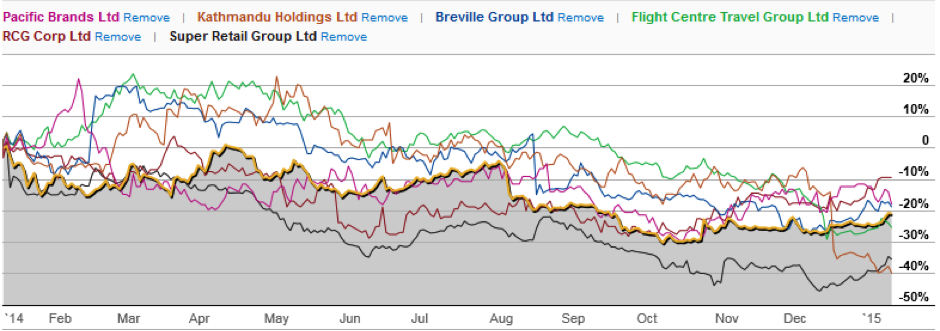

How did retailers go over Christmas?

Since we last published this chart back in November, our view on listed retailing stocks remains largely unchanged and based on anecdotal feedback to date, the wealth effect from rising share markets and property prices is still not translating into spending. We have seen three downgrades (Kathmandu, Flight Centre & Oroton) and based on our research, it’s entirely possible these will not be isolated cases.

Indeed, since we published the chart below, if anything the picture has become slightly worse.

Many retailers are heavily reliant on the Christmas trading period to fuel the majority of their sales and as such, earnings can be generated largely in just the few weeks leading up to and post-Christmas.

Based on our research to date however, it appears that the Christmas spending came late, very late. Shoppers really did not open their wallets until just a few days just before Christmas and if our sources are correct, as late as December 20.

It perhaps signals a shift in consumers’ behaviour – take this post below from the Australian Retail Index as an example.

Australian retail sales show weekend dip in Christmas lead-up

Across Australia, overall sales dipped 17.3% this weekend (29th/30th Nov) compared to last weekend. This may be a sign of consumers consolidating their spending in anticipation of Christmas gifts shopping.

This year there appears to have been a shift in the expectations of consumers driven by news headlines reporting a likely ‘ok but not great’ retailing period. It appears that many read into this as the post-Christmas boxing day-like sales would come early this year and come early they did. We’ve heard numerous stories of friends and family members buying presents at up to 30-50 per cent off the prices just a few weeks before and in that final week to Christmas.

From a retailers perspective this can be problematic. If most sales, margin and earnings are generated during such a small window and if you are forced to discount heavily to get your foot traffic up, then despite reporting an ‘OK’ sales or revenue number, the logical question becomes if you discounted, at what cost was this to your margins and earnings?

Retailers are subject to high levels of fixed costs such as rents, wages and electricity, so any level of discounting can have a profound impact on their bottom line. A one per cent reduction in gross margin for example can often translate into a five per cent reduction in earnings for example. A five per cent reduction in top-line margins can have a 25 per cent impact.

It is yet another reason we are so wary of investments in this sector and why we are eagerly waiting for the half-year reporting season to assess the impact of consumers delaying their purchases this year.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, found out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Random Ash

:

Hi Russell, does TMF still hold shares in FLT?