a highly profitable business into a barely profitable one in the space of 12 months. Now that’s operating leverage!

Indeed if you took all of the hitherto-labelled ‘resource evaluation and mine development expenditure’ expenses straight to the Profit and Loss account as opposed to the Balance Sheet, DOM would have made a loss of several million.

Given the many variables and accounting flexibility, if exposure to this sector is your goal, perhaps your focus could move from those who ‘look for’ and ‘produce’ to those who ‘service’ – the suppliers of the picks and shovels and those engineering businesses that install, maintain and replace all the picks and shovels. In my opinion, there are fewer variables and the economics haven’t changed since the days in 1851 when a gold rush in Ballarat saw 10,000,000 grams of gold delivered to Melbourne’s Treasury.

Back to my A1’s… the only entrant this week is Centrebet International (CIL). Remember that this is in addition to the 30 revealed so far in my previous posts – Part I, Part II and Part III. My A1’s now total 31.

CIL is in the business of online wagering and gaming and appears to have carved out a niche in Australia’s multi-billion dollar gambling market.

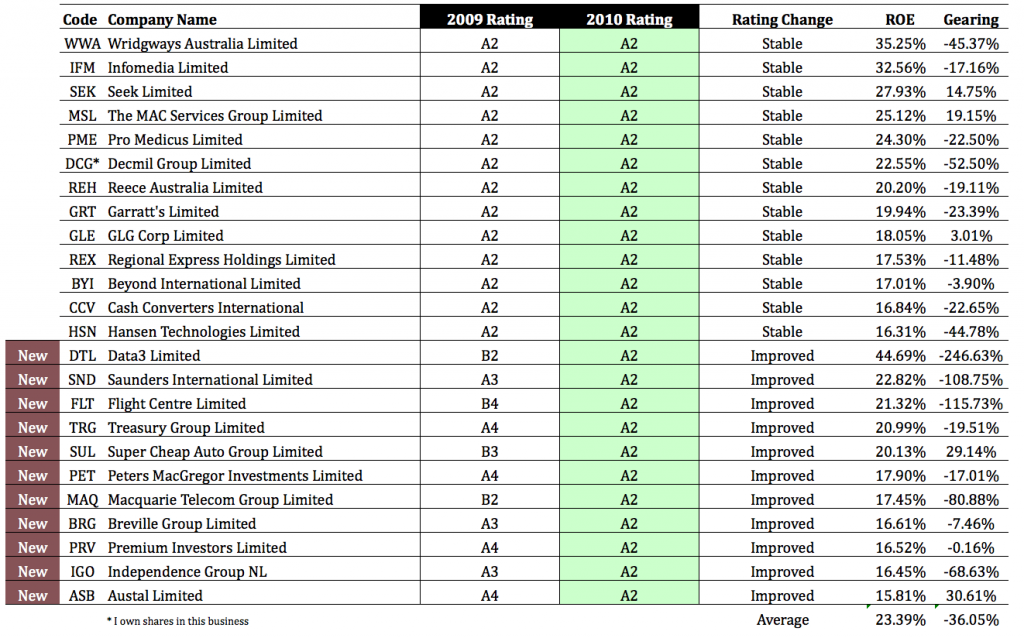

Take a look below and you will also see those companies that have achieved an A2 Montgomery Quality Rating since my previous blog post. The average ROE of this group is an impressive 23.39% (albeit around half that of my A1’s) with an average gearing level of -36.05%. There are plenty of Balance Sheets here reflecting a net cash position.

Combine my A1s and A2s (78 in total) published in the past couple of weeks and you have an excellent starting point from which to begin your own digging (by doing your own research and seeking independent personal and professional advice).

I will also mention that I may own any of the above companies and that I may buy or sell at any time – even tomorrow, and I am under no obligation to keep the list up to date in any way, shape or form. Before you do anything, YOU MUST conduct your own research and I insist you obtain independent personal and professional advice considering your needs and circumstances.

Value.able gives you the simple steps to follow to estimate a value for each company yourself and some thoughts to consider in regards to qualitative factors, such as competitive advantage. If you are not already a Value.able Graduate, why not?

Also remember that the share price may halve tomorrow. DO NOT buy shares in any company simply because I like it or own it – that is not investing, that is speculation. Speculating that I am right is not investing. That is the exact opposite of the value investing doctrine I espouse.

Reporting season will soon be a distant memory and the media, analysts and ‘investors’ will start to think about other things… the economies of the US, China and Europe will start to tickle the minds of idle analysts and commentators, but your focus should remain on great quality companies trading at very big discounts to intrinsic value.

Posted by Roger Montgomery, 15 September 2010.

Andew M

:

Hi Guys, don’t know if this is the right place to be posting this. I am looking to start up a new portfolio, that will likely comprise of the following:

JBH(Can the success continue?)

DWS(Negative Cash flow? and share price!)

WOW(How much bigger can they grow?)

FGE(After a 16 fold increase over 5 years is the run over?)

ORL(High debt than I would like!)

TGA?

MIN (Overpriced)

MND(Overpriced)

SWL(New to stock market)

ITX?

WBC(How much future exposure to bad debt?)

Any advice on the above companies would be much appreciated?

How many are A1s?

Thanks

Andy

Roger Montgomery

:

And please give Andy even a small does of optimism!

Andew M

:

Too true Roger, I tend toward glass half empty! I am really just trying to get opinions on how many of these companies are A1s! In addition I am also considering KOV and HSN, any thoughts?

Roger Montgomery

:

Jim Chanos runs a fund called Kynikos, which I believe is the greek word for sceptic. So you are in good company.

Mark

:

Hi Everyone

Just started reading the book and the thing that i find the most interesting is that a lot of what is said is commonsense yet commonsense seems to be absent in many of the ramblings of business analysts and so called market experts.

A general question for Roger and everyone out there. If you find an investment that meets all the criteria set out in Rogers book, e.g. share price significant discount to intrinsic value, good track record, rising ROE etc do you borrow funds or leverage off existing equity to get maximum value out of your investment?

Roger Montgomery

:

Hi Mark,

Regarding borrowing money, you can be very successful if you are not in a rush, without borrowing. It is something you obtain personal professional advice about.

Ben

:

Hi Roger,

Obviously ORL is not discussed on this post or anywhere else as they hadn’t reported yet, but now that they have, it looks like it hit the mark and pretty much maintained its astronomical ROE levels. On my calculations ORL’s valuation for 2011 is close to $10.70 and for 2012 rises to well over $12, using consensus forecasts.

Will be interested to hear your thoughts given you have said previously it is one of your favourite stocks!

Cheers

Roger Montgomery

:

Hi Ben,

My valuations for Oroton are a bit lower but only because I think I might be using a higher discount rate to you. Thats all. Well done. Its still one of my favourite companies. Note the Lane family sold a lot of shares two days ago. Given the patriarch’s influence over the sons, one suspects he was pulling the strings. Intriguing. Did they have a mortgage to pay off, a ski resort to buy or something else??? We’ll never know. Hong Kong/Asia roll out/toe-in-the-water will cost surprisingly little.

James

:

Hi Roger,

I was wondering if you had heard of/had an opinion of ZGL (Zicom). They seem like a good, solid company; although ROE is not bad; this has dropped a little recently – but it looks quite cheap.

Roger Montgomery

:

Hi James,

For whatever reason it hasn’t appeared on my short list. I will of course have all the stats so let me have a look and consider it for a near term blog post.

Peter

:

Hi Roger, I have been watching Astivita (AIR) in the past few weeks. My valuation is around $2.60, substantially higher than the currnt price of $1.14, the newly listed business is looking very positive with a very high ROE, little debt and operates in a high growth sector. Just wondering what is ur insights on AIR and did I left anything important out??? Thanks,

Roger Montgomery

:

Hi Peter,

Astivita looks interesting indeed. Only listed in December last year a demerged entity from Tamawood Ltd. Full year result shows no debt, no goodwill and good ROE. I am not sure about its prospects because while renewable energy is widely regarded the way of the future and 65% of the company revenues come from retail uptake of solar panels (9% from solar hot water systems and the rest from Bathroom & Kitchen sales), I am not sure the barriers to imitation or entry are very high. The prospectus described the business:

“The primary business activity is to import, warehouse and distribute bathroom, kitchen and solar products to a range of retailers, plumbing merchants, hardware suppliers, and Solar Power dealers. AstiVista seeks to source quality mid-market products and grow its customer base with a low cost distribution strategy. Key product lines currently distributed include tapware, kitchen appliances, vanity units, acrylic baths, vitreous china products and solar products used in the building and renovation industry.”

What makes you think this is the business amongst all the others that will succeed? Why should it be listed? There are many privately owned businesses that are bigger and with a more recognised brand. It may indeed be the business that wins the race, but what gives you that certainty? Cash flow from operations was negative. That needs a quick explanation. The AGM is being held at a restaurant.

Nigel

:

Roger,

Enjoyed the book immensely. Would value your thoughts as well as fellow bloggers on ThinkSmart’s (TSM) IV. On my calculations it is trading well below its IV ($0.9 @ an RR of 15). Has some great clients including JBH and Dick Smith.

Retained earnings too expand its UK footprint, has no debt though currency headwinds likely too impact NPAT going foward. How does it fit on the Montgomery Quality Ratings scale.

Regards

Nigel Clarke

Roger Montgomery

:

Hi Nigel,

I am delighted to hear that you enjoyed the book. For Thinksmart (the consumer electronics/computer finance company with brands like RentSmart and retail partners such as those you have mentioned as well as Officeworks and NextByte), based on earnings per share jumping from 2 cents in 2009 to 9 cents in 2010 (ROE from 10% to 43%), 11 cents and then 13 cents in 2011 and 2012 respectively, I get a very large jump in intrinsic value from 13 cents in 2009 to well over $1.00. By way of background to save readers a bit of time, it started trading on June 6, 2007 after an IPO at $2.15. It listed at $2.35 and subsequently fell to 10 cents. Currently 67 cents. The company is forecasting 13% increases in revenue and 8-12% EBITDA growth but that excludes the UK business which potentially exposes the company to a market 4 times the size of Australia. It gets an A3 on the MQRs. Worth doing some work on to identify whether there is a sustainable competitive advantage.

Nigel

:

Hi Roger,

Appreciate your comments in regard to ThinkSmart, one too do some further due dilligence. I am also interested in your IV for ISS which made your A1 list this year. On my reckoning it is trading at a discount to its IV of 40 cents (RR of 15). Difficult to find future earning forecasts to gauge what is happening with IV going forward.

Regards

Nigel

Roger Montgomery

:

Hi Nigel,

TSM have just announced a capital raising too.

Steve

:

Hi Roger,

I am looking forward to your blog with updated valuations. I have been gradually getting through some of the companies and attempting to apply my own valuations.

From what I have found SO FAR it appears perhaps only Matrix and Forge are at substantial discounts to intrinsic value. Going by the principles in your book, this would suggest there are only a few companies that are perhaps worth investing in.

While there might be a number of companies trading close to IV, so far there does not seem to be the substantial discount that we are told to look out for. Would you agree with this?

Roger Montgomery

:

Hi Steve,

Regarding your comments about a lack of good value; you are right. There are only a handful trading at substantial discounts. Of course, that would not prevent the market from rising and for prices to move even further above intrinsic value. Our job however, is not to try and guess what prices are going to do. Our job is simply to take advantage of qualifying investments as they occur.

Matthew

:

Hi Roger,

I’m sure many who read this blog would agree when I say that I wish you had published your book (OR AT LEAST that we knew what we do now) in mid-late 2007 in the final stages of the bull market. Bring on the next GFC and the big IV discounts of 2009!

Regarding the above comment of only a few good companies currently trading at substantial discounts to intrinsic valuation:

For those of us who are new to value investing, in your experience are we in a “normal” pattern where the majority of high quality stocks trade above or about IV? Therefore, do we need another GFC / major catastrophe to see the wide ranging discounts to IV that I can see were present in 2009?

Thank you for continuing to be so generous with your time and knowledge,

Matthew

Joris

:

Hi Roger,

I enjoyed your book immensely, finally someone that can explain in simple terms what to look for in financial reports and how to anchor investment decisions.

My question is about GLE, one of your A2 companies. This company looks very attractive. I have a current intrinsic value for it of $1.63 (using 11% investor required return and 20% ROE). The price at the moment is around $0.30, so a significant potential upside.

However, GLE is very illiquid. Why do you include this stock in your classifications if it’s this difficult to get in/out of? Should your quality/risk classifications also incorporate the liquidity of a stock?

Kind regards,

Joris

Roger Montgomery

:

Hi Joris,

Market conditions is not something that is factored into the assessment of the value of a business. Remember we are valuing businesses as if they were unlisted or the stock market were closed. In those circumstances, liquidity is not a consideration. In reality it is and so one must necessarily consider the size of a position in one’s portfolio with reference to liquidity. Be sure to seek and take personal professional advice.

Regard

Roger

Si

:

Hi Roger and james

I just had a look at TFS (TFC.asx)…wow is all i can say. I agree this is a monopoly in the making. They have control over customers with many signing up to a % of production years in advance and $$ to be set at point of sale. There appears to be medical interest developing, significant cosmetci and industry demand and cultural / religous need not want. So demand is very strong and lackicg substitutes. On the supply side I see world suppy is dwindling and TFS is really the only viable source – also natural / sustainable and green!

There also appears to be huge barriers to entry for any competition and TFS is 15 years ahead of any rivals!

So using Porters 5 forces: they have power over customers, power of suppliers, no realistic substitute, huge barriers to entry and a monopoly position….WOW they are also vetically integrated soil to end product!

Also trading on a PE appox 5, making money now growing trees, paying a dividend and yet to bennefit from revenue from harvest….which appears to offer huge revenue flows starting in 2 years.

Found these broker reports

http://tfsltd.com.au/shareholders/research-reports/

Wow thanks for that.

Si

Roger Montgomery

:

Ok Si,

Thanks for that very enthusiastic post about TFS. Do you own the stock already Si or are you connected to the company in any way?

Ashley Little

:

Thanks for that Si

I would also recommend you look at the cashflow statement in the financials,

This paints a far less rosy picture

Pat Fitzgerald

:

Hi Si

I owned TFS before I purchased Roger’s book and I wish I had never purchased it. There may be some blue sky in the future but who knows.

Roger Montgomery

:

Hi Pat,

TFS’s intrinsic value is higher than the current price BUT, intrinsic value is lower than it was in 2007, intrinsic value is only forecast to rise by about 5% in the next couple of years (if it reverses recent declines), its a B3 and the latest results cash flow doesn’t inspire. So far capital raisings have helped bridge the gap between the cash flow from operations and the money required to invest in the business. That could change in the future of course. Be sure to seek and take personal professional advice.

ron

:

hi roger,

could you please provide your IV for fy10, fy11 and fy12 for Forge group?

thanks.

Roger Montgomery

:

Hi Ron,

Will do in the next week or so. Forge group valuations for next three years (and a few other companies) coming up…

Matt Smith

:

Hi Roger,

Do you construct pro-forma financial statements in your analysis??

Roger Montgomery

:

Not for every company Matt. Plenty that don’t deserve that kind of attention.

Matt

:

Hi Roger,

I would firstly like to add to the many accolades on your book. A fantastic piece of work. After dabbling in the share market for 10 years I thought I vaguely knew what I was doing. I first heard you on the ASX podcasts and have been devouring as much of your knowledge as possible since then. Now I have read your book and realise I have another lifetime of learning ahead of me. Luckily I have a few more working and saving years ahead of me to bang my portfolio in shape.

Now I have started really diving into company reports to apply your valuation methodology. Could you shed some light on how you would treat companies that have a deferred income tax benefit that boosts the bottom line? Is this something that should be disregarded when calculating your ROE, or is it sustainable and a byproduct of the way the business operates.

Keep up the great work,

Matt

Roger Montgomery

:

Hi Matt,

I factor deferred income taxes (credits and debits) into my estimate of cash flow. There wasn’t room in the book to cover it and it may offend some viewers but I will cover it here in a blog post.

david phillips

:

a concern i have relates to goodwill and other intangibles. for example, in the case of wotif intangibles are greater than claimed equity and there are a number of others in your A1’s where this occurs.

i realise that the intangibles are put through a form of stress test each year and that in some cases represent pure value.

can you explain your philosophy in relation to this.

best

david

Roger Montgomery

:

Hi David,

Regarding the intangibles and goodwill, did you read my chapter on the subject in Value.able?

Tim

:

Hi Roger

I have long been a fan of MMS, however like you, was unsure about its new acquisition so i headed for the exit. Bad timing! its gone gangbusters recently despite this. To steal one of BG’s favourite quotes, Is this a classic example of the “short run voting machine” in play? Or have we missed something?

Thanks

Tim

Roger Montgomery

:

Hi Tim,

I have met with the CEO of MMS recently and they are most definitely the guys to pull it off. The synergies are genuine and they are already proving the acquisition of the operating leasing business was a smart move. Interestingly, even after my meeting, the best valuation I can get is $6.68. I have sent an email to the broker that invited me to the meeting with the company requesting their modeling so I can see whether my estimates are too conservative.

Gavin

:

Hi Roger

What valuation do you get for the Remuneration Services segment?

What valuation do you get for the Asset Finances segment?

Roger Montgomery

:

Hi Gavin,

Sum of the parts valuations intrigue me. They are relevant if you expect a takeover bid and for someone to come along and break it up and sell the two parts. Or if you plan to do that yourself. Otherwise, as a passive investor/minority shareholder you are buying a going concern. Now that will stir controversy but thats how I approach it.

Gavin

:

Hi Roger

I’m not talking about a breakup value for MMS or anything else.

You are averaging two businesses with vastly different metrics and then applying your valuation method. Is that sensible?

A cross check of your method would be to allocate unsegmented assets and profits to each of the operating segments (assumptions are easy with latest annual report and presentation)

Apply your model to each business separately and then add. Does this give you the same outcome as averaging the two businesses before applying your valuation model?

Just food for thought – Not trying to have a debate on the value of MMS – will leave that to the market.

Cheers

Roger Montgomery

:

Hi Gavin,

I understand your approach and in no way wish to invalidate it. Its just that such an approach conceptually, is the one to take if you and I were buying it and were going to split it up. Buy shares on the market however, we are not buying two separate businesses and brining them together. If the value of each is higher separated – as you suggest they might be – then management have made a mistake bringing them together. Why did they do that? Leaving the valuation of MMS to the market, is exactly what we should be taking advantage of! We are in 100% agreement there.

Jay

:

Hello Roger…

This may seem like a trivial question… But I can’t wrap my head around the ROE of 22% for DCG when the information that i’m getting from COMSEC is only about 9%.

Just wondering also… How do you calculate gearing??

Thanks

Roger Montgomery

:

Hi Jay,

Go to the annual report rather than the Commsec data which I believe is coming from Morningstar. Then come back and let me know what you arrive at. When you say gearing, I suspect you are also interested in all Financial Leverage ratios. There’s LT Debt/Common Equity, LT Debt/Total Capital, LT Debt/Total Assets, The Capitalization Ratio, Total Debt/Common Equity, Total Debt/Book Value, Total Debt/Total Assets, Net Debt/Shareholders equity (the one I like), OPerating income/Total Debt, trailing Net Debt/EBITDA (a favourite of my analyst peers) and it goes on. I hope that provides some ideas to go and study.

Matthew

:

Hi Roger,

I have a question about valuing a company based on it’s half year report.

Do you estimate the second half figures or do you work out the previous years second half year and add it to this year’s half year to get the last 12 months?

How do you do suggest it is done?

Thanks!

Roger Montgomery

:

Hi matthew,

There is no single way to do this (using half year numbers). You have to try and understand also whether there is any seasonality in the numbers too. Then of course a fast growing company’s numbers can mute the seasonal effect. To help, lay out the half yearly numbers. You can do this for the second half by subtracting the first half numbers from the full year results. Lay them all out chronologically and you will get maybe just an inkling of what the full year result might be. Its not enough though. You need to model revenues and working capital changes to get an even better understanding. Stock turns, debtor days etc can all help to improve forecasts. For retail businesses, you need to look at sales per square meter, how many new stores are being rolled out in the half, how long they take to mature etc…Its serious modeling and after all that many analysts go and reverse all their good work by applying an inferior valuation model. Quite simply, the valuation technqiues applied here are not about next years result but the change over several years. Better to get a conservative ROE approximately right, than next years profit number exactly wrong.

Mark H

:

Hi Roger and fellow bloggers,

Great site to learn from – thanks to all!. The favourable comments on ‘value-able’ are very well deserved in my view. If you haven’t read it yet, I’d encourage fellow bloggers to put it on your ‘to read’ list..

A couple of points/observations I noticed recently.

1. My 1st piece of IV homework after reading value-able is to run an IV for Blackmores, which interestingly had a ‘buy’ quote at $23.48 in Sept’s money magazine (to get to at least $24.70) – it already ended at $26.81 last Friday. Would be interested in a 2010 IV range for Blackmores. Maybe it can feature as part of a look into the performance of the ‘healthiest pharmaceuticals’.

2. On price, I agree with what you say about the wrong focus in today’s press, especially misleading price indicators. You don’t have to look far to see examples – there was 1 recently in an AFR article 2 weeks ago talking about ‘hidden gems’ in today’s stockmarket. Company was Colorpak, I quote: ‘CP’s share price surged following the result, however there could be more upside to come as the company’s price-earnings ratio relative to consenus f/c for 2010/11 is only 6.4 times earnings….’

I now know how to interpret this after reading your book! Let me assure you it isn’t favourable. Interestingly in the same article (p46, AFR) MMS is in there too. Probably best to replace the ‘smart money’ heading at the top of this article with a more accuratre one ‘casino or lost money’ perhaps.

Keep up the continuing great work all!

Roger Montgomery

:

Hi Mark,

I really appreciate the encouraging words. Thank you for suggesting those that read the blog, and don’t have the book, go out and order it.

Ken Milhinch

:

******** ARP ********

Of all the variations I see in other people’s valuations and mine, this is the one that really has me puzzled. I read where others think it is trading below IV, yet I can’t get it anywhere near the IV, and in fact I have it trading at $2.95 over the IV as of Friday 17/9. I know that the RR% you use will determine your final IV, and the way you calculate ROE% will also influence the result, but none of that explains the really optimistic valuations that I have seen.

My figures are as follows;

TY equity $111.406

LY equity $92.039

Shares 72.481

NPAT $32.628

Divs $33.316

Calculated ROE (using TY equity) 32.08% – Use 32.50%

RR used 11%

IV $4.54

Trading $7.49

Good company but a long way short of offering a margin of safety for my money I think.

Pat Fitzgerald

:

Hi Ken

ARP paid a special dividend during the 2010 FY and this should possibly be excluded from the dividends ? For 2011 most people would probably be using a payout ratio of about 50%. For 2011 using payout ratio ’53’ ROE ’30’ & RR ’11’ I get an IV of $7.61.

Stuart

:

Ken, I am loving your comments. The range of Decmil IV’s clearly shows what you are talking about. They are helping us beginners a lot. One of the areas I still have not got my head around is on the basis to change an RR from 10% to 11% to 12%. Until I understand this better I will go the more conservative path. If you have some guidance you could share with us. It may have been covered in a previous blog but I have only just got my browser starting to update properly and it will take me a long time to backtrack previous entries.

Roger Montgomery

:

Hi Stuart,

There is a discussion about discount rates in my book – think of it as a starter culture. I have made comments here about choosing the discount rates throughout the blog on a regular basis but I would be delighted to hear others share their methods of choosing a discount rate. Keep in mind there is no “right” method although using WACC is “wrong”.

Pat Fitzgerald

:

For businesses with a NPAT of greater than $100m I start with a ‘Required Return’ of ’11’, for businesses with a NPAT of $5m-$100m I start with a ‘RR’ of ’12’ and for businesses with a NPAT below $5m I start with a ‘RR’ of ’13’ and then I add or subtract a small amount by assessing the following:

debt/equity ratio: [no or low debt (-0.5) up to (+2) for very high]

high % of goodwill & other intangibles: (+0.5)

stability and volatility in Return on Equity: [stable (-0.5) up to (+2) for very volatile]

very high return on equity: (-0.5)

strong competitive position: (-0.5)

around a long time and stable: (-0.5)

Note: I deduct a maximum of ‘2’ from the starting ‘RR’.

Roger Montgomery

:

Hi Pat,

This kind of scoring matrix is better than many alternatives and a significant improvement on the wet thumb in the air trick.

Ken Milhinch

:

Stuart,

Sorry to others if I seem like I am repeating myself, but my approach is as follows.

I apply a percentage to the various GICS sectors, and then when my spreadsheet does its calculations, it looks up the percentage to use based upon the sector in which the company operates. Of course I can override it at any time, but I feel it offers at least a consistent approach to companies in similar businesses.

As follows;

Automobile & Components 11%

Banks 10%

Capital Goods 12%

Commercial & Professional Services 12%

Consumer Durables & Apparel 12%

Consumer Services 12%

Diversified Financials 11%

Energy 14%

Food & Staples Retailing 11%

Food Beverage & Tobacco 11%

Health Care Equipment & Services 11%

Household & Personal Products 12%

Insurance 12%

Materials 14%

Media 11%

Pharmaceuticals, Biotechnology & Life Sciences 13%

Real Estate 13%

Retailing 12%

Semiconductors & Semiconductor Equipment 11%

Software & Services 11%

Technology Hardware & Equipment 11%

Telecommunication Services 11%

Transportation 12%

Utilities 12%

Of course not everyone will agree with this or even the actual percentages I am using, but it’s an approach that seems to work for most companies.

Regards,

Ken

Roger Montgomery

:

Great stuff Ken,

I too would be very interesting in seeing your table of discount rates generating some discussion.

Pat Fitzgerald

:

Hi Stuart

I have another slightly different approach to my first one (I am still tinkering). Maybe using Ken’s as a starting point and then adjusting for factors that can increase or decrease the risk to earnings is another approach.

‘Required Return’ Guide:

Start with a ‘RR’ of ’12’.

Rate each of the below (1 to 5) (1=Excellent, 2=Good, 3=OK 4=Poor, 5 Very bad):

Strong competitive position

Dominant in its industry

Around a long time and stable

Good management

Solid cash flow

Add the ‘Ratings’ and if the ‘Total’ is (5-8) subtract ‘2’ from ‘RR’, (9-12) subtract ‘1’, (13-17) no adjustment, (18-21) add ‘1’ (22-25) add ‘2’.

Then do the following:

Large businesses (NPAT of greater than $100m): subtract ‘1’

Very Small businesses (NPAT below $5m): add ‘1’

Net Debt/Equity ratio: 100-150% add ‘1’, greater than 150% add ‘2’

If they have a High % of Goodwill & other Intangibles check to see if it is creating revenue & profits: if not add ‘1’

High Volatility in Return on Equity: add up to ‘2’

Matthew

:

Hi Ken,

I think you will find that the higher valuations being suggested are for future financial years.

Also, you are including the special dividend in your dividend payout ratio. I would suggest that the special dividend shouldn’t be included (just as abnormals shouldn’t be included in the profit (unless they are normal!)). Remove that special dividend from your dividends paid and then see what the valuation for 2010 is. It will be much higher as the compounding from the retained earnings will add significant value.

Best of luck and post back when you have had a chance to do the above.

I have to thank Roger, his book and the other readers here for helping me with similar problems. Armed with that knowledge I can now help you…

Roger Montgomery

:

Amazing stuff Matthew!!! Well done, indeed.

Ken Milhinch

:

Matthew,

Thank you for your advice. Just this afternoon, I started (against my better judgement) to calculate some forward values, and ARP being at the start of the list, I encountered the issue of dividends then. I had decided to exclude it for future years, and of course it makes a big difference to the IV. When I also exclude it from 2010 as you suggest, it makes a huge difference to 2010. They still do not offer a sufficient margin of safety for me, but I really appreciate your input. Thanks again.

Regards, Ken

Roger Montgomery

:

My Valuation of ARP puts it at a circa 6% discount to intrinsic value. Well done.

Robert

:

Hi Roger,

Some weeks ago I stumbled upon a macro plugin that some wondrously benevolent programer has written (and maintains) for Excel. It enables you to load in complete set financial data (amongst other things) from certain websites, for free! The plugin is called RCH_Stcok_Market_Functions and there are various forums dedicated to its use.. Just Google that name to find it/them. I have built and borrowed a spreadsheet that downloads balance sheet data etc which feeds a model based on your method.. The only issue I am having with it is the structural differences between the way Australian and American balance sheets etc are constructed, as the data sources are from American sites. For instance, using your cash-flow method, the American sites don’t use “borrowings” and as yet haven’t been able to reconcile the differences between the feed data and actual company report. This may only be a peculiarity with the sites used, I just need more time to research… Everything else works wonderfully well. Also, the sites update very shortly after companies report, next day in some cases – allowing – Montgomery style – the quick assessment of opportunities. I posted this with the hope of maybe starting a dialogue amongst the tech savvy, around the use of this excellent tool, based on your method. One other thing, it is written in VBA and only runs on windows machines – but there are ways around this for those of us who use proper computers most of the time. Your most recent posts have really driven home to me the fact that the valuation is only half the problem (maybe the easiest part) the rest is spotting opportunities quickly. Thanks once again for this excellent blog.

Roger Montgomery

:

Hi Robert,

You need to be quick after reporting season because this is the time everyone is processing all the data and the markets are inefficient. Taking advantage of inefficient markets is what value investing is all about.

Ken Milhinch

:

Robert,

I have pretty well automated a lot of my calculations in Excel too, but my concern with downloading data as you suggest would be that you will not be aware of abnormal items in the NPAT. I don’t think there is any substitute for reading the financial reports personally. I take a download of end of day prices from Commsec and use a macro to format that and drop it into my spreadsheet so that each night I can see what is trading below IV and what is not, but I would prefer to enter the 5 inputs for IV myself. Having said all that, I will take a look and thank you for the tip.

Regards,

Ken

Robert

:

Hi Ken,

I agree. I don’t know how the data is disseminated to the various sites around the internet, and they could very well be subject to mistakes or omissions. I have been using is a s a quick check.. With a cross check if the outcome is at all positive. I have it setup so that all that is needed is to type in the company code and it populates a balance sheet / Cash-flow sheet and uses it spits out a valuation.. So far its been pretty accurate.

The spreadsheet i’m using downloads information from here: http://moneycentral.msn.com/investor/invsub/results/statemnt.aspx?Symbol=AU%3AJBH Everything on this page is loaded into the spreadsheet.

There is a Yahoo group dedicated to the use of this plugin called: stock_analysis_group · Stock Analysis and Valuation Models Members have uploaded (for sharing) a heap of valuation sheets for stocks to options and everything in between..

Enjoy!

Roger Montgomery

:

Hi Robert,

Thanks for sharing these free sources. I have not checked their accuracy so caveat emptor!

Roger Montgomery

:

Hi James.

I will will put it on the list to cover in a future post. of course anyone else is free to post a comment or insight.

Stephen

:

Roger,

I’m somewhat confused with the ROE on ARP being 31.73%.

I’ve calculated it out a number of times at 35.45% based upon the following figures from the 2010 report:

2010 NPAT divided by 2009 equity shown as:

$32,628,000 (2010 – NPAT)

$92,039,000 (2009 Equity)

This gives me 35.45% ROE

Am I using the wrong figures from the report?

Stephen

Roger Montgomery

:

Hi Stephen,

Try using average equity.

Ken Milhinch

:

Roger,

I have been looking at PRV today and was quite surprised to see that after reducing their equity by about $100M last year through a share buyback, they are now embarking on a share issue to existing shareholders, which will potentially raise about $30M ( if all shareholders take up the offer). This seems highly contradictory behaviour to me, and given that they have no debt and almost no capital requirements to run the business, I wonder what they are going to do with the money ? Am I missing something ?

Regards, Ken

Roger Montgomery

:

Hi Ken,

Whether they are doing something smart or not depends on the prices they bought back and the prices they are now issuing.

James

:

I was reading Finbar’s Annual Report and found it extraordinary that they

only employ 9 employees at their head office – and outsource and contract

the rest when building their projects.

I think this is a good business; but my only concern is the shares on issue

rise steadily year-on-year.

Roger Montgomery

:

Hi James,

These are the sorts of questions that are worth asking the company about. Finbar is indeed an interesting company to analyse.

James

:

Hi Roger,

I was wondering if you had an opinion on TFC – producers of Indian

Sandalwood plantations – which I believe they have monopoly in the Indian

market – and due to religious reasons, has a pretty inelastic demand.

Their ROE is good, payout low and currently well under value.

Roger Montgomery

:

Hi James,

TFC is one I will revisit now that I have some capacity. Thanks for the suggestion.

paul

:

Hi Roger

I had a closer look at CIL and according to my calculations was well under IV at $2.35 but I am having trouble trying to find forecast eps and dps. Any idea where I would be able to get these figures from.

I have tried comsec,etrade, google and yahoo finance.

Does the IV I get sound about right? It is at %10.

Thanks

Paul

Roger Montgomery

:

Hi Paul,

Sounds like you need to ask the company which broking forms/analysts cover the stock. Its trading at about IV on my estimates. Seek personal professional advice.

Pat Fitzgerald

:

Hi Paul

Try ‘Reuters’, its free:

http://www.reuters.com/finance/stocks/financialHighlights?symbol=CIL.AX

Richard O'Brien

:

Dear Roger,

Many thanks for sharing your analysis with us.

Thank you also for your book, which has been a revelation to me. It has completely changed my approach to investing.

Since reading the book, and studying your A1 and A2 company lists I have made a number of investments, and they are doing very well!

Kind regards

Richard O’Brien

Roger Montgomery

:

Hi Richard,

I am delighted to hear your investments are going well. Please remember everyone, that short term share prices can reverse in a heartbeat and I have no ability to predict share prices. You MUST seek and take personal professional advice before acting or transacting.

Lloyd Taylor

:

Roger,

On DOM… there has been a 59% blow out in cash operating costs.

It is a fact of life that many, if not most resource companies are characterized by “fair weather” leaders and management who rely on a tail wind of rising commodity prices to cover the fact that every controllable factor in the business is out of control.

As soon as the tail wind drops a little, or shifts, they scream about the external factors adversely affecting the business, but beyond the screaming do little about it.

I suggest that this, rather than the inherent commodity price volatility is what makes these companies problematic from anything other than a speculative proposition. Find one with truly competent management and the risk to the investor is greatly reduced.

The competency and capability required is not simply operational but involves mastery of subsurface risk and uncertainty and considerable international commodity market smarts to manage the price and currency risks. This is a rare combination of skills and means that the truly competent and capable resource sector management is as scarce as hens teeth.

Regards

Lloyd

David

:

Hi Roger.

Thanks for posting your update, always much appreciated and a good read. It’s refreshing to see quite a number of stocks I’ve recently added to my watchlist being in your top lists of companies.

I’m interested in your ROE calculation on Hansen Tech. I had ROE in the low 20’s based on net profit of over $11m and equity averaged at just over $47m. Have I missed something?

Cheers.

Roger Montgomery

:

Hi David,

I will revisit the Hansen numbers and post something if I find something wrong. In the meantime, can I suggest you have another look too and be sure you are using average equity and taking out any abnormal items.

David

:

Hi Roger.

I’ve just very quickly had a look over my figures again, I’ve used average total equity and the profit doesn’t contain any one offs. The company appears to be growing year on year and a nice rate.

On another note, they have a fair bit of cash on the balance sheet, it should be interesting to see how the management team going about using this cash (they appear to be making a fair bit of it).

Roger Montgomery

:

Hi David,

Can you run through the numbers you are using and note where exactly you got them from?

Stuart

:

It’s good to see some of the companies I have been looking at are on your A1 and A2 list. Your inclusions of the ROE and Gearing figures will certainly help us beginners cross check our calculations as we become more familiar with the methodology. I am busy constructing spreadsheets and constantly referirng back to Value.Able with prompts and page references to help with my long term understanding. I know I still have a long way to go but I definitely feel I am on the right road and heading in teh right direction. Many thanks to you and fellow bloggers who I am also learning from.

Roger Montgomery

:

Great stuff Stuart,

I am really encouraged that so many investors are excited about value investing and are working diligently to apply the precepts. Really great. Remember that prices can halve and a value investor sees that as an opportunity provided the value of the business has not changed.

Tyler

:

Great List!!!! of good companies

however, unfortunately most are valued or overvalued.

Roger Montgomery

:

Thanks for your thoughts Tyler. Thats what makes a market!

Jean-Pierre Vecchi

:

Hi Rodger,

Can you please give me your intrinsic value on wotif.com.

It looks a good buy.

Roger Montgomery

:

Hi Jean Pierre,

$4.54. Not a recommendation. Seek personal professional advice.

Chris

:

Hi Roger,

It seems to me that the real value in WTF (which I now hold) is in its rising future value. I have it trading well below its 2012 IV.

On a related note, I read a report downgrading WTF because it has decided to spend more on advertising. The report suggested this was foolish as they operate in a cyclical environment and wouldn’t really be able to inrease demand by advertising.

Are they really suggesting that a company can’t increase market share in a cyclical environment by advertising? This is exactly what a company (especially one with a strong cash position) should be doing. Mr Market as his finest!

Roger Montgomery

:

Hi Chris,

Thanks for your thoughts about WTF. Remembers to always seek and take professional personal advice before or selling any shares. I am of the view that WTF’s Wotflight website is a superior user experience to Webjets too.

Craig

:

Hi Roger,

Lots of information to digest and research to perform. Thanks.

I’m at the point where I’m relatively comfortable calculating IV from a given annual report, though I probably need more work when it comes to items like abnormals, capital raisings, etc, complicating matters for me.

Now, regards to forecasting future IV, I’ve got your “source data” document, and I’m comfortable with obtaining the inputs I need, but despite a few reader comments on the topic, I’m still not 100% on how I go about doing this.

I had a few lightbulb moments listening to your Melbourne podcast, but I am wondering if you, or one of your regulars here, may be able to put a few dot points up to help me get on with the challenge of forecasting future IV?

Could also possibly be a future blog topic? Thanks Roger.

Regards,

Craig.

Roger Montgomery

:

Hi Craig,

I will indeed make forecasting next year’s intrinsic value a topic for a blog post. It is a subject that you won’t find discussed anywhere else or in any other book so I owe it to you to write something further about it. You will see the concept is covered in part from page 213 in my book.

Callan

:

Hi Roger, Congratulations on the book. Is an extremely good read and will be re-read numerous times.

Do you access all of your figures from annual reports (i.e. Wotif’s current ROE of 67.42%)? When i view the financials of Wotif (Through Commsec) it shows a ROE for 2010 of 61.6%. Would appreciate if you could clarify.

Also i know you have mentioned it in the past, but i am really struggling to find analysts reports who project all of the information required.

Appreciate your time Roger.

Cheers

Roger Montgomery

:

Hi Callan,

Its all out there. The information is available but not all of it is free or online. I receive a lot of broker reports and read the annual reports too. Our ROE’s can be different for a host of reasons. Abnormals and the equity figure are some of the usual reasons for discrepancies.

Phil

:

Callan/ Roger-

Many people I have seen around the internet struggle to find forecast information without paying for it BUT, having said that, I did solve two of my biggest problems.

Those were- finding forecasts for NPAT; and forecasts for ‘end of year equity’

NPAT- someone pointed out to me that if EPS= NPAT/ # shares then simple math tells you that NPAT must = EPS x # shares

EQUITY- Roger actually answers this one on his site with a simple formula ( I refer to equity per share as EqPS below):

e.g. 2011 (forecast) EqPS = 2010 EqPS + 2011 (forecast) EPS – 2011 (forecast) DPS + 2010 new share capital/ share – 2010 buybacks/share

DPS and EPS forecasts can be found on most broker sites like Commsec

Once you have forecast EqPS I think you can then multiply that by the # of shares to get a forecast for that year’s ‘end of year equity’.

Using these methods I got to within 1.5% of Roger’s IV forecast for ARB. He doesn’t give away all his secrets in Value.able so I think that’s pretty good considering :)

Hope that helps.

What do you think Roger?

Cheers

Roger Montgomery

:

Spot on Phil. Couldn’t have said it any better myself. A growing number of Value.able graduates about to take flight and teach the world value-investing. Go to the value investing congress in New York or Pasadena and you may be surprised just how much more you know about true value-investing than some of the speakers! I couldn’t be more excited about that. Thanks Phil.

Robyn Clancy

:

Hi Roger,

Absolutely loving the book – taking my time to make sure I understand all the concepts and calculations but so far – all pretty easy – well done!

I am not ready to buy into the market yet as I am still getting to know the formula and the areas where the risk is suitable to my investing style but I like to keep watchlists on my trade site of all A1s so I know where they are in relation to their IV -is there an easy way to look the latest IVs on your site?

Thanks, Robyn Clancy

Roger Montgomery

:

Hi Robyn,

Be sure to get some personal professional advice too because things like position sizes or portfolio weighting have not been covered. Portfolio construction is a very important part of a complete investing process and you will need advice at least on that subject if not also for a professional opinion about the companies you are interested as well.

Pete

:

Hi Roger

Sorry if you get this twice as I am unsure that it is being sent.

In the above table you have an ROE of 17.45% for MAQ.

Using Commsec data but confirming data on company reports I have an ROE of 28.57%. I have a IV of $15.82 with a discount on current share price of 55.75%. Are my calculations anywhere near yours and could you comment on any possible reason for my higher REO on MAQ. To make my calculations I used Req REO of 10%. Any other comments on MAQ in general would be appreciated.

Regards Pete

Roger Montgomery

:

Hi Pete,

On MAQ, I get a valuation for 2011 and 2012 that is below the current price. There are of course factors that can cause the anticipated profits to rise having a positive impact on the valuations, but thats the situation for me at present. Seek personal professional advice.

Pat Fitzgerald

:

Hi Pete

MAQ sold an asset, see Note 29 in the annual report, you should remove that from the profit and that will result in a lower ROE. The ROE for 2011 & 2012 looks like it will be around the 17-18%. For a small business I would suggest using a higher RR than ’10’.

Rob Walker

:

Hi Pat,

Your response for Pete was great, thankyou. I had the same problem with MAQ, and once I read the annual report I had a Light Bulb Moment. I have now coloured all my stocks on my watchlist Red, untill I have read and understand the Annual Report. Thanks again

Regards

Rob Walker

Roger Montgomery

:

Well done Rob,

Any process you implement that reduces the chance of human error and saves time is a big advantage.

Ken Milhinch

:

Roger,

Not wishing to sound pedantic, but you mention there are 78 A1 & A2 companies, but I make it 84. A1=31, A2=53.

Roger Montgomery

:

Hi Ken,

Thanks for showing me how to do long addition. ;-)

Nick Mason

:

Dear Roger, I would like to take this opportunity to thank you for the continuing work you do on your website and also to let your readers know about a company which has so far escaped your analysis on this website and one which I wrote to you about a couple of months ago which has since changed its name and asx code, Resource Equipment Limited (RQL)

This is a fantastic business which delivered a maiden profit of $8 million in its first year as a publicly traded company. RQL’s ROE is 20%, it has very little debt and an extremely conservating gearing ratio, it grew market share in 2009 and 2010, has strong cash flow and its opportunities to expand within this new industry (specialising in mine dewatering) are very strong. Most mining companies handle mine water issues in house.

Readers interested in investigating this company further should read their latest investor presentation which gives a far more comprehensive summary of the company then I have offered.

I am not advising any reader to buy or sell shares in this company.

Roger Montgomery

:

Hi Nick M,

Thanks for bringing RQL to the attention of the investors who visit this blog. I get an A2 and IV’s of 46 cents. No-one is making any recommendations. I will do some more work on it too. I trust while you are not suggesting buy or sell, you also have no links to the company.

Pat Fitzgerald

:

Hi Nick

I have RQL on a watchlist with an IV of 57 cents in 2011 and rising to 67 cents in 2012. I don’t own shares in RQL but I will be watching it closely to see if it continues to win new business and meets the earnings forecasts.

Nick Mason

:

Hello Pat,

if you haven’t already done so I strongly recommend you read RQL’s latest investor presentation, available in the investor section on their website. Also, for a closer look at what the company does their most recent activity report is also very interesting.

Roger Montgomery

:

Hi Everyone,

RQL gets an A2 and an intrinsic value of 46 cents for 2011, rising to 54 cents in 2012 and 64 cents in 2013. I am using forecast ROE’s of 18%. Unless you are aware of some major upgrade it seems there are others in the resource servicing space with higher ROE’s and bigger discounts to intrinsic value.

Pat Fitzgerald

:

Hi Nick

I have read RQL’s ASX releases and I have done some other research. The mining services area is booming at the moment, there are many choices.

thank you

Jonno

:

Hi Nick,

This is a growth play which has the potential for significant upside.

I don’t think the brokers covering the stock at the moment are factoring in the potential level of growth that this company could see both in AUS and overseas.

Roger, what is your view of the growth potential this company offers, given James Cullen’s 13 year history at PCH Group? James seems to be a very easy going but diligent operator who sets achievable targets, while under-promising and over-delivering.

Cheers.

Tom Graham

:

Hey Roger,

Just having a look at some IV’s for a couple of companies. Platinum asset management being one, which i had a value of $3.40 using diluted earning per share and $3.80 using basic earnings per share. Just thought that was a bit low. The other being ARB corp, had a value of $8.40 (seems cheap), but the dividends appear more than EPS due to bonus dividend, I used just the 19.5c normal dividend to get 42% payout ratio…is that right? cheers

Roger Montgomery

:

Hi Tom,

The payout ratio you adopt will be important so its important to use a number that reflects the likely situation in future years.

Roger Montgomery

:

Hi Tom,

Thanks for your appraisal of the values of PTM and ARB. I will let others make comment on the valuations and I will post mine in a future blog post.

Phil

:

Tom/ Roger-

I managed to catch Roger on YMYC the other night and heard his forecast for ARB. I think you did the right thing by ignoring the ‘special’ dividend (Commsec lists the DPS without it too).

To test this and to see how close I could come to Rogers IV for ARB I crunched the numbers using what I learned in Value.able:

I used a margin of safety of 12% and got 2010 ($8.07), 2011 ($8.40) and 2012 ($8.75)

It looks like Roger used about 12% too because he got-2010 ($7.95), 2011 ($8.52) and 2012 ($8.83)

Roger- you have ARB as a steady A1 on your website but from my calculations it’s ROE is declining- 2010 (34.8%) 2011 (31.7%) and 2012 (30.2%).

Are my numbers about right?

using a 12% margin of safety

2

Roger Montgomery

:

Hi Phil,

Your numbers look good. ROE is just one of the very many inputs that produce the MQR (Montgomery Quality Rating) for each company.

Andrew

:

Sorry if this has already been covered.

I have a company that is performing a buy back during this financial year, I am also looking at a company that could be potentially raising capital and would like to analyse the impact that will have.

I am having trouble working out the buy back and capital raising amount per share to come up with the inputs for the Forecast Equity Per Share.

Any help? How are other people working this out?

Roger Montgomery

:

Hi ANdrew,

It has been discussed before (buy backs and share issues) and I will also be making it a topic for another blog post. In the meantime, I am sure there are many here who can help…

Paul

:

Interesting on arp at a roe of %30 I get a current IV of 8.70 and using commsec forecast eps and dps and using a ROE of %25 I get a 2011 IV of $7.40 and 2012 IV of $8.70.

Lloyd Taylor

:

Roger,

I am a little surprised at your implied enthusiasm for MIN.

The company is diversifying beyond its core business of mining services in an acquisition based strategy.

Whether this acquisition based diversification strategy proves to be diworsification, as is usually the case, remains to be seen. However, I do note that the competencies and capabilities of a producer managing reserves uncertainty and risk into an international commodity market place are markedly different to those possessed by the guys who provide “the picks and shovels”, not to mention the project pre-development risks that are now being assumed in the new business strategy.

The downside risk in this diversifcation strategy is very apparent. Overlay this with the serial acquirer tag and its one I would choose to avoid. Certainly past performance will be no guide to the future for this business.

To each his own I guess.

Regards

Lloyd

Roger Montgomery

:

Hi Lloyd,

As always thank you for your insights and reviews of the companies mentioned. Don’t read too much into the text. I can’t see the implied enthusiasm you speak of. Remember the quality scores are a probability of default only and not a prediction of success of the business model – acquisition strategy or not.

Lloyd Taylor

:

Roger,

By way of clarification of my introductory remark:

Previously you said that “At this point you may have already noticed that I have blacked out 3 of the 19 A1’s for this week. There is a good reason for that. I am currently researching a number of businesses to see if an investment opportunity is available at current prices.”

From this and the subsequent revelation of the three I inferred, incorrectly is seems, that you would have bought MIN if the price was right.

This is the basis for my comment regarding “your implied enthusiasm for MIN”, rather than your A1 rating for the business. Apologies if I read too much in linking the comments on your two posts on the business.

Regards

Lloyd

Roger Montgomery

:

Hi Lloyd,

As has been the case with almost every one of your posts, you were correct and I did say “I am currently researching a number of businesses to see if an investment opportunity is available at current prices”. But I did find reasons not to invest. You have also highlighted a number of reasons why I posted the next blog (without an investment in MIN) – an investment opportunity at current prices, may not be available. I am still researching this one.

Pete Bowyer

:

Hi Roger

In your A’2 listings you have for MAQ an ROE of 17.45%

From Commsec I get an REO of 28.57 calculated as net profit of 17m divided by average of shareholder equity for 2009 and 2010 of 59.5m.

I have an IV for 2010 of $15.82 and a discount on current share price of 55.75%.

Any thoughts as to why my REO is higher than yours and any general comments on MAQ.

Regards Pete

Roger Montgomery

:

Hi Peter,

Check for abnormals. Its quite possible that is a source of the difference.

Michael

:

Hi Roger,

With WTF, the current liabilities exceed the current assets by $30.7 million. Operating cash flow has declined from $81.4 million in 2010 to $59.2 million in 2009. I think it is a quality business but being an A1, I am not so sure.

ARB, couldn’t agree more with the A1 assessment. Luckily I already own this one.

Regards

Michael

Roger Montgomery

:

Hi Michael,

Thank you for your thoughts about WTF and ARB. Remember what the quality scores mean.

Russell

:

E*Trade have a data base programthat is a bit hiddenand may not be known to many users. I tried to locate the missing companies from Rogers’ previous post without success. I may not have asked the right questions as I did not get the right answers.

If you use E*Trade their data base is worth a look.

Ashley Little

:

Thanks Russell

Are you refering to the advanced stock filter under tools on the Etrade site?

If so I agree it is a great start.

I run a simple plus 20% ROE minus 10% debt to equity filter about 3 to 4 times a year. That said, Roger’s treasure map had me running it 3 to 4 times an hour.

It does however have certain limitation. ie it uses ending equity to calculate ROE.

Also it does not take out abnormal items so it shows DCG at less than 9% when the real figure is much higher.

Does anyone here know where the same info can be obtained on the comsec website?

Thanks Guys

Matthew

:

on the CommSec website click on “News & Research” from the top yellow menu bar

then point to “Company Research” on the black menu and click on “Advanced Search Tool” at the bottom of the menu that drops down

unfortunately on the CommSec one if you want to adjust your search criteria you have to re-enter all of the search criteria again. I found the Etrade one easier in that respect as you can edit your search

Ashley Little

:

Much Thanks Matthew

Pat Fitzgerald

:

Hi Russell

The data on Etrade uses the end equity to calculate ROE and therefore it has a lower ROE than Roger. I think COMMSEC and other online brokers also use the same data.

Phuong

:

Interesting you were thinking of WTF (seemingly no discount to IV) and ARP (was great until share price raced ahead last week). Though the cynic in me is telling me that maybe this was a distraction to the companies you were really looking at, would you be willing to share those thoughts at a future date (after you made a decision of course)?

Roger Montgomery

:

Phuong,

I am not staying up late at night writing about things that I am not thinking about. That would be way too much work! If I started thinking hard about one thing and then writing about something else, that would be double the present work load. No thanks!

Michael Vanarey

:

Hello Roger.

Wow, I love what you’re doing for Value Investing in Australia in general – simple logic and reason.

Some constructive criticism, When I print an article (For example – http://rogermontgomery.com/part-iv-where-should-you-focus-your-digging) two things happen:

One: All tables displayed in the blog article are too wide for the printer to fit on one page width and are cut in half.

Two: Approximately 2-3 pages are “wasted” on the blog’s webpage header and footer unformatted text.

I’m not sure if something is wrong at my end or if it is a design issue at your end but it would great if in future blog entries the tables and text fit on one page width when printed.

I notice that other blogs have a “PRINTER FRIENDLY” link at the bottom and top of the article. Once clicked it opens another window and display the article you are viewing without the blog’s webpage header and footer and prints just show the raw article with all the tables in a single page width size.

I obviously love your blog enough to be concerned about the formatting of your articles! (Sad I know).

Regards,

Michael

Roger Montgomery

:

Hi Michael V,

I published your printer friendly comment as a reminder to me to look into it for you. Thank you for taking the time to help me make the blog even better.

Phil

:

Howdy Roger,

Thanks for another informative post.

I’m catching up with my ‘Roger homework’ and getting the hang of calculating IV by looking at annual reports.

In a previous post we discussed the methods in your book vs. the sum total of what you use to calculate IV. Rather than expecting or wanting you to share every single step of yours, I was wondering if you would be willing to share some forward looking evaluations of a handful of companies? That way we could use your methods as outlined in your book, go out and do the research amongst the anaylsts projections (and annual reports) and see if we can come up with the same numbers. I have heard you on YMYC give some forward projections in the past… but that was before I bought your book and stopped speculating… so I never wrote them down :(

Thanks again.

Phil

Roger Montgomery

:

Will do Phil. I will write a post with some forward IV’s – perhaps in the same post about how to go about estimating future IVs.

Mick

:

Hi Phil –

If you ever miss YMYC, they have the podcasts up the next day on their website, and Rogers YouTube/Facebook has links to pretty much all of his past appearances.

Adam

:

G’day Roger and everyone,

Just wondering if you could comment on a little issue I’ve had problems with in the past. I understand macro factors shouldn’t influence a value investor, and I’m not naive enough to believe I can predict what will actually happen, but my current feelings about the global economic environment is affecting my confidence in buying shares now.

Even if I find a company I’m happy to invest in and its shares are trading at a price I’m happy with, I’m a little worried about buying it all in the one hit. A few times I’ve bought half my allocation, only to see the price move up and above what I consider good value.

Does anyone else struggle with this?

On topic, I have CIL IV at $2.45, using 25% ROE and 10% RR. Admittedly I did it in a rush, but I’m reasonably confident I had the numbers right. I got a 2009 IV of $0.92 and haven’t got to 2011,’12 yet.

Roger Montgomery

:

Hi Adam,

I am delighted you have so clearly articulated a concern many people will certainly have. Buying shares even when they tick all the boxes can be difficult if you are always looking over your shoulder about the economy. I don’t have a crystal ball so I cannot help with a forecast of the future but I know that when the market is really expensive I cannot find many or anything to buy. That is not the case now. It is important to protect capital ahead of a GFC – note that Buffett had billions in cash at berkshire and personally for years ahead of the GFC. Thats all spent now and he recently said there would be no double dip. Its seems even he is now willing to comment on the economy. The best thing he has said on the subject is that it is a mistake to forego the opportunity to purchase a great company because of short term fears about the market or the economy. You do have to adopt a very long term perspective however.

Mal

:

Thanks Roger, Awesome work. Do you sleep?

New to the “community” and I am awaiting the book, so I am not even on the L plates yet let alone a graduate. In planning for future purchasing descions, when you say get professional advise how do I go about getting it? (I really am at the beggining) Are you talking about financial planners and the like, any tips on selecting advisors? By the way I am not in any rush to buy something, I did note you said in something I read of yours having a home loan and paying that down gives me a 12% risk free return, a good starting place and therefore time to graduate. Thanks again.

Roger Montgomery

:

Hi Mal,

Welcome to the value investing community. I am delighted to see you already commenting. In answer to your question about advice, you should find a broker with access to research with a good track record for your shares and for structuring and diversification an advisor with a willingness to charge a flat fee and not push you into insurance/products. Perhaps there are some people on the blog who have advisors they can say positive things about and perhaps suggest to you.

Mike King

:

Hi Roger,

I notice that Woolies (WOW), Cabcharge (CAB), Fantastic Furtniture (FAN) & Platinum Asset Mgmt (PTM) aren’t on your list anywhere, but you mentioned them as your pick of the top 10 businesses recently.

What rating do you give these companies, if not A1?

cheers

Mike

Roger Montgomery

:

Hi Mike,

I believe I did say that the lists produced where not exhaustive. I hope that helps.