Insightful Insights

-

Will the Greeks wreck your retirement?

Roger Montgomery

February 17, 2015

On Monday night, the US markets were closed for the Presidents’ Day holiday but Greece was not sleeping comfortably.

To understand whether there are risks to your wealth from Greece’s posturing (and remember the US markets return to work tonight) it pays to understand where we are currently and how we arrived at this juncture. If you would like to know more read on. continue…

by Roger Montgomery Posted in Economics, Financial Services, Foreign Currency, Insightful Insights, Market commentary.

-

It’s Coco-nuts!

Roger Montgomery

February 16, 2015

Chasing yield, wherever it can be found, is a pastime for many baby boomers whose income returns from traditional securities and bank deposits are being decimated. The fad global and Basel III banking capital requirements are potentially legitimising some securities, that under normal interest rate settings, might not have seen the light of day. continue…

by Roger Montgomery Posted in Economics, Financial Services, Foreign Currency, Insightful Insights.

-

IMF: A Step-Change

Ben MacNevin

February 13, 2015

Regular followers of the blog should be well aware of our favourable view of Bentham IMF (ASX: IMF) – see here. We are pleased with the company’s recent 2015 half-year results. continue…

by Ben MacNevin Posted in Companies, Insightful Insights, Intrinsic Value, Montgomery News and Updates.

-

PWC’s: The World in 2050

David Buckland

February 12, 2015

PricewaterhouseCoopers (PWC) has recently released a report analysing how the world economy could look in 2050. As countries with large populations; including Saudia Arabia, Vietnam, Nigeria, Bangladesh and Iran, continue the urbanisation process Australia was predicted to slip from 19th in the world currently, down to 28th position by 2050. continue…

by David Buckland Posted in Economics, Insightful Insights.

- 5 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

Do Property Prices Ever Fall?

Roger Montgomery

February 11, 2015

It was December 14, 2011. The Australian Resource Boom was in full swing and the Pilbara was ground zero. In Port Hedland the median house price had almost doubled in four years from $600,000 in 2007 to more than $1 million, according to Real Estate Institute of WA figures. In Wedge Street, you needed plenty of ‘wedge’ – $995,000 to be exact – to buy a brand new ‘off the plan’ two-bedroom unit in a multilevel apartment complex.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Property.

-

How low can you go? Deflation and negative bond rates

Roger Montgomery

February 10, 2015

With everyone getting very hot under the collar or excited (depending on whether you are a borrower or a lender) about the prospect of Australia’s cash rate falling below two per cent, we thought it might be interesting to point to something even more interesting that transpired last week in Europe. continue…

by Roger Montgomery Posted in Economics, Foreign Currency, Insightful Insights.

-

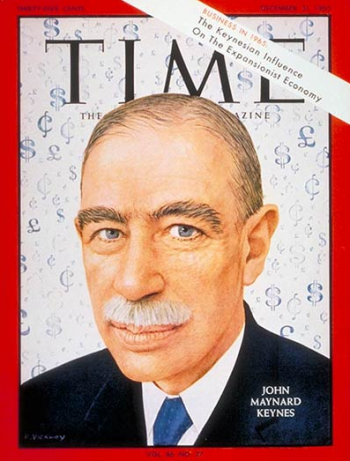

We’re all in this together

Scott Shuttleworth

February 9, 2015

For the historically minded reader you will note that this title was a famous quote attributed to John Maynard Keynes, the grandfather of Keynesian economics. The quote is said to have been made by Keynes as he commented on the harsh post-war conditions placed on Germany at Versailles in 1919. In short, one condition required that Germany repay the Allies for the cost of the war. continue…

by Scott Shuttleworth Posted in Economics, Foreign Currency, Insightful Insights, Market commentary.

-

Everybody Loves Raymond

Roger Montgomery

February 7, 2015

A couple of weeks ago at the World Economic Forum in Davos, Switzerland, Ray Dalio spoke with CNBC. Prominent economic thinkers in Davos believe the U.S. economy is strong, but its ability to deal with the next crisis is in doubt. “The U.S. is growing and I think that’s a non-debatable fact,” Gary Cohn, president of Goldman Sachs, said Thursday at the World Economic Forum in Switzerland. “What I am concerned about is the actual ability of the U.S. to raise rates with what’s going on with the rest of the world.” Below, we summarise the outtakes.

by Roger Montgomery Posted in Economics, Insightful Insights.

- 1 Comments

- save this article

- POSTED IN Economics, Insightful Insights

-

Is there early pressure from the collapsing oil and gas price?

David Buckland

February 6, 2015

In late 2013, I wrote a number of blogs on Liquefied Natural Gas (LNG) concluding that unless the industry cost structure in Australia changes and productivity improves, there are unlikely to be any new offshore “green field” LNG projects, except for Floating LNG facilities. continue…

by David Buckland Posted in Energy / Resources, Insightful Insights, Technology & Telecommunications.

-

Investing Overseas: Time to buy Greece?

Roger Montgomery

February 4, 2015

There is a definite element of contrarianism to value investing. Not always of course, but sometimes the market’s negative reaction, to news that is of a temporary nature, prices the shares of a company as if the problem were permanent. Going against the tide in these cases can produce very satisfactory investment outcomes. continue…

by Roger Montgomery Posted in Foreign Currency, Insightful Insights, Investing Education.