Companies

-

MEDIA

Uncovering the best value stocks

Roger Montgomery

May 2, 2012

Join Roger as he discusses his Value.able approach to picking the best stocks for this ASX Investor Hour presentation delivered 2 May 2012. Watch here.

by Roger Montgomery Posted in Companies, Intrinsic Value, TV Appearances.

- save this article

- POSTED IN Companies, Intrinsic Value, TV Appearances

-

MEDIA

When is an offer too good to refuse?

Roger Montgomery

May 1, 2012

Roger Montgomery discusses why the Spotless (SPT) board has finally accepted a Pacific Equity Partners takeover offer in this Sydney Morning Herald article published 1 May 2012. Watch here.

by Roger Montgomery Posted in Companies, In the Press, Takeovers.

- save this article

- POSTED IN Companies, In the Press, Takeovers

-

They may never be needed but are there enough?

Roger Montgomery

April 18, 2012

Republished: PORTFOLIO POINT: Leighton’s recent performance issues have been exacerbated by a poor relationship between management and staff.

Republished: PORTFOLIO POINT: Leighton’s recent performance issues have been exacerbated by a poor relationship between management and staff.The 15th of April will mark the 100-year anniversary of the tragic sinking of the Titanic on its maiden voyage from Southampton England to New York. Owned by The Oceanic Steam Navigation Company or White Star Line of Boston Packets, the tragedy was not that her advanced safety features, which included watertight compartments and remotely activated watertight doors malfunctioned. The tragedy was the operational failure and that the Titanic lacked enough lifeboats to accommodate any more than a third of her total passenger and crew capacity.

It occurred to me on this anniversary that there are many lumbering, giant business boats listed on the Australian stock exchange today, whose journeys have been equally eventful, if not fatal, and whose management is no less responsible for operational failures and for providing lifeboats only for themselves.

Take the situation over at Leighton (ASX: LEI) – a company I wrote about here some time ago, saying: “There is a significant risk of downward revisions to current forecasts for the 2012 profit.” On March 30, the company wrote a further $254 million off its two biggest projects – Airport Link and the Victorian desalination plant. More broadly, Leighton downgraded its FY12 profit guidance to $400 million-$450 million from $600 million-$650 million, taking the company’s writedown tally to almost $2 billion in the past two years. This will reduce the return on equity from 22% to 15% for 2012, and significantly reduce the 2012 intrinsic value, which now sits below $14.00 (see graph below).

Source: Skaffold.com

Back when I wrote my prediction, I also noted that workers at the desalination plant had cited ‘safety concerns’ causing them to work more cautiously (read slowly) to ensure their physical safety and the safety of their $200,000 per year wage, which of course would not continue beyond the project’s completion.

This week, it was revealed that similar problems have emerged at Brisbane’s Airport Link project. According to one report, “an increasing level of aggressive behaviour” from unionised workers who wanted to “get paid for longer” was an attempt to “leverage this finishing phase” of the project.

Leighton must construct to a deadline, and liquidated damages clauses cost the company about $1.1 million per day for every day that the Airport Link project is delayed. My guess is that as a result of the workforce’s alleged ‘go slow’, Leighton is forced to bring in hundreds of sub-contractors such as sparkies (with “specialist commissioning skills and experience”, according to John Holland) to complete the work. Either way, it costs Leighton more. A 25% blow-out on a multi-billion dollar project can amount to $1 billion.

On top of these problems, Leighton has a $200 million deferred equity commitment to make two years after Airport Link opens. And if my speculation that the operator may be broke before Christmas comes to fruition, Leighton will be forced to write off another $63 million – the amount remaining to be written down.

But before you jump to attack the unions reported to be responsible for Leighton’s woes – something I believe is often justified, not because of what the unions represent, which is honourable, but because of the tactics they sometimes use to seek redress – you should remember that there are many companies whose more humble management works in harmony with its workforces, unionised or otherwise.

Management is an important part of the investment analysis mix and while I firmly believe, as Buffett does, that the business boat you get into is far more important than the man doing the rowing, I do also believe that management will make the bed that ultimately every stakeholder must lie in.

Any company whose management drives flash cars to the office, pays herculean salaries to themselves and/or takes advantage of company relationships for self-gain is always going to be the target of unrest and distrust from its staff. This is driven often by envy, a sense of unfairness or lack of equity, and while I am not saying this is the case at Leighton, clearly there’s something amiss that is the root cause of this much trouble.

Over the last decade, Leighton has generated cash flow from operations of $8.3 billion, but its capital expenditure has now exceeded $7.5 billion. This would leave $800 million for dividends, but the company has paid dividends of over $2 billion (perhaps to appease non-unionised, income-seeking shareholders who support the share price upon which management’s lucrative remuneration is based). Given the cash to fund this dividend largesse was not generated by business operations, $850 million of ownership-diluting equity has been raised and $1.3 billion of debt borrowed. And for this less-than-spectacular performance, the top 10 current executives were paid almost $20 million last year. Eight of those were paid more than $1.2 million in 2011, four were paid more than $2.3 million, and the year before, three of the 10 were paid more than $4.5 million each.

Forecast profits for 2012 will not be any higher than five years ago, and the company workforce has doubled to 51,281 employees at June 30, 2011. But $190 million in salaries for 15 senior executives (excluding van der Laan’s $47,000) between 2007 and 2011 (see table), while overseeing such performance does not sit well with staff (or vocal but ineffectual minority shareholders) and it’s the relationship between management and staff that is more than partly to blame for the company’s ills.

Whether or not the CFMEU’s Dave Noonan’s claim in The Australian Financial Review this week is correct – specifically that “the markets were the last to know [about Airport Link], everybody else in the industry knew that the company were going to drop hundreds of millions of dollars and obviously they chose to tell the stock market very late in the piece” – is less significant than whether a carcinogenic tumour has grown between management and staff. The former can be resolved but the latter is potentially more permanent, and therefore damaging to shareholder returns.

Leighton is a fixture in the portfolios of thousands of superannuants nearing retirement and their disappointment with their investment returns can be at least partly attributed to the poor wealth-creating contribution of this company and its management. In turn, this can be attributed to the motivation and satisfaction of staff.

Shareholders are also the owners and have a right to know how management is performing, but now the majority shareholder’s demands will hold sway and the majority shareholder is Spain’s Grupo ACS, not the many Australian super funds who thought the company’s management was working for them. Oh, and I am guessing there is the risk of further writedowns on projects that haven’t yet hit the headlines.

Like the Titanic, where only the executives at White Star Line were truly safe, minority shareholders may find there aren’t enough lifeboats for them either.

First Published at Eureka Report April 11. Republished and Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 19 April 2012.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights, Investing Education, Manufacturing, Skaffold.

-

Guest Post: The Happiest Company on Earth?

Roger Montgomery

April 18, 2012

Many of us grew up with a diet of the brilliant work of Walt Disney. As children we laughed and cried along with the characters of Donald Duck and Mickey Mouse, Cinderella and Bambi. More recently, boosted by the purchase of Steve’s Job’s Pixar business, Disney continues to build its library and draw many more generations into the fold with the characters of Finding Nemo, Toy Story, Monsters Inc and Cars. The company dominates with its ‘share-of-mind’ competitive advantage. In this Guest Post Andrew takes the scalpel to the company and dissects its major components.

Many of us grew up with a diet of the brilliant work of Walt Disney. As children we laughed and cried along with the characters of Donald Duck and Mickey Mouse, Cinderella and Bambi. More recently, boosted by the purchase of Steve’s Job’s Pixar business, Disney continues to build its library and draw many more generations into the fold with the characters of Finding Nemo, Toy Story, Monsters Inc and Cars. The company dominates with its ‘share-of-mind’ competitive advantage. In this Guest Post Andrew takes the scalpel to the company and dissects its major components.What does your company REALLY do?

A nuts and bolts look inside the happiest company on earthThe ability to make assumptions about the future prospects of a business is fundamentally linked to how we understand that business. Without a good understanding you will be more than likely flying blind and your perceptions and reality could be in very different places and therefore throwing a great deal of uncertainty into any estimate of intrinsic value (which is linked more to the future prospects than anything).

A company that I am very fond of and one that I am sure almost everyone here has heard of is the Walt Disney Company (NYSE:DIS). I thought this would make a great case study in understanding the business.

So what does Walt Disney do? The first thing that comes to mind is the feature cartoons that it made its name on and its theme parks. These are the most iconic images that are attached to this famous company and more than likely where we were first knowingly exposed to the brand whether it be entering Disneyland for the first time and looking up Main Street towards the castle or watching movies like Snow White, Dumbo, Pinocchio.

What may surprise some people however is that most of the revenue and net income for the company comes from television.

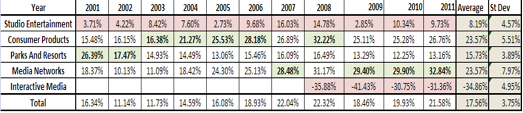

Take a look at the below table:

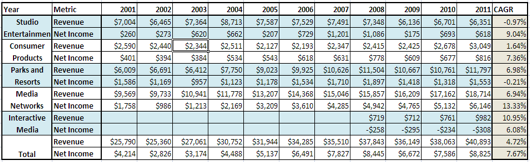

Figure 1-Yearly breakdown of DIS segment revenue and net income (net income is before non-controlling interests taken out and are reported in US$ Millions)

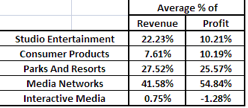

As you can see in Fig.1, every year from 2001 to 2011, the largest contributor to revenue and profit (except 2002) was the Media Networks segment of the business. Over this period the company has on average brought in around 41.5% of the groups revenue and 55% of the net income as shown by fig 2.Figure 2- Average % of total group figures

This technique of looking at the individual segment results and comparing them to the overall group is a technique I like to use to really understand the nuts and bolts of the business. Looking at these figures I can see that even though DIS made its name by animating feature cartoons and opening gigantic theme parks, it is the TV channels they own that make up the most crucial element of the business as it is today. There for if you were interested in investing in DIS you would be very wise to focus particular attention on understanding how the media Networks business derives its revenue and what risks are associated with this segment. Luckily the DIS annual report defines this in quite good detail but back to this later. One thing to realise though is that this type of analysis is greatly influenced by scale of operations. The biggest divisions will or at least should, bring in the bulk of the revenue and profits. It may be helpful to see on a relative basis at where the magic happens.To do this, you might like to use profit margins of each segment. It is not uncommon for a diversified businesses smallest division to have the highest profit margin as in Qantas with their frequent flyer division. Disney is no different. It can change from year to year as shown in figure 3 however. Once again as you can see, lately it has been about the media networks. Looking at this however, you can gain a clearer picture of the profitability of each division in a relative manner. Despite being one of the smallest divisions, the consumer products segment is right up there in regards to profitability.

Figure 3- Net margins by division and overall group

So now, simply by looking at the financials we can get a clearer picture as to what DIS is really all about. We can see that the media networks business is arguably the most important. I can also see that the parks and resorts division is a pretty predictable segment with revenue and profit growth pretty consistent throughout the years and whose margins remain quite stable.So where to next? Well you want to understand the risks associated with each segment so that you can be better placed to understand them and be able to make informed decisions and assumptions on the future. As mentioned earlier, the DIS annual Report actually goes into detail about the specific risks of each segment as well as detail as to how they derive their revenue. All annual reports will have a description of what the principal activities of the business are as well and if the management is shareholder orientated than it may include some very handy bits of information about the companies past, present and future. This is the next step, read all the information you can about that company whether it be through annual reports or newspaper articles, also read about the industry and read industry specific media to see what the insiders are doing and saying about the future. Knowledge is indeed power.

These are the simple steps to understanding a business and is aimed at the beginning investor although I think everyone can benefit from thinking more about how to understand a business they want to invest in.

Have you got any examples of businesses where the core operation may differ from what people may perceive? What gems can be found in the nuts and bolts of existing businesses? What techniques do you use to understand a new business? Feel free to post any thoughts below.

What do I think of Disney? Their return on equity has been increasing but is still below my required return so my valuation would still be at around or lower than their reported book value but I would love to own them personally. They are one of the biggest brands in the world and when they get it right, they create products that will last generations.

Guest Author: Andrew Leggett. Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 18 April 2012.

by Roger Montgomery Posted in Companies, Investing Education.

- 9 Comments

- save this article

- POSTED IN Companies, Investing Education

-

Building Heaps & Piles at BHP

Roger Montgomery

April 18, 2012

PORTFOLIO POINT: Given the outlook for Chinese growth and iron ore prices, is it time to cast a critical eye over your BHP holding?

PORTFOLIO POINT: Given the outlook for Chinese growth and iron ore prices, is it time to cast a critical eye over your BHP holding?The 2001 merger of BHP Limited and Billiton Plc created the world’s largest diversified resource company. The company is also one of the largest in the world by market capitalisation and I would guess one of the longest-held stocks in many investors’ portfolios, as well as one of the most likely to have been inherited by superannuants from their parents.

Operationally, the company is nothing like it once was. Seriously underperforming assets and overpriced acquisitions had to be written off in the late 1990s, and since then external candidates including Paul Anderson, Brian Gilbertson, Chip Goodyear and, most recently, Marius Kloppers have taken the top job at the Big Australian. Under their sound stewardship – and the biggest mining boom in history – BHP’s share price has risen from less than $10 when the merger was consummated to almost $50 prior to the GFC, and again a year ago. But since then, BHP’s share price has crashed 30%.

A year ago, with the share price at its zenith, many analysts were extolling the virtues of BHP. I note one company said their positive view on BHP was due to low-cost and long-life mines, growing production and cost discipline. With demand from China strong, the common refrain of course was – and still is – that the outlook for BHP’s products was (and is) bright. Many also went on to add that copper had a strong bullish case over the next two years, and with global consumption outpacing supply and a lack of new high-grade deposits coming into production imminently, the marginal cost of copper was set to rise, which could only be positive for the price. And back in November 2010, some analysts were applying a notional price/earnings multiple of 12 to the EBIT numbers of UBS and Goldman Sachs of $US12.4 billion to $US12.8 billion, to arrive at an independent iron ore business valuation of $US144 billion – roughly the same as the market of the entire conglomerate at that time.

So what has happened?

Well, the copper price is indeed up 13% since March 2010, but BHP’s share price languishes. And I wonder whether the talk of new in-the-ground metrics to value iron ore assets is akin to the bubble-talk price/sales and price-per-click ratios being proffered as a new way to value internet companies back in 1999 and early 2000.

BHP’s principle revenue drivers are the price of iron ore (for the manufacture of steel), the price of oil and base metal prices (predominantly copper). Emerging economies and their insatiable demand for construction and manufacturing materials has thus far ensured BHP grows its revenues and earnings.

Talk to BHP employees and they’ll tell you it’s all really quite simple: ‘Dig it (iron ore) out of the ground for $33 and sell as much of it as you can (currently the price is $US140/mt)’.

But how much of it can they sell? And at what margin?

China’s economic data shows its economy is growing at the slowest pace in recent memory. China’s economy expanded at its weakest pace in 2.5 years in the fourth quarter of 2011. Sagging real estate (something I have warned investors here to watch) and export sectors have heralded a sharper slowdown, while triggering pro-growth responses from the government.

Most recently, gross domestic output rose just 2% from the previous quarter, suggesting to some economists that underlying momentum is slowing more rapidly than expected.

Interestingly, the fourth-quarter growth rate was the slowest pace since the second quarter of 2009. And this was when the global economy was emerging from a deep recession. It also marked the fourth straight quarter in which growth had slowed down.

Importantly, recent data shows net exports and property investment subtracting from growth. This latter development is a serious concern for investors in BHP, because the property sector is worth some 13% of total economic output and steel is the primary input for building construction.

Back in March 2010, I wrote: “The key concern for investors is to examine the valuations of companies that sell the bulk of their output to China. Any company that is trading at a substantial premium to its valuation on the hope that it will be sustained by Chinese demand, without a speed hump, may be more risk than you care for your portfolio to endure.

“The biggest risks are any companies that are selling more than 70% of their output to China, but anything over 20% on the revenue line could have major consequences.

“BHP generates about 20%, or $11 billion, of its $56 billion revenue from China; and Rio 24%, or $11 billion, from its $46 billion revenue. BHP’s adjusted net profit before tax was $19.8 billion last year and Rio’s was $8.7 billion.

“…BHP’s profitability would be substantially impacted by any speed bumps that emerge from China…”

Annual growth in China’s property investment of 12.3% as at December marked a sharp slowdown from November’s 20.2% pace. Housing investment dropped precipitously in December, while many property developers are warning 2012 looks worse.

The booming housing market helped drive China’s parabolic growth, but the government’s attempts to engineer a ‘deflation’ of the property bubble appear to have had a sharper effect.

This compounds the adverse impacts on the country’s manufacturers and exporters from weakening European export markets, rising labour costs and inflation, as well as the widely reported leadership handover.

If you inherited BHP Billiton (BHP) and/or own it in your superannuation fund, you have to do more than simply keep a close eye on China. If indeed the writing is already on the wall, you need to decide whether you are going to respond.

Skaffold’s valuation for BHP has, as I previously predicted, been falling. The 2012 valuation of $36.85 has indeed been leading the share price lower, as Ben Graham might have suggested it would when he explained that in the long run the market is a weighing machine. (BHP is currently trading at about $34.51) For those who are interested, my Rio valuation is $70.62 (Rio is currently trading at about $66.12).

However, my BHP valuation currently rises to $44 for 2014, but I say “currently” because I suspect by 2014 an iron ore supply response will have forced the iron ore price lower, and triggered a raft of earnings revisions that will reduce BHP’s valuation.

China may continue to drive GDP with capital and fixed investment spending on fast trains, highways, cities and airports, but irrespective of whether the GDP is 9% or 6%, the proportion of fixed-asset investment cannot be sustained at 60% of GDP. More importantly, the iron ore China does require may be purchased at much lower prices and like the declining margins Apple faces on its new generation iPads, and Gerry Harvey endures on sales of widescreen TVs, BHP may also have to endure lower margins on iron ore while also selling less.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 18 April 2012.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 3 Comments

- save this article

- POSTED IN Companies, Energy / Resources

-

MEDIA

How can you beat the market?

Roger Montgomery

April 14, 2012

For many, beating the market indices is the hold grail of share market investing. In this Australian article published 14 April 2012 Roger Montgomery discusses how you too can beat the market using his Value.able investing strategy. Read here.

by Roger Montgomery Posted in Companies, In the Press, Investing Education, Value.able.

- save this article

- POSTED IN Companies, In the Press, Investing Education, Value.able

-

MEDIA

What are Roger Montgomery’s Value.able insights into Mining Services?

Roger Montgomery

April 14, 2012

Do New Hope Corporation (NHC), Northern Star Resources (NST), Mt Gibson Iron (MGX), Navarre Minerals (NMC), Allmine Group (AZG), Credit Corp Group (CCP), Matrix composites (MCE), Coffey International (COF), Data #3 (DTL), Breville Group (BRG), UGL (UGL), QR National (QRN) and Seymour Whyte (SWL) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 14 April 2012 to find out, and also learn Roger’s current insights into the Mining Services sector. Watch here.

by Roger Montgomery Posted in Companies, Energy / Resources, Intrinsic Value, Investing Education, TV Appearances, Value.able.

-

MEDIA

In April 2012 where does Russell Muldoon see good Value.able investments? (Part 2)

Roger Montgomery

April 10, 2012

Do Lonrho Mining (LOM), Integrated Research (IRI), Hawkley Oil and Gas (HOG), Boart Longyear (BLY), Forge (FGE) and Environmental CleanTechnologies (ESI) achieve Roger and coveted A1 grade? Watch Part 2 of Sky Business’ Your Money Your Call 10 April 2012 program now to find out. Watch here.

by Roger Montgomery Posted in Companies, Investing Education, TV Appearances, Value.able.

-

MEDIA

In April 2012 where does Russell Muldoon see good Value.able investments? (Part 1)

Roger Montgomery

April 10, 2012

Do Thorn Group (TGA), Maverick Drilling (MAD), Campbell Brothers (CPB) and Galaxy Resources (GXY) achieve Roger’s coveted A1 grade? Watch Part 1 of Sky Business’ Your Money Your Call 10 April 2012 program now to find. Watch here.

by Roger Montgomery Posted in Companies, Investing Education, TV Appearances.

- save this article

- POSTED IN Companies, Investing Education, TV Appearances

-

MEDIA

How can the Biggest not be the Best?

Roger Montgomery

March 31, 2012

Roger Montgomery expounds upon his Value.able investing approach to illustrate how Big does not mean Best when choosing companies in this Australian article published on 31 March 2012. Read here.

by Roger Montgomery Posted in Airlines, Companies, In the Press, Investing Education.

- save this article

- POSTED IN Airlines, Companies, In the Press, Investing Education