Did Christmas come at all?

Following on from our anecdotal feedback we posted last week that Christmas trading came very, very late for retailers, the Australian Chamber of Commerce and Industry (ACCI) has trumped even our most negative expectations.

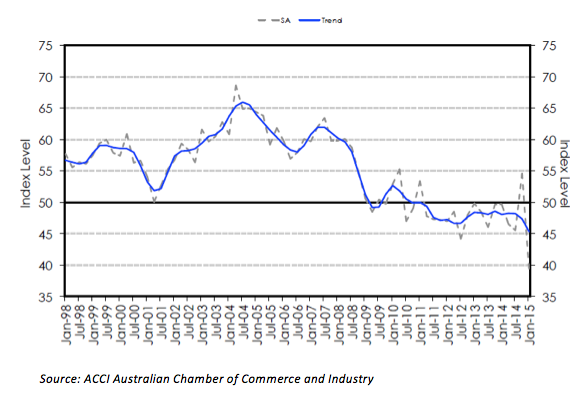

ACCI produce a quarterly survey of a group of businesses and their investing confidence. The latest survey for the December 2014 quarter described the all-important Christmas retailing period as “the worst for 23 years”.

While this statement makes for a good headline, we note that retail conditions have been very weak for many years. As shown below, the index for Current Sales has been below the neutral 50 level since the December 2010 quarter. Still, the latest result should give the RBA some food for thought as to the direction of the next interest rate movement (down).

Our read through is that recent downgrades from retailers such as Flight Centre, Oroton and Kathmandu are just the tip of the iceberg. We believe that challenging conditions will persist in 2015.

Along with weak consumer sentiment, retailers must deal with a lower Australian dollar which increases the cost of importing stock. Retailers may struggle to pass on the full extent of these costs in a low household-income growth environment. This may result in slower sales or a reduction in margins, both of which are undesirable outcomes from an investment perspective.

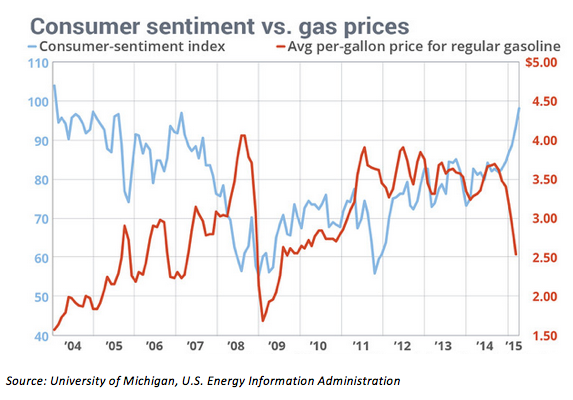

With that said, retailers should benefit somewhat by lower petrol prices. Having visited the bowser recently, it only cost $50 to fill the car when it would previously cost upwards of $70. Fuel costs comprise a considerable share of household expenses, so the average consumer should have more income at their disposal.

Marketwatch has published a chart that illustrates the strong inverse relationship between gas prices and consumer sentiment in America. Not only do lower fuel prices at the bowser represent more disposable income for consumers, but rising confidence is the key to unlocking those savings and seeing them spent elsewhere in the economy. Whilst the above represents a more buoyant mood for the US consumer, we are yet to see a similar picture in Australia.

In a highly cyclical industry, we expect the Australian consumer will come out of hiding eventually. But we won’t be investing our clients’ funds into the retail sectors until we see signs that the tills are once again beginning to ring. Which appears to be someway off just yet.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Graeme Cox

:

Thanks for the update.

It would seem that the lower Aus $ does NOT affect FLT and quite the contrary, could be of benefit as it has no ‘product’ to import and pay higher costs for. This coupled with lower fuel costs should be very positive for this company.