Part III: The avalanche is over – where should you be digging for A1s?

More than 900 companies reported their results over the past 3 weeks and having reviewed the bulk of them, some still remain. I should have completed digging through the reporting season avalanche within the next week or two. You will have to bear with me for a little while longer.

More than 900 companies reported their results over the past 3 weeks and having reviewed the bulk of them, some still remain. I should have completed digging through the reporting season avalanche within the next week or two. You will have to bear with me for a little while longer.

Rest assured that the companies that are amazing and who deserve a place in the ‘investment universe’ have been prioritised and covered first. While some of the businesses left to cover may make it in, overall I expect that I have broken the back of reporting season and already uncovered in the main those worth focusing on.

So since my last update you may be wondering what has transpired.

Firstly, Information Technology and Mining/Oil & Gas Services sectors have continued to stand out, with a number of additional companies receiving high MQRs (“Montgomery Quality Ratings”). To this we can add businesses that I generally classify as ‘financial services’, for example funds management.

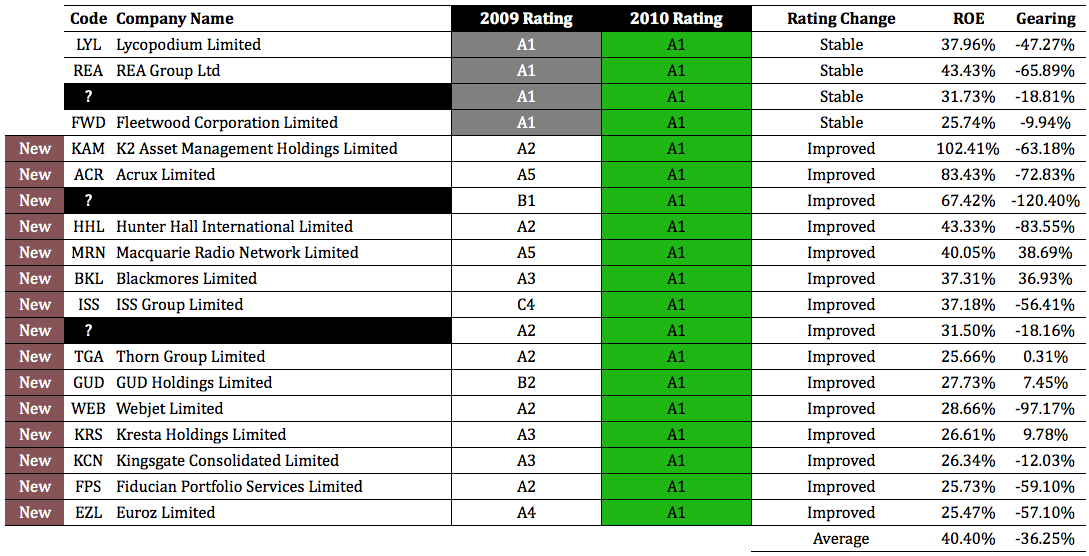

Secondly, there are a number of new entrants into my A1 list this week – 19 in total. This is in addition to the 11 uncovered in my previous posts – Part I and Part II. My A1’s now total 30.

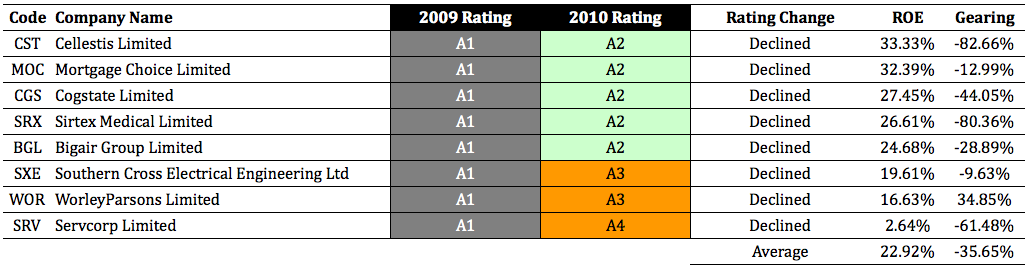

To get to the magic number of 19 for this week there are 15 outright new inclusions, four that continued to hold the rating from last year and eight businesses that experienced a MQR decline. That’s a net increase of 11 businesses with MQRs of A1.

Of the eight businesses that received lower MQRs, all due to specific business issues, Servcorp (SRV) Limited saw the largest decline, followed closely by Worley Parsons (WOR) and Southern Cross Electrical (SXE).

Worley Parsons experienced a number of project delays and deferrals. In particular, services in the Canadian oil sands and minerals & metals sectors, coupled with a material downturn in the United States power markets appear to be the main issues. Also, with a large segment of the business’s operations being conducted in foreign currencies, the continued strength of the Australian Dollar impacted the translation of profits to the tune of $41 million. All these factors had a significant impact on profitability and performance. While Worley remains a very high quality company, the business’s performance slipped.

Southern Cross Electrical was also impacted by delays and project deferrals. In this case the uncertainty around the proposed Resources Super Profit Tax (RSPT) and operational issues following the resignation of the Managing Director appears to have impacted on the frequency of tendering activity and subsequently, the awarding of new projects. All of this – because of the operating leverage inherent in the business – reduced SXE’s margins and profitability.

Servcorp experienced the largest performance decline, falling from 1 to 4 (5 is the lowest). This was mostly due to the $80 million capital raising in October last year, in order to aggressively expand the business. Only time will tell if new management are able to get the business back to its former A1 status. New, wiz-bang ads alone won’t do it, although they may help.

Now don’t go panicking about these companies or their downgraded status. It’s not as though they are C5s! A2 and A3 can be regarded as investment grade (with a smaller allocation), although I would adopt a wait-and-see policy with an A4.

The second table reveals the 19 additional A1s.

If you look to the bottom right of this table you can see the average ROE reported by my A1 list of businesses is an impressive 40.40% – significantly higher than the All Ords average ROE of 9.54%.

Also impressive is the average gearing level of my A1’s at -36.25%. The negative number means that many of the businesses are debt free and have plenty of cash. If you read my McMillan Shakespeare post, you should now see why I avoid businesses that are geared; there is a ready supply of other quality players to look at that aren’t laden with debt.

At this point you may have already noticed that I have blacked out 3 of the 19 A1’s for this week. There is a good reason for that. I am currently researching a number of businesses to see if an investment opportunity is available at current prices.

I will reveal them at a later date along with whether or not I have decided to buy the shares. I have however left you with some important information – their respective ROE and net-debt to equity levels. Note they all have impressive returns on equity and net cash. If you dig hard enough, you may be able to find them before I reveal them.

Posted by Roger Montgomery, 7 September 2010.

Macca

:

Roger

Noticed you’ve included Euroz Limited (EZL) in your A1 list. I don’t know much about the company other than it is a mid-sized Perth based broker / financial services company. What is it that you like about the company?

Many thanks

Roger Montgomery

:

Hi Macca,

I think you may have asked me this question previously. A1 means it has the lowest probability of a ‘liquidity event’. It has the lowest probability of going broke, needing to raise capital, defaulting on a loan, breaching a covenant etc. Whether I ‘like’ or not, is the result of a lot more research. Brokers are great businesses if they can find a niche and develop a competitive advantage but thats hard because there are so many in Australia.

Macca

:

Roger

What valuations do you have for Euroz going forward?

Thanks

Roger Montgomery

:

Hi Macca,

You requested my estimates of future intrinsic values for Euroz. I currently estimate the valuations at $1.43 and $1.51. They are based on an extrapolation of past returns. Do you have some insights into future returns? My valuations are not a forecast of price nor advice and they subject to change of course so seek and take personal professional advice.

Macca

:

Roger

Many thanks. I’ve just started reading your book so not yet able to do my own valuations, so appreciate your help. You’ll probably hate to hear this but I thought EZL was a good buy at $1.30 given their track record and quality of management. Seems like a good business well positioned in the WA mid-market, where I’m hoping there will be plenty of activity and therefore opportunity for EZL in the next couple of years.

Roger Montgomery

:

Thanks for your thoughts Macca. The great thing about the stock market is that there is room for many different opinions and many different techniques can be profitable, simultaneously.

Mike Fox

:

Hi Roger

I’ve now read Value*Able twice and am beginning to understand. Thank you.

In your analyses you state -ve gearing ratios. eg for KCN you calculate -12.03%. Can you (or someone) explain how this is calculated? I understand the +ve gearing.

Regards

Mike

Roger Montgomery

:

Hi Mike, negative gearing means the company has more cash than debt.

david

:

Roger,

Thanks for all the work identifying your current A1s

I have “attempted” my IV for these.

Only ones I can identify at discount to current price are

KRS Pr 0.38 my IV 0.61

KAM 0.6 1.2

LYL 4.0 6.34

ISS 0.18 0.58

TGA 1.45 2.20

FRI 1.05 1.92

RHD 0.63 1.02

FGE 3.80 7.70

Are my IVs close.

Thanks

Roger Montgomery

:

Hi David,

Thank you for sharing your estimated intrinsic values for the A1s. Thanks again for taking the time to do that.

Edward Aspell

:

Hi Roger,

Thanks for all of your insight and feedback. I’m sure that I’m not alone in appreciating the time you take to share your insights. I have noticed the time of your replies which are at time when most are asleep. MANY THANKS.

Roger Montgomery

:

Happy to help Edward. Thanks for noticing.

David C.

:

Hi Roger

I am intrigued by LYL. You have rated it A1 for the last two years and it appears to be trading at a 40%+ discount to IV yet it appears to not to have been featured in any of your articles, even those dealing with engineering companies.

Are we missing something?

DC

Roger Montgomery

:

Hi David C,

You don’t need me to tell you its up 30% since July. Its a consistent A1 business. Its ROE is expected to decline over the next couple of years but the real reason is that the combination of metrics on the others appeared to be more compelling and I like the idea of focusing on the 1st best thing rather than the 2nd best thing.

Ken Milhinch

:

David,

“Trading at a 40% discount to IV” ? I have it trading at about 10% over IV. The RR that you choose will affect the IV of course, but even when I drop mine to 10% (I use 12% for this type of company) I still can’t arrive at your figure. Would you care to compare numbers ?

2010 Equity $44.72

2009 Equity $39.12

2010 Shares 38.8

EQPS $1.15

NPAT $12.8 (Note there is approx $3.2M in abnormals in their announced result of $16M.)

Dividends $9.7

ROE 30%

RR 12%

IV $3.65

Regards, Ken

Edward Aspell

:

Hi Roger,

Thanks for the book and the great insight to value investing. I still have the L plates on and was wondering if you could post some homework as to finding the required information in financial reports?

Roger Montgomery

:

Hi Edward,

Its coming soon.

Chris

:

Hi Roger,

Even though my numbers don’t quite match those listed in the above table I am willing to take a stab at the 3 mystery businesses, – DTL, ARP and SFH.

It has been good fun searching.

Regards,

Chris

Roger Montgomery

:

Lock them in Eddie! Thanks Chris.

Ken Milhinch

:

Roger,

My selections are ARP WTF IFM, though ARP is the only one whose figures match yours exactly. I also cannot get ARP anywhere near their current trading price, so I am not confident of these picks at all.

Roger Montgomery

:

Stay tuned Ken.

Eamon

:

Hmm, considered recruiting some apprentices, that could take on your researching role. Hence allowing yourself more time to focus on the game show. Or perhaps you can do the Apprentice, that would be very interlectually simulating to watch.

Eamon

Roger Montgomery

:

Thanks for the suggestion Eamon.

Nathan

:

Hi Guys

Help please! im trying to work out IV of FGE

2010 Eq = $93.4 Shares = 78.8 EQPS = $1.19

2009 Eq = $48.80 NPAT = $29.50 ROE = 60.5%

EPS = 37c DPS = 7c Payout Ratio = 18.6%

RR = 12% ROE=60% XPOR= $1.10 X1-POR =$17.48

Intrinsic = $18.58 Current Share price = $3.78

Have I used the wrong figures somewhere or is FGE just extremly cheap atm, I do know they did $20m of capital raising, do I need to change the figures at all to reflect this?

I went back through the ’08/’09 figures and came up with an intrinsic value of $8.40 for End of 2009 also

Any help would be greatly appreciated

Roger Montgomery

:

Hi nathan,

A recent capital raising will have the effect of increasing equity and the number of shares on issue. So yes, it most definitely has an effect. I will let the Value.able graduates help you with the remainder.

Ken Milhinch

:

Nathan,

NPAT was $29.5 & Dividends paid was $3.4 so that is a Payout ratio of 11.5% not 18.6%

EQPS I agree with your number.

RR 12% I agree with your number, although is a personal choice.

ROE% I strongly disagree with.

I use 32.5% because of the significant increase in equity from last year. It appears you are using last year’s figure solely. At the very least I think you should average last year and this year to calculate ROE.

I have taken the approach that if the equity has increased by more than 25% year on year, then I use the current year equity in my calculation, because that is what the company is going to have to deliver against going forward.

My IV for FGE is $6.67 and I own some.

Hope this helps.

regards, Ken

Roger Montgomery

:

Hi Ken,

If I have not said it already, thanks for taking the time to produce all the valuation work you have done for everyone. I haven’t checked your work, however under peer review here on the blog, any issues should be spotted by others. Well done and thank you again Ken.

Matthew

:

Hi Nathan,

Your inputs are correct, it is just the how you are doing the calculation that might need some adjustment.

I (and Roger and many others here) normally calculate ROE based on average equity, therefore average the 2010 and 2009 company equity figures and use that equity figure to calculate your ROE. Using that average figure I get an ROE of 41.1%

To explain: the profit was made over the course of the whole year using X amount of equity. That X amount was neither the amount the company started the year with, nor the amount it ended the year with. But it can be estimated as an average of the starting and ending equity.

For what it is worth, my 2010 valuation at a RR of 12% is $9.64. 2011 is $10.26. So yes, based on these figures it is trading at a discount.

Please do your own research. It is important to remember that the price may never reach that value, or it may approach it so slowly that before it can reach it economic factors cause the value of MCE to move toward the price!

Roger Montgomery

:

Great Stuff Matthew,

I am truly delighted to see the effort you are putting in to help others. Thanks.

Nath

:

Thankyou Ken and Matthew

I Have reworked my figures and get a $9.16 using the average equity method and I like Kens 25% method as well which i got $6.35, The difference is because im still using the higher Payout ratio. I know it is because im using the DPS/EPS method instead of using the annual reports to find the actual dividend money figure which ill do in the future, because i want to be as accurate as possible.

Thankyou again for your help, and thankyou Roger, this is fun even if im not actually buying any shares at the moment, im just enjoying my time working out values and comparing them to other peoples valuations, keeps me out of trouble :)

Roger Montgomery

:

Hi Nath,

Take your time. Big margins of safety are necessary as it personal professional advice, which I suggest everyone seek and take.

michel

:

Roger,

I have almost finished the book- congratulations- the principles and patience you instill have already helped me.

I now have my ‘trainer wheels” on for some calculations but am struggling to know which figure to use for end of year equity figure.

In the JB Hi Fi one you use 302.3 million on page 188 in the book.

I cant see this listed on the research report.

Sorry for such a silly question.

thanks

michel

Roger Montgomery

:

Hi Michael,

if you search through the various comments in the recent past, you will find some discussion about this. The answer is Most recent equity + profit – dividends =/- share issues/buybacks.

Hope that helps.

Tom Graham

:

Hi guys,

Just beggining my value investing journey! I rate your book very highly Roger and find your insights invaluable. I was just trying to work out the intrinsic value for Lycopodium (LYL), one of your A1’s, but not sure if my IV is right. I got a value of around $7.15… What did other people get? I got and equity per share of $1.15, payout ratio 65% , used rogers 38% ROE, and required return of 10%

Cheers

Roger Montgomery

:

Hi Everyone, I know that a few of you are following LYL so if you can share your insights or your valuation estimates with Tom, go right ahead. Thanks for posting the question Tom.

Nick

:

Hi Tom,

For LYL I used (from comsec data): – An equity per share of $1.16

– Payout ratio of 67%

– 37.5% ROE

My valuation using a 10% required return comes to around $7.02 :) pretty close to yours. So it’s trading at quite the discount at the moment.

David

:

I also like LYL. That said my valuation is only around $5.40, but I am conservative in my approach to the valuations. I have ROE at 32.5% and RR of 10%. The issue I found with LYL is even though it is trading at a discount to IV, I have IV staying stagnant through 2011 and 2012. Have you found the same? Analyst forecasts have the payout ratio increasing back to 75% and eps dropping to 2009 levels.

Roger Montgomery

:

Hi David,

$4.22 for me on LYL.

Ken Milhinch

:

Tom, Nick,

I have an IV for LYL of $3.65 which is vastly different to yours. I agree with your EQPS figure, but your payout ratios, ROE and RR are all different to mine. I am working on a NPAT of $12.8, whereas you are working on $16 I think. In the notes to the accounts, it was mentioned that the NPAT was favourably impacted by the resolution of a taxation issue in Tanzania, and I believe this was in the order of $5M before tax, so I have reduced the NPAT by $3.2M to allow for this. I also use a higher RR (12%) for what I consider higher risk businesses. This may not be the bargain you think it is.

Pat Fitzgerald

:

Hi Tom

I have earnings forecasts that indicate that ROE will be lower in 2011 & 2012 than in 2010. Therefore a forecast ROE of 38% looks high. Using EPS of 34 cents for 2011, I get an IV of $4.45 for 2011. I used the EPS from Reuters, I am not sure how accurate they are as they are from one broker only. I will wait until I get a better idea of LYL’s earnings for 2011.

Craig

:

Tom,

I got just a touch more…$7.33….using a ROE of 40% (I used last years Equity).

Shaun McTaggart

:

Hi Roger,

A little while ago when you were on Sky Business a caller rang in and asked your opinion on Atlas Iron (AGO). The comment I remember from you was that based on the companys forward projections the share price is very cheap based on instric value, as long as the forward projections are right.

Obviously the Rent Resource Tax uncertainty will play apart, as well as any decline or increase in the Iron Ore price, but can you please share with me what your intrisic value of AGO would be based on those forward projections?

Congratulations on yourbook, I like the read.

Shaun

Roger Montgomery

:

Hi Shaun,

Depending on which estimate you adopt, the valuation can be anything from $3.00 and up! Keep in mind the Iron Ore price has already declined 11% and some experts reckon it could fall 50%! They’re better forecasters than me.

peter bryan

:

Hi Roger,

In your book, Table 9.2 , which shows the cash flow calculations, does not include PP&E, as does Table 9.3 ( for JBH).

When should table 9.2 be used and when should Table 9.3 be used?

I think the book is InValuAble

Peter

Roger Montgomery

:

Hi Peter,

I think the Tables you are referring to are 9.3 and 9.4. The purpose of 9.4 is to demonstrate or explain the reason for volatility of cash flow in a business that is growing aggressively (and successfully – high ROE). Adding back PP&E helps to see if that is the source. I have explained the reason on the bottom of page 154.

Nigel

:

Geez, I love this blog. It’s become 1 of only a handful of websites I check daily.

Roger: well done – you have brought together a gang of like-minded individuals and I sincerely hope your webmaster sets up a forum sooner than later. This latest post has garnered over 130 comments & nearly 900 Facebook ‘likes’ (!!!); if that doesn’t demand a forum, I stumped as to what would…

Keep up the great work, everybody!

BTW: for what it’s worth, ARB & Thorne look quite good to me…

Nigel.

Roger Montgomery

:

Thanks for the very supportive and encouraging comments Nigel!

Craig

:

How about Zicom (ZGL) & FSA Group (FSA)?

I calc them in at current market prices WAY under their intrinsic values. They are very small firms, so not on anyone’s radar, but have shown some consistency in earnings over the last 4 years, and Zicom has very low debt. Bit harder to figure out the debt situation with FSA as they are in Finance and borrow a lot of capital.

Zicom is buying back shares to cover their share employee dishouts, so they are trying to reduce any resulting dilution. Not much in the way of dividends from them, and FSA pay zero dividends.

Big margin of safety with their current prices according to my numbers.

Craig

:

And Nick Scali (NCK) is definitely the other one.

Craig

:

I retract Zicom. The ROE isn’t high enough.

Surely it can’t be Wotif or ARP. They aren’t undervalued enough.

Roger Montgomery

:

Hi Craig, maybe not now but what about when the piece was written?

Roger Montgomery

:

Thanks for the suggestion Craig,

Does anyone have any insights into these companies they would like to share before I wade in?

Craig

:

The ROE for Zicom dropped to 15% last Fin Year, which was mostly due to a steep decline in revenue in their offshore, marine, oil and gas machinery.

The order book for this segment in 2010/2011 is already 20% above the total revenue last year.

Calvin

:

My guesses are:

DTL

WWA

WTF

I don’t think ARP is at a substantial discount to the IV at the moment.

Roger Montgomery

:

Thanks Calvin,

Good guesses and I will reveal them soon.

william gill

:

Hi Roger

I will keep it simple, ARP, WTF,ORL.

warmest wishes

Roger Montgomery

:

Thanks for taking a stab WIlliam. Very soon now.

Ron

:

Hi Roger

Looking at Cellestis financial reports I was intrigued that it had slipped from A1 to A2. Overall it looks pretty solid similar to last year, marigins down tad, cashflow and earnings perhaps plateauing a bit and a decline in ROE. No debt apart from bank guarantees. Difficult to tell the future direction but this was the case last year too.

Is there a specific development causing the lower MQR or is it just a sense that quality might be dropping off?

Thanks

Ron

Roger Montgomery

:

Ron,

I think everyone needs to realise that the difference between A1 and A2 is like having a contrasting colour for the leather piping on the seats or not being offered this option. The difference is small. We are not talking about a drop to a C4 or C5 or anything of that nature. I will go back and run through the numbers again to isolate the change that caused the drop. Give me a few days to get back to you.

Darren

:

Hi Again, going for the third time lucky ….must be the old speculator/gambler in me, but I think the three blacked out stocks are ARP (ARB Corp), WTF (WotIf) and CCV (Cash converters).

And thanks to roger and everyone else for thier comments – great stuff (learning is the beginning of wealth)

haveagoodweekend

Darren

Roger Montgomery

:

Delighted Darren. Thanks for having another go!

ron

:

hi Roger,

some companies have a large accumulation of losses from previous years. when they calculate their equity they deduct these losses, thus showing a smaller equity figure. my question is, do you use that equity figure after accumulated losses or the initial equity that was put into the business? thanks

cheers.

Roger Montgomery

:

Hi Ron,

Its a great one to consider and it can depend on whether you want to give the company the benefit of the doubt. More importantly, the bigger you make the equity, the lower will be the ROE and while the effect on intrinsic value won’t be equal, they will at least partially offset each other.

Matthew

:

For those who are having trouble seeing the page you may like to try subscribing to the RSS feed.

For those who have not heard of RSS before, think of it as a simple way to display website articles (in fact the “RS” part or RSS stands for “Really Simple”!).

You will need a web browser that is capable of displaying RSS feeds and I recommend Firefox (http://www.mozilla.com/firefox/) which is free.

In Firefox go to http://rogermontgomery.com/feed/

The 10 most recent articles will display on the screen. To go to the full article click on the article title and you will be taken directly to the article on the rogermontgomery.com website.

This is how I keep up to date with the most recent articles and I have never had a problem with them not displaying.

Other browsers that I know can also show RSS feeds are Safari (on mac) and the most recent version of Internet Explorer.

Roger Montgomery

:

Thats great Matthew. Thank you for providing that solution for everyone. We now have a number of solutions, which is fantastic.

Ashley Little

:

Hello again fellow blogger,

After throwing away the MTM I have found Decmil.

Well worth checking out.

Would have looked at this days ago if it wasn’t from for that dam treasure map

Make sure you look at profits from continuing operations not just Npat

Paul

:

Hi all

This new valuation of shares is turning into an enjoyable and hopefully profitable hobby. Am getting confident now and with a little tweaking I am getting in line with everyone elses valuations on this blog- and what a great resource it is.

Seeing that everybody is calculating WTF and arp here are my valuations

wtf:4.64@%10- Would look to but @ around $3.50

arp:9.74@%10- Now seems like an opportunity.

The main reason I am posting is about ezl that was listed in the chart above.

I got the figures are from the annual report and have gone back over them a number of time. The reason being I got $2.89 @ %10

using

ROE :22.5

npat :26,331,750

2010 equity: 109,417,413,

2009 equity 96,295,687.

It is currently trading at $1.23.

To me this represent a great opportunity if you are comfortable with the business. Does this add up with everyone else or am I missing something.

Cheers

Paul

Roger Montgomery

:

Hi Paul,

If ROE can continue to increase from the 2009 levels, then you may well be right. Brokers do usually have some cyclicality in their performances that is unavoidable and you should note the big drop in ROE following the capital raising a couple of years ago.

Matt

:

Paul,

I got $2.13 @12% (being a bit more conservative because of variable roe) so our calculations look to be similar. I have found most of the brokers to be at discount but as Roger alluded to i’m unsure of their ability to maintain ROE so staying on the sidelines with these tpes of stocks.

Roger, any thoughts about whether they have competive advantages? I note a few talk about having a niche, but not so sure.

Roger Montgomery

:

Hi Matt,

Will be posting a blog about competitive advantages soon.

Ken Milhinch

:

Paul,

You need to be aware that the NPAT you are using contains $10M of abnormals. Take this out and ROE falls to 15.8% and you will get a very different result. I rate them at an Iv of $1.13 using 11% RR. Currently trading above that.

Matt

:

Ken,

Good point on abnormals in NPAT. My question is Roger has talked about including ‘abnormals’ when the involve an impairment of goodwill (hence decreasing equity), but if the abnormal go the other way (ie add to the equity of the company) are we supposed to leave them out?

The scientist in me thinks we should be consistent, the Roger voice inside me says be conservative and do as Ken has done.

Roger Montgomery

:

Conservative and consistent Matt! If abnormals are abnormal, they aren’t normal and by definition aren’t going to be repeated. if they happen every year, they are ‘normal’

Phuong

:

Here are my guesses:

ARP

NCK

DCG

I was going to put down ORL but noticed they didn’t seem to report. Also originally thought WTF but that’s still trading at a premium (and doesn’t seem to have a strong competitive advantage). All three seem to be trading at a discount to IV.

Roger Montgomery

:

Thanks for your suggestions Phuong. I will lock them in.

Ashley Little

:

Hi Roger and fellow bloggers,

Just like to say this has been the most enjoyable blog you have ever done.

You have shouted out load “there is gold in them their hills” and we have all rushed off with our pick and shovel, glassy eyed trying to find it.

You gave us a Montgomery Treasure Map (MTM) of where the gold lay and I have this mental picture of you sitting back laughing at the chaos you have caused.

Even though it has been so much fun I for one have forgotten some of the principles of Investing.

All I have been trying to do is find the hidden treasure. That is, a company that has the exact ROE and gearing and has moved from an A2 business to an A1 business.

I have forgotten that my job is not to follow a MTM but find great businesses below its intrinsic value wherever it is.

For the last few days I have trawling through the companies with ROE of between 25%-35% trying to find the last on stock on your list.

I found plenty of frogs that I hoped with one kiss would turn to a Prince. My first thought being pucker up buddy.

All the time totally ignoring the companies with a higher ROE thinking – no no it can’t be you, you are too good a business.

How smart is this?

The first two were easy as they are already within my circle of competency. I have wasted two days trying to find the third. It has been a fun few days but wasted none the less

I know there is gold in them there hills and we all don’t need a MTM to find it.

Roger Montgomery

:

I am sorry to have caused such a distraction Ashley! Perhaps you would like to share the companies you dismissed as being “Too good a business”?

Ashley Little

:

Hi Roger,

DTL is one that immediately springs to mind

Ashley Little

:

Hi again,

Also a little one I don’t mind the look of at the moment is DDT

Craig

:

Absolutely Roger

After reading your post Ashley it looks like you have discovered a whole host of new great businesses. I think any company with a ROE over 25% would be a great place to start research and maybe you have inadvertently developed an expanded circle of competence.

I have enjoyed this post and actually discovered a bit more about a few businesses I have neglected in the past ie MIN and IFM – not that I am saying they are worth buying but both are trading below my estimate of IV.

I also have had a more detailed look at ARP, initiated by this post, now this is a gem. Long-term growth, competitive advantage and undervalued.

I know the argument will come back – anybody can make 4 wheel drive accessories but these guys make the stuff that every 4WD enthusiast wants – go to a carpark and look at the 4WDs what you will notice is that little ARB symbol on most of the bullbars or accessories. Over the last decade I have heard lots of arguments about there growth stalling ie the dollars going up will make them uncompetitive, the price of fuel will have everyone selling 4WDs for small cars and the price of inputs will also make them uncompetitive. Nothing seems to halt them; they get over each hurdle and continually maintain a high ROE.

Great management + great products = great business then add the high ROE and a reasonable valuation and I think the answers easy.

Disclosure: don’t own a 4WD, any ARB products or ARP shares but may in the future, not a recommendation just an observation.

Now I also read somewhere by a blogger that WTF doesn’t have a competitive advantage, well I think the size of its inventory is an enormous competitive advantage sure anyone can set up a website and post rooms but these guys have that “loop” – more rooms leads to more eyeballs leads to more suppliers with more rooms leading to more eyeballs. This scenario goes for CRS, SEK and REA as well, hope I am not stating the obvious. I have an IV of $4.50 for WTF going to $5 next year so not undervalued. These I do own and am happy to continue holding til that irrational Mr Market comes back.

Thanks Roger for this great post and I agree with Ashley it’s been fun but not a waste of time.

Roger Montgomery

:

Appreciate the feedback Ashley. Thank you.

Ashley Little

:

Hi Craig/Roger,

I have WTF IV a little above where it is today but rising to closer to $6 in 2011 and rising to close on $7 by 2013.

Remember the stock did get as low as $4.07 so this would have been good buying.

Also my comments regarding the blog were said with tounge firmly in cheak so I hope no one took offence.

Thanks again

Roger Montgomery

:

Hi Ashely I just mentioned the WTF value in a comment elsewhere. Recently at the lows, it was at a slight discount.

fred

:

Hi Roger,

Without giving all the details out I have had a $9000.00

win using your book/blog. Thankyou

Roger Montgomery

:

Thanks Fred,

Now I believe you are a professional in the finance sector but if you are not be sure to seek and take personal professional advice. Thank you for sharing the story of your success and for which you should take total credit!

Ron

:

Hi Roger

Lookiing at Cellestis I am intrigued by your rating decline from A1 to A2. The reports are good, company appears solid and has no debt (apart from guarantees). The only obvious material differences are that its earnings growth and cashflow appear to be plateauing, its margins are down a tad and its payout ratio and dividends have increased. What’s impacting on its MQR?

Thanks

Ron

Roger Montgomery

:

Hi Ron,

We aren’t talking about a drop to C5! Its just a small decline and still in the high class part of the mall.

Brad

:

I’m going:

ARP

SWL

SFH

Roger Montgomery

:

Great Brad. Thank you for your list. Locked in.

Eamon

:

My clairvoyant has suggested the 3 stock could be the following;

WTF; FGE and RFG

Eamon :-)

Roger Montgomery

:

Change Clairvoyants Eamon!

Daksha

:

Hi Roger,

Thanks a lot for sharing your A1 companies with all of us. Though I must admit I tried to find the names of the three companies from your list only one comes to my mind is ARP. Can’t wait to get the names.

Also I would like to thank all the participants of your blog there is so much to read and learn from this discussions. I would like to make a suggestion how about we run the competition of portfolio and see who wins for value investors on your blog ? Just like portfolio on Eureka report?

You must be feeling so good and proud to see what a amazing effect your book is having on all of us. I have made up mind from now on no panic buying of shares or nor any panic selling ( I am guilty of doing both ).

By adopting this method one can only loose capital and not gain money so no more listening to the daily noise in the stock market world is not going to come to an end, but instead stay focused look for companies with MQR. Of course then do your own research before rushing to buy those companies shares.

Kind Regards

Daksha

Mike

:

Hi Roger,

I know the 3 stocks are:-

ARP – ARB Corp

WTF – WOTIF.com

MIN – Mineral Resources

Also, I have a question about ROE. For companies with large Cash balances, (CSL for example) ROE doesn’t represent the actual return the company is making. Do you ever adjust Equity to exclude cash, or use some other method to discount the large cash balance?

Cheers

Mike

Roger Montgomery

:

Hi Mike,

I think we need to get Eddie in and find out whether you would like to ring a friend or lock it in.

Eamon

:

Roger,

Have you ever considered being a talk show host. Perhaps you can create a new millionair hot seat show asking questions about the stock market. It would be a very interesting watch indeed.

Eamon

Roger Montgomery

:

Hi Eamon,

Thanks for your show suggestion! I am open to hearing everyone’s ideas for a show format. It has to leave me with plenty of time to research & invest because THAT is my first priority.

Mike

:

Lock ’em in I say.

Re the ROE issue for companies with large cash balances, do you have any comments on that?

Cheers

Mike

Roger Montgomery

:

Hi Mike,

Regarding high cash balances: 1) You cannot control whether its handed out. 2) It may be required for bonding, a timing issue or otherwise inhibited (eg maintenance capex that has been deferred). 3) You are buying the business as a passive investor, as a going concern and with present management running the show. This could be described a catalyst free zone!

James P

:

You might have to change your rating on Kresta. Latest announcement requesting a halt in trading due to “potential accounting anomalies.”

Roger Montgomery

:

Hi James P,

Can’t be helped if a company’s auditors allow the wrong numbers to be published in the reports. Most importantly, I don’t own Kresta, never have.

Ken Milhinch

:

James,

Where did you hear the “accounting anomalies” bit of info ?

Pat Fitzgerald

:

Hi Roger

I get IV’s for ARP & WTF lower than their current trading price, therefore my RR is probably higher than yours. Would it be possible to give half a dozen examples businesses with RR’s from 9-14 and the reasons you have selected the RR for those businesses.

Roger Montgomery

:

Hi pat,

A subject for a future blog I am thinking.

Ken Milhinch

:

Pat,

I also have ARP & WTF trading well above their IV’s so I am puzzled why everyone is going for them as their mystery companies. Hang on a minute……I did too !!

Brad

:

I recently read the BRK 2009 chairman’s letter

Buffett talks about dozens of boards he’s sat on and in M&A he says never has the question of value of companies being aquired came up. Only talk os of the share price. Deals sprooked by investment bankers pushing the deal who get paid if it goes through. his solution – hire second investment banking team that get paid if the deal doesn’t get up to also advise the board – Classic!

Roger Montgomery

:

Perfect solution Brad. Shareholders should be given the opportunity to do that. Funding issues springs to mind though, so obviously intended as a joke.

fred

:

hi Roger,

David Jones looks pretty good to me. A1 you think?

Roger Montgomery

:

A2 for DJs Fred.

Ashley Little

:

Hi All

My three guesses are

WTF

ARP

TSM

Roger Montgomery

:

Just be patient Ashely. They’re coming.

Ashley Little

:

Thanks Roger,

This is the most fun I have had since my wife left me

Roger Montgomery

:

Hi Ashely,

Thanks for the enthusiasm. I need everyone to know that if you are not in Ashley’s position, this site is not intended as a source of marital discord! Make it something you do together!

Ashley Little

:

Thank Roger,

I might be wrong but i think someone on this blog has allready got all 3

and it is not me

Pat Fitzgerald

:

Hi Ashley

ARP – ARB Corp

WTF – WOTIF.com

MIN – Mineral Resources

have been mentioned by Gavin and Mike and I also agree with them and they are locked in for me.

Roger Montgomery

:

OK Pat,

Lock’em in Eddie!

Eamon

:

TSM valuation remains static on my calculation of 73cents this years result and last years result is pretty much the same. That’s why we saw weakness in the stock price recently. So I don’t think it would be TSM.

Ashley Little

:

Thanks Eamon,

You are right it is not TSM

I read their preso on the half yearly accounts and management have a 12.5% ebitda growth next few years.

If this falls through to the bottom line (which it should because interest & Dep are not big parts of the equation) then valuation is mid eighties 2011 and rising.

The question is will management forecasts be right.

Lloyd Taylor

:

Roger,

Three comments and questions follow:

Comment 1: You appear to be valuing TSM using an RR 0f 14%.

Question 1: What weighs in your consideration to use a high required return for this business?

Comment: As an observation the RR used seems to be one of the biggest variables in your IV calcs. For some businesses (e.g. PTM) you appear to go as low as 7% while for others its at 14% (e.g TSM) with commodity businesses like BHP sitting at 12% discount rate. Yet the rationale for the discount rate, at least at the company specific level, are sometimes not apparent blog readers like me.

2) What factors determine the RR you use for the purposes of calculating your IV at either the sector and/or the business specific level ?

Comment 3: In this approach I surmise that you are in effect risking (using a higher discount rate or RR) to account for future earnings uncertainty.

Question 3: If so, does this then alter your required margin of safety and by what quantum?

Three specific comments/questions – and now a fouth: Do you play poker?

You don’t appear to like to play too many cards at once so I have structured this post this way because I observe that many a time you like to skirt the issues raised by focusing on one question, or aspect.

So come on…. out with to the answers to three questions posed!

Regards

Lloyd

Roger Montgomery

:

Lloyd,

Where’s the fun in ‘prescribing two aspirin’? Don’t forget this is all free…

Lloyd Taylor

:

Roger,

Touche!

You’re a consummate poker player. I can see your big smile as you wrote this in response to my “six asprin headache” questions probing the background considerations to your selection of a rate of return.

To mix metaphors, i don’t want a fish, I want to learn how to fish and the selection of the right hook (discount factor) is paramount to success.

Do I detect a new book coming on dealing with this, the most critical aspect of the whole valuation exercise?

That said (all in jest I might add) I am concerned that you’re readers may in effect double discount (or risk) the purchase price and decision in the approach of applying a variable discount rate (Required Return) plus seeking a large margin of safety. Its a careful balancing act between the two.

Regards

Lloyd

Roger Montgomery

:

Lloyd,

This blog represents an effort to give everyone a leg up. If demands for a hand-out rather than a leg up compromised my first priority (the investing itself) then it would be the blog that goes. Yes there is a careful balancing act in selecting discount rates. There is also a balance that needs to be found between offering a leg up or a hand out.

I have an approach for choosing the discount rate that I won’t be disclosing.

Eamon

:

I was about to buy into it, but thought better to just wait and see the results before acting, which I’d ended up doing nothing.

Eamon.

Ashley Little

:

Hi Lloyd, Roger and all

My thoughts for what they are worth is that the required return is the absolute bare minimum that YOU require to compensate YOU for the risks involved in undertaking the Investment.

For me, for example I have a much lower RR on WOW than BHP or as the earnings are more certain and I can with a much greater degree on confidence predict WOW future cash than I can BHP.

Someone with a greater knowledge of future world commodity supply and demand may take a very different.

There are formulas for calculating RR that involve finding Market Return, Risk free rate of return and Beta. Which can be googled but in the opinion of this country bumpkin it is just a lot of garbage.

RR is a personal thing and a great deal of time on this blog is spent trying to work out what Roger’s RR is for a certain stock. Without trying to offend you Roger this time would be better spent trying to determine your own RR.

Andrew

:

I am comfortable now with coming up with a value based on the reported figures and now i am moving onto the much more difficult and murkier waters of forecast intrinsic value

How does my 2011 forecast valuation for REA match with others.

I had equity per share of 2010 at $1.08

The comsec forecast eps for 2011 was 51.8 cents

The comsec forecast dps for 2011 was 23.7 cents

So i went 1.08+0.518-0.237 to come up with a forecast equity per share of $1.36 for 2011. I could not see much of a history of capital raisings and not aware of any buyback so i left it at that figure.

I got a ROE for 2011 by dividing the EPS by the Equity per share and got 38% and when i average 2010 and 2011 came up with a total ROE of 37.27%.

By dividing the commsec forecasts of DPS by the EPS for 2011 i got a payout ratio of around 45% which i think would be high based on the 2010 figures but doesn’t hurt to stay on the safe side and know the higher the payout for this company the lower the IV.

Not used to forecasting i think i would once again open up my work to the floor so that the fellow members of this blog can comment, point me in the right direction.

By using all these figures i got a total value of $8.72 for 2011 which is based on a selected ROE of 37.5% and a 12% Return.

How does this compare with anyone who has ran a forecast figure for REA in 2011. It is slightly down from my 2010 valuation which i put down to the ROE for 2011 being around 43% and now using 37.5% for 2011.

Roger Montgomery

:

Hi Andrew,

ALl your logic for REA 2011 looks great and your valuation is not far off mine. I get $9.07, so well done. Now the real work begins – thinking about whether that ROE is sustainable.

Andrew

:

Thanks for the confirmation Roger. Thanks for all your help regarding my REA questions and to everyone else. They are one company that ticks all my boxes (all the stuff you talk about, particularly competitive advantage as well as it is a business i can understand) and although i know i have time on my side as i believe it is very expensive at the momebnt i thought i would give this one a try.

So thanks everyone, and Roger, you deserve a holiday for all the work you have put in over the reporting season and all the work you have put in on the blog helping out young novices like me.

Paul

:

I’ve got $7.68 using the method above – does that mean I’m far off? I don’t understand how Andrew got $8.72 at a 12% RR.

I’ve also done the average over the last 2 years in terms of shares outstanding and shareholders equity where as per comsec:

Shares outstanding 09/10:

(127.3+128.4)/2 and then multiply by EPS 0.518

divided by shareholders equity over 09/10:

(92.1+134.6)/2

Plugging these figures in give 58.4% ROE for 2011. Resulting in $15.04.

I’m sorry to waste everyone’s time, but I need some guidance to the method.

Many thanks,

Paul.

Roger Montgomery

:

Hi Paul,

Someone here will be able to help. There are plenty of value.able graduates here.

Peter

:

Hi Roger,

In arriving at his 2011 forecast ROE and IV, I note that Andrew has divided the 2011 forecast earnings per share by the 2011 forecast equity per share and is therefore using the 2011 forecast total equity. Is this correct or should the 2011 forecast earnings be divided by the prior year’s total equity?

In the case of the latter, using the same payout ratio (45%) and RR (12%), produces a materially higher 2011 forecast ROE (45%) and IV ($10.50) compared to the ROE and IV numbers quoted by you and Andrew. I’d appreciate if you could provide some clarity as to which approach is correct.

Thanks

Roger Montgomery

:

Hi Peter,

You will find the book talks about two methods and I don’t mind which you use but you must be consistent across time and across companies. Remember the approach is not about getting shares at intrinsic value but at very big discounts. I usually use an average.

Peter

:

Hi Roger,

Thanks for your help and clarity on the issue.

Whilst I realise that our aim is to buy shares in quality businesses at big discounts to their intrinsic values, getting the base IV right is paramount. The resultant difference in IV between the two methodologies in this case ranged between 16% and 20% representing a material difference in the base IV and consequent investment decision. In future, I will use an average for forecasting purposes.

Thanks again for your help and for taking the time to respond to my query which is very much appreciated.

Roger Montgomery

:

Any time Peter.

Andrew

:

Hi Paul, I have since realised their was an error in my calculations and have since got myself a $9.09 vaulation for 2011 using a 10% return. I messed up with the ROE in my initial one.

As for the rest, i will go back over and see what i have done to get there. The calculator that i set up does divide botht he 2010 equity per share and 2011 equity per share to come up with an averaged ROE. Not sure if this is what Roger does, but i seem pretty happy with the results it brings out so i might just stick with it.

Roger Montgomery

:

Hi Andrew,

Just be consistent.

Andrew

:

As per my last m,esage. I think it was with a 10% return, it was either that or 12%. I can’t rmember at the moment

ron

:

hi roger,

I’m taking back my guesses as i just realized that WTF and SMX are trading above their IV. I assume that you wouldn’t be looking at them unless they were cheap. so my new guesses are:

ARP – I’m willing to put money on this one…. :-)

ORL – maybe… ROE close….

FGE – maybe…. % of cash to equity doesn’t match up quite right….

am i getting warmer……?

Roger Montgomery

:

I wonder Ron if you might be enjoying this even more then me. Not the right guesses this time. Come back and try again.

Vishal

:

Hi Roger, I have to say I loved the chapter in your book on competitive advantage. These more qualitative aspects on investing are harder to grasp for a numbers guy like me!

I just wanted to ask is the discount rate (required return) you use related to the MQR at all? For example would you use a lower discount rate for a very low risk A1 company and a higher one for an A5?

Roger Montgomery

:

Hi Vishal,

Its not direct. Do you think that would be logical?

Vishal

:

Well I was thinking in terms of adding a premium over the risk free rate just like the rate used to discount bond cash flows. Can an analogy be drawn to the higher credit spread for a company rated BBB by the rating agencies when compared to a AAA company? I’m sure there are other factors involved, not just the default risk?

Roger Montgomery

:

Hi Vishal,

That is indeed a reasonable option. Only problem is finding such ratings for the smaller companies.

David

:

Hi Roger.

I’m interested in your opinion on the recent retirement of Kresta’s MD. In you opinion do you believe this potentially lowers the value of KRS? They stress in their most recent final year report the importance of their management, yet within a matter of weeks their long standing MD has quit.

I have valued them slightly higher than current prices, but have my concerns on how they will go about changing the management team.

Roger Montgomery

:

David,

Regarding Kresta, go and talk to people who are buying blinds and ask them what they think?

Darren

:

Hi Roger

most people seem to agree that WTF and ARP are two of the blacked out stocks and I agree with those and my guess for the third stock is DWS which also seems to pretty much match the gearing and ROE in your table……..

it has been very enjoyable calculating IV for much of the ASX and your book has been a revelation for my investing strategy (I was a speculator prior to reading and now understand/appreciate the difference…although still trying to improve my patience in waiting for the price of the extrodinary businesses to become cheap :( )

cheers

Darren

Darren

:

Hi again Roger……hmm a bit of a whoopsie in that my third guess (DWS) was already released in Part 2 of your reporting season blog………so feel free to delete/remove/ignore my stupid mistake..and, ah sorry for wasting your time! I did think that IFM might have been the third initially but seemed a bit ‘lumpy’ in certain metrics – an interesting situation with company buying back a lot of its own stock below IV (which I had at about $0.49 on 2010 results) which is a good thing, right ??? although who knows what the future holds for the auto industry…

Roger Montgomery

:

Thanks Darren,

Keep guessing. Don’t give up. No-one has all three right. That should help!

Roger Montgomery

:

Hi Darren,

As I say in the book, Patience is an essential ingredient but not one that I can teach you.

Gavin

:

ARP?

WTF?

MIN?

Roger Montgomery

:

Hi Gavin,

Are they your final guesses? Do you want to ring a friend? Lock ’em in Eddie?

Terry

:

Hey Roger,

KAM’s ROE looks pretty impressive but once you factor the

‘once off Tax Benefit” into NPAT their ROE comes back down to earth. Your book is working a treat. :) Im analysing companies so much better. Now able to read through the jargon!!!!

Thanks again for your knowledge.

Roger Montgomery

:

Hi Terry, many thanks for the kind feedback.

I am most happy that the book is having such a material impact.

Keep tying it all together and make sure you help others.

ron

:

for the record these are my guesses:

WTF – wotif

ARP – ARB corp

SMX – SMS management (not 100% sure on this one)

Roger Montgomery

:

Hi Ron, certainly 3 top shelf ideas there.

No one has guessed all three correctly. Keep digging.

Wing

:

Hey,

Any prizes for the one who can guess all of them?

I would suggest a dinner with Roger will be a good one! :)

FGE

SFH

NFK

Have a nice day,

Wing

Roger Montgomery

:

Hi Wing,

Good suggestion but no prize for that list.

Wing

:

haha, pending for your next post and see how many out of 3 we got :)

Also looking forward to a similar game next time (but with a prize stated maybe)! It seems people love it.

Many Thanks.

Cheers,

Roger Montgomery

:

The prize Wing is that you have learned about value investing! Thats worth far more over a life than any prize that I could offer.

Deb

:

Hi Roger,

Thank-you for your analysis. I’ve also been looking at MAQ and am wondering your rating for them.

I do note however they intend to pay $8m in dividends that are not reflected in the financial statements..to calculate a ROE should I reduce ending equity by this “phantom” amount?

thanks, Deb

Roger Montgomery

:

Hi Deb, good question.

MAQ get an A2 ‘MQR’ – so high quality and good performance for 2010. This is an improvement on the ‘B2’ MQR they received last year.

I wouldn’t exclude the dividend amount from closing equity. If they have paid it, this calculation should already be done for you.

Andrew

:

One final question on REA. As this is really the first time i have went searching for the information myself i want to get it right, so i am slapping the L plates back on and wanting some help from the people here before i put the red p’s and cautiously go out on my own to learn to do it all by myself.

For the payout figure i have used the 4033 amount from the cashflow statement which gives me a payout percentage of just under 8%. From what i can tell by looking at the changes of equity section of the report they paid out more but after the money from the DRP was retained it ended up “only” paying out 4033.

Is this the correct input to use as the rest was eventually retained by the company?

If i divide the DPS by the EPS i get a far higher percentage and this was confirmed by the figures from comsec.

Roger Montgomery

:

Hi Andrew, great question. Stay on the L plates for as long as you need too.

Using the as reported numbers my payout ratio is 25.13%. I get this from using reported NPAT of $50,657 and dividends of $12,726.

The dividend figure comes from the notes. See note 25 ‘retained earnings’ or note 26 ‘dividends’.

Ken Milhinch

:

Roger,

I hesitate to disagree with you but that seems illogical to me for the following reasons;

The cash flow statements reflect the actual sum paid, nett of DRP.

The effect of dividends reinvested in new shares would be reflected in the increased number of shares on issue and would therefore reduce the EQPS figure in the IV calculation. If you also include it in the Dividend figure in the IV calculation I believe you are accounting for it twice in a sense.

Roger Montgomery

:

Hi Ken. No problem at all.

I am actually being consistent in the way I approach my calculations. I use the accounting / accrual ‘NPAT’ to calculate ROE so it makes sense to also use the accounting ‘dividends declared / paid’.

To be consistent with your method in using ‘cash’ dividends, you would need to make your own assessment as to the actual ‘cash’ profit for the business. As we know accrual accounting has its limitations (so does cash accounting), but at the end of the day what we are aiming for is to be approximately right not precisely wrong. I get my profitability and retention rates using accrual ‘estimated’ accounting.

Peter

:

Hi Andrew,

I too noted the dividend payout discrepency between the numbers reported in the cash flow statement and those contained in the note on retained earnings and opted to apply the number in the cash flow statement. I’d be interested in Roger’s view as to why this discrepency has occurred and which of the two numbers should be used in this instance.

Roger Montgomery

:

Hi Peter,

One figure represents the two dividends that are actually paid and the other has one paid dividend and one declared (but unpaid) dividend. I hope that helps.

justin

:

roger, thanks for all the hard work. I guess you know how that dog in the photo feels. after much digging I think i’ve found one of your mystery companies. However, as with other high return companies (such as KAM and PTM), i’ve found it difficult to value accurately. My poor algebra means that i have been unable to work out the multiples in your table 11.2 beyond ROE of 60. Should I simply lower the expected return, or can you explain the formula in the table?

Roger Montgomery

:

Hi Justin,

Do you want to take a stab at the companies on the record?

justin

:

i thought two were WTF and ARP, still looking for the third.

Roger Montgomery

:

Hi Justin,

Can’t break the hypothetical prize into thirds! You have to go for all three before I can even recognise you have made a guess!

Vic

:

Hi Roger,

There appears to be something “weird” with your website. Your latest blog entries do not always appear when I first go to the blog (others have told me they have the same problem). It requires a undefined sequence of “Back”, “Refresh” etc before I finally get to see the latest blog entries. Possibly some sort of caching? Maybe you should get a “boffin” to have a look.

And, while I’m on it. Even though I have subscribed to your blog (twice) I do not get an email when you make a new blog entry.

Roger Montgomery

:

Thanks for the feedback Vic. I will check with the IT Boffins.

Can I also suggest trying a different browser? Try firefox. You can download it for free.

Ken Milhinch

:

Vic,

I have similar issues, though not every time. ( I am using Firefox). I also don’t receive any emails.

David

:

Hi Roger,

Same problem here. I have to load your site and the refresh the page to see the new content. I thought it might be a cache issue on my end but maybe not.

Roger Montgomery

:

Hi David,

I am not sure how to fix this but the guys at MIT (Montgomery IT!) are on it and I am told will try for a solution at our end.

justin

:

try starting off on roger’s facebook page then use the link to the blog.

Roger Montgomery

:

Thanks Justin,

Your attention Everyone;

Justin is suggesting a solution to making sure you are seeing the latest version of the blog when you enter. We are aware that some of you are not seeing the latest version. Another option is to empty the cache on your browser and click refresh. Thanks Justin for taking the time to help. Nice to talk to you too.

Scott

:

Hi Roger,

I have this issue too. I can only see a new Blog post when you mention it on your Face book page with a link. I am using IE8. I too have subscribed but have never got an update notice.

Love your work.

Roger Montgomery

:

Hi Scott,

I am miffed! Have you ever received an email from me and opened it?

Vic

:

I believe that another (temporary) solution is to refresh the page by pressing Shift-F5. This should refresh directly from the server, bypassing your cache (or so I am reliably informed).

I suspect that you IT people need to do something to signal the browsers to always fetch from server, not cache (as most forum type websites do).

Roger Montgomery

:

Thank you Vic. I will pas that IT suggestion on.

Nick

:

ctrl + F5 works a charm to refresh the page fully.

It is because the browser is being told to cache the last version of the page for you in order to save on load time and bandwidth on static pages.

However since this site is a dynamic one (constantly changing/updating), this means that the cached version the browser is displaying won’t necessarily be the most up-to-date one. Hence a manual refresh being required.

An example of a server side fix is: http://www.tech-faq.com/prevent-caching.html

The IT peeps who run this site probably have a rough idea about it though.

Roger Montgomery

:

ANother solution for visitors that I am glad you have taken the time to offer Nick. Sincerely appreciated.

Ken Milhinch

:

A suggestion for all CommSec users.

Now that Roger has given us a fairly long list of A1 & A2 companies to look at, you may want to keep an eye on their share prices compared to IV. If you are a CommSec user, you can do this easily, as follows;

1. Create a watchlist (or several) and enter a quantity of 1 and the IV as the price.

2. Save and then, instead of displaying the watchlist, click on “Custom Portfolio”.

3. The entries which appear in RED are those which are trading at a discount to their IV.

4. A further benefit, is that the percentage figure in the far right column represents your “margin of safety” already calculated for you.

Hope this is of help to some of you.

Roger Montgomery

:

That’s a great idea Ken. I hope everyone can get some use out of your suggestion so thanks for sharing.

Make sure you do your own research and seek advice to ensure that those in your watch list are worthy of being followed.

Ashley Little

:

Hi Ken

Well done.

When IV changes to do just go in and edit the price?

Ken Milhinch

:

Ashley,

Yes, you can change it at any time.

Ashley Little

:

Thanks Ken,

I have etrade and I can do the same thing but I don’t think the percentes come up anymore.

They changed things a few months back

Thanks again

Scott

:

That is an excellent suggestion, I already have a watch list called RogerMon, however I hadn’t thought far enough ahead to think of this idea of using IV to compare to daily price movements to highlight an opportunity.

Many thanks, I am indebted.

Michael Vanarey

:

Dear Ken.

Brilliant! Thank you very much :)

Michael.

peter wallace

:

roger

what’s your take on IDT ? I currently hold

Roger Montgomery

:

Hi Peter. Thanks for your question. This is a business which is on my 2010 to-do-list. I will get to it soon!

Adnan

:

I have WTF and ARP both with rising intrinsic values but only have a value of 8.74 for ARP for 2011 and WTF at 4.57 for 2011. So WTF is not cheap on my calculations. Keen to see what Roger reveals!

Roger Montgomery

:

All in good time Adnan! Not long now.

David

:

Ok – Got the third now but I have a different ROE%. Is it ARB?

Roger Montgomery

:

All will be revealed soon. Keep digging.

Craig

:

Hi Roger

you’ve really got me intriqued who the three might be, wot if I have a guess I am sure you’d Think i’m Smart but I have no Idea so I wonder why 1300smiles doesn’t rate a mention?

Roger Montgomery

:

Hi Craig, all will be revealed.

How do you know that 1300 smiles is not one of them??

Ashley Little

:

Hi Roger,

Don’t know if I am right but I think his 3 guesses are

Wotif

Think Smart and

1300 smiles

Roger Montgomery

:

Hi Ashley, all will be revealed soon.

Roger Montgomery

:

Hi Ashely, keep digging.

Eamon

:

Ive been selling out of 1300smiles lately. I think im the only seller at the moment at $3.40. I’ve a valuation of $3.50 for 2011, so selling out at around this price looks attractive. Have alread disposed of 17k worth of shares, 90% in cash at the moment. Look for other oppotunities out there.

If you are interested in 1300smiles, please snap it up from me at 3.40, all smiles.

Eamon ;-)

Roger Montgomery

:

Hi Eamon,

Transparency appreciated.

Eamon

:

Now that eveyone knows my cards (90% in cash). Hence, if I do get this wrong, I know that I’ll slapped much harder for sure. :-(

Eamon

Craig

:

Hi Roger and Ashley

yes they were my first three guesses but after further digging I am confident that the three in order are ARP, WTF and I hope this is wrong ’cause I don’t like this company but it fits the ROE and gearing figures – IFM.

I would rather it was ONT but it’s ROE is just to high and it has a little bit of debt and I own some.

Roger Montgomery

:

Hi Craig,

Great guesses but no prize. I really like hearing that you are a glass half full person!

Tim

:

Hi Roger,

Just purchased your book and can’t wait to have a read. I am curious though why you have rated MOC as an A1/A2. Not doubting that they are a great business but I believe they always pay all profit out as dividends and this was not a strategy you preferred. Especially if the money could be retained by the company earning 32%ROE.

Also your evaluation on MOC if you can.

Thanks

Tim

Roger Montgomery

:

Hi Tim, very good question.

I do prefer compounding machines.

But before I consider this, I use my ‘MQR’ (Montgomery Quality Rating) to identify companies that have little chance of going bust. MOC fits this criteria.

Think of the rating as adding another layer / margin of safety (capital preservation) to an investment decision.

Nathan

:

Hey guys

Just wondering where u got the payout ratio of 100% for MOC, ive looked through their balance sheet and financial report and only get 61%, the highest its ever been was 97% in 2006, am I doing something wrong?

Roger Montgomery

:

Hi Nathan,

I can’t find 100% either. Its much higher over the next three years than the last three but can you refer to the particular comment that was made? When valuing a company, vital you look forward not backwards.

James

:

Hi Roger,

Does MOC pass your investment grade test nowadays?

I note that a few months ago on Sky (I believe its posted on youtube) that you stated that you used to think the business was great but that due to the GFC, people would prefer going to the banks for their mortgages (thus eroding MOC’s business.)

This was a factor in you believing MOC couldn’t become a substantially bigger and better company in the future. Do you still hold this opinion?

Roger Montgomery

:

Hi James,

I will revisit MOC as I have been reading a few company updates that are worth factoring in to any refreshed view.

David

:

Hi Roger and All,

Thanks for your contributions. Over time I might actually get this stuff and we can only hope to find ourselves in early retirement through the value of investing in great businesses. One of my previous posts related to LYL and I’m happy to see it up as an A1 as it helps reinforce that I am looking in the right areas. I concur that I think one of the mystery companies is FGE and one is WTF. Can’t pick the 3rd so I look forward to the reveal!

Thanks again Roger for sharing your knowledge and insights. I hope that I can learn from the example you have set.

Kind Regards,

David

Roger Montgomery

:

Thats Very kind David,

Well done on putting your thoughts about the companies on the record. Lets see.

Michael

:

Hi Roger,

Does NCK make the grade? Big turnaround from last year. Perhaps risks if consumers defer big ticket purchases but well run and management have plenty of their wealth invested. ROE has been historically high and had a dip only last year

Roger Montgomery

:

Hi Michael,

I have previously mentioned with peter Switzer that NCK is an A1. I also said that I think selling furniture is a tough game. Discount Variety of course is also a tough game but TRS do an amazing job of that. The competitive landscape however does not look kindly on furniture sellers and the emergence of the Replica furniture sellers takes out another share of consumer wallets.

Brad S

:

Hi Roger,

Enjoyed the book, and learning how a professional approaches investing.

I was wondering if you could give some insight into what extra research you do after crunching all the numbers ( ie calculating ROE, incremental ROE, debt to equity, intrinsic value, assessing for a competitive advantage, etc) and analysing the latest reports, before actually buying shares.

Do you contact the actual company? Go to the AGM? Call the CEO and ask some questions? Call the chief financial officer? Some insights would be greatly appreciated!

The main concern I have is the unknown about the future. Maybe you could highlight what you did in between getting excited about MCE and actually making the step and buying the shares.

Thanks again,

Brad

Roger Montgomery

:

Hi Brad,

There is a lot of insights that can be garnered by talking to a company but there is also the opportunity to be led astray.

Brad S

:

Hi Roger,

Thats a good point. You will probably only get a positive outlook, even if business conditions are looking grim. Do you have any suggestions about ongoing monitoring of businesses, other than looking at announcements on comsec research?

I would also like to ask about a company called Seymour White (SWL). This is not one of your three blanked out in the chart, however I do wonder if this could be an A1 or A2. It has a high ROE in 2010 of 56%. Payout ratio of 50%, minimal debt, and a strategy of organic growth as well as strong order book for 2011/2012. It also seems to be trading at a significant discount to IV of $3.12, using a required return on 12%.(Equity/share 0.36) The company only floated earlier this year and seems to be thinly traded, however does seem to have generated some degree of competitive advantage in the mid tier infrastructure development space. As I read through the latest report, it is like they have read your book Valueable, and presented the info. as value investors would like.

Your view or other views would be greatly appreciated.

Cheers,

Brad

Roger Montgomery

:

Hi Brad,

I have been looking at SWL in the last few days. Listed in July if I recall. Cash flow is just one of the possible issues. Have a look.

Brad S

:

Thanks for the reponse. I also am having problems viewing all the latest comments and updates on the blog. I normally login via Safari on my MAC and it is never up to date. I have just entered the site via internet explorer on a PC and you have reponded to my earlier post, and the site is more current.

Can your individual comments to our responses on the blog be sent to our email address aswell as appearing on the blog?

I will have a look at the cashflow of SWL.

Cheers,

Brad

Roger Montgomery

:

Hi Brad,

I am not sure if that is possible? I will try and find out what would be involved.

Josh

:

Hi Roger,

I’ve been looking at SWL too. SWL’s 2010 Full Year Results Presentation says “The latest Cash flows fluctuations due to short term timing differences (common in industry)”. Given operating cash flow was significantly higher in the previous two years I expect this means that they believe cash flow is abnormally/temporarily low. However operating cash flow is also trending down over those last 3years. Keen to hear more on this one if you continue to look into it… if it is not cheap there is obviously a lesson for both Brad and I to learn.

Roger Montgomery

:

OK Josh,

I am working through the numbers as one of my projects at the moment.

Bruno

:

Hi Roger,

Great job! it must take you ages to get all the information together and put it all up on your website! Thank you very much!! I have noticed that there have been a few, not many, but a few companies that have come from a C3, 4 or worse still C5 rating and managed to bring itself up to an A1 within 12 months! that’s a huge achievement by those companies to turn things around so quickly, and obviously it can go in the reverse as well.

However I have been wondering, in your experience,

how often do these companies tend to go back into their old habbits?

A rising tide floats all boats, is it just a case that these companies may be cyclical? Or have you noticed a commonality?

Generally your C5’s are unloved by the market because of their poor track record, hense their share price is very low, and intrinsic value increases dramatically as their ROE increases when ratings are improved. So I guess its a question of being able to pick the dogs of the dow which have a broken leg, rather than terminal cancer.

Roger Montgomery

:

Hi Bruno,

C5 companies can and many do have very high prices compared to their intrinsic values. the C% has nothing to do with share prices. A company can move to a higher quality rating (low risk of liquidation) if it simply raises capital. Remember A1 doesn’t mean its an immediate buy. It just means that the company is not going bust any time soon.

Bruno

:

Thanks Roger. that makes a lot of sense, I keep thinking of capital raising as a bad thing. It is one of the many tests I put a stock through before I decide whether or not I want to be an owner of that particular business. In doing so I had fogotten the positive side a capital raising can have if shares are issued at the right price, and the money is used the right way.

Thanks again

Bruno

Roger Montgomery

:

Great Bruno. I am delighted to have added another piece to your investing framework.

Steve

:

Hi Roger,

I’m curious as to how you calculated the ROE for SRX as 26.61%. Looking at the stats from the 2010 annual report I see the following (all figures $’000):

2010 Net profit: 16,080

2010 Equity: 51,543

2009 Equity: 39,179

By my calculations, if I average the equity I get a ROE of 35. If I use the 2009 equity figure I end up with a ROE of 41%.

Any idea where I went wrong?

Thanks, Steve

Roger Montgomery

:

Let me go back and have a look Steve. Thanks for the heads up. I will check it again.

Craig

:

Hi Roger and Steve

I also get 41% ROE for this year and with a 24% POR makes for a nice valuation

Roger Montgomery

:

Hi Steve and Ken.

I have reduced my profit figure to account for two abnormal items;

* Interest income from legal settlement and;

* Proceeds from Legal settlement Dr Gray/UWA.

Make sure you investigate note 2(b) in the annual report. You should be able to spot the items which I consider to be non-recurring.

Hope that helps.

Peter

:

Hi Steve,

Just to let you know that I’ve used exactly the same numbers as you and arrived at the same ROE.

Ken Milhinch

:

Steve,

I get exactly the same answer as you. Now I am puzzled too.

Eamon

:

Oh man, this is way harder than I thought initially. Roger, I

only managed to find Forged (FGE), as one of the 3 you left blank.

I failed miserably :-(

Eamon.

Robert Walker