Companies

-

Is your portfolio filled with quality and margins of safety?

Roger Montgomery

February 20, 2012

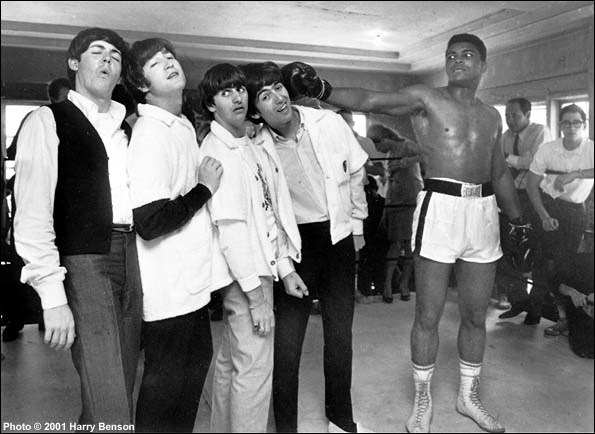

Click on the image at left to see a close up of the stocks we like.

Click on the image at left to see a close up of the stocks we like.I reckon 2012 will be the year to get set and fill your portfolio with high quality businesses, demonstrating bright prospects for intrinsic value growth and a margin of safety. That will be the topic of my talk today as I kick off the ASX’s 2012 Investor Hour series. Here are the details:

Topic: Buying opportunity

When: Tuesday 21 February

Where: Wesley Conference Centre, 220 Pitt Street, Sydney (venue location)

Time: 12 noon – 1pm. Please arrive by 12.00 noon for start

Details:The time to get interested in share investing and make good returns is precisely when everyone else isn’t. But know that the key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently.

At this event Roger will set out his principles for stock selection.

Roger Montgomery is a highly-regarded value investor, analyst and author and a regular contributor and commentator across the media. Roger is an analyst at Montgomery Investment Management Pty Ltd.

Presenter(s): Roger Montgomery, www.Skaffold.com, www.Montinvest.com

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 21 February 2012.

by Roger Montgomery Posted in Companies, Investing Education, Market Valuation.

-

Gold v Stocks; Who will win?

Roger Montgomery

February 14, 2012

On one side of the investing coin is the idea that you lay out money today to get more back later. The flipside is that buy purchasing today you forego consumption today for the ability to consume more later.

On one side of the investing coin is the idea that you lay out money today to get more back later. The flipside is that buy purchasing today you forego consumption today for the ability to consume more later.They aren’t quite the same thing of course, because the latter idea introduces inflation and suggests the purpose of investing is to at least maintain purchasing power (generate returns in line with inflation) or increase purchasing power (generate real returns in excess of inflation). In a useful reminder Buffett observes:

“Even in the U.S., where the wish for a stable currency is strong, the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire. It takes no less than $7 today to buy what $1 did at that time. Consequently, a tax-free institution would have needed 4.3% interest annually from bond investments over that period to simply maintain its purchasing power. Its managers would have been kidding themselves if they thought of any portion of that interest as “income.””

Therefore an investment that is price stable but loses purchasing power is very risky (think US T-Bonds) while an asset that is volatile in price but almost certain to increase purchasing power over time is less risky than the conventional measures of risk would dictate.

This is how Buffett begins an excerpt of his forthcoming letter to Berkshire Hathaway shareholders HERE. One scenario his introduction does not contemplate of course is deflation. Japanese real estate and equity prices are fractions of their previous levels and a bond offering even a miniscule return would produce an increase in purchasing power. Like many readers, you might reach the conclusion that the absence of this scenario in his letter along with the knowledge of aggressive equity purchases in recent months, indicates he does not believe deflation is a possibility.

The other subject of his letter is Gold. Melted down all the gold in the world would amount to one 68 cubed foot of uselessness. Somewhat ironically he reflects on its purchasing power today – all the agricultural land in the United States, sixteen companies as valuable as Exxon and a trillion dollars in walking-around money.

But he points out that the companies will have thrown off dividends and the land would have produced food. And so the article leads to the defence of buying businesses as a superior strategy (to owning gold ‘that just sits there’) – as we believe at Montgomery Investment Management, and you might as Value.able graduates (after seeking and taking personal professional advice).

I believe Buffett’s take on the investing landscape is ultimately correct (bubbles are always followed by a bust and nothing goes up forever);

“What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As “bandwagon” investors join any party, they create their own truth — for a while.”

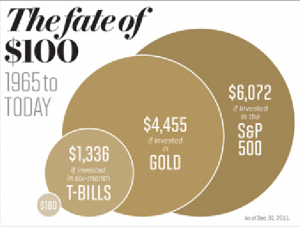

But I trust you can see the irony in claiming gold is useless and yet it can buy 16 Exxons and so on. As the chart shows, it has underperformed stocks over the long term and without boasting about it Buffett uses the S&P500 index to demonstrate the superiority of stocks. In a thinly veiled warning to gold bugs he likens the current enthusiasm for gold to the internet bubble and US housing speculation pre-2007.

In his enthusiasm for stocks being best able to retain purchasing power or increase it, I can’t but help remembering that Buffett was a more circumspect proponent of stocks in the seventies – a period of very high inflation. While in 1974, when Forbes asked Buffett how he felt about the stock market at the time, Buffett replied, “Like an oversexed guy in a whorehouse”, his 1979 letter to investors serves as a useful reminder of the limits of any asset to retain purchasing power during bouts of high inflation.

In his enthusiasm for stocks being best able to retain purchasing power or increase it, I can’t but help remembering that Buffett was a more circumspect proponent of stocks in the seventies – a period of very high inflation. While in 1974, when Forbes asked Buffett how he felt about the stock market at the time, Buffett replied, “Like an oversexed guy in a whorehouse”, his 1979 letter to investors serves as a useful reminder of the limits of any asset to retain purchasing power during bouts of high inflation.“Just as the original 3% savings bond, a 5% passbook savings account or an 8% U.S. Treasury Note have, in turn, been transformed by inflation into financial instruments that chew up, rather than enhance, purchasing power over their investment lives, a business earning 20% on capital can produce a negative

real return for its owners under inflationary conditions not much more severe than presently prevail.

If we should continue to achieve a 20% compounded gain – not an easy or certain result by any means – and this gain is translated into a corresponding increase in the market value of Berkshire Hathaway stock as it has been over the last fifteen years, your after-tax purchasing power gain is likely to be very close to zero at a 14% inflation rate. Most of the remaining six percentage points will go for income tax any time you wish to convert your twenty percentage points of nominal annual gain into cash.

That combination – the inflation rate plus the percentage of capital that must be paid by the owner to transfer into his own pocket the annual earnings achieved by the business (i.e., ordinary income tax on dividends and capital gains tax on retained earnings) – can be thought of as an “investor’s misery index”. When this index exceeds the rate of return earned on equity by the business, the investor’s purchasing power (real capital) shrinks even though he consumes nothing at all. We have no corporate solution to this problem; high inflation rates will not help us earn higher rates of return on equity.”

Another warning to stick to high ROE businesses…

Finally remember that if you are buying stocks, unlike commodities, there exists management risk, execution risk, result risk, competitor risk, economic risk, currency risk etc. Anything can go wrong in a business and frequently does. And while Chalrie Munger has pointed out that “Almost all good businesses engage in ‘pain today, gain tomorrow’ activities”, you must know what you are doing.

I think stocks are indeed the best opportunity to retain and increase purchasing power but only the good quality ones. Knowing what you are doing and sticking to high rates of return on equity, little or no debt and A1 or A2 businesses increases your chances of doing even better than the both the stock market index of which they are constituents and inflation.

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 14 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Skaffold.

- 40 Comments

- save this article

- POSTED IN Companies, Insightful Insights, Skaffold

-

The colour of money?

Roger Montgomery

February 9, 2012

It’s been a lackluster start to this year’s company confession session. Only a few companies have so far bucked the stable / downward trend in revenues and profits.

It’s been a lackluster start to this year’s company confession session. Only a few companies have so far bucked the stable / downward trend in revenues and profits.At the top of this list, reporting what I would consider to be quality results are CCP (SQR A2) – so far the clear standout and a business we own in the Montgomery Private Fund. This is followed by WEB (SQR A2) a business whose Total Transaction Value (TTV) is growing at rates 4x the industry average but is a little expensive in terms of its future prospects for now.

And that’s about it at the quality end of the investment spectrum (with the exception of Breville, Forge and Decmil’s updates). Remember that we rate every single listed company from A1 (the best) to C5 (the worst) so we follow them all. If you want to find opportunities such as CCP before everyone else, take a look at Skaffold.com

There have been a number of other businesses which have reported so far and on face value, while LGD (SQR B2) experienced strong revenue and profit growth; a large proportion of its growth was driven by several recent acquisitions. Organic growth is less than 50% of that being reported currently; something to watch in future reporting seasons.

Now to our friends long Telstra:

(SQR B3) the half year was a little sobering for those who have bought the stock for its dividend yield. Whilst reported Free Cash Flow was $1,795b and dividends paid amounted to $1,738b, one would assume the yield was fully covered. Not so. The free Cash number reported did not include $559m in interest repayments on almost $15b debt. $500m additional debt was borrowed to fund dividends and CAPEX – debt to equity thus increased and is currently 104%. While dividends are being paid, and will probably continue being paid, its just worth noting how they are being funded…

Over at the Big Australian – BHP:

Staying at the big end of town and global diversified mineral and petroleum producer BHP (SQR B1) reported a HY NPAT $9.9b NPAT down on last year’s. The lower results was despite very attractive Iron Ore, Bulks and Petroleum margins – prices which declined in the latter part of 2012 and which may impact profits further in the 2nd half. The acquisition of Petrohawk for $13b (which pushed gearing to 34%) contributed to earnings but couldnt arrest the decline. Industry-wide cost pressures with consumable, labour and contractor costs added $400m to cost inflation! On a more positive note, the project pipeline of $27b and $5b in actual committed projects. In the half total CAPEX (investment) projects + exploration spend was $9b – this continues to support EPC / EPCM engineers, drillers, mud suppliers (Decmil, Forge, Maca, Fleetwood et. al.) which are all operating at full capacity and expanding like there is no tomorrow. However for BHP investors, because the company continuously has to invest in greenfield projects to offset natural production decline, this results in a capital intensive investment program – something investors in BHP 20 years ago might be acutely aware of. Although they have long-life, world class assets and significant cash flows that are able to meet the demands currently, over the past three months profits have been downgraded from circa $25b to circa $19b. Indicative of an economic slowdown and slowing demand for resources. So something to be watchful of is the fact that declining profits = declining cashflows = declining future investment. Albeit the investment future and plans looks like its all boom time right now.

Posted by Russell Muldoon per Montgomery Investment Management, Value.able and Skaffoldauthor and Fund Manager, 9 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Skaffold.

- 5 Comments

- save this article

- POSTED IN Companies, Insightful Insights, Skaffold

-

Does your adviser agree with these stocks?

Roger Montgomery

February 9, 2012

The ability to pick stocks that never go down, is NOT one of our skills. Plenty of you can attest to that. Value investing using the method we advocate in Value.able and using Skaffold.com cannot prevent losses, it is about minimising the cases of permanent impariment.

The ability to pick stocks that never go down, is NOT one of our skills. Plenty of you can attest to that. Value investing using the method we advocate in Value.able and using Skaffold.com cannot prevent losses, it is about minimising the cases of permanent impariment.Asked by BRW’s Tony Featherstone which small caps we liked we nominated a few. Here’s the list and if you cannot read it properly or would like to also read about the TOP 10 Start Ups of 2011, grab this week’s copy of the BRW.

Remember to seek and take personal professional advice before engaging in any security transactions.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 9 February 2012.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights, Skaffold.

-

An upgrade amid the malaise!

Roger Montgomery

February 2, 2012

Reporting season has begun in ernest and a few companies we have been watching (and some of which we own in the Montgomery Private Fund) have reported. Today it was Credit Corp’s turn (ASX: CCP, SQR* A2). You can find the presentation here (be sure to read and agree to the ASX and our disclaimer).

Reporting season has begun in ernest and a few companies we have been watching (and some of which we own in the Montgomery Private Fund) have reported. Today it was Credit Corp’s turn (ASX: CCP, SQR* A2). You can find the presentation here (be sure to read and agree to the ASX and our disclaimer).Skaffold members are likely to have already seen CCP on the Aerial Viewer with an A2 rating and a discount to Skaffold’s estimate of Intrinsic Value. In the Montgomery Private Fund, we have owned the stock for some time now and I have mentioned it as a stock to investigate on many TV and Radio programs. Today’s 10 per cent gain is certainly a welcome boost to the gains already registered.

The highlights from the announcement of the half year results for us were 1) that earnings were at the top end of guidance, 2) a 12% increase in revenue translated to a 23% increase in NPAT, 3) a welcome reduction in debt to its lowest level since listing and 4) strong free cash flow after an increase in dividends and finally a conditional settlement of a “distracting” class action. This final point is particularly important for many investors who will now feel vindicated that it was not the investor who erred. The impact of the settlement on earnings will be immaterial thanks to insurances. At current rates of cash flow generation, debt could be extinguished completely by the end of the financial year.

Grant Duggan – a regular blog poster here – was kind enough to make the following comments below: “If i recall on YMYC a caller asked for one xmas stock to put under the tree for 2012, and much to your dislike [Roger] to only be able to pick one it was CCP, and i know two months don’t make a market but to me this is another indicator of value able investing starting to prove its worth. Thanks to Roger and all blog posts once again.”

I know I am harping on about it but if you have not joined as a member of Skaffold, how are you planning to find the best opportunities during reporting season? Join Skaffold who have done all the hard valuation and quality assessments for every single listed company so you don’t have to.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 2 February 2012.

by Roger Montgomery Posted in Companies, Investing Education, Skaffold, Value.able.

-

Will Facebook’s IPO be a one day Circus?

Roger Montgomery

February 2, 2012

Unless you live under a waterfall in the rainforests of South America, you will have heard that Facebook has lodged its S-1 (Prospectus) for a probably May 2012 IPO. Skaffold members can look forward to Facebook being available to view in Skaffold when the team loads up all the international stocks.

To become a Skaffold member today and discover how we have been investing click here

Back to our regular programming…

Hyped by the media around the world as the biggest internet IPO in history and asked whether we would ‘invest’ in Facebook, we note the following:

The company already has 500 shareholders and would have been required by the SEC to lodge financials in April.

Facebook Stock Code: FB

Maximum aggregate offering price: $5Bn

as yet, there is not sufficient valuation information listed in the S-1 filing with the SEC nor how many shares are being offered.

According to the S-1 cover:

845 million monthly active users (MAU)

483 million daily active users (DAU)

Users generated on average 2.7 billion Likes and Comments per day in Q4 2011.

100 billion friendships

250 million photos uploaded per day

Our observation: Not a mention of any dollars yet! “likes”, “friends” and ‘uploaded photos’ are today what ‘page impressions’ and ‘visitors’ where in the tech boom of 1999/2000.

FB generated $3.7 billion in Revenue in 2011, up from $2 billion in 2010. 12 percent of Facebook’s revenue in 2011 was linked to its relationship with online gaming giant Zynga.

FB generated $1 billion in net income in 2011, up from $606 billion in 2010, a 40% growth rate, compared to the 165% growth rate from 2009’s $229m.

EBIT margin peaked at 52.3% in 2010 ($1m in EBIT on $2 billion in revenue), has since declined to 47.3% or $1.756Bn on $3.711Bn in Revenue, still incredible.

$3.9 billion in cash and marketable securities

Western world user growth is slowing but thats the law of large numbers. Facebook says: “We believe that our rates of user and revenue growth will decline over time. For example, our annual revenue grew 154% from 2009 to 2010 and 88% from 2010 to 2011. Historically, our user growth has been a primary driver of growth in our revenue. Our user growth and revenue growth rates will inevitably slow as we achieve higher market penetration rates, as our revenue increases to higher levels, and as we experience increased competition.”

The company still reported +60% earnings growth rates in 2011. The key is whether users stay and whether they can be ‘monetized’ further. MAU additions peaked in 2010 when FB added 248m to a total of 608m; in 2011 it added 237MM to 845m.

On the subject of dividends FB says: “We do not intend to pay dividends for the foreseeable future. We have never declared or paid cash dividends on our capital stock. We currently intend to retain any future earnings to finance the operation and expansion of our business, and we do not expect to declare or pay any dividends in the foreseeable future. As a result, you may only receive a return on your investment in our Class A common stock if the market price of our Class A common stock increases. In addition, our credit facility contains restrictions on our ability to pay dividends.”

Here’s access to the S-1: http://www.sec.gov/Archives/edgar/data/1326801/000119312512034517/d287954ds1.htm

The map of the world connected by facebook users is intriguing. What are those pirates on the west coats of Africa doing on Facebook?

I have previously written about the forthcoming floats of internet and social media sites here: http://rogermontgomery.com/which-ipos-are-you-watching/

‘Paradigm changers’ (remember Yahoo?) have come and gone so it is essential you don’t get caught up in the hype and instead stick to the valuation approach that is the bedrock of our approach. If you don’t know it, buy a copy of Value.able today for just $49.95. Or to save yourself reading the last ten annual reports for every listed company, try Skaffold.

There were eight large and highly media-promoted IPOs in the last year or two (GRPN, ZNGA, LNKD, P, YOKU, DANG, AWAY, and FFN). One analyst reported that if you could get stock in the IPO (forget it if you weren’t a major client of the lead broker or a ‘friend’ of the company) there was an average gain of 50%. If you bought each IPO in the market on Day 1 you now have an average loss of 54% with incredibly only 1 of the 8 names (ZNGA) still holding on to gains (+11%) thanks to a rally of 15% in the last week.

We would like to go through the numbers for Facebook today and try to come up with a valuation for you. You can do it yourself if you have a copy of Value.able.

There’s about $5.2 billion in equity, including $1bln of retained earnings. There’s 4.1bln Class A shares and the same number of class B’s. The preferred’s will be converted and only Class A’s sold. We cannot calculate equity per share because the S-1 does not disclose how many shares will be issued. ROE is about 26 per cent. No dividends will be paid. The company states in its S-1 that it will continue to grow by acquisition as well as organically. But the company will takeover Earth if it continues to retain profits and generates 26% returns on the incremental equity. Assuming earnings grow at 40% and faster than the rate of return on equity, then you can expect ROE to rise. Using these favourable metrics we reckon Facebook is worth $26-$28bln in 2012 rising to $57-$63bln in 2014. If the IPO ‘values’ the company at $100bln as many media outlets suggest, watch out.

This paragraph from the S-1 is important:

“If you purchase shares of our Class A common stock in our initial public offering, you will experience substantial and immediate dilution.

If you purchase shares of our Class A common stock in our initial public offering, you will experience substantial and immediate dilution in the pro forma net tangible book value per share of $ per share as of December 31, 2011, based on an assumed initial public offering price of our Class A common stock of $ per share, the midpoint of the price range on the cover page of this prospectus, because the price that you pay will be substantially greater than the pro forma net tangible book value per share of the Class A common stock that you acquire. This dilution is due in large part to the fact that our earlier investors paid substantially less than the initial public offering price when they purchased their shares of our capital stock. You will experience additional dilution upon exercise of options to purchase common stock under our equity incentive plans, upon vesting of RSUs, if we issue restricted stock to our employees under our equity incentive plans, or if we otherwise issue additional shares of our common stock. For more information, see “Dilution”.

Note the blanks, which makes FB impossible to value on a per share basis, yet.

We’ll have to wait until the final days of the capital raising before we can come up with a firm valuation on a per share basis but for now, the circa $27bln valuation stands.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 2 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are investors giving up?

Roger Montgomery

December 20, 2011

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.If your portfolio still has some rubbish in it, then being able to identify it is a key part of preparing for cheaper prices if they eventuate.

I recently wrote a column for the ASX and pondered the possibility of a climactic event coinciding with a complete throwing in of the towel by equity investors who are simply fed up with poor medium term returns and increased volatility recently.

The ASX200 hasn’t generated a positive capital return since 2005 but quality companies have. The ASX200 contains stocks that are rubbish so it is no wonder that an index based on that rubbish has gone nowhere. Step 1 then is to clean up the portfolio and step 2 is to be ready for quality bargains when they arise.

This is just one of many scenarios and frameworks I am operating with and I wonder what would transpire if the poor returns or the recent heightened volatility continues for a little longer? Will investors simply throw in the towel, leave equities and believe all those advisors offering their own brand of ‘safe’, ‘secure’ and stable investments? On the one hand, I hope so. It would mean certain bargains.

Here’s the Column:

As global sharemarkets decline, remain volatile and produce poor historical returns compared to other asset classes, it will be easy to be swayed by the latest investment trend – to move out of shares. I believe the trend away from shares will gather pace soon as more and more “experts” use the rear-view mirror to demonstrate why sharemarket investors would have been better off somewhere else.

In 1974 US investors had just endured the worst two-year market decline since the early 1930s, the economy entered its second recessionary year and inflation hit 11 per cent as a result of an oil embargo, which drove crude oil prices to record levels. Interest rates on mortgages were in double digits, unemployment was rising, consumer confidence did not exist and many forecasters were talking of a depression.

By August 1979, US magazine BusinessWeek ran a cover story entitled ‘The Death of Equities’ and its experts concluded shares were no longer a good long-term investment.

The article stated: “At least 7 million shareholders have defected from the stockmarket since 1970, leaving equities more than ever the province of giant institutional investors. And now the institutions have been given the go-ahead to shift more of their money from stocks – and bonds – into other investments.”

But be warned. The time to get interested in share investing and make good returns is precisely when everyone else isn’t.

Your own once or twice-in-a-lifetime opportunity may not be that far away and Labor’s promised tax cut on interest earnings may sway even more to give up shares and put their money in a bank, providing the opportunity to obtain even cheaper share prices.

If prices do fall further – and they could – you will need to be ready and will need some cash. The very best returns are made shortly after a capitulation. Cleaning up your portfolio becomes crucial and this article looks at how to do that.

Rule one: Don’t lose money

The key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently. Sure, good companies will see their shares swing but the poor companies see the downswings more frequently.

Therefore, the easiest way to avoid losing money is to avoid buying weak companies or expensive shares. One of the simplest ways I have avoided losing money this year in The Montgomery [Private] Fund has been to steer clear of low-quality businesses that have announced big writedowns.

These are easy to spot using Skaffold.

Not-so-goodwill

I have often seen companies make large and expensive acquisitions that are followed by writedowns a couple of years later. Writedowns are an admission by the company that they paid too much for an asset.

When Foster’s purchased the Southcorp wine business in 2005 for $3.1 billion, or $4.17 per share, my own valuation of Southcorp was less than a quarter of that amount. Then in 2008 Foster’s wrote down its investment by about $480 million, and then again by another $700 million in January 2009 and a final $1.3 billion in 2010.

When too much is paid for an acquisition, equity goes up but profits do not and you can see that too much was paid because that ratio I have worked so hard to make popular, return on equity (ROE), is low.

These low rates of return are often less than you can get in a bank account, and bank accounts have much lower risk. Over time, if the resultant low rates of return do not improve, it suggests the price the company paid for the acquisition was well and truly on the enthusiastic side and the business’s equity valuation should now be questioned. If return on equity does not improve meaningfully, a large writedown could be in the offing. This will result in losses if you are a shareholder, and you have also paid too much.

Just remember one of the equations I like to share:

Capital raised + acquisition + low rate of return on equity = writedown.When return on equity is very low it suggests the business’s assets are overvalued on the balance sheet. That, in turn, suggests the company has not amortised, written down or depreciated its assets fast enough, which in turn means the historical profits reported by the company could have been overstated.

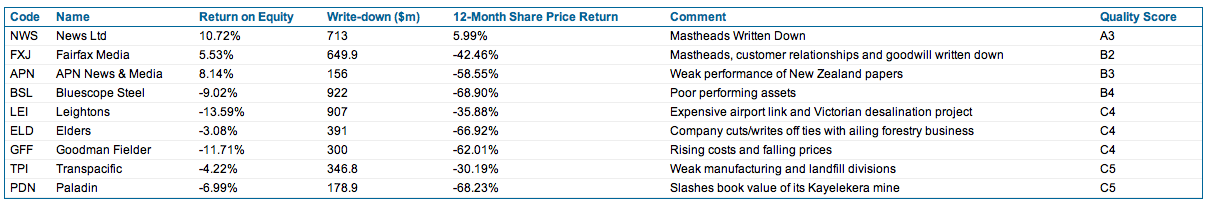

Scoring bad companies: B4, B5, C4 and below…

These sorts of companies tend to have very low-quality scores and often appear down at the poor end of the market – the left side of the screen shot in Figure 1 below.

Figure 1. The sharemarket in aerial view (Source; Skaffold.com)

Each sphere in Figure 1. represents a listed Australian company and there are more than 2000 of them. The diagram is taken from Skaffold. Their position on the screen can change daily as the price, intrinsic value and quality changes. The best quality companies and those with positive estimated margins of safety (the difference between the company’s intrinsic value and its share price) appear as spheres at the top right.

Companies that are poor quality (I call them B4, C4 and C5 companies, for example) are found on the left of the screen and if they have an estimated negative margin of safety, they are estimated to be expensive and will be located towards the bottom of the screen.

Highlighted with blue rings in Figure 1 are eight of the companies that announced this year’s biggest writedowns. Notice they tend to be at the lower left of the Australian sharemarket, according to my analysis.

If your portfolio contains shares that are red spheres and on the lower left, you could also be at risk because these companies tend to have low-quality ratings and are also possibly very expensive compared to their intrinsic value.

As is clear from Figure 1, this year’s biggest writedown culprits were all already located in the area to avoid.

The impact of owning such a business outright would be horrendous. Table 1 below reveals the size and details of these writedowns and as you can see, collectively the losses to shareholders amount to $4.6 billion.

Table 1. Predictable losses?

Warren Buffett once said that if you were not prepared to own the whole business for 10 years, you should not own a piece of it for 10 minutes.

Clearly you would not want to own businesses that pay too much for acquisitions and subsequently write down those assets. If you are not willing to own the whole business, don’t own the shares. Although in the short run the market is a voting machine and share prices can rise and fall based on popularity, in the long run the market is a weighing machine and share prices will reflect the performance of the business. Time is not the friend of a poor company, and companies Skaffold rates C4 or C5 are best avoided if you want the best chance of avoiding permanent losses.

Look at Figure 2 below. Those big writedown companies not only performed poorly but so did their shares. These companies (shown collectively as an index in the blue line below) produced bigger losses for investors than the poorly performing indices of which they are part. And that’s just over one year.

Figure 2. The biggest writedowns compared to the market

Take a look at the companies in your portfolio. Do they have large amounts of accounting goodwill on their balance sheet as a portion of their equity? Have they issued lots of shares to make acquisitions and are they producing low and single-digit returns on equity? If the answer to all these questions is yes, you may have a C5 company.

Cleaning up your portfolio not only lowers its risk but will produce cash that may just prove handy in coming months.

If you have made it this far then here’s evidence of the giving up I referred to in the column: http://www.smh.com.au/business/investors-turn-to-term-deposits-in-shift-away-from-equities-20111219-1p2ir.html

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

Cochlear update

Roger Montgomery

December 20, 2011

Aside from fears of reputational damage, one of the big concerns surrounding Cochlear’s recall earlier this year, was how long it would take to return to market. As you know we purchased shares after the announcement that it had recalled its Nucleus CI500 cochlear implant much to the chagrin of some investors who follow our musings here at the Insights blog.

In NSW every child receives a hearing test within two days of birth. Those identified as having profound hearing loss are often assisted by Cochlear. And thats just NSW. Cochlear sells its devices in 100 countries. Once implanted changing devices is not easy. Changing brands may be even harder. Audiologists and speech pathologists are involved and the devices are finetuned to ensure the device suits the individual.

As Matthew pointed out here on the blog a few days ago: “A family member [of Matthews’s] is a key member of a large Australian charity that does a lot of work with children that are deaf and many get the implants. All the equipment they use to “map” or finetune the device after implanting is specific to that company. For example the only brand they have is Cochlear. Recently they had a child from the US that they began to support that had a different brand implanted – they had to change many things to be able to help them. When thinking about market share with these devices I think it is important to know that the decision isn’t solely with the surgeon or specialist, because all of the support people have to change too. I don’t think market share will change quickly or by very much because of these barriers.”

Analysts at Macquarie recently surveyed 389 US-based Audiologists. Despite the product recall, Cochlear is still the world leader in CI devices and retains 60% market share selling into 100 countries. The broker also believes the market is growing at 12 per cent per year.

Many of you know we purchased shares in Cochlear after the September recall (see below), confident this was a temporary issue being treated as permanent by a perennially short-term-focused market.

That now appears to be the case as today’s announcement, posted on the ASX platform by the company reveals; 20122011_COH CI500 impant update

The company previously covered the subject in its AGM presentation here: http://www.cochlear.com/files/assets/corporate/pdf/agm_presentation_18102011.pdf

Analysts were subsequently concerned that 1500 units are going to have to be removed through surgery and another 2800 units have been pulled from shelves. They also worry that an inventory shortfall across the entire market will lead to market share losses from insufficient inventory as well as damage to reputation.

Today’s announcement reveals any small market share loss (we estimate five percent and some analysts suggest between five and ten per cent overall) will be now stemmed by the timely identification of the manufacturing issue that resulted in the failure of 1.9% of devices and their subsequent recall.

Cochlear has ramped up production and its early intervention has enhanced its reputation rather than damaged it as evidenced by several surveys with clinicians. In fact, 93% of doctors surveyed by Macquarie felt that Cochlear handled the recall well, while only 8% believe the company’s reputation has been tarnished.

Ultimately the company’s intrinsic value is determined by its profit and we expect there will be an impact on profit of some import. Cochlear has already created a provision of $130-$150 million and an after tax cash cost of $20 to $30 million. Given the news flow that will now transpire, one expects these costs may be treated by analysts as a ‘one-off’ and investors may have to wait for another temporary setback before being able to buy shares cheaply again…

For those of you interested in following our thoughts back in September 14 (COH $51.30), I wrote the following :

“Imagine spending years waiting patiently for the opportunity to buy that rare coin, vintage bottle of wine or celebrated painting, only to be outbid when it finally comes up for auction.

Sometime later the opportunity presents itself again and you are outbid once more, this time by much more. Successive auctions only take the price further out of your reach – if only you acted sooner!

Then one day you stumble across that very thing you desire being offered for sale by someone who appears to have no interest in its long-term value, for a price you regard as a fraction of its real worth.

Would you buy it?

That is the situation I find myself in today as the Cochlear share price plunges another 14% to $51.30, or about 40% since its April 2011 high of $85.

As Cochlear’s technicians work to isolate the problem with the Nucleus 5 range, the company will dust off the Nucleus Freedom range, which it has marketed successfully for many years against products such rivals as Advanced Bionics and Med-El.

Overnight one of those rivals received FDA approval to sell its product (which was itself recalled in November last year) into the US market. This turn of events is not unusual for the industry … but it is unusual for Cochlear and that’s why the news this week came as such a blow. Cochlear is one of the highest-quality companies trading on the ASX today. The company that almost never puts a foot wrong appears to have tripped itself up and investors are spooked.

The financial impacts of these events (and there will be an impact) have yet to be quantified so until they are why don’t we look at how the company has performed in the past and see if we can’t learn something about it in the interim.

Over the past decade, Cochlear has increased profits every year with the exception of 2004. Net profit was just $40 million in 2002 and last week the company reported profits of $180 million for 2011.

Operating cash flow over the same period has risen from less than a $1 million (an exception for 2002) to more than $201 million, allowing debt to decline to just $63 million from nearly $200 million in 2009. Net gearing is now minus 1.86%.

Those impressive economics have resulted in an intrinsic value that has risen by nearly 18% each year since 2004. If your job as a long-term investor is to find companies with bright prospects for intrinsic value appreciation – believing that in the long run prices follow values – then it quite possible that Cochlear is being served up on a plate.

The recently reported net profit figure of $180.1 million for 2011 was up 16% and in line with consensus analyst estimates, although this occurred despite sales of $809.6 million exceeding analysts’ estimates. It seems the analysts did not expect the EBIT and NPAT margins that were reported. These were flat, which given a very strong Australian dollar, suggests impressive efficiency gains in the operations.

If only that blasted “Australian peso” would go down and stay down!

Back on August 19, 2009, I wrote: “Fully franked dividends have risen every year for the past decade, growing by almost 500% (or 22% pa) since 2000. These are not numbers to be sneezed at; the company has produced an impressive and stable return on equity since 2004 of about 47% with very modest debt. Clearly this is a company worth some significant premium to its equity.”

Nothing changed really for 2011. A final dividend of $1.20 per share was 70% franked and up 14%.

Importantly, it seems Cochlear’s market is growing. Unit sales volumes were up 17% for the year and, given in the first half they were up 20%, it suggests the second half were up 14%. Double digit growth was reported in sales volumes for all major regions and Asia was the most impressive, rising more than 30% to the point where it makes up 16% of total revenues.

This really is impressive stuff. Just two years ago the company reported unit sales growth of only 2%, to 18,553 units, and many analysts were blaming slow China sales. Nobody expected the company to ever repeat its 2007 and 2008 volume growth of 24% and 14% respectively, and certainly not off a higher base.

Growth has always been viewed as is limited by the high cost of the devices and the reliance on insurance and healthcare schemes to subsidise the costs and those of surgery to implant to them.

According to the World Health Organization however, almost 280 million people suffer from moderate to profound hearing loss and an ageing population means this figure will rise. Cochlear is one of a handful of companies that actively contributes to improving the quality of life of its clients.

When great companies stumble, the impact can be exaggerated by the reaction of shareholders who never believed it could happen. Then comes a wave of selling amid doubts that the company will ever regain its mantle.

But strong market share and strong cash flow, high returns on equity and low debt, are rarely offered at bargain prices so I picked up some Cochlear stock yesterday for the Montgomery [Private] Fund. It is likely that I will to add to this position over the coming days and weeks when the full financial impact of the recall is known.

I must confess I didn’t bet the farm on this particular investment because the financial impact of the recall – and there will be one – remains unclear; when that changes it will impact my intrinsic value estimate (UBS has revised its forecast net profit for 2012 by 10.5% to $179.5 million).

Whatever the impact, it will be temporary, even though it won’t necessarily preclude lower prices from this point. During the GFC, Cochlear shares fell from $78 to $44. No company is immune to lower share prices and I don’t know when or in what order they will transpire.

What I do know is that in 2021 we aren’t likely to be thinking about this recall, just as nobody now talks about the Wembley Stadium delays that dogged Multiplex back in 2006. Mercifully, investors’ memories tend to be short.

Recalls, competition, marketing gaffes and wayward salary packages are all part of the cut and thrust of business and if lower prices ensue for Cochlear shares, it will be important to determine whether the recall will inflict permanent scars. My guess is that it will not.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Health Care, Investing Education, Value.able.

-

Not so High at JB Hi-Fi?

Roger Montgomery

December 16, 2011

You will have noticed that since November 16 every post here at the Blog has been a cautionary one. You have not seen me post a ‘here’s possible good value’ story. There is a little method in that, even though we might be unduly conservative. But here goes again…

You will have noticed that since November 16 every post here at the Blog has been a cautionary one. You have not seen me post a ‘here’s possible good value’ story. There is a little method in that, even though we might be unduly conservative. But here goes again…Many of you have heard me discuss JB Hi-Fi and its preferred status among retailers – I believe if JBH is doing it tough everyone else is doing it even tougher. But we sold JBH from our holdings at $15.50 recently and I thought the story of why (ahead of a downgrade as it turns out) would be a good insight into the way we think. Hopefully other investors can gain some insight into the process and fill in the 1) ‘bright prospects’ part of the equation that also requires 2) extraordinary businesses and 3) discounts to intrinsic value.

Starting way back in February 2010 we commented on the impending retirement of JBH’s Richard Uechtritz (now looking as well-timed as other prominent CEO departures, such as the Moss departure from Macquarie and I am sure you can list a few more – go right ahead) and the maturing outlook for the business itself.

“If JB Hi-Fi could re-employ all of its profits at the returns of about 45% it is generating now, its value would be over $38. That’s a pipe dream. The company is generating cash faster than it can ask its employees and contractors and landlords to employ the funds to open new stores. And because the profits also produce taxes and associated franking credits that have no value for the company, shareholders are being handed back the funds, which is a disappointment. However, as chairman Patrick Elliott implied when I spoke with him on radio this week, this is a function of growth and the limited size of the Australian population.

It happens eventually to all retailers and it will happen to JB Hi-Fi in the next five to seven years. The best you can hope for is that once the stores have saturated the market, directors stick to their knitting, and the company continues to generate high returns but pays out all of those earnings out as a dividend (becoming like a bond) rather than make some grand attempt to buy something offshore or diversify too far away from their core expertise (often at the behest of some institutional shareholder) and blow up the returns.

The result of not employing as much retained earnings at 45% is that the intrinsic value declines. It is still going up but not as much.”

In August here at the blog we wrote:

“The big story however is that Terry Smart will need to start looking beyond this organic growth to other strategies if JB Hi-Fi is to avoid developing the profile of another mature Australian retail business like Harvey Norman.”

and

“JB Hi-Fi needs to establish new and emerging business models to try and counter the shift away from physical music unit sales.”

and

“Having said that, the current sales environment is probably not representative of the future. Share market investors generally use the rear view mirror when assessing the future. I have previously discussed the “economics of enough”, which David Bussau from Opportunity International introduced me to many years ago. As it applies to consumers generally, they will get sick of trying to keep up with the latest technology, be happy with their TVs and replace everything less often – opting instead to ‘experience’ travel, food, adventure and other cultures. That of course doesn’t mean JB can’t grow its share-of-wallet. In the face of declining retail sales volume growth over the last five to ten years and deflation, JB is proving it is already the market leader.”

and

“JB Hi-Fi’s quality score dropped from A1 to A3 and interestingly, this was only partly due to the increase in debt. (We really need to know whether it was just timing issues and new stores that contributed to the jump in inventory).”

In addition to these comments I wrote more recently:

“The release of the iPhone 4S seemed to underwhelm technology reviewers when launched and a portion of the population do take their purchasing cues from such quarters.

The 4S is apparently an evolution in the iPhone series, rather than a revolution, and as such, fewer users of the most recent release – the iPhone 4 – will upgrade. Instead, it is likely that they will wait until the iPhone 5 is released next year (owners of the previous model the iPhone 3GS, however, should be coming off their two-year contracts about now and are expected to upgrade). We’ll come back to that shortly.

The iPhone doesn’t contribute anything like a majority profit to JB Hi-Fi’s bottom line. This is because margins on Apple products are slim. But the iPhone does generate foot traffic and phone upgraders also buy protective covers and other accessories on which JB Hi-Fi makes much more significant margins.

So why do we care so much about the iPhone?

It’s because when JB Hi-Fi announced its full-year results the company forecast more than $3 billion in sales and management cited growth from computing, telco, and accessories. They said:

“While we anticipate the market to remain challenging, our diversified product portfolio, particularly the categories of computers, telco and accessories, from which we expect strong growth, will assist JB Hi-Fi in delivering another year of solid sales and earnings in FY12. Assuming trading conditions are comparable with FY11, we expect sales in FY12 to be circa $3.2b, an 8% increase on prior year.”

It’s the lower “telco and accessories” sales that are expected to stem from the iPhone 4S underwhelming so-called early adopters and its most ardent fans that may put pressure on that sales forecast.”

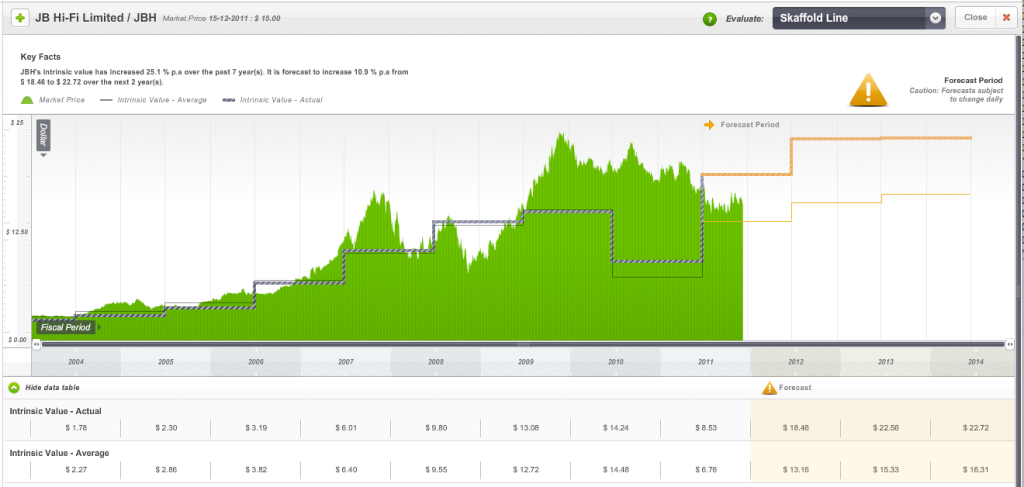

Indeed the only thing that was going for JB Hi-Fi was its discount to intrinsic value. Many investors believe that a stock I mention is below intrinsic value is a “darling’ of mine. It isn’t. A company must meet all of our criteria and it will only be held for as long as it does. Those of you using Skaffold will however have seen JBH was trading only at a discount to one of the intrinsic value estimates – the intrinsic value based on analyst forecasts – but not the more conservative Skaffold Line valuation estimate of $13.16. See Figure 1.

Figure 1.

Both valuations are now likely to decline further in coming days -even the more conservative $13.16 valuation SKaffold has been displaying – and the downgrade may also be reflected in pressure on the company’s cash flow which Skaffold members would have already seen in the 2011 results and which prompted some of the above comments. (See Figure 2. and note the negative funding gap line (international patents pending))

Figure 2. Showing declining operation cash flow and a growing Funding Gap (patents pending).

JB Hi-Fi was 5 per cent of our portfolio however we sold all of our position at $15.50 recently. Our reasoning was simple; Given present circumstances and expectations for retailing (having spoken to many retailers recently) many retailers JB Hi-Fi would have to revise their earlier outlook statements and this would produce lower future valuations. At the same time analyst forecasts are typically optimistic in the first half of the financial year (this year being no exception to that rule) and we should therefore be demanding much larger discounts and JBH was not offering that margin of safety. We also commented to our peers in conversations over the phone and in person that the delfation story – as explained by Gerry Harvey who noted selling plasma TVs for $399 this year means he has to sell three times the volume as last year to make the same money – would put pressure on profits because people already had enough plasma TVs. Finally we also believed that ANZ’s profit growth being dominated by bad debt provisioning writedowns meant that credit growth was non-existant. When you take away growth in credit card purchases – thats got to hurt discretionary retailers.

On November 7 we wrote to our Montgomery [Private] Fund investors thus:

“We aren’t so arrogant to presume we know what will happen next. We have taken earnings expectations for 2012 and beyond (expectations that are typically optimistic in the first half of a financial year) and reduced them to where we believe they could safely be regarded as conservative. The resultant estimations for intrinsic values … are significantly lower and suggest we should require larger margins of safety before committing your funds to many companies…I expect in coming months we may not be as aggressive in purchasing and you might even find our cash levels increase. It’s always preferable to protect capital because we can come back to reinvest at any time. Recovering from losses is much more challenging and demoralising for you.”A prominent media commentator and broker however wrote on December 6

“Our No.1 discretionary retail recommendation remains JB Hi-Fi (JBH). We all know 21% of JBH’s register is currently shorted, a massive short position usually reserved for financial impaired or structurally stuffed stocks. JBH is neither, and that is why we continue to be aggressively recommending buying the stock which generates 25% of its annual profit in December. JBH is trading on 11.2x bottom of the cycle earnings. Nowadays, the P/E’s of cyclical stocks compress with their earnings, meaning that both P/E and E bottom concurrently.”

So, JBH still has long term prospects that surpass many of its peers and I believe it still has a competitive advantage. And if all those short sellers cover their position, the stock could rally. That however would be speculating. On the flip side, changes to accounting reporting standards will give it a lot more liabilities – contingent liabilities such as operating leases will need to come onto the balance sheet. Also, the medium outlook, which includes deflation continuing, will put pressure on JB to sell more volume at precisely the time everyone may just have enough stuff. Finally, the market may now finally catch up to the maturity story we described way back in 2010. Of course consumers will return at some point and spending and credit growth will recover, but given the current weakness and fear among consumers the idea of requiring very, very large discounts to the more conservative estimates of intrinsic value dominates our thinking.

As always be sure to do your own research and seek and take personal professional advice.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 December 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Investing Education, Skaffold.

-

Are bargains available at Woolworths?

Roger Montgomery

November 17, 2011

On Wednesday November 2 Woolworths held a strategy briefing for professional investors. Woolworth’s effectively asked us to adopt a longer time frame before judging its performance and revealed four strategic priorities that I will describe in a moment.

Prior to the strategy day, the company updated the stock market with a growth outlook that was the lowest in a decade. The market responded negatively to the change and it entrenched previous sentiment by professional investors to switch from Woolworths to Coles.

But Woolworths remains a superior business from a business economics perspective, with high return on equity and it also remains cheaper than its competitor as measured by the larger discount to an estimate of its intrinsic value.

The wider sentiment towards Woolworths Supermarkets is that the period of strong growth is over, and the other businesses, such as Big W, the New Zealand supermarkets, the Masters hardware venture and a possible acquisition of The Warehouse group could be the focus of earnings growth for the company. Gambling pre-committments would not be.

Meanwhile, the Woolworths-owned Dick Smith electronics business appears to have failed to excite consumers and has certainly failed to excite investment professionals. Dick Smith is a relatively weak offering in a market that has been hit particularly hard by the empowerment of the consumer through high Australian dollar.

Moreover, in many ways these businesses are peripheral since the Australian Food & Liquor division accounts for 80% of earnings before interest and tax.

The impact of the company’s lower growth profile on intrinsic value, particularly intrinsic values over the next two years, has been negative and intrinsic value does not appear to be going anywhere in a great hurry (see Skaffold chart below).

This combination of circumstances, in my experience, set Woolworths shares up to be vulnerable to any negative shocks.

Estimating intrinsic value is not the same as predicting price direction, however the above circumstances are not unique historically in putting a lead on price appreciation.

On top of the above combination of factors, there is also the continuing debate in Parliament about the introduction of preset loss limits for poker machines, which, if introduced, would negatively impact Woolworths’ gaming business. Though it is most closely associated with supermarkets, Woolworths is actually the largest poker machine owner in the country, with more than 10,700 pokies.

And a few weeks ago, The Economic Times of India also reported that Woolworths appears to have been dumped by its Indian partner, Tata Group. Woolworths enjoyed a five-year partnership with Tata, introducing Dick Smith-style electronics stores to India under the Infiniti Retail brand. Even though foreign retailers are not permitted to have a direct presence in India, Woolworths partnership offered the hope of growth – albeit with a partner – if the rules were ever relaxed.

Nonetheless, despite these accumulative negative factors, Woolworths is regarded by conventional analysts and investors as a defensive’ company. Its strong cash flows and its status as a major retailer of food makes it an ideal investment in a recessionary or slow or low growth environment. The company also enjoys entrenched competitive advantages over smaller rivals that, until now, the ACCC has done little about. One example of this are the new EFTPOS charges.

From the first of this month, the new Eftpos Payments Australia Limited (EPAL) fees mean retailers incur a 5¢ fee for every transaction over $15 (75% of all EFTPOS transactions). Previously there was no fee and that will still be the case for transactions under $15, which means 25% of transactions.

The retailer’s bank will charge the retailers, some of whom are describing the charges as an “EFTPOS tax”, and they will have no choice but to pass on to the consumer.

Unsurprisingly, EPAL’s members include the major banks, Coles and Woolworths and, because they manage their own terminals, they can opt out of the new charges.

But despite these entrenched advantages, Woolworths has been hit – or so it says – by the state of the economy, noting in its annual report: “Consumer confidence remained historically low as customers reacted adversely to rising utility costs, interest rate hikes in the first half of the year and general global uncertainty, and opted to save rather than spend their money”.

From an investment perspective it is worth noting that retail investors now have a choice of supermarkets, with Coles improving its offering to consumers and taking market share from the incumbent Woolworths.

The investment community is not convinced that further changes to private-label offerings or more innovation around the supply chain will make a dramatic difference to the growth prospects for Woolworths, which set below forecast growth in household income, population and the economy.

One other source of earnings growth is cost-cutting, but the reality is that gains from such strategies are one-offs and again unlikely to excite investors.

Having presented the negatives – which have caused the share price to fall 12% since July, one positive was the strategy briefing’s opportunity to showcase new CEO Grant O’Brien, who replaces Michael Luscombe. The company announced that it planned to extend and defend its leadership in food and liquor, act on the “portfolio” to maximise shareholder value, maintain its track record of building new growth businesses (we’ll ignore Dick Smith) and finally, put in place the enablers for a new era of growth.

In the supermarkets business WOW hopes to grow fresh produce from 28% market share to 36% market share. If achieved this would be an additional $2.5b in sales. Woolies also wants to target a doubling of home brand sales and this aim flies in the face of the ACCC’s stated concerns.

The company will also open 35 new BIG W stores in next 5 years reaching 200 by 2016.

In a reflection of the massive structural shift online, BIG W’s 85,000 in-store SKUs will be expanded and all put online.

And the topic on the tip of everyone’s tongue; Masters. There are now five stores open, another two are due to open in December/January, there are 16 under construction another 100 in the pipeline and the company reported the venture is well ahead of budget.

I also note the advertised sale of $900 million of property ($380 million of which was sold last financial year); and, most recently, the oversubscribed $500 million hybrid note raising that substantially extend the balance sheet strength of the company.

Below we examine the intrinsic value track record and prospects for Woolworths based on current expectations for earnings growth and returns on equity using Skaffold.com

Woolworths (MQR: B2) is currently trading at the same price it was in December 2006 and February 2007, despite the fact profits have risen 11.1% pa, from $1.3 billion to a forecast $2.2 billion in 2012. This growth in profit however is offset by having 16 million more shares on issue; by increased borrowings – up $1.8 billion to $4.8 billion; and by retained earnings, which have risen by $2 billion. The increase in shares on issue and retained earnings have offset the positive impact on return on equity rising profit would normally have.

The latest estimate of its intrinsic value, of $23.23, is forecast to rise modestly over the next two years. For investors looking at opportunities to investigate only when a meaningful discount to intrinsic value is presented, a price of $19 or less for Woolworths would represent at least 20 per cent.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Skaffold.